Aluminium Powder Market Size, Share & Industry Analysis, By Type (Atomized Aluminium Powder and Flake Aluminium Powder), By Application (Industrial, Automotive, Aerospace & Defense, Building & Construction, Electronics & Semiconductors, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

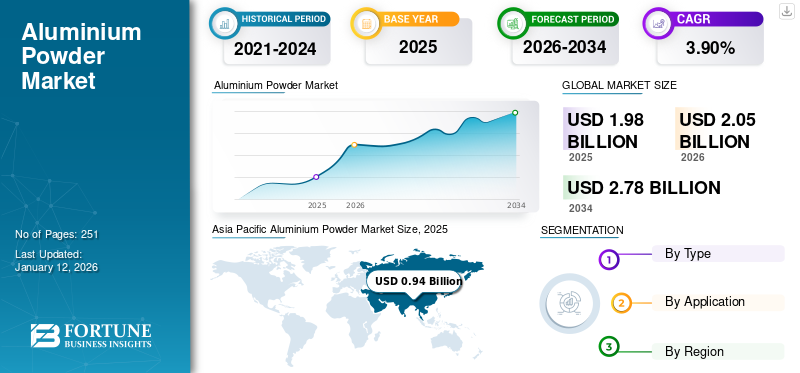

The global aluminium powder market size was valued at USD 1.98 billion in 2025. The market is projected to grow from USD 2.05 billion in 2026 to USD 2.78 billion by 2034, exhibiting a CAGR of 3.90% during the forecast period. Asia Pacific dominated the waterproofing membrane market with a market share of 48% in 2025.

Aluminium powder is a fine, granular, and crushed aluminium product. One common method to produce it involves spraying molten aluminium at high velocity to create a dense powder. Two types of powders can be generated depending on the atomizing gas used to break apart the molten aluminium. Another processing method includes dry magnetic stirring and hammering, where the former produces granular and nodular powder, and the latter yields crusted and flattened powder. The global market is growing rapidly, driven by increased demand in brick manufacturing within the construction industry. It is also popular in fast prototyping and powder metallurgy. Additionally, it is a key component in solar cell production, further boosting market growth.

AMG Advanced Metallurgical Group NV, AMPAL Inc., and VALIMET, Inc. are the key players operating in the market.

The COVID-19 pandemic affected the year-on-year growth rate of the global market. In 2020, this growth rate saw a significant decline compared to 2019 due to supply chain disruptions in key consumer countries globally. The demand for bauxite ore was severely impacted due to factors such as raw material shortages, inventory issues, temporary production halts, economic slowdowns, trade restrictions, and shifts in consumer behavior related to the COVID-19 outbreak. However, the market recovered gradually in the following years due to the mitigation strategies, business continuity plans implemented by leading manufacturers, and government initiatives to revitalize the economy.

Aluminium Powder Market Trends

Significant Growth in the Powder Metallurgy Industry Coupled with Rising Industrialization to Boost Market Growth

Powder metallurgy is a widely used manufacturing technology that involves pressing metal powders in a rigid die under very high pressure to create parts or components. Its application spans across industries including automotive, aerospace, defense, and electronics, and it continues to expand as an effective alternative to traditional machining or casting methods. Growing awareness of fuel efficiency in certain developing regions has further increased demand for powder metallurgy in the automotive sector. Moreover, processes include metal powder forging, metal injection molding, and hot pressing, aimed at reducing vehicle weight, along with lightweight materials and a rising need for alternative energy sources, all boost the demand for powder metallurgy parts. These parts are used to produce various automotive components. As powder metallurgy increasingly enters the aerospace, energy, medical, and electrical industries, new growth opportunities emerge for market players. The sector's expansion in these fields is expected to generate lucrative prospects for market growth.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Consistently Rising Product Demand from Automotive and Aerospace & Defense Industries to Propel Market Growth

The properties of aluminium powder, including lightweight, high strength, malleability, flexibility, conductivity, and reflectivity, are pushing its demand from the rapidly growing automotive industry. In recent years, the automotive sector has witnessed a paradigm shift, with stakeholders bidding high on the electric future. For instance, major automakers including Tata, Ford, Volkswagen, Toyota, and General Motors have invested significantly in developing hybrid and electric vehicles. The key motivation for these investments is that major automakers expect increased demand for electric vehicles and want to gain market share. This, in turn, is anticipated to significantly boost the growth of the market owing to applications of the powdered aluminium for manufacturing components used in automotive and the manufacturing of electronics and semiconductors.

In aerospace & defense, aluminium powder is mainly used for solid-fuel rocket boosters, along with several other applications. Boosters are used in the first stage of spaceflight. For instance, the world's most powerful launch vehicle, Saturn-5, burns through 36 tonnes of aluminium powder in the period before reaching orbit. Increasing rivalry in the defense & aerospace industry among the major economies of the world, including the U.S., China, France, India, Germany, and the U.K., has pushed the growth of the industry in the recent past, which is anticipated to continue during the forecast period, driving the demand for aluminium powder.

Market Restraints

Stringent Environmental Regulations coupled with High Cost May Limit the Market Growth

Governments' and private associations' implementation of stringent environmental regulations is expected to affect aluminium powder market growth in the coming years negatively. The increasing environmental issues and rising public expectations of reducing pollution have forced several countries to introduce new rules and regulations.

Manufacturing plants have been asked to meet new emission standards, which have increased the cost of the product. Furthermore, aluminium is known to have detrimental effects on human beings. Its exposure can have effects such as headaches, rashes, asthma, and insomnia. The product can ignite or explode, thereby posing workplace hazards, and its inhalation can cause pulmonary fibrosis.

Moreover, the availability of substitutes in different industries, including aerospace and defense, automotive, and certain industrial applications, may limit the market growth.

Market Opportunities

Increasing Adoption in the Building and Construction Industry to Create Significant Market Growth Opportunity

In the building and construction industry, powdered aluminium is widely used for lightweight bricks, slurry preparation, Autoclave Aerated Concrete (AAC), and paints and coatings manufacturing. AAC is a building material with high heat insulation efficiency, excellent fire resistance, and superior load-bearing capacity. AAC offers a lightweight construction solution with superior thermal and sound insulation, higher compressive strength, and excellent resistance to water penetration. These properties have resulted in increased demand for AAC from the growing building and construction industry.

Additionally, developing countries in the Asia Pacific region are home to around 60% of the global population. People in countries such as China, India, and some ASEAN countries have substantially improved their living standards and purchasing power over the past few decades. Improved spending ability and the untapped regional construction industry will likely prompt the initiation of new infrastructure and construction projects during the forecast period. Therefore, the increasing adoption of the product from the rising building & construction industry is anticipated to impact the market growth significantly.

Market Challenges

Raw Material Cost Volatility Could Lead to Several Market Challenges

Aluminum is the primary raw material utilized in manufacturing aluminum powder, a process crucial for various applications, including automotive, aerospace, and additive manufacturing. When the market price of aluminum increases, it directly hikes up the expenses associated with acquiring raw material for powder production. This escalation in raw material costs subsequently leads to a rise in the overall production expenses.

Moreover, producing aluminum powder, particularly through atomization, which involves transforming molten aluminum into fine particles, demands significant energy. This process is not only resource-intensive but also heavily reliant on electricity. Consequently, fluctuations in energy costs, especially electricity prices, can profoundly affect the financial viability of aluminum powder manufacturing. These rising energy costs can further exacerbate the challenges producers face, as they strive to maintain affordability while ensuring quality and efficiency in their production operations.

Segmentation Analysis

By Type

Atomized Aluminium Powder Segment to Dominate Owing to Superior Characteristics

Based on type, the market is segmented into atomized aluminium powder and flake aluminium powder.

The atomized aluminium powder segment accounted for the largest market share 58.05% in 2026 and is expected to remain dominant throughout the forecast period. Key product features that differentiate atomized aluminium are its shape, metal chemistry (alloy), and particle size distribution. Industry applications for atomized powder commonly include pigment production, explosives for mining and drilling, rocket propulsion, and various other uses.

The flake aluminium powder segment is projected to experience significant growth in the forecast period. This powder is produced using a wet milling process, followed by vacuum drying to ensure safety in subsequent handling. Additionally, aluminium flakes can undergo oxidation in a controlled drying environment. They are valued for technical uses such as civil explosives and autoclaved aerated concrete, where selecting specific lubricants and additives during milling results in products with leafing or non-leafing properties. For final applications requiring color, these powders are commonly utilized in coatings, printing inks, and surface materials.

By Application

To know how our report can help streamline your business, Speak to Analyst

Industrial Segment Dominated Due to Rising Demand for Production of Inorganic and Organic Aluminium Products

Based on application, the market is segmented into industrial, automotive, aerospace & defense, building & construction, electronics & semiconductors, and others.

The industrial sector experienced the fastest growth and led the market share 39.51% in 2026. The rising need for both inorganic and organic aluminium chemicals—driven by their weather resistance, chemical compatibility, hardness, and high tensile strength—is fueling the market segment's expansion.

The increasing adoption of aluminium in the automotive sector is driven by its use in high-strength alloys produced from powders through a streamlined, advanced manufacturing process. Recently, many emerging economies including China, India, Brazil, and South Africa have experienced a notable increase in per-capita income. Additionally, growing defense competition among major countries, fueled by global geopolitical tensions, is contributing to this trend. These developments are significantly fueling the growth of the automotive industry, creating promising opportunities for the market.

The product is widely used in the building and construction sector. It enhances the gas-forming admixtures, resulting in concrete with increased porosity and a more extensive pore structure.

The aerospace and defense sector has a high demand for the product, with diverse applications including rocket propellant additives, thermite mixtures, and construction materials.

Furthermore, rising product demand within the electronics and semiconductors industry is anticipated to fuel the segment's growth.

Aluminium Powder Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Aluminium Powder Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 0.94 billion in 2025 and USD 0.99 billion in 2026.. This region includes several developing economies, notably China, India, and others, with significant yet-to-be-fully-realized economic growth potential. This potential is driven by increasing urbanization, economic development, and expanding industrial activities, which are likely to boost demand for the product in the region. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.68 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026.

North America

North America is expected to lead the global aluminium powder market with a share of 20% in 2025. The growth of the North America market can be attributed to the rapid expansion of the industrial and automotive industries in the region. According to the Alliance for Automotive Innovation, the automotive sector contributes USD 1.0 trillion to the U.S. economy annually, with 4.9% of its GDP, and the demand for construction products is rising from both the commercial and residential sectors. The growing electric vehicle (EV) segment, supported by U.S. government incentives and consumer demand for sustainable mobility, is further driving the application of product in battery components and structural parts. Thus, it creates a rise in U.S’s domestic demand for the product from the major end-use industries, which is expected to drive the market growth in the region. The U.S. market is projected to reach USD 0.36 billion by 2026.

Europe

Europe is expected to lead the global aluminium powder market with a share of 20% in 2025. Strong product demand in Europe is driven by rapid growth in the automotive industry and urban development. The main powder produced is used in automobile manufacturing and industrial applications within the region. Additionally, a larger portion is used to produce automobile paints and sealants. It also has substantial demand in the defense and aerospace sectors, particularly for rocket launches. The UK market is projected to reach USD 0.05 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

Latin America

Latin America is one of the fastest-growing regions in terms of technological progress and urbanization. Major manufacturers including Schlenk and Alcoa Alumínio S.A. are likely to boost growth in the region.

Middle East & Africa

Middle East & Africa are expected to experience significant growth with a share of 5% in 2025. The development of mega-projects in UAE, Qatar, and Saudi Arabia over recent years has increased the demand for powder, fueling regional expansion.

Competitive Landscape

Key Market Players

Key Market Players Focus on Capacity Expansion to Stay Ahead

In terms of the competitive landscape, the market depicts the presence of established and emerging companies. AMG Advanced Metallurgical Group NV, United States Metal Powders, Inc., and VALIMET, Inc. are some of the key players in the global market. These players have a significant manufacturing capacity and are engaged in research and development for producing advanced products such as nano-aluminium powder for industry-specific applications. They are also engaged in the expansion of their manufacturing capacity and distribution, and sales network in different parts of the globe.

List of Top Aluminium Powder Companies Profiled

- AMG Advanced Metallurgical Group NV (U.K.)

- United States Metal Powders, Inc. (U.S.)

- VALIMET, Inc. (U.S.)

- AVL METAL POWDERS n.v. (Belgium)

- YuanyangTechnology (China)

- Angang Group Aluminium Powder Co., Ltd (China)

- NovaCentrix (U.S.)

- MMP Industries Limited (India)

- SCHLENK SE (Germany)

- Sri Kaliswari Metal Powders Pvt Ltd. (India)

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on crucial aspects such as leading companies, applications, and types. It also offers insights into market trends and highlights vital industry developments. In addition to these factors, the report encompasses various factors that have contributed to the market's growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.90% between 2026 and 2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 1.98 billion in 2025 and is projected to reach USD 2.78 billion by 2034.

Growing at a CAGR of 3.90%, the market is expected to exhibit steady growth during the forecast period.

Based on application, the industrial segment is leading the market.

Consistently rising product demand from the automotive, aerospace & defense industries is a key factor driving the market growth.

AMG Advanced Metallurgical Group NV, AMPAL Inc., and VALIMET, Inc. are a few of the leading players in the global market.

Asia Pacific dominated the waterproofing membrane market with a market share of 48% in 2025.

The continuous growth in the construction industry is expected to drive product adoption during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us