Antiviral Drugs Market Size, Share & Industry Analysis, By Drug Class (Protease Inhibitors, Polymerase Inhibitors, Integrase Inhibitors, Combination Drugs, Reverse Transcriptase Inhibitors, and Others), By Disease Indication (Hepatitis, Human Immunodeficiency Virus (HIV), Influenza, and Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Channel) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

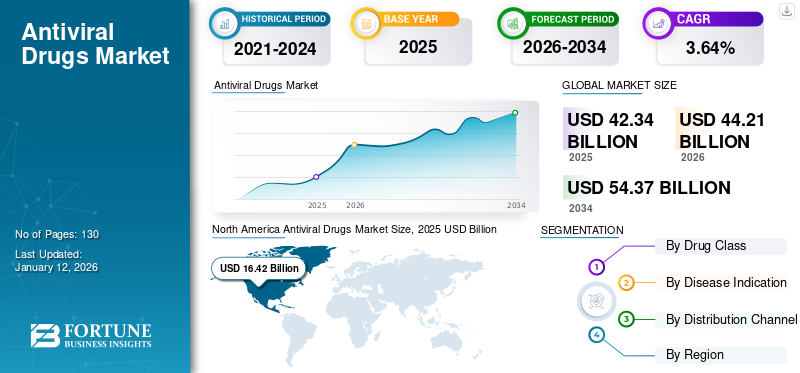

The global antiviral drugs market size was valued at USD 42.34 billion in 2025 and is projected to grow from USD 44.21 billion in 2026 to USD 54.37 billion by 2034, exhibiting a CAGR of 3.64% during the forecast period based on our analysis in the existing report. North America dominated the antiviral drugs market with a market share of 38.78% in 2025.

Virus is a particle of RNA or DNA enclosed in a structural protein. They infect the human cells and proliferate to cause viral infections. Viral infection is considered to be one of the most common causes of human illness and has a significant impact on the healthcare system across the globe. The infections spread rapidly in the community and are responsible for considerable morbidity. They can be severe and require a systematic approach for their management. In the developed economies, it is estimated that around 30% to 40% of the infectious gastroenteritis cases are attributable to viruses. Antiviral agents are thus, the therapeutics that restore the normal function of cells and eliminate the viral infection. They generally inhibit the replication of viruses inside the body.

Download Free sample to learn more about this report.

Various pharmaceutical companies are engaged in developing novel antiviral therapies across the globe to prevent the spread of communicable viral infections. Rising burden of viral diseases, especially in the developing nations and improved research collaboration of industries in the development of blockbuster therapeutics are the key factors associated with the market growth. For instance, around 125,000 to 200,000 infections occur annually in the U.S., out of which about 70% of adults are symptomatic, according to the Centers for Disease Control and Prevention. Such increasing prevalence of viral disease is expected to boost the antiviral drugs market size during the forecast period. There are over a thousand different types of viruses that infect humans and they account for around 60% of all human infections. However, lack of rapid diagnostic reagents and the speedy replication of viruses make it difficult to develop potent and effective antiviral therapy.

Global Antiviral Drugs Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 42.34 billion

- 2026 Market Size: USD 44.21 billion

- 2034 Market Size: USD 54.37 billion

- CAGR: 3.64% from 2026–2034

Market Share:

- Region: North America dominated the market with a 38.78% share in 2025. This is due to the strategic presence of key pharmaceutical giants in the U.S., a high prevalence of infections such as HIV, and a high rate of new drug approvals from the USFDA.

- By Disease Indication: The Human Immunodeficiency Virus (HIV) segment held the largest market share in 2018. The segment's dominance is driven by the rapid rise in the prevalence of HIV infection, improved treatment regimens, and favorable reimbursement policies for antiretroviral therapy in several countries.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by an improved pharmaceutical industry, frequent outbursts of viral diseases, and a strong focus on research and development for new antiviral therapies.

- United States: The market is fueled by a high prevalence of viral infections, with an estimated 125,000 to 200,000 new infections occurring annually. The country is also a major hub for the launch of blockbuster drugs, such as Biktarvy, which has significantly changed the landscape of antiretroviral therapy.

- China: Growth is supported by a large patient population, an improved pharmaceutical industry, and increasing government participation in the management of viral infections, which is driving the demand for effective antiviral therapeutics in the Asia Pacific region.

- Europe: The market is advanced by new product launches, favorable health reimbursement policies, and active government support for the development and distribution of antiviral drugs. The market is also seeing strategic collaborations, such as Boehringer Ingelheim's partnership to develop a new immuno-oncology candidate for gastric cancer.

MARKET DRIVERS

“Rising Prevalence of HIV and Influenza to Fuel Growth of Market”

HIV is emerging as the most common form of viral infection across the globe. Enhanced surveillance for HIV by using demographic and biological data has improved the diagnosis rate of the disease. According to WHO, around 37.9 million people were living with HIV in the globe in 2018, while 770,000 people died of this disease. Hence, the increasing burden of this infection is boosting the demand for targeted and specific treatment regimen and in-turn propelling the antiviral agents market growth.

Moreover, the rising incidence rate of influenza and its quick diagnosis are contributing to the high demand for antiviral therapeutics across the globe.

“Introduction of Blockbuster Therapeutics to Boost the Market”

Various key pharmaceutical giants are actively investing in the research and development of antiviral agents. The introduction of blockbuster drugs, such as Biktarvy by Gilead Science and Triumeq by GlaxoSmithKline have changed the face of antiretroviral therapy. Rising uptake of such blockbuster agents and their improved distribution by the manufacturers are likely to propel the antiviral market revenue during 2025-2032. Biktarvy received approval in February 2024 and it is targeting the populaces that are living with HIV globally. Out of those, around 21 million people are receiving antiretroviral therapy which allows the immune system to strengthen.

SEGMENTATION

By Drug Class Analysis

“Combination Drugs Segment to Witness Remarkable Growth”

Based on the drug class, the antiviral medication market is classified as protease inhibitors, polymerase inhibitors, integrase inhibitors, combination drugs, reverse transcriptase inhibitors, and others. Out of these, the combination drugs segment accounted for the highest market with a share of 63.32% in 2026., which is attributable to the remarkable performance of combination brands, such as Genvoya, Mavyret, Triumeq, etc. Also, green signal by USFDA for the launch of novel combination therapies of antiviral medication for flu is anticipated to boost the growth of this segment during 2019-2032.

To know how our report can help streamline your business, Speak to Analyst

The integrase inhibitors segment is projected to expand in the coming years owing to the remarkable performance of drugs, such as Tivicay and Isentress/Isentress HD. It is a well-tolerated class of antiretroviral drugs and has relatively higher potency than the other antiviral agents. These are the key factors for the significant investment in the R&D of integrase inhibitors and the estimated growth of this segment.

By Disease Indication Analysis

“Human Immunodeficiency Virus (HIV) Segment to Dominate the Market”

On the basis of disease indication, the antiviral therapeutics market is segmented into hepatitis, human immunodeficiency virus (HIV), influenza, and others. The others segment is further comprised of herpes infection, rotavirus infection, etc. The HIV segment registered the maximum market with a share of 82.04% in 2026., owing to the rapid rise in the prevalence of HIV infection. Also improved treatment regimen for HIV infection and favorable reimbursement policies for antiretroviral therapy in several countries are anticipated to augment the growth of this segment. It is, in turn, set to impact the market positively during the forthcoming period.

Participation of the governments in developing economies to promote virology education and to address the unmet need for effective antiviral therapeutics, especially for HIV infection, are improving the collaborative research for antiretroviral drugs. Moreover, the development of comprehensive guidelines on HIV-preventive interventions and evaluation of HIV preventive capacity of drug treatment services by WHO are likely to enhance the demand for HIV drugs during the forecast period.

By Distribution Channel Analysis

“Strong Government Support to Favor the Hospital Pharmacy Segment”

In terms of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online channel. Strong government support for viral diseases through establishment of government-aided hospital pharmacies, favorable reimbursement policies, and improved supply network of key companies are the major factors attributable to the expansion of the hospital pharmacy segment. The online channel segment is expected to register a relatively significant CAGR during the forecast period, due to the emergence of online pharmacy offering discounts and their rapid adoption by the masses. The retail pharmacy segment is anticipated to expand on account of the 47.66% market share in 2026. increasing patient pool and availability of OTC and generic medications for minor viral infections.

REGIONAL ANALYSIS

North America Antiviral Drugs Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

North America

North America, with a revenue of USD 16.42 billion in 2025, accounted for a major antiviral drugs market share. This is attributable to the strategic presence of key pharmaceutical giants in the U.S., increased prevalence of infections such as HIV in the country, and green signal by USFDA for the launch of blockbuster and effective therapies in North America. Europe is anticipated to witness a remarkable growth in the coming years owing to the favorable reimbursement policies for antiviral therapy and key players involved in the R&D of antiviral medication for HIV. The U.S. market is projected to reach USD 14.22 billion by 2026.

Asia Pacific

However, Asia Pacific is anticipated to reflect a relatively higher CAGR during the forecast period, which is attributable to the established supply network, improved pharmaceutical industry in countries, such as India and Japan, and frequent outburst of viral diseases, such as Ebola, dengue, and swine flu in the developing nations. Government participation in the management of viral infections in Brazil & Mexico and rising penetration of generic pharmaceutical companies are expected to boost the size of Latin America antiviral medication market during 2025-2032. Also, efforts made by public players to improve the awareness for key viral infections, such as HIV in the Middle East & Africa and effective therapeutics launches in countries such as South Africa are projected to augment the revenue generation from Middle East & Africa in the coming years. The Japan market is projected to reach USD 1.86 billion by 2026, the China market is projected to reach USD 2.72 billion by 2026, and the India market is projected to reach USD 2.57 billion by 2026.

Europe

In Europe, the market is estimated to flourish owing to new product launches, favorable health reimbursement, and active government support. In April 2019, Boehringer Ingelheim, a Germany based company, collaborated with PureTech Health, which will help the former to apply PureTech’s lymphatic targeting platform to the company’s immuno-oncology candidate for gastric cancer. As a result, the drug can be administrated directly to the gut lymphatics. The expected launch of such drugs that can be directly administered to the site is anticipated to fuel the market in Europe. In Latin America and the Middle East & Africa, the demand for gastric carcinoma treatment are projected to boost owing to the improving health infrastructure, unmet patient needs, and the launch of new products. The UK market is projected to reach USD 1.71 billion by 2026, while the Germany market is projected to reach USD 2.71 billion by 2026.

INDUSTRY KEY PLAYERS

“Gilead Sciences and GlaxoSmithKline to Lead the Market”

In terms of revenue, Gilead Sciences dominated the antiviral agents market owing to the remarkable sale of its drugs such as Biktarvy, Harvoni, etc. Genvoya, a leading fixed dose combination antiretroviral drug by Gilead, accounted for a revenue of more than USD 4.5 billion in 2018, which propelled the market share of the company. Another leading combination called Triumeq by GSK, generated over USD 3.4 billion revenue in 2018, which has provided a strategic position to the company in global market. Another key player operating in the market is AbbVie. The company is growing because of its significant performance in Hepatitis C.

List of key Companies Covered:

- Gilead Sciences

- GlaxoSmithKline

- Abbvie, Inc.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Janssen Pharmaceuticals, Inc.

- Mylan N.V.

- Novartis AG

INDUSTRY DEVELOPMENT:

- July 2021 - Vaxart, Inc., biotechnology company made an announcement that it has signed a licensing agreement with Altesa Biosciences Inc. The agreement is aimed at granting Altesa the right to develop and manufacture Vaxart’s proprietary formulation of Vapendavir, a clinical-stage broad spectrum antiviral.

- June 2021 - Pardes Biosciences, Inc. and FS Development Corp. II announced merger agreement. The agreement is aimed at advancing the oral antiviral drugs indicated for treatment against SARS-CoV-2 infections.

- March 2021 – Pfizer announced the initiation of Phase 1 clinical study for the development of oral antiviral drug indicated against SARS-CoV-2 infections. The oral antiviral candidate PF-07321332 is a protease inhibitor.

- January 2021 - ViiV Healthcare, a worldwide specialist HIV company majorly owned by GlaxoSmithKline plc along with Pfizer Inc. announced that the company received the approval from US Food and Drug Administration (FDA) for Cabenuva. The drug helps in reducing the treatment dosing days from 365 days to 12 days per year.

REPORT COVERAGE

The antiviral therapy has evolved over the years and is expanding at a rapid rate with the introduction of effective therapeutics by key companies. Investment by key pharmaceutical manufacturers in the R&D aiming to eradicate the viruses that are resistant to the existing traditional antiviral therapy, is changing the scenario of antiviral therapeutics market. Moreover, strong pipeline of the companies is expected to boost the market growth in coming years. For instance, Gilead Sciences entered in an antiviral deal with Novartis to gain exclusive rights to preclinical programs involving candidates for the treatment of herpes viruses, human rhinovirus, and influenza.

The antiviral drugs market report offers an in-depth analysis of the market. It further provides details on the prevalence of key viral infections for major countries, regulatory and reimbursement scenario for key countries, new product launches, and key industry developments, such as mergers, acquisitions, and partnerships. Information on drivers, opportunities, threats, and restraints of the market can further help stakeholders to gain valuable insights into the market. The report offers a detailed competitive landscape by presenting information on key players, along with their strategies, in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Drug Class

|

|

By Disease Indication

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

The value of the global antiviral drugs market was USD 42.34 billion in 2025.

Fortune Business Insights says that the antiviral drugs market is projected to reach USD 54.37 billion by 2034.

The value of North America antiviral drugs market was USD 16.42 billion in 2025.

The antiviral drugs market is projected to grow at a CAGR of 3.64% during the forecast period (2026-2034).

The combination drugs segment amongst the drug class criterion is the leading segment in the global antiviral drugs market.

The rising prevalence of viral infection, such as influenza and HIV and the presence of potential pipeline drugs are the key factors driving the global antiviral drugs market.

Gilead Sciences and GlaxoSmithKline are the top players in the global antiviral drugs market.

North America is expected to hold the highest share in the antiviral drugs market.

Investments in the development of potent antiviral agents and rising adoption of integrase inhibitors are the key global antiviral drugs market trends.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us