Autism Spectrum Disorder Treatment Market Size, Share & Industry Analysis, By Treatment Type (Communication & Behavioral Therapies {Applied Behavior Analysis (ABA), Speech & Language Therapy, Occupational Therapy, and Others} and Drug Therapies {Antipsychotic Drugs, Selective Serotonin Reuptake Inhibitors, Stimulants, Sleep Medications, and Others}), By Type (Autistic Disorder, Asperger Syndrome, Pervasive Developmental Disorder, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

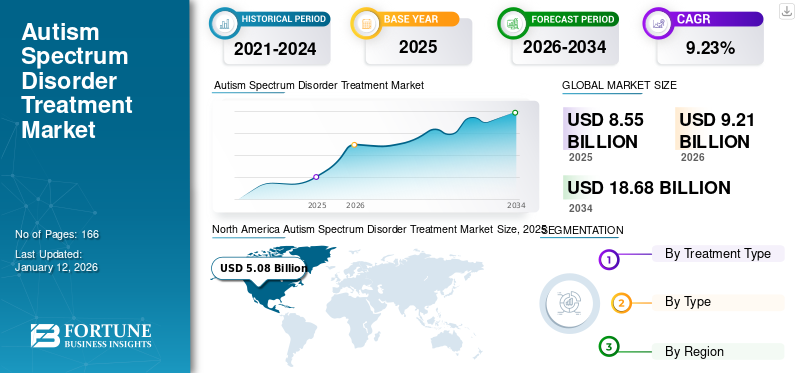

The global autism spectrum disorder treatment market size was valued at USD 8.55 billion in 2025 and is projected to grow from USD 9.21 billion in 2026 to USD 18.68 billion by 2034, exhibiting a CAGR of 9.23% during the forecast period. North America dominated the autism spectrum disorder treatment market with a market share of 59.45% in 2025.

Autism Spectrum Disorder (ASD) is a complex neurodevelopmental disorder characterized by persistent communication and social interaction deficits with a repetitive/restricted pattern of behavior or activities.

The market is witnessing an upward growth trajectory driven by rising ASD prevalence, growing awareness about the disorder, and persistent unmet need for therapies. Key players are focusing on investing in innovation and technology-based support solutions.

- For instance, according to the Center for Disease Control and Prevention (CDC) data published in May 2025, approximately 1 in 31 children aged 8 years in the U.S. are diagnosed with ASD. This number has increased from the prevalence rate of 1 in 68 children in 2010.

The market is also observing a strong growth owing to the active involvement of key players such as Bluesprig, Action Behavioral Centers (ABC), ACES ABA, Centria Autism, and others. These entities are focusing on advancements in service offered, collaboration & mergers, and other strategic initiatives to capture the untapped opportunities of the market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Autism Spectrum Disorders to Propel Market Growth

Rising prevalence of autism spectrum disorders is one of the prominent factors driving the autism spectrum disorder treatment market growth. The higher incidence of late marriages and conception, and increasing survival rate of premature babies is majorly contributing to the rising prevalence of autistic disorders globally. Moreover, exposure of certain environmental toxins such as pesticides, consumption of antidepressants drugs during pregnancy, or infection caused due to consumption of alcohol during pregnancy are few other factors contributing to the rising prevalence of autistic children.

- For instance, a research study was published by the team of researchers from India in the National Center for Biotechnology Information (NCBI) in February 2025. This study stated that Australia has the highest prevalence rate for autism, and the global prevalence rate was estimated to be 0.77%.

- Similarly, Singapore, South Korea, Japan, Brunei, and New Zealand are some of the leading countries with the highest autism rates.

This growing rate, combined with the high-unmet patient population in emerging countries, is anticipated to surge the demand for novel and effective drugs and therapies for autism spectrum disorder treatment. Consequently, this surge in demand is expected to drive market growth.

MARKET RESTRAINTS

Limited Access to Specialized Care May Impact Market Expansion

One of the major limitations for the adoption of ASD treatments is the inadequate access to advanced care options. Many regions suffer from clinician shortages in behavioral therapy, long waitlists, and single-person service delivery models. This results in limited access to specialized care in these regions. Limited access to qualified professionals for diagnosis and treatment, as well as specialized therapies including Applied Behaviour Analysis (ABA) in certain resource-restricted areas or for individuals with specific needs also hamper market growth.

Additionally, the diverse nature of ASD (Autism Spectrum Disorder) and the varying responses to treatments create uncertainty in clinical practice, making it challenging to define clear regulatory pathways and treatment protocols. The strict guidelines released by regulatory bodies regarding drug development for ASD restrict the key companies from developing and commercializing new drugs, thus deterring the treatment options.

MARKET OPPORTUNITIES

Growing Investments for Autism Treatment to Offer Lucrative Growth Opportunities

In recent years, the market space is witnessing a strong influx of investments by private equity companies. This is anticipated to offer lucrative growth opportunities for the market players. The autism treatment industry is one of the most underserved markets but the effectiveness of ABA therapy witnessed among the patient population is enlarging the investment rate in this market.

Also, owing to the high demand but shortage of supply, autism care is one of the fastest growing sectors in private equity funding. Private equity firms are actively investing in autism service providers, seeking to consolidate fragmented markets and drive efficiency.

- For instance, in June 2024, Tenex Capital Management acquired Behavioral Innovations from Shore Capital Partners LLC.

MARKET CHALLENGES

Challenges in Disease Diagnosis to Hinder Market Growth

The market faces challenges in diagnosis of the disease resulting in slower market growth. In regions such as China and South Korea, cultural beliefs and stigma reduce diagnosis rates and impede service uptake, even when symptoms are visible.

Additionally, misattribution of comorbid physical or mental health symptoms to autism can delay care. Marginalized groups such as women and racial minorities face more misdiagnosis and access barrier issues. Moreover, lack of definitive medical tests, variability and complexity of symptoms, and cultural & socioeconomic factors are some other factors creating challenges for the diagnosis of the disease.

AUTISM SPECTRUM DISORDER TREATMENT MARKET TRENDS

Introduction of Interventions for Autism Spectrum Disorder Treatment

One of the prevailing trends witnessed in the communication and behavioral therapies used for treating autism spectrum disorder (ASD) is the introduction of novel interventional and educational programs for children with autism. This involves a multi-faceted approach, often incorporating behavioral, psychological, educational, and pharmacological therapies. These treatments are aimed to enhance the patient’s ability to function independently and enhance their quality of life.

- For instance, Enzyme replacement therapy was introduced to address this medical condition and has become one of the most significant trends witnessed in autism spectrum disorder treatment.

Additionally, AI, and technology-based therapies are gaining traction, where systems using machine learning/deep learning and virtual/augmented reality are being explored to improve diagnosis and personalize interventions.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Treatment Type

Communication & Behavioral Therapies are Widely Adopted Due their Effectiveness

On the basis of treatment type, the market is divided into communication & behavioral therapies and drug therapies.

In 2024, communication & behavioral therapies dominated the global market with highest market shareof 74.75% in 2026. The segment is further divided into applied behavior analysis (ABA), speech & language therapy, occupational therapy, and others. The lack of approved drugs to treat the autism spectrum disorders results in higher demand for these therapies. In addition, increasing adoption and usage of various therapies globally also supports the segment growth. Notably, Applied Behavior Analysis (ABA) has proven to be more effective than any other treatment. Leading players in ABA therapy franchise model are also undertaking various initiatives to increase awareness and expand their market presence.

- For instance, according to the data published by Behavioral Health Business in May 2024, Able Autism Therapy Services expanded its geographical presence and sold two franchises by the end of 2024. The company also aims to accelerate this expansion in the near future with a goal to have around 50 franchises in the next five years.

On the other hand, the drug therapy segment includes some key drug classes, such as stimulants, SSRIs, antipsychotics, sleep medications, and others. This segment is anticipated to witness considerable growth in the coming years. The growing focus of pharmaceutical companies on the research & development of effective drugs is majorly contributing to the growth of this segment.

By Type

To know how our report can help streamline your business, Speak to Analyst

Autistic Disorder Segment Dominates Due to its Increasing Prevalence

The global market is categorized by type into Asperger syndrome, autistic disorder, pervasive developmental disorder, and others.

In 2024, autistic disorder segment captured the largest autism spectrum disorder treatment market share of 50.14% in 2026, supported by high prevalence of this disease, government support for people with learning disability, autism and others. Additionally, expansion of ABA therapy services through franchise models also helps segment growth.

- For instance, in October 2022, SUCCESS ON THE SPECTRUM inaugurated its new autism treatment center in Coppell, Texas, intending to expand its geographical presence in the U.S.

The pervasive development disorder (PDD) held the second largest market share in 2024. The rising number of individuals displaying impairment in verbal & nonverbal communication skills or presence of stereotyped behavior, interests, or activities is augmenting the segment’s growth.

Furthermore, Asperger syndrome and the others segment are estimated to grow at a relatively slower rate in the coming years. This is largely due to limited initiatives for conducting clinical studies for these types of ASD.

AUTISM SPECTRUM DISORDER TREATMENT MARKET REGIONAL OUTLOOK

Based on region, the market is divided into Europe, North America, Latin America, Asia Pacific, and the Middle East & Africa.

North America

North America Autism Spectrum Disorder Treatment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, North America dominated the global market with a revenue generation of USD 5.08 billion in 2025. The region is anticipated to maintain its dominance throughout the forecast period owing to several factors. These factors include high prevalence rate of autism, increasing number of treatment options, and others. Moreover, the growing support from private & public organizations to provide insurance coverage for this disease treatment is driving the adoption rate of the therapy across the region.

U.S.

The U.S. led North America’s market with the highest share in 2024. Widespread penetration of communication & behavioral therapies, growing adoption of ABA therapy, and emergence of franchise models by service providers to expand the customer reach are some of the key factors supporting the country’s growth. The emergence of the Franchise model to provide the ABA therapy has revolutionized the treatment landscape in the U.S. The U.S. market is projected to reach USD 5.11 billion by 2026.

- For instance, in January 2025, Success on the Spectrum (SOS) opened the first ABA therapy franchise in Austin, Texas. This center aims to help children with ASD reach their full potential and make a significant impact in the community.

Europe

In 2024, Europe accounted for the second-largest share of the global market. The growing prevalence of autism spectrum disorder in the region has brought opportunities for many pharmaceutical players to introduce new drug therapies. This is, in turn, driving the regional market growth. The UK market is projected to reach USD 0.21 billion by 2026, while the Germany market is projected to reach USD 0.37 billion by 2026.

- For instance, Aelis Farma, a France- based clinical-stage biopharmaceutical company is analyzing the feasibility of developing AEF0217 for autism spectrum disorder.

Asia Pacific

The market in Asia Pacific is poised to grow at the fastest rate over the forecast period. Several factors including supportive government policies, rising number of awareness initiatives, and increasing number of diagnosed cases of autism have cumulatively driven the regional market growth. The Japan market is projected to reach USD 0.42 billion by 2026, the China market is projected to reach USD 0.4 billion by 2026, and the India market is projected to reach USD 0.16 billion by 2026.

- According to an article published by YUVA in April 2023, there were more than 18 million reported cases of autism in India and the statistics demonstrated it affects 1 in 100 children.

Latin America and the Middle East & Africa

The markets in the Latin America and the Middle East & Africa regions are estimated to grow at a slower rate during the forecast period. The lack of provisions and government support for the diagnosis and treatment of this disorder has led to its slower growth.

COMPETITIVE LANDSCAPE

Key Market Players

Emphasis of Key Players on Collaborations & Expansion to Boost their Market Presence

The competitive structure of the autism spectrum disorder treatment market is highly fragmented with the presence of several global and regional companies that offer communication & behavioral therapies. On the other hand, the companies offering medications for autism are also high in number, as the market comprises both branded as well as generic drug manufacturers.

Some of the prominent players in the market that offer communication & behavioral therapies include BlueSprig, Action Behavioral Centers (ABC), ACES ABA, Centria Autism, CARD, and others. These service providers maintain their market position by expanding presence across the globe with strong service offerings for autism treatment.

- For instance, in October 2023, BlueSprig Family of Companies acquired Trumpet Behavioral Health, along with its affiliates Therapeutic Pathways and The Behavior Center.

Moreover, Otsuka Pharmaceuticals Inc., H. Lundbeck A/S, and Johnson & Johnson Services, Inc. are some of other leading companies in the drug therapy sector. Some key contributing factors include a strong distribution network, products with key regulatory approvals, and a strong emphasis on R&D initiatives.

LIST OF KEY AUTISM SPECTRUM DISORDER TREATMENT COMPANIES

- Hopebridge, LLC. (U.S.)

- SUCCESS ON THE SPECTRUM (U.S.)

- Center for Autism and Related Disorders, LLC. (U.S.)

- Behavior Innovations (U.S.)

- Applied Behavior Consultants, Inc. (U.S.)

- BlueSprig (Fusion Autism Center) (U.S.)

- Otsuka Holdings Co. Ltd. (Japan)

- AstraZeneca (U.K.)

- Pfizer Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2025: DeFloria, Inc. announced that the U.S. FDA has cleared its Investigational New Drug Application for phase 2 clinical trial of AJA001, an oral cannabinoid drug.

- December 2024: Kingdom Therapeutics Ltd. completed the meeting with the U.S. FDA for its lead candidate, KT-20610. This oral drug focuses on the ECS in Autism Spectrum Disorder (ASD).

- December 2024: Goldman Sachs Alternatives acquired Center for Social Dynamics (CSD) from NMS Capital (NMS). The acquired company is a leading provider of applied behavior analysis for individuals with Autism Spectrum Disorder (ASD).

- November 2024: Hopebridge, LLC. partnered with several universities to provide higher education to the Hopebridge’s staff and their immediate family members.

- May 2023: Hopebridge, LLC. launched a new Board Certified Behavior Analyst (BCBA) Career Pathway program for their behavior analyst professionals.

REPORT COVERAGE

The global autism spectrum disorder treatment market report offers in-depth and detailed analysis of the current market scenario. The report focuses on several key aspects related to the market such as growth drivers, market challenges, advancements in service offerings, regulatory framework, and others. Additionally, the report also encompasses key industry developments such as mergers, acquisitions, & collaborations and reimbursement scenario & economic cost burden for the treatment. Besides these, market analysis offers insights into the market trends and comprises a detailed overview of new models in treatment delivery.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.23% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Treatment Type

|

|

By Type

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 9.21 billion in 2026 and is projected to reach USD 18.68 billion by 2034.

In 2025, the North American market size stood at USD 5.08 billion.

Registering a CAGR of 9.23%, the market will exhibit significant growth over the forecast period (2026-2034).

By treatment type, the communication & behavioral therapies segment led this market during the forecast period.

The rising prevalence of this condition, along with increasing awareness about ASD through various initiatives, are the prominent factors driving the market growth.

Bluesprig, Action Behavioral Centers (ABC), and ACES ABA are some of the key players in the market in terms of service offerings.

North America held the dominating share of the market in 2024.

Increasing need for effective treatment options for autism coupled with growing investment for research & development of innovative candidates is expected to drive the drug adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us