Clinical Trials Market Size, Share & Industry Analysis, By Phase (Phase I, Phase II, Phase III, and Phase IV), By Application (Oncology, CNS Disorder, Cardiology, Infectious Disease, Metabolic Disorder, Renal/Nephrology, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

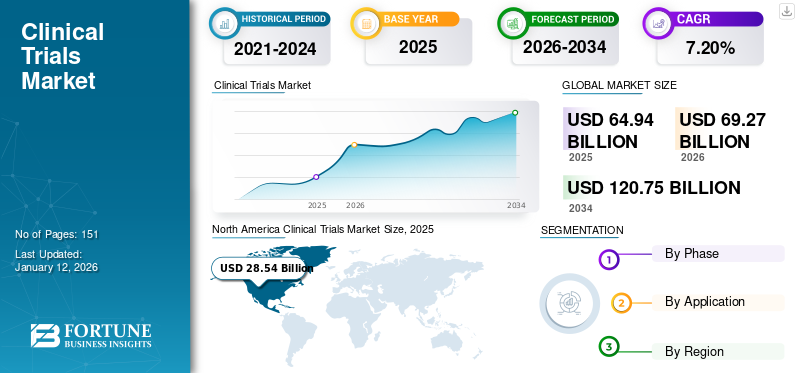

The global clinical trials market size was valued at USD 64.94 billion in 2025 and is projected to grow from USD 69.27 billion in 2026 to USD 120.75 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. North America dominated the clinical trials market, accounting for a 43.90% market share in 2025.

Clinical trials are a critical process in developing new therapies or medical devices. These studies analyze new drugs, medical devices, or other therapeutic agents, providing a scientific basis for effective patient care and evaluating the safety and efficacy of these agents. The increase in research and development by pharmaceutical and biotech companies worldwide has led to a corresponding rise in the number of clinical studies.

Market players, including IQVIA, Laboratory Corporation of America Holdings, and Pfizer, Inc., have been focusing on adopting advanced technology to increase the efficiency of their clinical research studies. Furthermore, the growth of these companies has also contributed to the market's expansion, with a focus on developing new treatments for chronic diseases and increasing demand for R&D outsourcing. For example, in July 2021, China's Beijing Disease Fund (ICF) established a strategic relationship with Palexel. This innovative collaboration aimed to obtain direct feedback from people with rare diseases to improve their participation in these studies.

Global Clinical Trials Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 64.94 billion

- 2026 Market Size: USD 69.27 billion

- 2034 Forecast Market Size: USD 120.75 billion

- CAGR: 7.20% from 2025–2034

Market Share:

- Region: North America dominated the market with a 43.90% share in 2025. This is due to increased R&D spending by pharmaceutical companies to improve drug development and a strong focus from Contract Research Organizations (CROs) on enhancing their service offerings.

- By Phase: Phase III clinical trials held the largest market share. This is attributed to the increasing trend of pharmaceutical and biotechnology companies outsourcing their late-stage clinical studies to CROs and the significant investment required for these large-scale trials.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan is seeing a rise in clinical trial activity due to the increasing prevalence of infectious and chronic diseases, which is propelling the demand for new and effective drugs.

- United States: The market is driven by high R&D expenditure from major pharmaceutical companies. For example, the pharmaceutical industry’s R&D spending reached USD 83.00 billion in 2019, and a significant portion of this is allocated to clinical trials.

- China: As an emerging market, China is becoming an attractive destination for clinical trials. This is due to its diverse patient population, cost-effective operational environment, and a growing number of CROs establishing a presence in the region.

- Europe: The market is advanced by substantial R&D expenditure from leading pharmaceutical, biotechnology, and MedTech companies. In 2022, the pharmaceutical R&D expenditure in Europe was approximately USD 46.8 billion, a significant portion of which is dedicated to funding clinical trials.

Market Dynamics

Market Drivers

Rising Prevalence of Chronic Diseases has been Fueling the demand for Effective Therapeutics

The burden of chronic diseases, such as cancer, diabetes, and asthma, has been growing significantly across the globe, fueling the demand for effective therapeutics.

- For instance, a per the data provided by the University of Washington (UW) education, in June 2023, the global population of individuals living with diabetes currently exceeds half a billion, and projections indicate it will surpass 1.30 billion within the next three decades. This growth is anticipated across all countries, marking a significant global increase.

- Similarly, according to the data published by the Global Cancer Observatory, in 2022, around 605,805 new cancer cases were reported in Germany, with 1,886,716 prevalent cases over the past five years .

To fulfill the increasing demand for effective treatments, market players have been focusing on conducting trials, fueling the clinical trials market growth.

Rising Number of Clinical Trials Globally to Fuel Market Growth

The number of clinical trials conducted annually has been growing significantly.

- For instance, as per the data published by WHO in 2022, the total number of these trials conducted in 2021 experienced an increase of 11.7% from the prior year.

Therefore, the increasing number of trials globally has been fueling market growth.

Market Restraints

Limited Availability of Skilled Workforce and High Costs of Study Trials Limit the Market Growth

Globalization has driven the adoption of advanced technologies across inustries, leading to the creation of new professional opportunities in the clinical trial sector. Furthermore, the increased industrialization and the requirements for new amenities have sparked the need for new skills, causing competency issues in the job market.

Contract Research Organization (CRO) services face issues to attract and retain proficient experts, as they require experienced scientists from pharmaceutical, biotechnology, academic & research institutes, and medical device industries. To remain competitive, companies must give high-paying roles and other such recognitions to compete efficiently. This shortage of skilled professionals impacts the capital and operational outcomes of various market players, especially small-scale analytical testing providers. Limited acess to experienced professionals could limit the adoption of advanced technologies and processes, potentially restraining market growth in the coming years.

Regulatory compliance plays a significant role in increasing clinical trial costs. From the early phase studies to product approval and launch, the whole process is quite costly. According to the Tufts Center for the Study of Drug Development, on average, the complete drug development process costs USD 2.60 billion to develop a new medicine, including the cost of failures. Moreover, only 12.0% of drug candidates entering study clinical trials receive U.S. FDA approval.

Another important factor driving trial costs is the complexity of study protocols and design. In addition to financial costs, clinical trials face challenges such as personnel recruitment difficulties, long-term terms, participant retention issues, gaps in the clinical research studies, and regulatory obstacles affecting drug approval.

Market Opportunities

Increasing Outsourcing to CROs to Stimulate Market Development

Clinical trial costs for certain disease indications can be very high, depending on the number of sites and patients recruited. In recent years, private pharmaceutical R&D spending has surged significantly to develop effective therapeutics.

- For instance, as per the European Federation of Pharmaceutical Industries and Associations (EFPIA), pharmaceutical R&D expenditure in 2022 was USD 46,792.8 million, reflecting a 7.2% higher from the prior year.

Many pharmaceutical, biotechnological companies, and research institutes have started collaborating with CROs to outsource their research studies to reduce the overall clinical trial cost and speed up the process.

- For instance, in March 2023, ICON plc partnered with LEO Pharma to conduct clinical studies and develop effective medicines for dermatology patients.

Earlier, research conducted by small pharmaceutical and biotechnological companies was limited due to a lack of in-house reaserch facilities. However, with the rise of CROs, many small and emerging companies are increasingly outsourcing their research studies to reduce costs.

Market Challenges

Patient Recruitment and Retention

Enrolling and retaining participants remain a significant hurdle, often leading to extended timelines and increased expenses.

- Regulatory Hurdles

Strict regulatory approval processes and variations across countries can result in delays and increase trial costs.

- Ethical Considerations

Ensuring informed consent, maintaining data privacy, and upholding ethical standards are critical, especially with the rise of rapid trials and AI integration. This factors can delay the initiation and completion of clinical studies.

Download Free sample to learn more about this report.

Clinical Trials Market Trends

Increased Investments in R&D by Pharmaceutical and Biotechnological Companies to Fuel Market Growth

Many medical, pharmaceutical, and biopharmaceutical companies continue to invest significant resources in developing technologies and drugs. The pharmaceutical sector, in particular, has prioritized R&D initiative to develop innovative therapies. Pharmaceutical and biotechnology companies have increased their focus on expanding their R&D efficiencies by investing in R&D.

- For instance, according to the research article published by NCBI, in 2021, overall pharmaceutical expenditures in the U.S. increased by 7.7% compared to 2020, reaching a total of USD 576.90 billion.

Moreover, over the past two decades, both R&D spending and the launch of new drugs have witnessed notable growth, driven by the rapidly growing demand for clinical studies for innovative medicines to treat a wide range of diseases.

- For instance, as per the data published by the Congressional Budget Office in April 2021, the pharmaceutical industry’s research and development expenditure reached USD 83.00 billion in 2019, marking a tenfold increase compared to its yearly spending in the 1980s, when adjusted for inflation.

Furthermore, pharamaceutical companies are increasingly outsourcing their R&D activities to CRO to enhance efficiency and ensure the smooth execution of these trials.

Other Trends

- Artificial Intelligence (AI) Integration

Pharmaceutical companies are increasingly adopting AI to expedite drug development processes, enhance data analysis, and improve patient recruitment strategies. Artificial intelligence’s potential to reduce costs and timeframes is transforming traditional clinical trial methodologies.

- Shift Toward Emerging Markets

Countries such as India and China are becoming attractive destinations for trials due to their diverse patient populations and cost-effective operational environments.

- Decentralized Clinical Trials (DCTs)

The adoption of DCTs, which utilize digital health technologies to conduct trials remotely, is rising. This approach enhances patient participation and streamlines data collection, addressing traditional logistical challenges.

Impact of COVID-19

The impact of the COVID-19 pandemic slowed market growth during the pandemic in 2020, as many clinical studies were suspended due to lockdown restrictions and limited resources. However, pharmaceutical and biotechnological companies have increased their focus on partnership and collaboration for developing vaccines and therapeutics for the COVID-19 virus.

- In January 2021, ICON plc, BioNTech, and Pfizer announced their partnership to develop an experimental COVID-19 vaccine program to provide clinical trial services.

Moreover, the market experienced significant growth in 2021 and 2022 following the lifting of lockdown restrictions and an increase number of clinical studies aimed at developing effective vaccines.

Segmentation Analysis

By Phase

Increasing Investment by Pharmaceutical Companies in Outsourcing their Research Studies is Responsible for the Phase III segment dominance

Based on phase, the market is segregated into phase I, phase II, phase III, and phase IV.

Phase III segment dominated the global market share by 46.95% in 2026 attributed to the increasing focus of the pharmaceutical and biotechnology companies in outsourcing their clinical studies to the CROs.

- For instance, according to a 2021 article published by the Congressional Budget Office, pharmaceutical companies spent an average of USD 282 million in phase III clinical studies in the U.S.

The phase II segment is expected to grow at the fastest CAGR during the forecast period attributed to the increasing prevalence of chronic diseases and increasing investment by pharmaceutical companies in the R&D of novel treatments.

To know how our report can help streamline your business, Speak to Analyst

By Application

Oncology Segment Led due to Rising Need for Cancer Therapeutics

Based on application, the market is segmented into renal/nephrology, cardiology, metabolic disorder, infectious disease, CNS disorder, oncology, and others.

The oncology segment dominated the market by generating the highest revenue in 2026 attributed to the increasing demand for effective cancer therapeutics. The segment is likely to capture 29.67% of the market share in 2026.

- For instance, Shandong Suncadia Medicine Co., Ltd. initiated a phase I trial in April 2024 to study the safety and efficacy of HRS-7058 for treating advanced malignant tumors, With an expected completion date in June 2026.

The CNS disorder segment is expected to grow at a significant CAGR during the forecast period, driven by the increase in the prevalence of CNS disorders. For instance, as per the data published by the World Health Organization (WHO) in March 2024, around 1 in 3 people suffer from neurological disorders globally.

The metabolic disorder segment is expected to grow substantially during the forecast period. This is due to the rise in prevalence of chronic diseases, such as diabetes. For instance, according to a published article in 2020 by OECD-iLibrary, in Asia Pacific, around 227 million people were living with type 2 diabetes, with half of them undiagnosed, propelling the demand for CRO services in the metabolic disorder segment.

Cardiology segment is anticipated to capture a CAGR of 4.6% during the forecast period.

Clinical Trails Market Regional Outlook

Based on geography, the market is studied across North America, Europe, Asia Pacific, and Rest of the World.

North America

North America Clinical Trials Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for a major clinical trials market share, generating a revenue of USD 28.54 billion in 2025, and in 2026, the regional value was accounted for USD 30.27 billion. Pharmaceutical companies have increased their spending on R&D to improve their drug development, driving market growth.

- For instance, Pfizer Inc. spent USD 10,822.0 million on R&D in 2024, experiencing a growth of 1.3% compared to 2022.

Furthermore, the U.S. dominated clinical trials market in 2025 attributed to the increasing focus of the CROs on enhancing their service offerings. The U.S. market size is expected to hit USD 26.25 billion in 2026.

Europe

The market in Europe accounted for a substantial market share in 2025 and is expected to witness stagnant growth during the forecast period. The region is anticipated to account for the second-highest market size of USD 23.10 billion in 2026, exhibiting the second-fastest growing CAGR of 33.60% during the forecast period. The market growth in the region is attributed to increased R&D expenditure by leading pharmaceutical, biotechnology, and MedTech companies. The U.K. market size is estimated to be 4.10 billion in 2026, whereas Germany market is expected to be USD 4.51 billion and France is likely to hold USD 3.73 billion in 2025.

- For instance, in 2024, Novartis AG spent around USD 10,022.0 million on R&D.

Asia Pacific

Asia Pacific is likely to be the third-largest market with a value of USD 13.71 billion in 2026. Moreover, the market across the Asia Pacific region is expected to expand at the fastest CAGR during the forecast period. The increasing prevalence of infectious and chronic diseases across the region is expected to propel the demand for new drugs, thereby increasing market growth. The market in China is expected to be USD 3.87 billion in 2026. On the other hand, India is expected to be USD 3.24 billion and Japan is projected to hit USD 2.81 billion in 2026.

- For instance, as per the data published in December 2023, around 35.0% of the Indian population is suffering from chronic illnesses, including diabetes and cardiac-related disorders.

Rest of the World

The market in Latin America and the Middle East & Africa is expected to grow significantly due to the increasing focus of healthcare companies in conducting research studies in these regions with an aim to perform cost-effective studies.

Competitive Landscape

Key Industry Players

Pharmaceutical Companies with a Strong Focus on the R&D for New Product Launches to Hold Key Market Share

IQVIA Inc., Icon plc, and Syneos Health are among the prominent players in the market and captured significant portion of the global market share in 2024.

IQVIA Inc. accounted for significant market share in 2024, driven by its strong emphasis on R&D service enhancement.

- For instance, in November 2021, IQVIA Inc. announced its data aggregation strategy as a foundation to improve market insights. This intiative helped the company’s ability to integrate data and services, improving help patient outcomes and operational efficiency.

Other significant players operating in the market, such as Parexel International Corporation, Thermo Fisher Scientific Inc., and Medpace, emphasize various strategic developments such as service expansion and partnerships to enhance their market position.

LIST OF KEY CLINICAL TRIALS COMPANIES PROFILED

- IQVIA Inc. (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Parexel International Corporation (U.S.)

- Medpace Holdings, Inc. (U.S.)

- Icon plc (Ireland)

- Syneos Health (U.S.)

- WuXi AppTec (China)

- Charles River Laboratories (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2024 – Thermofisher Scientific Inc. partnered with the National Cancer Institute (NCI) to enhance the clinical research for Acute Myeloid Leukemia (AML) and Myelodysplastic Syndrome (MDS) treatment therapeutics.

- June 2024 – IQVIA Inc. announced the launch of One Home for Sites, a platform that acts as a single sign-on and a single dashboard for key systems and tasks required at trial sites for various types of clinical trials.

- June 2024 – Laboratory Corporation of America Holdings launched Labcorp Global Trial Connect, a laboratory service, desgned to increase the speed clinical trial.

- December 2023 – Thermo Fisher Scientific Inc. introduced CorEvidence, a cloud-based optimizing pharmacovigilance case processing and safety data management.

- December 2021 – Laboratory Corporation of America Holdings acquired Toxikon Corporation, strengthening its non-clinical development portfolio.

- November 2021 – Icon plc announced the expansion of reach and capabilities of its Accellacare Site Network through new partnerships with six research sites across four countries.

REPORT COVERAGE

The clinical trials market report provides a detailed competitive landscape. It includes the number of clinical trials and key industry developments such as partnerships, mergers, and acquisitions. Additionally, it focuses on key points such as new product launches in the market. Furthermore, the report covers regional analysis of different segments, company profiles of key players, and market trends. The report consists of quantitative and qualitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.20% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Phase

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 64.94 billion in 2025 and is projected to reach USD 120.75 billion by 2034.

In 2025, the market value stood at USD 28.54 billion.

The market is expected to exhibit a CAGR of 7.20% during the forecast period.

The phase III segment leads the market by phase.

The key factors driving the market are the increasing prevalence of chronic diseases and the rising number of clinical trials.

IQVIA Inc., Icon plc, and Syneos Health are the top players in the market.

Clinical trials are research studies conducted to test how new medical treatments, drugs, or devices work in people. They help determine whether a new approach is safe, effective, and better than existing options.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us