Automotive Glass Market Size, Share, and Industry Analysis, By Glass Type (Tempered, Laminated), By Application (Windshield, Sidelite, Backlite, Sunroof), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

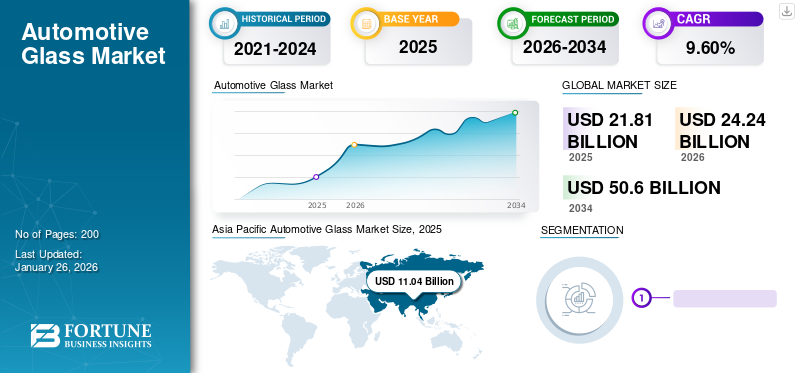

The automotive glass market size was valued at USD 21.81 billion in 2025 and is projected to grow from USD 24.24 billion in 2026 to USD 50.60 billion by 2034, exhibiting a CAGR of 9.60% during the forecast period. Asia Pacific dominated the global market with a share of 50.60% in 2025.

Rapid growth in the transportation and logistics sector has fueled the production of heavy-duty vehicles. Increasing disposable income and rising population across the globe has also boosted the manufacturing and sales of automobiles. These key factors are driving the automotive glass market growth. Technological advancements in vehicle glass are enabling cost and weight reductions while improving driver comfort and safety.

Also, safety standards implemented by various governments concerning occupant crash protection are fueling the advancement in this type of glass. For instance, the Federal Motor Vehicle Safety Standard 205, introduced by the US government, addresses precise standards for auto glass transparency and strength. Additionally, they also introduced Standard 212, which includes standards for the amount of force/damage a windshield could withstand during an accident.

The COVID-19 pandemic lockdown caused a significant downturn in automobile production, notably in the first half of 2020. Global auto production, per the International Organization of Motor Vehicle Manufacturers (OICA), fell by 16% to under 78 million vehicles in 2020, akin to 2010 sales levels. Consequently, this downturn directly impacted auto glass demand in 2020. However, electric vehicle (EV) sales continued to surge, buoyed by existing policies and new stimulus measures to revive the automotive sector. The International Energy Agency reported a 40% increase in global EV sales to 3 million in 2020 from 2.1 million in 2019, with China alone witnessing a 12% rise compared to 2019.

Download Free sample to learn more about this report.

Automotive Glass Market Trends

Increased Adoption of Sunroof and Growing Focus on Safety to Drive Market Growth

Focus on improving the application of sunroof in mainstream vehicles and use of features such as head-up displays to improve driver alertness has led to increased investment in technological up-gradation of automotive glass. Set standards for windshield retention and roof crush during the rollover to enhance the safety features of cars is driving market trends. All these factors support and complement each other, owing to which the market is witnessing substantial growth. In March 2024, MG Motor continued its portfolio expansion with additional variants for the ZS EV, following the Hector and Comet EV. The ZS EV offers four variants: Executive, Excite Pro, Exclusive Plus, and Essence. The Executive variant introduces a dual-pane, panoramic sunroof.

Increasing Application of Glass in Automobiles and Environmental Benefits to Boost Market

Aerodynamic styling results in a more pronounced installation angle of windshields and back windows, thus making them longer. The added surface area increases the importance of the look of glass on the vehicles resulting in increasing preference for sunroofs and moonroofs. Reflective coatings decrease the air conditioning load, thus saving gas and reducing air pollution. Therefore environmental benefits of advancement in this type of glass are expected to have a positive impact on the market.

Automotive Glass Market Growth Factors

Growing Demand for Electric & Hybrid Vehicles to Drive Market Growth

Emphasis on emission control and stringent environmental regulations are advancing the production of hybrid and electric vehicles, boosting the market growth. Consumers and manufacturers are likely to seek more eco-friendly cars to comply with government norms, giving a push to hybrid & electric vehicles, which is driving the product.

Rise in Vehicle Production Drives the Market Demand

Vehicle manufacturers require large quantities of automotive glass for new vehicle assembly. As the production of vehicles increases, so does the demand for automotive glass from OEM suppliers. This demand encompasses various types of glass, including windshields, side windows, rear windows, and panoramic roofs. The automotive industry's expansion into new markets, especially in emerging economies, leads to increased vehicle production. As more vehicles are manufactured globally, there is a corresponding rise in demand for automotive glass to equip these vehicles with windows and other glass components. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production increased by around 10.3% in 2023, as compared to the previous year, 2022.

RESTRAINING FACTORS

High Cost and Intensive Capital Investment to Restrain Market Growth

The cost of laminated glass is substantially higher compared to tempered glass and the use of this technology is considerably restrained by low adoption in developing countries. Also, a high capital cost is required for R&D and the production of thin laminated glass for side windows. This investment, coupled with an emphasis on reducing production costs and cost burden on consumers, is anticipated to restrain the growth of this market.

Automotive Glass Market Segmentation Analysis

By Glass Type Analysis

Tempered Glass Segment Dominated Market in 2023 Due to Low Cost

Based on type, the market is segmented into laminated glass and tempered glass.

The laminated glass segment is anticipated to dominate the market over the forecast period. Some European OEMs such as Mercedes and BMW have standardized side glazing in their top-selling models. Laminated side glazing provides enhanced safety to occupants in case of vehicle rollover in an accident, which is projected to drive the growth of this market. The tempered glass leading segment with a share of 76.17% &, is estimated to show a steady increase in the market & leading in 2026. The more straightforward manufacturing process and low cost coupled with high demand for sidelite and backlite are projected to drive the growth in this segment.

By Application Analysis

Sidelite Segment will Dominate Market Attributed to Higher Number of Sidelite Required in Each Vehicle

By application, the market is segmented into windshield, sidelite, backlite, and sunroof.

The sunroof segment is anticipated to dominate the market over the forecast period. Sunroof offers more control over the entry of natural light into the car. Increasing investments by new market entrants and the demand for energy-efficient products is likely to drive market growth in this segment. The windshield segment is estimated to show significant growth in the market owing to technological advancements such as embedded sensors and smart materials, augmented displays, self-cleaning glass, etc. The sidelite segment is projected to show strong growth in the market, driven by rising road accidents, which will accelerate demand for higher-quality side glass. Backlite segment is also expected to show steady growth in this market. Leading in the segment with a share of 71.94% in 2026

By Vehicle Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Passenger Car Segment to Hold Largest Automotive Glass Market Share Owing to High Demand in Developing Countries

Based on vehicle type, the market is segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, and electric vehicles (EV). The passenger car segment is anticipated to dominate the market over the forecast period. The increasing sales of passenger cars in China and India are likely to drive the growth in this segment. The LCV segment is estimated to show steady growth in the market owing to the rising popularity of crossover SUVs and the high demand for intra-city trucks and buses. The HCV segment is projected to show significant growth in the market owing to the need for lightweight and safety-oriented long haul transport vehicles. The EV segment is also expected to show considerable growth in this market owing to the early adoption of technologies such as head-up displays and smart glass for the panoramic sunroof.

REGIONAL INSIGHTS

Asia Pacific Automotive Glass Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest share of the market and is valued at USD 9.54 billion in 2023. China and India are key driver countries for the growth of the market in this region. Improving economic conditions and high population growth has resulted in increased vehicle production. This factor has led to increased demand for the product, and consumer preference for SUVs in China and India, which require more volume of glass compared to other vehicles, is likely to drive the market growth in this region.

Europe holds the second-largest share in the market and is also estimated to show significant growth in the market over the forecast period. Strict vehicular safety regulations, the presence of leading innovators such as Saint-Gobain Sekurit, and the increasing share of electric vehicles are factors driving the market growth in this region.

North America is projected to show steady growth in the market during the forecast period. Early adoption of advanced glass glazing techniques by numerous companies, including Magna International and Guardian Glass, among others, is expected to have a positive impact on market growth in this region.

List of Key Companies in the Automotive Glass Market

Saint-Gobain to Remain Dominant Player in Market owing to Industry-Leading Products

Saint-Gobain is the leading player in this market. Through Saint-Gobain Sekurit, the group equips the world's leading automakers with glass roofs, backlites, windshields, sidelites, and pre-assembled modules. Saint-Gobain Sekurit glazing enables reduced vehicle energy consumption and provides innovative solutions to user demands for safety and comfort. Saint Gobain, through its Autover subsidiary, is also growing its business in the distribution of automobile glazing on the independent aftermarket. However, Magna International Inc. and Asahi Glass, among others, have provided intense competition via expansion strategies, partnerships, and new product development, which has led to an increased focus on research and development of vehicle glass.

LIST OF KEY COMPANIES PROFILED:

- Saint Gobain Sekurit (Herzogenrath, Germany)

- Fuyao Glass Industry Group Co. Ltd (Fuzhou, China)

- AGC Inc. (Tokyo, Japan)

- Xinyi Glass Holdings Limited (Hong Kong, China)

- Nippon Sheet Glass Co. Ltd (NSG) (Tokyo, Japan)

- Magna International Inc. (Aurora, Canada)

- Guardian Glass LLC (Michigan, U.S.)

- Webasto Group (Stockdorf, Germany)

- Corning Incorporated (New York, U.S.)

- Schott AG (Mainz, Germany)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - AGC, a leading provider of glass, chemicals, and high-tech materials for mobility, returns to CES 2024. The company will present over 20 advanced solutions to elevate connectivity, sensor integration, and passenger comfort in the evolving mobility landscape. The company will spotlight innovative, on-glass integrated solutions, reflecting market trends.

- September 2023 - Şişecam showcased its automotive replacement glass range at the Auto Glass Week Fair, held in Virginia Beach from September 20 to 22.

- August 2023 - Şişecam joined ZEvRA to produce low-carbon auto glass for electric vehicles, supported by USD 0.27 million from the EU's Horizon Europe. Fraunhofer Institute coordinated the project towards the EU's 2035 zero-emission goal with 28 partners, including Skoda, Citroen, Peugeot, Toyota, and Volkswagen.

- May 2022 - The NSG Group integrated its Automotive glass business in China with SYP Kangqiao Autoglass Co., Ltd. ("SYP Automotive"), a prominent Chinese automotive glass manufacturer. This integration with SYP Automotive enhanced NSG Group's capacity to fulfill the increasing demands of vehicle manufacturers in China.

- July 2021 - Corning Inc. introduced a product category in Automotive Glass Solutions with Hyundai Mobis' Augmented Reality Head-Up Display. AR HUDs transform windshields into immersive screens, projecting dynamic driving information directly onto the road for enhanced driver visibility and safety.

- May 2021: Wideye, the European division of AGC Automotive, announced the creation of Wideye Rhino, dedicated to developing sensor protection glass solutions for non-automotive applications.

- October 2020: NSG Group announced that its windshield Head-Up Display (HUD) technology that planned to be installed in General Motors’ all-new full-size SUVs: the 2021 GMC Yukon/Yukon XL, 2021 Chevrolet Tahoe and Suburban, and 2021 Cadillac Escalade/Escalade ESV models.

- September 2020: AGC Inc. launched Curved-large cover glass for car-mounted displays has been installed in Cadillac's Luxury SUV, new 2021 Escalade. It has been used as the protecting surface glass for the industry’s first curved P-OLED (Plastic OLED) display supplied by LG Display and LG Electronics.

- June 2020: AGC Inc. launched light control glass, 'WONDERLITETM Dx', which has been implemented for the panoramic sunroof of Toyota's new Harrier, launched for sale on June 17, 2020.

REPORT COVERAGE

The global automotive glass market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, Types, and leading applications of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market over recent years.

An Infographic Representation of Automotive Glass Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

202-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) & Volume (Thousand Units) |

|

Segmentation |

By Glass Type

|

|

By Application

|

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 21.81 billion in 2025 and is projected to reach USD 50.60 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 11.04 billion.

Registering a CAGR of 9.60%, the market will exhibit good growth over the forecast period (2026-2034).

In terms of vehicle type, the passenger car segment will dominate the market during the forecast period.

Easy availability of necessary raw materials and decreasing scale-up costs will drive the growth of the market.

Saint Gobain Sekurit, AGC Inc. and Nippon Sheet Glass Co. Ltd are the major key players in the global market.

The Asia Pacific held the largest share in the market in 2025.

Increasing consumer preference towards electric vehicles and larger cars such as SUVs and stringent safety norms will drive the growth of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic