Automotive Sunroof Market Size, Share & Industry Analysis, By Vehicle Class (Economical, Medium Priced, and Luxury), By Propulsion Type (ICE and Electric), By Material Type (Glass and Fabric), By Product Type (Panoramic Sunroofs, In-Built Sunroof, and Others (Tilt & Slide, Pop Up, and Top Mount)), By Operation Type (Electric and Manual), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

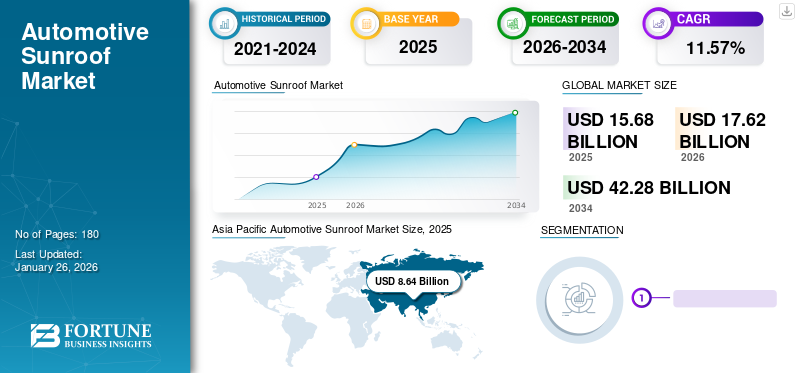

The global automotive sunroof market size was valued at USD 15.68 billion in 2025. The market is projected to grow from USD 17.62 billion in 2026 to USD 42.28 billion by 2034, exhibiting a CAGR of 11.57% during the forecast period. Asia Pacific dominated the global market with a share of 55.11% in 2025.

A vehicle sunroof is a fixed or operable opening in a vehicle roof that allows light and fresh air to enter the passenger compartment. This are either transparent or non-transparent panels that are manually operated or automatic. Various types of sunroofs are available in the market depending on the shapes, sizes, and features of the vehicles.

An automotive sunroof provides greater brightness, illumination, and improved air circulation, which further increases the comfort level of passengers. Hence, there is a growing trend among Original Equipment Manufacturers (OEMs) to offer spoiler-type or inexpensive removable sunroofs as an optional feature in passenger cars and premium vehicles in the automotive industry. The COVID-19 pandemic, due to lockdowns across the world, severely affected the automotive industry. The economic uncertainty created by the pandemic reduced consumer spending on vehicles. The decline in consumer demand for automobiles, including vehicles with sunroofs, negatively impacted the market growth.

Automotive Sunroof Market Trends

Technological Advancements in Passenger Vehicle Sunroofs to be a Prominent Market Trend

With the increasing integration of technology in automobiles, smart sunroofs have emerged as a recent trend. They come with automated opening and closing features, adjustable tinting, and integration with vehicle connectivity systems or smartphone apps. Thus, the increasing adoption of advanced sunroofs will drive the automotive sunroof market growth. Sunroofs with integrated solar panels and solar cells have emerged as a sustainable solution. These solar sunroofs can generate electricity to power auxiliary systems, such as ventilation or charging electronic devices, thereby reducing the load on the vehicle battery and improving the overall efficiency.

For instance, in February 2023, Indian startup Vayve Mobility announced that it would launch a solar-powered electric car Eva in the market in 2024. The electric vehicle contains 150-watt solar panels on the sunroof that can give it 10-12 km of range every day — or 3,000 km a year. Moreover, the power from the 14kWH battery can fuel a drive of 250 km. These developments will drive the market growth during the forecast period.

Download Free sample to learn more about this report.

Automotive Sunroof Market Growth Factors

Increasing Adoption of Sunroofs in Sport Utility Vehicles to Boost Market Growth

Sports Utility Vehicles (SUVs) have witnessed an increased adoption, particularly in developing countries, such as China and India, as they offer versatility in range, power output, and other features, and are suitable for off-road and rough terrain conditions. Hence, these factors have compelled manufacturers including Ford, Chevrolet, and Toyota, which are prominent players in the SUV segment, to provide advanced features for enhanced consumer satisfaction. Initially, automotive sunroofs were exclusive to premium cars.

However, their popularity among the youth and ability to maintain optimum levels of sunlight and better visibility within the vehicle has prompted OEMs to increase the variety of roofs offered in such multi-purpose SUVs. Kia Soul, Hyundai Tucson Limited, and Ford Flex are among the new and relatively affordable SUVs that offer panoramic roofs as an optional feature at a low cost. Furthermore, popular models, such as BMW X3, X5, X6, Acura RDX, Audi Q3, and Audi Q7, are also fitted with panoramic roofs. Thus, the rising adoption of SUVs is expected to positively impact the market growth.

RESTRAINING FACTORS

High Maintenance & Repair Costs and Reduction in Fuel Efficiency May Hamper Market Growth

Automotive sunroof installation can be expensive, especially if customers want high-quality panoramic or retractable sunroofs. The additional costs associated with design, engineering, manufacturing, and installation may deter cost-sensitive consumers and hamper the market growth.

Manufacturers are particularly focusing on reducing the weight of their vehicles as it enables improved braking, acceleration, and greater fuel economy. Also, hefty components, such as fuel tank, engine, and others, are usually positioned as low as possible to improve vehicle handling and stability. However, depending on the size, regular assemblies weigh around 20-30 kg, while the panoramic sunroof can weigh as much as 90 kg. For instance, panoramic glass roofs, in addition to the electric motor, drainage channel, and reinforcing bars, can weigh greater as the glass is considerably heavier and thicker than aluminum or steel roof panels. Hence, the additional weight can significantly affect the vehicle's fuel efficiency.

Furthermore, glass or clear synthetic resin is typically used, and the material’s ability to insulate from outside temperature is inferior as compared to a standard vehicle roof. Moreover, regular maintenance is required to ensure that the sunroof is in optimal working condition. Water leakage due to rain through the rubber sealant between the window panel and the roof is also a possibility. They are considerably expensive to integrate and repair in case of failure. These factors are likely to restrain the growth of the market.

Automotive Sunroof Market Segmentation Analysis

By Vehicle Class Analysis

Luxury Cars to Gain Major Traction with Significant Growth of Luxury Vehicle Offerings

By vehicle class, the market is segmented into economical, medium priced, and luxury contributing 65.55% globally in 2026

. The luxury segment is estimated to record the highest CAGR during the forecast period. Numerous offerings in luxury vehicles, rising disposable incomes of consumers, and shifting consumer preferences related to car features have propelled the demand for luxury cars globally. However, increased customs duty is expected to hamper the demand for luxury cars. The growth of the segment is also attributed to the increasing demand for comfort and convenience features in vehicles.

The economical segment is anticipated to hold the largest share globally in terms of volume and value. The rising population, increased urbanization, and improvement in economic conditions of various countries have actively prompted consumers to own technologically advanced cars, which propelled the growth of this segment.

By Propulsion Type Analysis

Increasing Availability of Infrastructure for ICE Vehicles to Fuel Adoption of ICE Propulsion Systems

Based on propulsion type, the market is segmented into ICE and electric. The ICE segment holds the largest share 76.48% in 2026 the market. The growth is attributed to the wide availability of infrastructure for manufacturing, distributing, and using conventional fuels, such as gasoline and diesel, making it easier for consumers to adopt and operate ICE vehicles. The electric segment is the fastest-growing segment in the market. The inclusion of sunroofs as a standard feature for better all-round visibility, coupled with the early adoption of innovative materials, is responsible for the positive growth of the electric vehicle segment. Also, the manufacturer/OEM is focusing on developing electric vehicles to boost the market growth.

For instance, in January 2022, BYD introduced the limited edition series of its Atto 3 electric vehicle at the Auto Expo 2023. Atto 3 consists of crustal LED headlamps; one-piece LED face and tail strips, and 18-inch alloy wheels. On the inside, the EV delivers a 12.8-inch infotainment screen that can rotate along with an eight-speaker sound system and a 360 camera. It also features a panoramic sunroof.

By Material Type Analysis

Rising Technological Advancements in Glass Material to Dominate Global Market

The market is segmented into glass and fabric, based on material type. The glass segment held the largest share 92.38% of the market in 2026 and is anticipated to observe exponential growth over the forecast period. Robust growth of this segment can be attributed to technological advancements and material innovations, such as improvement in sunroof glazing, which has reduced the overhead safety concerns, and glass, which can reflect UV rays. Glass sunroofs can reduce reliance on a vehicle’s air conditioning system as they allow a direct flow of natural light and improve the natural air circulation inside the vehicle. However, the market for fabric sunroofs is expected to decline over the forecast period with plummeting sales of convertible cars.

By Product Type Analysis

Innovative Features and Visibility to Boost Demand for Panoramic Type

The market is divided into panoramic sunroof, in-built sunroof, and others (tilt & slide, pop up, and top mounts), based on product type. The panoramic segment holds the largest market share 44.52% in 2026. It covers a larger area, ensuring that both the front and rear seat occupants benefit from the increased natural freshness. These are frequently offered as standard equipment in high-end vehicles. These factors are responsible for the positive growth of this segment.

The in-built sunroof segment holds the second largest share in the market as OEMs largely prefer providing inbuilt sunroofs in their cars and additional functions, such as vents, sunshades, and auto close, which further improve a vehicle’s comfort level. The others (tilt & slide, pop up, and top mounts) segment is anticipated to witness prominent growth in this market as a result of high demand for vehicles with short roof sizes and the ease of operation owing to their simple sliding process.

To know how our report can help streamline your business, Speak to Analyst

By Operation Type Analysis

Enhanced Functionality, Convenience, and Ease of Use to Drive Adoption of Electric Sunroofs

The market is segmented into electric and manual, based on operation type. The electric segment holds the largest market share. The growth of this segment is attributed to the rising adoption of electric sunroofs for convenience and ease of use. These can be opened, closed, tilted, or operated in various positions with the push of a button or through a control panel. This provides convenience and ease of use for the driver and passengers, as they can control the position of the sunroof without manually adjusting it.

Electric sunroofs also offer additional features, such as one-touch opening & closing, automatic closing with rain sensors, and programmable positions. These features provide added functionality and option for customization, making the sunroof more versatile and user-friendly. The manual segment holds the second largest market share as manufacturers prefer the manual type for the economical vehicle class to reduce the cost of the vehicle. Furthermore, manual sunroofs are simpler in design and operation, which can lead to lower maintenance costs and easier repairs.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific Automotive Sunroof Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in Asia Pacific is characterized by a rise in disposable income of the population, coupled with a surge in demand for premium vehicles in developing economies such as China and India. Manufacturers have been investing aggressively to increase their domestic manufacturing capacities in this region to fulfill the growing product demand. Furthermore, government initiatives to increase the adoption of electric vehicles and rise in the number of mass-segment cars offering sunroofs as an optional feature are responsible for stimulating the demand for in-vehicle sunroofs. These factors are anticipated to help Asia Pacific dominate the global market.The Japan market is projected to reach USD 0.89 billion by 2026, the China market is projected to reach USD 5.93 billion by 2026, and the India market is projected to reach USD 1.03 billion by 2026.

Europe is expected to hold the second-largest automotive sunroof market share. Rising passenger car sales despite stringent emission regulations in place and presence of leading manufacturers, such as Audi, BMW, Mercedes-Benz, and others, in the premium vehicle segment are driving the market growth in this region. North America is expected to witness steady growth in this market, with the U.S. accounting for the largest share. The early adoption of comfort-oriented features and high sales of Sports Utility Vehicles (SUVs) have positioned the region as a steady contributor to this market.The UK market is projected to reach USD 0.43 billion by 2026, while the Germany market is projected to reach USD 0.63 billion by 2026.

List of Key Companies in Automotive Sunroof Market

Companies to Focus on a Wide Range of Product Offerings to Gain Competitive Edge

Major players in the global market include Webasto Group, CIE Automotive, and Inalfa Roof Systems Group BV. Sunroof manufacturers are focusing on providing technologically advanced automotive sunroofs for various vehicle customers across the world.

Webasto Group is a leading manufacturer of roofs and thermal systems. It offers panorama roofs, sunroofs, convertible roofs, heating systems for fuel & electrically operated vehicles, as well as charging solutions and battery systems. The company started offering a wide range of roof systems including openable roofs, fixed roofs, convertible roofs, and roofs for autonomous driving.

List of Key Companies Profiled:

- Webasto Group (Germany)

- CIE Automotive (Spain)

- Inteva Products LLC (U.S.)

- Inalfa Roof Systems Group BV (Netherlands)

- Valmet Automotive (Spain)

- Johnan America Inc. (U.S.)

- Yachiyo Wuhan Manufacturing Co., Ltd. (Japan)

- Magna International Inc. (Canada)

- Mitsuba Corporation (Japan)

- AISIN SEIKI Co. Ltd (Japan)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Webasto Group opened a second automotive sunroof production facility in India. The company is investing in the rapidly growing India market and opening another plant for panoramic roof production in Chennai. The new plant offers an initial capacity of 250,000 units per annum and a production and storage area extending over approximately 9,500 square meters. The plant will be responsible for the roof’s production and shipping to customers in Southern India.

- May 2023: Gabrial India signed a contract with Inalfa Roof Systems to manufacture SUVs and sedans. The company planned to invest USD 20.72 million to set up a greenfield facility in Chennai and Tamil Nadu. The facility, which will become operational in the first quarter of 2024, can produce 200,000 sunroofs per annum in the first phase.

- August 2022: Gentex announced that it invested USD 300 million to expand its business in Zeeland, Michigan with support from the Michigan Strategic Fund, creating 500 jobs. Gentex planned to construct a new high-tech manufacturing facility and distribution center in Zeeland Charter Township, and expand its existing manufacturing facility in the city of Zeeland. The project would provide the company with increased capacity for glass processing, manufacturing of auto-dimming interior & exterior mirrors, displays, and electronics for automotive and aerospace applications. Gentex ships its products to OEMs worldwide and currently employs over 5,000 Michigan residents.

- July 2022: Inteva Products announced that it planned to open a second engineering technical center in Mexico to provide enhanced support to automotive manufacturers and its manufacturing facilities operating in the region. Currently, Inteva operates a number of technical and manufacturing facilities in Mexico.

- June 2021: Webasto announced that it had supplied elegant sliding panorama sunroofs for the new Mercedes-Benz S-Class. The large glass surface provides a pleasantly bright ambiance in the sedan’s interior. Two roof modules allow the driver and passenger in the rear seat of the vehicle to determine their desired settings individually and independently.

REPORT COVERAGE

The market research report provides a detailed market analysis and focuses on key aspects such as leading market players, competitive landscape, and vehicle class. Besides, the report includes insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.57% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vehicle Class

|

|

By Propulsion Type

|

|

|

By Material Type

|

|

|

By Product Type

|

|

|

By Operation Type

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 15.68 billion in 2025.

The market is projected to record a CAGR of 11.57% over the forecast period of 2026-2034.

The electric propulsion segment is the fastest growing segment in the market due to the adoption of electric passenger vehicles globally.

The market size in Asia Pacific stood at USD 8.64 billion in 2025.

Webasto Group, CIE Automotive, and Inalfa Roof Systems Group BV are some of the top players in the market.

Asia Pacific held the largest share of the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us