Automotive Wiring Harness Market Size, Share & Industry Analysis, By Component (Electric Wires, Connectors, Terminals, Others), By Application (Body, Engine, Chassis, HVAC, Sensors), By Vehicle Type (Passenger Cars, Commercial Vehicles), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

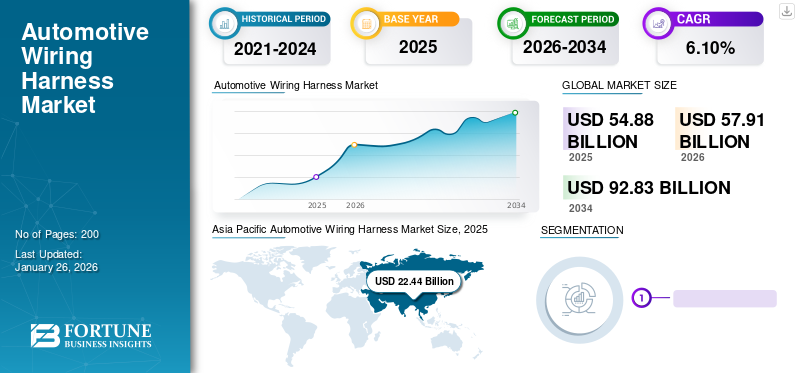

The global automotive wiring harness market size was valued at USD 54.88 billion in 2025 and is projected to grow from USD 57.91 billion in 2026 to USD 92.83 billion by 2034, exhibiting a CAGR of 6.10% during the forecast period. Asia Pacific dominated the automotive wiring harness market with a share of 40.89% in 2025. Automotive Wiring Harness Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 16.65 Billion By 2032

An automotive wiring harness is an electrical and electronic assembly of several automobile components that plays a vital role in connecting all electronic and electrical components for sensor signals and power supply, as well as transmitting data to improve vehicle performance. The assembled components include electrical devices, heating, ventilation, air conditioning (HVAC) systems, speed sensors, and other electronic components. Further, increasing the integration of electrical and electronic systems into automobiles to offer enhanced safety and security features has propelled the market growth. Installing these systems in a vehicle provides several benefits, such as the low probability of electrical shortage, enhanced performance, and improved fuel efficiency.

The rapid growth of the automobile industry worldwide due to several technologically advanced features implemented in vehicles is one of the major factors driving the automotive wiring harness market growth. In line with this, increasing electrification of vehicles, expanding demand and usage of hybrid and electric cars, and the growing emphasis on safety solutions are expected to boost the market over the forecast period.

The COVID-19 pandemic disrupted the global automotive wiring harness market, causing supply chain disruptions and reduced vehicle production. Lockdown measures and economic uncertainties led to a temporary slowdown in market growth. However, the increasing demand for electric vehicles and advanced driver assistance systems post-pandemic is expected to drive market recovery. Additionally, the emphasis on vehicle electrification and lightweight will further boost demand for automotive wiring harnesses in the long term.

Automotive Wiring Harness Market Trends

Surge in Electric Vehicle (EV) Sales Expected to Drive Market Growth

In 2024, global electric cars sales increased YOY by around 51% than previous year. In 2020, Europeans overtook China as the world's largest buyer of electric vehicles. Europe and China sold about 1.3 million electric cars, four times the number sold in the U.S. Moreover, the EV market has shown substantial growth rates in current years.

Further, in 2023, EV sales will be increased by double digits in several European countries despite the economic crash reflecting two policy measures. Carbon dioxide (CO2) emissions standards in the European Union (EU) play an important role in stimulating electric car sales. The growth in EV numbers is still majorly driven by the government policy environment. The leading countries in the EV market, such as the Netherlands, China, Norway, the U.S., Japan, Germany, Sweden, the U.K., Canada, and France, have a range of policies to encourage the acceptance of electric vehicles. As more EVs come on the road, the market is also anticipated to witness growth as automotive wiring harness is utilized in EVs than conventional fossil fuel-based vehicles.

Download Free sample to learn more about this report.

Automotive Wiring Harness Market Growth Factors

Increasing Trend of Integrated Advanced Features in Vehicles that Propels Market Growth

Today’s cars are advanced with a large number of electronic integrations. By 2022, about 125 million vehicles are expected to be equipped with 5G connections that will hit the roads. Further, the head-up-display units, infotainment systems, and dashboards in vehicles require many electronic and electric components. As these electronic equipment are becoming a standard accessory, car manufacturers and consumers have pushed the electronic component suppliers for more integrations and innovations. Today’s consumers demand more intuitive technology, and they want an in-vehicle experience that allows them to stay connected, entertained, and comfortable. Therefore, car manufacturers look for best-in-class features and technology. These significant factors play an essential role in driving the global market.

Rising Automobile Production to Propel Market Growth

Increasing automotive production globally due to improving economies, increasing purchasing power, and improving lifestyles drive the overall demand for automobiles production. Presently, the Asia Pacific region accounts for the highest volume of automotive output due to the greater need for automobiles, especially in China and India. In addition, governments' increasing financial and regulatory initiatives boost the prospects in this market.

RESTRAINING FACTORS

Increasing Complexity of Vehicle Electrical Systems and the Challenges Associated with Integrating Advanced Technologies Hurdle to Hinder Growth

The automotive industry is witnessing rapid advancements in vehicle electrification, autonomous driving, and connectivity features, leading to a higher demand for sophisticated wiring harnesses capable of supporting these technologies. According to industry reports, the proliferation of sensors, cameras, radar systems, and other electronic components in modern vehicles has led to a significant increase in the number of wires and connectors within automotive wiring harnesses. This complexity not only increases the manufacturing cost of wiring harnesses but also poses challenges in terms of design, installation, and maintenance.

Integration of electric vehicle (EV) technology further exacerbates the complexity of wiring harnesses, as EVs require additional wiring for battery systems, electric motors, and charging infrastructure. The need for lightweight and space optimization in EVs also adds constraints on the design and routing of wiring harnesses.

Addressing these challenges requires innovation in materials, manufacturing processes, and design techniques to develop more compact, lightweight, and efficient wiring harness solutions. Collaboration between automakers, wiring harness suppliers, and technology providers is essential to overcome these constraints and ensure the seamless integration of advanced technologies in modern vehicles. Failure to address these challenges may hinder the growth of the global automotive wiring harness market and impede the adoption of innovative automotive technologies.

Automotive Wiring Harness Market Segmentation Analysis

By Component Analysis

Terminals Segment to Dominate Owing to Increasing adoption of Advanced Vehicle Technologies

Based on component, the market is segmented into connectors, terminals, electric wires, and others, wherein others include sheaths, convoluted tubes, clamps, grommet, and protectors.

The terminals segment holds a significant share in 2023 and is expected to be the fastest-growing market in the coming years. This is attributed to increasing adoption of advanced vehicle technologies such as connected vehicles and self-driving vehicles. This is a major factor in boosting automotive terminals sales in the coming years. The terminals segment is projected to dominate the market with a share of 42.49% in 2026.

Moreover, automotive wiring harness connectors used in wiring harnesses are installed in automobiles integrated with technologically advanced safety systems such as vehicle immobilizers, anti-lock braking systems (ABS), and airbags. The need for incorporating safety systems into cars is expected to increase due to increasing incidents of vehicle thefts, thus surging the demand for the segment growth over the forecast period.

By Application Analysis

Chassis Segment to Dominate Due to its Wide Application Scope in Components

Based on application, the market is segmented into the body, engine, chassis, HVAC, and sensors.

The chassis segment held a major share in 2023 due to its extensive application scope in components such as infotainment systems, fog lamps, turn indicators, fuel flaps, and headlamps. Further, the sensors segment is anticipated to register the highest CAGR during the forecast period. This is due to its increasing use in advanced vehicle systems, which include many systems such as battery systems, infotainment systems, lighting systems, and safety and security systems. The chassis wiring harness segment is projected to dominate the market with a share of 29.56% in 2026.

To know how our report can help streamline your business, Speak to Analyst

By Vehicle Type Analysis

Passenger Car Segment is Expected to Hold the Largest Market Share Owing to Growing Sale of Passenger Cars

Based on vehicle type, the market is classified into commercial vehicles and passenger cars.

The passenger cars segment held the highest global market share in 2023. The growth of the passenger cars segment can be attributed to the growing sale of passenger cars across the world that is directly contributing to the market growth. Moreover, the commercial vehicles segment is projected to be the fastest-growing market from 2026 to 2034. The passenger cars segment is expected to lead the market, contributing 73.15% globally in 2026.

REGIONAL INSIGHTS

Asia-Pacific to Dominate the Market Due to Increased Vehicle Production

In terms of geography, the market can be categorized into North America, Europe, Asia Pacific, and the Rest of the World.

Asia Pacific

Asia Pacific Automotive Wiring Harness Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest share of the market (with China accounting for the highest market share) and was valued at USD 22.44 billion in 2025. This is due to the growing demand for safety features in vehicles, low labor costs, developing infrastructure, and growing automotive manufacturing. Many prominent automobile manufacturers of luxury cars such as Porsche, Audi, Mercedes Benz, Volkswagen, Daimler, and BMW have dynamically developed their markets in Asia Pacific, particularly China. For instance, according to Statistics from the China Passenger Car Association, in 2023, a total of 1.16 billion luxury cars were sold in China. The Japan market is forecast to reach USD 3.82 billion by 2026, the China market is set to reach USD 14.02 billion by 2026, and the India market is likely to reach USD 2.51 billion by 2026.

Europe

Moreover, in Europe, Germany is by far the leading importer of automobile wiring harnesses. Also, the key manufacturers have headquarters, logistical centers, and design and testing labs in Germany. Further, increasing EV adoption, innovation in drive technologies, and growing automobile production are expected to surge the demand in Europe. The UK market is expected to reach USD 3.65 billion by 2026, while the Germany market is anticipated to reach USD 5.47 billion by 2026.

Rest of The World

he Rest of the World market is poised to reach USD 2.15 billion by 2026 and the U.S. market is estimated to reach USD 11.38 billion by 2026.

List of Key Companies in Automotive Wiring Harness Market

Key Market Players Are Focusing on Collaborations, Partnerships, and New Product Launch Strategies to Gain Competitive Edge

The extremely competitive marketplace comprises key players, including Sumitomo Electric Industries, PKC Group Ltd., Yazaki Corporation, THB Group, Lear Corporation, FURUKAWA ELECTRIC CO., LTD., Nexans Autoelectric GmbH, Leoni AG, Motherson, and Spark Minda. The major companies are focusing on acquisitions, expansions, and partnerships strategy to strengthen their position in the market.

LIST OF KEY COMPANIES PROFILED:

- Sumitomo Electric Industries (Osaka, Japan)

- PKC Group Ltd. (Helsinki, Finland)

- Yazaki Corporation (Tokyo, Japan)

- THB Group (London, U.K.)

- Lear Corporation (Michigan, U.S.)

- FURUKAWA ELECTRIC CO., LTD. (Tokyo, Japan)

- Nexans autoelectric GmbH (Germany)

- Leoni AG (Nuremberg, Germany)

- Motherson (Noida, India)

- Spark Minda (New Delhi, India)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Cable harness manufacturer Leoni expanded its production facility for automotive wiring systems in Cuauhtemoc, Mexico. This is aimed at the increasing demand for electric cars in North America.

- September 2022: Motherson opened a new wiring harness facility in Serbia. This is Motherson’s third facility in Serbia, and it will manufacture wiring harnesses for Daimler trucks.

- July 2022: Sumitomo Wiring Systems Ltd. launched a new manufacturing plant dedicated to automobile wiring harness products within the Royal Group Phnom Penh Special Economic Zone in Cambodia.

- May 2022: Leoni AG agreed to divest its automotive cables business to Bangkok-based Stark Corporation Public Company Limited for an undisclosed sum. The automotive cables segment contributed USD 1.31 billion to Leoni AG's revenues in 2021.

- March 2022: Morocco announced USD 180 million in wiring system investments with 5 automotive cable suppliers as it pushes to meet the growing demand from electric vehicle makers.

- March 2021: Lear Corporation acquired M&N Plastics, the U.S.-based engineered plastic components manufacturer. With this acquisition, Lear expanded its vertical integration capabilities to manufacture complex parts for electrical distribution, including power electronics and high-voltage wire harnesses.

REPORT COVERAGE

The research report provides a detailed automotive wiring harness market forecast analysis and focuses on critical aspects such as leading companies, applications, and vehicle types. The report covers North America, Europe, Asia Pacific, and the Rest of the World automotive wiring harness market statistics from 2024 to 2032. Besides, this market report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth over recent years.

An Infographic Representation of Automotive Wiring Harness Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.10% (2026-2034) |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By Application

|

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 54.88 billion in 2025. The market is projected to grow to USD 92.83 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 22.44 billion.

The market is projected to grow at a CAGR of 6.10% and will exhibit steady growth over the forecast period (2026-2034).

The passenger cars segment market is expected to be the leading segment during the forecast period.

Increasing electrification of vehicles, expanding demand and usage of hybrid and electric vehicles, and the growing emphasis on safety solutions to propel the market growth.

Asia Pacific dominated the market with a share of 40.89% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic