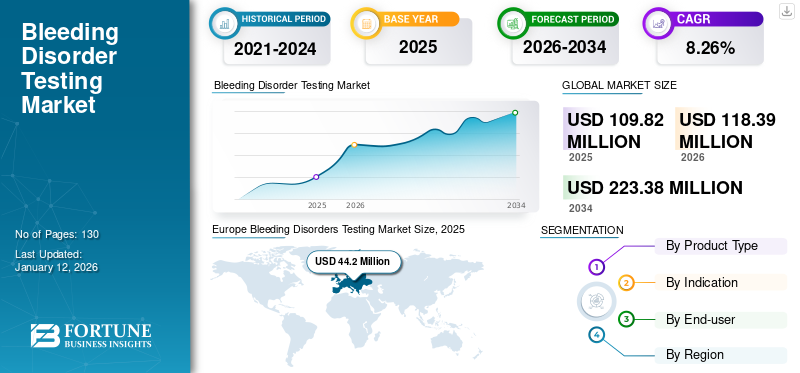

Bleeding Disorders Testing Market Size, Share & Industry Analysis, By Product Type (Reagents & Consumables and Instruments), By Indication (Hemophilia A, Hemophilia B, Von Willebrand Disease, Idiopathic Thrombocytopenic Purpura, and Others), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global bleeding disorders testing market size was valued at USD 109.8 million in 2025. The market is projected to grow from USD 118.39 million in 2026 to USD 223.38 million by 2034, exhibiting a CAGR of 8.26% during the forecast period. Europe dominated the bleeding disorders testing market with a market share of 40.25% in 2025.

Bleeding disorders is a group of conditions that result when the blood clotting process is disrupted leading to excessive bleeding. These disorders are almost always inherited and they result when the blood lacks certain clotting factors. The market for bleeding disorders testing has grown and developed in recent years to meet the rising demand. The major factor contributing to the growth of the market is the rising prevalence of bleeding disorders such as Von Willebrand disease, hemophilia A, hemophilia B, and others among the population.

Moreover, the development of testing instruments and integration of Artificial Intelligence (AI) and Machine Learning (ML) by leading market players has emerged as an important contributing factor.

- For instance, according to the National Hemophilia Foundation, Von Willebrand disease is the most common bleeding disorder, affecting approximately 1 in every 100 people or up to 1% of the U.S. population.

- For instance, in March 2021, F. Hoffmann-La Roche Ltd. launched eight new configurations for Cobas pro integrated solutions with an aim to maximize throughput and increase testing efficiency.

Bleeding Disorders Testing Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 109.8 million

- 2026 Market Size: USD 118.39 million

- 2034 Forecast Market Size: USD 223.38 million

- CAGR: 8.26% from 2026–2034

Market Share:

- North America dominated the bleeding disorders testing market with a 40.25% share in 2025, driven by strong healthcare infrastructure, rising awareness, and favorable reimbursement policies for diagnostic tests in the U.S. and Canada.

- By Product Type, reagents & consumables accounted for the largest market share in 2024 and are projected to grow at the fastest rate due to increased testing volume, expanding diagnostics access, and growing demand in both developed and emerging regions.

Key Country Highlights:

- Japan: Market growth is supported by the presence of major diagnostic companies like Sysmex and HORIBA, increasing testing for hemophilia and Von Willebrand disease, and government support for rare disease diagnostics.

- United States: The launch of advanced diagnostic solutions, regulatory approvals (e.g., FDA’s approval of Roctavian gene therapy in 2023), and awareness campaigns from groups like the National Hemophilia Foundation drive testing rates.

- China: Rapidly expanding healthcare infrastructure, increased focus on rare disease diagnosis, and international support such as CSL Behring’s donation of coagulation therapy are boosting demand for bleeding disorder diagnostics.

- Europe: Held a leading market share in 2024 due to high prevalence of Von Willebrand disease (e.g., 11,183 cases in the U.K. in 2020), strict diagnostic guidelines, and strong presence of leading companies like Siemens and Roche.

COVID-19 IMPACT

Market Growth Hindered Due to Reduced Number of Testing among the Population amid COVID-19

The COVID-19 impact on the market was negative due to a significant decrease in the number of patient visits during the lockdown. The COVID-19 restrictions imposed by the governments of different countries led to a reduced number of diagnostic procedures for hemophilia A, B, and other diseases. In addition, the increased focus of healthcare providers and diagnostic centers to conduct higher number of tests and procedures related to the COVID-19 led to a reduced number of testing and procedures for other disorders. This along with the fear of contracting infection among the bleeding disorder patients was one of the factors that resulted in lower number of testing for these disorders among the population.

The market players witnessed a significant decline in revenue generated during 2020. For instance, F Hoffmann-La Roche Ltd. registered a decline of 5.1% in the revenues generated in 2020 as compared to the previous year. The decline in the revenue was due to the reduced number of routine blood tests and testing for disorders such as hemophilia A, B, Von Willebrand disease, and others owing to the COVID-19 pandemic.

However, the growing prevalence of bleeding disorders globally, along with the increasing diagnosis rate and treatment, is creating demand for testing of these disorders among the patient population. Thus, the increased demand for these tests during 2021 and 2022 helped companies recover and witness growth in the revenue generated. For instance, Siemens Healthcare GmbH registered a growth of 11.9% in the revenues generated from diagnostic segment in 2022 as compared to the previous year. In addition, the higher number of approvals and launches of products in various countries is expected to spur the bleeding disorders testing market growth during the forecast period.

Bleeding Disorders Testing Market Trends

Increasing Implementation of Artificial Intelligence and Nanomaterials in Testing and Diagnosis to Boost the Market Growth

The increasing R&D activities and investments by various foundations, national, and international organizations are resulting in technological advancements in the field of diagnosis of blood disorders. One of the trends in the market is the use of artificial intelligence in the diagnosis of disorders, which is anticipated to propel the market growth.

The use of machine learning in various clinical trials for the diagnosis of bleeding disorder such as hemophilia is leading to an increasing efficiency and accuracy.

- According to a 2022 article published by the National Center for Biotechnology Information (NCBI), the utilization of artificial intelligence in hemophilia is in its early phases owing to its several advantages such as the prediction of severity of hemophilia A, improved recognition of mutated gene causing the disease, and others.

The rising awareness regarding the disorders among the population and technological advancements and innovations by various foundations in developed as well as emerging countries are some of the factors responsible for the rising number of testing globally.

- According to a 2021 news release by the Novo Nordisk Hemophilia Foundation, a project for the development of an AI chatbot for hemophilia in several African countries was approved in April 2021. The chatbot will be integrated into web-based mobile phones for early diagnosis and care for hemophilia.

In addition, there is a rising number of clinical studies using nano diagnostics for the detection of bleeding disorders owing to their increasing potential. Thus, rising advancements in technology are resulting in increasing applications of artificial intelligence, machine learning, and nanoparticles in the diagnosis and testing of bleeding disorders such as hemophilia and others.

Europe Bleeding Disorders Testing Market Size, 2021-2034 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Bleeding Disorders Testing Market Growth Factors

Rising Prevalence and Diagnosis of Bleeding Disorders among General Population to Favor the Market Growth

The rising prevalence of disorders, such as Hemophilia A, B, idiopathic thrombocytopenic purpura, and others, among the population is increasing in both developed and emerging regions owing to various genetic factors. This is resulting in a higher patient population suffering from bleeding disorders.

- According to a 2020 annual global survey conducted by the World Federation of Hemophilia, the total number of patients suffering from bleeding disorders increased from around 287,066 in 2015 to 393,658 in 2020. This increase is attributable to the rise in the diagnosis rate of the disorder among the population.

Also, increasing efforts and initiatives by healthcare organizations and other foundations are resulting in rising awareness among the general population regarding these disorders, available testing, and treatment options.

- In January 2021, clinical practice guidelines on the diagnosis and management of Von Willebrand Disease were updated by the collaborative efforts of the National Hemophilia Foundation (NHF), the American Society of Hematology (ASH), World Federation of Hemophilia, and the International Society on Thrombosis and Hemostasis (ISTH).

Also, the rising number of treatment centers that provide training and education about the disorders, diagnosis, and treatment to the patients suffering from bleeding disorders such as Hemophilia, Von Willebrand Disease, and others is also contributing to the higher rate of diagnosis. The above mentioned factors along with increasing healthcare infrastructure in the emerging regions is projected to fuel the market growth during the forecast period.

Increasing Research & Development Activities for the Introduction of Technologically Advanced Products to Accelerate the Market Growth

There is increasing research and development activities by the market players owing to rising prevalence of bleeding disorders and demand for testing procedures. Also, increasing research activity is an important factor leading to advancements and innovations in the test kits and instruments for the diagnosis of bleeding disorders such as Hemophilia A, Hemophilia B, Von Willebrand Disease, and others.

- In August 2021, rHEALTH in partnership with a global biopharmaceutical company developed a highly accurate, fingerstick-based approach to measure thrombocytopenia (low platelet counts).

Moreover, continuous efforts of the major players in the market and investment in research and development activities by government bodies are resulting in a higher number of launches of bleeding disorders testing kits and instruments.

- In March 2023, National Hemophilia Foundation launched a venture philanthropy fund named ‘Pathway to Cures’ to drive the development of transformational therapies and technologies for inheritable blood disorders.

Thus, all these factors are resulting in higher rates of diagnosis among the population especially in developed regions, which is expected to propel the growth of the market for bleeding disorders testing during the forecast period.

RESTRAINING FACTORS

Low Adherence to Guidelines and Low Testing Penetration in Emerging Countries May Restrain the Industry Expansion

Various organizations in developed countries such as the U.S., the U.K., and others are establishing national guidelines for the diagnosis and management of bleeding disorders. This is a primary factor leading to higher rate of diagnosis and proper management of these disorders in these nations.

On the other hand, emerging countries with comparatively lower adherence to the guidelines for the diagnosis and testing are depict a lower penetration of testing and diagnosis of these conditions in the region.

- According to the 2020 global annual report published by the World Federation of Hemophilia, the number of surveys to identify patients with Hemophilia and other bleeding disorders conducted in the UAE, Kuwait, and other Middle East countries is one. This indicates lower focus on diagnosis and penetration of testing in these countries compared to developed countries.

The lower focus of the national organizations and other institutions in emerging countries toward increasing the awareness regarding these conditions and the management of these disorders is resulting in the lower penetration of testing among the population.

Along with these, the procurement of reagents and instruments in regions such as Africa and others owing to the high cost is one of the challenges that is limiting the early diagnosis and proper care of patients suffering from bleeding disorders.

Bleeding Disorders Testing Market Segmentation Analysis

By Product Type Analysis

Increasing Penetration of Testing Procedures to Augment the Reagents & Consumables Segment Share

On the basis of product type, the market is segmented into reagents & consumables and instruments.

The reagents & consumables accounted for the highest market with a share of 69.34% in 2026 and is expected to expand at a fastest growth rate during the forecast period, 2025-2032. The increasing rate of testing, owing to developing healthcare infrastructure and healthcare access in emerging regions fuels the growth of the reagents & consumables segment.

Moreover, the instruments segment is projected to grow at a considerable growth rate over the forecast period. The increasing incidence of bleeding disorders among the population along with the rising awareness regarding the bleeding disorders testing options is leading to an increased demand for bleeding disorder testing instruments globally.

- According to a 2020 report published by the Centers for Disease Control and Prevention (CDC), the prevalence of hemophilia A and B in the U.S. is estimated to be 1 in 5,617 male births and 1 in 19,283 male births, respectively.

Moreover, advancements in technology leading to improving automation and portable analyzers are anticipated to further aid the increasing adoption of these instruments in clinical laboratories.

By Indication Analysis

Hemophilia A Segment Dominated Owing to Rising Disease Prevalence

On the basis of indication, the market is subdivided into hemophilia A, Von Willebrand disease, hemophilia B, idiopathic thrombocytopenic purpura, and others.

In 2026, the Hemophilia A segment accounted for the highest market contributing 46.19% globally in 2026. The rising prevalence of bleeding disorders such as hemophilia A & B is leading to an increased patient population among all regions. This, coupled with rising awareness of diagnostic options available, is resulting in a higher rate of diagnosis.

- For instance, according to the 2020 annual global survey conducted by the World Federation of Hemophilia, the number of people with hemophilia was 209,614, which represents around 60.4% of the people affected by bleeding disorders.

The government bodies and other healthcare organizations are increasing their focus and efforts to develop guidelines for diagnosis and management of bleeding disorders such as Von Willebrand disease. This, along with rising prevalence of the disorder among the population, is anticipated to fuel the segmental growth.

The rising advancements in technology and increasing number of launches of hematology and hemostasis analyzers are leading to the higher adoption of analyzers and other instruments across the laboratories globally. This is a crucial factor that is anticipated to propel the testing of indications such as idiopathic thrombocytopenic purpura and others during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Rising Rate of Diagnosis of Bleeding Disorders Among the Population Fueled the Hospitals & Clinics Segment Growth

On the basis of end-user, the market is segmented into hospitals & clinics, diagnostic centers, and others.

In 2026, the hospitals & clinics segment accounted for the highest market with a share of 60.31% and is expected to expand at a substantial CAGR over the projected period. The growth is mainly attributed to the rising awareness among the population regarding bleeding disorders and the rising prevalence of the disorders is leading to a higher rate of diagnosis among the population.

Furthermore, the diagnostic centers segment is projected to grow at a highest CAGR over the forecast period. The increasing technological advancements and rising number of launches of portable analyzers and software are contributing to the rising rate of testing in diagnostic centers.

- In March 2021, F. Hoffmann-La Roche launched Cobas pure integrated solutions in countries accepting the CE mark with an aim to simplify the diagnostic procedures in small to medium sized labs with automation technology.

On the other hand, the increasing hospitalization rate due to the severity of these disorders is leading to an increased demand for testing instruments and reagents in hospitals and clinics. Thus, the increasing prevalence, diagnosis rate, and growing healthcare infrastructure in the regions are anticipated to augment the market size for bleeding disorders testing.

REGIONAL INSIGHTS

Based on the regional ground, the market is studied across Europe, North America, Asia Pacific, and the rest of the world.

Europe

Europe Bleeding Disorders Testing Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 44.2 million in 2025 and USD 47.75 million in 2026. Europe held a dominating share and is expected to register a higher growth rate due to factors such as increasing prevalence of bleeding disorders in the U.K., Germany, and other countries. The rising number of patient population along with rising adherence to the guidelines for diagnosis of these disorders is driving the market growth. The UK market is valued at USD 16.24 million by 2026, and the Germany market is valued at USD 7.07 million by 2026.

- For instance, according to the 2020 report published by the World Federation of Hemophilia, there were in total 11,183 people with Von Willebrand disease in the U.K. among the study countries in 2020.

North America

The increasing number of regulatory approvals and launches of testing instruments and devices in the U.S. and Canada are anticipated to increase the bleeding disorders testing market share of North America during the forecast period. The U.S. market is valued at USD 28.98 million by 2026.

- For instance, in June 2023, BioMarin received the U.S. FDA approved for its ROCTAVIAN gene therapy product for the treatment of adults with severe hemophilia A. Roctavian is administered as a single dose via intravenous infusion.

Rest of World

The improving healthcare infrastructure in emerging countries, such as China, Japan, Australia, and other countries, and increasing awareness and donation programs for bleeding disorders testing are some of the major factors that are anticipated to fuel the market growth in Asia Pacific, the Middle East, and other regions. The Japan market is valued at USD 3.85 million by 2026, the China market is valued at USD 17.42 million by 2026, and the India market is valued at USD 3.06 million by 2026.

- For instance, in April 2022, CSL Behring donated 500 million international units of coagulation factor replacement therapy to the World Federation of Hemophilia charitable aid program to help people suffering from bleeding disorders.

KEY INDUSTRY PLAYERS

Leading Companies Develop a Strong Portfolio of Bleeding Disorders Testing Instruments & Consumables to Secure Competitive Edge

The global market is fragmented, with many players operating in the market. Sysmex Corporation, Siemens Healthcare GmbH, F Hoffmann-La Roche, and HORIBA, Ltd. are some of the major companies.

The strong product portfolio of bleeding disorders testing products, strategic partnerships with other regional market players, and continuous efforts to develop and launch innovative products to strengthen its portfolio are some of the factors contributing to the dominance of these players in the market.

- In August 2021, Siemens Healthcare GmbH as per its agreement with Sysmex Corporation launched Sysmex’s CN-3000 and CN-6000 Hemostasis Systems for mid and high-volume coagulation testing.

Furthermore, companies, such as Beckman Coulter, Inc., Abbott, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and others, with their increasing focus on product approvals and launches is one of the important factors contributing to the rising market share of these players.

Precision BioLogic Incorporated, Diapharma, Boule, Atlas Medical GmbH, and others are some of the market players that are emerging in the market. The rising prevalence of bleeding disorders along with awareness is resulting in emphasis of market players to launch products and strengthen their presence.

- In January 2020, Precision BioLogic Incorporated received the authorization to commercialize the CRYOcheck Chromogenic Factor VIII assay in Australia, New Zealand, Canada, and the European Union.

Thus, the increasing focus on product approvals, launches, mergers and acquisitions, among the market players is anticipated to create growth opportunities for the emerging players and spur the market growth for bleeding disorders testing.

List of Top Bleeding Disorders Testing Companies:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthcare GmbH (Germany)

- HORIBA Ltd. (Japan)

- Sysmex Corporation (Japan)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Atlas Medical GmbH (Germany)

- HYPHEN BioMed (France)

- Precision Biologics (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2022 - HORIBA, Ltd. rolled out new products in its Yumizen H500 and H550 hematology product family with increased benefits, new features, and enhanced performance.

- February 2022 - Sysmex Corporation established a new arm, Sysmex LLC, in Saudi Arabia with an aim to reinforce its sales and services structure in the country. The new subsidiary would focus on strengthening its hematology, hemostasis, and urinalysis markets.

- November 2021 – Precision BioLogic Incorporated introduced a new CRYOcheck Factor VIII Deficient Plasma with VWF. The solution was rolled out in Canada, New Zealand, the European Union, and Australia.

- August 2021 - Siemens Healthcare GmbH as per its agreement with Sysmex Corporation launched Sysmex’s CN-3000 and CN-6000 Hemostasis Systems for mid and high-volume coagulation testing.

- March 2021 - F. Hoffmann-La Roche Ltd. rolled out eight new configurations. Intended at maximizing throughput and increasing testing efficiency, the new configurations were launched for Cobas pro integrated solutions.

REPORT COVERAGE

The research report provides a detailed market analysis. It focuses on key aspects such as disease indication, end user, leading companies, competitive landscape. Besides this, it offers insights into the market trends, impact of COVID-19, and the prevalence of bleeding disorders, among other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth rate of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 8.26% from 2026-2034 |

|

Segmentation |

By Product Type

|

|

By Indication

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 109.82 million in 2025.

In 2025, the market value stood at USD 31.87 million.

The market will exhibit steady growth at a CAGR of 8.26% during the forecast period (2026-2034).

By indication, the hemophilia A segment will lead the market.

The rising prevalence of bleeding disorders among the general population and the increasing penetration of testing and diagnostic services among the patient population, especially in developed countries, are the key factors driving the market.

Sysmex Corporation, Siemens Healthcare GmbH, F. Hoffmann-La Roche Ltd., and HORIBA Ltd. are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us