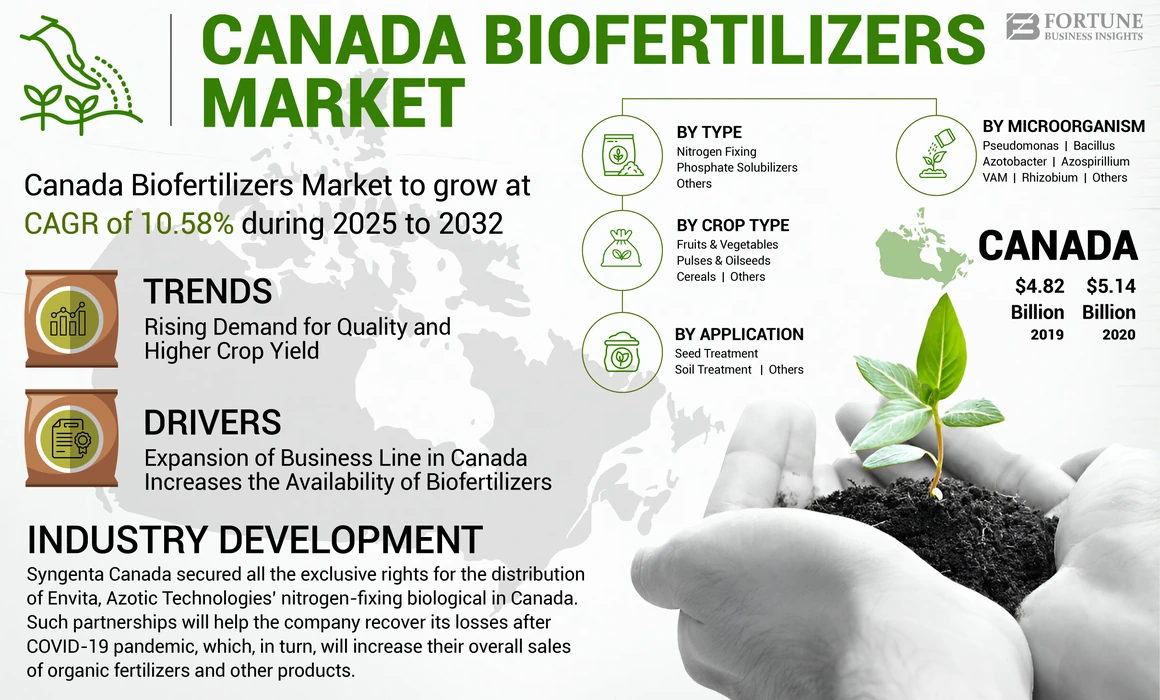

Canada Biofertilizers Market Size, Share & COVID-19 Impact Analysis, By Type (Nitrogen Fixing, Phosphate Solubilizers, Others), By Microorganism (Rhizobium, Azotobacter, Azospirillum, Pseudomonas, Bacillus, VAM, Others), By Application (Seed Treatment, Soil Treatment, Others), By Crop Type (Cereals, Pulses & Oilseeds, Fruits & Vegetables, Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The Canada biofertilizers market size is projected to grow at a CAGR of 10.58% during the forecast period.

Biofertilizers are an essential tool to help farmers in Canada and across the globe to meet the challenge of feeding a growing population. They have emerged as the most feasible option for promoting soil quality, and crop health, and thus have been witnessing considerable market acceptance since they were first introduced. Moreover, the Canadian Government is investing their efforts in minimizing the usage of synthetic fertilizers and has announced “Canada’s Strengthened Climate Plan (December 2020), which focuses on reducing the total Greenhouse Gas Emissions (GHG) by 40-45% associated with fertilizers by 2030.

Canada Biofertilizers Market Trends

Rising Demand for Quality and Higher Crop Yield to Boost Product Adoption

Sustainable farming, previously seen as a niche market that originated around 15 years ago, is gaining rapid growth with the surging consumer demand for sound quality produce. The demand for organic farm products in Canada is growing swiftly – at a rate of approximately 8% annually as compared to the past four years. Moreover, according to the “Export Development Canada,” 2020, the country has been recognized as an active player in this growing market and trades organic products with around 127 countries. In addition, Canada encompasses about 7,500 organic operations, accounting for roughly 2% of total arable land in Canada. Thus, all such instances pave the way towards the growth of Canada biofertilizers market share.

Canada Biofertilizers Market Growth Factors

Expansion of Business Line in Canada Increases the Availability of Biofertilizers

The Canadian market is the largest growing country in the North America market and is witnessing a sharp rise in the demand for organic food items due to growing concerns about the use of fertilizers and the increased use of genetically modified organisms in crop plantations. Canada is still at its nascent stage in the production of biofertilizers but the demand for biofertilizers is increasing rapidly. Thus, the manufacturers of other countries are trying to expand their distribution line in Canada, which will later help generate more profit and boost the sales of the products. Moreover, the government of Canada is working toward accelerating the production capabilities for agri-businesses and focusing on investing in projects such as biofertilizers. Therefore, such initiatives will further help in spreading awareness regarding the importance of biofertilizers amongst consumers, which will later increase the product demand across the country.

RESTRAINING FACTORS

Poor Production in Canada to Restrict Market Growth

Agricultural yield depends upon the availability and quality of agricultural inputs used across the fields. Chemical fertilizers have been used since the period of the Green revolution in the country. Due to its substantial contribution toward maintaining the agri-business, Canada has emerged as the leading consumer and producer of synthetic fertilizers. Moreover, the poor focus on emerging eco-friendly methods and lack of knowledge about biofertilizers and its raw materials amongst the growers further negatively affect the Canada biofertilizers market growth. In addition, the lack of an effective regulatory system and shelf life issues are one of the prominent factors contributing to the low production and adoption of such products.

As per data provided by Export Development Canada (EDC), the consumption of organic products, such as fruits and vegetables, in Canada has increased by 6.70% from 2019 to 2020. The number of organic farms has also increased significantly in recent years.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, the market depicts the presence of fragmented biofertilizer companies in the country. Some of the key players in the Canadian market include Nurture Growth Biofertilizer Inc., Novozymes, and Lallemand Inc., among others. The companies are largely investing in collaborations with other key players and launching new bio-based technology or inoculants, which can be used for soil treatment as well as seed treatment across the field.

List of Top Canada Biofertilizers Companies:

- Nurture Growth Biofertilizer Inc. (Canada)

- Novozymes (Denmark)

- Lallemand Inc. (Canada)

- Agrinos (Canada)

- UPL Limited (India)

- Anuvia Plant Nutrients Corporation (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Groundwork BioAg Ltd. (U.S.)

- Kiwa Bio-Tech Products Group (U.S.)

- SYMBORG CORPORATE, SL (Spain)

KEY INDUSTRY DEVELOPMENTS:

- May 2022 – Syngenta Canada secured all the exclusive rights for the distribution of Envita, Azotic Technologies’ nitrogen-fixing biological in Canada. Such partnerships will help the company recover its losses after COVID-19 pandemic, which, in turn, will increase their overall sales of organic fertilizers and other products.

- April 2021 - Corteva Agriscience and Symborg entered into a multi-year agreement for microbe-based nitrogen fixation products in Canada. Moreover, Symborg is providing its distribution license to Corteva, which helps in leveraging its distribution network across the country.

- November 2020 – Anuvia Plant Nutrients Corporation, a U.S.-based biologicals company, announced the launch of its latest “SymTRX10S,” bio-based fertilizer for several crop types, which will enhance plant growth. The product is available in the Canada market, and thus these new launches will aid the way toward market growth and will help in generating more profit.

REPORT COVERAGE

The market research report includes quantitative and qualitative insights propelling the industry growth. It offers a detailed analysis of the market size and growth rate for all possible market segments. Various key insights presented in the report are an overview of related markets, competitive landscape, recent industry developments such as mergers & acquisitions, regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.58% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Microorganism

|

|

|

By Application

|

|

|

By Crop Type

|

Frequently Asked Questions

The market is projected to grow at a CAGR of 10.58% during the forecast period (2025-2032).

The nitrogen-fixing segment is expected to be the leading type segment in the Canada market

Expansion of business lines in the country is expected to drive the market growth.

Novozymes, Nurture Growth Biofertilizer Inc., and Lallemand Inc. are some of the top players in the Canada market.

Poor production in the country impedes market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us