Car Detailing Service Market Size, Share, & COVID-19 Impact, Analysis, By Type (Exterior Type [Exterior Wash and Dry, Paint Claying, Polishing, and Sealing/Waxing] and Interior Type [Vacuuming, Scrubbing and Brushing, Steam Cleaning, and Others]), By Car Type (Hatchback, Sedan, and SUV), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

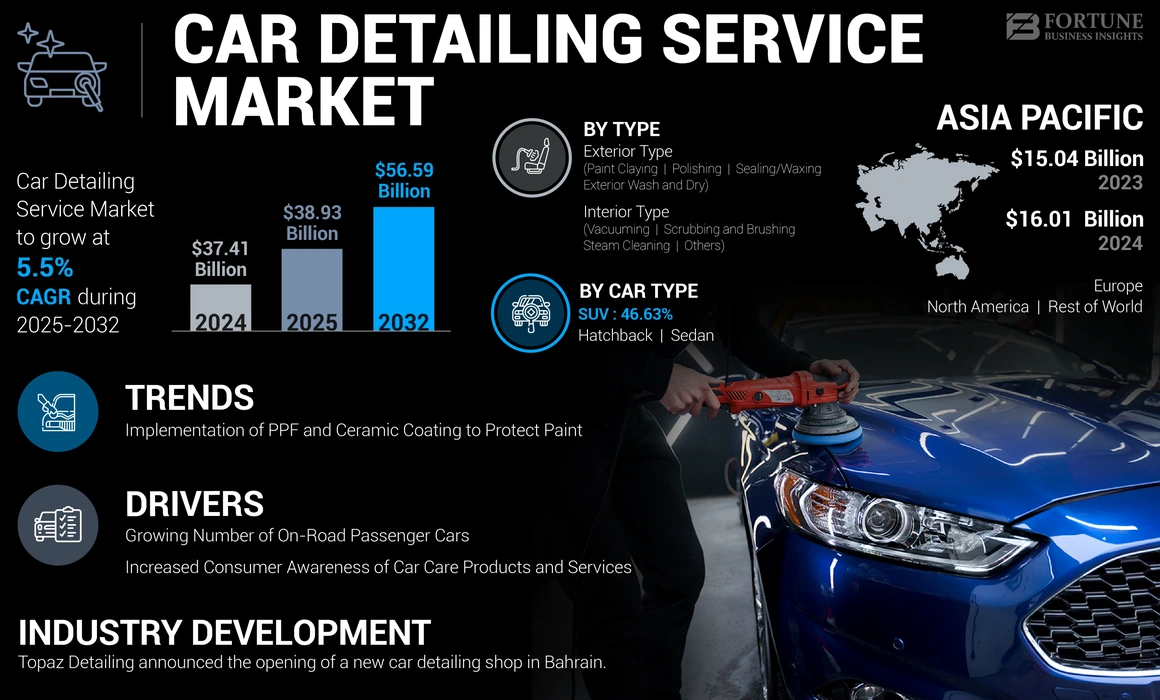

The global car detailing service market size was valued at USD 37.41 billion in 2024. The market is projected to grow from USD 38.93 billion in 2025 to USD 56.59 billion by 2032, exhibiting a CAGR of 5.5% during the forecast period. The Asia Pacific dominated the Car Detailing Service Market Share with a share of 42.53 % in 2024

The car detailing service is a car care service that consists of various steps involved in car cleaning and restoring the car to a new condition. Car detailing is generally the more advanced type of car cleaning than regular car washing and involves labor-intensive jobs. It comprises of two types: exterior and interior car detailing. Both detailing services include manual labor jobs performed by professionals to remove accumulated dust and clean the vehicle body.

The car detailing service market growth is attributed to increased consumer spending on upgrading luxury vehicles. In addition, growing awareness among vehicle owners towards car care products and services in developed and developing countries supports the market growth. These factors contribute to the growing demand for detailing services globally.

COVID-19 IMPACT

Temporary Shutdowns and Government Restrictions During the Pandemic Hampered the Demand for Detailing Services

Increased COVID-19 cases in 2020 resulted in a high alert situation in various countries worldwide. The government and economies of various nations struggled to function efficiently during the period. In addition, the increasing human deaths and the inability to provide proper medical treatments for patients worsened the situation and resulted in the extension of the lockdown, further disallowing various markets to reform and stabilize. Moreover, reduced movement by the public on the road due to restrictions on businesses and on-road presence resulted in more significant losses in the car detailing market.

The post-pandemic situation, however, created favorable situations as the governments successfully retained and reduced the outbreak along with a populace equipped with personal safety to reduce the impact of COVID-19. In addition, the reduction in business restrictions and opening of public curfews further allowed car detailing owners to get going and recover from the pandemic. The accelerated vehicle production resulted in more on-road vehicles, which led to global market growth for car detailing workshops.

LATEST TRENDS

Implementation of PPF and Ceramic Coating to Protect Paint is an Upcoming Trend Observed Among Car Users

PPF coating, which stands for paint protection film, is a type of wrap film applied to the vehicle's exterior body. PPF is one of the options for body protection of cars, among others available in the market. It uses a layer of polymer or polyurethane film that is incredibly strong, which protects the paint against chemicals, UV rays, acid rain, and road debris, ultimately saving car owners with lower vehicle maintenance and repair costs.

Similarly, car owners are showing interest in ceramic coating and paint correction. Ceramic coatings, known as nanocoatings, glass coatings, and quartz coatings, are semi-permanent coatings applied on car surfaces to protect the body paint and provide a shine and a glossy finish to the vehicle body. Thus, the market is expected to grow significantly as consumer interests grow in car care products and car detailing services such as PPF, ceramic coating, and waxing.

Download Free sample to learn more about this report.

DRIVING FACTORS

Growing Number of On-Road Passenger Cars to Propel Market Growth

The increased disposable income and purchasing power accompanied by more accessible finance and lease facilities have increased the overall car presence on the roads. In addition, the growing population in urban cities due to rapid infrastructure and metropolitization has led to a population shift in the major cities, further increasing the number of cars on the roads.

This market is witnessing an increasing demand for car detailing and various forms of body paint and restoration services, especially in metro cities. Thus, the market is expanding in various regions as more and more car owners opt for these services. This has led to the emergence of new small players in major countries with higher penetration for car detailing services. Thus, the increasing number of on-road passenger cars is expected to propel the market growth.

Increased Consumer Awareness of Car Care Products and Services to Drive Market Growth

The demand for car care products and services is expected to grow significantly during the forecast period. The demand is attributed to increasing consumer awareness of various body and paint protection services. Growing focus of consumers to protect car body paint and restoring faded exterior parts of cars are some of the major factors contributing to the market growth.

The increasing penetration of advanced car detailing services such as PPF and ceramic coatings waxing is further expected to propel market growth. These detailing techniques protect the vehicle paint from external dust, chemicals, and harsh sunlight, providing a glossy, new-like shine while the vehicle paint is protected under the layer. In addition, the solution reduces the overall repair and maintenance price of cars, lowering their ownership cost and increasing their resell value. Thus, these few benefits, among others, are the primary reasons why consumers are shifting toward the solution in major metropolitan and suburban areas.

RESTRAINING FACTORS

Improper Availability of Skilled Laborers Might Hamper the Market Growth

The rapid expansion in the market with increasingly small players has created a shortage of skilled laborers. The shortage of skilled technicians and laborers in the market can be attributed to various factors. The primary reason is the high labor-intensive work involved with car detailing processes. The car detailing process has broken down into two major types with more sub-tasks involved in both types, and all of them involve labor-intensive work, further increasing the job difficulty for lesser pay. Thus, the market is witnessing a rapid demand, but the shortage of skilled laborers may hamper the market growth.

SEGMENTATION

By Type Analysis

Increased demand for Paint Restoration and Glossy Finish Services to Drive the Exterior Type Segment Growth

Based on type, the market is segmented into exterior type and interior type. The exterior type car detailing segment is further divided into exterior wash and dry, paint claying, polishing, and sealing/waxing. The interior type segment is further divided into vacuuming, scrubbing and brushing, steam cleaning, and others.

The exterior type segment dominated the market share in 2024. The segment growth can be attributed to the higher consumer preference for exterior car detailing services, especially for exterior bodies, to improve the paint shine and glossy finish. Within the exterior segment, the sealing/waxing sub-segment is expected to grow significantly during the forecast period, owing to increasing consumer awareness of the benefits of waxing car bodies to improve shine.

The interior type segment accounted for a significant share in 2024 and is expected to grow at the highest growth rate during the forecast period owing to rising consumer awareness toward interior car cleaning services available in the market, which reduces the hassle for car owners to do it on their own. Within the interior segment, the steam cleaning segment is expected to gain the highest traction during the forecast period and grow significantly owing to the ease of cleaning the vehicle interior with better quality results than traditional techniques.

By Car Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Increased Penetration of SUVs across the World Contributes to the Increased Demand for Car Detailing Services for SUVs

Based on car type, the market is segmented into hatchback, sedan, and SUV.

The SUV segment held the dominant market share in 2024 and is expected to continue its dominance during the forecast period. The segment growth is attributed to the increasing demand for SUVs among car users due to the advantages of SUVs over other car types. SUV types of passenger cars have slightly higher space than a sedan and increased power and performance compared to typical hatchbacks, making them suitable for almost every car driving scenario. Thus, these factors, among many others, have led car consumers to shift toward SUVs more than other car types and this segment is expected to grow at the highest growth rate during the forecast period.

The hatchback and sedan segment is expected to grow at a significant CAGR during the forecast period owing to the increasing demand for these types of passenger cars by various car consumers. The sedan car market is expected to grow more steadily due to increased car detailing awareness among sedan users, followed by hatchback car users.

REGIONAL INSIGHTS

Regionally, the market is classified into North America, the Asia Pacific, Europe, and the rest of the world.

Asia Pacific Car Detailing Service Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the largest car detailing service market share and stood at USD 14.15 billion in 2024. The increased public awareness of car care products and available services related to exterior and interior car detailing is a primary factor contributing to the Asia Pacific market growth. In addition, this region's higher number of on-road cars further contributes to the market size.

North America and Europe regions also accounted for a significant market size in 2024 and are expected to show substantial growth in the market during the forecast period due to the high demand and awareness among car users for detailing services. Well-matured markets in North America are also expected to boost market growth.

The rest of the world is expected to grow at the highest rate during the forecast period owing to increased demand for car detailing services, especially in Middle Eastern countries such as UAE, Oman, Saudi Arabia, and others. In addition, the growing sale of high-end luxury cars in the region is further expected to fuel the market growth during the forecast period.

KEY INDUSTRY PLAYERS

Major players in the Market are Focused on Expanding their Businesses Through Franchising To Capture Largest Market Share

The car detailing service industry's competitive landscape consists of several established players with a high amount of small market competitors operating on local and regional scales. The market is highly fragmented, as all the auto detailing businesses operate on a small scale and serve the local market, except for a few major players.

The global industry consists of key players such as 3M, Splash Car Wash, Topaz Detailing, and more, some of the largest operating businesses in the detailing service industry. They majorly operate in global and regional markets with a limited presence in small-scale markets. These players emphasize on expanding their market presence through the franchisee business model. Other small-scale businesses operate on local levels, occupying smaller shares in major cities and towns. However, the increasing number of small businesses in the market is expected to create a more fragmented market during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- 3M Company (U.S.)

- Splash Car Wash (U.S.)

- Autobell Car Wash, Inc. (U.S.)

- Carzspa (India)

- MotorServ (U.K.)

- MPIRE Cars (India)

- Topaz Detailing (U.K.)

- Mr Wash (Germany)

- Autokorrect (U.K)

- Elite Detailing and Protection (U.K.)

KEY TECHNOLOGY DEVELOPMENTS:

- September 2023: Wavex Auto Care announced to expand its offline brand showrooms across India, with almost 100 franchise stores by 2026. The company is known for its products in India, such as foam wash shampoos, matte maintainers, matte wash shampoos, ceramic coatings, and SiO2-based products.

- April 2023: The global Federation of National Associations for the printing community launched WrapFest, an event for the vehicle wrapping and car detailing industry in Northamptonshire, U.K. The latest trends and technology used in car detailing services were displayed.

- December 2022: Calgary Auto Detailing launched an official guidebook for paint protection film to raise awareness about the technique and educate car owners before opting for PPF treatment for their cars. The company specializes in car detailing services such as car wash, paint protection, and other detailing services to protect and clean vehicles.

- June 2022: Topaz Detailing announced the opening of a new car detailing shop in Bahrain. It is the first international shop set up by the company aiming toward expanding its business across territories.

- May 2019: Castrol and 3M announced a partnership to promote care products for the automotive aftermarket. The partnership introduced a wide range of 3M-Castrol branded bike and car care products such as shampoo, glass cleaner, cream wax, dashboard, and tire dressers.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product types, and leading product technology. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market growth over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.5% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Car Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 37.41 billion in 2024 and is projected to reach USD 56.59 billion by 2032.

The market is expected to register a growth rate of (CAGR) 5.5% during the forecast period 2025-2032.

The increased consumer awareness of car care products and services is expected to drive the market growth.

The Asia Pacific led the global market in 2024.

By car type, the SUV segment dominated the market share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us