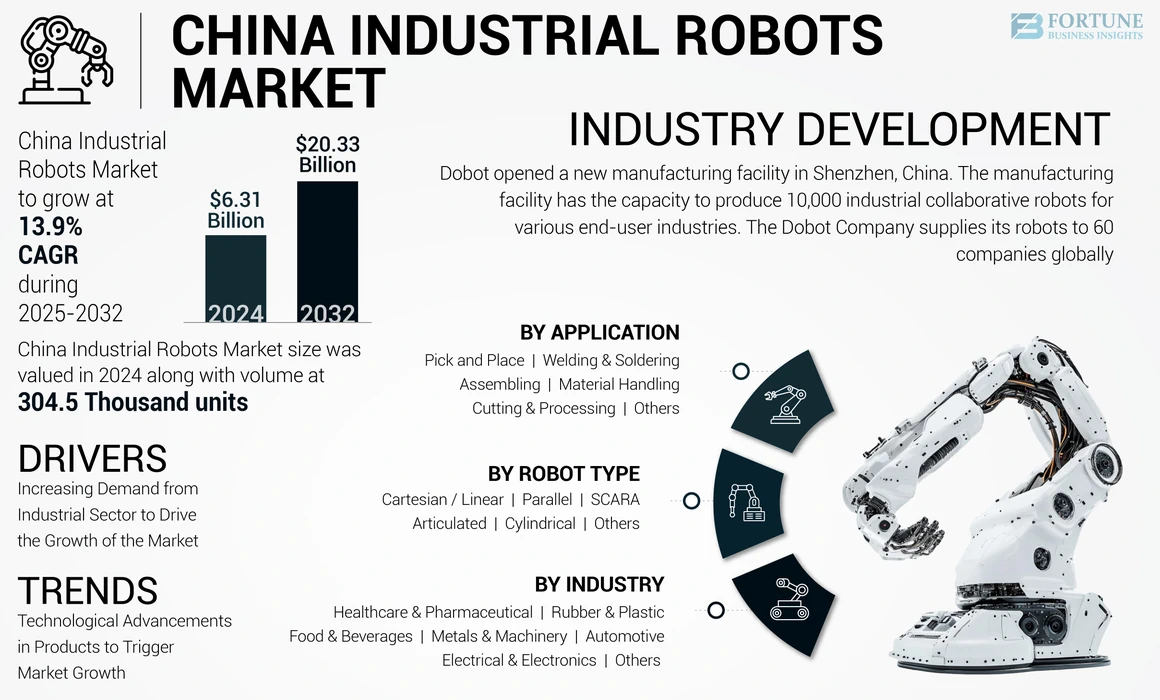

China Industrial Robots Market Size, Share & COVID-19 Impact Analysis, By Robot Type (Articulated, SCARA, Cylindrical, Cartesian/Linear, Parallel, and Others), By Application (Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, and Others), By Industry (Automotive, Electrical & Electronics, Healthcare & Pharmaceutical, Food & Beverages, Rubber & Plastic, Metals & Machinery, and Others), 2025-2032

China Industrial Robots Market Size

China industrial robots market size was valued at USD 6.31 billion along with volume of 304.3 thousand units in 2024 and is projected to grow USD 20.33 billion by 2032, at a CAGR of 13.9% during the forecast period.

Rapid growth in industrialization and automation across China is expected to fuel the growth of the market. In addition, increasing urbanization and disposable income of end users create the demand for consumer goods and household appliances. Such a factor, coupled with increased production capacity, adds to the growth of this market. Additionally, the growth in the sales of industrial robots across China drives the demand for the robotics industry. This is owing to increasing demand for these robots in various end users such as automotive, healthcare & pharmaceuticals, and metal and machinery sectors.

For instance, according to a source from the Chinese Ministry of Industry, the net sales of industrial robots in China increased by approximately 15%- 20% compared to the previous year plan 2024. China is one of the most automated countries in the world, which consumes large quantities of robots for handling logistics and industrial operations automatically, for increasing the productivity of operations.

COVID-19 IMPACT

Positive Surge in Demand for Industrial Robots During COVID-19

The continuing shift from manual to automated operations is driving up the demand for industrial robots. Increasing urbanization, industrialization, and shortage of laborers across manufacturing sectors create the trends of manual to automation operations across China. Robotic technology is largely used among various industrial sectors, which enhances the demand for industrial type of robots across China during the COVID-19 pandemic. The growth in small as well as medium-sized businesses and growth in automation across multiple end-user industries is expected to propel industry growth. The need for robots is speeding up due to increased expenditure on automation across sectors and strict regulatory rules governing the handling of dangerous chemicals and goods.

Furthermore, major manufacturers adopted key strategies such as acquisitions, mergers, and cooperation to broaden their global reach and meet market capitalization after COVID-19 pandemic. For instance, in June 2022, ABB launched a new next-generation industrial robot namely OmniVance Flex Arc, and OmniVance machining cell. It offers a high durable solution and capable to operate up to 20,000 hours in extremely harsh conditions. It has features such as small in space, easy to use, robust, and flexible. All such instances are contributed positively to the China Industrial Robots Market growth of the 2024.

China Industrial Robots Market Trends

Technological Advancements in Products to Trigger Market Growth

Major key players such as Qjar EVS, SIASUN, and ESTUN and among others are planning to introduce new industrial robots with new technological advancements such as Artificial Intelligence (AI) enabled big data and Internet of Things (IoT) enabled robots, to intensify the market competition and to improve the geographical presence over diversified locations. For instance, in August 2022, Xiomi Inc., launched a new humanoid robot “CyberOne” to the market. It is artificial intelligence (AI) based robot with 177 cm in height and 52 kg in weight. This is specifically designed to bring automation in the Tesla Company (an automotive and electric automotive manufacturer). Such an introduction of new advancements in robot technology including robotics, which drives the growth of the market.

China Industrial Robots Market Growth Factors

Increasing Demand from Industrial Sector to Drive the Growth of the Market

In general, the automotive sector is one of the important sectors in China. In addition, consumer electronics industry, healthcare & pharmaceuticals, manufacturing industry, and information technology, metal & machinery, and food & beverages sectors are the important industries which having strong growth across China. For instance, Marina Bill, a president of the International Federation of Robotics (ifr) International Federation of Robotics (IFR) said that the growth of the electronics industry grew by 38% from 2020 to the year 2021.

An increasingly aging population in China put more robotic systems into operation owing to the lack of young population present in the market. Additionally, the growth in the automotive sector increased by 97% year on year across China’s prominence. In addition, the growth of industrial robots in China went from 10 industrial robots per 10,000 employees in 2010 and this number increased by 246 robots per 10,000 employees by 2020. This led to an increasing density in the manufacturing sector and uplifted the China’s market share.

Download Free sample to learn more about this report.

RESTRAINING FACTORS

High Initial Capital Investment and Maintenance Costs to Restraint Market Growth

Industrial robots are largely utilized in various end-user industry verticals such as automotive, electronics, electrical, healthcare, and metals & machinery sectors. Also, industries require more robots to perform various industry applications. These robots require huge capital investment and differs from robot to robot. Also, it requires to repair and maintenance costs for performing industrial work. For instance, according to the International Federation of Robotics (IFR), the costs required for these robots range from USD 25,000 to USD 400,000. Also, it requires annual maintenance cost of around USD 500 per unit. All such factors are anticipated to restrain market growth.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, major players operating in the China industrial robots market are adopting key strategic developments such as product launch, product development, acquisition, and business expansion among others to improve the product portfolio of industrial robots along with maintaining the supply chain through China.

For instance, in December 2022, ABB planned to open a new manufacturing facility in Shanghai province. The new manufacturing facility was done by an investment of around USD 150 million. This new facility having area of 67,000 square meter. The main aim of this business expansion is to improve the product portfolio of industrial robots through multiple industry verticals across China.

List of Top China Industrial Robots Companies:

- EVS Tech Co Ltd (China)

- Siasun Robot Automation Co Ltd (China)

- Estun Automation (China)

- Efort Intelligent Equipment Co Ltd (China)

- Jaka Robotics (China)

- Xiomi Inc (China)

- Shanghai Step Electric Corporation (China)

- HGZN Group (China)

- Borunte Robot Co Ltd (China)

- ABB (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- September 2022 – Dobot opened a new manufacturing facility in Shenzhen, China. The manufacturing facility has the capacity to produce 10,000 industrial collaborative robots for various end-user industries. The Dobot Company supplies its robots to 60 companies globally.

- April 2020 – HGZN Group signed a partnership with Hyundai Robotics to build a new manufacturing facility to manufacture industrial robots in Haining, China. This manufacturing facility is able to produce around 10,000 industrial robots.

- June 2021– EVS Tech Co Ltd launched a new welding robot for the market, which is capable of performing welding work that is dangerous for a human being. These consist of (MIG) metal inert gas welding, and tungsten inert gas (TIG) welding and spot welding. These robots have a speed of 5X more than other robots.

REPORT COVERAGE

The market report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the technological advancements and key industry developments such as mergers, partnerships, & acquisitions and the impact of COVID-19 on the market. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 13.9% from 2025 to 2032 |

|

Unit |

Value (USD Billion), and Volume (Thousand Units) |

|

Segmentation |

By Robot Type

|

|

By Application

|

|

|

By Industry

|

Frequently Asked Questions

Growing at a CAGR of 13.9%, the market will exhibit steady growth in the forecast period (2025-2032).

An increasing demand from various industry verticals such as automotive, electrical & electronics, and food & beverages sector, are the factor that drive the growth of market.

Estun Automation, Jaka Robotics, Effort Intelligent Equipment Co Ltd, and Xiomi are the major market players in the China market.

Material handling segment is expected to register highest CAGR in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us