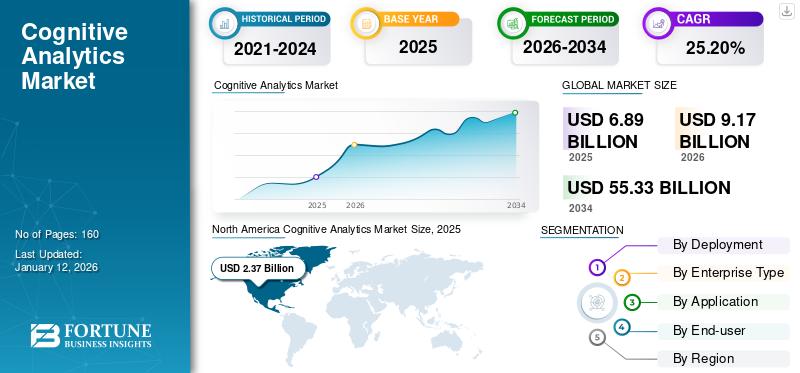

Cognitive Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Application (Customer Management, Fraud Detection & Security, Supply Chain Management, Sales & Marketing Management, and Others), By End-user (BFSI, IT & Telecom, Government, Retail, Healthcare, Education, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global cognitive analytics market size was valued at USD 6.89 billion in 2025 and is projected to grow from USD 9.17 billion in 2026 to USD 55.33 billion by 2034, exhibiting a CAGR of 25.20% during the forecast period. North America dominated the global cognitive analytics market with a share of 34.40% in 2025.

Cognitive analytics companies deploy technologies such as artificial intelligence, machine learning, natural language process, deep learning, and others to understand unstructured and structured data. The technology offers analysis of large sets of information, images, or recognizes certain objects that helps enterprises in enhancing its business model operations. The advanced technology further supports the cognitive application with real-time insights. The increase in digitalization and increased adoption of analytical tools is expected to boost market growth.

During the COVID-19 pandemic, industries, such as retail, healthcare, manufacturing, IT and telecom, BFSI, and others rapidly implemented technologies to support remotely working staff and help continue business operations. The healthcare industry witnessed growth due to healthcare providers and research institutes implementing analytics tools to understand disease history, pandemic patterns, different patients’ medical records, and others to understand future results.

Cognitive Analytics Market Trends

Focus on Hyper-personalization to Boost Market Growth

The enterprises are facing higher competition in acquiring customers across industries. To boost sales, companies are focusing on acquiring new customers and maintaining loyal customers with various strategies. These strategies are focused on the personal experience of the customers and enterprises are keen in understanding the need and changing trends amongst the customers. Market players are focusing on implementing hyper-personalization techniques, allowing enterprises to attract customers with personalized webpages and dynamic pricing and offering customized services after the purchase.

This has fueled the demand for cognitive analytics tools that support real-time insights helping businesses with better decision making. As the technology uses customer buying behavior patterns, it can help in offering personal marketing strategies. These tools can help access social media data and provide current trends insights for the businesses to prepare customer targeting strategies. Thus, the rising product adoption by customer-centric enterprises is estimated to boost cognitive analytics market share.

Download Free sample to learn more about this report.

Cognitive Analytics Market Growth Factors

Growing SME Investments in Digital Tools to Drive Market Growth

Aimed at digital transformation, small & medium enterprises are significantly investing in cognitive analytics tools for better decision making. It helps small businesses in tackling the operational challenges by providing real-time insights. Furthermore, these enterprises lack in funding and acquiring skillful staff. This makes it essential for such businesses to integrate technologically advanced solutions. Moreover, organizations acquire and produce valuable information through the factors that drive demand for cognitive analytics:

- Digital transformation and productivity initiatives

- Cloud migration and new IT platforms

- Managing a higher volume of information

- The high volume of new employee hires

- Increased remote and hybrid work

Similarly, there is a rise in digitalization and involvement of customers in online transactions. With the adoption of advanced and intelligent analytical tools, SMEs can gain insights such as identifying bottlenecks, purchasing habits, and others. This can help in enhancing the business strategies and deliver customer satisfaction. Thus, growing SMEs’ investments in digital solutions is expected to propel the cognitive analytics market growth.

RESTRAINING FACTORS

Security Concerns and Safety Challenges May Hamper Market Growth

The tool requires ample data to understand the pattern and provide analysis. Besides, it uses advanced technologies such as AI, machine learning, natural language processing, and others. It increases the risk of data theft and security breach. Furthermore, the increasing number of government policies, such as Europe’s General Data Protection Regulation, to reduce the usage of customer personal information for businesses may hamper the market growth.

Cognitive Analytics Market Segmentation Analysis

By Deployment Analysis

Cloud-Based Segment to Grow as Real-time Data Analysis Fuels Demand for Cloud-Based Solutions

By deployment, the market is segmented into cloud and on-premises. The cloud-based segment is expected to gain maximum segment share of 57.30% in 2026 and is set to grow at a rapid CAGR during the forecast period. The cloud computing model helps enterprises in expanding their businesses and offers easy digital transformation. The cloud-based analytics offers real-time data that help business operations.

The on-premises segment is expected to showcase steady growth rate during the forecast period. This can be attributed to the in-house data storage feature of these solutions.

By Enterprise Type Analysis

Large Enterprises Segment to Lead as Ease of Business Management Fuel Product Demand

Based on enterprise type, the market is fragmented into small and medium enterprises and large enterprises. The large enterprises segment is expected to gain maximum segment share of 62.62% in 2026. The secured IT budget and increase in adoption of advanced digital solutions by the large enterprises is expected to drive the growth rate. These enterprises cater to a vast set of customers. Therefore, quick business decisions are needed to solve the operational challenges. This is expected to boost the market growth.

The small and medium enterprises segment is set to register rapid growth rate over the forecast period. This is due to steady investment in advanced solutions by these enterprises to attract new customers.

By Application Analysis

Customer Management Segment to Lead Due to Rising Focus on Enhancing Sales

By application, the market is subdivided into customer management, fraud detection & security, supply chain management, sales & marketing management, and others. The customer management segment is set to register dominant share during the projected time frame. Organizations are adopting cognitive platforms in customer care operations to substantially reduce the time and resources they spend on attaining customer issues. In addition, organizations are finding the technology useful as it helps them to change their customer care centers into profit centers. The analytics tools with technologies such as machine learning and AI support businesses in gaining deep customer insights, thus further driving segment growth.

The fraud detection and security segment is poised to witness substantial growth rate during the estimated period. The technology with the help of natural language processing, data mining and others detects any kind of anomalies and change in patterns.

The supply chain management segment is expected to gain maximum segment share of 26.48% in 2026. The technology helps with tracking the inventories, analyzing entry logs to offer a smoother process. Various logistics companies are shifting toward cognitive computing and machine learning to minimize the challenges of supply chain processes. The adoption of cognitive computing in the supply chain model allows companies to overcome transparency and visibility and enable a collaborative decision-making process.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

IT & Telecom Segment Share to Propel Owing to Exponential Growth in Number of Customers

By industry, the market is classified into BFSI, IT & telecom, government, retail, healthcare, education, and others. The IT and telecom segment is set to record maximum share during the forecast period. As the industry faces challenges in managing the wide sets of customer data, the demand for cognitive analytics is set to gain traction in the coming years. To equip the industry with new and innovative technology, the need for cognitive tools is expected to grow. For instance,

- In June 2023, Mphasis launched Mphasis.ai, a business unit focused on developing organizations globally, enhancing the potential of AI and maximizing business results. The business unit integrates AI capabilities into existing technology, allowing organizations to improve customer experience and develop operational efficiency while minimizing issues.

The education segment is slated to witness rapid growth rate during the forecast period. The increase in self-learning and distance learning courses is set to drive the demand for advanced analytics. The healthcare segment is poised to showcase significant growth rate over the forecast period. This is owing to the surging demand for understanding patient patterns, disease outbreaks, and others.

The BFSI segment is poised to record prominent revenue share over the study period. This is owing to the increase in fraud cases and vulnerability. The technology offers advanced alerts by continuously monitoring the data and operations. Retail to invest in technology to enhance customer service.

REGIONAL INSIGHTS

Geographically, the market is studied across Asia Pacific, Europe, the Middle East & Africa, North America, and South America.

North America Cognitive Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is set to record the largest revenue over the study period. The region is an early adopter of the advanced analytics tools, artificial intelligence, and machine learning, among others. The increasing security concerns and fraud practices is driving the adoption of technologies that can predict and analyze potential occurrences in advance. The U.S. is estimated to gain dominant market share owing to the presence of prominent market players.

To know how our report can help streamline your business, Speak to Analyst

Europe is poised to register significant market share during the forecast period. The rise in adoption of technologies such as machine learning and artificial intelligence, is set to fill the digital gap. As per the leading analytics report on Europe AI frontier, the European countries have 25% of AI start-ups, thus likely to drive Europe market expansion.

Asia Pacific is set to showcase substantial growth during the forecast period. Increase in investment in digital solutions and analytics tools are expected to fuel the product demand. South Korea, India, China, and others are likely to invest in the technology to understand the customer trends and demand.

The Middle East and Africa market is expected to exhibit a significant growth rate over the forecast period. This is owing to the government emphasis on digitalization. The countries’ future endeavors on implementing digital solutions are expected to propel market growth.

Similarly, South America is estimated to showcase steady growth rate during the forecast period. The region offers numerous digital transformation opportunities, which is likely to boost market growth.

Key Industry Players

Focus on Addressing Business Operation Challenges Through Industry-specific Offering to Boost Key Players Revenue Share

Key players in the market are investing in research and innovation to address the industry related business issues. The players are providing advanced analytics capabilities by enabling technologies such as cloud platforms, 5G, and others. The rise in collaboration and partnership with various businesses to boost the competitive edge of the key players.

- August 2022: Kyndryl Inc. announced collaboration with Fice9 Inc. to offer contact center services to the customers powered with automation, AI, and cognitive analytics solution capabilities. Together, the companies aimed to offer modern business solutions with personalized IT support.

List of Top Cognitive Analytics Companies:

- IBM Corporation (U.S.)

- Capgemini SE (France)

- Google LLC (U.S.)

- SAS Institute, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Nuance Communications, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Infosys Limited (India)

- Oracle Corporation (U.S.)

- Intel Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Ericsson launched advanced troubleshooting capabilities with an extension of Ericsson Expert Analytics. The solution implements AI, machine learning, and analytics tools to identify root-cause of issues.

- July 2023: Canada-based Neurotechnology Company NeuroCatch Inc. announced partnership with HealthTech Connex to support its team’s mental performance. The companies would use cognitive analytics solutions to support data-driven decision making capabilities.

- May 2023: Microsoft launched Microsoft Fabric, a unified analytics platform that unifies data and insights through one common architecture and experience, allowing healthcare organizations to eliminate the costly, time-consuming process of storing health data sources.

- May 2023: Tata Consultancy Services strategically collaborated with Google LLC Cloud to provide generative AI and cognitive-powered services to customers. It caters to industry specific applications that focus on pushing business value in the real-world.

- March 2023: Tata Consultancy Services launched 5G-powered cognitive plant operations adviser to support industries such as oil and gas, manufacturing, retail, and others with advanced analytics and artificial intelligence. It would help clients in building prescriptive and predictive capabilities.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 25.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 55.33 billion by 2034.

In 2025, the market was valued at USD 6.89 billion.

The market is projected to grow at a CAGR of 25.20% during the forecast period.

By end-user, the IT and telecom industry segment is expected to lead the market.

The rising investments by SMEs in digital technology is a key factor driving market growth.

IBM Corporation, Capgemini SE, Google LLC, SAS Institute, Inc., Microsoft Corporation, Nuance Communications, Inc. are the top players in the market.

North America is expected to hold the highest market share.

The cloud segment is expected to exhibit the largest share in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us