Cloud Computing Market Size, Share & Industry Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others), and Regional Forecast, 2026 – 2034

Cloud Computing Industry Insights [Latest]

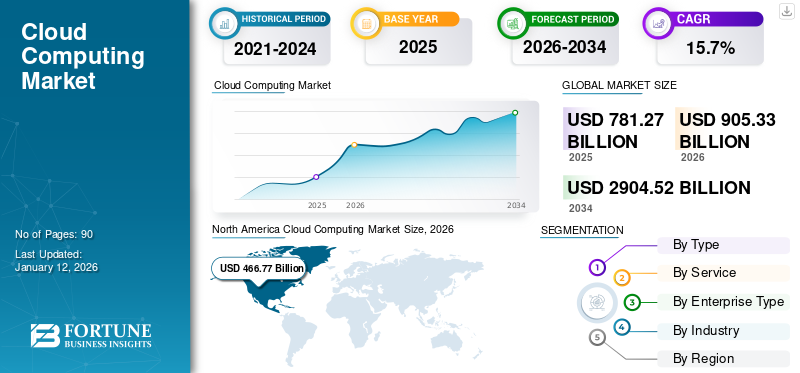

The global cloud computing market size was valued at USD 781.27 billion in 2025 and is projected to grow from USD 905.33 billion in 2026 to USD 2,904.52 billion by 2034, exhibiting a CAGR of 15.7% during the forecast period. The North America dominated the cloud computing industry with a market share of 52.0% in 2025.

Cloud computing is a term used to describe the process of storing, processing, and managing data on a network of remote computers hosted on the internet. This is in contrast to traditional data storage methods, which rely on local servers or personal computers. It provides businesses with the ability to store and process data remotely, enhancing operational efficiency and mobility.

In recent years, enterprises have increasingly adopted cloud-based platforms not only for cost efficiency but also to achieve agility, scalability, and business continuity. The global shift toward hybrid and multi-environment operations has made cloud computing a core element of digital infrastructure. As organizations pursue data-driven decision-making, the ability of cloud systems to integrate AI, analytics, and automation capabilities is further driving their strategic importance in the corporate IT ecosystem.

GLOBAL CLOUD COMPUTING MARKET OVERVIEW

Market Size:

- 2025 Value: USD 781.27 billion

- 2026 Value: USD 905.33 billion

- 2034 Forecast Value: USD 2,904.52 billion, with a CAGR of 15.7% from 2026–2034

Market Share:

- Regional Leader: North America held the 52.0% market share in 2025, driven by early adoption of cloud technologies and the presence of key players such as Amazon Web Services, Microsoft Corporation, IBM Corporation, and Oracle Corporation.

- Fastest-Growing Region: Asia Pacific is the fastest-growing region, fueled by rapid digitalization, government investments in IT infrastructure, and increasing adoption of cloud-based solutions across China, India, and Japan.

- End-User Leader: The IT and telecommunications segment led the cloud computing market in 2025, driven by the need for high-performance data storage, scalability, and advanced analytics capabilities.

Industry Trends:

- Omni-Cloud Integration: Enterprises are adopting omni-cloud platforms to enhance data connectivity, streamline operations, and achieve greater efficiency.

- AI and ML Empowerment: Integration of Artificial Intelligence and Machine Learning strengthens automation, data analytics, and decision-making accuracy across industries.

- Generative AI Expansion: Implementation of generative AI on cloud platforms enhances productivity, cybersecurity, and real-time analytics capabilities.

- Hybrid Cloud Growth: The shift toward hybrid cloud models combining public and private systems offers better flexibility, control, and data security.

- Strategic Alliances: Partnerships such as Google Cloud-VMware and Microsoft Globant are driving innovation and expanding market presence.

Driving Factors:

- Digital Transformation Acceleration: Rising adoption of digital business models is boosting the demand for scalable and cost-effective cloud infrastructure driveing the cloud computing industry growth.

- Integration of Advanced Technologies: AI, ML, Big Data, and IoT are enhancing the performance and reliability of cloud-based services.

- SME Cloud Adoption: Small and medium-sized enterprises are embracing pay-as-you-go models to reduce costs and improve operational agility.

- Edge and 5G Integration: The expansion of edge computing and 5G networks enhances real-time data processing and connectivity performance.

- Government and Regulatory Support: Public and private investments, including initiatives like the EU’s IPCEI CIS project, are promoting widespread cloud adoption.

The cloud computing industry is growing due to several major factors, including increasing digital transformation across industries, growing internet and mobile device adoption around the world, and increased usage of big data. As industries undergo modernization, cloud platforms have become indispensable in supporting digital business operations. Furthermore, the implementation of Internet of Things (IoT), edge computing, 5G, and real-time analytics driven by Artificial Intelligence (AI) and Machine Learning (ML) is anticipated to increase the value of cloud computing technology across different businesses. For instance,

- In January 2025, SAP SE integrated AI and Machine Learning (ML) into its enterprise ecosystem to help companies make better data-driven decisions and increase productivity.

In order to speed up deployment cycles and guarantee flexibility across cloud environments, businesses are also concentrating on cloud-native application development and containerization. Strong demand is anticipated in the global cloud services market as a result of this ongoing change, especially in sectors like retail, healthcare, and BFSI where data security and intelligence are essential. Another important factor influencing the size of the cloud computing market and guaranteeing the industry's sustainable growth is the integration of cybersecurity measures and compliance-driven architectures.

CLOUD COMPUTING INDUSTRY TRENDS

Growing Acceptance of Omni-Cloud over Multi-Cloud to Propel industry Growth

An Omni-cloud platform offers upgraded connection facilities to businesses, enabling data to be rationalized and integrated across different platforms. By adopting Omni-cloud systems, companies can achieve greater precision in data management while improving operational efficiency. Hence, major players are leveraging strategies, such as new product innovations, partnerships, and mergers & acquisitions to expand their market presence. For instance,

- In November 2023, Google Cloud and VMware expanded their alliance to integrate AlloyDB Omni on the VMware Cloud foundation. The tech preview combines the robust proficiencies of AlloyDB Omni and VMware’s Data Services Manager, providing users with a solution to streamline PostgreSQL management, improve existing databases, and modify processes into generative AI applications.

These added advantages of omni-cloud over multi-cloud platforms will boost the cloud computing market share. Additionally, the growing inclination towards Omni-cloud models corresponds with the business need for unified data management across hybrid environments and centralized governance. Additionally, this trend is hastening the adoption of AI-based workload optimization solutions, cloud orchestration tools, and API-driven integration. Organizations are investing in automation-first strategies to effectively manage complex multi-cloud operations due to rising data volumes and a greater dependence on distributed networks. Global hyperscalers like Amazon Web Services, Microsoft Azure, and Google Cloud are expected to further solidify their dominance in the cloud services market as a result of this evolution, which is predicted to redefine competitive dynamics within the cloud computing industry.

Also the regional diversification is becoming a major strategic focus for cloud providers. While North America continues to lead, Asia Pacific is emerging as the fastest-growing regional market, driven by rapid enterprise digitalization, cloud-first government policies, and expansion of data center infrastructure in India, China, and Japan. Similarly, Europe is witnessing strong growth due to the enforcement of data sovereignty regulations and the rise of sovereign cloud frameworks designed to protect critical enterprise and public sector data. These developments are strengthening the overall cloud computing market growth globally.

CLOUD COMPUTING MARKET GROWTH FACTORS

Integration of AI, Machine Learning, and Big Data with Cloud to Fuel Market Progress

The growing adoption of Artificial Intelligence (AI), big data, Machine Learning (ML), and other emerging technologies is anticipated to drive industry growth. Such technologies are reshaping the market landscape as enabling real-time data processing, visualization, and analytics. Various service providers, such as Google, Amazon, Microsoft, and many others, continue to implement artificial intelligence to enhance efficiency and reduce cost in cloud services.

- For instance, in August 2023, Microsoft partnered with Globant's to launch an AI and cloud innovation studio, combining Microsoft’s advanced cloud solutions with Globant's expertise in AI-driven digital transformation.

Thus, the rising integration of AI, big data and ML technologies are anticipated to drive the market’s growth. Simultaneously, businesses are increasingly utilizing AI-driven automation and predictive analytics to optimize resource allocation, enhance security posture, and lower cloud operating costs. This cloud-based intelligence integration is improving value delivery and speeding up industry-wide innovation cycles.

Additionally, there is a noticeable shift in the market toward cloud infrastructure that is both sustainable and energy-efficient. To meet corporate sustainability objectives and adhere to environmental regulations, major industry players are investing in green data centers and cloud operations powered by renewable energy. In the highly competitive cloud computing market, the drive for carbon-neutral operations is emerging as a crucial differentiator.

It is anticipated that businesses that invest in AI-integrated cloud systems, autonomous cloud infrastructure, and automation-driven operational models will acquire a competitive edge, driving the next stage of the global cloud industry growth.

RESTRAINING FACTORS

Data Privacy and Security Concerns to Hamper Market Growth

Customers adopt cloud services to securely store business and personal data on cloud platforms. However, concerns related to data privacy and data breaches, loss of data, unexpected emergencies, application susceptibilities, and cyberattacks pose significant challenges to the growth of the cloud industry. Cybercrimes, such as cloud malware injection, service or account hijacking, meltdown, and man-in-the-cloud assaults can expose critical company data resulting in financial losses and operational disruptions. Cyberattacks also disturb corporate functions, thereby restraining the progress of the market.

- For instance, as per a Thales Cloud Security Study, 2023, more than 39% of businesses encountered a data breach in their cloud environment in 2022, marking a 35% increase from the previous year. Human error was identified as the leading reason for data breaches.

The cloud computing market landscape is also becoming more complicated due to differing compliance regulations across nations. Businesses that operate internationally must comply with numerous jurisdictional standards pertaining to data localization and privacy, which greatly raises operational complexity and expenses. In order to maintain customer trust, providers are investing in sovereign and hybrid cloud frameworks due to the increasing need for advanced encryption solutions and regulatory alignment.

Additionally, ongoing worries about the security of shared infrastructure in public cloud environments continue to discourage adoption among government agencies and financial institutions, which has a moderate effect on the expansion of the cloud computing industry as a whole.

CLOUD COMPUTING USE CASES

|

Infrastructure as a Service (Technology) |

Challenges: Netflix initially relied on traditional data centers, but scaling them became increasingly difficult as the platform’s popularity grew. The physical infrastructure couldn’t keep up with the demands of its global user base, especially as content streaming needed more computational power and storage. Solution: Netflix teamed up with IaaS providers such as Amazon Web Services to host its content streaming services. By using cloud infrastructure, Netflix can dynamically scale their resources based on demand, ensuring seamless content delivery to users globally. |

|

Retail (Industry) |

Challenges: Maintaining an on-premise infrastructure required constant investment in hardware, software, and IT personnel. As Walmart’s operations expanded globally, this became increasingly expensive, particularly with data centers that needed constant monitoring and updates Solution: Walmart adopted cloud platforms such as Microsoft Azure to integrate its online and offline systems, enabling a seamless Omni channel experience. Now, customers can shop on Walmart’s website and mobile app while receiving real-time updates. |

The Role of Generative AI in Enhancing Cloud Infrastructure Performance

Implementation of Generative AI Capabilities Across Cloud Infrastructure to Fuel Market Expansion

Generative AI can transform cloud investment and returns, creating numerous growth opportunities for market players. Cloud infrastructure supports generative AI’s innovations, enabling enterprises to improve threat detection, data augmentation, data anonymization, tech democratization, and cybersecurity. End-to-end, generative AI-driven workflows allow enterprises to mitigate their transactional applications to the cloud, optimizing efficiency.

- For instance, according to industry experts, generative AI can provide around 75-110% points of Return on Investment (ROI) to cloud programs. Its key benefits include minimizing the cost and time of application migration and remediation, creating new business use cases, and improving the efficiency of application expansion and cloud infrastructure.

Leading vendors are increasingly using generative AI to improve operational intelligence and scalability in the cloud computing sector. Predictive resource allocation, dynamic workload management, and cost optimization are made possible by the incorporation of large language models (LLMs) and AI automation into cloud systems. This development gives businesses real-time flexibility for complex data environments while also bolstering the effectiveness of the global cloud services market. Therefore, over the course of the forecast period, it is anticipated that the generative AI and cloud platforms will significantly increase the size of the cloud computing market and further solidify the market share of major players.

Get comprehensive study about this report by, Download free sample copy

Source: Forrester September 2024 Artificial Intelligence Pulse Survey

CLOUD COMPUTING MARKET SEGMENTATION ANALYSIS

By Type Analysis

Public Cloud Segment Dominated Owing to Rising Cost-Efficient Solution of Cloud Computing

Based on type, the market is categorized into public cloud, private cloud, and hybrid cloud.

The public cloud segment accounted for the highest market share of 55.88% in 2026 driven by the rising demand for secure, scalable, and cost-efficient solutions. Further, it is driven by factors such as digital transformation, increasing data storage needs by users in major countries.

The growing adoption of multi-cloud strategies by enterprises to ensure flexibility and avoid vendor lock-in is expected to further boost the demand for public cloud infrastructure. The expanding global cloud services market, driven by hyperscalers such as AWS, Microsoft Azure, and Google Cloud, continues to shape the competitive dynamics of the cloud computing industry.

The hybrid cloud segment is predicted to record a leading CAGR during the forecast period due to the increasing usage of cloud-driven solutions and the added benefits of cloud platform over public and private cloud. These benefits include minimized costs, improved control and scalability due to the integration of both private and public cloud and improved security and risk.

- For instance, in December 2023, Lenovo, in partnership with Intel, announced the launch of a hybrid cloud platform and services. ThinkAgile, the hybrid cloud solution, enhances the performance of Artificial Intelligence and quickness of cloud solutions by providing more computing power and better memory to its product line.

Additionally, businesses in the manufacturing, BFSI, and retail sectors are gradually implementing hybrid cloud solutions to comply with data sovereignty regulations and facilitate smooth workload migration. The growth trajectory of the cloud computing industry will continue to depend heavily on the hybrid segment's momentum, especially as companies look for a balance between performance, scalability, and compliance.

By Service Analysis

Rising Need for Easy Deployment Models to Increase the Use of Software as a Service (SaaS)

By service, the market is segmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

The Software as a Service (SaaS) segment held the highest market share in 2024, due to its ease of deployment, lesser maintenance costs, and low cost of possession. These features will give new market opportunities for SaaS in different regions including North America, APAC and European countries.

The SaaS model continues to be a major contributor to the global cloud computing market size, accounting for substantial revenue generation across verticals such as education, healthcare, and retail. The proliferation of remote work and cloud-native business applications is accelerating the demand for SaaS solutions, particularly in enterprise collaboration tools and CRM platforms. This sustained demand underpins the long-term scalability and innovation potential within the cloud services market.

Infrastructure as a Service (IaaS) will grow at the highest rate during the forecast period (2026-34), along with holding 26% market share in 2025, as it minimizes initial investment costs by eliminating the need for onsite data centers and reducing ongoing service and maintenance costs. Moreover, the rise of digitization, along with the increasing adoption of cloud computing services are key drivers of the cloud computing market growth.

IaaS demand is also expected to be strengthened globally by the growth of edge computing, AI, and ML workloads on cloud infrastructure. The cloud computing industry is becoming more competitive as cloud vendors offer more sophisticated compute instances and storage options.

The Platform as a Service (PaaS) estimated to hit the CAGR of 17.06% during the forecast period. New developments like serverless computing and container orchestration are altering the PaaS environment and helping the cloud industry as a whole grow.

By Enterprise Type Analysis

SMEs Segment to Dominate due to Increase Product Adoption among SMEs

Based on enterprise type, the market is bifurcated into SMEs and large enterprises.

The SMEs segment is projected to display the highest CAGR of 18.78% during the forecast period as cloud technology has revolutionized the operations of small and medium-sized enterprises. It helps SMEs decrease spending on expensive hardware and software by offering flexible payment options, such as a pay-as-you-go, thereby reducing overall costs. Moreover, various market players are introducing new cloud solutions designed for SMEs, driving adoption.

For instance, DE-CIX and BasicBrix collaborated to leverage cloud computing solutions for SMEs in Malaysia. With the unification of hassle-free computing services of BasicBrix and high performance and secure direct connections of DirectCLOUD, a service offered by DE-CIX, Malaysian start-ups and SMEs can take advantage of these solutions.

Governments in the Middle East and Asia are encouraging SME digitalization initiatives that integrate cloud infrastructure, thereby bolstering the expansion of the cloud computing sector. In the upcoming ten years, this trend will greatly increase small and mid-sized businesses' market share in cloud computing worldwide.

The large enterprises segment accounts for the highest market share of 52% in 2025 as cloud technology enhances operational efficiency, offers better scalability, and drives widespread adoption among large enterprises.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Higher Adoption of Cloud Solutions Propels IT & Telecommunications Industry Expansion

Based on industry, the market is distributed into BFSI, IT and telecommunications, government, consumer goods and retail, healthcare, manufacturing, and others.

The IT and telecommunications segment holds the largest market share of 25% in 2025 due to the rising popularity of cloud-powered computing solutions in different organizations. With the help of this technology, telecommunication service providers and operators can store and calculate customer data, build cloud data warehouses, transfer cloud data, manage with other cloud-based telecommunication services, autonomously access tele service with the help of cloud, and many more. Moreover, various market players are collaborating and forming alliances with telecom providers to drive business growth.

- For instance, in February 2023, Airtel announced a strategic alliance with Vultr to provide cloud solutions to businesses in India. These cloud solutions are hosted at Airtel’s data centers across Mumbai, Bangalore, and Delhi-NCR, allowing businesses to measure their digital functions globally.

The global cloud computing market continues to rely heavily on the IT and telecom industries for growth. Telecommunications companies are increasingly using cloud infrastructure to provide low-latency, data-intensive services as 5G networks, edge computing, and IoT ecosystems emerge.

The healthcare segment is projected to record the highest CAGR of 19.04% during the forecast period. The segment’s growth can be accredited to the increased deployment of mobile applications, cloud-based software, wearable healthcare tools, and smart healthcare apparatus. Additionally, the healthcare industry's cloud computing market is expanding due to the rise in telemedicine, AI-driven diagnostics, and electronic health records (EHRs).

REGIONAL ANALYSIS OF THE CLOUD COMPUTING INDUSTRY

North America Cloud Computing Industry Trends

North America Cloud Computing Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America will account for the highest market share during the forecast period owing to the early adoption of high-tech technologies, such as AI, Blockchain, robotics, the Internet of Things (IoT), and the cloud. The major presence of leading cloud providers, such as IBM Corporation, Oracle Corporation, and Microsoft Corporation, will further contribute to the adoption of cloud in the region.

- For instance, in September 2023, Oracle announced a partnership with TELMEX-Triara and became the first hyperscaler with two cloud regions in Mexico. Enterprises benefit from Oracle’s Cloud Infrastructure (OCI), which enhances performance, strengthens security, and provides advanced analytics, and distributed cloud proficiencies.

Download Free sample to learn more about this report.

The market in the U.S. is undergoing a continuous digital transformation across various industries, where emerging and established companies are integrating new technologies to deliver real-time user experiences to consumers. The U.S. market stands at USD 282.62 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe Cloud Computing Industry Trends

Europe is estimated to capture a noteworthy share of USD 205.63 billion in 2026 in the global market, with the second-largest CAGR of 16.80% during the forecast period. Government initiatives and investments to improve cloud adoption and implementation will fuel the market’s growth across European countries. Additionally, private corporations are accelerating cloud adoption through growing investments and business expansions.

- For instance, in December 2023, the European Commission approved financial aid worth USD 1.2 billion for cloud computing projects in the region. The project, named IPCEI CIS (Next Generation Cloud Infrastructure and Services), was developed by seven European Union states, including France, Poland, Hungary, Germany, Italy, the Netherlands, and Spain.

The market in the U.K. stands at USD 55.20 billion, along with France estimated to hit USD 22.77 billion and Germany market accounting for USD 53.94 billion in 2026.

Asia Pacific Cloud Computing Industry Trends

Asia Pacific is the third-largest market of USD 123.40 billion in 2026 and expected to dominate the global market with the highest CAGR during the forecast period, driven by the rising demand for cloud-based solutions in telecommunications and healthcare sectors. The cloud computing industry in China holds USD 39.94 billion, along with India estimated to hit USD 20.70 billion and Japanese market accounting for USD 27.86 billion in 2026.

- For instance, in February 2023, Tech Data introduced cloud services in Australia, offering customized solutions for AWS and Microsoft’s IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) business models.

Middle East & Africa

The cloud computing industry in middle east & africa is the fourth-largest market in 2026, valuating at USD 62.85 billion and projected to grow at a rapid pace in the market in the coming years. The region’s progress is attributed to improved investments in developing technologies, such as 5G, Machine Learning (ML), Big Data, Artificial Intelligence (AI), and cloud computing, by governments of Israel, the GCC countries, and Turkey. The GCC countries projected to value at USD 19.45 billion in 2025.

South America

The cloud computing industry in South America is in an evolving phase, owing to the increased use of smartphones, laptops and the internet. The need to store and process huge volumes of data has increased significantly, allowing businesses to provide customer-centric services to their customers, driving market growth.

COMPETITIVE LANDSCAPE

Key Market Players

Key Players to Focus on Advanced Solutions to Strengthen Their Market Positions

Key market players are working on creating a wide variety of distributed cloud solutions to address the needs of customers and organizations. The introduction of innovative solutions helps companies increase their business expertise. In addition, the upgrading and expansion of existing product portfolios will improve vendors’ market position.

List of Top Cloud Computing Companies:

|

Cloud Computing Large Companies |

Cloud Computing SMEs |

|

· Amazon Web Services, Inc. (U.S.) · Oracle Corporation (U.S.) · IBM Corporation (U.S.) · Alibaba Group Holdings Limited (China) · Microsoft Corporation (U.S.) · VMware, Inc. (U.S.) · Google LLC (U.S.) · SAP SE (Germany) · Salesforce, Inc. (U.S.) · Rackspace Technology, Inc. (U.S.) · And More… |

· ScaleWay (France) · Turkcell Cloud (Turkey) · Vargonen (Turkey) · CtrlS Datacenters (India) · Linx Cloud (Brazil) · Netmagic Solutions (India) · Sentia (Netherlands) · Cegeka (Belgium) · CloudVPS (Netherlands) · UOL Diveo (Brazil) · And More… |

RECENT DEVELOPMENTS IN THE CLOUD COMPUTING INDUSTRY:

- February 2025: Accenture collaborated with Google Cloud to accelerate the adoption of generative AI and cloud solutions in Saudi Arabia. The initiative aims to help enterprises unlock new business opportunities, improve customer experiences, enhance modern digital core and scale generative AI agents.

- January 2024: Microsoft and Vodafone signed a ten-year strategic alliance to bring generative AI, cloud, and digital services to over 300 million consumers, businesses, and public sector organizations across Africa and Europe. This collaboration enables Vodafone to leverage Microsoft’s generative AI to enhance customer experiences, build new digital and financial facilities for enterprises, and overhaul its global data center cloud strategy.

- January 2024: IBM collaborated with American Tower to introduce edge cloud services, driving innovation and improving customer experiences. The company aims to fast-track the progress of multi-cloud and hybrid cloud computing platforms at the edge.

- November 2023: Udemy collaborated with Google Cloud as an initial member of its new cloud-driven content program. The partnership addresses the increasing demand for cloud computing expertise across the globe.

- February 2023: Akamai Technologies, Inc. announced the launch of the Connected Cloud platform for content delivery, security, and cloud computing to preserve applications and avoid threats.

CLOUD COMPUTING INDUSTRY INVESTMENT ANALYSIS AND OPPORTUNITIES

Key players are focusing on Research and Development (R&D) activities to develop a comprehensive range of cloud computing offerings to meet the customers' and organizations' needs. In January 2025, Microsoft invested USD 3 billion in AI and cloud computing in India. Furthermore, the launch of advanced cloud computing solutions assists players in sustaining their business competence. The enhancement and expansion of the existing product portfolio uplift the position of vendors in the market.

CLOUD COMPUTING INDUSTRY REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

CLOUD COMPUTING INDUSTRY REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Type, Service, Enterprise Type, Industry, and Region |

|

Segmentation |

By Type

By Service

By Enterprise Type

By Industry

By Region

|

|

Companies Profiled in the Report |

Amazon Web Services Inc. (U.S.), Oracle Corporation (U.S.), IBM Corporation (U.S.), Alibaba Group Holding Limited (China), Microsoft Corporation (U.S.), VMware, Inc. (U.S.), Google LLC (U.S.), Rackspace Technology, Inc. (U.S.), SAP SE (Germany), and Salesforce, Inc. (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 2,904.52 billion by 2034.

In 2025, the market was valued at USD 781.27 billion.

The market is projected to grow at a CAGR of 15.7% during the forecast period.

By industry, IT and telecommunications segment leads by holding the largest market share.

Integration of AI, machine learning, and big data with cloud is a key factor driving market growth.

Amazon.com Inc., Oracle Corporation, Microsoft Corporation, and IBM Corporation are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us