Drilling Services Market Size, Share & Industry Analysis, By Service (Directional Drilling {Logging While Drilling (LWD), Measurement While Drilling (MWD), Rotary Steerable System (RSS), Mud Motors, and Others} and Non-Directional Drilling), By Application (Onshore and Offshore {Shallow Water, Deepwater, and Ultra-Deepwater}), By End-User (Oil & Gas, Mining, Water Exploration, and Others), and Regional Forecast, 2026-2034

Drilling Services Market Size and Future Outlook

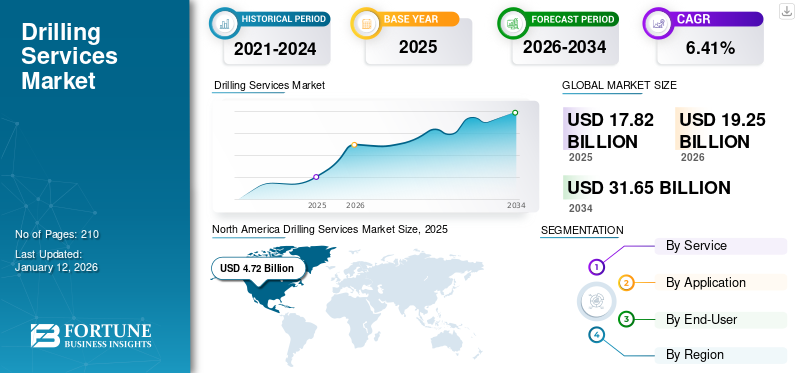

The global drilling services market size was valued at USD 17.82 billion in 2025. The market is projected to grow from USD 19.25 billion in 2026 and is expected to reach USD 31.65 billion by 2034, exhibiting a CAGR of 6.41% during the forecast period. North America dominated the global market with a share of 26.48% in 2025.

Drilling services encompass the specialized processes of creating holes in the earth (or other materials) for a variety of purposes, ranging from resource extraction to construction and scientific research.

The market is projected to witness high demand in the coming years due to increasing global energy consumption and the increasing need for resource exploration and production.

Halliburton is one of the key players in the market. It offers a wide array of services, including drilling fluids, cementing, drill bits, and well construction, providing integrated solutions for various drilling requirements.

MARKET DYNAMICS

MARKET DRIVERS

Rapidly Rising Energy Demand Owing to Construction of New Infrastructure to Help Industry Growth

Different countries across the globe have observed a substantial spike in overall energy intake over the decades. The setup of new commercial and industrial infrastructures has propelled the emerging as well as developed economies to concede huge power demand, fostering the drilling services market size. Additionally, increased spending in mining, manufacturing, commercial, construction, and many other verticals has led numerous private and public authorities to soar their efforts to cater to consumer demand during peak hours. For example, based on the IEA Oil Market Report (OMR), global oil demand is expected to grow by an average of 1.1 mb/d in 2025, increasing from 870 kb/d in 2024. China is anticipated to be the main source of drilling services market growth, primarily fueled by developments in its petrochemical industry, followed by other Asia Pacific countries.

New Developments in Hydrocarbon Industry, Coupled with New Oil Field Discovering, to Play Major Role in Market Outlook

The growing investments to explore and produce a bulk volume of hydrocarbons to suffice the international energy demand is projected to be one of the key factors augmenting the global drilling services market share. Additionally, continuous drilling of wildcat wells and deployment of geological surveys to uncover new capacity reservoirs that can effectively deliver oil production over a longer period is set to unveil new opportunities for the industry. For instance, in October 2020, Odfjell Drilling reported obtaining a 15-well drilling contract from the industry giant Equinor to drill and complete wells in the North Sea as part of its Breidablikk project. The new drilling sites are set to be situated offshore Aberdeen and were likely to start in 2022 with expansion over 2.5 years.

MARKET RESTRAINTS

Increasing Inclination Toward Adoption of Clean Energy Generation Technologies May Obstruct Industry Pace

Various governments and organizations have introduced substantial renewable power generation targets to curb the carbon discharge that may hamper the global drilling service market. Furthermore, different administrations are also focusing on reducing their dependency on fossil fuels, thereby adhering to low-emission technologies. For instance, according to the latest reports of IEA, 2023 and 2024 marked a historic year for the growth of renewable capacity, with yearly additions expected to increase annually. Significant policies introduced in 2022, particularly REPowerEU in the EU, the Inflation Reduction Act (IRA) in the USA, and China’s 14th Five-Year Plan for Renewable Energy, are anticipated to provide additional support for expediting the deployment of renewable energy in the years ahead.

MARKET OPPORTUNITIES

New Contracts for Developing Mining Assets Along with Collaboration Activities to Propel Industry Outlook

Increasing efforts by numerous companies to produce a significant quantity of metals & minerals are set to unveil new opportunities for the global drilling services. Furthermore, the industry has also observed various partnership contracts to explore bulk reserves. For instance, in August 2020, Swick Mining Services Limited announced that it would receive new drilling contracts for mining in MATSA’s copper and BHP’s Olympic Dam mines, which are located in Spain and Australia. The company is set to undertake a five-year agreement to deliver underground drilling services in Australia, along with a five-year contract for Spanish assets.

MARKET CHALLENGES

Price Volatility Directly Impacting Investment Decisions is a Challenge for Market

Drilling services market players face challenges due to changes in oil and gas prices since E&P (Exploration and Production) companies frequently cut their drilling budgets and project operations during times of low prices. This results in reduced demand for drilling services, intense competition for scarce projects, and, eventually, a contraction in profit margins. This continuous need for adaptation and cost management to navigate the fluctuations in prices and changing energy demands poses a major challenge for the drilling services sector. For example, the price decline from 2014 to 2016 resulted in significant job losses and bankruptcies in the drilling industry. Likewise, the decrease in prices during the COVID-19 pandemic in 2020 led to major reductions in capital spending by oil and gas firms, directly affecting drilling operations.

DRILLING SERVICES MARKET TRENDS

Continuous Launch of New Tools & Services to Boost Production Output is Projected to Shape Market Dynamics

Various industry players are continuously striving to perform Research & Development (R&D) activities to fortify their position & maximize the output advancing the global drilling service market. Additionally, companies are also focusing on integrating advanced solutions with their portfolio to evaluate the downhole conditions in real-time for better wellbore optimization. For instance, in October 2024, Halliburton launched its iCruise Force intelligent, high-performance rotary steerable system, which, when paired with Halliburton's LOGIX automation and remote operations platform, enhances drilling abilities. Fueled by high-efficiency mud motors, the system boosts effectiveness with increased rig functionalities and deeper drilling in intricate formations, aiming to assist customers in attaining quicker penetration rates, reduced drilling expenses, and more accurate wellbore positioning.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic adversely affected the market for numerous verticals. Different industries suffered significant losses of operations owing to the imposition of strict policies such as nationwide lockdowns to curb the reach of the virus. Accordingly, the outbreak of the disease altered the demand for hydrocarbons and obstructed mining operations, leaving the drilling services industry in jeopardy.

Additionally, different parameters, such as disruptions in value chains, ongoing price wars, deteriorating international crude oil prices, unavailability of new investments, declining energy demand, and many others, acted as governing factors in shaping the industry trend during the pandemic. For instance, in April 2020, the International Energy Agency (IEA) evaluated that the international crude oil need is likely to fall by 9.3 million barrels a day (mbpd) in 2020 as compared to the preceding year.

SEGMENTATION ANALYSIS

By Service

Directional Drilling Services Dominates the Market Due to Increased Drilling of Highly Technical Wells

Based on service, the market is broadly categorized into directional drilling and non-directional drilling, with the directional segment further divided into Logging While Drilling (LWD), Measurement While Drilling (MWD), Rotary Steerable System (RSS), mud motors, and others.

The directional drilling services is likely to lead the industry size due to the increased drilling of highly technical wells in unconventional formations, coupled with the discovery of new reserves in complex reservoirs. Additionally, numerous operational benefits, including cost-effective solutions along with a higher Rate of Penetration (ROP), are anticipated to propel demand for the Rotary Steerable System (RSS) services segment. Measurement While Drilling (MWD) service is also set to observe significant growth owing to efficient operation, convenient integration, and the advancing of long-standing drilling technologies. The segment is set to capture 77.82% of the market share in 2026.

For non-directional drilling, demand is driven by the necessity for efficient and economical drilling in traditional reservoirs and aging fields. Increasing energy demand and the growth of available reserves persist in backing this sector, especially in areas with developed oil and gas infrastructure, which is driving segment’s growth. the segment is likely to grow with a considerable CAGR of 7.73% during the forecast period (2025-2032).

By Application

Low Costs for Drilling Along with Substantial Recovery Rate to Propel Onshore Segment Landscape

Based on application, the market is segmented into onshore and offshore, with further segmentation into shallow water, deepwater, and ultra-deepwater.

Onshore application dominates the market as the growth of onshore drilling services is backed by developing infrastructures, new bulk potential reserves, and significantly lower drilling costs, among other factors. This segment is expected to dominate by holding the market share of 69.49% in 2026.

The increasing global energy demand for exploration of offshore reserves and innovations in technology, such as deepwater drilling methods, are promoting unattainable resources. Moreover, the growing efforts by E&P companies to integrate innovative alternatives to combat challenging issues in various water depths are likely to augment the offshore segment outlook. The offshore segment is poised to grow with a CAGR of 8.65% during the forecast period (2025-2032).

By End-User

Increasing Global Energy Demand to Help Oil & Gas End-User to Dominate Industry Size

Based on end-user, the market is divided into oil & gas, mining, water exploration, and others.

Oil & gas end-user dominates the drilling services market share due to increasing investments in new hydrocarbon assets, unlocking new reserves, and significant production targets. The segment held 62.23% of the market share in 2026

The mining segment is expected to witness substantial growth owing to expansion strategies for prevailing mineral sites along with the exploitation of new reserves.

Water exploration is likely to observe substantial CAGR over the forecast timeline due to an increase in groundwater exploration projects across different areas.

To know how our report can help streamline your business, Speak to Analyst

DRILLING SERVICES MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America is Evolving Drilling Services Market with New Projects

North America dominate the market with the largest share valued at USD 4.72 billion in 2025 and USD 5.16 billion in 2026. The region is projected to dominate the global drilling service market share owing to the presence of various key industry players, long-standing expertise in drilling complex formations, large unconventional reserves, favorable government policies, and new projects, among other factors. For example, the Canadian Association of Energy Contractors (CAOEC), representing 95 member companies in land drilling, offshore drilling, and service rigs in Canada, indicates that its drilling outlook for 2025 is expected to increase. CAOEC expects the greatest levels of drilling operations and related employment since 2015, with an estimated total of 6,604 wells drilled in 2025, which is a rise of 448 compared to 2024, with 6,156 wells.

North America Drilling Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

U.S.

U.S. Leads Market Driven by Shale Gas Production Boom and Technological Advancements

The U.S. continues to be a leading player in the drilling services sector, fueled by the abundant shale formations found in areas such as the Permian Basin, Eagle Ford, and Marcellus. The revival of onshore drilling operations, along with technological improvements such as horizontal drilling and hydraulic fracturing, keeps driving the need for advanced drilling services. For instance, the U.S. Energy Information Administration (EIA) estimated that crude production would increase from a record high of 13.2 million barrels per day (bpd) in 2024 to approximately 13.6 million bpd in 2025. The U.S. market is poised to grow with the valuation of USD 4.02 billion in 2026.

Europe

Shifting Energy Environment Driving Demand for Drilling Services in the Region

Europe is the third leading region estimated to reach USD 2.60 billion in 2026. The drilling services market in Europe features a combination of established offshore fields in the North Sea and increasing interest in geothermal energy. The U.K. market is set to gain USD 0.23 billion in 2026. Although oil and gas exploration is under growing environmental scrutiny, the demand for drilling services continues due to the necessity of sustaining current production levels. For instance, in March 2025, Expro obtained two agreements with OMV Petrom, Southeastern Europe's integrated energy company, valued at over USD 10 million for the largest natural gas initiative in the Romanian Black Sea. Norway is forecasted to gain USD 0.50 billion in 2025, while Russia is predicted to stand at USD 1.23 billion in the same year.

Asia Pacific

Increasing Energy Demand in Developing Economies Drive Market Growth in the Region

Asia Pacific is the second largest market set to be valued at USD 4.89 billion in 2026, exhibiting a CAGR of 9.48% during the forecast period (2025-2032). China is poised to be valued at USD 2.61 billion in 2026. Asia Pacific industry size is also projected to observe a considerable growth rate owing to abruptly increasing energy demand, growing E&P activities, dependence on coal reserves, and significant metal & mineral reserves. For example, as per the BP Statistical Review of World Energy published in June 2020, the total coal production from China stood at 79.82 exajoules by the end of 2019, growing from 76.58 exajoules in 2018, observing an increase of over 4.2% annually. India is estimated to be worth USD 0.57 billion in 2026, while Thailand is predicted to reach USD 0.42 billion in the same year.

China

Investments in Advanced Drilling Technologies and Services Fuel Market in China

China is one of the leading players in the global market, with an increasing focus on local oil and gas production to reduce its reliance on imports. Government programs aimed at enhancing exploration and production in areas such as the Tarim Basin are generating considerable demand for drilling services. Chinese drilling firms are also quickly advancing their technological skills to compete with global competitors. For instance, in November 2024, China introduced its first deep-sea drilling ship, Meng Xiang (Dream), which was entirely designed and built domestically in Guangzhou, Guangdong Province. The vessel, able to drill as deep as 11 kilometers, represents a significant milestone in ocean exploration and inquiry.

Latin America

Resurgent Exploration and Production Activities Influence Drilling Services Demand

Latin America is anticipated to hold USD 2.56 billion in 2026. Latin America, especially Brazil, presents considerable growth opportunities because of its extensive unexploited oil and gas reserves. Brazil's pre-salt finds persist in fueling offshore drilling operations. Political and economic turmoil can affect investment amounts, yet the long-term prospects for drilling services in the area continue to be encouraging.

Middle East & Africa

Increased Investment in Offshore Oil & Gas Fields Driving Demand for Drilling Services in the Region

The Middle East & Africa is also anticipated to grow in the global drilling service market. Huge, untapped potential to produce hydrocarbons, low drilling costs, availability of reservoirs at shallower depths, and abundant mineral reserves are some of the key factors propelling the regional landscape. For instance, in December 2020, Saudi Aramco, an oil & gas giant situated in Saudi Arabia, announced the discovery of four new oil & gas fields estimated to have high-capacity reserves across different parts of the kingdom. Saudi Arabia is projected to reach a market value of USD 0.78 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Dominate Market Owing to Extensive Service Portfolios and Advanced Technologies

The drilling services market is characterized by intense competition, with global players accounting for a major share. Leading companies, such as Schlumberger, Halliburton, Baker Hughes, and Weatherford International, dominate the market due to their extensive service portfolios, advanced technologies, and established global presence. These major players continuously invest in R&D to develop innovative drilling solutions, including advanced drilling techniques, automation, and digitalization, to gain a competitive edge.

Other notable companies, including Nabors Industries, Helmerich & Payne, and Precision Drilling Corporation, also play significant roles, often specializing in specific geographic regions or types of drilling services. The competitive landscape is further shaped by smaller regional players that offer specialized services and compete on price and local expertise.

List of Key Drilling Services Companies Profiled:

- Schlumberger (U.S.)

- Baker Hughes (U.S.)

- Petrofac (U.K.)

- Nabors Industries (U.S.)

- Halliburton (U.S.)

- Weatherford (Switzerland)

- TechnipFMC (U.K.)

- China Oilfield Services Limited (China)

- Epiroc (Sweden)

- Patterson UTI (U.S.)

- Valaris (U.K.)

- Seadrill (Bermuda)

- Precision Drilling Corporation (Canada)

- Petrofac (U.K.)

- International Drilling Services LLC (Oman)

KEY INDUSTRY DEVELOPMENTS:

March 2025: Halliburton Co. and Sekal AS launched the first automated on-bottom drilling system, which combines Halliburton’s LOGIX automation and remote operations, Sekal’s Drilltronics, and the rig automation control system. The team implemented the system for an Equinor ASA well located on the Norwegian Continental Shelf, featuring an integrated closed-loop control solution.

March 2025: Schlumberger introduced EWC electric well control technologies that lower both capital and operational expenditures while enhancing safety in essential drilling operations. This well control technology, necessary for avoiding the uncontrolled discharge of fluids from the well, has usually relied on hydraulic systems that consist of an intricate arrangement of hoses, valves, and actuators.

January 2025: Halliburton won a contract from Petrobras for comprehensive drilling services in various offshore fields in Brazil, following a competitive selection process. Under this agreement, Halliburton will supply the iCruise intelligent Rotary Steerable System (RSS) to minimize well time and precisely position wells, along with the LOGIXTM automation and remote operations platform to enhance well construction consistency and efficiency.

November 2024: Weatherford International plc announced two contracts in the Middle East: one with a National Oil Company in Qatar and another with Kuwait Oil Company. By implementing Weatherford's cutting-edge VictusTM Intelligent MPD technology, KOC gave Weatherford a Managed Pressure Drilling ("MPD") services contract with an emphasis on increasing operational effectiveness, boosting safety, shortening well delivery schedules, and cutting expenses.

October 2024: Nabors Industries Ltd. and Parker Wellbore announced a definitive agreement under which Nabors will acquire all of Parker's issued and outstanding common shares in exchange for 4.8 million shares of Nabors common stock.

Investment Analysis and Opportunities

- Drilling service demand is significantly impacted by investments in oil and gas exploration and production, especially in unconventional resources such as shale. Additionally, drilling businesses with flexible technologies are finding new growth opportunities as a result of investments in renewable energy sources such as geothermal drilling.

- For instance, Egypt announced the drilling of 110 exploratory wells with a USD 1.2 billion investment in the 2024/2025 fiscal year to boost the country's oil and gas production capacity. During a session with a parliamentary committee examining the new government's agenda, Egypt’s Minister of Petroleum and Mineral Resources Karim Badawi announced that the nation intends to drill 586 exploratory wells for oil and gas, allocating an investment of USD 7.2 billion by 2030.

Similarly, U.S. Energy Development Corporation (U.S. Energy) announced it is broadening its activities in the rich Permian basin. U.S. Energy is ready for substantial expansion and progress in one of the most efficient oil and gas areas in the U.S. In the coming years, the firm anticipates investing more than USD 750 million, primarily allocating this funding to initiatives in the Permian region.

REPORT COVERAGE

The global drilling services market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, it offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, it encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.41% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service, Application, End-User, and Region |

|

Segmentation |

By Service

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 17.82 billion in 2025.

The market is likely to grow at a CAGR of 6.41% over the forecast period of 2026-2034.

The oil & gas segment is expected to lead the market during the forecast period.

The market size of North America stood at USD 4.72 billion in 2025.

Rapidly rising energy demand owing to the construction of new infrastructure and new developments in the hydrocarbon industry, coupled with the discovery of new oil fields, are the key factors driving market growth.

Some of the top players in the market are Schlumberger, Baker Hughes, Petrofac, and others.

The global market size is expected to reach USD 31.65 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us