Employee Surveillance and Monitoring Software Market Size, Share & Industry Analysis, By Software Type (Standalone, Integrated), By Deployment (On-premise & Cloud), By Type (Remote Employee Monitoring & Premises Employee Monitoring), By Enterprise Type (Large Enterprises & SMEs), By Application (Productivity Monitoring, User & Entity Behavior Analytics, Application & Website Monitoring, Insider Threat Detection & Prevention) By Industry (BFSI, IT & Telecom, Manufacturing, Retail, Energy & Utility, Government), Regional Forecast, 2065 – 2034

KEY MARKET INSIGHTS

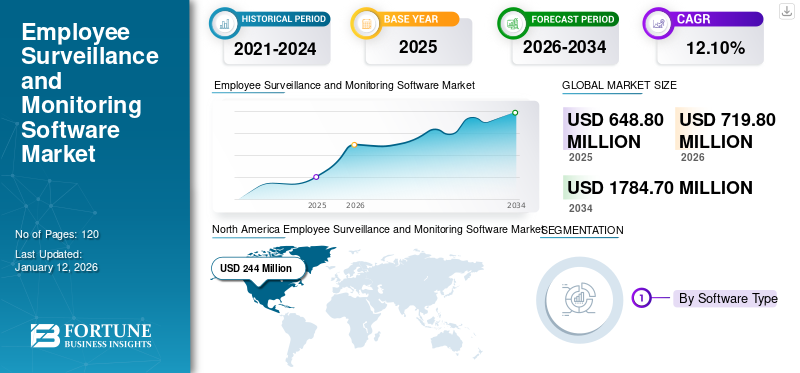

The global employee surveillance and monitoring software market size was valued at USD 648.8 million in 2025 and is projected to grow from USD 719.8 million in 2026 to USD 1,784.70 million by 2034, exhibiting a CAGR of 12.10% during the forecast period. North America dominated the global market with a share of 37.60% in 2025.

Employee surveillance and monitoring software is a systematic method of tracking employee work data that prevents and identifies costly data breaches, optimizes inefficient workflows, and boosts employee engagement. The data collected through this software is analyzed to find patterns, trends, and correlations across teams, departments and groups to gain insights into business processes and how to improve them.

Micromanagement at work has been rooted in traditional workplaces for years. However, the COVID-19 pandemic normalized the arrangement of hybrid and remote work models. Such a system has been termed “productivity paranoia” by Microsoft Corporation. According to a report published by Microsoft (Work Trend Index Special Report) in 2022, over 85% of employers felt troubled believing their employees were actually being productive. Thus, the demand for employee surveillance and monitoring software market skyrocketed during the COVID-19 pandemic.

According to a report published by Top10VPN.com, searches for employee monitoring tools increased by 75% in March 2020 compared to the previous year’s monthly average. In 2021 and 2022, the global demand remained strong.

Furthermore, with the wave of generative AI gaining momentum, the need to integrate new-age technologies increases substantially. Several recent developments showcase the integration of AI into existing software solutions. For instance,

- February 2024: T-Mobile, Walmart, Chevron, Starbucks, and Delta have been using Aware’s solutions to track employee messages.

However, relying solely on technology to monitor employees has faced a major pushback from employees worldwide.

Employee Surveillance and Monitoring Software Market Trends

Gamification of Time Tracking Software and Increasing Hybrid Work Model Arrangements to Pave Way for Market Growth

Gamification of time tracking improves the productivity of employees and motivates them to showcase their work. In simple terms, integrating game mechanics into non-game scenarios means gamification. There are several ways employers can implement this technology, including incentives, awards, and challenges based on their employees’ performance.

Moreover, the increasing inclination of employees to adopt the hybrid work model increases the need for an employee monitoring system globally. According to the Remote Work & Compensation Pulse Survey in May 2021, 48% of respondents (employees) expressed their wish to work remotely. In addition, over 44% desired a hybrid work model. However, among employers, only 5% mentioned working remotely, and 51% support the hybrid working arrangement. These statistics indicate that as more employees prefer the hybrid working model, the need to monitor their activities demands the adoption of employee surveillance and monitoring solutions.

Thus, a surge in the adoption of solutions that include gamification of time tracking and the hybrid work model is driving the employee surveillance and monitoring software market growth.

Employee Surveillance and Monitoring Software Market Growth Factors

Increasing Inclination toward Adopting Algorithmic Management Arrangements to Create Lucrative Opportunities for the Market

There has been a surge in demand for algorithmic management arrangements across businesses and they are currently rare in traditional workplaces. Mostly these systems are found in logistics at workplaces, including delivery and storage services, transportation, manufacturing, retail, hospitality, and financial services. Across the law enforcement and healthcare sector, such digital technologies are introduced at the workplace to monitor workers for health reasons and occupational safety requirements. Depending on sectoral characteristics, algorithmic management is implemented at different places across the globe. The implementation of algorithmic management across digital health platforms and its use cases are mentioned below:

- Used in the decision making process to enhance efficiencies and improve the accuracy of diagnosis. Such practices improve diagnosis and limit resource wastage, unnecessary costs, and inequities.

- Used to plan an effective healthcare system that aims to improve efficiency (cost saving) and quality of care.

Such use cases were found mainly across France, Italy, South Africa, and India after the pandemic.

Besides, with the wave of expanding applications of generative AI, there are several lucrative opportunities for the employee surveillance and monitoring software in the coming years. The integration of new-age technologies is expected to lead to major advancements in employee surveillance and monitoring software. Furthermore, regulatory compliance for increased security and access is expected to create opportunities for the market in the coming years. Integrating employee surveillance and monitoring software with Security Incident and Event Management (SIEM) and Identity and Access Management (IAM) is among the most demanding solutions across the end-users.

RESTRAINING FACTORS

Solutions Lack a Perfect Blend of Employee Privacy and Effective Monitoring Capabilities

Employee surveillance and monitoring software tracks all employee behavior, including browsing history, email box, and phone activity, among others. This raises a high risk of security breaches and privacy concerns, which prove to be major restraining factors in the market. Employee surveillance and monitoring software solutions should have a perfect blend of privacy and monitoring features. Across the market, major privacy issues are being debated by governments and businesses, such as violation of privacy, computer matching, computer monitoring, and unauthorized personnel.

Besides, the lack of skilled professionals to manage the employee surveillance and monitoring software proves to be another factor hampering market growth. Extreme levels of surveillance and monitoring may result in employees feeling commoditized and developing a sense of alienation. To curb these restraining factors, involving employees in the software design process, providing better information about the use of such tools, and reskilling workers can prove to be effective strategies. Thus, several factors impact market growth, and it is expected that as these obstacles are removed, the market will gain high momentum.

Employee Surveillance and Monitoring Software Market Segmentation Analysis

By Software Type Analysis

Increasing Adoption of Integrated Software to Aid Segment Growth

By software type, the market is segmented into standalone & integrated.

The integrated segment is expected to register the highest CAGR during the forecast period as using integrated software enables companies to connect various areas of the business easily, and no division works in isolation. Additionally, integrated software allows all systems to act as one, as data is shared between them, which eliminates information silos and unnecessary administration.

The standalone software type segment is projected to account for 14.06% of the total market share in 2026, as businesses use standalone software to improve particular business processes. Since this type of software is completely disengaged from any other software, the chances of security breaches are less.

By Deployment Analysis

Ongoing Trend of Cloud Solution Boosted Segment Growth

By deployment, the market is bifurcated into on-premise and cloud.

The cloud deployment segment is expected to contribute 15.55% of the total market share in 2026 and is estimated to register the highest CAGR during the forecast period, as cloud-based software helps to monitor every work action of the employees in a much more transparent way. As per the Microsoft Survey in January 2022, 76% of respondents stated that they have adopted the cloud as a proactive business strategy. This shows that cloud-based employee surveillance and monitoring software solutions are expected to gain traction in the coming years.

The on-premise is estimated to grow steadily during the forecast period, as setting up on-premises systems is expensive due to costs related to storage, ongoing maintenance, power consumption, and IT support costs.

By Type Analysis

Companies Providing Remote Working is Driving the Premises Employee Monitoring Segmental Growth

By type, the market is bifurcated into premises employee monitoring and remote employee monitoring.

The premises employee monitoring type segment is anticipated to hold a market share of 13.74% in 2026. Premises employee monitoring is increasing to track the productivity of employees. By tracking employee activities and performance, companies are able to identify and address issues that impact customer satisfaction, including inadequate services and poor communication.

Remote employee monitoring is estimated to showcase the highest CAGR during the forecast period. The increasing popularity of working from home has led to a surge in the need for software that can monitor employees. One major factor for remote worker monitoring is ensuring accountability. When employees work remotely, it becomes difficult to track their work and confirm that they are completing their tasks as needed. By monitoring their work, employers can check that employees are delivering their work on time and meeting their responsibilities.

By Enterprise Type Analysis

Increasing Demand for Monitoring Software to Enhance Productivity among SMEs to Propel Segment Growth

By enterprise type, the market is bifurcated into large enterprises and SMEs.

The large enterprises segment is expected to account for 12.93% of the total market share in 2026. As the team size in large enterprises is big, keeping track of every employee manually is difficult for managers or employers. Therefore, enterprises are adopting monitoring solutions to keep track of employee performance and to identify insiders. Players in the market are introducing new tools that allow managers to see a much broader picture in terms of project management within their company.

The small and medium sized enterprises is estimated to grow at the highest CAGR during the forecast period. According to the U.S. Bureau of Labor Statistics, around 20% of new businesses fail during the first two years of being open, 45% during the first five years, and 65% during the first 10 years. An essential yet repeatedly overlooked tool that can support startups during this period is employee monitoring. When utilized effectively, it can help strengthen security, enhance productivity, and foster a culture of transparency and trust.

By Application Analysis

Ongoing Trend of Cloud Solution Boosted Productivity Monitoring Segment’s Growth

By application, the market is segmented into productivity monitoring, user & entity behavior analytics, application & website monitoring, insider threat detection & prevention, attendance tracking, file transfer tracking, & others.

The productivity monitoring segment dominated the market in 2024 due to the growing fear of losing out on employee productivity among companies. Therefore, employee monitoring programs are mostly used to monitor employee productivity.

Insider threat detection & prevention is expected to grow with the highest CAGR during 2025-2032. Employee monitoring is used to detect and prevent data breaches. Monitoring employee activity helps to identify strange behavior or activities that may indicate a breach and notify the employer about potential security risks, enabling them to take preventive action.

To know how our report can help streamline your business, Speak to Analyst

By Industry Analysis

Monitoring Software Helps IT Companies to Shield Data Driving IT & Telecom Sector’s Growth

By deployment, the market is categorized into BFSI, IT & Telecom, manufacturing, retail, energy & utility, government, healthcare, & others.

Among these, IT & telecom dominated the market in 2024 and is estimated to grow with the highest CAGR during the forecast period, as the IT & telecom companies are increasingly adopting this software for shielding the company’s data. According to a survey by Zipdo, around 71% of IT professionals believe that employee monitoring is important for protecting company data.

The government sector is estimated to grow at a significant rate during the forecast period. Government agencies have citizen’s personal information that could be used by unauthorized persons for identity theft, fraud, impersonation, and other crimes. Therefore, the monitoring and surveillance of employees is important in the government sector.

REGIONAL INSIGHTS

The market is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further classified into leading countries.

North America Employee Surveillance and Monitoring Software Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America generated the maximum revenue in 2024, owing to the fact that companies are increasingly adopting employee monitoring software to prevent company data from fraudulent activities and increase the productivity of employees. As per the American Management Association study, companies that adopted employee monitoring solutions reported an increase in employee productivity by 22%. In the U.S., around 45% of companies have experienced a data breach, indicating that a significant portion of businesses have fallen victim to unauthorized access or exposure of their digital information. According to U.S. Employers Survey 2023, around 60% currently use monitoring software. The most recent figures show that 6.1 million companies with employees in the U.S. are using the software to monitor their employees. The U.S. market is projected to reach USD 157.4 billion by 2026.

Download Free sample to learn more about this report.

Asia Pacific

Asia Pacific is undergoing rapid changes in terms of the workforce landscape and human resources strategies. Companies, organizations, and educational institutions are all required to keep up with these transformations in order to remain competitive and benefit from them. Currently, the region is undergoing rapid digital transformation that is changing the way businesses are managed. Automation and AI are commonplace in business processes, allowing companies to streamline operations and increase efficiency. This has had a direct impact on HR initiatives, as companies are able to gain better insights into employee performance and provide more personalized feedback. The Japan market is projected to reach USD 32 billion by 2026, the China market is projected to reach USD 63.6 billion by 2026, and the India market is projected to reach USD 21.9 billion by 2026.

Additionally, mobile access and cloud technology have enabled employees to access critical HR information while on the go. Asia Pacific is estimated to showcase the highest CAGR during the forecast period owing to the digitalization of work, combined with the increasing hybrid and remote work practices, which has spurred greater interest in keeping tabs on workplace productivity. However, the demand for employee monitoring software in the market is increasing.

Europe

Europe is witnessing substantial growth, as per the European employee monitoring laws, employers in European countries have the legal right to monitor employees at work as long as there is a valid business interest. For instance, on August 1, 2022, in Germany, amendments to the Notification Act came into force, binding all employers to notify newcomers about their working conditions in detail and writing. Although rules for tracking social media and internet activities vary across Europe, in most EU countries, tracking the use of the internet and social media depends on its purpose, whether it is for private use or business use. The UK market is projected to reach USD 26.1 billion by 2026, while the Germany market is projected to reach USD 34.9 billion by 2026.

South America and the Middle East & Africa are experiencing significant growth as companies in Brazil, Argentina, GCC, and South Africa have started to adopt monitoring solutions to safeguard their data. Data privacy is the biggest concern among the organizations in these regions. According to a PwC study, around 62% of companies’ concerns are regarding data breaches, 58% have concerns regarding unauthorized access, and 54% have issues related to evolving regulations.

Key Industry Players

Major Players Focus on New Product Launches to Strengthen Market Positions

The global employee monitoring market key players such as Hubstaff, ActivTrak, Time Doctor, Insightful, Clockify, and Toggl are considered among the key players in the market, covering a major market share. These leading players retail their products and services in numerous countries across the globe. These vendors use a multichannel distribution strategy to sell their products and services to end-user businesses. Their marketing strategy is focused on developing an effective subscription model, investing in new-age technologies to keep up with evolving trends, creating market awareness, generating demand for sales force and channel partners, building brand reputation, and communicating customer advantages.

List of Top Employee Surveillance and Monitoring Software Companies:

- Hubstaff (U.S.)

- ActivTrak (U.S.)

- Time Doctor (U.S.)

- Clockify (U.S.)

- Kickidler (Cyprus)

- Insightful.io, Inc, (U.S.)

- Traqq (Sydney)

- Desktime (Latvia)

- Toggl (Estonia)

- Connectteam.com (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024: Toggl added a feature, Toggl Analytics, to its time-tracking tool. This new addition unlocks a broader and more insightful view of the team's productivity and profitability.

- March 2024: ActivTrak introduced a new workforce planning upgrade called Headcount Planning. This new addition enables its end-users to spot untapped potential in their workforce and optimize their investments. The Headcount Planning Dashboard can be integrated with additional data points and is highly customizable.

- January 2024: DeskTime, a Draugiem Group brand, introduced a subsidiary of one of its largest markets – India. With this, the company expects to expand its global operations and customer base.

- May 2023: Softline Venture Partners invested over USD 1 million in the company for developing solution for time and employee performance control. SVP is a venture capital fund of the Russian company Softline.

- March 2022: Connecteam secured an investment of over USD 120 million, which Stripes and Insight Partners led. The financing was made in tandem with Qumra Capital, Tiger Global, and O.G. Tech.

REPORT COVERAGE

The employee surveillance and monitoring software market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 12.10% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Software Type

By Deployment

By Type

By Enterprise Type

By Application

By Industry

By Region

|

Frequently Asked Questions

The market is projected to reach USD 1,784.70 million by 2034.

In 2025, the market was valued at USD 648.8 million.

The market is projected to grow at a CAGR of 12.10% during the forecast period.

In 2025, the standalone segment led the market in terms of market share.

Increasing inclination towards adopting algorithmic management arrangements to create lucrative opportunities for the market.

Hubstaff, ActivTrak, Time Doctor, Insightful, Clockify, and Toggl are the top players in the market.

In 2025, North America held the highest market share.

By industry, the IT & telecom is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us