Digital Health Market Size, Share & Industry Analysis, By Product Type (mHealth {Apps [Disease and Treatment Management Apps], Wearables [Body & Temperature Monitors, Sleep Trackers, Fitness Trackers, Glucose Monitors]}, Healthcare Analytics {Financial Analytics, Clinical Analytics etc.}, Digital Health Systems {EMR/HER, e-Prescribing Systems}, and Telehealthcare {Telehealth & Telecare}); By Component (Services, Software, Hardware), By End-User (Business to Business and Business to Consumer) & Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

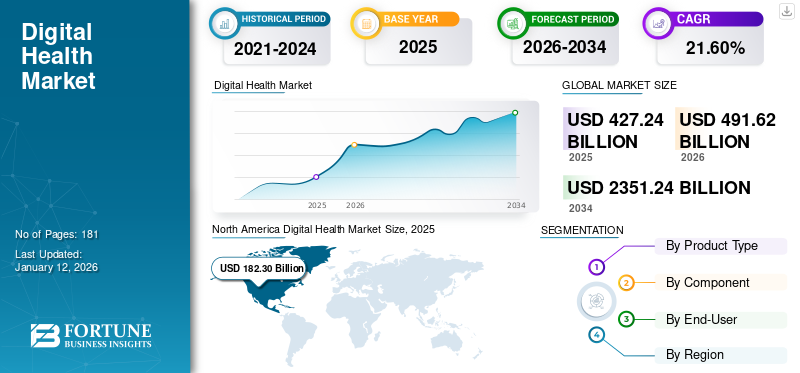

The global digital health market size is projected to grow from USD 491.62 billion in 2026 to USD 2,351.24 billion by 2034, exhibiting a CAGR of 21.60%. In 2025, the market was valued at USD 427.24 billion. North America dominated the digital health market with a market share of 42.67% in 2025.

Digital health is an emerging field of study, which includes the use of digital technologies in healthcare. The U.S. Food and Drug Administration (FDA) considers a broad scope of digital health technologies, including mobile health, telehealth, wearable devices, telemedicine, health information technologies, and personalized medicines. According to a World Bank report published in August 2023, evidence-based digital investments can help governments save up to 15.0% of health system costs across the globe.

Artificial intelligence and machine learning have a broad number of applications in the healthcare industry, such as image analysis, patient monitoring, and medical device automation, all of which support healthcare staff in managing clinical workflows. In addition, the advances in telecommunications, particularly with the introduction of 3G, 4G, and 5G networks, have begun to release high bandwidth, increasing the adoption of digital health solutions in the healthcare industry globally and proliferating market growth. Therefore, there is a rising demand for remote health services and the integration of artificial intelligence and wearable technologies among the population.

The COVID-19 pandemic had a positive impact on the market. This can be attributed to an increase in the adoption of digital technologies for the diagnosis and treatment of various diseases and an increase in the volume of teleconsultations during the period. Moreover, restrictions on travel and free movement, limitations on medical services for emergencies, and increased cases of COVID-19 infections led to the surge in teleconsultation platforms. The increased demand for digital solutions during the COVID-19 pandemic, along with the benefits of using teleconsultations and mHealth applications, further supported the adoption of healthcare technologies in the global market. Thus, the increased demand for teleconsultations, telemedicine, and mHealth in 2021 helped companies generate more revenues. The steady demand is expected to drive robust growth prospects in the forecast period of 2024-2032.

Digital Health Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 427.24 billion

- 2026 Market Size: USD 491.62 billion

- 2034 Forecast Market Size: USD 2,351.24 billion

- CAGR: 21.60% from 2026–2034

Market Share:

- North America dominated the digital health market with a 42.67% share in 2025, driven by widespread smartphone use, favorable reimbursement policies, high per capita spending on advanced digital technologies, and proactive adoption of healthcare innovations in the U.S. and Canada.

- Telehealthcare held the largest market share by product type in 2024, supported by increased penetration during the COVID-19 pandemic, demand for faster diagnosis, and reduced waiting times. mHealth followed closely, fueled by rising health consciousness and widespread use of mobile fitness and wellness applications.

Key Country Highlights:

- Japan: Demand is driven by advanced telecommunications infrastructure, a growing aging population, and initiatives to digitize the national healthcare system. Japan is also adopting wearable devices for chronic disease monitoring and leveraging AI for early diagnostics and treatment optimization.

- United States: The U.S. digital health market was valued at USD 179.78 billion in 2026, with rapid adoption of telehealth, AI-based tools, and wearables. Strategic collaborations (e.g., Amazon, Google, and healthcare providers) and government support (e.g., FCC’s USD 200 million telehealth program) have strengthened digital infrastructure and patient access to virtual care.

- China: Government initiatives such as the Healthy China 2030 plan and the expansion of 5G infrastructure are driving digital health adoption. High smartphone penetration and rapid urbanization have accelerated the use of mobile health applications, remote diagnostics, and AI-powered platforms.

- Europe: Growth is supported by national health initiatives, such as the U.K. NHS’s push for virtual wards and electronic prescriptions. A significant rise in repeat prescriptions via the NHS app (from 13 million in 2022 to 25 million in 2023) highlights the region’s growing reliance on digital healthcare platforms.

DIGITAL HEALTH MARKET TRENDS

Rising Adoption of Remote Care Solutions and Telemedicine Among the Population

Technological advancements are evolving patient and physician preferences, improving the accessibility of patient care and services. The increasing awareness regarding remote diagnostic and virtual hospital wards in healthcare facilities, along with the rising adoption of wearable devices, are some of the major trends witnessed currently in the market.

- According to a 2023 article published by the National Heart, Lung, and Blood Institute, almost one in three adults in the U.S. uses a wearable device, such as a smartwatch or fitness band, to track their health and fitness.

Wearables and At-Home Health Monitoring

The rising adoption of wearable devices among patients suffering from chronic conditions, along with a growing preference for personalized health management tools, is increasing the focus of companies on developing and launching novel products with advanced features. Additionally, the home-health monitoring features in wearable devices are another prominent reason for the rising adoption of these devices among the population.

- According to 2022 data published by the American Medical Association (AMA), the percentage of physicians using remote monitoring devices grew to 30% in 2022, up from 12% in 2016.

- Similarly, the average number of digital health tools used by physicians grew to 3.8% in 2022 as compared to 2.2% in 2016.

Integration of Artificial Intelligence and Machine Learning (ML)

The expanding use of AI-enabled technologies, including machine learning, deep learning networks, and others, holds vast growth potential to drive positive outcomes in healthcare. These advancements can lead to new treatments, accurate and earlier diagnostics, better prevention methods, and overall improvement in the quality of care provided to patients. Generative AI (GenAI) is expected to play a significant role in drug development, diagnostics, and personalized medicine treatment in the healthcare industry.

Rising Importance Toward Mental Health and Women's Health

The growing awareness regarding the importance of mental health and women's health is leading to increased adoption of mental health solutions and women's health devices in the market.

- According to a 2023 article published by the NHS, around 47% of people in the U.K. used health apps in 2022 as compared to 38% in 2021.

- Similarly, MomConnect, a flagship program of the South African National Department of Health, has reached over 5.0 million pregnant women since its launch in 2014.

Rising Number of Emerging Startups and Increasing Venture Funding

The increasing demand and adoption of digital solutions and applications among the population is leading to a rising number of health-tech startups globally. Moreover, growing investment by companies to develop and introduce novel applications for various chronic conditions and fitness is also boosting the market growth.

- According to a 2024 article published by Rock Health, U.S. digital health startups such as Allez Health, Fabric, and Zephyr AI raised USD 5.70 billion across 266 deals in the first half of 2024.

Along with this, the increasing number of strategic mergers and acquisitions within the industry is expected to advance the technology behind these solutions.

Technological Developments in Telecommunication to Augment the Demand for Digital Solutions in Healthcare

Advancements in the telecommunication sector, such as the introduction of the Internet of Things (IoT), 5G, network infrastructure, and artificial intelligence, provide various opportunities for market growth. For instance, in May 2023, a health tech company, January AI, introduced a new generative Artificial Intelligence (AI)-enabled app to estimate and predict the glucose response of individuals to more than 32 million food items. The introduction of faster network capabilities has enabled the telehealth industry to provide a better experience to their patients and thereby boost product demand.

In addition, advancements in mobile technology and telecommunications have resulted in the development of easily accessible applications for patients. The rising investments by national and international healthcare organizations to develop and support the integration of these tools and solutions are another crucial factor fostering the market's growth.

- In September 2024, the World Health Organization (WHO) announced an additional investment of USD 0.24 per patient-year in digital health interventions, such as telemedicine, mobile messaging, and chatbots. The aim is to save more than two million people suffering from non-communicable diseases.

For instance, according to a June 2021 article by TM Forum, Telco Systems, a pioneer in telecommunications, launched telehealth partnerships and services globally as the healthcare sector ramps up its digital transformation and remote care offerings. Such partnerships with telecom service providers are expected to strengthen the healthcare infrastructure and favor the adoption of telehealth.

Moreover, telepresence robots are designed to autonomously move around rooms, being remote-controlled using a software interface connecting the user to the robot through a Wi-Fi connection. Thus, technological development in the telecommunication sector is expected to create lucrative opportunities for the market players during the forecast period.

In recent years, remote monitoring technologies and telemedicine have been witnessing a stronger adoption. This has allowed healthcare professionals and patients to stay connected despite geographical barriers, benefitting individuals with limited mobility and those in rural communities.

- North America witnessed a growth from USD 144.37 Billion in 2023 to USD 161.29 Billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Initiatives Taken by Governments of Various Countries to Promote Digital Health to Propel Market Growth

In both developing and developed countries, the adoption of digital tools is on the rise due to the widespread use of smartphones, tablets, and other mobile platforms. Additionally, various governments are initiating efforts to promote digital solutions for managing diseases. Global organizations such as the World Health Organization (WHO) along with government organizations are working to increase adoption of digital tools in various countries. Number of initiatives and programs have been launched in recent years to support the adoption of digital tools in the healthcare sector. For instance, in February 2024, the WHO launched the Global Initiative on Digital Health (GIDH) virtually, aimed at sharing knowledge and digital products amongst the various countries in the world. Similarly, in April 2020, the Federal Communications Commission (FCC) developed and approved a USD 200 million program to fund telehealth services and devices for medical providers.

During the COVID-19 pandemic, governments of various countries launched mobile applications to manage the virus's influence. For example, the government of India introduced the Arogya Setu mobile application in response to COVID-19. The application was developed for self-assessment, syndrome mapping, contact tracking, and educating the public regarding the infection.

Major market players are also focusing on R&D to develop and introduce new and advanced solutions. In March 2022, Google announced the launch of its new AI initiative for healthcare. Thus, the rising focus of companies on introducing novel solutions, along with various initiatives taken by governments around the world, is supporting the adoption of digital tools in both developed and developing countries, thus fueling digital health market growth.

Increasing Penetration of Smartphones, Tablets, and Other Mobile Platforms to Accelerate Market Growth

The penetration of smartphones, tablets, and other mobile platforms is rapidly growing across the globe. This can be attributed to the widespread availability of the internet, accompanied by high internet bandwidth in developed countries. According to the International Telecommunication Union (ITU) estimates, the number of internet users across the world is 5.4 billion, which accounts for 67% of the total global population. Furthermore, data from the Pew Research Center in April 2021 revealed that approximately 85% of Americans own a smartphone, a significant increase from 35% in 2011, when the first study was conducted.

Due to the increasing penetration of smartphones and tablets, people are transitioning toward wearables and other healthcare applications. Consequently, companies are focusing on developing a multitude of health applications to meet this demand. For instance, according to the IQVIA Institute for Human Data Science's 2021 trends report, more than 90,000 health apps were released globally in 2020.

In recent years, people are more focused on maintaining their health through different ways, including physical activities, mental health balance, and other aspects of well-being. This shift has resulted in the rapid usage of digital tools for healthcare monitoring and diagnosis in developing countries. According to cohort study results published by BioMed Central Ltd., two out of three Americans are willing to adopt health insurance wellness programs based on wearable devices, especially if they offer benefits related to health promotion and disease prevention. This willingness is particularly strong when financial incentives are included.

Hence, the increasing internet penetration, the rising number of health-conscious individuals globally, and the increasing prevalence of chronic diseases among the population are supporting the adoption of mobile health applications. The growing development of new mobile applications and devices, coupled with their increasing adoption, are key elements projected to bolster market growth.

MARKET RESTRAINTS

Privacy Concerns Regarding Patient Data May Hamper Market Growth

With the increasing adoption of these solutions in developed and developing countries, privacy issues have emerged as a major global challenge. Health data is being generated in large amounts and stored in diverse formats within different health information systems. Thus, safeguarding this data from cybercrimes has become a significant concern for healthcare providers worldwide. According to the Healthcare Cyber Attack Statistics 2022 report, healthcare data breaches in 2021 affected over 40.0 million patient records in the U.S., making the country one of the most targeted for cyber-attacks globally.

A significant challenge in health data privacy is finding ways to share health data among medical practitioners while protecting personally identifiable information. Additionally, hacking Personally Identifiable Health Information (PHI) by cybercriminals has become a growing trend, with hackers aiming to exploit patients' personal information. According to statistics from the HIPAA Journal published in 2020, a majority of healthcare data breaches reported globally occurred in the year 2020.

Consequently, the frequency, number of exposed records, and financial losses related to data breaches related to patients' personal health records are rapidly increasing. This situation has limited market growth to some extent.

MARKET CHALLENGES

Lack of Regulatory Standardization for Digital Health Solutions

Several technical and regulatory challenges in emerging countries such as India, Brazil, and others hinder the consistent implementation and delivery of health tools and solutions in healthcare settings. The lack of established framework along with outdated guidelines and disorganized regulations, hampers the implementation of these tools in these countries.

Adoption of Digital Tools and Integration Issues

Limited healthcare facilities and existing infrastructure make it a major challenge for health-tech companies to implement various health tools and solutions required for diagnosing and treating patients suffering from chronic conditions.

MARKET OPPORTUNITIES

Rising R&D Activities Among Companies

The growing number of companies in the field of digital health that are focused on developing and introducing technologically advanced products and solutions to meet the rising demand is creating lucrative opportunities for market players.

The integration of AI tools into healthcare is set to transform drug development, personalized treatment plans, and various other aspects of patient care.

- For instance, Eko Health developed algorithms that significantly improve the detection of heart conditions in routine screenings, which reduces the rates of undiagnosed cardiac issues by up to 30%.

The rising adoption of technology, such as 3D printing for customized medical devices, is prompting companies to increase their 3D printing capacity to meet the rising demand in the market.

- In August 2023, Materialise, a leading 3D printing and personalized medical solutions provider, opened a new 3D printing facility in the U.S. to accelerate the delivery of patient-specific and customized medical implants.

Therefore, the rising integration of health tools and features such as electronic health records (EHR) to provide comprehensive healthcare solutions will create a lucrative opportunity for the growth of the companies in the market. This includes integration in the development of regenerative medicine, wearable therapeutics, and non-invasive diagnostic devices

SEGMENTATION ANALYSIS

By Product Type Analysis

mHealth Segment Dominated Owing to Rising Focus on Fitness and Well-being

On the basis of product type, the market is segmented into mHealth, healthcare analytics, wearables, digital health systems, and telehealthcare.

The telehealthcare segment dominated the market in 2024 and is anticipated to experience significant growth during the forecast period, primarily due to the advantages of telemedicine, such as reduced waiting time, leading to faster disease diagnosis. Furthermore, the increased penetration and adoption of teleconsultations during the COVID-19 pandemic have also bolstered the growth of this segment during that period. The segment is likely to capture 59.5% of the market share in 2025.

The mHealth segment accounted for the significant market share in 2024. The increasing focus of people on well-being and fitness is driving the demand for mobile apps, propelling the growth of this segment. Additionally, the growing emphasis on early diagnosis and routine monitoring has further fueled the adoption of health monitoring applications, thereby fostering growth within this segment. For example, in April 2021, Fitbit Inc. launched Fitbit Luxe, a fitness and wellness tracker designed for stress management and sleep tracking, aimed at promoting mental and physical wellness.

The healthcare analytics segment is set to grow with a considerable CAGR of 25.15% during the forecast period (2025-2032).

By Component Analysis

Services Segment Led Owing to Low Teleconsultation Charges

On the basis of component, the market is segmented into services, software, and hardware.

The services segment dominated the market in 2026 with a share of 54.13%, due to the comparatively low cost of teleconsultation services. The expansion of companies providing teleconsultation services further supports the growth of this segment. For instance, in September 2020, Sesame, Inc. expanded its Direct-to-Patient Platform services into New York City and Houston, aiming to make healthcare more accessible, affordable, and transparent for patients.

The software segment is poised to experience the highest CAGR during the forecast period, owing to the increasing initiatives for the development of innovative technologies to enhance the solution. Additionally, the growing number of new product launches in the market is supporting the growth of this segment.

- In June 2022, Bajaj Allianz launched a health insurance industry-first ‘Global Health Care’ plan in collaboration with Allianz Partners to provide health insurance coverage anywhere across the globe.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Business to Business Segment Dominated Owing to Increasing Strategic Collaborations

On the basis of end-user, the market is segmented into business to business and business to consumer.

The business to business segment dominated the market in 2026, holding a significant share owing to the growing collaborations between market players to integrate various digital technologies for better solutions. For instance, in October 2020, Takeda Pharmaceutical Company Limited, Accenture, and Amazon Web Services (AWS) entered into a five-year strategic agreement to accelerate Takeda’s digital transformation and fuel its cloud-driven business transformation. This partnership aimed to modernize platforms, accelerate data services, and establish an internal engine for innovation to benefit patients. The segment is poised to hold 61.39% of the market share in 2026.

On the other hand, the business-to-consumer segment is expected to grow at a higher CAGR during the forecast period. The growth of this segment can be attributed to the increasing launch of various technologies, such as mHealth apps and software, due to the high demand from global consumers. The segment is expected to grow with a CAGR of 20.18% during the forecast period (2025-2032).

DIGITAL HEALTH MARKET REGIONAL OUTLOOK

The market is categorized by region into Europe, North America, the Asia Pacific, Latin America, and the Middle East and Africa.

North America

North America Digital Health Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

What are the Factors Responsible for the Dominance of North America in the Global Market?

North America was valued at USD 182.30 billion in 2025 and USD 208.79 billion in 2026. This dominance can be credited to factors such as favorable reimbursement policies in the U.S., high per capita expenditure on advanced technologies, and a rising demand for healthcare technologies in the region. For instance, in August 2020, Fitbit Inc. launched Fitbit Sense, an advanced health smartwatch designed to help manage stress. It incorporates advanced heart rate tracking technology, a new ECG app, and an on-wrist skin temperature sensor. The smartwatch tracks key trends in one’s health and well-being, such as Heart Rate Variability (HRV), breathing rate, and SpO2, and presents them through the new Health Metrics dashboard.

The U.S. digital health market was valued at USD157.37 billion in 2025. High adoption of health applications and tools among healthcare providers and general population are contributing to the growth of the market in the U.S. This growth is owing to increased penetration of smartphones and increased awareness of the applications globally. The U.S. market is poised to be valued at USD 179.78 billion in 2026.

Europe

Europe accounted for a significant share in 2025 and is predicted to gain USD 132.85 billion in 2026, exhibiting a CAGR of 27.01% during the forecast period (2026-2034), driven by the availability of various telemedicine initiatives and solutions in the region. This growth, coupled with the proliferation of digital technologies, mainly wearables and mobile applications, is supporting the market growth. For instance, according to an article published by Healthcare Digital Magazine in January 2021, the U.K.'s National Health Service (NHS) website attracted around 360 billion visits a year. The U.K. market continues to grow, projected to reach a value of USD 19.34 billion in 2026.

Additionally, according to 2023 data by the NHS, the number of repeat prescriptions ordered via the NHS app increased from 13 million 2022 to 25 million in 2023, witnessing a growth of nearly 92%.

Germany is estimated to reach a valuation of USD 38.33 billion in 2026, while France is poised to gain USD 19.15 billion in the 2025.

Asia Pacific

Asia Pacific is slated to grow at the highest CAGR during the forecast period, owing to technological and medical transformation and changing regulatory policies in the region. Additionally, initiatives taken by the governments of developing countries are promoting digital solutions in healthcare. China is forecasted to hit USD 19.60 billion in 2026. According to the Ministry of Health and Family Welfare, in July 2022, the National Health Authority (NHA) announced the expansion of the digital health ecosystem under its flagship scheme, Ayushman Bharat Digital Mission (ABDM). This expansion included the successful integration of 52 health applications in India. India is anticipated to stand at USD 11.14 billion in 2026, while Japan is likely to reach USD 31.57 billion in the same year.

Latin America

Latin America is the fourth leading region set to gain USD 24.67 billion in 2026. The region is growing due to the increased adoption of digital technologies by various healthcare facilities during the COVID-19 pandemic. Furthermore, the launch of telemedicine apps and services in the region is supporting market growth.

Middle East & Africa

The Middle East & Africa market is expected to continue to expand at a considerable CAGR during the forecast period, attributed to the strategic initiatives taken by the governments of various countries for new technological reforms in the healthcare industry. The GCC market will capture the valuation of USD 9.47 billion in 2025.

KEY INDUSTRY PLAYERS

What Strategies Are Adopted by the Leading Market Players?

The market is fragmented, with a large number of players holding a significant digital health market share in 2024. Industry leaders, including Cerner Corporation, Apple, Epic Systems Corporation, Huawei, Cisco, and Philips Healthcare, hold a dominant position due to their strong portfolio of digital health technologies. The increasing number of product launches by these companies supports their growth. For instance, in August 2021, Koninklijke Philips N.V. introduced two new HealthSuite solutions to provide cost-effective, cloud-based solutions for patients.

Furthermore, industry players such as Doctor on Demand, AthenaHealth, MIDITECH, American Well, MDLIVE, Boston Scientific Corporation, Babylon Health, Teladoc, Polycom, Allscripts, Zoom, Headspace, Livongo Health, Doctolib, Kry, Cure.fit, and Noom have a strong global presence. The increasing product approvals and strategic decisions formulated by these players are supporting their growth.

- In January 2023, Teladoc unveiled a new app integrating services for primary care and mental health.

LIST OF KEY COMPANIES PROFILED:

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Allscripts Healthcare, LLC (U.S.)

- Cerner Corporation (U.S.)

- Epic Systems Corporation (U.S.)

- McKesson Corporation (U.S.)

- Medical Information Technology, Inc. (U.S.)s

- Siemens Healthineers AG (Germany)

- Boston Scientific Corporation (U.S.)

- FUJIFILM Holdings Corporation (Japan)

- Medtronic (Ireland)

- IBM (U.S.)

- Validic (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – The World Health Organization (WHO) launched S.A.R.A.H., a digital health promoter prototype powered by generative artificial intelligence (AI) that features enhanced empathetic responses.

- October 2023 - Cedars-Sinai introduced a mHealth application based on artificial intelligence, providing virtual care options for various medical conditions.

- July 2023 - The Peterson Center on Healthcare announced the launch of the Peterson Health Technology Institute (PHTI), a nonprofit organization. The company provides independent evaluations of innovative healthcare technologies to improve health outcomes and lowering costs.

- May 2022 - The Organization for the Review of Care and Health Applications (ORCHA) announced its involvement with the U.S. framework for assessing health technologies, including mobile apps and web-based tools used by healthcare providers and consumers. This initiative is led by the American College of Physicians (ACP) and the American Telemedicine Association (ATA) in collaboration with ORCHA.

- May 2022 - FUJIFILM Holdings Corporation collaborated with the National Rural Health Association (NRHA) to provide rural areas with products and services, including digital radiography and in-vitro diagnostics solutions.

- March 2022 - MEDITECH collaborated with Google Health to provide easy and quick access to patient information.

- March 2022 - Validic announced the availability of its remote patient monitoring (RPM) platform, Validic Impact, on the Epic Systems 'App Orchard' platform. The App Orchard is a platform where developers can launch their apps for the Epic Systems community members.

FUTURE OUTLOOK AND PREDICTIONS

Continued growth in data-driven healthcare solutions:

The rising demand for mental health and women's health solutions globally, along with the increasing number of companies focusing on the development of digitally driven solutions. This is expected to create growth opportunities for these companies in the future.

- In September 2024, the U.S. Department of Defense (DoD) committed USD 500 million to women’s health research to support the health needs of women.

Expansion of digital health tools like virtual hospital wards

The increasing adoption of remote healthcare solutions and services among the population, along with the rising focus of companies and national organizations, is anticipated to boost the concept of virtual hospital wards and remote diagnostics in the market.

- In August 2024, the National Health Service (NHS) introduced a framework to support and increase the virtual ward capacity and occupancy in England above 80%.

Strategic Collaborations and Partnerships

The growing strategic collaborations and partnerships among market players in the field of health-tech sectors are expected to boost the development and introduction of health solutions and tools with novel and technologically advanced features.

- In May 2024, Sanofi, Formation Bio, and OpenAI collaborated to develop AI-powered software to accelerate drug development and bring new and innovative medicines to patients.

REPORT COVERAGE

The market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product types, components, and end-users. Moreover, it offers insights into the digital health market trends and other aspects. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.60% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Component

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global digital health market was valued at USD 427.24 billion in 2025 and is projected to reach approximately USD 2,351.24 billion by 2034.

In 2025, the North America market value stood at USD 182.30 billion.

The market is expected to exhibit steady growth at a CAGR of 21.60% during the forecast period.

By product type, the mHealth segment dominated the market in 2025.

Technological advancements, increasing penetration of smartphones, tablets, other mobile platforms, and initiatives taken by governments of various countries to promote digital health technology are key factors driving market growth.

Cerner Corporation, Apple, Epic Systems Corporation, Huawei, Cisco, and Philips Healthcare are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us