Flexitank Market Size, Share & Industry Analysis, By Reusability (Single Use and Reusable), By Layer (Monolayer and Multilayer), By Loading Type (Top Loading and Bottom Loading), By Application (Food-Grade Liquids [Alcoholic Beverages, Edible Oils, Juices, Syrups, and Concentrates, and Others], Non-Hazardous Liquids, and Pharmaceutical Liquids), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

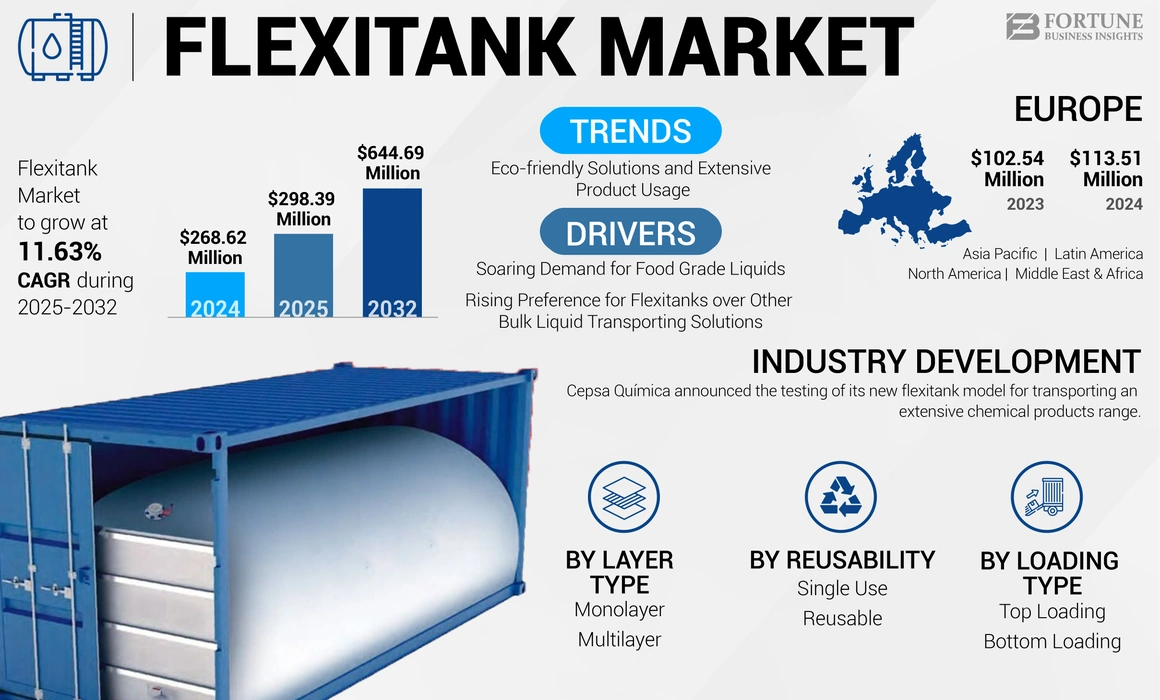

The global flexitank market size was valued at USD 268.62 million in 2024. The market is projected to grow from USD 298.39 million in 2025 to USD 644.69 million by 2032, exhibiting a CAGR of 11.63% during the forecast period. Asia Pacific dominated the flexitank market with a market share of 42.26% in 2024. Moreover, the flexitank market in the U.S. is projected to grow significantly, reaching an estimated value of USD 419.71 billion by 2032, driven by the increasing demand for grade oils, chemicals, and beverages particularly in industries like food and beverage, chemicals and pharmaceuticals.

Flexitank is a soft, lightweight, high-strength, and disposable plastic bladder utilized for bulk shipments of non-hazardous liquid materials within a standard 20-foot ISO shipping container. It facilitates the transportation of non-hazardous chemicals and food-grade liquids across oceans at significantly lower costs compared to other methods of bulk liquid transportation, such as Intermediate Bulk Containers (IBCs) and ISO tanks. It holds around 30% more payload than these options when fitted in the container and resist bulking on the container sidewalls, making bulk transportation of liquids secure and safe.

Container Owners Association (COA) has set stringent guidelines regarding the manufacturing, installation, and application of flexitanks. Furthermore, these tanks must meet standards the U.S. FDA, EU, and Halal certification agencies set to ship food-grade liquids. With exports of food products, chemicals, and pharmaceuticals crossing the mark of USD 3 trillion in 2018, the market growth opportunities are plenty, and the participants in the market are expanding their portfolio by new product launches to facilitate high-volume transportation with reduced cost for their clients.

Global Flexitank Market Overview

Market Size & Forecast

- 2024 Market Size: USD 268.62 million

- 2025 Market Size: USD 298.39 million

- 2032 Forecast Market Size: USD 644.69 million

- CAGR (2025–2032): 11.63%

Market Share

- Asia Pacific: Dominated the market with a 42.26% share in 2024, driven by dense manufacturing of food products and chemicals, and rising export activities.

- North America: Set for strong growth, fueled by significant exports of fruit juices, syrups, and pharmaceuticals.

Regional Insights

- Asia Pacific: Leading due to large-scale manufacturing and export capacity of food and chemicals

- North America: Growth from intermodal rail-based transport and exports of processed liquids

- Europe: Driven by pharmaceutical and wine exports; strong compliance with flexitank regulations

- Latin America: Expanding juice and beverage exports to other continents

- Middle East & Africa: Strong growth from petrochemical exports and intra-Africa base oil shipments

COVID-19 IMPACTS

Market Plunged amid Pandemic Due to the Negative Demand from Customers

The coronavirus spread affected the growing and established economies. Several markets witnessed declining demands from consumers, and others observed positive and moderated growth while some have remained untouched. This market witnessed negative growth during this period due to lowered demand from customers and almost negligible trade activities globally. The transportation of food grade liquids, such as edible oil, concentrates, and syrups, among others, was at a halt. The demand from the pharmaceutical industry was high, although it did not assist the market to grow positively. The post-pandemic phase has seen an increase in the growth of this market due to increasing demand from the food-grade liquid and non-hazardous liquid segment.

Flexitank Market Trends

Development of Flexitanks using Renewable and Recyclable Materials to Facilitate Lightweight and Enhanced Design Quality

Traditionally, these tanks were manufactured using rubber materials, however plastics completely replaced rubber in the early 90s. Moreover, concerns regarding environmental damage caused by conventional plastics have warranted the development of tanks from recyclable and renewable materials. Currently, recyclable polyethylene (PE) and polypropylene (PP) are majorly used to manufacture flexitanks. Furthermore, companies have collaborated with material developers such as Dow to research materials such as low-density and high molecular weight Low-Density Polyethylene (LDPE), improving the toughness of manufacturing tanks. Such research shall bring about materials that are high in strength and safe for transporting food products and chemicals.

Currently, only non-hazardous liquids can be transported using these tanks, and companies are seeking materials that can resist chemical corrosion, facilitating the transport of all liquids with enhanced safety. This trend shall provide novel growth pathways for the companies operating in this market.

Download Free sample to learn more about this report.

Flexitank Market Growth Factors

Increase in Transportation of Commodity Products to Drive the Demand for Flexitanks

According to a report by the World Trade Organisation, the export of manufactured goods increased by 22% in 2021 after a decline of 5% in 2021. The growth is expected to continue its path upward with the increasing dependence of countries on each other for various commodities. Food products, chemicals, petroleum products, and pharmaceuticals are some of the major commodities expected to show maximum traction in the near future. Their transportation is expected to be increasingly safeguarded to avoid potential losses. As these are preferable for the transportation of these goods in liquid form due to ease of loading and unloading and low losses during transportation, this is expected to drive the market growth during the forecast period.

Cost Effectiveness of Flexitanks over Other Bulk Liquid Transportation Methods to Provide Growth Pathways

Flexitanks are not the only option for the transportation of liquid products, yet they are very cost-effective compared to other alternatives, such as IBCs and drums. While the cost of manufacturing is higher than other conventional products, their installation requires almost a quarter of the time and a very low amount of labor. According to SIA Flexitanks, standard flexitanks can hold up to 24 tons of payload, about 15% more than IBCs and 40% more than drums. This facilitates the reduction of transportation costs. Furthermore, these tanks attract lower demurrage costs at unloading ports compared to other storage solutions, which leads to a lower cost of transportation compared to IBCs and drums, and thus, it is expected to drive the growth of the market.

RESTRAINING FACTORS

Tearable and Inability to Sustain High Pressure Restrict the Adoption of Flexitanks

Flexitanks are used in the transportation and storage of liquids and are highly prone to wear & tear if the proper lining of the shipping container is not carried out, as any sharp object or corner can easily tear the product, leading to loss of payload. Furthermore, while loading material, if the pressure inside the tank increases beyond the specified level, there is a possibility of the bursting of the tank. The pressure-sustaining capacity of these tanks is considerably lower than other bulk liquid transportation methods, which further restricts its adoption for the carriage of high-density liquids.

Flexitank Market Segmentation Analysis

By Reusability Analysis

Single Use Segment Holds the Largest Share Due to Low Cost of the Product

Based on reusability, the market is classified into single use and reusable. The single use segment accounts for the largest share of the market on account of low cost and ease in the disposal of the tank. Single use tanks reduce the cost of unloading the payload as the remnant material is discarded as compared to complete removal of products from reusable flexitanks to reduce the chances of future contamination. Furthermore, many manufacturers have started manufacturing flexitanks using recyclable material to meet the demand for environmentally sustainable operations, further driving single use segment growth.

On the other hand, the reusable segment is expected to grow at a significant rate over the forecast period. This is due to the usage of reusable flexitanks for the transportation of oils and non-hazardous liquid chemicals less prone to contamination detriments.

By Layer Analysis

Multilayer Segment Accounts for the Largest Share Due to Potential Benefits Offered

Based on type of layer, the market is divided into monolayer and multilayer segments. The multilayer segment holds the largest flexitank market share. The multilayer solutions have high benefits over the monolayer ones. These include high strength and durability, which are required to transport bulk liquids. The multilayer tanks also prevent the cargo from getting contaminated by providing oxygen and moisture barriers.

By Loading Type Analysis

Bottom Loading Segment to Gain Market Share Due to Convenience of Loading & Unloading Procedures

Based on loading type, the market is categorized into top and bottom loading segments. Initially, the flexitanks were designed with top loading configurations. However, bottom loading offered benefits such as easy loading & unloading procedures and reduced losses of payload during the unloading process. These benefits have led the bottom loading segment to gain considerable market share in the past and shall continue the same during the forecast period.

On the other hand, the top loading segment holds the second largest share in the market. This is owing to higher demand for these tanks from fruit juice and alcoholic beverage manufacturers. These liquids form lower bulk heads during the loading process and do not require special configuration to stop the backpass of liquids. The economical option of top loading is preferred by the customers operating in these sectors.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Food-Grade Liquids Segment to Dominate due to Rising Government Emphasis on Strengthening Food Security

In terms of application, the market is segmented into food-grade liquids, pharmaceutical liquids, and non-hazardous liquids. Food-grade liquids are further categorized into alcoholic beverages, edible oils, juices, concentrates, syrups, and others. The food-grade liquids segment holds the largest share in the market and is estimated to be the fastest-growing segment. This comes as governments of developing countries such as India, China, Brazil, and South Africa emphasize on strengthening their food security. These governments are ensuring the same for their citizens by importing processed food products such as fruit juices, sauces & condiments, and other beverages from developed nations, which in turn shall create demand for shipping products such as flexitanks in the near future.

On the other hand, the demand for pharmaceutical liquids is set to observe an enormous spike after the occurrence of the COVID-19 pandemic as people become increasingly concerned about their health and well-being. This shall create massive demand for packaging and logistics products, including flexitanks for the shipment of medicines during the forecast period.

REGIONAL INSIGHTS

Geographically the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Flexitank Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific region is expected to lead the market owing to the region's heavy density of food products and chemical manufacturing hubs. Furthermore, governments of China, India, and Southeast Asian countries have focused on increasing their exports, which shall present a significant growth opportunity for this market in the Asia Pacific.

North America will grow on account of significant exports of fruit juices and syrups from the region to the eastern countries. Moreover, the transport of liquids via rail-based containers has expanded tremendously in North America, creating a demand for flexitanks in the region.

On the flip side, the European market will mirror the growth of pharmaceutical exports from the region. According to FTS Container Packaging Co., Ltd., about 30% of the global wine shipping is done via flexitanks. Additionally, the trade data provided by the UN shows that Europe accounts for the largest share of wine and other alcoholic beverages exports globally. This represents an attractive opportunity for market growth in the region.

Latin America will show significant growth over the study period. This is due to an increase in alcoholic beverages and fruit juices exported from the region to food processing industries in North America and Europe.

The Middle East & Africa based market is expected to grow during the forecast period as demand for petrochemicals expands across the globe. Furthermore, demand for flexitank is expanding for transportation of base oil to Sub-Saharan Africa from the Middle East, which is expected to drive the growth of the market in the region.

List of Key Flexitank Market Companies

Key Market Players Focus on Capacity Expansion to Maintain Their Authority in the Market

The competitive landscape of the market depicts a highly consolidated market, with the top 10 companies accounting for a majority share. Many new players have emerged considering the attractive opportunity present in the market, while key players present in the market are investing a large number of resources to expand their footprint across multiple regions to gain market share.

Furthermore, players operating in the market have sought alternative transportation routes where flexitank can be utilized. These include railways and roadways to serve their customers efficiently. This trend will positively impact the global market during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Infinity Logistics and Transport Venture Limited (Malaysia)

- TRUST Flexitanks (Spain)

- Sun Flexitanks (India)

- Bulk Liquid Solutions (India)

- United Accredited Company (UAC) (Saudi Arabia)

- ONE Flexitanks (Malaysia)

- Neoflex (Turkey)

- Wiefferink (Netherlands)

- Qingdao LAF Packaging Co., Ltd. (China)

- LiquA Europe SLU (Spain)

KEY INDUSTRY DEVELOPMENTS:

- June 2022 – Mediterranean Shipping Company became one of the companies to provide in-house liquid cargo solutions by introducing flexibag for shipping liquid cargo. Flexibags can carry up to 24,000 liters of non-hazardous liquids such as wine, edible oils, petroleum products, and chemicals, offering a cost-effective and safe alternative to other bulk liquid transportation solutions.

- March 2022 – SIA Flexitanks launched its innovative trinity tank. This three-pod reefer flexitank system would enable shippers to load multiple flexitanks in the same container to transport the bulk liquids. The tank has a total capacity of 27,000 liters, and one of the triple tanks can hold 9,000 liters.

- October 2020 – Hillebrand launched pulse Flexitank, which is designed to transport liquids with high density or that tend to solidify. Such liquid includes drilling mud, paint slurries, oleochemicals, and vegetable oils.

- January 2020 – VTG Tanktainer GmbH expanded its liquid goods transportation facilities range via the launch of flexitanks. The move was made for providing efficient and multiple transportation solutions to its customers.

- September 2019 – SIA Asia, the subsidiary of SIA Flexitanks, reaffirmed its progress in the Asia Pacific market. The company opened warehouse facilities and a new office in Malaysia. The facilities would benefit the company through the provision of efficient service to customers and enhancing its footprint throughout the Asia Pacific region.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentations

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 11.63% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Reusability

|

|

By Layer

|

|

|

By Loading Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market was at USD 268.62 million in 2024.

The global market is projected to grow at a CAGR of 11.63% over the forecast period.

The market size of Europe stood at USD 113.51 million in 2024.

By application, the food-grade liquids segment is expected to be the leading segment in this market during the forecast period.

An increase in the transportation of commodities is the key factor driving the growth of the market.

Asia Pacific held the highest market share in 2025.

The top players in the market are Infinity Logistics and Transport Venture Limited, TRUST Flexitanks, Sun Flexitanks, Bulk Liquid Solutions and United Accredited Company (UAC) among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us