ISO Container Market Size, Share & Industry Analysis, By Transport Mode (Road, Rail, and Marine), By Capacity (Below 20,000 Liters, 20,000 – 35,000 Liters, and Above 35,000 Liters), By Container Type (Multi-Compartment Tank, Lined Tank, Reefer Tank, Cryogenic & Gas Tank, and Swap Body Tank), By End-use Industry (Chemicals, Petrochemicals, Food & Beverage, Pharmaceuticals, Industrial Gas, and Others), and Regional Forecast, 2026 – 2034

ISO Container Market Size

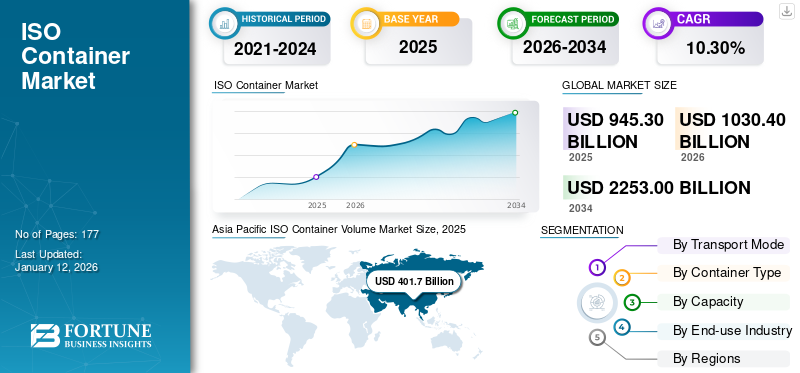

The global ISO container market size was valued at USD 945.3 billion in 2025 and is projected to grow from USD 1,030.40 billion in 2026 to USD 2,253.00 billion by 2034, exhibiting a CAGR of 10.30% during the forecast period. Asia Pacific dominated the global market with a share of 42.50% in 2025. The ISO containers market in the U.S. is projected to grow significantly, reaching an estimated value of 312.15 thousand units by 2032, driven by the rise in demand of Oil and Gas Exports to Contribute to Market Growth.

ISO containers, also known as intermodal containers, are standardized steel boxes used for transporting goods across various modes of transportation, including ships, trains, and trucks. These containers follow the specifications set by the International Organization for Standardization (ISO), safeguarding uniformity in size, design, and handling methods. The standardization allows for smooth transfer between different transportation modes without the need to unload and reload the cargo. They are typically made of corrugated steel panels, providing durability and strength to withstand the rigors of transportation. The corners of these containers are reinforced to facilitate stacking and lifting.

While standard dry containers are the most common type, these containers also come in specialized variations. Refrigerated containers (reefers) for temperature-sensitive goods, tank containers for liquids and gases, flat racks for oversized cargo, and open-top containers for easy loading of goods from above are some types. These containers are also considered for intermodal transport, meaning they can be effortlessly moved between different modes of transportation without the need to unpack and repack the cargo. This interoperability enhances efficiency and reduces cargo handling costs.

During the COVID-19 pandemic, China's exports significantly outperformed imports, as there was a drop of 5.8% in imports between March and May 2020, while exports experienced a rise of 1.3%. UNCTAD discovered the thwarting factors that were hindering trade recovery due to unprecedented container shortages. Unexpectedly, demand for container shipping also increased during the pandemic, which made the possibility of a quick recovery from an initial slowdown. However, post-pandemic, manufacturers restructured their operational business model. They created a more disruption-proof model in order to cope with such crucial situations in the future.

ISO Container Market Trends

Digitalization and IoT Integration in ISO Container to Drive Market Growth

The integration of digital technologies and Internet of Things (IoT) solutions continues to transform the market. Smart containers equipped with sensors for tracking location, temperature, humidity, and other parameters are becoming more prevalent. This data-driven approach enhances supply chain visibility, improves cargo security, and enables predictive maintenance, ultimately driving efficiency and reducing costs.

Additionally, advancements in technologies such as automation, robotics, and artificial intelligence are poised to impact the market. Automated container terminals, autonomous trucks, and drones for container inspection are just a few examples of how technology is transforming container handling and transportation processes. These innovations have the potential to increase efficiency, reduce labor costs, and enhance safety in the container industry, contributing toward the ISO container market growth.

Download Free sample to learn more about this report.

ISO Container Market Growth Factors

Emphasis on Containerization and Rise in Trade Activities to Accelerate Market Growth

The expansion of international trade is a primary driver of the ISO container market. As global trade volumes increase, there is a corresponding rise in the demand for containers to transport goods across borders. Factors such as economic growth, population growth, and the proliferation of free trade agreements contribute to the expansion of global trade.

Moreover, the shift from traditional break-bulk cargo handling to containerization is a significant driver of the ISO container market share. Containerization offers numerous advantages, including increased efficiency, lower transportation costs, reduced cargo damage, and faster turnaround times at ports. As a result, industries and logistics providers increasingly prefer containerized shipping for transporting goods.

RESTRAINING FACTORS

Volatility in Fuel Prices and Infrastructure Constraints to Hinder Market Growth

Fluctuations in fuel prices, particularly diesel fuel used in trucks and ships, can affect transportation costs and profitability for shipping lines and logistics providers. High fuel prices increase operating expenses, while low fuel prices may incentivize containerized shipping over other modes of transportation. However, sudden spikes in fuel prices can strain profit margins and lead to adjustments in container shipping rates.

Furthermore, inadequate transportation infrastructure, including ports, railways, and intermodal terminals, can constrain the growth of the ISO container market. Bottlenecks at ports, congestion on transportation networks, and lack of investment in infrastructure upgrades may limit the capacity and efficiency of containerized shipping operations, hindering market expansion.

ISO Container Market Segmentation Analysis

By Transport Mode Analysis

Marine Segment Dominates Due to Cost-Effective Transportation

On the basis of transportation mode, the market is classified into rail, marine, and road.

The marine mode of transport dominates the market due to its adoption in the long-distance transportation of ISO containers, especially for international trade. Large container ships carry containers between ports worldwide, facilitating global supply chains. Maritime shipping offers cost-effective transportation over long distances and can accommodate large volumes of cargo. The marine segment accounted for 51.81% of the total market share in 2026.

The road transport segment is projected to lead the market in terms of CAGR as it plays a crucial role in the first and last-mile delivery of ISO containers, as well as transporting containers between ports, warehouses, distribution centers, and final destinations. Trucks equipped with chassis transport containers over short to medium distances, providing flexibility and accessibility to remote locations. Road transport offers door-to-door delivery capabilities and enables just-in-time delivery. However, it faces challenges such as congestion, road infrastructure limitations, and environmental concerns.

The rail transport segment is expected to witness considerable growth during the forecast period as it is commonly used for inland transportation of containers, connecting ports to inland distribution centers and industrial hubs. Rail transport offers advantages such as high capacity, reliability, and reduced carbon emissions compared to road transport.

To know how our report can help streamline your business, Speak to Analyst

By Capacity Analysis

20,000 - 35,000 Liters Commands Market Position Owing to Industry-Specific Requirements

Based on capacity, the market is divided into below 20,000 liters, 20,000 - 35,000 liters, and above 35,000 liters.

20,000–35,000 liters capacity ISO containers are anticipated to hold a major market share of 48.56% in 2026 and to exhibit a substantial CAGR during the forecast period. The segment’s growth is credited to its versatility and common use for transporting a wide range of perishable and non-perishable goods, including food products, industrial chemicals, and agricultural commodities.

The above 35,000 liters is projected to exhibit extensive growth during the forecast period owing to its predominant use in industries such as oil and gas, chemical manufacturing, and food processing, where high-volume shipments are necessary.

By Container Type Analysis

Multi-Compartment Tank to Lead the Market Due to Flexibility in Cargo Handling

Based on container type, the market is divided into, lined tanks, reefer tanks, cryogenic & gas tanks, swap body tanks, and multi-compartment tanks.

The multi-compartment tank segment led the market in 2026, accounting for 31.90% of the total market share, supported by its ability to enable the simultaneous transport of different types of liquids or gases within a single container. These containers are commonly used for transporting various chemicals, oils, and hazardous materials where segregation of cargo is necessary.

The cryogenic & gas tank containers are expected to depict robust development as these containers are specially designed for transporting liquefied gases at extremely low temperatures. They are used for transporting gases such as LNG (liquefied natural gas), LPG (liquefied petroleum gas), nitrogen, oxygen, and hydrogen.

By End-use Industry Analysis

Petrochemicals Industry Dominates with Cost-Effective and Efficiency in Transportation

Based on end-use industry, the market is segmented into industrial gas, petrochemicals, food & beverage, chemicals, pharmaceuticals, and others that include paints.

The petrochemicals industry dominated the market in 2026, accounting for 28.31% of the total market share. The segment’s development is credited to ISO containers, as they are widely used in the transportation of petrochemical products derived from petroleum and natural gas processing. Petrochemicals transported in containers include Liquefied Petroleum Gas (LPG), ethylene, propylene, butadiene, benzene, and other hydrocarbons.

The food & beverages industry is expected to witness major growth in upcoming years as these containers are utilized in the production, processing, packaging, and distribution of food and beverages. These products range from agriculture and food processing to packaged goods and beverages such as soft drinks, alcoholic beverages, and dairy products.

In addition, other industries, such as pharmaceuticals, industrial gases, and paints, are also expected to showcase considerable growth over the forecast period.

REGIONAL INSIGHTS

The market report's scope comprises five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific ISO Container Volume Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific was the largest and fastest-growing market for ISO containers, with the market size valued at USD 401.7 billion in 2025 and increasing to USD 440.1 billion in 2026, driven by its role as a major manufacturing hub and global trade powerhouse. Ports in China (e.g., Shanghai, Shenzhen, and Ningbo-Zhoushan), Singapore, and South Korea are major container hubs. The region's rapid industrialization and urbanization drive the demand for containers for both imports and exports. China, which is the world's largest producer of containers, accounts for more than 80% of global production. In recent years, as India started to manufacture its container in order to reduce its dependency on Chinese traders, China's production on the world market has decreased. Currently, owing to high taxes and rising freight costs on goods originating in both countries, India is paying up to 40% of the real cost of imported containers. The Japan market is projected to reach USD 65.1 billion by 2026, and the India market is projected to reach USD 91.3 billion by 2026.

China is predicted to showcase modest growth during the forecast period. In addition, it has also become a major manufacturing base for shipping containers around the world. Huge companies are setting up production facilities in China to benefit from low labor and raw material prices. The country is also increasing investments to expand its ports and shipping capacity. China's supportive policies and favorable environment, along with its growing industrial capabilities, have enabled the growth of the global market. This will trigger demand for shipping containers on a global scale. Further, various initiatives, including China's One Belt, aim to improve the current scenario for shipping ports in the region, thus enabling market growth. The China market is projected to reach USD 184.2 billion by 2026

To know how our report can help streamline your business, Speak to Analyst

Europe is predicted to observe significant growth due to the rise in maritime trade activities. Moreover, the presence of major key players in the region will further propel the growth of the International Standards Organization (ISO) shipping container market in the region in the coming years. The UK market is projected to reach USD 62.6 billion by 2026, while the Germany market is projected to reach USD 73.3 billion by 2026.

North America is also expected to hold a major share of the market with the rapid construction of warehouses and distribution centers in the region. Growth in chemicals, petrochemicals, and pharmaceuticals will play a major role in the revenue growth. The strong presence of prominent manufacturers in North America also aids the growth of the market. The US market is projected to reach USD 168.4 billion by 2026.

The Middle East & Africa is projected to witness considerable growth in the coming years. The region’s growth is credited to a thriving transport and logistics sector and an increase in sea and land trade activity. Additionally, the growing demand for convenience and affordability has led to tremendous product adoption across multiple sectors. ISO tankers are mostly used for the import and export of oil and gas as the region consists of many oil-based economies. The UAE and Saudi Arabia are the two main consumers of goods in the region.

Latin America continues to be considered an emerging region on the global container trade map. Despite this, the volume of trade in the region has increased significantly in the last decade, and the countries are highly dependent on container transport to develop and maintain their economies. Latin America is also home to the Panama Canal, which connects the Pacific and Atlantic oceans. In addition, with digitization and continuous globalization, Latin American countries strive more than ever to become part of the global economy.

Key Industry Players

Adoption of Various Business Strategies to Tackle the Supply-Demand Gap

The market of ISO containers is identified as a highly competitive market with the presence of multiple players operating at a global level, as well as certain regions where the domestic players have a substantial market share. Stolt Tank Containers, New Port, and Intermodal Tank Transport Hoyer group, among others, are the prominent players in the global market, covering a decent share of the market. These key players also own container operation businesses, which have expanded to many countries.

List of Top ISO Container Companies:

- Intermodal Tank Transport (U.S.)

- Bertschi AG (Switzerland)

- Bulkhaul Limited (U.K.)

- Royal Den Hartogh Logistics (Netherlands)

- HOYER GmbH (Taiwan)

- Interflow TCS Ltd. (U.K.)

- New Port Tank (Netherlands)

- Sinochain Logistics Co., Ltd. (China)

- Stolt-Nielsen Limited (U.K.)

- VTG Tanktainer GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: With the acquisition of H&S Group, one of Europe's largest transporters of food and liquids, Royal Den Hartogh Logistics is expanding its product range to include worldwide transport for chemicals, gas, and foodstuffs.

- October 2023: Aldrees Bertschi Logistic Services, has introduced the world's first temperature controlled container storage facility in Saudi Arabia at a terminal of Aldrees Bertschi. This facility offers a unique solution for customers who seek to protect and cool their products, since it is able to endure the extremes of desert heat.

- December 2023: Stolt Tankers is the first shipping company in the world to use a cutting-edge, durable coating on one of its chemical tanker’s hulls.

- December 2022: In Value Park Terneuzen, Bertschi has increased the size of its multimodal transport and storage facilities by 22,000 square feet.

- March 2022: Suttons Group announced that it has invested in ISO containers. One hundred 24,000 liter ISO tanks were invested to strengthen the company's international tank fleet.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion ) |

|

Segmentation |

By Transport Mode

|

|

By Capacity

|

|

|

By Container Type

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was $945.3 billion in 2025.

The market is likely to grow at a CAGR of 10.30% over the forecast period (2026-2034).

The multi-compartment tank is expected to lead the market due to its increasing adoption.

The market size in Asia Pacific stood at $401.7 billion in 2026.

Rise in demand for oil and gas exports to contribute to market growth.

Intermodal Tank Transport, Bertschi AG, Bulkhaul Limited, Royal Den Hartogh Logistics, HOYER GmbH, Interflow TCS Ltd., New Port Tank, Sinochain Logistics Co., Ltd., Stolt-Nielsen Limited, and VTG Tanktainer GmbH are the top companies.

China dominated the market in 2025, being a major manufacturing base for shipping containers.

The multi-compartment tank is expected to lead the market with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us