Identity Verification Market Size, Share & Industry Analysis, By Deployment Model (On-Premises and Cloud), By Type (Biometric Identification and Non-biometric Identification (Document Verification, Knowledge-based Verification, Two-Factor Authentication, and Others)), By Enterprise Type (Small and Medium-sized Enterprises and Large Enterprises), By End-user Industry (BFSI, E-commerce & Retail, Government, IT & Telecom, Healthcare & Life Sciences, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

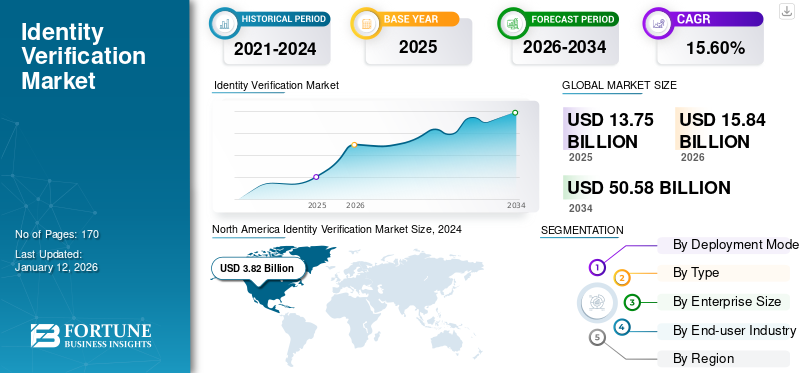

The global identity verification market size was valued at USD 13.75 billion in 2025. The market is projected to grow from USD 15.84 billion in 2026 to USD 50.58 billion by 2034, exhibiting a CAGR of 15.60% during the forecast period.

Identity verification is a security measure that ensures the individual is who they claim to be. This is crucial to prevent fraud, strengthen security, and establish trust in online transactions. It is an important deterrent against malicious activities such as identity fraud and identity theft. By enforcing strict ID verification measures, businesses can ensure that only authorized individuals have access to sensitive information or services. Stringent identity verification is often implemented in high-security government environments such as nuclear power plants, weapons storage facilities, government offices, and other facilities.

The market growth is mainly driven by the increasing financial crimes, rapidly evolving regulatory landscape, growing adoption of digital services, and advancements in technology, such as artificial intelligence (AI) and biometrics. According to “The State of Fraud and Financial Crime in the U.S.” by PYMNTS, around 64% of financial institutions reported an increase in fraud attacks on credit cards. Most institutions have noted that financial fraud approaches are becoming more sophisticated, and tackling them effectively is a major challenge.

To address the growing concern of financial crimes, several companies operating in the global market are launching AI-driven solutions to mitigate fraud and comply with all relevant Know Your Business (KYB) and Know Your Customer (KYC) requirements. For instance,

- In November 2023, Vouched, an AI-driven ID verification platform, unveiled “VouchedAuto”, an AI-powered solution to streamline the KYC process, mitigate fraud, and maintain compliance with regulatory norms.

The COVID-19 outbreak accelerated cybercrimes globally owing to the rapid adoption of remote work and increased digital transformation. Cybercriminals benefitted by targeting vulnerable people and systems. ID verification solutions played a vital role during the pandemic by providing touchless verification services to contain the virus and fulfil KYC regulations.

IMPACT OF GENERATIVE AI

Integration of AI with Biometric Technology to Augment Market Growth

Governments and businesses globally have embraced biometric technology to maintain the safety and security of vulnerable people and systems. However, biometrics technology is still challenging in mitigating terrorist activities and other financial theft crimes. Many researchers have tried different AI techniques for biometric identification to tackle this issue. AI can be used in face, fingerprint, iris, and behavior recognition. For instance,

- In August 2022, the Defence Research & Development Organisation (DRDO) Government of India developed an AI-powered facial recognition system to identify low-resolution images. In addition, this system can identify individuals with disguises such as masks, sunglasses, beards, monkey caps, and others. This AI-driven face recognition system can be deployed for live video surveillance in secure and restricted zones.

Identity Verification Market Trends

Rising Threat of Deepfakes to Fuel the Implementation of ID Verification Techniques among Organizations

Deepfakes are a rising and sophisticated threat that is crafted using artificial audio, videos, or images that use AI to produce a synthetic output. Deepfakes can be used to breach an organization’s systems and compromise internal data. According to "The State of Identity Verification in 2023" by Regula, around 37% of businesses have faced synthesized voice fraud, and 29% have fallen prey to deepfake videos. As per the "Threat Intelligence Report 2024" by iProov, face swap technology used for remote ID verification increased by 704% in 2023. This, in turn, is anticipated to increase the demand for identity verification solutions during the forecast period.

With the potential for significant financial losses and erosion of trust, organizations are increasingly strengthening their ID verification measures. Due to the sophistication of deepfakes, businesses are deploying cutting-edge AI and machine learning tools to detect subtle irregularities that would be challenging for humans to detect.

Download Free sample to learn more about this report.

Identity Verification Market Growth Factors

Stringent Regulations to Drive the Demand for Robust Identity Verification Systems

Stringent regulations, such as the General Data Protection Regulation (GDPR) and Electronic Identification, Authentication, and Trust Services (eIDAS), are anticipated to drive the demand for robust ID verification solutions. The regulatory authorities are increasingly becoming more stringent toward compliance with KYC and AML (anti-money laundering) globally. Regulators in the European Union (EU), the U.S., and the U.K. are making stringent demands of financial institutions and levying hefty fines on those who fail to comply. Due to the rapid digital transformation globally, AML and KYC regulations are being updated frequently and have included a broader range of directives. To comply with stringent rules and regulations, organizations are increasing the amount of scrutiny and investing significantly to stay compliant and legal. For instance,

- In January 2022, FV Bank announced the integration of Internet Original Documents, Inc.’s (dba DIRO) original documents online technology to effectively verify individuals and documents from the original authorized online source. DIRO’s technology doesn’t depend on API integrations with third-party data sources and complies with strict data privacy laws.

RESTRAINING FACTORS

High Cost Coupled with Less Adoption in Developing Economies to Hamper Market Growth

Enforcing advanced ID verification solutions can be expensive, especially for small and medium-sized enterprises or startups with limited resources. These solutions often deliver false positives and negatives. Both false positives and negatives can result in bad customer experiences, increased costs, and reputational damage. In addition, there is less or slower adoption of digital verification solutions in developing economies due to low digital literacy, infrastructure challenges, and financial constraints. This, in turn, limits the adoption of identity verification solutions. The countries that implement robust ID verification solutions benefit in terms of GDP growth and can expect economic benefits. These factors are set to hamper the identity verification market growth.

Identity Verification Market Segmentation Analysis

By Deployment Model Analysis

Cost-effectiveness and Scalability to Drive Cloud Segment Growth

Based on deployment model, the identity verification market is segmented into on-premises and cloud.

The cloud segment is anticipated to record the highest CAGR during the forecast period owing to numerous benefits offered by this deployment model, such as increased collaboration, cost-effectiveness, scalability, and ability to identify emerging threats in real time. Highly automated, AI-powered, cloud-based ID verification SaaS tools verify real identities and check backgrounds remotely while complying with regulations.

Additionally, the on-premises segment is predicted to hold the highest market share during the forecast period. This model enables organizations to have full control over the data and is less prone to security threats than cloud-based solutions.

By Type Analysis

Advancements in Biometric Technology to Propel Market Growth

Based on type, the market is divided into biometric identification and non-biometric Identification.

The biometric identification segment led the market accounting for 62.05% market share in 2026. From law enforcement to unlocking phones, the use of biometric technology is becoming more and more widespread across the globe. Rapid technological advancements, such as AI, cloud computing, and the Internet of Things (IoT) drive biometrics companies to create more accurate and safe identity authentication methods.

The non-biometric identification segment is further divided into document verification, knowledge-based verification, two-factor authentication, and others. Two-factor authentication is expected to show the fastest CAGR during the forecast period due to rising cyber threats, adoption of cloud computing, and mobile device proliferation.

By Enterprise Type Analysis

Rapid Business Digitalization of Small and Medium-sized Enterprises (SMEs) to Fuel Segment Growth

Based on the enterprise type, the market is divided into small and medium-sized enterprises and large enterprises.

The small and medium-sized enterprises (SMEs) segment is expected to grow at the highest CAGR during the forecast period. Increased digitalization has a substantial impact on SMEs and offers ample growth opportunities. Advanced technology adoption helps SMEs protect their employees' personal and business assets and sustain the competition.

In addition, the largest market share was held by large enterprises due to the increasing adoption of verification solutions by these organizations to comply with regulations, protect data, and increase customer trust. Organization size with significant presence globally, usually handle vast amounts of sensitive data. Hence, integrating robust ID verification solutions helps protect this data from unauthorized access, ensuring confidentiality, integrity, and availability.

By End-user Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Surge in E-commerce Transactions Coupled with Rising Concerns about Fraud and Identity Theft to Propel E-commerce Segment Growth

Based on end-user industry, the market is segmented into BFSI, e-commerce & retail, government, IT & telecom, healthcare & life sciences, and others.

The e-commerce & retail segment is expected to grow with the fastest CAGR during the forecast period. Due to the growing identity fraud, online retailers are rapidly increasing their measures to ensure that transactions are secure and customers are genuine. While complying with stringent data regulations, online retailers are increasingly making significant use of ID verification solutions to onboard new customers, protect existing customers from account takeovers, and stop fraudulent transactions.

In addition, the government segment is expected to account for the largest market share during the forecast period. Governments are recognizing the importance of proactive security solutions to prevent various threats to individuals and systems. ID verification tools play a crucial role in their incident response preparedness by providing early detection and response capabilities to security incidents.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America Identity Verification Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America held the dominant share in 2026 valuing at USD 4.93 Billion and also took the leading share in 2025 with USD4.33 Billion. According to the "Annual Data Breach Report 2022" by IRTC, in 2022, the U.S. witnessed the second-highest number of data breaches in a year, affecting at least 422 million people. As per the FBI’s “Internet Crime Report 2022”, total cybercrime losses were evaluated to be USD 10.2 billion in 2022, nearly doubling the amount compared to the previous year (USD 6.9 billion). All these factors have propelled the adoption of advanced ID verification solutions in this region. The U.S. market is projected to reach USD 2.93 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Moreover, the Asia Pacific market is anticipated to show the highest growth rate due to rapid cloud adoption, favorable government initiatives, and rapid digitization. In addition, the augmentation of online services in this region creates a high demand for robust ID verification solutions to enable secure access to digital platforms and protect against cyber threats. The region is home to some of the world’s fastest-growing e-commerce markets, offering lucrative business opportunities to ID verification solution providers.

The Japan market is projected to reach USD 0.46 billion by 2026, the China market is projected to reach USD 1.3 billion by 2026, and the India market is projected to reach USD 0.69 billion by 2026.

The market in Europe is majorly driven by digital identity initiatives, such as the eIDAS (Electronic Identification, Authentication and Trust Services) regulation. The eIDAS represents a precise legal framework for individuals, businesses, and government administrations to gain higher security and convenience for online activities and digital transactions. The UK market is projected to reach USD 0.58 billion by 2026, while the Germany market is projected to reach USD 0.72 billion by 2026.

In South America, the emergence of the startup & innovation ecosystem and the rapid adoption of cloud solutions and services are expected to drive market growth.

In the Middle East & Africa region, the rapid digital transformation offers ample opportunities for ID verification solutions to support secure online interactions.

Key Industry Players

Key Players Focused on Strengthening their Market Position with Continuous Developments

The global market is consolidated by leading players, such as Equifax, Inc., Jumio, Thales Group, TransUnion, Experian, Trulioo, Onfido, Shufti Pro, Mitek Systems, Inc., and DocuSign, Inc. These companies in the market are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships. For instance, in September 2023, Equifax, Inc. and Mitek Systems, Inc. partnered to fight rapidly against evolving digital frauds and strengthen Equifax’s capabilities to mitigate identity fraud.

List of Top Identity Verification Companies:

- Equifax, Inc. (U.S.)

- Jumio (U.S.)

- Thales Group (France)

- TransUnion (U.S.)

- Experian (Ireland)

- Trulioo (Canada)

- Onfido (U.K.)

- Shufti Pro (U.K.)

- Mitek Systems, Inc. (U.S.)

- DocuSign, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: AU10TIX, an identification service provider, launched a new KYB solution that helps businesses determine exactly who they are doing business with and mitigate potential financial and reputational losses. AU10TIX integrates KYB with KYC processes to cater to every KYB business need.

- January 2024: Onfido, a technology company unveiled its new all-in-one ID verification solution that enables enterprises to expand into new markets and address local regulatory requirements for customer onboarding.

- December 2023: HireRight, LLC., an employment background screening firm unveiled “Global ID”, a new ID verification solution that can verify a candidate’s identity through Global ID’s optional digital Liveness and Biometric Face Match feature.

- July 2023: ID-Pal, an Irish-based ID verification service provider has expanded their footprint in the U.S. market to address the growing ID verification demands from both SMEs and large enterprises.

- July 2023: Checkout.com announced the launch of an AI-powered ID verification solution to improve customer onboarding and ID verification process. This AI-driven solution is trained on a vast amount of identity and facial recognition documents from across 195 countries

REPORT COVERAGE

The report offers qualitative and quantitative insights into the market for identity verification and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 15.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment Model

By Type

By Enterprise Type

By End-user Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is predicted to reach USD 50.58 billion by 2034.

In 2025, the market value stood at USD 13.75 billion.

The market is projected to record a CAGR of 15.60% during the forecast period of 2026 – 2034.

The government segment is the leading end-user industry segment in the market.

Increased adoption of advanced technologies, such Artificial Intelligence (AI), Machine Learning (ML) along with surge in the digitalization to aid the market growth.

Some of the top players in the market are Equifax, Inc., Jumio, Thales Group, TransUnion, Experian, and others.

Asia Pacific is expected to show the highest CAGR due to the rapid digitalization, favorable government initiative, and expansion of e-commerce sector.

By end-user industry, the e-commerce & retail segment is expected to show the fastest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us