Air Handling Units Market Size, Share & Industry Analysis, By Type (Packaged, Modular, Custom, and Rooftop Mounted), By Business Type (New Equipment and Aftermarket), By Capacity (Less than 5,000 M3/h, 5,001 M3/h-15,000 M3/h, 15,001 M3/h-30,000 M3/h, and More than 30,000 M3/h), By End-user (Residential, Commercial, and Industrial), By Effect (Single-effect and Double-effect), and Regional Forecast, 2026 – 2034

AIR HANDLING UNITS MARKET OVERVIEW AND FUTURE OUTLOOK

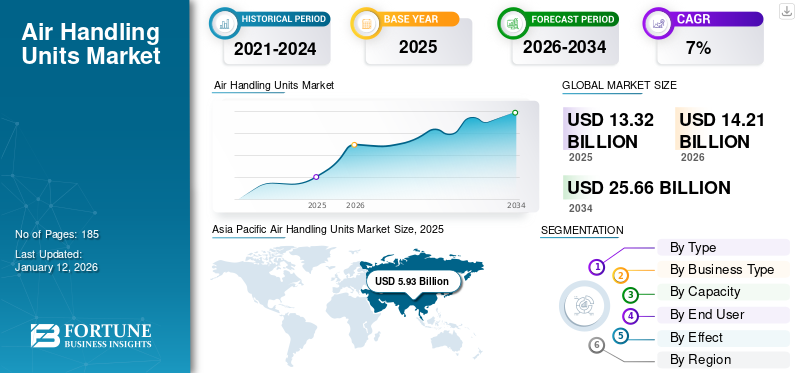

The global air handling units market size was valued at USD 13.32 billion in 2025. The market is projected to grow from USD 14.21 billion in 2026 to USD 25.66 billion by 2034, exhibiting a CAGR of 7.7% during the forecast period. Asia Pacific dominated the global market with a share of 44.5% in 2025.

The AHUs market has grown significantly due to the increasing need for effective indoor air quality management across commercial, industrial, and residential spaces. These units are critical for ventilating, heating, and cooling air, making them integral to HVAC systems. Market growth is driven by rising construction activities, stricter energy efficiency regulations, and heightened awareness about the importance of indoor air quality, especially in post-pandemic scenarios.

Advancements in technology, such as smart and energy-efficient AHUs, have spurred adoption, making these systems more appealing for retrofits and new installations. Key sectors such as healthcare, commercial buildings, and data centers have shown a strong demand for AHUs, further fueling market growth.

The AHUs market is expected to see steady growth, with trends favoring energy-efficient and environmentally friendly solutions. The shift toward green building certifications and increasing emphasis on reducing carbon emissions will push manufacturers to develop AHUs with improved energy performance. In addition, the integration of the Internet of Things (IoT) and AI-based control systems into AHUs is expected to enhance operational efficiency and predictive maintenance, making these units more cost-effective in the long term.

The COVID-19 pandemic disrupted the AHUs market in the initial stages due to supply chain and manufacturing delays. However, increased demand for improved indoor air quality and ventilation, particulary in healthcare and commercial spaces, fueled market recovery.

MARKET DYNAMICS

Market Drivers

Rising Population and Urbanization Boosts the Need For Air Conditioning Product

The expansion of urban areas and the increasing global population are key factors driving the growth of the AHUs market. As cities become more densely populated, there is a heightened need for improved infrastructure across residential, commercial, and industrial sectors. This surge in construction projects—ranging from homes and offices to shopping centers and hospitals—necessitates effective heating ventilation and air conditioning HVAC solutions to maintain indoor air quality and comfort. AHUs, being a critical component of HVAC systems, are therefore in greater demand as urban environments develop, contributing significantly to air handling units market growth.

Moreover, the growth in urban populations creates a need for enhanced infrastructure such as schools, hospitals, and industrial facilities, where precise air control is crucial for health and safety. This expansion of essential services requires more advanced and efficient air-handling solutions that meet modern building standards and regulations. As cities grow, the focus shifts to sustainable, energy-efficient heating, ventilation, and air conditioning HVAC systems that can support larger populations while minimizing environmental impact. This trend opens up new opportunities for manufacturers to innovate and introduce advanced AHU technologies, thereby fueling the overall market growth.

Market Restraints

High Installation and Maintenance Costs are Projected to Restrain AHUs Market Growth

High installation and maintenance costs pose a significant restraint to the growth of the global AHUs market. The initial investment required for purchasing and installing AHUs, especially those with advanced features such as energy efficiency or smart technology, can be substantial. This high upfront cost can be a barrier for smaller businesses, residential buildings, and budget-conscious industries, making it difficult for them to adopt or upgrade to modern AHU systems. Moreover, the need for professional installation services, which ensures that the units operate efficiently and adhere to safety standards, further increases initial expenditure.

Ongoing maintenance costs associated with AHUs can deter potential buyers, particularly in industries or facilities with tight budget constraints. Regular servicing is essential to ensure optimal performance, prevent breakdowns, and extend the lifespan of the units. Maintenance activities include filter replacements, cleaning of components, and repairs, which can be costly over time. Without proper upkeep, the efficiency of AHUs can diminish, leading to higher energy consumption and operational costs. As a result, these recurring expenses can discourage new installations and replacement of outdated units, slowing the growth of the AHU market, especially in regions with limited resources or economic challenges.

Market Opportunities

Rising Adoption of Smart Buildings to Create Lucrative Opportunities

The growing demand for smart building solutions is creating lucrative opportunities in the AHUs market. As buildings become increasingly interconnected and integrated with advanced technologies, there is a rising need for HVAC systems that can operate seamlessly within these smart infrastructures. Smart AHUs are equipped with IoT-enabled sensors, advanced control systems, and real-time monitoring capabilities, allowing them to be part of a larger building management system (BMS). These systems provide building managers with valuable insights into energy usage, system performance, and indoor air quality, enabling more efficient control of heating, ventilation, and air conditioning based on real-time conditions.

Furthermore, predictive maintenance capabilities in smart AHUs allow facility managers to monitor the condition of units continuously and identify potential issues before they lead to system failures. This helps in minimizing downtime and reducing long-term maintenance costs. With growing interest in energy efficiency and sustainability, especially in urban areas where energy costs are high, the adoption of smart AHUs offers a competitive advantage by ensuring that HVAC systems operate at peak efficiency.

This trend presents a significant growth opportunity for manufacturers to develop advanced AHUs that cater to the demand for smart buildings. This enables them to tap into new market segments and offer solutions that align with the future of connected energy-efficient infrastructure. As a result, the market for AHUs stands to benefit significantly from the shift toward smart, data-driven building management systems.

Market Trend

Growing Focus on Sustainability Has Become a Global Trend

The focus on energy efficiency and sustainability has become a major trend in the global AHUs market, driven by increasing regulatory pressures and growing awareness of environmental impact. As governments and industry bodies around the world introduce stricter regulations on energy efficiency and carbon emissions, the demand for AHUs that can help meet these standards is on the rise. Many countries now require buildings to adhere to energy efficiency certifications such as LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method), which prioritize the use of HVAC systems with reduced energy consumption. This shift has led manufacturers to innovate and design AHUs that can offer higher energy savings through advanced heat recovery systems, variable speed drives, and improved airflow management.

Sustainability is also a growing concern for both businesses and consumers, leading to an increased emphasis on reducing the carbon footprint of buildings. This has driven the market toward AHUs that consume less energy and designed with sustainable materials and have lower environmental impact over their lifespan. Additionally, fans and motors, coupled with better insulation, contribute to overall reductions in energy consumption. This focus on energy-efficient and sustainable AHUs aligns with the broader shift toward greener building practices, making such units more appealing to end-users who aim to reduce operational costs and meet their environmental goals.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Packages Segment Dominates Due to Increasing Demand from Commercial and Residential Buildings

By type, the market is classified into packaged, modular, custom, and rooftop mounted.

Packaged AHUs segment is expected to hold the highest air handling units market share, exhibiting the highest CAGR of 7.50% during the forecast period (2025-2032) in the global market, attributed to their compact design, cost-effectiveness, and ease of installation. These pre-configured units are ideal for small commercial spaces and residential buildings, making them popular in a wide range of applications.

Modular AHUs are expected to exhibit the highest CAGR over the forecast period. This growth is driven by their flexibility and scalability, making them suitable for a variety of applications, including large commercial buildings and hospitals. Their ability to be customized or expanded for future needs aligns well with the increasing focus on energy efficiency and retrofitting projects.

Custom AHUs are set to encounter 37.23% of the market share in 2026. They are designed for specialized projects requiring precise control over airflow and humidity, such as pharmaceutical manufacturing and industrial facilities. These AHUs hold the second highest market share as they are essential for complex air handling needs.

Rooftop mounted AHUs are popular in commercial spaces with limited indoor space, such as retail stores and shopping malls. Their ability to save space by being installed on building roofs makes them a preferred choice in certain applications, ensuring steady demand in the market.

To know how our report can help streamline your business, Speak to Analyst

By Business Type

New Equipment Dominates With Rise in Demand from Commercial and Industrial Sectors

By business type, the market is categorized into new equipment and aftermarket.

New equipment holds the highest market share and the highest CAGR in the global AHUs market. This is due to the continuous demand for new AHU installations driven by ongoing construction activities across residential and commercial sectors, particularly in rapidly urbanizing regions. Additionally, stringent energy efficiency regulations and the adoption of smart building solutions are encouraging the installation of modern, efficient AHUs in new buildings, further boosting demand for new equipment.

Though growing at a slower pace than new equipment, aftermarket services remain a crucial part of the market. The aftermarket includes maintenance, retrofitting, and component replacement, helping to ensure the optimal performance of existing AHUs. The segment is supported by building owners' efforts to extend the lifespan of their systems and enhance energy efficiency through regular servicing and upgrades.

By Capacity

Less than 5,000 M3/h Segment to Dominate owing to its Suitablility in Commercial Spaces

The market is categorized by capacity into less than 5,000 M3/h, 5,001 M3/h-15,000 M3/h, 15,001 M3/h-30,000 M3/h, and more than 30,000 M3/h.

The less than 5,000 M3/h segment will dominate the market and gain the highest CAGR of 7.96% during the forecast period (2025-2032) due to its compact size, making it ideal for residential and commercial spaces. An increase in the number of single-family homes across the U.S. and Canada is projected to surge the demand for these types of handlers.

The 5,001 M3/h-15,000 M3/h and 15,0001 M3/h-30,000 M3/h segments are anticipated to grow with moderate growth, owing to increasing demand for these products in hospitals, shopping complexes, laboratories, and data centers. Increasing awareness about the benefits of AHU units in commercial spaces is expected to drive the growth of the market. The 5,001 M3/h-15,000 M3/h segment is anticipated to hold the share of 34.98% in 2026.

The more than 30,000 M3/h segment is anticipated to witness decent growth, as these larger systems are being used for heating and cooling purposes. These types of systems are generally used in commercial and industrial spaces. They improve the air quality and circulate fresh air in the spaces, which is expected to fuel demand in this market segment.

By End-user

Commercial Segment to Dominate Owing to Increase in Construction-related Activities

Based on end-user, the market is segmented into residential, commercial, and industrial.

The commercial segment holds the highest market share and highest CAGR of 7.69% during the forecast period (2025-2032) in the global AHUs market. This is driven by the high demand for AHUs in commercial buildings such as office spaces, shopping malls, hospitals, and educational institutions, where maintaining optimal indoor air quality and energy efficiency is crucial. The adoption of smart building technologies and the need for advanced HVAC systems in new commercial constructions further support this segment's strong growth.

Industrial applications represent a significant portion of the AHU market that is 60.52% in 2026, as many manufacturing facilities, data centers, and specialized environments such as pharmaceuticals and clean rooms require precise climate control and ventilation. Although the growth rate is slower than the commercial segment, the industrial sector continues to provide steady demand for robust and custom-designed AHUs that can meet the rigorous needs of industrial processes.

While residential end users have a smaller market share compared to commercial and industrial segments, they still represent a vital part of the AHU market. Demand in this segment is driven by the growing awareness of indoor air quality and energy-efficient HVAC systems in homes and apartment complexes. As urbanization continues, the residential market sees consistent demand, particularly in regions with a focus on energy-efficient building standards.

By Effect

Double-Effect Segment Dominates the Market Due to Their Superior Energy Efficiency

Based on effect, the market is segmented into single-effect and double-effect AHUs.

Double-effect AHUs hold the highest market share and exhibit the highest CAGR of 6.76% during the forecast period (2025-2032) in the global AHU market. These units are preferred for their superior energy efficiency, as they utilize both primary and secondary heat exchange processes, which help significantly reduce energy consumption. Double-effect AHUs are especially popular in large commercial and industrial applications where efficient heating, cooling, and ventilation are critical, making them a key choice for projects with stringent energy efficiency requirements.

While having a smaller market share compared to double-effect units, single-effect AHUs remain relevant for applications with a share of 63% in 2026, where initial cost considerations are more important than advanced energy-saving capabilities. They are often used in smaller commercial spaces and residential applications, where configurations can provide adequate climate control. Though their growth rate is slower, they are still favored in projects where budget constraints play a crucial role.

AIR HANDLING UNITS MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Air Handling Units Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the highest market share with the valuation of USD 5.53 billion in 2024 and USD 5.93 billion in 2025 and the highest CAGR in the global AHUs market. This growth is driven by rapid urbanization, industrialization, and increasing construction activities in countries such as China, India, and Southeast Asian nations. Rising awareness of energy-efficient HVAC systems and supportive government regulations are also contributing to market growth. Additionally, the demand for AHUs in commercial spaces such as offices buildings, shopping malls, and educational institutions, has surged, solidifying the region's market leadership. India is estimated to reach a market value worth USD 0.42 billion in 2026, where as Japan is set to be valued at USD 1.25 billion in the same year.

China plays a crucial role in the global AHUs market, holding a significant share worth USD 2.63 billion in 2026 within the Asia Pacific region. The country’s rapid urbanization and industrial growth have created substantial demand for AHUs across commercial, industrial, and residential sectors. The Chinese government’s emphasis on green buildings and energy efficiency has led to increased adoption of advanced HVAC systems, including energy-efficient air handling units. Additionally, extensive construction activities, from new urban developments to large industrial facilities, continue to drive demand for both new installations and retrofitting projects. The presence of local manufacturers also contributes to competitive pricing and innovation, further bolstering the market's growth prospects in the country.

To know how our report can help streamline your business, Speak to Analyst

North America

North America represents a significant market share worth USD 4.15 billion in 2026 and the highest CAGR of 7.15% during the forecast period (2025-2032) for AHUs. This growth is driven by strong demand from both the commercial and industrial sectors. The focus on energy-efficient HVAC solutions and the presence of strict energy regulations have prompted the adoption of modern AHUs across new constructions and retrofitting projects. The region’s mature commercial sector, combined with a growing emphasis on smart buildings, has led to steady demand for advanced AHU solutions. Furthermore, the expansion of data centers and technological infrastructure supports the demand for robust air handling systems in the region.

The U.S. is a key market for air handling units within North America, driven by a strong emphasis on energy efficiency and indoor air quality. Demand for AHUs is particularly high in commercial sectors such as office buildings, hospitals, and educational institutions, where maintaining optimal climate control is critical. The U.S. market value stood at USD 2.78 billion in 2026.Additionally, the trend toward smart buildings and retrofitting older structures with modern HVAC systems supports the steady demand for advanced AHUs. The presence of stringent energy regulations and a well-established commercial sector further bolsters market growth in the country.

South America

South America shows a steady demand for air handling units, primarily in the commercial sector. Countries such as Brazil and Argentina are the main contributors to the market, driven by urbanization and the development of commercial spaces. The focus on improving energy efficiency in buildings and the increasing awareness of indoor air quality standards are driving investments in modern HVAC solutions. While economic fluctuations have impacted growth rates, the long-term potential remains positive as governments and industries emphasize energy-efficient infrastructure.

Europe

Europe is the fourth largest market for AHUs, representing a market value of USD 4.15 billion in 2026. This growth is supported by the region's commitment to sustainability and energy-efficient building standards. The European Union’s stringent regulations for energy use and emission control drive demand for advanced AHU systems that help achieve these goals. The U.K. market is expanding, projected to be worth USD 0.09 billion in 2025. The market witnesses strong demand from sectors such as healthcare, hospitality, and manufacturing, where maintaining high air quality standards is essential. Countries such as Germany, France, and the U.K. are leading in the adoption of advanced AHU systems, with both new constructions and retrofits increasingly seek efficient HVAC solutions. Germany is anticipated to reach a market value of USD 0.55 billion in 2026. While France is expected to be valued at USD 0.25 billion in the same year.

Middle East & Africa

The Middle East & Africa presents a growing market for air handling units with a market valuation of USD 0.80 billion in 2026, driven by increasing infrastructure projects and the need for climate control solutions in extreme temperatures. Demand for AHUs is particularly strong in the commercial and hospitality sectors, as the region continues to build hotels, resorts, and office complexes to support tourism and business activities. Despite economic challenges in some areas, countries such as the UAE and Saudi Arabia remain key markets, focusing on energy-efficient HVAC systems to support their sustainability goals. GCC is predicted to be valued at USD 0.46 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players are Focusing on Intensifying their Market Positions Through Innovation

The major players in the global air handling units (AHU) market are putting their focus on innovation, energy efficiency, and extensive product portfolios. These companies prioritize the development of advanced AHUs that meet stringent energy efficiency standards and environmental regulations, catering to the diverse needs of commercial, industrial, and residential sectors. They typically maintain a strong global presence with well-established distribution networks, enabling them to serve customers in multiple regions, including North America, Europe, and the fast-growing Asia Pacific market.

List of Companies Studied:

- Daikin Industries Ltd (Japan)

- Carrier (U.S.)

- Trane Technologies Plc (Ireland)

- Johnson Controls International Plc (Ireland)

- Systemair AB (Sweden)

- LG Electronics (South Korea)

- Lennox International Inc (U.S.)

- Munters AB (Sweden)

- Investment AB Latour (Publ) (Swegon Group AB) (Sweden)

- Trox GmbH (Germany)

- Blue Star Limited (India)

- Flakt Woods Group (Sweden)

- LG Electronics (South Korea)

- Hitachi, Ltd (Japan)

- Zehnder Group International AG (Switzerland)

- Voltas Limited (India)

- AMX ITALIA (Italy)

- Waves Aircon Pvt Ltd (India)

- Air Design (U.K.)

- AirEase (U.S.)

- VTS Group (Luxembourg)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Modine, a global player in the thermal management and ventilation market, acquired Scott Springfield Manufacturing, a leading manufacturer of air handling units in Canada.

- February 2022: Salda UAB launched a new Amber Air Compact S-CX air handler system for commercial and industrial applications. This system is easy to install, energy-efficient, and coated with good material.

- January 2022: Munters AB acquired EDPAC International based in Ireland, offering air handling units and HVAC systems. The acquisition aimed to improve the product portfolio of air handling units and HVAC systems and also increase geographical presence in the European market.

- December 2021: Daikin Industries Ltd. acquired distributors in Washington, such as Thermal Supply Inc. and AirReps LLC, which deals in HVAC Systems and air handling units. The acquisition was made to expand their business in the North American region.

- March 2021: Carrier Corporation launched a new high-wall ductless system which includes 38 MARB outdoor units and 40 MAHB indoor units. It is available in 36K, 24K, and 48 K sizes and is best suited for commercial and industrial applications.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The global air handling units (AHU) market presents a promising investment opportunity, driven by the increasing focus on energy efficiency, sustainability, and rapid urbanization, especially in emerging markets such as Asia Pacific. The market’s growth is supported by rising demand for advanced HVAC systems in commercial and industrial sectors, where maintaining indoor air quality and meeting energy standards are critical. For example, in North America and Europe, investments in energy-efficient retrofitting projects are creating steady demand for AHUs, as businesses aim to comply with stringent energy regulations.

The high growth potential in the Asia Pacific region, due to new construction projects and the adoption of green building standards, makes it an attractive market for investors. China, in particular, is a key focus, with government policies encouraging sustainable urban development. Moreover, the increasing adoption of smart building technologies, such as IoT-enabled AHUs, provides additional avenues for innovation-driven investment. As the demand for smart and modular AHUs continues to rise, companies with a strong focus on technological advancements and regional expansion are well-positioned to capitalize on this growing market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Business Type

By Capacity

By End User

By Effect

By Region

|

|

Key Market Players Profiled in the Report |

Daikin Industries Ltd (Japan), Carrier (U.S.), Trane Technologies Plc (Ireland), Johnson Controls International Plc (Ireland), Systemair AB (Sweden), LG Electronics (South Korea), Lennox International Inc (U.S.), Munters AB (Sweden), Investment AB Latour (Publ) (Swegon Group AB) (Sweden), Trox GmbH (Germany), etc. |

Frequently Asked Questions

The market is projected to reach USD 25.66 billion by 2034.

In 2025, the market was valued at USD 13.32 billion.

The market is projected to grow at a CAGR of 7.7% during the forecast period.

By type, the packaged segment is leading the market.

Rising urbanization and population across the globe is one of the important factors driving market growth.

Daikin Industries Ltd, Carrier, Trane Technologies Plc, Johnson Controls International Plc, Systemair AB, LG Electronics, Lennox International Inc, Munters AB, Investment AB Latour (Publ) (Swegon Group AB), and Trox GmbH are the top players in the market.

Asia Pacific holds the highest market with a share of 44.5% in 2025.

By end user, the commercial segment captures the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us