North America HVAC System Market Size, Share & Industry Analysis, By Application vs Capacity (Residential, Commercial, and Industrial), By Product Type (Heating Equipment, Cooling Equipment, and Ventilation Equipment), By Application (Commercial, Residential, and Industrial), and Country Forecast, 2025 – 2032

North America HVAC System Market Size

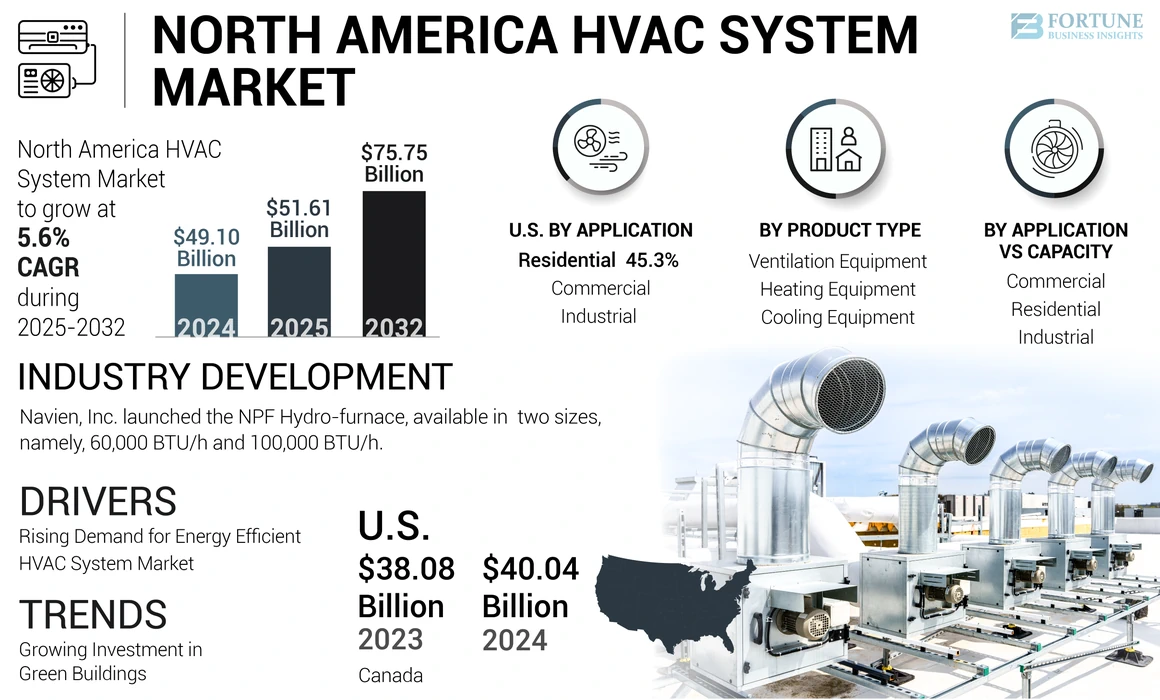

The North America HVAC system market size was valued at USD 49.10 billion in 2024. The market is projected to grow from USD 51.61 billion in 2025 to USD 75.75 billion by 2032, exhibiting a CAGR of 5.6% during the forecast period. The North America HVAC System Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 62.35 billion by 2032, driven by the extensive installation Of pipelines to improve energy infrastructure across regions.

The Heating, Ventilation, and Cooling (HVAC) system transfers air between indoor and outdoor spaces, filtering indoor air to maintain a healthy environment and ideal comfort level for humidity. In North America, the growth of the market is primarily driven by the need for systems that offer high operational performance and minimal energy consumption, resulting in the highest market share. Additionally, the production of HVAC is expected to increase in the forecast period due to the rising demand for automobiles. The American government’s strict filter standards also complement the market growth.

Heating and cooling technologies are being rapidly adopted across the region in response to changing climate conditions and growing population demands. Advancements in HVAC system are driving the demand for greater energy efficiency in heating and cooling. Market participants have made significant investments in research and technological advancements to address these demands.

During the COVID-19 pandemic, workforce adapted to new working conditions, including social distancing, which enhanced productivity. Moreover, recommendations from the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) to reduce COVID-19 transmission had increased the demand for the product across the U.S. and Canada. The future growth outlook is robust, as the pandemic has created opportunities to automate these system, which is expected to bolster the HVAC system market share in North America throughout the forecast period.

North America HVAC System Market Trends

Growing Investment in Green Buildings to Boost the Growth of HVAC Systems

The fast-track construction of green buildings is empowering the North America heating, ventilation, and cooling (HVAC) system market. This is owing to the stringent norms and standards imposed by the governmental bodies for raising awareness of occupants’ health, energy consumption, rising hazardous emissions, and others. As a result, these System became the decisive units in green building design.

Several government policies and investments in green building projects is likely to upsurge the demand for energy-efficient systems. For instance, the U.S. Department of Energy has invested about USD 6 billion for 33 projects to decarbonize energy-intensive industries.

Download Free sample to learn more about this report.

North America HVAC System Market Growth Factors

Rising Demand for Energy Efficient HVAC System Market to Propel During the Forecast Period

A growing number of building professionals are now emphasizing on reducing energy consumption by utilizing building automation systems, including include smart thermostats, Internet of Things (IoT) lighting controls, and sensors. The rising adoption of energy-efficient heating ventilation and cooling systems across residential, commercial, and industrial sector is supporting overall market growth by offering efficient operations at marginal expense. Manufacturers are expanding their product portfolio to provide efficient HVAC experience to end-users thus, propelling the North America HVAC system market growth.

Energy-efficient HVAC equipment is preferred by end users owing to changing industry standards and regulations. Thereby, several OEMs are supplying HVAC with increased energy savings, compact design, and low GWP refrigerant compatible products along with quieter operations. For instance, in August 2023, Carrier a leading manufacturer introduced packaged rooftop ventilation units (WeatherExpert) optimized for outdoor air application. This highly efficient rooftop unit features electronically commutated (ECM) motors for enhanced performance.

RESTRAINING FACTORS

Demand for Skilled Workforce and Increased Maintenance Costs to Limit Market Growth

The ever-growing HVAC system industry has generated the prerequisite of automation processes for all types of products and services. It has, therefore, raised the demand for advanced HVAC systems’ manufacturing and installation across residential, commercial, and industrial applications. Several end-users procure local units or components as a replacement that hampers the working environment across the spaces in terms of reduced pressure drop. In addition to the maintenance and repair cost concerns, the industry as a whole is facing a concern regarding the unavailability of skilled technicians. The current workforce is on the verge of retiring within the next 10 years further raising the workforce shortages concern.

North America HVAC System Market Segmentation Analysis

By Product Type Analysis

Heating Equipment to Account for Highest Revenue Market Share Owing to Investment in Climate Controlled Solutions

By product type, the market is further classified into heating equipment, cooling equipment, and ventilation.

Heating Equipment includes heat pumps, furnaces, boilers, and unitary heaters. Products considered under cooling equipment include unitary air conditioners, Variable Refrigerant Flow (VRF) Systems, chillers, room air conditioner, cooler and cooling towers. Ventilation Equipment is further segmented into air-handling units, air filters, air purifiers, ventilation fans, and others. Others segment include humidifiers, and dehumidifiers.

Heating equipment leads the market as North American region is primarily driven by heating solutions as demand for climate controlled solutions increases due to varying climatic conditions. Growing concerns about energy efficient and sustainable adoption of heating technologies is further gaining market traction in North American market. Urbanization and investment in real estate sector to further boost the market demand for heating equipment such as heat pumps and boilers across diverse geographic regions. Population growth and rapid industrialization in countries such as Mexico and Canada are all projected to surge the market demand for heating solutions.

Ventilation equipment to witness strong growth during the forecast period as a result of rising demand across industries including commercial, and residential.

By Application vs Capacity Analysis

Commercial Sector To Grow with Highest CAGR with Increasing Number of Investments

By Application vs Capacity, the market is classified into residential, commercial, and industrial. Residential is further segmented in up to 2 and 5 Tons. The commercial segment has further been classified in up to 10 tons, 10 to 25 tons, and above 25 tons. The industrial segment has further been diversified into 25 to 50 tons, 50 to 120 tons, and above 120 tons.

Under commercial segment, 10 to 25 tons capacity systems are witnessing a strong growth during the forecast period. Increasing investment in commercial facilities such as supermarkets and entertainment spaces are propelling the market demand for 10 to 25 tons systems. The Commercial segment to witness highest CAGR during the forecast period owing to rising investment in public infrastructure and entertainment spaces.

Home heating solutions are primarily driven by increasing demand for sustainable heating solutions. Demographic shifts and increasing demand for comfortable indoor climatic conditions to further boost the market demand in residential sector.

Industrial segment to witness moderate growth during the forecast period as a result of strong demand for manufacturing facilities, warehouses, and industrial complexes ensuring operational efficiency across diverse industrial sectors.

By Application Analysis

Residential Application to Capture Highest Market Share Due to Rising Awareness About Indoor Air Quality

Based on application, the market is segmented into residential, commercial, and industrial.

Residential segment is poised to lead the market followed by commercial and industrial. These systems are largely required to maintain comfortable temperatures and ventilation throughout homes. Their integration in residential buildings contributes significantly to overall living comfort and health by creating a controlled environment that adapts to varying weather conditions and user preferences. Improved awareness about indoor air quality (IAQ) has further generated strong demand for HVAC System across the residential segment.

The commercial segment is expected to experience the highest growth throughout the forecast period. This growth is primarily attributed to a significant increase in the construction of schools, hospitals, telecom centers, laboratories, and other new commercial facilities, which is driving the market expansion

REGIONAL INSIGHTS

The North America market is anticipated to showcase strong growth over the forecast period owing to the rising trend of green building initiatives, rising residential and commercial (renovated buildings, and new construction buildings) construction and industrial facilities, government incentives, and growing demand for energy-efficient solutions. Furthermore, the adoption of the Internet of Things (IoT) is driving manufacturers to invest in advanced air conditioning, ventilation systems, and smart heating offerings, further propelling HVAC System market growth across the U.S. and Canada.

The U.S. has the biggest part in the North America HVAC system market share which is growing at a steady growth rate. The increasing construction activity, extreme climatic conditions, and availability of high-efficiency systems favor the installation of HVAC systems across the country. Furthermore, the availability of large manufacturers, such as Emerson Electric Co., Carriers, and others, is complimenting the North America market demand.

To know how our report can help streamline your business, Speak to Analyst

The mounting construction spending across Canada is spurring the demand for the product across several applications. Building owners are prioritizing upgrades for air conditioning, ventilation, and other systems across the facilities to support the lowering energy-consumption trend. Additionally, government energy-efficiency incentives are expected to benefit this market.

KEY INDUSTRY PLAYERS

Investment in New Product Launches and Emphasis on Technology Advancement to Upsurge the Presence of Market Players

Major players, including Carrier, Johnson Controls International plc, Trane, DAIKIN INDUSTRIES, Ltd., and LG Electronics, are aggressively investing in technological developments to increase their profitability in air conditioners, refrigeration, and other products, thereby expanding their market reach in North America. Additionally, these market participants are offering training programs to boost the HVAC technician count across the region. DAIKIN INDUSTRIES, Ltd. focuses on increasing product expansion across countries and high profitability by strengthening the core businesses. As a result, the company is introducing new products, upgrading existing equipment, and utilizing refrigerants that align with updated emission standards.

List of Top North America HVAC System Companies:

- AAON Inc. (U.S.)

- Carrier Corporation (U.S.)

- Midea Group Co. Ltd.

- Lennox International Inc. (U.S.)

- SAMSUNG (South Korea)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Trane (Ireland)

- Johnson Controls (Ireland)

- LG Electronics (South Korea)

- Mitsubishi Electric Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Navien, Inc. introduced the NPF Hydro-furnace, available in two sizes: 60,000 BTU/h and 100,000 BTU/h. The company also announced a NHW-A tankless water heater, a non-condensing model featuring the ComfortFlow recirculation pump and buffer tank.

- February 2023: Johnson Controls-Hitachi Air Conditioning presented its latest addition to the VRF lineup, known as the air365 Max. This cutting-edge product was meticulously crafted to provide uninterrupted comfort, exceptional energy efficiency, and user-friendly functionality. The air365 Max represents a comprehensive solution tailored for HVAC professionals, architects, and building owners.

- January 2023: Daikin Comfort Technologies North America completed the acquisition of Williams Distributing, a prominent distributor specializing in HVAC equipment and residential building products in the Great Lakes region. This strategic move aligns with Daikin's overarching vision to foster the widespread adoption of inverter heat pump technology, particularly in colder climates.

- August 2022: Airzone, a global leader in dynamic HVAC control solutions, entered the North American market with a cutting-edge smart control solution designed specifically for HVAC inverter systems.

- July 2022 – Carrier, a leading air conditioned & heating ventilation and air conditioning system designer and manufacturer company, launched its high-performance multizone heat pump outdoor ductless system, which is (38MG(R/H)B). This product replaced the old 38MGR series to provide a better solution in VRF technology for its customers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, By Application vs Capacity, Application, and Country |

|

Segmentation |

By Product Type

By Application vs Capacity

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 75.75 Billion by 2032.

In 2024, the market was valued at USD 49.10 Billion.

The market is projected to grow at a CAGR of 5.6% during the forecast period.

By product type, heating equipment to cater highest revenue market share.

High demand for energy efficient systems is a key factor supporting market growth.

Carrier, DAIKIN INDUSTRIES, Ltd., Johnson Controls, LG Electronics, and Emerson Electric co. are the top companies in the market.

The commercial segment is likely to register highest growth during the forecast period.

Fast-track construction and increasing investment of green buildings are the key industry trends.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us