Autotransfusion Devices Market Size, Share & Industry Analysis, By Product Type (Autotransfusion Systems {Intraoperative, Post-operative, and Dual-Mode} and Consumables & Accessories), By Application (Cardiovascular Surgeries, Orthopedic Surgeries, Neurological Surgeries, Obstetrics & Gynecological Surgeries, and Others), By End User (Hospitals and Specialty Clinics & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

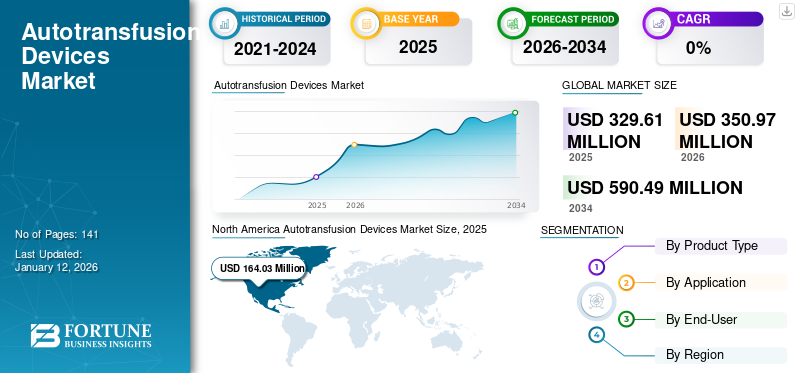

The global autotransfusion devices market size was valued at USD 329.61 million in 2025. The market is projected to grow from USD 350.97 million in 2026 to USD 590.49 million by 2034, exhibiting a CAGR of 6.72% during the forecast period. North America dominated the autotransfusion devices market with a market share of 49.76% in 2025.

Autotransfusion is an innovative medical procedure that enables patients to utilize their own blood during surgical procedures instead of depending on donated blood. This advanced technology is also known as cell saver that provides a safe and effective alternative to traditional blood transfusions. This technology is beneficial for patients at high risk of complications from transfused blood, such as those with blood disorders or autoimmune conditions.

Furthermore, it removes the necessity for cross-matching, lowering the chances of transfusion reactions and decreasing the risk of infection. Autotransfusion devices are utilized in cardiovascular, orthopedic, neurological, obstetrics & gynecological, and various other invasive operations. These devices can be classified based on system usability into intraoperative systems, post-operative systems, and dual-mode systems.

The rising number of surgical procedures among the population for various chronic conditions, including cardiac disorders, neurological disorders, and others, is resulting in an increasing demand for autotransfusion devices. Furthermore, the growing number of organ transplantation, number of organ donations in developed and emerging countries is another prominent factor supporting the adoption of these systems in healthcare settings.

Furthermore, growing geriatric population, susceptible for developing chronic diseases, increases the demand for advanced blood management systems while performing major surgeries are some of the additional factors expected to boost the global market growth throughout the forecast period.

The market is highly consolidated, with the presence of key players such as LivaNova Plc., Haemonetics Corporation, and Fresenius SE & Co. KGaA, among others. The growing focus of market players on receiving regulatory approvals for the launch of new products in the global market.

Global Autotransfusion Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 329.61 million

- 2026 Market Size: USD 350.97 million

- 2034 Forecast Market Size: USD 590.49 million

- CAGR: 6.72% from 2026–2034

Market Share:

- North America dominated the autotransfusion devices market with a 49.76% share in 2025, driven by the increasing number of major cardiovascular and orthopedic surgeries, advanced healthcare infrastructure, and established guidelines promoting intraoperative and post-operative autotransfusion practices.

- By product type, the Consumables & Accessories segment is expected to retain its largest market share, owing to the rising volume of surgical procedures and the frequent replacement needs of consumable items.

Key Country Highlights:

- United States: The growing number of surgeries and organ transplantations is driving the adoption of autotransfusion devices across hospitals and healthcare facilities.

- Europe: Increasing surgical procedures and growing awareness regarding the benefits of autotransfusion systems among healthcare providers support market growth in the region.

- China: The expansion of healthcare infrastructure and the rising number of hospitals and community health centers are fostering the demand for autotransfusion technologies.

- Japan: The focus on advanced blood management practices and rising healthcare innovations is expected to enhance the adoption of autotransfusion systems.

MARKET DYNAMICS

Market Drivers

Increasing Number of Surgical Procedures to Boost Market Growth

Intraoperative and post-operative cell salvage along with blood transfusions are key components of blood conservation in any surgical procedure. Furthermore, the focus on preventing complications linked to allogeneic transfusions, along with a rise in high-bleeding surgeries, is expected to propel the expansion of the global market throughout the forecast period.

- According to the 2023 report of the American Joint Replacement Registry (AJRR), there were around 3.2 million primary and revision hip and knee arthroplasty procedures in the U.S.

Furthermore, rising awareness about cell salvage performed during and after surgery is an additional factor expected to drive autotransfusion devices market growth throughout the forecast period.

Market Restraints

Rising Demand for Minimally Invasive Surgeries to Limit the Use of Autotransfusion Devices

The rising patient preference for minimally invasive surgeries due to shorter hospital stays, lower costs, quicker recovery, and, and superior patient comfort, are some of the factors expected to increase the adoption of minimally invasive surgeries during the forecast period. The growing adoption of minimally invasive surgeries is anticipated to eventually lessen the necessity for blood conservation or allogeneic transfer, as there is a minimal blood loss associated with these procedures.

- For instance, according to a report published by the NCBI in 2021, the use of minimally invasive surgery for cystectomy increased by around 2.3% from 2016 to 2018.

Furthermore, the growing focus of the market players on developing and introducing hemostatic devices with novel technology is expected to limit the adoption of these systems in the market.

Market Opportunities

Huge Gap in Blood Demand and Supply to Offer Lucrative Growth Opportunity for the Market

There is a growing demand for blood and its components among the population for various surgical procedures among the population in both developed and emerging countries globally.

However, certain factors, including lower blood donation, limited healthcare infrastructure, and insufficient blood inventories, are anticipated to present a huge opportunity for market players to raise awareness regarding the benefits of these systems and lead to higher adoption among healthcare providers.

- According to a study conducted by the Ministry of Health, China, in 2018, the blood supply in China has grown by an estimated 7.0% during the past decade. However, there is still a shortfall in blood supply due to the 18.0% growth in the number of surgical procedures in the region.

Market Challenges

High Cost of Autotransfusion Systems May Create Challenges for Industry Growth

The increasing technological advancements in autotransfusion devices by market players are leading to high costs of product development, operational costs, and other costs associated with these devices. The high cost of these devices can be a challenging factor for the adoption of these devices in healthcare settings in emerging countries with low financial resources.

Risk of Complications and Infections May Affect Product Adoption

The increased risk of infection and complications with the use of autotransfusion systems in patients with contaminated laparotomy fields is one of the prominent barriers to the adoption of these systems in all types of surgeries and patients.

AUTOTRANSFUSION DEVICES MARKET TRENDS

Technological Advancements

The growing demand for alternative procedures for allogenic blood transfusions for various surgical procedures among the patient population is resulting in a rising focus of companies and research institutes to develop and introduce novel products with technological advancements in the market.

- In September 2022, Atlanpole Biotherapies received CE approval for its i-SEP autotransfusion medical device. The device can recover both red blood cells and platelets during bleeding surgical procedures.

Integration with Advanced Monitoring Systems

The rising adoption of autotransfusion systems among healthcare settings globally is resulting in the growing focus of prominent companies to develop and introduce novel platforms to support the adoption of the systems.

- In March 2023, Haemonetics Corporation received the U.S. Food and Drug Administration (FDA) approval for the next-generation software for the Cell Saver Elite+ Autotransfusion System. This software upgrade, named Intelligent Control, provides customers key enhancements for helping the simplification of operations, offering an improved user experience, and supporting enhanced efficiency.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The global autotransfusion devices market witnessed a negative impact during the COVID-19 pandemic. The significant decline in the number of surgical procedures, transplantations during the pandemic owing to lockdown restriction, and less focus toward non-emergency cases globally was few of the major factors for the impact.

- According to an article published by the University of Alabama, Birmingham, in 2021, it was reported that in 2020 there was a sharp decline of approximately 36.0% in CABG surgeries in the U.S. compared to 2019.

Several players operating in the market also witnessed a decline in their revenues in 2020 due to lesser demand for these devices in the market. LivaNova PLC generated a revenue of USD 446.7 million from its cardiopulmonary business segment in 2020, registering a decline of nearly 11.5% compared to 2019 owing to the decreased sales of these systems.

However, there was an overall increase in the number of surgeries, transplantations procedures, among others in 2021, leading to a rise in the demand for these devices in healthcare settings. Thus, the growing number of surgeries along with rising focus toward product innovations by the companies are anticipated to boost the growth of the market.

SEGMENTATION ANALYSIS

By Product Type

Consumables & Accessories Segment Dominated Due to Mounting Number of Surgical Procedures

Based on product type, the market is divided into autotransfusion systems and consumables & accessories. The autotransfusion systems are further categorized into intraoperative autotransfusion systems, post-operative autotransfusion systems, and dual-mode autotransfusion systems.

The consumables & accessories segment dominated the market in 2026 with a share of 58.10%. The rising number of surgical procedures among the population, including cardiovascular, neurological, among others, along with the growing adoption of these devices, are some of the primary factors supporting the segment growth.

The autotransfusion systems segment is projected to grow at a steady rate during the forecast period. The growing awareness regarding the benefits of autologous blood transfusion during surgical procedures among the patient population is leading to the increasing adoption of autotransfusion systems. Certain advantages of these systems, such as increased efficiency, reduced risk of infections, among others, is expected to boost segment growth during the forecast period.

Furthermore, increasing technological advancements in these devices for better clinical outcomes and connectivity is an additional factor expected to drive segmental growth throughout the forecast period.

By Application

Rising Number of Cardiovascular Surgeries Led the Dominance of the Segment

Based on application, the market is categorized into cardiovascular surgeries, orthopedic surgeries, neurological surgeries, obstetrics & gynecological surgeries, and others.

The cardiovascular surgeries segment dominated the global market with a share of 60.11% in 2024, mainly due to the higher utilization of these devices during cardiovascular surgeries. Further, the rising number of cardiovascular procedures, such as Coronary Artery Bypass Grafting (CABG), heart transplantations, implantable cardioverter-defibrillator (ICD) & pacemaker implantations, and valve replacement surgeries, are some of the factors projected to drive segmental growth throughout the forecast period.

- According to 2021 data published by the Annals of Thoracic Surgery (ATS), the number of isolated coronary artery bypass graft (CABG) surgery was around 191,472 in 2020 which increased to 211,533 in 2021, witnessing a growth of around 10.5% compared to the previous year.

The orthopedic surgeries segment held second highest market share in 2024 and is expected to grow at a normal rate throughout the forecast period. High burden of bone related disorders and increasing number of orthopedic surgeries are some of the factors driving segmental growth over 2025-2032.

The neurological surgeries segment is anticipated to grow at a slower pace throughout the forecast period. The rising prevalence of brain related disorders across the globe, along with increasing diagnosis for the conditions are some of the factors supporting the growth of the segment.

The obstetrics & gynecological surgeries segment is expected to grow at a nominal rate during the forecast period. The increasing number of caesarian sections, is anticipated to drive the segmental growth throughout the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End User

Increasing Number of Surgical Procedures Carried Out in Hospital Settings to Drive Growth of the Segment

On the basis of end user, the market is segmented into hospitals and specialty clinics & others.

The hospitals segment dominated the market in 2026 with a share of 89.67%, and is projected to grow at a higher rate during the forecast period. The increasing number of cardiovascular and obstetrics & gynecological surgeries carried out in hospitals is projected to drive the segment growth during the forecast period. In addition, the growing number of hospitals in developed and emerging countries is another major factor anticipated to boost the growth of the segment.

The specialty clinics & others segment is projected to grow during at a steady rate during the forecast period. The rising adoption of intraoperative and post-operative cell salvage technique in specialty clinics, particularly in developed countries, is projected to drive segmental growth from 2025-2032.

AUTOTRANSFUSION DEVICES MARKET REGIONAL OUTLOOK

Based on geography, the market has been studied across North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Autotransfusion Devices Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 164.03 million in 2025 and USD 174.85 million in 2026.

The region is anticipated to grow during the forecast period, owing to the growing use of blood transfusion devices during major cardiovascular and orthopedic surgeries. The presence of advanced healthcare infrastructure in this region, is anticipated to drive the market growth throughout the forecast period. For example, the guidelines from the American Association of Blood Banks recommends that post-operative and intraoperative autotransfusion should be implemented in surgeries where 20% of bleeding out of the total surgical bleeding is expected.

The U.S. market is projected to grow during the forecast period. The rising number of surgeries, transplantations, among the population in the country is one of the major factors leading to the rising demand for autotransfusion devices in the U.S. The U.S. market is projected to reach USD 160.63 million by 2026.

- According to the 2023 statistics published by the U.S. Health Resources and Services Administration (HRSA), 46,632 organ transplants were performed in 2023, representing an increase of nearly 8.7% compared to 2022.

Europe

Europe depicts a rapid increase in the number of surgeries in key countries such as the U.K., France, and Germany. The growing awareness regarding the benefits of these devices among healthcare settings and providers is expected to offer substantial opportunity for the market growth in the region. The UK market is projected to reach USD 21.7 million by 2026, while the Germany market is projected to reach USD 32.61 million by 2026.

Asia Pacific

The Asia Pacific market is expected to grow at a significant CAGR during the forecast period. The regional market growth is attributed to the growing awareness of cell salvage technologies and increasing number of surgical procedures. The Japan market is projected to reach USD 12.24 million by 2026, the China market is projected to reach USD 11.75 million by 2026, and the India market is projected to reach USD 3.8 million by 2026.

- According to 2021 statistics published by the National Health Commission of the People’s Republic of China, there were 12,649 primary hospitals in China, along with more than 36,100 community health centers in urban areas.

Rest of the World

The market in rest of the world is projected to grow steadily during the forecast period. The increasing number of surgical procedures performed in countries such as Brazil, Saudi Arabia, and the UAE is projected to boost the demand for autotransfusion devices, especially in small and mid-sized healthcare facilities.

COMPETITIVE LANDSCAPE

Key Industry Players

LivaNova Plc and Haemonetics Corporation to Dominate with Strong Product Offerings

Market players such as LivaNova Plc., Haemonetics Corporation, and Fresenius SE & Co. KGaA are among the major players, accounting for a significant autotransfusion devices market share in 2024. The significant presence of these companies in the market is attributed to their focus on the expansion of product offerings in the global market. LivaNova Plc has a strong brand presence, robust distribution channels, and a strong product portfolio.

Furthermore, market players are increasingly focusing on strategic initiatives such as acquisitions and partnerships to expand their footprint in the global market.

- For instance, in November 2021, Fresenius SE & Co. KGaA collaborated with Omnicell, Inc., to provide innovative medical devices to U.S. hospitals and health systems.

Moreover, other players, such as Medtronic, Beijing Jingjing Medical Equipment Co., Ltd., ProCell Surgical Inc., and BD, among others, have been focusing on the launch of new autotransfusion devices and other market expansion strategies to enhance their presence across the globe.

List of Key Companies Profiled

- LivaNova PLC (U.K.)

- Medtronic (Ireland)

- Haemonetics Corporation (U.S.)

- Fresenius SE & Co. KGaA (Germany)

- BD (Becton, Dickinson, and Company) (U.S.)

- Beijing Jingjing Medical Equipment Co., Ltd. (China)

- ProCell Surgical Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- February 2024: ProCell Surgical Inc. was successfully registered and certified to be compliant with the requirements of ISO 13485:2016 under the MDSAP scope. Additionally, ProCell received CE-marked approval for its Sponge Blood Recovery Unit, which was found to conform with Regulation (EU) 2017/745 for Medical Devices.

- January 2024 – Medtronic participated in the Arab Health conference and showcased its blood management and diagnostic products, including autotransfusion systems.

- March 2023: Haemonetics Corporation received 510(k) clearance from the U.S. Food and Drug Administration (FDA) on next-generation software for the Cell Saver Elite+ Autotransfusion System.

- June 2020: ProCell Surgical Inc., announced the launch of ProCell, its first medical device designed to effectively automate the manual and outdated activity of surgical sponge-blood recovery for intraoperative autotransfusion.

- December 2019: Haemonetics Corporation launched the Next Generation SafeTrace Tx Transfusion Management Software in North America. The newly released software provides an enhanced user experience and superior operational workflow, thereby enabling extended care quality.

REPORT COVERAGE

The global autotransfusion devices market report provides a detailed competitive landscape and market insights. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, the report covers regional analysis of different market segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market growth.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.72% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 350.97 million in 2026 and is projected to reach USD 590.49 million by 2034.

In 2025, the market size stood at USD 164.03 million.

The market will exhibit steady growth at a CAGR of 6.72% during the forecast period.

By application, the cardiovascular surgeries segment is set to lead the market.

The increasing number of surgical procedures and the rising awareness of intraoperative & post-operative cell salvage are the key factors driving the market.

LivaNova Plc, Haemonetics Corporation, and Fresenius SE & Co. KGaA are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us