Biomethane Market Size, Share & Industry Analysis, By Feedstock (Organic Residue & Wastes (Biowaste, Municipal Waste, Sewage Waste, Agriculture Waste, and Others) and Energy Crops), By Production Method (Anaerobic Digestion and Gasification), By Application (Automotive, Power Generation, and Others), and Regional Forecast, 2026-2034

Biomethane Market Size

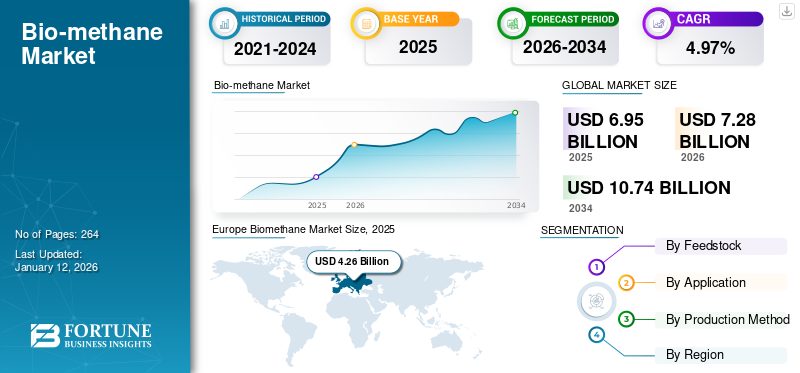

The global biomethane market size was valued at USD 6.95 billion in 2025 and is projected to grow from USD 7.28 billion in 2025 to USD 10.74 billion by 2034, exhibiting a CAGR of 4.97% during the forecast period. Europe dominated the global market with a share of 61.34% in 2025. The Biomethane market in the U.S. is projected to grow significantly, reaching an estimated value of USD 8.05 billion by 2032.

Biomethane is a compressed form of biogas, also known as Renewable Natural Gas (RNG), and is a source of energy. It is produced from degrading organic substances such as agricultural waste, sewage sludge, domestic waste, and animal flesh. Furthermore, it is produced by anaerobic digestion and gasification methods. Since the raw material of RNG is organic, this gas is environment-friendly and has a diverse application range such as home cooking, heating, and power generation. It is also used as an alternative fuel in the automotive industry. It is ideal and environment-friendly as it reduces carbon dioxide emissions from the environment compared to other fuel options.

The outbreak of the infectious disease known as the coronavirus disease, triggered by the newly discovered coronavirus, caused chaos and panic globally, causing the termination of all normal daily activities like going to work, gatherings, meetings, and commuting between countries, even stepping a foot outside the house. The biogas industry depends on forestry harvesting and residues. The sector faces a significant challenge due to the pandemic as regional or national movement restrictions have been forced in substantial countries. However, electricity and heat from biogas and bio-methane have continued to be generated.

One of the significant challenges that could affect the growth of the biogas market is the capital investment required to set up a production unit. Establishing the transmission and distribution lines for biogas also requires a considerable investment. The market is expected to face challenges due to the pandemic; however, the challenges are expected to be short-lived.

Biomethane Market Trends

Increasing Applications of Biomethane to Open New Doors in the Market

Anaerobic plants are switching from biogas to biomethane for power generation. Furthermore, various uses of this gas for different purposes create new opportunities. High exposure to air pollution released from petroleum fuel is dangerous for both the environment and humans. Europe has a huge opportunity as it is a key producer of renewable natural gas and other biofuels. The European Renewable Gas Registry is continuously working to implement a European administration system that will permit cross-border biogas trade.

Technological Advancements in Anaerobic Digestion Technology to Drive the Market Growth

Enhanced reactor configurations and process optimization are increasing biogas yields and improving feedstock handling capabilities. Developing microbial cultures with higher digestibility and methane production efficiency optimizes biogas output and resource utilization. Continuous AD systems improve operational efficiency and stability, leading to higher production volumes and cost reduction. Advanced membrane technologies offer efficient and cost-effective methods for purifying biomethane to pipeline-quality standards, facilitating grid injection and wider applications.

PSA systems provide another route for upgrading biogas, offering flexibility and potential for modular configurations. This technology directly converts CO2 from biogas into methane, further increasing biomethane yield and purity. Advancements in techniques such as mechanical, thermal, and enzymatic pretreatment help break down complex feedstocks, enhancing their digestibility and biogas yield. Overall, advancements in technology are acting as key drivers for the biomethane market growth by improving efficiency, reducing costs, and expanding its reach and applications.

Download Free sample to learn more about this report.

Biomethane Market Growth Factors

Conversion of Waste into Renewable Energy and Rising Environmental Concerns to Propel the Market Growth

Rising demand for such gas due to rising environmental concerns is one of the key factors driving revenue growth in the global market. Additionally, the rising adoption of this gas for different purposes, such as power generation, heating, and use as an alternative fuel in the automotive industry, further boosts the market.

Moreover, this facility converts waste into energy and produces revenue. The eco-friendly nature of this gas further propels the market as it reduces greenhouse gas emissions and surges energy demand, further boosting the market.

Growing Demand for the Product in the Automotive Industry to Propel Market Growth

The demand for this gas is rapidly increasing worldwide owing to its emission-free nature and the growing generation of raw materials such as industrial waste, food waste, agricultural waste, and others. The upgraded biogas can be effectively used in transportation fuel and power generation.

A German Energy Agency named Deutsche Energie Agentur (DENA) stated that in 2020, filling station sales surpassed 1 TWh, which was around 733 GWh in 2019. Many CNG filling stations are switching to this gas, indicating the upcoming rise in this market.

As per the European Biogas Association (EBA), only 3.9 TWh of this gas is used to fuel natural gas in Europe. It is planned to increase the availability of renewable natural gas by 117TWh for vehicles by 2030, which will comprise around 13.2 million vehicles by 2030.

RESTRAINING FACTORS

Enormous Financial Investments for Installing Facility and Highly Combustible Nature of the Gas to Hinder Market Growth

The major restricting factor for renewable natural gas production is the required capital. The industry must establish a production unit, waste acquisition, gas transmission, and distribution lines. Furthermore, many projects need to be carried out with government support, but the government also provides a certain amount of funding. Other factors that can hamper the market's growth are the low efficiency of the systems used in biogas production and the presence of impurities in the final product.

Biomethane Market Segmentation Analysis

By Feedstock Analysis

Organic Residue & Waste Segment Dominated due to Availability of a Diverse Range of Feedstock

Based on feedstock, the market is segmented into organic residue & wastes and energy crops.

Organic residue & waste is divided into biowaste, municipal waste, sewage waste, agriculture waste, and others. The organic residue & wastes segment holds the largest market share of 73% in 2026 due to easy availability of this raw material globally. According to the sub-split of organic residue & wastes, agriculture waste and biowaste are the prime raw materials commonly available everywhere.

For instance, China generates an agricultural waste output of about 4.8 billion tons. India generates about 350 million tons, France generates about 60 million tons, Canada generates about 81 million tons, and the Brazilian agro-industrial chain generates about 291 million tons/year.

The energy crops segment is anticipated to grow with a significant market share. Energy crops have wide varieties, such as rice straw, maize, cassava tubers, corn waste, and potato. Crop residue management and curbing stubble burning is of global interest.

By Production Method Analysis

Anaerobic Digestion Segment to Dominate the Market Owing to its Cost-effectiveness

The anaerobic digestion segment is majorly dominating the market with 80.11% shares in 2026. Recently, anaerobic digestion units have been developed worldwide, especially in the United States, Europe, and China. The U.S. presents the highest total biogas production but originates from landfill at 75%. This country's 1,497 anaerobic plants treat sewage sludge, bio waste, and agricultural and industrial wastes. On the other hand, biogas production in Germany is mainly based on farming and industrial wastes.

The anaerobic digestion method is easy to apply and cost-effective, and a normal person can use this production method at a small scale to produce such nature friendly methane. Owing to this, the anaerobic digestion segment is significantly growing worldwide.

The gasification segment will likely grow with 7.40% of the market share. The gasification method is immature compared to the anaerobic digestion method, which needs high capital cost and low volume production. Additionally, maintain several parameters during production, such as temperature and pressure.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Power Generation Segment to have Highest Rate Due to High Energy Demand and Consumption of Electricity

In terms of application, the global market is segmented into automotive, power generation, and others.

The power generation segment holds the largest market share of 51.06% in 2026 owing to increased requirement for electric grid networks at residential locations for several uses such as water heating and cooking. Also, there has been a rise in the number of building construction projects in the residential sector, owing to snowballing urbanization, which has been the catalyst for the segment growth.

Furthermore, many anaerobic digesters are switching from power generation from biogas to upgraded biogas units for better efficiency. The rising demand for electricity consumption owing to the rising population further boosts the electricity generation segment.

The automotive segment is anticipated to grow owing to the rising demand for renewable natural gas for vehicle fuel. RNG is eco-friendly and reduces carbon dioxide emissions from the environment. Additionally, RNG is compatible with vehicle engines, further propelling this segment.

REGIONAL INSIGHTS

Geographically, the global market has been analyzed across five main regions, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe Biomethane Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe significantly dominates the biomethane market share in the global market. Growing environmental awareness, advancement of technologies, and steadily increasing demand for Renewable Natural Gas (RNG) for electricity generation applications are some of the region's market expansion factors.

Furthermore, Europe has noticeable RNG plants and many ongoing projects related to RNG. Germany, the U.K., the Netherlands, Denmark, Sweden, and France are major contributing countries. During the forthcoming years, the European biomethane market growth is anticipated due to rising investments in biogas upgrading technologies and rising support from regional governments. The presence of key manufacturers in the European market is generating income streams owing to supportive policies by governments for the production of such methane.

North America is likely to grow significantly throughout the forecast period. The demand for heating and electricity is increasing in the region. The region regularly faces winter for a long time in a year, increasing the demand for heating water and electricity generation. The U.S. holds a leading share in this region in this market.

Furthermore, the construction of new RNG plants in the U.S. continues to transform the world's electricity needs and inspire the industry to swell with possible GHG reduction and coal alternatives.

Asia Pacific region is the most profitable market for renewable natural gas. This region's huge agricultural waste ratio further drives market growth. The growing demand for renewable natural gas and import activities will boost the market. The key countries of these regions are China, India, Malaysia, Singapore, and Japan.

Latin America is anticipated to grow due to the rising demand for electricity generation and heating for residential and industrial applications, propelling the market in this region. Furthermore, government financial support for constructing new biogas and RNG plants further lifts the market in this region.

The Middle East & Africa shows significant growth in this market as rapid adoption of RNG production facilities and constructing new plants further boost the market in this region.

Key Industry Players

Key Market Players Concentrating on Enhancing Product Portfolio

The market's competitive landscape portrays a fragmented market with producers and service providers, such as EnviTec Biogas AG, ETW Energietechnik GmbH, and Future Biogas Limited, occupying a considerable share in the global market. These companies have been successful in acquiring new and long-term contracts from different countries in every region over the years. The market also includes other players such as WELTEC BIOPOWER GMBH, AB Holding SpA, RENERGON International AG, Gasrec, PlanET Biogas Global GmbH, and others who are increasing their customer reach and establishing a strong footprint in the market.

- In June 2021, Future Biogas Limited announced plans to build its portfolio of 25 new biogas plants by 2028, along with carbon capture and storage capabilities to supply green gas to the grid. It also plans to build an additional 20 bolt-on sites of CCS. Future biogas intends to sell the carbon offsets generated by permanent geological CO2 storage to corporate buyers seeking to offset their emissions.

- In September 2020, Weltec Biopower started building a new biogas plant in South Korea. This plant will transform biogas into heat in an integrated gas boiler. The plant is expected to be commissioned in spring 2021 with a 7 MW capacity and can digest up to 93,000 tons of food waste a year.

LIST OF TOP BIOMETHANE COMPANIES:

- EnviTec Biogas AG (Germany)

- Future Biogas Limited (U.K.)

- WELTEC BIOPOWER GMBH (Germany)

- AB Holding SpA (Italy)

- RENERGON International AG (Switzerland)

- PlanET Biogas Global GmbH (Germany)

- StormFisher (Canada)

- Quantum Green (India)

- Scandinavian Biogas (Sweden)

- Ameresco (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2021– WELTEC BIOPOWER, an RNG plant manufacturer, announced a service partnership agreement with Bristola, a company based in the U.S. The main purpose of this partnership is to promote renewable energies by service and by building efficient biogas plant expansion.

- July 2021– Weber Green Tech, a partner and investor in Renergon International AG, invests in advanced biogas technology to support the global sustainability goals of energy conversion. This merger creates a new major player in operation and construction of organic waste processing plants.

- June 2021– Liquind 24/7 and EnviTec announced signing an agreement for the sale of Bio-LNG. A new liquefaction plant will produce this bio-LNG, and EnviTec will construct this plant in Pomerania, Germany, by EnviTec. The transport and distribution of bio-LNG to heavy-duty customers at its truck fueling stations will be organized by Liquind.

- May 2021– LIQVIS GmbH and EnviTec signed a contract for the supply of bio-LNG. EnviTec will start supplying bio-LNG in the third quarter of 2022, and this bio-LNG will be produced from the biogas plant in Gustrow.

- May 2021– Weltec Biopower GmbH is building a biomethane plant for the Spanish dairy cattle farm Torre Santamaria. The farm has already secured contractually sales of biomethane at an early stage.

REPORT COVERAGE

The global biomethane market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, feedstocks, and leading applications. Besides this, the report offers insights into this market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.97% from 2026 to 2034 |

|

Unit |

Volume (GWh) and Value (USD Billion) |

|

Segmentation |

By Feedstock

|

|

By Application

|

|

|

By Production Method

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 6.95 billion in 2025.

Growing at a CAGR of 4.97% the market will exhibit healthy growth over the forecast period (2026-2034).

By application, the power generation segment is the leading segment in the market

Conversion of waste into renewable energy and rising environmental concerns propel the market growth

WELTEC BIOPOWER GMBH, AB Holding SpA, RENERGON International AG, Gasrec, and PlanET Biogas Global GmbH are among the leading players in the global market.

Europe dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us