Carbon Capture and Sequestration (CCS) Market Size, Share & Industry Analysis, By Capture Source (Chemicals, Natural Gas Processing, Power Generation, Fertilizers Production, and Others), By End-Use (Enhanced Oil Recovery {EOR} and Dedicated Storage & Treatment), and Regional Forecast, 2025-2032

Carbon Capture and Sequestration (CCS) Market Size

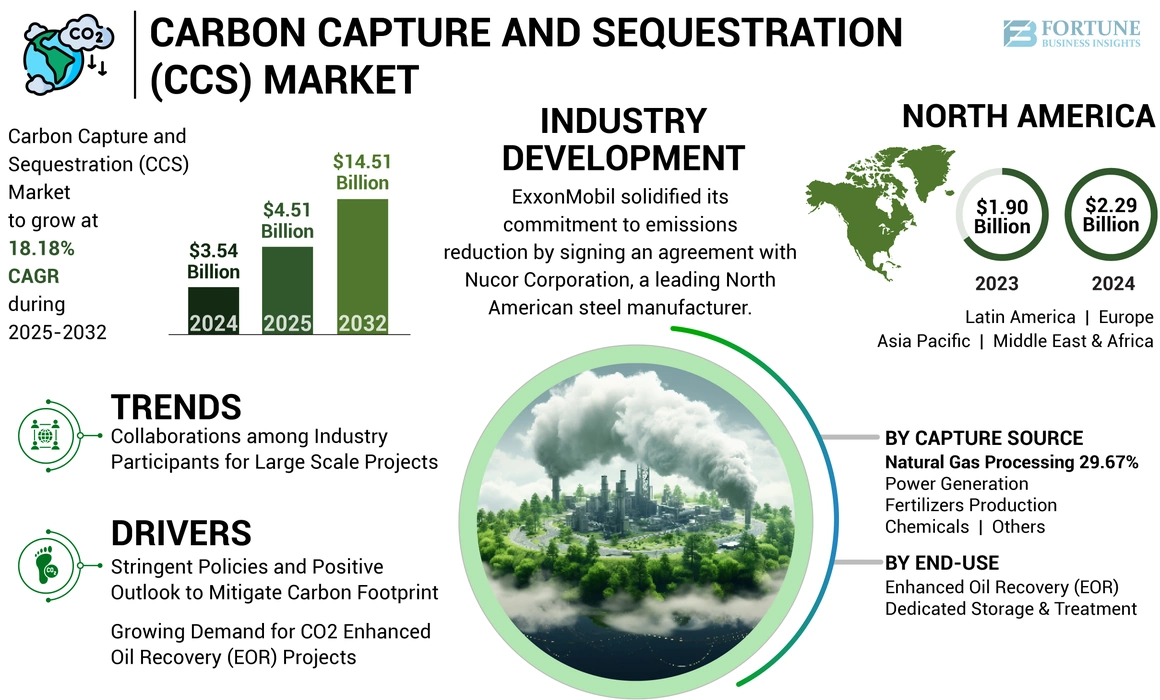

The global carbon capture and sequestration (CCS) market size was valued at USD 3.54 billion in 2024. The market is projected to grow from USD 4.51 billion in 2025 to USD 14.51 billion by 2032, exhibiting a CAGR of 18.18% during the forecast period.

Carbon capture and sequestration technology involves trapping, transporting, and storing harmful carbon dioxide emissions from various sources. The capture of CO2 is usually performed through numerous procedures such as pre-combustion, oxy-fuel, post-combustion capture, industrial separation, or an amalgamation of various industrial processes. The seized CO2 is transferred by multiple modes, such as pipelines and tankers, for storage in deep aquifers or reservoirs beneath the earth’s surface.

The COVID-19 pandemic affected the commercial segments, such as cement plants, chemical plants, and others, which play vital roles in running the CCUS market. After the revival of these businesses, CCUS companies quickly adapted to changes and began their operations after months of lockdown. Thus, the pandemic lockdown caused the delay for the planned ventures, which has influenced the development of the CCUS.

Global Carbon Capture and Sequestration (CCS) Market Overview

Market Size & Share:

- 2024 Market Value: USD 3.54 billion

- 2025 Estimate: USD 4.51 billion

- 2032 Forecast: USD 14.51 billion

- CAGR (2025–2032): 18.18%

- Top Region: North America – driven by strong government support and operational CCS facilities

- Leading Capture Source: Natural gas processing – widely adopted for its cost-efficiency and emission control

- Top Application: Dedicated storage & treatment – permanent CO₂ storage in geological formations

- Fastest-Growing Use Case: Enhanced Oil Recovery (EOR) – leveraging CO₂ to boost oil production

Key Trends and Drivers:

- Policy momentum: Global net-zero targets and emission control mandates boost CCS adoption

- Industrial collaborations: Strategic partnerships (e.g., Fluor & FCL) enable large-scale CCS projects

- CO₂-EOR synergy: CCS supports oil recovery while reducing emissions, gaining policy support in Canada & U.S.

- Post-pandemic green push: Recovery initiatives focus on sustainable infrastructure, including CCS

- Tech investment surge: Companies like Chevron and Svante scale up CCS filter production and storage technologies

Market Challenges:

- High setup costs: Capital-intensive infrastructure for capture, transport, and storage limits adoption

- Operational complexity: Requires long-term funding, cross-border regulation alignment, and monitoring systems

- Feasibility issues: Multi-MTPA capture scale difficult to achieve across smaller or less-developed markets

Market Opportunities:

- Net-zero commitments: Rising global investments in decarbonization and ESG-backed energy transition

- Old reservoir repurposing: Use of depleted oil & gas fields for CO₂ storage offers scalable opportunities

- Asia Pacific emergence: Large-capacity projects in China and Australia gain traction with policy support

- Hydrogen synergy: Integration of CCS in hydrogen production supports broader clean energy ecosystems

The economic slowdown led to decreased industrial activity, resulting in reduced carbon dioxide (CO2) emissions. It also caused delays in carbon capture projects and investments. Many CCS initiatives required significant funding and government support, which could be sidetracked to more immediate pandemic-related needs. Furthermore, travel restrictions and supply chain disruptions slowed down construction and technology deployment, impeding the progress of carbon capture infrastructure.

The pandemic's focus on public health reinforced the importance of clean air and a sustainable environment. This heightened awareness could lead to increased public and political support for CCS as part of a larger strategy for achieving net-zero emissions. Governments seeking post-pandemic economic recovery might view carbon capture and sequestration investments as an opportunity to create jobs and stimulate economic market growth while simultaneously addressing climate concerns.

Carbon Capture and Sequestration (CCS) Market Trends

Collaborations among Industry Participants for Large Scale Projects to Propel Market Growth

Various market players are concentrating on joining forces to complete large-scale carbon capture and sequestration facilities and commercialize the technology. The partnerships are also focused on helping to gather the significant CAPEX required for new projects, coupled with the easy-rolling out of regional contracts to support the construction and operation of projects. For instance, in July 2023, Fluor Corporation formalized a licensing agreement with Federated Co-Operatives Limited (FCL). This agreement pertains to the utilization of Fluor's cutting-edge Econamine FG PlusSM carbon capture technology at FCL's Co-op Renewable Diesel Complex, situated in Regina, Saskatchewan, Canada. The inclusion of Fluor's technology is a pivotal component of FCL's energy strategy and is aligned with their substantial USD 2 billion commitment to establishing an integrated agricultural complex. The FCL renewable diesel project, anticipated to be fully operational by 2027, represents a significant milestone in its comprehensive energy roadmap.

Download Free sample to learn more about this report.

Carbon Capture and Sequestration (CCS) Market Growth Factors

Stringent Policies and Positive Outlook to Mitigate Carbon Footprint Will Propel Product Demand

Different governments have introduced strict action plans to stabilize climate change and diminish the overall carbon emissions in short- and long-term periods. Stern activities to monitor and curb greenhouse gas (GHG) emissions from power generation facilities are poised to augment the carbon capture and sequestration market growth further. In March 2023, The Net Zero Industry Act was introduced by the European Union, announcing an annual objective of injecting 50 million metric tons of CO2 per year by 2030. The Act also establishes enhanced authorization protocols for Carbon Capture, Utilization, and Storage (CCUS) initiatives. In a related development, the inaugural phase of Project Greensand in Denmark commenced operations in March 2023, involving the secure transportation and storage of CO2 from Belgium in a former North Sea oil field in Denmark.

Growing Demand for CO2 Enhanced Oil Recovery (EOR) Projects to Complement Industry Landscape

Enhanced oil recovery (EOR) is a tertiary oil recovery method deployed to recover over 65% of the total recoverable oil in place not produced through primary and secondary phases. Rising measures to cut the maximum carbon dioxide levels generated from fossil fuel production and utilization boost the market growth for carbon capture and storage. For example, in November 2021, in Canada, the Province of Saskatchewan declared that pipelines engaged in the transportation of CO2 are now qualified for inclusion in the Carbon Capture, Utilisation, and Storage (CCUS) framework, which encompasses enhanced oil recovery (EOR) as part of the Provincial Oil Infrastructure Investment Program (OIIP). Similarly, the Province of Alberta disclosed its Alberta Hydrogen Roadmap in the final quarter of 2021, signifying the province's ambitious aspiration to attain a global leadership position in the realm of clean hydrogen. This roadmap places significant emphasis on carbon capture and sequestration integration. Subsequently, during the initial quarter of 2022, the Canadian government unveiled its 2030 Emissions Reduction Plan, outlining the nation's commitment to transitioning its industries toward both eco-friendliness and competitiveness. A pivotal facet of this plan involves the establishment of a comprehensive carbon capture and sequestration strategy aimed at fostering the advancement and widespread adoption of this technology.

RESTRAINING FACTORS

High Initial Cost & Feasibility Associated with New Projects May Hinder Market Growth

The significant capital costs required to set up large-scale carbon capture systems may obstruct the carbon capture and sequestration market growth. Additionally, the projects also need substantial annual operational expenses to run systems at optimum levels. Furthermore, the achievability of high-capacity plants seizing multi-MTPA of CO2 also limits the adoption of technology across various countries.

Carbon Capture and Sequestration (CCS) Market Segmentation Analysis

By End-Use Analysis

Dedicated Storage & Treatment Segment to Observe Considerable Growth Backed by High Storage Potential

Based on end-user, the market is segmented into dedicated storage & treatment and enhanced oil recovery (EOR).

The dedicated storage & treatment segment is projected to lead the carbon capture and sequestration market share. The segment is growing due to its approach involving the direct capture of CO2 emissions from various sources, followed by transportation and injection into geological formations for permanent storage. Its application lies in its alignment with the ultimate goal of emission reduction by preventing CO2 from entering the atmosphere altogether.

By Capture Source Analysis

To know how our report can help streamline your business, Speak to Analyst

Natural Gas Processing Segment is dominating the Market due to its Strong Use in Industry

Based on capture source, the market is divided into chemicals, natural gas processing, power generation, fertilizers production, and others.

Natural gas processing is leading the market due to its high efficiency, low cost, and lower carbon dioxide emissions compared to other sources. Raw natural gas often contains significant amounts of CO2 and other greenhouse gases. Processing natural gas involves separating and capturing CO2, which can then be stored or utilized for other purposes, such as enhanced oil recovery or industrial processes.

The carbon capture and sequestration market for gas-fired power generation is critical to meet global sustainability goals associated with gas use, generating significant employment and economic benefits across diverse sectors.

REGIONAL INSIGHTS

Based on geography, the market has been analyzed across five key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Carbon Capture and Sequestration (CCS) Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is likely to lead the global industry due to the significant investments in research & development activities and the existence of different high-capacity carbon capture plants. Additionally, funding initiatives from the regional governments have also favored regional expansion. For instance, the U.S. government is working toward achieving a net-zero economy by 2050, including policies that provide significant funding for cutting-edge technologies to capture, remove, and store carbon dioxide safely and efficiently. In Canada, carbon capture and sequestration is critical in its economic and environmental path to meet its net-zero objective by 2050, with increasing emphasis on ESG (environmental, social, and governance) principles.

Various large-scale projects in early development and feasibility study stages across Australia and China are projected to surge the market size in Asia Pacific. Furthermore, the presence of high-volume storage locations, primarily across subsea oil & gas reservoirs with EOR operations coupled with favorable government initiatives, is set to favor the regional landscape. For instance, in August 2021, the governments of Australia and the U.K. declared their strategies to boost low-emission technologies such as CCS, green hydrogen, carbon capture and sequestration, and small modular reactors, among many others.

The availability of old bulk oil & gas reservoirs and the untapped potential to boost hydrocarbon production from enhanced oil recovery methods favor the Middle East & Africa CCS market. Furthermore, the announcement of new projects, low injection well drilling costs, and high storage capabilities in huge underground formations are other key factors propelling the regional outlook.

Key Industry Players

Chevron is focused on Increasing Investments in New Ventures to Boost Market Presence

The industry has observed many small and large products and services providers serve carbon capture methods and storage technology. Various companies have depicted significant interest in entering into collaboration agreements to outline the competitive landscape. Chevron is increasingly concentrating on setting up new carbon capture and sequestration stations and its partnerships with various key players to enhance its presence across the different stages of operations.

For instance, in December 2022, Chevron, the lead investor in Svante's Series E funding round, raised USD 318 million. This substantial capital injection is earmarked for expediting the production of Svante's carbon capture technology. Svante has pioneered a method of carbon capture and extraction utilizing structured adsorbent beds, commonly referred to as filters. The financial support would play a pivotal role in establishing Svante's sizable manufacturing facility in Vancouver, which is dedicated to producing filters on a commercial scale. This endeavor is projected to enable the capture of millions of metric tons of carbon dioxide annually, spanning numerous extensive carbon capture and storage facilities.

List of Top Carbon Capture and Sequestration (CCS) Companies:

- Fluor Corporation (U.S.)

- Carbon Engineering Ltd (Canada)

- ADNOC Group (UAE)

- Equinor (Norway)

- Dakota Gasification Company (U.S.)

- Aker Solutions (Norway)

- Exxonmobil (U.S.)

- Shell (Netherlands)

- BP (U.K.)

- Linde Plc (Ireland)

- Chevron (U.S.)

- Total Energies (France)

- NRG Energy (U.S.)

- China National Petroleum Corporation (China)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: Fluor Corporation announced its recent agreement by which it has secured a license to implement Fluor's advanced Econamine FG PlusSM carbon capture technology within Federated Co-Operatives Limited's (FCL) Co-op Renewable Diesel Complex located in Regina, Saskatchewan, Canada. This partnership aligns with FCL's broader energy roadmap, where the renewable diesel initiative stands as a prominent feature within their comprehensive USD 2 billion investment strategy, focusing on the development of an integrated agricultural complex. The operational target for this endeavor is set for the year 2027.

- January 2023: ADNOC Group introduced an unprecedented initiative, marking the world's inaugural fully Sequestered CO2 Injection Project. ADNOC has initiated the implementation of a CO2 injection well, wherein the entirety of the injected CO2 would be meticulously captured and stored within Abu Dhabi's carbonate saline aquifer. This undertaking constitutes a crucial component of ADNOC's comprehensive USD 15 billion long-term strategy to reduce the carbon footprint of its operations systematically. Furthermore, this endeavor stands as a steadfast endorsement of ADNOC's commitment to curbing its carbon intensity by 25% before 2030, in alignment with its overarching objective of achieving Net Zero status by 2050.

- January 2023: Equinor signed a contract with Linde that encompasses a significant Front-End Engineering Design (FEED) contract for the H2H Saltend project. In addition, a service contract for operation and maintenance has been awarded to BOC. The pioneering H2H Saltend venture involves the development of a substantial 600-megawatt low-carbon hydrogen production facility featuring carbon capture technology. This undertaking holds the distinction as the inaugural initiative of its size and kind. Its primary aim was to contribute to establishing the Humber region as a prominent global center for the production and distribution of low-carbon hydrogen.

- June 2023: ExxonMobil signed an agreement with Nucor Corporation, a prominent steel manufacturer in North America, which underscores our ongoing commitment to facilitating emissions reduction for industrial clients. This marked the third carbon capture accord in the last seven months, following partnerships with Linde, a notable industrial gas company, and CF Industries, a leading producer of agricultural fertilizers. This sequence of collaborations highlights the company’s dedication to driving positive environmental impact across various industries.

- November 2022: Carbon Engineering Ltd secured substantial investments from Airbus and Air Canada aimed at propelling the rapid development of scalable and cost-effective decarbonization solutions. These investments were earmarked to expedite the progress of Carbon Engineering's cutting-edge Direct Air Capture (DAC) technology, designed to extract carbon dioxide (CO2) directly from the atmosphere on a significant industrial scale. The injected funds would play a pivotal role in advancing Carbon Engineering's ongoing technological innovation efforts at its CE Innovation Centre, which stands as the world's largest specialized research and development facility dedicated to DAC.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 18.18% from 2025 to 2032 |

|

Unit |

Value (USD Billion) and Volume (MTPA) |

|

Segmentation |

By Capture Source, End-Use, and Region |

|

Segmentation |

By Capture Source

|

|

By End-Use

|

|

|

By Country

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 3.54 billion in 2024.

The market is likely to grow at a CAGR of 18.18% over the forecast period (2025-2032).

The dedicated storage & treatment segment is expected to lead the market due to the development of carbon capture and sequestration globally.

The market size of North America stood at USD 2.29 billion in 2024.

Stringent GHG emission reduction norms and the increasing focus on decarbonization are the key factors driving market growth.

Some of the top players in the market are Equinor, ExxonMobil, Flour Corporation, ADNOC Group, and NRG Energy.

The global market size is expected to reach USD 14.51 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us