Well Intervention Market Size, Share & Industry Analysis, By Service (Logging & Bottom Hole Survey, Tubing/Packer Failure & Repair, Stimulation, Remedial Cementing, Zonal Isolation, Sand Control, Artificial Lift, Fishing, Reperforation, and Others), By Type (Light Intervention, Medium Intervention, and Heavy Intervention), By Application (Onshore and Offshore), and By Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

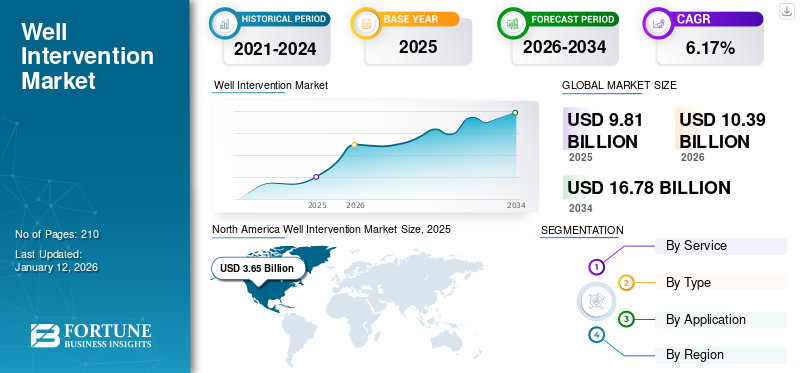

The global well intervention market size was valued at USD 9.81 billion in 2025. The market is projected to grow from USD 10.39 billion in 2026 to USD 16.78 billion by 2034, exhibiting a CAGR of 6.17% during the forecast period. North America dominated the well intervention market with a share of 37.19% in 2025. Furthermore, North America is expected to dominate the market owing to the increasing efforts to increase oil & gas production.

Well intervention refers to the operation performed on an oil or gas well during or at the end of the production life to enhance efficiency. These operations involve maintenance, repair, and replacement of equipment to improve well geometery and prevent blockages. Common well intervention techniques includes workover, slackline, wireline, or coiled tubing services.

Baker Hughes Company is one of the major players in the global market. The company delivers several oil field management services globally for multiple applications. The company’s wide product and service portfolio provides safer, cleaner, and more efficient solutions for industries.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Discoveries In Oil & Gas Industry to Boost Market Growth

The increasing number of oil & gas discoveries in oilfield reserves, along with significant advancements in technology aimed at producing production output from oil wells, is driving the demand for the well intervention market. The growing number of key discoveries in multiple areas is influencing market growth. For instance, in December 2024, Equinor, an energy company has made a discovery of the Troll field in the North Sea covers oil & gas resources. The recovery is estimated to hold between 2 and 12 million barrels of oil equivalent.

In addition, a projected rise in oil prices in the coming years is expected to support market expansion, as U.S. focuses on enhancing domestic oil production capabilities.

Growing Initiatives To Increase Production From Aged Wells To Boost Market Growth

Growing initiatives to integrate efficient production techniques and the adoption of advanced equipments to enhance output produced from aging and mature wells are set to propel industry growth in the coming years. Well intervention techniques play a crucial role in effective planning, exploration activities, and production of oil & gas wells. These methods help extend the life of production tubing, reduce operational risk, escalate production output, and improve overall efficiency. For instance, in February 2025, India’s petroleum product consumption rose by 3.5% driven by increased demand for high speed diesel, aviation fuel, and LPG. and lubricants. In addition, crude oil production increased by 5.2%, with total crude oil processed reaching 23.7 MMT, further supporting the well intervention market growth.

MARKET RESTRAINTS

Increasing Focus on Renewable Energy Along With Stringent Regulations For Protecting the Environment to Hamper Market Growth

The increasing focus on power generation from renewable energy sources, along with stringent regulations on exploration and production activities, is projected to hamper market growth. As per the Energy Information Administration (EIA) data forecast, renewable energy will account for nearly 49% of global electricity output by 2050. Many countries are implementing strict environmental regulations to maintain air quality. For instance, Alberta has enacted the Environmental Protection and Enhancement Act aimed at supporting and promoting environmental conservation efforts.

MARKET OPPORTUNITIES

Increasing Focus on Enhancing Operational Efficiency to Augment Market Growth

Growing focus on enhancing operational efficiency and a decline in operating and capital expenses has led to increased adoption of intelligent digitalized devices, services, and solutions. The widespread application of wireless mobility, data analytics, advanced technologies, and data collection platforms has substantially improved decision-making and performance. Production optimization includes intelligent decisions, data analysis, accurate measurement, and advanced modelling techniques, all of which contribute to increased oil output from oilfields.

MARKET CHALLENGES

Climate Change Activities May Create New Challenges in the Market

In recent years, climate change has significantly impacted the oil and gas sector due to extreme weather events such as global warming, floods, hurricanes, and heatwaves. These events can negatively impact infrastructure, disrupt operations, and increase the risk of accidents and spills, particularly in coastal and offshore areas. Additionally, rising sea levels and thawing permafrost further compromise the stability of infrastructure. Moreover, growing societal and regulatory pressure to transition away from fossil fuels is increasingly influencing the industry’s direction and long-term viability.

WELL INTERVENTION MARKET TRENDS

Increasing Investment in the Offshore Sector Fuels Market Growth

The market growth is propelled by increasing investment in the subsea exploration and growing energy demand. Major upstream countries such as the U.S., China, Russia, and Norway are intensifying efforts to discover new reservoirs and improve recovery from existing wells. This has escalated the demand for oilfield services, including intervention, completion, offshore drilling services, floating platforms, and workover services around the globe.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a negative impacted on the oil industry significantly worldwide. As countries implemented lockdown measures to control the spread of the virus, many oil companies were forced to shut down their manufacturing facilities and suspend services. As per the International Energy Agency, oil demand decreased by 29 million barrels per day (bpd) in April 2020 and by 23.1 million bpd in the second quarter of 2020.

SEGMENTATION ANALYSIS

By Service

Logging & Bottom Hole Survey Segment to Dominate owing to Increasing Number of Active Rig

Based on service, the well intervention market is categorized into logging & bottom hole survey, tubing/packer failure & repair, stimulation, remedial cementing, zonal isolation, sand control, artificial lift, fishing, reperforation, and others.

The logging & bottom hole survey segment is estimated to hold the largest market share owing to an increase in the number of active rigs across the globe. Moreover, the bottom hole survey measures wellbore angle and direction, helping ensure accrurate welldrilling. The segment held the dominant market share of 19% in 2024.

Furthermore, the tubing/packer failure & repair segment is also expected to grow considerably owing to increasing investment in offshore production. As the tubing/packer failure & repair services helps well managing companies to avoid corrosion, pressure fluctuations, mechanical damages, or seal degradations. Growing awareness for such services is expected to propel the market growth over forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Type

Light Intervention Segment to Lead due to its Affordability

Based on type, this market segment is divided into light intervention, medium intervention, and high intervention.

The light intervention segment is estimated to hold the largest market share of 59.85% in 2026, owing to its cost-efficiency compared to other types of interventions. The light intervention is the cost effective method to perform minor well maintenance without removing the wellhead. Using tools like wireline or coiled tubing, it enables tasks such as logging, cleaning, and valve repairs, helping to extend well life with minimal downtime.

The medium intervention segment is growing driven by its role in enhancing the quality of subsea wells. This segment is anticipated to exhibit a CAGR of 6.41% during the forecast period.

Moreover, the heavy intervention segment is estimated to grow significantly as it becomes necessary for operations such as tubing strings and pumps.

By Application

Offshore Segment To Dominate due to Growing Investment in Subsea Oil & Gas Assets

Based on application, this market is segmented into the onshore and offshore.

The offshore segment is estimated to hold the largest market share owing to increasing investment in subsea oil & gas assets. Offshore well intervention involves perfoming operations on subsea wells to restore or enhance production. It includes techniques such as wireline, coiled tubing, and hydraulic interventions carried out from rigs or specialized vessels. This segment is anticipated to exhibit a CAGR of 5.68% during the forecast period.

The onshore segment is also estimated to grow significantly during the projected period due to the growing number of matured oilfields along with a high focus on developing heavy oil reserves. The segment is expected to dominate the market share of 5.68% in 2025.

WELL INTERVENTION MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Well Intervention Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Focus On Increasing Oil production to Influence Market Growth

North America holds the largest well intervention market share globally, with the U.S. playing a dominant role. The regional market value in 2025 was USD 3.65 billion, and in 2026, the market value led the region by USD 3.84 billion. There is a growing focus on fossile fuels production supported by government efforts of U.S. and Canada, aimed at reducing dependency on other foreign crude oil imports. This policy direction significantly impaced the growth of the oilfield services market, including the wll intervention services.

U.S.

Robust Presence of Major Players Boosts Market Growth

The U.S. is the dominating country in the North American region, owing to the strong presence of major players such as Schlumberger, Ltd., Halliburton, and Baker Hughes Company. These companies continuously invest in technological developments and offer a broad range of solutions across various segments of oil & gas industry, which contributes positively to market growth. The U.S. market size is expected to hit USD 3.06 billion in 2026.

Europe

Increasing Crude Oil Demand in the Region to Boost the Market Growth

Europe is anticipated to account for the third-highest market size of USD 2.31 billion in 2026. Well intervention market in Europe is witnessing considerable growth globally owing to the rising demand for crude oil and increasing dependency on fuel-powered industrial machinery.

Moreover, the region’s rising focus on nuclear energy, such as hydrogen production, is creating the demand for well intervention services. Countries such as Norway, Russia, and the U.K. are major contributors to the global market. Russia holds the majority of the oil production share, after Saudi Arabia. The market value in U.K. is expected to be USD 0.22 billion in 2025.

On the other hand, Norway is projecting to hit USD 0.42 billion and Russia is likely to hold USD 0.24 billion in 2026.

Asia Pacific

Increasing Investment in Offshore Gas in the Region will Drive the Market Growth

Asia Pacific is one of the fastest-growing regions driven by rapid industrialization. Asia Pacific is anticipated to account for the second-highest market size of USD 2.61 billion in 2026, exhibiting the second-fastest growing CAGR of 5.85% during the forecast period. The rapid expansion in the industry to fulfill regional demand is influencing market growth for well intervention. Countries such as China and India are actively participating in the energy sector to support technical advancements and infrastructure development. Moreover, automotive sector, one of the largest consumer of petrol and diesel, continues to fuel demand for oil and gas. The market value in China is expected to be USD 1.48 billion in 2026.

On the other hand, India is projecting to hit USD 0.34 billion in 2026. Indonesia is likely to hold USD 0.20 billion in 2025.

For instance, in July 2024, according to Rystad Energy, Southeast Asia’s offshore gas production could unlock USD 100 billion opportunity, determined by planned final investment decisions (FIDs) predicted to materialize by 2028.

Latin America

Rising Emphasis on Reducing Oil & Gas Dependence on Other Countries to Contribute to Market Development

Latin America is witnessing growing activity in oil & gas operations, with countries such as Brazil and Mexico playing key roles in the well intervention market. This growth is driven by the focus on reducing oil & gas dependence on other countries. In addition, the region offers high returns on investments, especially in power generation and industrial applications, which is driving market demand.

Middle East & Africa

Large Scale Oil And Gas Production in the Region to Boost Market Growth

The Middle East & Africa is emerging as the fourth-fastest growing markets of global well intervention sectors. The region market size is anticipating to be USD 0.96 billion in 2026.This growth is owing to the availability of major oil & gas producing resources in countries such as Saudi Arabia, the UAE, Kuwait, Iraq, and Iran. These countries are major crude oil exporters to neighboring Asian countries such as China and India, which have high energy demand. Furthermore, the growth of the market in the Middle East & Africa is due to the growing focus on drilling activities and the implementation of inspection and monitoring systems to optimize production from mature fields. The GCC market size is estimated to be USD 0.59 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Engaged in Continuous Technological Advancements to Increase Market Share

The global market is highly fragmented, comprising key intenational players and several medium-scale regional providers offering comprehensive oil & gas management services. Market players are increasingly required to prove their technological advancements that align with regulatory requirements and help improve operational efficiency across applications.

For instance, in July 2024, Saudi Arabia recently invested USD 100 billion, aiming to develop itself as a major player in data analytics, artificial intelligence, and advanced technology.

Some of the Key Companies Profiled in the Report

- Schlumberger (U.S.)

- Baker Hughes (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- National Oilwell Varco (U.S.)

- HELIX ESG (U.S.)

- Oceaneering International, Inc. (U.S.)

- Expro Group (U.K.)

- Hunting Energy Services (U.S.)

- Deepwell AS (Norway)

- Welltec (Denmark)

- TechnipFMC (U.K.)

- C&J Energy Services, Inc. (U.S.)

- Superior Energy Services, Inc. (U.S.)

- Altus Intervention (Norway)

KEY INDUSTRY DEVELOPMENTS

- December 2024- AKOFS Offshore secured a USD 300 million contract extension from Norwegian energy giant Equinor for a well intervention vessel. The selection period for the extension is projected to begin in the late fourth quarter of 2025

- June 2024- Baker Hughes recently launched a new line of hydrogen measurement technologies, including gas flow, and moisture sensor. These innovations are designed to deliver advanced levels of accuracy, dependability, and durability across a wide range of applications.

- February 2024- Digi International launched Digi IX40, an IoT-based a 5G edge computing industrial router solution. The product is purpose-built for Industry 4.0 use cases such as predictive maintenance, asset monitoring, advanced robotics, industrial automation, and smart manufacturing. This product will be applied to industrial sectors, including oil & gas.

- April 2023- North Sea-based well plugging and abandonment service provider Well-Safe Solutions launched the D300 fullness diving system aboard its Well-Safe Guardian P&A rig, enhancing its subsea operational capabilities.

- April 2023- C3 AI, a Leading provider of AI Software, announced the introduction of the C3 Generative AI Product Suite that embeds progressive transformer models with C3 AI’s pre-built AI applications. It offer support across business functions and industies, including oil & gas, utilities, CRM, ESG, and Aerospace.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product type, competitive landscape, and leading source of the engine. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Reoprt Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.17% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service, By Type, By Application, and By Region |

|

Segmentation |

By Service

|

|

By Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 9.81 billion in 2025.

The market is likely to grow at a CAGR of 6.17% over the forecast period.

The offshore segment is estimated to hold the largest market share owing to increasing investment in subsea oil & gas assets.

The North America market size stood at USD 3.65 billion in 2025.

Increasing discoveries in oil & gas industry is a key factor boosting market growth.

Some of the top major players in the market are Baker Hughes Company, Schlumberger Limited, sand Halliburton.

The global market size is expected to reach USD 16.78 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us