Marine Engine Market Size, Share & COVID-19 Impact Analysis, By Ship Type (Oil Tankers, Bulk Carriers, General Cargo Ships, Container Ships, Gas Carriers, Chemical Tankers, Support Vessels, Ferries and Passenger Ships, and Others), By Capacity (0 – 10000 HP, 10000 – 20000 HP, 20000 – 30000 HP, 30000 – 40000 HP, 40000 – 50000 HP & Greater Than 110000 HP), By Fuel (Heavy Fuel Oil, Intermediate Fuel Oil, Marine Diesel Oil, Marine Gas Oil, LNG, and Others), By Speed (High Speed, Medium Speed, and Low Speed), By Stroke (Two Stroke, Four Stroke, and Others), and Regional Forecast, 2026-2034

Marine Engine Market Size

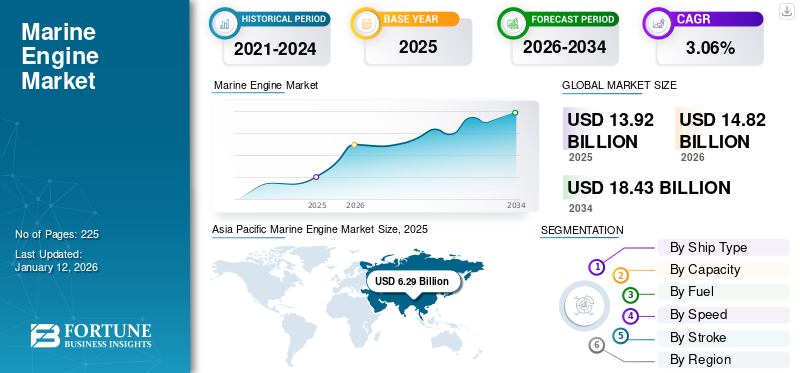

The global marine engine market size was valued at USD 13.92 billion in 2025 and is projected to grow from USD 14.82 billion in 2026 to USD 18.43 billion by 2034, exhibiting a CAGR of 3.06% during the forecast period. Asia Pacific dominated the global market with a share of 45.22% in 2025. The Marine Engine Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.44 billion by 2032.

A marine engine is a heat engine used to convert the heat generated by burning fuel into useful work, that is, to develop thermal energy and convert it into mechanical energy. These engines are widely employed in many different applications, such as cruise and ferries, marine vessels, offshore, industrial & small scale fishing activities, military and government boats, and more. Maritime transport vessels are one of the main sources of Greenhouse Gas (GHG) emissions. Moreover, the development of various technological advances over the past few years has led to the creation and development of special engines, significantly improving the market for these engines. Furthermore, the market is also witnessing huge demand for clean and efficient electricity generation technology, which further contributes to the overall growth of the market. Therefore, these factors will contribute to promoting market growth in the coming years.

COVID-19 Impact:

Lack of Access to Raw Materials Amid COVID-19 Pandemic Severely Affected Market Growth

The COVID-19 outbreak caused widespread unrest and concern globally, resulting in a cessation of all normal activities. The implications of this pandemic affected many industries in various ways, such as domestic industrial shutdowns, value chain disruptions, lack of international transactions to market products, no orders for new products, lack of access to raw materials, lack of operating workforce, and many others. The impact of COVID-19 on this market was unpredictable. The COVID-19 outbreak forced governments across the globe to implement strict lockdown measures and ban the import and export of essential raw materials for most of 2020 and a few months in 2021. This situation led to a sudden decline in supplies of vital raw materials for this market. Due to disruptions in supply chains and production schedules caused by the COVID-19 pandemic, boat and engine manufacturers suffered heavy losses. Additionally, the nationwide lockdown forced component factories to partially or completely close their activities.

However, the world is gradually returning to normalcy in daily business operations by taking appropriate measures in various economic sectors. Increased vaccination and reduced deaths have improved the shipbuilding and renovation market scenario, which is expected to boost demand in the global marine engines market over the forecast period.

Marine Engine Market Trends

Flexibility in Fuel Source in Modern Marine Engine to Augment Growth

The flexibility in the fuel type used for marine propulsion is a vital advantage of modern engine systems for the marine sector. This fuel acts as a cost-effective measure for marine propulsion, reduces greenhouse gases, and keeps them within limits. Dual-fuel or tri-fuel marine engines are gaining importance in newly constructed ships. Such engines are future-ready and can quickly adapt to the changes in rules and regulations regarding marine emissions.

The trend in the shipping and boating industry has shifted toward reducing GHG emissions, mainly due to environmental factors. The gas carriers use natural gas as fuel and emit the least amount of sulfur oxides and nitrogen oxides. The number of oil tankers, bulk carriers, general cargo ships, and container ships is steadily increasing and boosting the growth of this market.

Download Free sample to learn more about this report.

Marine Engine Market Growth Factors

High Growth in Seaborne Trade to Drive the Market

Seaborne trade continues to expand in the international market as shipping is the lifeblood of the global economy. Shipping brings benefits to consumers across the globe through low and decreasing freight costs. International trade, the bulk transport of raw materials, and the import/export of food and manufactured goods are essential in any economy. The international shipping industry is responsible for carrying out around 80% of the world trade. According to the United Nations Conference on Trade and Development (UNCTAD), merchant ship operations contribute close to USD 380 billion in freight rates within the global economy, which is equivalent to about 5% of the total world trade. The expanding seaborne trade has widened the scope of shipping containers across the globe.

Increasing Demand for Gas-based Marine Engine to Augment Market Growth

Natural gas is one of the cleanest types of fuel available to propel ships and boats. Natural gas-based engines are used dominantly in gas carriers. Even though the storage and handling of on-board natural gas are complicated, the burning of natural gas emits minimal quantities of sulfur oxides and nitrogen oxides, which fall under the emission norms. Propane-based marine gas engines are becoming more popular for small boats, yachts, and others. To limit sulfur emissions, from 1st January 2020, the International Maritime Organization (IMO) regulated the use of fuel that contains less than 0.5% sulfur or the installation of scrubbers or equivalent technology to reduce net sulfur emissions. The market dynamics have boosted the research, development, and demonstration of alternative technologies for marine propulsion. The global market scenario is favorably inclined toward LPG as fuel, and investigations are underway for the same.

RESTRAINING FACTORS

Rising Adoption of Clean Energy Technologies Along with Stringent Emission Norms May Hinder Market Growth

Different regional governments and organizations have implemented vast targets to deploy green energy technologies, such as solar, hydro, wind, and many others, to reduce dependency on fossil fuels. For instance, MARPOL Annex VI guidelines released by the International Maritime Organization (U.K.) in 2005 defined the limits for NOx emissions and mandated the use of fuels with low sulfur content. These guidelines are applicable to vessels and ships trading in U.S. waters as well as within 200 nautical miles of North America's coast. The adherence of various nations to exceed the required objectives is likely to hinder the market pace.

Furthermore, stringent norms introduced by numerous administrations to cut the usage and emission of harmful substances from different sources may obstruct the industry's size. These laws can additionally lead to surplus expenditure as they may discard the usage of prevailing metals and need a replacement in machinery components. For instance, Directive 2011/65/EU of the European Commission enforced the Restriction of Hazardous Substances in Electrical and Electronic Equipment (RoHS 2) legislation, limiting the usage of harmful materials in different tools. The law is likely to hamper the installation of these engines across the globe.

Marine Engine Market Segmentation Analysis

By Ship Type Analysis

Increasing Focus on Reducing GHGs to Boost Gas Carriers Segment Growth

Based on ship type, the market is segmented into oil tankers, bulk carriers, general cargo ships, container ships, gas carriers, chemical tankers, support vessels, ferries & passenger ships, and others.

The gas carriers segment is expected to grow at the highest CAGR during the forecast period. The shipping industry is focusing on reducing GHGs, and gas carriers emit the least amount of sulfur oxides and nitrogen oxides, which is fostering segment growth.

The oil tankers, bulk carriers, general cargo ships, and container ships are the lifeline of world trade and economy. Any disruption in the operations of these ships adversely affects the trade and economy. Support vessels are used in every port and are key to the operations of several offshore oil & gas facilities. The bulk carriers segment share contributing 37.79% globally in 2026.

By Capacity Analysis

0 – 10000 HP Segment to Hold the Major Share of the Global Market due to Modularity of Smaller-capacity Engines

Based on capacity, the market is segmented into 0 – 10000 HP, 10000 – 20000 HP, 20000 – 30000 HP, 30000 – 40000 HP, 40000 – 50000 HP, 50000 – 60000 HP, 60000 – 70000 HP, 70000 – 80000 HP, 80000 – 90000 HP, 90000 – 100000 HP, 100000 – 110000 HP and greater than 110000 HP.

The 0-10000 HP segment held the dominant share of 87.92% in 2026, the global market as a result of the modularity of smaller-capacity engines. They are readily available in stock and can be customized as per requirement.

The engine capacity of 50000 – 60000 HP, 60000 – 70000 HP, 70000 – 80000 HP, 80000 – 90000 HP, 90000 – 100000 HP, 100000 – 110000 HP, and greater than 110000 HP are used for large vessels or fleets. These large-capacity engines are made to order and are not readily available in stock. Large ships upgrade their engines to increase efficiency and reduce operating costs.

By Fuel Analysis

LNG to Take Lead as It is One of the Cleanest Fuels Available to Propel Ship and Boats

Based on fuel, the market is divided into heavy fuel oil, intermediate fuel oil, marine diesel oil, marine gas oil, LNG, and others.

The LNG segment is expected to grow at the highest CAGR during the forecast period. The LNG is one of the cleanest fuel types available to propel ships and boats. The burning of LNG emits minimal quantities of sulfur oxides and nitrogen oxides, which are under emission norms. Competitive pricing, coupled with reduced carbon emissions in commercially viable regions, is one of the key factors contributing to the segment growth.

The marine diesel oil segment held the significant marine engine market share owing to oxidation & thermal stability characteristics. Diesel fuel has the power of 10x extra energy per gallon than gasoline fuel. Technical characteristics of diesel fuel, higher efficiency, and lower cost compared to refined fuel makes marine diesel oil particularly favored by the shipping industry.

The heavy fuel oil segment is expected to contribute significantly during the forecast period. The growth of the heavy fuel oil segment is attributed to its use in medium- and low-speed engines in this market.

To know how our report can help streamline your business, Speak to Analyst

By Speed Analysis

Low-Speed Marine Engines to Dominate Market Due to Their Growing Usage in Large-capacity Ships

Based on speed, the market is classified into high speed, medium speed, and low speed.

Low-speed engines segment holds maximum market share of 60.80% in 2026 and is expected to grow at the highest CAGR over the forecast period. These engines are dominantly used in large-capacity ships. Low-speed engines provide high torque and power to propel the ship forward. These variants are custom-made to order and not readily available in stock.

Few variants of medium-speed engines are readily available in stock and can be installed in ships and boats with very low lead time. Medium-sized boats and ships use medium-speed engines. The high-speed variants are used in motorboats, yachts, ferries, and cruises, which cover the distance quickly and are dominantly used for recreation and transport.

By Stroke Analysis

Two-stroke Engines to Dominate the Market as They Power Supertankers

Based on stroke, the market is segmented into two-stroke, four-stroke, and others.

Two-stroke engines held the largest market share with a share of 71.59% in 2026 and are projected to dominate the market with highest CAGR. These engines are large-sized with low-speed, they power supertankers and ultra-large vessels used for trade. Two-stroke engines are not preferred for small-capacity installations as they increase emissions of GHGs as compared to four-stroke engines.

The four-stroke engines segment is expected to contribute significantly during the forecast period. These engines are used largely in small ships and boats, which are used as a means of transport and pleasure. Reduced noise levels, cost efficiency, high speed, and greater fuel proficiency are some major factors driving the demand for four-stroke engines.

REGIONAL INSIGHTS

The global market regions are segmented as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Marine Engine Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific currently dominates the global market and is anticipated to lead during the forecast period. Asia Pacific is the manufacturing hub of the world, and a lot of items, including machinery and electronics, are exported to different places in the world via marine transportation. China, the Republic of Korea, and Japan maintained their traditional leadership in shipbuilding industries in 2024. Each country specializes in different shipping segments. China is the leading builder of bulk carriers, offshore vessels, and general cargo ships; the Republic of Korea manufactures gas carriers, oil tankers, and container ships; and Japan makes chemical tankers. The Japan market is projected to reach USD 1.1 billion by 2026, the China market is projected to reach USD 2.56 billion by 2026, and the India market is projected to reach USD 0.36 billion by 2026.

Europe

Europe is the second-largest market for marine engines. It is home to the world's largest shipping fleet. European shipowners operate one of the largest, youngest, and most innovative fleets across the globe. With its diverse fleet of container ships, tankers, passenger ships, bulk carriers, offshore service vessels, and many other specialized ships, the EU total external merchandise imports and exports in 2021 was USD 2,446.34 billion. The construction of cruise ships or vessels, support vessels, and luxury yachts is dominated by Europe. The UK market is projected to reach USD 0.32 billion by 2026, while the Germany market is projected to reach USD 0.71 billion by 2026.

Latin America, and the Middle East

Latin America, and the Middle East comparatively have a lower share of the market.

North America

North America is expected to account for the maximum growth in the market over the forecast period. Increased maritime tourism, governments and the shipping industry collaboration in maritime technology, and increased government funding for naval defense are the primary factors contributing to the marine engine market growth in North America. The U.S. market is projected to reach USD 1.19 billion by 2026.

Key Industry Players

Innovative Marine Engine Solutions from Market Players Have Ensured Market Growth

The global marine engine market is highly fragmented due to the existence of a huge number of players. Several players are increasingly participating in organic & inorganic developments to solidify their market positions globally. MAN Energy Solutions has one of the advanced technologies used in marine types of engines. In 2020, the company has created a world record for the construction of the largest diesel engine in the world, which is one of the most powerful engines rated globally.

List of Top Marine Engine Companies:

- Caterpillar Inc. (U.S.)

- Cummins Inc. (U.S.)

- Hyundai Heavy Industries (South Korea)

- Man Energy Solutions (Germany)

- Mitsubishi Heavy Industries (Japan)

- Honda Motors Co. Ltd. (U.S.)

- Wartsila (Finland)

- Kongsberg (Norway)

- Mahindra Powerol (India)

- General Motors (U.S.)

- Yanmar Holdings Co., Ltd. (Japan)

- Doosan Infracore (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- March 2023: Strategic Marine partnered with Trakindo, a Caterpillar dealer, to purchase 100 Cat C32 engines. These 100 engines are IMO III-ready, along with a selective catalytic reduction system.

- April 2022: Cummins Inc. introduced a new X15 marine engine, which is fuel-efficient and cost-effective engine to meet safety standards for the company's ABS, BV, RINA, and DNV certifications. This engine has a power range of 450– 600 HP (336 – 447 kW), offering the highest power density for continuous applications in its category, with a weight of 1724 kg (3800 lbs).

- July 2023: Cummins Inc. introduced Marine Overhaul Service Solutions in Singapore, Malaysia, Philippines, and Indonesia, from Papua New Guinea, Australia, New Zealand, and the Pacific Islands. This service solution aims to improve their fleet performance and maintain a competitive edge in this thriving maritime landscape. This new product offers comprehensive engine overhaul services with a flexible range and competitive prices to suit all budgets for vessels equipped with Cummins Model K19M/D, K38M, and K50M.

- July 2023: Hyundai HD Heavy Industries announced the development of a mid-sized engine for ammonia-powered ships using its technology and know-how by the end of next year. The company will develop, produce, and deliver such engines in cooperation with MAN Energy Solutions from Germany and Winterthur Gas & Diesel, also known as WinGD, from China.

- March 2022: Cummins Inc. launched the B4.5 marine generator and propulsion engine, expanding its hybrid-ready packages beyond the QSB6.7 and QSL9 power lines. This rugged, fuel-efficient pair, based on a proven industrial engine, the B4.5 engine, is available for recreational and commercial propulsion applications, meeting IMO II, ST V, and ECD 2 regulations without the need for further treatment. This powerful, lightweight engine delivers exceptional power, with a power range of 102 to 250 horsepower (76 to 186 kW).

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, leading ship type, and capacity of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 3.06% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Ship Type

|

|

By Capacity

|

|

|

By Fuel

|

|

|

By Speed

|

|

|

By Stroke

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights study shows that the global market size was USD 14.82 billion in 2026.

The global market is projected to grow at a CAGR of 3.06% over the forecast period.

The market size of Asia Pacific stood at USD 6.59 billion in 2026.

By fuel type, the marine diesel oil segment accounts for a considerable proportion of the market.

The global market size is expected to reach USD 18.43 billion by 2034.

Increasing demand for marine gas engines and high growth in seaborne trade are the key factors driving market growth.

The top players in the market are Cummins Inc., Wärtsilä, INNIO, and Caterpillar Inc., among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us