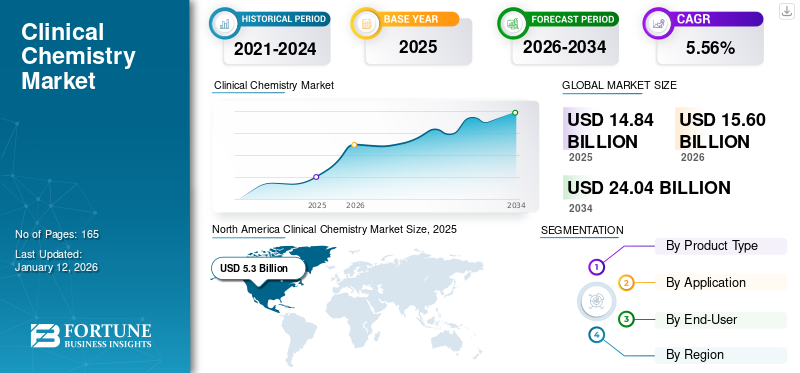

Clinical Chemistry Market Size, Share & Industry Analysis, By Product Type (Instruments, and Reagents & Consumables), By Application (Electrolyte Panel, Basic and Comprehensive Metabolic Panels, Liver Tests, Renal Tests, Lipid Panel, and Others), By End-User (Hospitals & Clinics, Clinical Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global clinical chemistry market size was valued at USD 14.84 billion in 2025. The market is projected to grow from USD 15.6 billion in 2026 to USD 24.04 billion by 2034, exhibiting a CAGR of 5.56% during the forecast period. North America dominated the clinical chemistry market with a market share of 35.68% in 2025.

Clinical chemistry refers to the biochemical analysis of various body fluids including blood, serum, urine, and others for diagnosing and treating diseases among patients. It includes different instruments that use chemical reactions to identify or quantify levels of chemical compounds, such as electrolytes and lipid profiles in bodily fluids. Increasing diagnostic tests, such as liver and renal tests, for quantifying chemical compounds in bodily fluids are likely to support the growing adoption of clinical analyzers in the market.

- According to 2021 data published by the American Society for Microbiology, it was reported that more than 13.00 billion tests on various specimens including blood, urine, and tissue samples, are performed each year in the U.S. This is subsequently driving the demand for novel product launches in the market.

Additionally, the growing focus of key players on research and development activities to launch innovative analyzers for the quantification of chemical compounds among patients is supporting the growth of the market.

The COVID-19 pandemic negatively impacted the global market due to the restrictions imposed by the government. Additionally, the restriction further led to decreased patient visits, resulting in reduced tests performed among patients. This, along with supply chain disruption among manufacturers of instruments, reagents & consumables also resulted in a decline in their annual revenue, thus decreasing the growth of the clinical chemistry market.

Global Clinical Chemistry Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 14.84 billion

- 2026 Market Size: USD 15.6 billion

- 2034 Forecast Market Size: USD 24.04 billion

- CAGR: 5.56% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 35.68% share in 2025. This leadership is driven by the high demand for and adoption of clinical chemistry analyzers for early disease detection, as well as strategic acquisitions and collaborations among key players in the region.

- By Product Type: The reagents & consumables segment held the largest market share in 2024. Its dominance is attributed to the growing adoption of testing kits for improved accuracy in diagnostic procedures and the continuous launch of innovative reagents and kits by key manufacturers.

Key Country Highlights:

- Japan: The market is characterized by strong domestic players, such as Sysmex and HORIBA Ltd., who are actively launching new and fully automated analyzers to expand their product offerings and provide advanced solutions tailored to customer needs.

- United States: Growth is fueled by an extremely high volume of annual diagnostic tests, strategic partnerships to introduce new analyzers to the market, and consistent U.S. FDA approvals for novel diagnostic instruments from major companies.

- China: The market is influenced by major domestic players like Shenzhen Mindray, which are expanding their global presence through strategic acquisitions. However, growth is also tempered by the high cost of advanced analyzers, which can limit adoption.

- Europe: The market is driven by a high prevalence of chronic disorders, such as cardiovascular disease, which increases the number of diagnostic procedures. Growth is further supported by key players establishing new R&D centers and launching new solutions to meet regional demand.

Clinical Chemistry Market Trends

Technological Advancement in Clinical Chemistry Analyzers

The increasing demand for novel technology for analyzers is prompting prominent players to focus on research and development activities in the market. Increasing R&D activities to launch these analyzers with advanced technology including high productivity and throughput, among others is expected to support the growing adoption of clinical chemistry analyzers.

The increasing number of launches, along with government approvals for these products is resulting in a preferential shift toward advanced analyzers for the early detection, treatment, and management of the disease among patients.

- For instance, in February 2023, Erba Mannheim launched its latest XL range of fully automated analyzers that incorporate state-of-the-art systems. These products are performance-oriented, boost lab productivity, and support a comprehensive test menu spanning various disorders.

Growing awareness and increasing R&D expenditure among critical players are further resulting in the introduction of technologically advanced analyzers in the market.

Thus, the trend is shifting toward technologically advanced products for the early detection of disease, including cardiovascular and urological disorders, among healthcare facilities, highlighting the clinical benefits of these products.

Download Free sample to learn more about this report.

Clinical Chemistry Market Growth Factors

Increasing Prevalence of Chronic Disorders Globally to Augment Market Growth

The increasing prevalence of disorders such as cardiovascular disease is leading to an increase in the number of patient visits to hospitals and clinics. Increasing patient admissions is resulting in the growing number of diagnostic procedures among patients, further supporting the increasing adoption of clinical analyzers.

- For instance, according to 2023 data published by the Centers for Disease Control and Prevention (CDC), it was reported that about 1 in 20 adults aged 20 and older is suffering from cardiovascular diseases.

Additionally, the growing technological advancement of the analyzers is driving the focus of key players toward R&D activities to launch innovative clinical analyzers.

- For instance, in July 2023, Siemens Healthineers AG launched Atellica CI analyzer for immunoassay and clinical chemistry testing, aiming to provide a compact testing system to tackle lab challenges among healthcare facilities.

Along with this, the increasing benefits of clinical analyzers, including precision and accuracy in the early detection of disorders, and others is likely to aid the growing demand for these products in the market. Moreover, increasing acquisitions and collaborations among the major players in the market with an aim to strengthen its presence is likely to contribute to the growth of the market.

Thus, the growing number of research activities, along with growing collaborations among key players for manufacturing clinical chemistry analyzers, is expected to spur the adoption of these products during the forecast period.

RESTRAINING FACTORS

High Cost Associated with Clinical Chemistry Analyzers to Limit Adoption

Despite the growing demand for these analyzers globally, certain factors are hampering the growth of the market. The high cost associated with the analyzers is one of the significant factors limiting the adoption of these devices in the market.

- For instance, according to Shenzhen Mindray Bio-Medical Electronics Co., Ltd., the cost of BS-240 biochemistry fully automated analyzer lies in the range of USD 3,000.0 – 6,000.0 per piece.

Along with this, growing technological advancement for these analyzers is also aiding the growing cost for these products, thus hampering the adoption for these products in the market, especially in emerging countries such as China, India, and others. This, coupled with increasing maintenance cost for these analyzers, is likely to hamper the demand for these products in the market.

Thus, high cost, along with limited adoption of technologically advanced analyzers in emerging countries, is a significant factor limiting the growth of the market.

Clinical Chemistry Market Segmentation Analysis

By Product Type Analysis

Increasing Product Launches of Reagents & Consumables Led to Market Dominance

Based on product type, the market is segregated into instruments and reagents & consumables. The reagents & consumables segment held the share of 76.35% the market in 2026. This dominance is attributed to the growing adoption of testing kits in diagnostic procedures for improved accuracy and precision. This, along with, increasing focus of key players toward launching innovative testing kits, including reagents and kits, is likely to support the growth of the segment in the market.

- For instance, in November 2021, Medix Biochemica launched a new range of diagnostic reagents to diagnose several disorders among patients in Germany.

On the other hand, the instruments segment is also growing in the market. The growth is owing to increasing prevalence of chronic disorders such as cardiovascular, liver disorders, resulting in increasing patient admissions in healthcare facilities. Furthermore, the growing adoption of analyzers in healthcare facilities is expected to spur the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Liver Tests Segment Dominated owing to Higher Number of Liver Tests Performed Among Patients

Based on application, the market is segmented into electrolyte panel, basic and comprehensive metabolic panels, liver tests, renal tests, lipid panel, and others. The liver tests segment dominated and accounting for 24.00% market share in 2026. The increasing prevalence of liver disorders such as non-alcoholic fatty liver disease, and others is resulting in the number of tests in the market. Increasing patient admissions and the rising number of diagnostic procedures are driving the growing adoption of these analyzers in the market.

- According to a 2023 study published by the Journal of Hepatology, it was reported that 83.7% of patients were suffering from metabolic dysfunction associated with liver disease among 9,606 participants.

The lipid panel and renal tests segments are also growing due to increasing number of diagnostic procedures performed for accessing renal function and lipid panel profiles to detect diseases among patients. This, along with the growing number of clinical laboratories adopting advanced analyzers for the early detection of cardiovascular and kidney-related diseases, is expected to support the growth of the segment.

Additionally, electrolyte panel, basic and comprehensive metabolic panels, and others segments are also growing due to the increasing preference of patient population toward routine electrolyte check-ups to identify early signs of health issues or prevent further growth of the disease. Additionally, growing awareness of the health routine check-up, among patients is likely to support the growing adoption of these analyzers, thus contributing to the growth in the market.

By End-User Analysis

Increasing Adoption of Clinical Chemistry Analyzers Among Clinical Laboratories Supports Segmental Dominance

Based on end-user, the market is segmented into hospitals & clinics, clinical laboratories, and others. The clinical laboratories segment dominated and accounted for the market share of 39.00% in 2026. The increasing number of clinical laboratories, resulting in growing adoption of these analyzers, contributing to the market growth.

- For instance, according to 2023 data published by the American Clinical Laboratory Association, there are approximately 322,488 clinical laboratories in the U.S.

The hospitals & clinics segment is anticipated to grow with a considerable CAGR during the study period. The growth is owing to a rising patient admissions for the diagnosis of chronic conditions including cardiovascular diseases, among others in hospitals & clinics across the globe. This results in increased diagnostic procedures performed in these settings, supporting the growing adoption of these products among healthcare facilities.

Similarly, the clinical laboratories and others segment are also expected to grow at a faster rate during the forecast period. This growth is due to rapid healthcare infrastructure development, along with an increasing number of clinical laboratories, resulting in a growing number of clinical tests performed in the market. Furthermore, increasing demand for clinical tests is leading key players to focus on launching advanced instruments in the market, thus supporting segmental growth.

REGIONAL INSIGHTS

Based on geography, the market is analyzed across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Clinical Chemistry Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 5.3 billion in 2025, with regional dominance driven by the increasing demand for clinical chemistry analyzers among the population. The increasing demand is resulting in the rising adoption of these analyzers among healthcare facilities for early detection, management, and treatment of a disease. Moreover, the growing acquisitions and collaborations among key players are resulting in an increasing penetration rate of products among healthcare facilities. These are some of the factors contributing to the growing adoption of analyzers in the region. The U.S. market is projected to reach USD 4.48 billion by 2026.

- For instance, in February 2021, Thermo Fisher Scientific, Inc., partnered with Mindray, a global developer, manufacturer, and supplier of medical devices, with an aim to offer Mindray’s clinical chemistry analyzers in the U.S. and Canada for drug screening in clinical laboratories in the countries.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe contributed a considerable share of the market in 2024 owing to an increasing prevalence of certain disorders such as cardiovascular diseases among the patient population. Increasing prevalence is resulting in the growing number of diagnostic procedures among patients along with government initiatives to promote the diagnosis of various diseases, which is further supporting the growing adoption of these analyzers in the market. The UK market is projected to reach USD 0.68 billion by 2026, while the Germany market is projected to reach USD 1.02 billion by 2026.

- For instance, according to 2024 statistics by the British Heart Foundation, it was reported that there are more than 7.6 million people suffering from heart or circulatory disorders in Europe.

Asia Pacific

Asia Pacific is anticipated to grow with a considerable CAGR during the forecast period. Increasing demand for these analyzers is resulting in the growing focus of key players on research and development activities to launch novel products in the market. The Japan market is projected to reach USD 0.99 billion by 2026, the China market is projected to reach USD 0.82 billion by 2026, and the India market is projected to reach USD 0.53 billion by 2026.

- For instance, in September 2022, Sysmex launched the UF-1500 fully automated urine particle analyzer, with an aim to deliver a wide range of solutions specific to customer’s preference in Japan.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are expected to grow at a considerable CAGR during the forecast period. This is owing to the increasing initiatives by clinical laboratories, hospitals & clinics, among others, to collaborate with the prominent players in the region for innovative analyzers, thus supporting the growth of the market.

Key Industry Players

Increasing R&D activities Among Major Players is Responsible for their Dominant Share

The current scenario of the industry is consolidated, with various players offering a wide range of analyzers in their portfolios. Strong brand presence, coupled with receiving approvals for these analyzers, is offering immense growth opportunities for players, including Abbott, F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific Inc., among others during the forecast period.

- For instance, in August 2023, Abbott received U.S. FDA approval for the Alinity H-series diagnostic instrument for complete blood counts.

Additionally, certain other players, such as Siemens and Sysmex Corporation, are focusing on expanding their distribution channels to strengthen their geographical presence. This is expected to increase their global clinical chemistry market share during the forecast period.

- For instance, in January 2023, Siemens established a new R&D center in Ireland, intending to support laboratories and hospitals with innovative laboratory diagnostic equipment.

Apart from that, the growing focus on inorganic growth strategies including acquisitions and mergers among the major players operating in the market is expected to contribute to the growth of players such as Shenzhen Mindray Biomedical Electronic Co. Ltd., ELI Tech Group, and others in the market.

- For instance, in July 2023, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. acquired Germany-based DiaSys Diagnostic Systems GmbH to strengthen its in-vitro diagnostic product portfolio.

Thus, the growing adoption of these analyzers among healthcare facilities owing to an increasing number of R&D activities is a major factor expected to augment the global clinical chemistry market growth of other players.

LIST OF TOP CLINICAL CHEMISTRY COMPANIES:

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- Danaher Corporation (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens (Germany)

- HORIBA Ltd. (Japan)

- Shenzhen Mindray Biomedical Electronic Co. Ltd. (China)

- Sysmex Corporation (Japan)

- Nova Biomedical (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – Horiba Ltd. launched three new clinical chemistry analyzers with an aim to expand its product offerings.

- January 2023 – Carolina Liquid Chemistries, Corp. partnered with Diazyme Laboratories, Inc., a provider of testing kits for diagnosis of cardiovascular disease and liver disease, to expand the test menu on the Diazyme DZ-Lite c270 benchtop analyzer.

- May 2022 – Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched the Powerful yet Efficient BS-600M chemistry analyzer with an aim to strengthen its product portfolio.

- September 2021 – F. Hoffmann-La Roche Ltd, launched Cobas Pure Integrated Solutions Analyser with an aim to offer more than 230 tests across various disease areas.

- March 2021 – Horiba Ltd., acquired MedTest Dx and Pointe Scientific with an aim to expand its offerings for products globally.

REPORT COVERAGE

The global market report provides detailed market insights on various market segments, including product type, application, and end-user, and focuses on critical aspects such as company profiles, SWOT analysis, and applications. Besides this, it offers insights into the market dynamics, trends and highlights strategic market growth analysis. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.56% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 15.6 billion in 2026 and is projected to reach USD 24.04 billion by 2034.

In 2025, North America stood at USD 5.3 billion.

The market will exhibit steady growth at a CAGR of 5.56% during the forecast period (2026-2034).

Based on product type, the reagents & consumables segment led the market in 2024.

The increasing R&D activities, growing number of product launches, and technological advancements are some of the key factors driving market growth.

Thermo Fisher Scientific Inc., Abbott, F. Hoffmann-La Roche Ltd., are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us