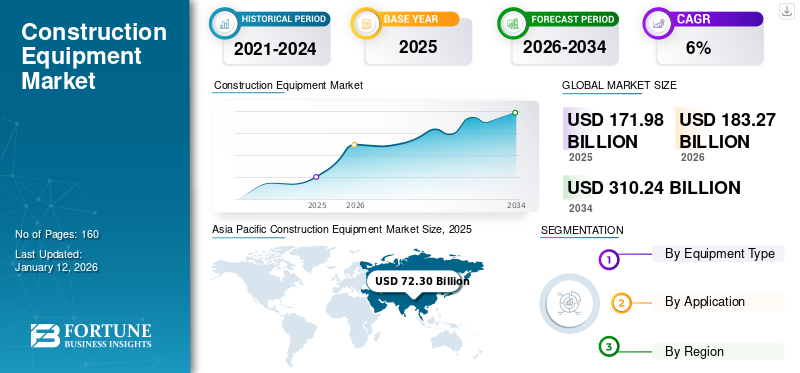

Construction Equipment Market Size, Share & Industry Analysis, By Equipment Type (Earthmoving Equipment, Material Handling Equipment & Cranes, Concrete Equipment, Road Building Equipment, Civil Engineering Equipment, Crushing and Screening Equipment, and Others), By Application (Residential, Commercial, and Industrial), and Regional Forecast, 2026–2034

Construction Equipment Market (2026-2034)

The global construction equipment market size was valued at USD 171.98 billion in 2025 and is projected to grow from USD 183.27 billion in 2026 to USD 310.24 billion by 2034, exhibiting a CAGR of 6.8% during the forecast period. Asia Pacific dominated the construction equipment market with a share of 42.00% in 2025.

The global market refers to the industry that encompasses the manufacturing, distribution, and sales of machinery and equipment used in construction activities, including earthmoving, material handling, road building, and other related operations. This market includes a wide range of equipment, such as excavators, loaders, cranes, dozers, and others, which are essential for large-scale construction projects, infrastructure development, and residential, commercial, and industrial buildings.

The construction equipment market is driven by factors such as increasing urbanization, rising infrastructure investments, and the growth of the construction sector across emerging economies. Technological advancements, such as the integration of automation, telematics, and electrification in construction machinery, are also propelling market growth by improving efficiency, reducing emissions, and lowering operational costs.

Top manufacturers in the market, such as Caterpillar Inc., CNH Industrial N.V., Doosan Corporation, and Hitachi Construction Machinery Co., Ltd., are distinguished by their ability to innovate, produce high-quality and durable machinery, and maintain a strong global presence. These companies invest heavily in research and development to introduce advanced technologies such as automation, telematics, and eco-friendly solutions that enhance equipment efficiency and reduce environmental impact.

The future outlook for the construction machinery market is positive, with continued growth anticipated due to government initiatives promoting smart cities, sustainable construction, and energy-efficient machinery. The adoption of electric and hybrid construction machinery is expected to rise, driven by stringent emission regulations and the push for greener alternatives. Moreover, the integration of IoT and AI-based predictive maintenance solutions will improve operational efficiency, reducing downtime and costs.

IMPACT OF CHINESE PLAYERS IN THE MARKET

Rising Influence of Chinese Manufacturers Reshaping Global Construction Machinery Dynamics

Chinese players are exerting a growing influence on the global construction machinery market, driven by their ability to offer cost-effective machinery without compromising significantly on quality. With strong government support, domestic innovation, and large-scale production capabilities, Chinese manufacturers have rapidly expanded their presence in both emerging and developed markets. They are particularly competitive in price-sensitive regions, where affordability is a key purchasing factor.

Additionally, many Chinese companies are investing in electric and intelligent construction machinery, aligning with global trends in sustainability and automation. Their aggressive international expansion strategies, including exports, joint ventures, and local assembly units, are intensifying competition and reshaping market dynamics worldwide.

Construction Equipment Market Trends

Growing Adoption of Excavators is a Key Trend in the Global Market

Increasing infrastructure projects, urban expansion, and the need for efficient earthmoving solutions drive the growing demand for excavators in the global construction machinery market. Excavators are essential for digging, material handling, demolition, and site preparation, making them indispensable for large-scale construction and mining operations.

Technological advancements, such as electric and hybrid excavators, autonomous operation, and telematics integration, are further boosting adoption by improving fuel efficiency, reducing emissions, and enhancing productivity.

Download Free sample to learn more about this report.

Additionally, the rising focus on smart construction and sustainable practices is driving demand for energy-efficient excavators, particularly in regions with stringent environmental regulations. With strong investments in residential, commercial, and industrial infrastructure, the excavator segment is expected to witness the highest growth within the global market.

MARKET DYNAMICS

Market Drivers

Technological Advancements Driving Efficiency to Push Market Growth

Technological advancements are transforming the global construction equipment market by enhancing efficiency, safety, and sustainability. Automation, telematics, and AI-powered predictive maintenance are reducing downtime, optimizing fuel consumption, and improving operational control.

The integration of GPS and IoT in construction machinery allows real-time tracking, remote monitoring, and data analytics, enabling construction companies to enhance productivity and cost efficiency. These innovations are driving demand for modern, high-performance construction machinery as companies seek to improve project timelines and reduce operational costs.

Additionally, the shift toward electric and hybrid construction machinery is gaining momentum due to stringent emission regulations and the global push for sustainability. Governments and regulatory bodies are enforcing strict environmental policies, encouraging manufacturers to develop energy-efficient and low-emission machinery.

Electric excavators, hybrid loaders, and hydrogen-powered construction machinery are becoming increasingly popular as companies look for greener alternatives. This transition helps reduce carbon footprints and lowers long-term operational costs, making advanced construction machinery a crucial investment for the future.

Market Restraints

Supply Chain Disruptions Slowing Production and Market Growth

Global supply chain disruptions have become a significant restraint for the global construction equipment market growth, leading to delays in production, increased costs, and reduced availability of critical components. Factors such as semiconductor shortages, raw material price volatility, and transportation bottlenecks have severely impacted equipment manufacturing.

Additionally, geopolitical tensions, trade restrictions, and fluctuating fuel prices further exacerbate supply chain inefficiencies. These challenges have resulted in extended lead times for equipment delivery, higher operational costs for manufacturers, and delays in construction projects globally.

Market Opportunities

Government Infrastructure Investments to Accelerate Market Growth

Governments across the globe are prioritizing large-scale infrastructure development to boost economic growth, enhance connectivity, and improve public services. Major economies, including the U.S., China, India, and the European Union, have announced ambitious plans for roadways, bridges, smart cities, and renewable energy projects.

Initiatives such as the U.S. Infrastructure Investment and Jobs Act, China’s Belt and Road Initiative, and India’s National Infrastructure Pipeline are driving significant demand for advanced construction machinery. These projects require a wide range of machinery, including excavators, cranes, loaders, and road-building equipment, creating a lucrative opportunity for manufacturers and suppliers in the construction machinery market.

As governments push for sustainable and efficient infrastructure, the demand for electric and automated construction machinery is also rising. Stricter emission regulations and green energy targets are encouraging the adoption of low-emission machinery, leading to increased R&D investments by manufacturers.

Additionally, public-private partnerships (PPPs) are fostering innovation and accelerating infrastructure development, further driving market growth. With continued government support and rising urbanization, the construction machinery market is set to expand, benefiting from sustained infrastructure spending and technological advancements in machinery.

SEGMENTATION ANALYSIS

By Equipment Type

Earthmoving Equipment Segment Dominated the Market Due to its High Demand for Infrastructure Projects

By equipment type, the market is divided into earthmoving equipment, material handling equipment & cranes, concrete equipment, road building equipment, civil engineering equipment, crushing and screening equipment, and others.

The earthmoving equipment segment held the leading position with 53.52% of the market share in 2026, driven by its essential role in excavation, grading, and site preparation. Strong demand from infrastructure, mining, and urban development projects, along with technological advancements such as electric and GPS-enabled excavators, strengthens its dominance.

The material handling equipment & cranes segment is expected to witness the highest CAGR during the forecast period, fueled by rising high-rise construction, smart city projects, and industrial expansion. Increased adoption of automated and electric cranes, along with growing warehouse and logistics operations, is accelerating its growth.

Other key segments include concrete equipment, which is experiencing growth due to rapid urbanization and increasing commercial construction, and road-building equipment, which is gaining traction due to government infrastructure investments. Civil engineering equipment, which is essential for large-scale public projects, and crushing & screening equipment, which is seeing a surge in demand owing to growing quarrying and mining activities. The others category includes specialized machinery catering to niche construction applications.

By Application

Residential Sector Led the Market Due to Growing Housing Demand

By application, the construction equipment market is fragmented into residential, commercial, and industrial.

The residential sector held the highest market share in 2025, driven by the continuous demand for housing and urban development. As cities expand and populations grow, governments and developers prioritize residential projects, boosting demand for earthmoving, material handling, and concrete equipment. Moreover, the residential segment holds 40.39% of the market share in 2026.

The industrial sector is expected to exhibit the highest CAGR of 6.8% due to increasing investments in industrial infrastructure, manufacturing plants, and logistics hubs. The rise in industrialization and automation across key industries is fueling the demand for specialized construction equipment such as cranes, material handling machines, and road-building equipment.

As growing economies such as India continue to industrialize, the industrial application is projected to see significant growth. The commercial sector also plays a vital role, with ongoing demand for office buildings, retail spaces, and commercial complexes driving construction activity.

To know how our report can help streamline your business, Speak to Analyst

CONSTRUCTION EQUIPMENT MARKET REGIONAL OUTLOOK

Geographically, the global market analysis covers North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific

Asia Pacific Construction Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the highest construction equipment market share with a value of USD 77.42 billion in 2026, driven by large-scale infrastructure projects, rapid urbanization, and strong government investments in smart cities and transportation networks. Countries such as China and India are key contributors, with growing demand for earthmoving and material handling equipment in road construction, residential projects, and industrial expansion.

The rising adoption of electric and automated machinery further fuels market growth in this region. The market in India and Japan holds the considerable value of USD 12.19 billion and USD 9.66 billion in 2026, respectively.

The construction equipment industry in china is the largest market for construction equipment with a notable value of USD 35.89 billion anticipated to hit in 2026, driven by extensive urbanization, industrial expansion, and government-funded infrastructure projects. The country’s Belt and Road Initiative (BRI) has significantly increased demand for heavy machinery, particularly in road, rail, and port construction, both domestically and internationally. Additionally, rapid industrialization is driving high demand for material-handling equipment and cranes in the manufacturing and logistics sectors.

Government initiatives promoting smart cities and sustainable infrastructure are pushing the adoption of electric and autonomous construction equipment. Companies are investing in AI-driven and telematics-integrated machinery, enhancing operational efficiency. Leading Chinese manufacturers, such as SANY and XCMG, are expanding globally while also benefiting from strong domestic demand.

However, challenges such as rising raw material costs, trade restrictions, and evolving emissions regulations shifts in emissions standards could impact market dynamics. Despite these hurdles, China remains the most influential player in the global market, with continuous technological advancements and infrastructure expansion supporting long-term growth.

North America

The construction equipment industry in north america is the third largest market valued for USD 37.64 billion, supported by stable infrastructure development, urban expansion, and strong adoption of advanced technologies such as automation and telematics.

The construction equipment industry in U.S. stands at USD 29.97 billion, leads in road construction and commercial projects, while investments in energy-efficient and electric machinery support market growth. Government initiatives for sustainable infrastructure and smart cities also contribute to demand.

Europe

In 2026, the construction equipment industry in Europe holds the second largest market with the value of USD 49.11 billion, exhibiting a CAGR of 6.8% during the forecast period. Market growth in Europe is fueled by rising investments in green buildings, renewable energy projects, and sustainable construction practices. Stringent emission regulations are pushing the demand for electric and hybrid construction machinery, especially in countries such as Germany, France, and the U.K.

The construction equipment industry U.K. is expected to hold a substantial market size of USD 8.02 billion. Meanwhile, the The construction equipment industry in Germany market will hit USD 16.60 billion and the France market will reach approximately USD 4.27 billion in 2026. Additionally, renovation and modernization of aging infrastructure also contribute to market growth in the region.

Middle East & Africa

The fourth largest construction equipment industry Middle East & Africa, is witnessing notable growth with a market size of USD 12.81 billion reaching in 2026, due to heavy investments in infrastructure, oil & gas projects, and smart city developments, particularly in UAE, Saudi Arabia, and South Africa.

The construction equipment industry GCC will stand at USD 7.41 billion in 2026. Mega projects, such as NEOM City and Expo-driven developments in the Gulf, are driving demand for high-capacity cranes, earthmoving equipment, and road-building machinery. The mining sector in Africa also fuels demand for specialized construction equipment.

Latin America

The Latin American market is growing at a moderate pace, supported by infrastructure development, mining activities, and road construction projects. Brazil and Argentina lead the market with government-backed initiatives for improving transportation networks and energy infrastructure. However, economic fluctuations and political uncertainties remain challenges to sustained growth.

Competitive Landscape

KEY INDUSTRY PLAYERS

Leading Companies Focus on Innovation and Global Expansion to Maintain their Competitive Position

The global construction machinery market is highly competitive, with key players focusing on technological advancements, product diversification, and global expansion to maintain their market positions. Leading companies invest heavily in automation, electrification, and telematics, integrating artificial intelligence (AI) and IoT for improved efficiency, safety, and predictive maintenance. These players have strong manufacturing capabilities and extensive distribution networks, enabling them to cater to diverse regional demands. Sustainability is a key focus, with major players developing fuel-efficient and electric construction machinery to comply with stringent emission regulations. Additionally, strategic partnerships, mergers, and acquisitions help market leaders expand their global footprint, particularly in emerging economies where infrastructure development is rapidly expanding.

Major Players in the Construction Equipment Market

To know how our report can help streamline your business, Speak to Analyst

Caterpillar, Komatsu, AB Volvo, Liebherr, and Hitachi are the largest players in the construction equipment industry. The global construction machinery market is consolidated, with the top 5 players accounting for around 44.8% of the market share.

Top Construction Equipment Companies Profiled

- Caterpillar Inc. (U.S.)

- CNH Industrial N.V. (U.K.)

- Doosan Corporation (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- HD Hyundai Construction Equipment Co., Ltd. (South Korea)

- J.C. Bamford Excavators Limited (U.K.)

- Komatsu Ltd. (Japan)

- Liebherr Group (Switzerland)

- SANY GROUP (China)

- Volvo Group (Sweden)

- Xuzhou Construction Machinery Group Co., Ltd. (China)

- Deere & Company (U.S.)

- Volvo Construction Equipment (Sweden)

- Terex Corporation (U.S.)

- Zoomlion (China)

- Kobelco Construction Machinery Co., Ltd. (Japan)

- Metso Outotec (Finland)

- Epiroc (Sweden)

- Liugong (China)

- HD Hyundai Infracore (South Korea)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Caterpillar and Trimble extended their long-standing joint venture to accelerate innovation in grade control technology. This collaboration aimed to enhance the efficiency and accuracy of construction and mining operations through advanced technology solutions. By combining their expertise, the two companies seek to deliver cutting-edge tools that improve productivity and project outcomes.

- June 2024: Doosan Bobcat expanded its Chennai factory in India by adding 11,300 square meters to support mini excavator production. Mass production is set to begin in 2025, with a target of 8,900 units by 2028. This initiative reinforces India's strategic importance in Doosan Bobcat's global growth strategy.

- June 2022: Liebherr Australia and Fortescue (Australia) joined forces with the aim of incorporating zero-emission power systems technologies in their mining haul tracks. The partnership would leverage Liebherr’s advanced equipment and technology along with Fortescue’s expertise in green technologies to produce mining equipment that emits zero pollutants.

- June 2022: Komatsu Ltd. and Cummins Inc. (U.S.) teamed up to create zero-emission haulage equipment. Their initial focus will be on zero-emission power technologies, particularly hydrogen fuel cell solutions designed for use in large mining haul trucks.

- January 2022: Hitachi, Japan's largest construction machinery company, announced the divestment of its 50% stake in a construction machinery fleet worth USD 1.6 billion. Itochu and Japan Industrial Partners would acquire the stake for USD 28.7 per share. Before the transaction, Hitachi held a 51.5% stake in the construction machinery fleet.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The global construction equipment market offers substantial investment opportunities, primarily driven by large-scale infrastructure projects and the growing adoption of advanced machinery. Governments across the globe are increasing spending on smart cities, transportation networks, and industrial expansion, creating a strong demand for earthmoving, material handling, and road-building equipment. Additionally, private sector investments in automation, AI-driven solutions, and electric construction machinery are rising as companies seek to improve efficiency and comply with stricter environmental regulations. The shift toward rental and leasing services is also attracting investors, offering businesses and contractors cost-effective, flexible equipment solutions.

Emerging markets in Asia Pacific, the Middle East & Africa hold high growth potential due to rapid urbanization and industrialization. Countries such as China, India, and Saudi Arabia are witnessing significant investments in megaprojects, driving demand for advanced construction machinery. Additionally, there is a growing focus on sustainable and energy-efficient equipment, leading investors to prioritize manufacturers developing hybrid and electric machinery. Strategic investments in aftermarket services, predictive maintenance, and digital fleet management solutions are also gaining traction, as these services help extend equipment lifespan and reduce operational costs. As the industry continues to evolve, investors focusing on innovation and sustainable solutions are expected to see strong returns.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, equipment types, and applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 6.8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment Type

By Application

By Region

|

|

Companies Profiled in the Report |

Caterpillar Inc. (U.S.), CNH Industrial N.V. (U.K.), Doosan Corporation (South Korea), Hitachi Construction Machinery Co., Ltd. (Japan), HD Hyundai Construction Equipment Co., Ltd. (Japan), J.C. Bamford Excavators Limited (U.K.), Komatsu Ltd. (Japan), Liebherr Group (Switzerland), SANY GROUP (China), Volvo Group (Sweden), etc. |

Frequently Asked Questions

The market is projected to reach USD 310.24 billion by 2034.

In 2025, the market was valued at USD 171.98 billion.

The market is projected to grow at a CAGR of 6.8% during the forecast period.

The earthmoving equipment segment led the market in 2025.

Technological advancements drive efficiency to push market growth.

Caterpillar Inc., CNH Industrial N.V., Doosan Corporation, Hitachi Construction Machinery Co., Ltd., HD Hyundai Construction Equipment Co., Ltd., J.C. Bamford Excavators Limited, Komatsu Ltd., Liebherr Group, SANY GROUP, Volvo Group, are the top players in the market.

Asia Pacific held the highest market share in 2025.

By application, the industrial segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us