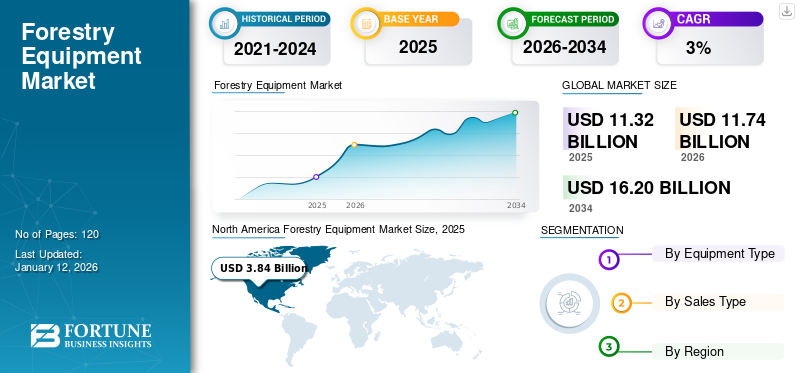

Forestry Equipment Market Size, Share & Industry Analysis, By Equipment Type (Felling Equipment, Extracting Equipment, On-site Processing Equipment, and Others (Mulchers, Stump Grinders, etc.)), By Sales Type (Used and New), and Regional Forecast, 2026-2034

Forestry Equipment Market Size and Future Outlook

The global forestry equipment market was valued at USD 11.32 billion in 2025 and increased to USD 11.74 billion in 2026, reaching USD 16.20 billion by 2034, registering a CAGR of 4.10% during 2026–2034. The North America dominated global forestry equipment market with a share of 33.90% in 2025.

The growing demand for bioenergy is a significant driver for the global market, primarily due to the increasing global shift toward renewable energy sources. Bioenergy refers to energy derived from organic materials such as wood, agricultural waste, and other biomass. Wood and forest residues are often used as sources of bioenergy, including biofuels, biogas, and wood pellets, which can be burned to produce heat or converted into electricity.

Governments and industries globally are focusing on reducing greenhouse gas emissions and promoting cleaner, more sustainable energy sources. As a result, bioenergy is gaining attention due to its ability to replace fossil fuels in several sectors. According to The International Energy Agency (IEA), bioenergy accounts for about 55% of the total renewable energy consumption presently, with wood being the dominant source. This demand for bioenergy increases the need for forestry equipment to efficiently harvest, process, and transport biomass.

The major players in the market include Deere & Company, Komatsu Ltd., Caterpillar Inc., Hitachi Construction Machinery Co., Ltd., and Ponsse Oyj. Key players in the market often collaborate with end users to develop advanced forestry equipment.

The global biofuels market, a key component of bioenergy, is projected to grow significantly. The biofuel sector uses forestry equipment to harvest wood and other biomass resources. According to Fortune Business Insights, the global liquid biofuels market is expected to reach USD 316.71 billion by 2032, growing at a CAGR of 8.9% from 2024. As more countries adopt biofuels in transportation and other sectors, the need for specialized forestry machinery (e.g., wood chippers, biomass harvesters, and wood pellet equipment) increases, driving market growth for forestry equipment.

The COVID-19 pandemic had a negative impact on the market. During the first few months of the pandemic, there was a significant disruption in the global supply chain, leading to shortages of components. The decline in timber harvesting and housing & construction slowdown further reduced demand for forestry equipment.

Download Free sample to learn more about this report.

IMPACT OF SUSTAINABILITY ON MARKET

Increasing Focus on Sustainable Forestry Practices to Drive Market Growth

Sustainability is becoming a pivotal factor in shaping the global forestry equipment market. The increasing emphasis on environmental conservation, carbon footprint reduction, and sustainable forestry practices is driving significant changes in equipment design, manufacturing, and utilization.

The rising awareness about deforestation’s impact on climate change and biodiversity has led governments, environmental organizations, and consumers to advocate for sustainable forestry. As a result, companies in the forestry industry are adopting sustainable logging methods, which require advanced equipment capable of minimizing environmental impact.

Forestry equipment manufacturers are responding by designing machinery that supports selective logging and reduced soil disturbance. For instance, low-impact harvesters and forwarders with advanced traction control systems minimize soil compaction, preserving the forest ecosystem.

Environmental regulations in many countries are pushing manufacturers to produce eco-friendly forestry machinery. Machines powered by electric or hybrid engines are gaining traction as they reduce carbon emissions compared to traditional diesel-powered equipment. Additionally, lightweight designs using sustainable materials are being adopted to lower fuel consumption and improve efficiency.

Programs such as the Forest Stewardship Council (FSC) and the Programme for the Endorsement of Forest Certification (PEFC) are gaining momentum. These certifications require forestry companies to adopt sustainable harvesting practices. Consequently, there is an increasing demand for forestry machinery that complies with certification requirements, such as machinery that supports selective logging and measures tree density.

MARKET DYNAMICS

Forestry Equipment Market Trends

Increasing Adoption of Automation and Smart Technologies in Forestry Operations to Augment Market Growth

One of the prominent trends in the global forestry equipment market is the rising adoption of automation and smart technologies. With advancements in technology, forestry operations are increasingly incorporating automated systems and digital solutions to enhance efficiency, accuracy, and safety.

Equipment manufacturers are developing machines integrated with GPS technology, remote sensing, and telematics to provide real-time data on operations. These technologies allow operators to monitor machine performance, optimize routes, and track timber yields, reducing downtime and fuel consumption. For example, automated harvesters equipped with sensor-based controls can improve precision in cutting and minimize wood wastage.

Below are some of the company initiatives driving this trend:

John Deere: The company offers forestry machinery equipped with TimberMatic Maps and TimberManager software, enabling real-time tracking of operations. These systems improve productivity by mapping and optimizing routes for harvesting and forwarding.

Komatsu: Komatsu has developed its “Komatsu Forest Machine Control System,” integrating GPS and telematics to ensure precise timber cutting while enabling remote monitoring for predictive maintenance.

Ponsse: Ponsse’s Opti 5G control system combines automation with data analytics, allowing operators to monitor forest density and log classifications in real time, ensuring efficient and sustainable operations.

Market Drivers

Rising Demand for Timber and Wood Products Drive Forestry Machinery Adoption

The growing demand for timber and wood products is one of the most significant drivers of the global forestry machinery market. Timber serves as a critical raw material across multiple industries, including construction, furniture, paper, and packaging. The expanding global population, rapid urbanization, and increased infrastructure development are boosting the demand for wood products, particularly in emerging economies. A report by the World Bank highlights that global timber demand is expected to quadruple by 2050, driven by economic growth and the need for sustainable materials in the construction and energy sectors.

In the construction sector, timber is widely used for structural purposes, flooring, and interior design. Its sustainable nature and eco-friendly appeal have further increased its popularity as an alternative to concrete and steel. Similarly, the furniture industry relies heavily on processed wood due to its aesthetic value, durability, and versatility, driving consistent demand for quality timber.

Additionally, the paper and pulp industry continues to thrive due to growing packaging needs driven by e-commerce expansion and the shift toward recyclable materials. Furthermore, rising interest in renewable energy sources has led to increased utilization of wood pellets and biomass for energy generation, further amplifying the need for timber.

To meet this escalating demand, forestry operations are scaling up, creating a need for efficient, high-capacity forestry machinery. Modern machinery such as harvesters, skidders, and forwarders enables logging companies to optimize their productivity, reduce labor dependency, and ensure sustainable harvesting practices. This trend is expected to continue driving the forestry equipment market growth.

Market Restraints

Deforestation Concerns to Limit Market Growth

Deforestation concerns are a significant restraining factor for the market. Rising environmental awareness and global efforts to combat climate change have brought the adverse effects of deforestation into sharp focus. Large-scale logging activities, driven by the demand for timber and wood products, contribute to habitat destruction, biodiversity loss, and increased carbon emissions. This has prompted governments, environmental organizations, and communities to implement stricter regulations and conservation measures aimed at protecting forests.

International agreements such as the Paris Agreement and initiatives such as the United Nations' Sustainable Development Goals (SDGs) advocate for reducing deforestation and promoting afforestation. In response, many countries have imposed logging restrictions, protected forested areas, and enacted policies to limit deforestation. Such measures reduce the scope of forestry operations, directly impacting the demand for forestry machinery.

Additionally, growing consumer awareness about the environmental impact of deforestation has led to increased demand for certified sustainable wood products. While this trend encourages sustainable practices, it often involves reduced logging volumes, further constraining the use of forestry machinery.

As businesses and governments shift toward reforestation and sustainable forest management, the market for traditional forestry machinery faces challenges. Companies operating in this space are now under pressure to innovate and develop equipment that aligns with sustainable logging practices to remain competitive in an increasingly eco-conscious market.

Market Opportunity

Expansion in Emerging Markets to Create Opportunities

The market is poised to benefit significantly from the expansion in emerging markets. Countries in Asia Pacific, South America, and Africa are experiencing rapid urbanization and infrastructure development, leading to increased demand for timber and wood-based products. This surge in construction activities, coupled with the growing furniture and paper industries in these regions, is driving the need for efficient and modern forestry machinery.

Emerging markets such as India, Brazil, Indonesia, and Vietnam have abundant forest resources, making them key contributors to global timber production. Governments in these regions are actively promoting sustainable forestry practices and investing in infrastructure projects, further supporting the growth of the forestry sector. For example, reforestation programs and incentives for sustainable logging create opportunities for forestry machinery manufacturers to supply advanced machinery tailored to local needs.

Additionally, as mechanization becomes a priority in these markets, there is a growing shift from traditional manual logging methods to modern, high-efficiency equipment. This transition is fueled by the increasing awareness of the benefits of mechanized operations, such as improved productivity, reduced labor costs, and enhanced safety.

Moreover, favorable trade agreements and policies encouraging the export of timber and wood products from these regions also boost the demand for forestry machinery. Manufacturers can capitalize on these opportunities by offering cost-effective, durable, and technologically advanced machinery designed to meet the unique operational challenges of emerging markets.

The combination of abundant natural resources, government support, and industrial growth positions emerging markets as key drivers for the expansion of the forestry machinery market.

SEGMENTATION ANALYSIS

By Equipment Type Insights

Rising Adoption of Felling Equipment in Large-Scale Commercial Forestry Operations to Fuel Market Growth

Based on equipment type, the market is segmented into felling equipment, extracting equipment, on-site processing equipment, and others.

The felling equipment segment emerged as the largest sub-segment, generating USD 4.36 billion in 2026 and accounting for 37.14% share, owing to its increased use in large-scale and commercial forestry operations. Felling equipment is crucial for cutting and handling trees. Additionally, the transformation of the forest sector from manual labor to mechanized operations has significantly increased the demand for felling machinery, which improves efficiency and decreases labor needs.

To know how our report can help streamline your business, Speak to Analyst

The extracting equipment segment is expected to show a moderate growth rate during the forecast period due to the increasing demand for wooden consumer goods in domestic and international markets. The extracting equipment segment holds 27% of the revenue share in the global market in 2025.

By Sales Type Insights

Increasing Focus by Forestry Operators on Replacing Aging Machinery to Boost Adoption of New Forestry Machinery

Based on sales type, the market is divided into used and new.

The new forestry equipment segment is generated USD 7.92 billion in 2026, representing a market share of 67.46% due to the preference for long-term investment by forestry operators, the availability of financing, and government incentives for new equipment. New forestry machinery represents equipment sold directly from manufacturers or authorized dealers. New machinery offers the latest technology and warranty support. In addition, the shifting focus by forestry companies on replacing aging forestry machinery with advanced features and meeting environmental and efficiency standards is expected to further increase the demand for new forestry machinery.

The used forestry machinery held 33% of the market share in 2024, which is a viable option for smaller forestry operators with limited budgets, as these machines are relatively inexpensive compared to the new machines. Used forestry machinery needs a lower initial investment, making it an affordable option in emerging markets.

FORESTRY EQUIPMENT MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Forestry Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America region accounted for the largest market share of USD 3.84 billion in 2025. The market in this region is expected to be driven by construction industry growth, reforestation programs, increasing exports of wood and wood products, and recovery of the pulp and paper industry. Additionally, the expansion of the population and urban areas is expected to sharply increase the consumption of furniture, paper, and packaging. This, in turn, is projected to augment the forestry machinery market growth in the region during the forecast period.

U.S. Set to Show Highest Growth Rate Due to Availability of Massive Woodland

In the U.S., wood is one of the dominant materials used in new home construction due to the availability of massive woodland. Moreover, the U.S. utilizes more forestry products than any other country in the world for furniture, flooring, and paper, along with construction. This, in turn, augments the demand for forestry machinery in the region.

The U.S. is projected to have the highest market share of USD 2.95 billion in 2026 and growth rate in the region. The country is the largest producer and consumer of wood, making timber an important industry. According to the U.S. Department of Agriculture, the United States Forest Products sector generates over USD 288 billion annually, which is about 4% of the total U.S. manufacturing GDP.

Asia Pacific

The market in the Asia Pacific region is valued at USD 2.82 billion in 2026, which is majorly driven by factors, such as the growing construction, furniture, and paper sector in nations such as China and India. In addition, countries such as Malaysia and Indonesia are key wood-producing countries globally. This creates a demand for efficient forestry machinery to address the global demand.

China dominates the forestry equipment market in the region. In the last decade, the forestry sector in China has experienced significant changes. Forest coverage and density have increased significantly, leading to a substantial rise in the value of forestry production. Additionally, China has developed a modern industrial framework for the production and distribution of forest products, propelled by market dynamics and institutional forces.

Additionally, the Chinese market size is valued at USD 1.32 billion in 2026, while India stood at USD 0.3 billion in 2026 and Japan market was approximated at USD 0.16 billion in 2026.

Europe

The major determining factors in Europe are technological advancements in forestry machinery manufacturing, expanding forest areas, and skilled labor shortages. Europe region holds the second-largest market value at USD 3.06 billion in 2025, with a CAGR of 2.63% during the forecast timeframe.

In 2022, it was estimated that the European Union (EU) had around 160 million hectares of forests, which accounted for 39% of its total land area. This marked a notable increase of 5.5% since the year 2000. The total timber stock in the EU was recorded at 28.6 billion m³, primarily contributed by Germany (13.2%), Sweden (12.6%), and France (11.8%). The growth in timber stock from 2000 to 2022 was largely a result of forest area expansion through afforestation and natural reforestation efforts. Additionally, the skilled labor shortages in the EU led to the high adoption of mechanized equipment to maintain productivity and meet the demand.

Additionally, the U.K. market size is valued at USD 0.21 billion in 2025, while Germany stood at USD 0.90 billion in 2025 and France market was approximated at USD 0.35 billion in 2025.

Middle East & Africa

The Middle East & Africa market was valued at USD 0.71 billion in 2025 and increased to USD 0.72 billion in 2026, representing 6.20% of the global market share in 2025. The Middle East & Africa market growth is largely fueled by rapid urbanization, infrastructure development, and investment in commercial plantations. South Africa is projected to have the highest market share and growth rate in the region. Commercial forestry represents an important component of the South African economy, and forest managers are required to maintain forest productivity.

Timber producers in South Africa include large growers, such as the government, around 1,300 medium-scale commercial timber farmers, and over 25,000 small-scale timber growers.

The growth in GCC accounted for USD 0.09 billion in 2025 is limited due to the restricted natural forests and high reliance on imported timber. Extreme temperatures restrict traditional forestry operations in GCC, limiting equipment demand.

South America

The growth in the South American region is valued at a whopping USD 1.05 billion in 2025, and attributed mainly to the increasing export of timber and wood products, the increasing number of plantation areas, and the economic development of the region.

Brazil is expected to dominate the region with the highest market share and growth rate. Brazil's forested areas comprise roughly 58.5% of its total land, covering around 497,962,509 hectares. In the year 2021, Brazil produced 8.2 million cubic meters of wood products. Since 2015, the nation has been increasing its presence in the global market, exporting over 3.2 million cubic meters of lumbers in 2021. Throughout the past ten years, exports have shown positive growth, reflecting an increase in the volumes shipped. Hence, the forestry machinery is crucial for the economic and social advancement of various regions within the country.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focused on Strengthening their Market Position with Continuous Developments

The leading players, such as Deere & Company, Komatsu Ltd., Caterpillar Inc., Hitachi Construction Machinery Co., Ltd., and Ponsse Oyj, dominate the market.

These players' dominance is largely due to their robust Research and Development (R&D) investment, strategic partnerships, and expansion of their dealer network, which strengthens their presence in emerging markets while maintaining strong customer support worldwide.

Major players increasingly focus on mergers & acquisitions to improve their position in specific regions, especially in North America and Europe. For instance,

- In June 2022, Komatsu Ltd. announced the acquisition of Bracke Forest AB, a Swedish company that manufactures and sells attachments for silviculture. Through this acquisition, Komatsu planned to include Bracke’s technologies in the planting field to accelerate the forestry mechanization in all processes other than forwarding and harvesting.

Major Players in the Global Forestry Equipment Market

To know how our report can help streamline your business, Speak to Analyst

List of Key Companies Studied:

- Caterpillar Inc. (U.S.)

- Deere & Company (U.S.)

- Hitachi Construction Machinery Co. Ltd. (Japan)

- Husqvarna Group (Sweden)

- J.C. Bamford Excavators Limited (U.K.)

- Komatsu Ltd. (Japan)

- Ponsse Oyj (Finland)

- STIHL HOLDING AG & Co. KG (Germany)

- Tigercat International Inc. (Canada)

- Yantai Lansu Co., Ltd. (China)

- Waratah (Canada)

- Rottne Industri (Sweden)

- Logset Oy (Finland)

- Vermeer Corporation (U.S.)

- MOROOKA Co., Ltd. (Japan)

- MARUYAMA MFg. Co., Inc. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- January 2025: Caterpillar unveiled five next-generation models of Skid Steer Loaders (SSL) and Compact Track Loaders (CTL) aimed at enhancing power, performance, and operator comfort. The new models include the Cat 250, 260, and 270 SSLs and the Cat 275 and 285 CTLs, which feature significant improvements in engine power, lift height, and stability. The redesign incorporates a lower engine placement for better stability and meets Brazil MAR-1 emission standards. Enhanced operator comfort is achieved through a larger cab and advanced technology integration, including high-flow hydraulic options and improved visibility features.

- December 2024: Tigercat launched the LX877 feller buncher, designed for enhanced productivity in timber harvesting. This model features advanced technology that improves operational efficiency and operator comfort. Its robust design allows it to perform effectively in various forestry environments, making it suitable for demanding logging tasks.

- December 2024: Tigercat introduced the 120 winch assist, aimed at improving productivity and safety in steep terrain logging operations. This winch assist system enhances stability and control while working on slopes, allowing operators to tackle challenging environments with greater confidence.

- November 2024: John Deere announced the expansion of its forestry equipment production at the Specialty Products facility in Langley, British Columbia, set to increase the manufacturing of tracked harvesters and feller bunchers. Production of the 900-Series models will begin in late 2024, followed by the 800-Series models in early Spring 2025. This initiative aims to enhance services for North American and global customers while creating new job opportunities at the facility, which currently employs around 100 people.

- November 2024: Tigercat unveiled the 6500 chipper, engineered for high performance in wood chipping applications. This machine is designed to handle large volumes of material efficiently while ensuring operator safety and ease of use. Its robust construction allows it to withstand rigorous forestry conditions.

REPORT COVERAGE

The forestry equipment market report offers qualitative and quantitative insights into the market and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro-economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2025 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 4.1% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion) |

|

|

Segmentation |

By Equipment Type

By Sales Type

By Region

|

|

|

Companies Profiled in the Report |

Caterpillar Inc. (U.S.), Deere & Company (U.S.), Hitachi Construction Machinery Co. Ltd. (Japan), Husqvarna Group (Sweden), J.C. Bamford Excavators Limited (U.K.), Komatsu Ltd. (Japan), Ponsse Oyj (Finland), STIHL HOLDING AG & Co. KG (Germany), Tigercat International Inc. (Canada), and Yantai Lansu Co., Ltd. (China). |

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 11.74 billion in 2026.

In 2034, the market is expected to record a valuation of USD 16.20 billion.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.10% during the forecast period.

The felling equipment segment is expected to lead the market over the forecast period.

The rising demand for timber and wood products is driving forestry equipment market growth.

Caterpillar Inc., Deere & Company, Hitachi Construction Machinery Co. Ltd., Husqvarna Group, J.C. Bamford Excavators Limited, and Komatsu Ltd. are the top companies in this market.

North America is projected to be the largest shareholder during the forecast period due to the growth of the construction industry, reforestation programs, and increasing exports of wood and wood products.

The increasing adoption of automation and smart technologies in forestry operations is fueling the market growth.

Based on sales type, new forestry machinery is projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us