Dental Caries Detectors Market Size, Share & Industry Analysis, By Product Type (Laser Fluorescence Caries Detector and Transillumination Caries Detector), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

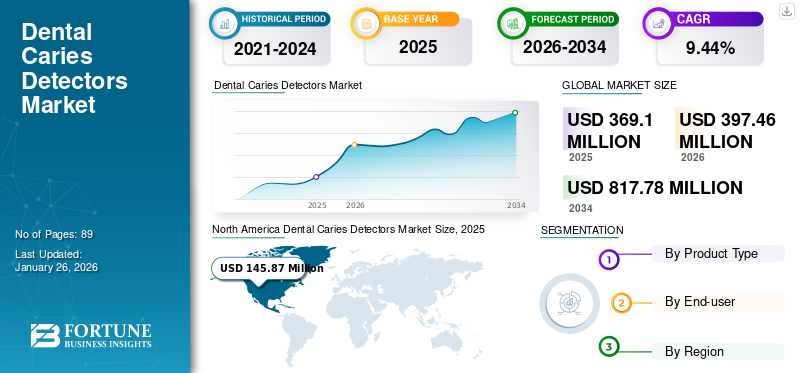

The global dental caries detectors market size was valued at USD 369.1 million in 2025 and is projected to grow from USD 397.46 million in 2026 to USD 817.78 million by 2034, exhibiting a CAGR of 9.44% during the forecast period. North America dominated the dental caries detectors market with a market share of 39.52% in 2025.

Dental caries detectors are devices used by dentists for early examination of cavities. These devices use laser light to detect tiny teeth lesions without causing any radiation harm. It is a safe, pain-free, non-invasive, and sensitive device for detecting tooth decay. The increasing prevalence of oral diseases among children and the elderly population is a major factor driving the growth of the global market. In addition, evolving medical tourism for dental treatment and increasing government initiatives to promote oral health care are other factors projected to drive the global dental caries detectors market growth over the forecast period.

For instance, in October 2022, the Canadian government invested in research activities to improve dental care in Canada. Recently, there has been a rise in the demand for advanced dental diagnostic tools to detect dental caries. Various new technologies have been developed to identify early signs of dental caries. Technologies, such as laser fluorescence, transillumination, Optical Coherence Tomography (OCT), light-emitting diode devices, alternating current impedance spectroscopy, photo-thermal radiometry, Fluorescence Cameras (FCs), and modulated luminescence technology are projected to create several growth opportunities for the market in the future.

The COVID-19 pandemic had a negative impact on the global market owing to the shutdown of dental clinics and decline in dental visits. For instance, according to the data published by the Agency for Healthcare Research and Quality in 2020, approximately 198,000 active dentists and dental specialists shut down their operations in the U.S. Moreover, the decline in dental equipment sales also hampered the global market growth in 2020. For instance, Henry Schein Inc. witnessed a decline of 7.8% in its dental business segment revenue in 2020 compared to the previous year. The decline was mainly attributed to disruptions in the global supply chains, which reduced the demand for dental products.

Global Dental Caries Detectors Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 369.1 million

- 2026 Market Size: USD 397.46 million

- 2034 Forecast Market Size: USD 817.78 million

- CAGR: 9.44% from 2026–2034

Market Share:

- North America dominated the dental caries detectors market with a 39.52% share in 2025, driven by the high adoption of technologically advanced diagnostic devices, a growing prevalence of dental caries, and an increasing number of dental clinics.

- By product type, laser fluorescence caries detectors held the largest share owing to their superior sensitivity, diagnostic accuracy, and growing penetration in developed markets.

Key Country Highlights:

- United States: Rising number of dental practitioners and strong focus on adopting innovative diagnostic technologies in dental clinics are major factors fueling market demand.

- Europe: Increased awareness of oral health and a growing number of new product launches are driving the region's adoption of advanced dental caries detection devices.

- China: Expanding dental care infrastructure and rising demand for non-invasive diagnostic solutions are expected to enhance the adoption of dental caries detectors.

- Japan: A well-established dental healthcare ecosystem and early adoption of precision diagnostic tools are key factors supporting market growth.

Dental Caries Detectors Market Trends

Technological Advancements in Dental Diagnostic Devices to Augment Market Growth

One of the most critical trends witnessed in the global market is the introduction of technologically advanced products. Conventionally, the diagnosis of dental caries has been performed using visual methods and X-ray imaging. However, traditional methods are limited in accurately identifying dental caries. This has created an unmet need for technologically advanced diagnostic devices to diagnose dental caries efficiently. Key players have identified dental professionals' unmet needs and strengthened their R&D programs to develop innovative products. These products are expected to provide effective and quick diagnosis of dental caries based on laser fluorescence and trans-illumination technologies. For instance, in May 2019, Air Techniques, Inc. launched the ScanX Classic View system in the market. It is an advanced digital radiography system that captures intraoral and extraoral images.

In addition, many leading industry players are focusing on the development of AI-based tools for the effective detection and management of dental caries. Therefore, by using the power of machine learning algorithms and image recognition technologies to identify early-stage caries, dental professionals are achieving improved diagnostic accuracy.

- For instance, in October 2023, Denti.AI announced that its Denti.AI Detect, an AI-powered imaging solution, had received clearance from the U.S. FDA. This innovative technology enhances the disease detection capabilities in both intraoral and extraoral dental radiography and automates charting.

Download Free sample to learn more about this report.

Dental Caries Detectors Market Growth Factors

Increasing Prevalence of Dental Caries to Drive Demand for Advanced Diagnostic Devices

One major driver influencing the market growth is the increasing prevalence of dental diseases in the general population due to factors, such as poor dental hygiene, lack of awareness about oral health, and sedentary lifestyle. Dental caries is affecting many people globally, which is anticipated to support the market growth in the future. According to the data published by the WHO Global Oral Health Status Report in March 2023, around 3.5 billion people are affected by oral diseases worldwide. In addition, nearly 2 billion people suffer from caries of permanent teeth, and 514 million children suffer from caries of primary teeth globally. The increasing prevalence of dental caries has created a large patient pool requiring dental diagnosis, which is projected to drive the demand for dental caries detectors in the forthcoming years.

Growing Number of Dental Practitioners to Aid Market Growth

One of the critical factors driving the market growth during the forecast period is the growing number of dental practitioners and clinics globally. For instance, according to data published by the American Dental Association in 2021, the number of dentists per capita in the U.S. is projected to grow by 10.4% between 2020 and 2040. This factor is expected to increase the demand for dental diagnostic equipment, including caries detectors, in the future. In addition, according to a report published by the Indian Dental Association, the number of dental practitioners in India increased from 180,000 in 2012 to 300,000 in 2020. The growing number of dentists in emerging countries, such as India and China will provide favorable conditions for the market growth.

RESTRAINING FACTORS

Availability of Alternative Procedures to Hinder Market Growth

One of the major factors restraining the market's growth is the availability of alternative procedures for diagnosing dental caries. Currently, x-ray imaging, intraoral scanners, and cameras are preferred by dental practitioners over dental caries detectors due to various factors including easy availability, low cost, and rising product awareness.

Moreover, the addition of caries diagnostic tools in commercially available intraoral scanners is being seen as a promising alternative to the established dental diagnostic methods.

Similarly, high-resolution micro-computed tomography serves as a recognized alternative to histology for assessing occlusal and proximal caries lesions, obviating the need for tooth sectioning during investigation. Awareness regarding advanced sensors is common in emerging countries such as China, India, and Brazil. Furthermore, the high cost of these devices has led to lower penetration in the market.

- For instance, KaVo Dental's Diagnodent costs around USD 4,000 in the U.S. Similarly, DEXIS CariVu costs nearly USD 5,000 in the U.S., which makes it unaffordable for small-scale clinics and individual practitioners. Hence, these factors are expected to restrain the market growth in the forecast period.

Dental Caries Detectors Market Segmentation Analysis

By Product Type Analysis

Laser Fluorescence Caries Detector Segment Dominated the Market Owing to the Launch of Technologically Advanced Products

Based on product type, the market is segmented into laser fluorescence caries detector and transillumination caries detector. The laser fluorescence caries detector segment is projected to dominate the dental caries detectors market, accounting for 66.45% of the global market share in 2026. The segment’s dominance is due to the introduction of technologically advanced detectors based on laser fluorescence technology. The dominance of laser fluorescent caries detectors is mainly due to the launch of technologically advanced detectors that are based on the laser fluorescence technology. Among all available methods, laser fluorescence devices offer the highest sensitivity and diagnostic accuracy for early detection of proximal caries. Moreover, the brand presence and penetration of laser fluorescence-based detectors, such as DIAGNOdent (KaVo Dental) are growing in developed countries, such as the U.S., Japan, Germany, France, and Italy. This scenario is anticipated to support the growth of this segment during the forecast period.

The transillumination caries detector segment is anticipated to register a moderate CAGR during the forecast period. The segment’s growth is mainly attributed to the high efficiency and sensitivity of transillumination caries detectors as compared to the other products. This detector has several advantages, such as high-intensity light source, affordability, ease of use, and pain-free diagnosis. DEXIS CariVu, LUMINDEXTM 3, Microlux Dental Caries Detection System, and DOE Transilluminator are some of the major transillumination technology-based brands available in the market.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Accounted for the Highest Dental Caries Detector Market Share in 2024 Due to Large Number of Dental Treatments

Based on end-user, the market is segmented into solo practices, DSO/group practices, and others. The solo practices segment accounted for the highest dental caries detectors market share in 2024 owing to a large number of dentists working independently. Furthermore, increasing number of patients undergoing dental treatment is projected to influence the segment’s growth in the future. The solo practices segment is expected to lead the market by end user, contributing 59.01% globally in 2026.

The DSO/group practices segment is projected to record the fastest CAGR over the forecast period of 2025-2032. The segment’s growth is mainly attributed to the increasing collaborations and partnerships between market players to meet the increasing demand for dental caries detectors and other products.

- For instance, in January 2024, Envista Holdings Corporation announced a partnership with Women in DSO. As part of this partnership, the company will support women in DSO in creating the next generation of female leaders in the dental space and support those already running dental practice groups.

REGIONAL INSIGHTS

Based on region, the global market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

North America Dental Caries Detectors Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 145.87 million in 2025 and USD 154.33 million in 2026. Major factors driving the growth of the North American market are higher adoption of technologically advanced diagnostic devices, growing prevalence of dental caries, rising awareness among healthcare providers regarding advanced devices available in the market, and increasing number of dental clinics in the region. For instance, according to the American Dental Association, as of 2023, there were 202,304 professionally active dentists operating in the U.S. The growing number of dental practitioners in the U.S. is anticipated to encourage the adoption of innovative systems in dental procedures, offering tremendous potential for the market’s growth in the region. The U.S. market reaching USD 146.61 million by 2026.

Europe

Europe held the second-largest share of the market in 2024. Higher awareness of oral health, comparatively higher per capita healthcare expenditure, and new product launches are expected to boost the regional market growth. For instance, according to data published by the OECD Health Statistics in 2021, private dental spending per capita between 2008 and 2019 increased by 55% across European countries. The UK market reaching USD 16.13 million by 2026 and the Germany market reaching USD 35.05 million by 2026.

Asia Pacific

The Asia Pacific market is expected to record a significant CAGR during the forecast period owing to the increased awareness about innovative products among healthcare providers, leading to higher adoption of these devices in dental clinics. The regional market’s growth is further augmented by the rising awareness of oral health among the general population and a growing number of people undergoing early diagnosis. Additionally, increasing dental tourism due to the availability of the best clinics and hospitals across the region will support the regional market growth. These clinics offer an extensive range of dental services, including preventive care, restorative procedures, and cosmetic treatments. The Japan market reaching USD 47.34 million by 2026, the China market reaching USD 12.49 million by 2026, and the India market reaching USD 8.80 million by 2026.

- For instance, as per the data published by Midas Touch in December 2023, India has a well-developed dental care system with the presence of various dental clinics and hospitals across the country. More than 5,000 dental clinics are located in India.

Rest of the World

The Rest of the World holds a comparatively lower share of the global market. There is a limited adoption of dental caries detectors in countries, such as Brazil, Argentina, and Saudi Arabia owing to low awareness among healthcare providers regarding innovative devices and lower per capita healthcare expenditure.

List of Key Companies in Dental Caries Detectors Market

Robust Product Portfolio of Prominent Companies to Help Them Dominate Market

This market is characterized by the presence of leading global and regional players, and the entry of domestic companies with an innovative portfolio of devices. KaVo Dental, Air Techniques Inc., and ACTEON Group are among the leading players in the market with diverse product offerings, strong brand presence, and well-established distribution channels.

These players are focusing on consolidating their market positions through a strong focus on inorganic growth strategies, mergers, and partnerships at the regional and global levels. For instance, in August 2019, KaVo Dental announced a partnership agreement with DKSH to distribute KaVo Dental’s products in Thailand. However, their leadership in the market is challenged by the emergence of domestic players, with cost-effective devices catering to smaller geographical pockets of the global market.

LIST OF KEY COMPANIES PROFILED:

- KaVo Dental (U.S.)

- ACTEON Group (France)

- Dentsply Sirona (U.S.)

- Quantum Dental Technologies Inc. (Canada)

- DentLight Inc. (U.S.)

- Air Techniques, Inc. (U.S.)

- AdDent, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023 - Incisive Technology announced the launch of a new preventive care solution, BlueCheck to detect and monitor dental caries. The solution will be used to increase the accuracy of detecting caries and improve patient care.

- November 2022 - Henry Schein One, Inc. announced a partnership with VideaHealth to launch a new Dentrix Detect AI- X-ray analysis tool. The tool is used to increase the accuracy of detecting caries and improve patient care.

- August 2022 - Pearl announced a collaboration with women in DSO to contribute to the advancement of women in dental support organizations.

- May 2022 - Overjet, the leader in dental AI solutions for payers and providers, announced the U.S. FDA 510(k) clearance for Caries Assist, its AI-powered dental caries detection and outlining software for chairside assistance to enhance patient care.

- April 2021 - GreenMark Biomedical Inc. received regulatory clearance from the U.S. FDA to market its LumiCare Caries Detection Rinse as a 510(k) Class II medical device.

- May 2020 - Ortek Therapeutics, Inc. announced the official commercial launch of the Ortek-ECD in the U.S. The FDA cleared this breakthrough electronic early cavity detection system for professional use only.

REPORT COVERAGE

The global dental caries detectors market research report provides a detailed analysis of the market. The dental caries detectors market report focuses on key aspects such as disease burden – by key region, healthcare overview – selective countries, industry trends – emerging markets to drive growth, competitive landscape, and key mergers, acquisitions & partnerships. Besides this, the report offers insights into the market trends and highlights vital industry dynamics. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the dental caries detectors market forecast in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.44% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is projected to grow from USD 397.46 million in 2026 to USD 817.78 million by 2034, exhibiting a CAGR of 9.44% during the forecast period.

In 2025, the North America market size was valued at USD 145.87 million.

Recording a CAGR of 9.44%, the market will exhibit steady growth during the forecast period of 2026-2034.

Laser fluorescence caries detector segment is the leading segment in this market.

Increasing prevalence of dental caries, growing awareness about dental health, technological advancements in dental caries detectors, and increasing number of dental clinics are the major factors driving the markets growth.

KaVo Dental, Air Techniques Inc., and ACTEON Group are some of the major players in the global market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us