Dental Market Size, Share & Industry Analysis, By Type (Dental Consumables {Dental Restoration Products [Dental Implants and Dental Prosthetics], Orthodontics [Clear Aligners and Conventional Braces], Endodontics, and Others} and Dental Equipment {Dental Radiology Equipment, Dental Lasers, Dental Surgical Navigation Systems, CAD/CAM Equipment, Dental Chairs, and Others}), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

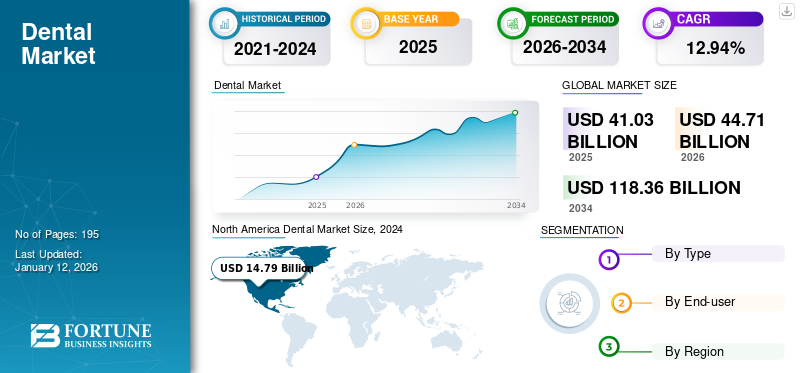

The global dental market size was valued at USD 41.03 billion in 2025. The market is projected to grow from USD 44.71 billion in 2026 to USD 118.36 billion by 2034, exhibiting a CAGR of 12.94% during the forecast period. North America dominated the dental market with a market share of 39.18% in 2025.

The global market comprises instruments and consumables that aid in diagnosing, preventing, and treating various oral diseases, including periodontitis, gum disease, malocclusion, and cavities. Numerous products, such as prosthetics, implants, endodontics, periodontics, and whitening, exist globally. There are innumerable benefits associated with using endodontics and periodontics, including virtually pain-free procedures and affordable costs. These benefits have fueled the adoption of these products in recent years.

The rising prevalence of periodontitis, tooth decay, and malocclusion mainly influences the global dental market growth. The increasing prevalence of such conditions boosts the demand for various products, driving market growth. Moreover, the growing demand for aesthetic dentistry and the increase in product launches by the major companies is expected to enhance market growth during the forecast period.

- For instance, in January 2023, according to the NCBI, the prevalence of chronic periodontitis among the general adult population was reported to be 5.0% to 15.0% globally.

- For instance, in October 2023, ZimVie Inc. announced the launch of Azure Multi-Platform Product Solutions, a complete range of restorative components to cater to the market efficiently.

The COVID-19 pandemic negatively impacted the global market due to the reduced demand for products used in dentistry owing to the lower patient volumes. Prominent players in the market reported a noteworthy decrease in their revenues due to the pandemic. For instance, in 2020, Dentsply Sirona recorded a revenue of USD 3,342.0 million, which was a decrease of 17.1% compared to 2019. However, in 2021 and 2022, the market regained momentum due to the relaxation of regulations imposed by the government. It bounced back patient volume in the U.S. This resulted in the increased demand for several products after the pandemic.

Global Dental Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 41.03 billion

- 2026 Market Size: USD 44.71 billion

- 2034 Forecast Market Size: USD 118.36 billion

- CAGR: 12.94% from 2026–2034

Market Share:

- North America dominated the dental market with a 39.18% share in 2025, driven by the widespread adoption of clear aligners, a high prevalence of periodontal diseases, and the strong presence of established market players.

- By product type, dental consumables are expected to retain the largest market share owing to rising demand for invisible orthodontics, increasing adoption of prosthetics, and a growing focus on aesthetic dental procedures.

Key Country Highlights:

- United States: Growth is fueled by the rising expenditure on oral health, growing adoption of advanced products like intraoral scanners, and increasing patient visits for periodontitis treatment.

- Europe: The demand for orthodontic treatments is rising due to growing awareness of aesthetic dentistry and increased spending on oral care services, influenced by lifestyle shifts post-pandemic.

- China: Advancements in dental implant and orthodontic solutions, along with national initiatives to improve oral healthcare infrastructure, are propelling market adoption.

- Japan: A strong emphasis on technological innovations in dental procedures and increasing focus on aesthetic treatments among the aging population is enhancing market growth.

Dental Market Trends

Increasing Popularity of Invisible Orthodontics to Fuel Market Growth

In treating malocclusions, invisible orthodontics offers numerous benefits over metal braces. These benefits include lesser irritation to gums and cheeks, fewer visits to dentists, customization based on the patient's requirements, and easy removal. Such benefits are expected to boost the adoption of invisible orthodontics in malocclusion treatment. This increasing adoption of invisible orthodontics has inspired key market players to increase the production of clear aligners.

- For instance, Align Technology, Inc. reported that clear aligner volume increased by 54.8% worldwide in 2021 compared to 2020.

- For instance, in August 2020, Institut Straumann AG’s subsidiary, ClearCorrect LLC, expanded its production capacity of orthodontic aligners by 30%.

Such growing adoption of invisible orthodontics, along with the intense focus of key players toward the expansion of production capacity, is anticipated to boost the demand for these products during the forecast period.

Download Free sample to learn more about this report.

Dental Market Growth Factors

Growing Demand for Aesthetic Dentistry to Surge Market Growth

In recent years, rising disposable incomes and growing beauty standards have fueled the demand for aesthetic dentistry. This higher demand has been witnessed among all age groups due to the continuous development of aesthetic products. Individuals highly opt for aesthetic dentistry over conventional dentistry as it provides superior comfort and incredible aesthetics. This increases demand for aesthetic procedures, propelling the market growth.

- For instance, in August 2021, according to an article published by West Hollywood Holistic Dental Care, nearly 15.0 million individuals in the U.S. underwent bridge or crown placement procedures in 2020.

Furthermore, the rise in the patient pool undergoing an extensive range of aesthetic procedures contributes to the growing demand for precise intraoral scanners. As a result, healthcare professionals are increasingly opting for advanced products such as CAD/CAM scanners and other related instruments.

Moreover, most young people, primarily females, are increasingly focusing on enhancing their maxillofacial appearances. This increasing focus leads to a strong demand for aesthetic dentistry, stimulating several prominent players to develop and launch innovative products with an aesthetic application.

- For instance, in September 2023, Align Technology, Inc. introduced the Invisalign Palatal Expander System, intended for rapid expansion and subsequent holding of skeletal and dental narrow maxilla in growing patients, including teenage patients.

Rising Prevalence of Dental Ailments to Boost Market Growth

The rising prevalence of oral diseases, such as periodontal disease, tooth decay, and malocclusion, significantly contributes to the growing adoption and increased demand for an extensive range of prosthetics, implants, and intraoral scanners, driving the market growth.

- For instance, in March 2023, according to the World Health Organization (WHO), severe periodontal diseases were estimated to affect approximately 19.0% of the adult population globally, representing over 1.0 billion cases across the globe.

Furthermore, the growing prevalence leads to an increased demand for early disease detection that can help in planning interceptive and preventive measures, advancing the development of misalignment and other deformities.

Moreover, companies are highly focused on launching various advanced products to treat several ailments, thereby expected to enhance the market growth during the forecast period.

- For instance, Henry Schein, Inc., through its orthodontics business (Henry Schein Orthodontics), launched Studio Pro 4.0, a novel web-based treatment planning software for Reveal Clear Aligners, in December 2021. The launch of such innovative products will increase demand among the workforce.

Such a high prevalence and increasing product launches are anticipated to foster market expansion.

RESTRAINING FACTORS

High Cost and Lack of Adequate Reimbursement for Dental Services to Impede Market Growth

The adoption of dental products is significantly increasing globally due to several advancements by key players. However, the expensive treatment and inadequate reimbursement may considerably constrain market growth, particularly in emerging countries. The expensiveness results in the delay and elimination of treatments, diminishing the usage of consumables to a limited amount.

- For instance, as per the Australian Institute of Health and Welfare, in November 2023, nearly 4 in 10 adults aged 15 and older postponed or avoided visiting a dentist due to high prices.

- For instance, according to the Nuvia Dental Implant Center, the cost of single-tooth implants ranges from USD 3,500 to USD 5,000 in February 2024. In contrast, dentures' cost ranges from USD 600 for each arch to USD 8,000.

- For instance, in January 2023, according to the Blyss. Cosmetic & Restorative Dentistry: The cost of a single dental implant and crown ranges between USD 3,000 and 7,000 in the U.S., which is relatively high.

Furthermore, the reimbursement for these oral services is comparatively lower than other healthcare services. Most financing is done through out-of-pocket spending or private health insurance. Such low reimbursement levels decrease clinic patient visits and treatments, thereby hindering market growth.

Dental Market Segmentation Analysis

By Type Analysis

Dental Consumables Segment Leads Market Share, Fueled by Rising Demand for Invisible Orthodontics

By type, the market is segmented into dental consumables and dental equipment. The dental consumables segment is further sub-segmented into dental restoration products (dental implants and dental prosthetics), orthodontics (clear aligners and conventional braces), endodontics, and others. In contrast, the equipment segment further includes dental radiology equipment, dental lasers, dental surgical navigation systems, CAD/CAM equipment, dental chairs, and others.

The dental consumables segment accounted for the largest dental market share with a share of 81.22% in 2026 and is projected to expand at the fastest CAGR during the forecast period. The rising prevalence of malocclusion coupled with the high demand for invisible orthodontics, most commonly among teenagers and females, are the key factors attributed to the large share of the segment. Such higher adoption of clear aligners encourages key players to launch novel products, increasing availability and accessibility and driving market growth. In addition, the high demand for prosthetics is due to the rising incidence of edentulism and caries, the increasing adoption of conventional braces due to misaligned jaws, and the focus on aesthetic appearances, which is also anticipated to boost segment growth.

- For instance, in February 2022, Bausch Health Companies Inc.’s oral health care business, OraPharma, announced the U.S. launch of the OraFit custom clear aligner system to correct malocclusion.

The equipment segment is estimated to grow substantially in the coming years. This segmental growth is expected to be fueled by increasing technological advancements in equipment. In addition, prominent players in the market are implementing various strategies to expand their product offerings in the equipment segment, thereby contributing to the segment growth over the forecast period.

- For instance, in March 2022, Benco Dental Supply Company partnered with Overjet to offer an FDA-cleared artificial dental intelligence platform to deliver clinical insights precisely to enhance the quality of practice performance and patient care. This collaboration provided accessibility to dentists across the U.S.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment to Dominate the Market Owing to the Growing Number of Dentists Globally

Based on end-user, the market is segmented into solo practices, DSO/group practices, and others.

Among these end-users, the solo practices segment held the largest dental market share with a share of 55.69% in 2026 and is expected to register a noteworthy CAGR during the forecast timeframe. This significant share is primarily attributed to the growing number of dentists, which increases the number of patients undergoing treatment in these settings across the globe. Many dentists working as solo private practitioners provide the highest level of independence possible in dentistry, which is estimated to propel market growth.

- For instance, according to the American Dental Association's Health Policy Institute, as of 2021, 73% of dentists were employed with independent practices.

The DSO/group practices segment is projected to expand at the highest CAGR over the forecast period. The segmental growth is highly attributed to the increased focus of independent dentists on collaborating with large group practices and increased partnerships of DSOs with prominent companies to fulfill the demand for intraoral scanners and other products. Additionally, minimum risks, better reimbursement support, and lack of qualified overhead burden for new dentists in group practices are anticipated to fuel segment growth.

- For instance, in June 2023, according to the American Dental Association Health Policy Institute (HPI) survey, approximately 13.0% of U.S. dentists were affiliated with a dental service organization in 2022.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for the largest market size, with USD 16.08 billion in the global market in 2025. The dominance is attributed to the widespread adoption of products, such as clear aligners, and the presence of established players in the region. In addition, increasing product launches by key players are predicted to surge the market growth in the region. Moreover, many individuals suffering from periodontitis and increasing patient visits have prompted the adoption of these products, which is expected to propel regional market growth. Moreover, growing expenditure on oral health in the U.S. is anticipated to boost the market growth in the region. The U.S. market is valued at USD 16.09 billion by 2026.

- For instance, according to the statistics in Health Affairs, the expenditure on dental care in the U.S. is projected to reach more than USD 203.0 billion by 2027 from USD 142.4 billion in 2020.

Europe

Europe held a substantial market share in 2024 and is projected to witness a notable growth rate over the forecast timeframe. The increase in the number of teenagers and adults undergoing orthodontic treatment, along with other regional procedures and an increase in spending on oral care services, is expected to contribute to the European market growth. The UK market is valued at USD 1.54 billion by 2026, while the Germany market is valued at USD 2.94 billion by 2026.

- For instance, in January 2023, according to a survey by the British Dental Journal, the demand for orthodontic treatment increased among the European population as a manifestation of the 'Zoom boom' effect in May 2021.

Asia Pacific

Asia Pacific is estimated to witness the fastest growth rate from 2025 to 2032. The increasing adoption of implants and orthodontics mainly influences this higher growth rate of the region. Furthermore, increasing investments by key companies and growing public awareness regarding oral health in the region are anticipated to foster market growth. The Japan market is valued at USD 2.07 billion by 2026, the China market is valued at USD 3.14 billion by 2026, and the India market is valued at USD 1.09 billion by 2026.

- For instance, in March 2023, the World Health Organization (WHO) urged the Southeast Asian countries to accelerate the implementation of the region’s new Action Plan for Oral Health 2022–2030, which intends to confirm that each individual in the region can adore the highest possible state of oral health, by achieving universal coverage for oral health by 2030.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are projected to grow considerably due to the high incidence of edentulism, increasing healthcare investments, and the introduction of technologically advanced products coupled with inorganic strategic partnerships by significant firms in these regions.

- For instance, in March 2023, according to the World Health Organization, around 44.0% of individuals in the African region suffered from oral diseases. Over the last three decades, the African region has experienced an increase of more than 257.0 million in oral diseases, including gum diseases, caries, and tooth loss.

List of Top Key Companies in Dental Market

Dentsply Sirona and Align Technology, Inc. with a Wide Range of Advanced Products to Lead the Global Market

Some prominent players in the market include Dentsply Sirona, Align Technology Inc., Institut Straumann AG, ENVISTA HOLDINGS CORPORATION, Align Technology Inc., and Henry Schein, Inc. These companies dominate the global market owing to their diversified portfolio and strong global presence. These key players are further introducing new products and extending the reach of their technologically advanced solutions to penetrate new markets.

- For instance, in December 2023, Dentsply Sirona announced the launch of OSSIX Agile, the innovative pericardium membrane powered by GLYMATRIX to meet all the challenges of bone and soft tissue regeneration. This launch aids in expanding the company’s product portfolio and market reach.

- For instance, in December 2023, Align Technology, Inc. revealed that its Invisalign Palatal Expander System had received an updated medical device license from Health Canada. This updated license will apply to a broad patient pool, including children, teens, and adults, which will aid in penetrating Canada’s market.

Furthermore, 3M, Zimmer Biomet, VATEC, Shofu Inc., Argen Corporation, YENADENT, Coltene, and BIOLASE, Inc. are other significant players operating in the global market. These players increasingly implement strategies and developments such as partnerships, collaborations, acquisitions, and new launches. Moreover, these players' emphasis on expanding their presence in untapped markets is projected to improve their position in the market.

TOP KEY COMPANIES IN DENTAL MARKET:

- 3M (U.S.)

- Institut Straumann AG (Switzerland)

- Henry Schein, Inc. (U.S.)

- Angelalign Technology Inc. (China)

- SHOFU INC. (Japan)

- Dentsply Sirona (U.S.)

- Align Technology, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Coltene (Switzerland)

- BIOLASE, Inc. (U.S.)

- ENVISTA HOLDINGS CORPORATION (U.S.)

- VATECH (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Dentsply Sirona entered into a four-year partnership with the International Association for Disability & Oral Health (iADH) to increase oral care access for people with disabilities.

- January 2024: Align Technology, Inc. announced the launch of iTero Lumina intraoral scanner with a 3X wider field of capture in a 50% smaller and 45% lighter wand to deliver faster scanning speed, superior visualization, higher accuracy, and a more comfortable scanning experience.

- April 2023: Henry Schein, Inc. acquired a majority ownership stake of Biotech Dental S.A.S to add a comprehensive, integrated planning and diagnostic software suite to its digital dental solutions portfolio.

- March 2023: Institut Straumann AG announced the launch of a new software solution for its Virtuo Vivo intra-oral scanner to advance the accuracy and speed of digital impression-taking.

- August 2022: Envista Holdings Corporation extended its commercial partnership with DSO, dentalcorp Holdings Ltd., to increase access to dental implants in Canada through a strong network of dentalcorp Holdings Ltd.

- January 2021: Henry Schein launched Reveal Clear Aligners for individuals looking to enhance their facial aesthetics. This product was designed with patient comfort and aesthetics in mind.

REPORT COVERAGE

The market research report covers industry statistics, such as the estimated number of orthodontists by key countries and the number of dentists by key countries. In addition, the report provides an in depth analysis of the competitive landscape. Moreover, the report focuses on market trends and key industry developments such as mergers, acquisitions, and partnerships. Additionally, it covers the impact of COVID-19 on the market and the industry overview during the pandemic.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.94% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 41.03 billion in 2025 and is projected to reach USD 118.36 billion by 2034.

In 2025, the North American market stood at USD 16.08 billion.

The market is expected to exhibit a CAGR of 12.94% during the forecast period (2026-2034).

The solo practices are set to lead the market by end-user.

The rising prevalence of disorders related to teeth, the increase in the number of dentists per population, the rising demand for aesthetic dentistry, and the growing acquisitions and mergers of major players are the key factors driving the market growth.

Dentsply Sirona, Align Technology Inc., ENVISTA HOLDINGS CORPORATION, and Institut Straumann AG are the top players in the market.

North America dominated the market in 2025.

Growing awareness regarding oral health care among the aging population and innovative product launches are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us