Clear Aligners Market Size, Share & Industry Analysis, By Patient Age Group (Teenager and Adult), By Material (Polyurethane/Co-polyester, Polyethylene Terephthalate Glycol (PETG), and Others), By End-user (Dentist & Orthodontist Owned Practices and Others), and Regional Forecast, 2026-2034

Clear Aligner Market Size Overview

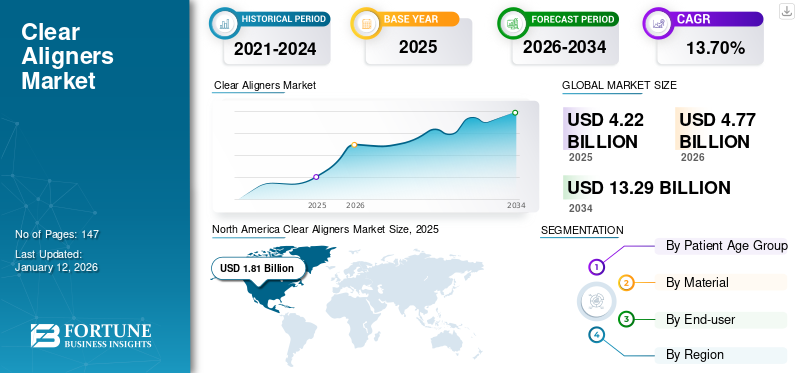

The global clear aligners market size was valued at USD 4.22 billion in 2025. The market is projected to grow from USD 4.77 billion in 2026 to USD 13.29 billion by 2034, exhibiting a CAGR of 13.70% during the forecast period. North america dominated the clear aligners market with a market share of 42.70% in 2025.

Clear aligners are transparent customized trays designed to align teeth. The global market for clear aligners is witnessing growth due to the increasing burden of dental disorders, such as dental malocclusion.

- For instance, as per the data published by J Dent & Oral Disord in 2024, malocclusion is ranked as the 3rd most critical dental health concern and impacts around 39-93% of adolescents and teenagers globally.

Increasing dental expenditure along with the growing awareness regarding these aligners has been fueling the penetration of clear aligners among the population globally.

Market players such as Align Technology, Inc., Institut Straumann AG, and Ormco Corporation have been focusing on partnerships and acquisitions to strengthen their product offerings.

Clear Aligners Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.22 billion

- 2026 Market Size: USD 4.77 billion

- 2034 Forecast Market Size: USD 13.29 billion

- CAGR: 13.70% from 2026–2034

Market Share:

- Leading Region: North America dominated the clear aligners market with a 42.70% share in 2025. This leadership is driven by the strong presence of key players like Align Technology, Inc., high orthodontic treatment awareness, favorable reimbursement policies, and established orthodontic clinics.

- Leading Product Type: Polyurethane/co-polyester materials led the market in 2024, supported by major brands such as Invisalign and Clarity, offering high durability, comfort, and customization in aligner treatments.

Key Country Highlights:

- Japan: Demand is supported by increasing adoption of advanced dental technologies and a growing focus on aesthetic dental treatments.

- United States: Growth is fueled by increasing awareness about dental aesthetics, the burden of dental malocclusion, and initiatives by leading companies such as Align Technology that drive product adoption and innovation.

- China: Rising dental healthcare expenditure and growing orthodontic awareness, along with expansion of multinational players in the region, are accelerating market growth.

- Europe: Market growth is supported by rising adoption of advanced orthodontic technologies and increasing demand among teenagers and adults for aesthetic dental solutions.

Market Dynamics

Market Drivers

Various Advantages Associated with Clear Aligners to Fuel Market Growth

On a global level, the demand for these products over traditional braces has grown due to their favorable outcomes in treating malocclusion. Some of the advantages of clear aligners include better appearance, higher convenience & comfort, and improved customization. In addition, companies are focusing on the development of new products and the enhancement of current product offerings by launching various R&D initiatives.

- In February 2022, Bausch Health Companies Inc. launched the OraFit custom clear aligner system in the U.S., which is intended to correct malocclusion.

In addition, market participants educate orthodontists, dentists, and general practitioners (GPs) on the advantages of these products through training.

- In January 2021, Henry Schein, Inc. completed its joint venture with Casa Schmidt, a comprehensive dental solutions provider in Spain and Portugal. This joint venture helped the company to increase awareness about its products and expand its customer reach.

Growing Number of Adults Seeking Orthodontic Treatments to Amplify Product Demand

The demand for orthodontic treatment has increased significantly among adults due to increasing public awareness regarding the benefits of improved dental health and the availability of advanced treatment options.

Furthermore, the increasing interest in improving aesthetic appearance among adults has further fueled the adoption of orthodontic solutions.

- For instance, as per the study published by the National Center for Biotechnology Information (NCBI) in 2022, 58.6% of adults in the studied population in Saudi Arabia preferred orthodontic treatment.

Market Restraints

Increased Competition from Direct-to-Consumer Companies to Hinder Market Growth

Despite the increasing adoption of these products globally, certain limiting factors are restraining market growth. For instance, many manufacturing companies that operate on a direct-to-consumer (DTC) business model are increasing their presence across the market. In the direct-to-consumer model, patients are not required to visit a doctor. Dental impressions of the patients are either taken at home or the company’s stores or reviewed by orthodontists working remotely. The products are then shipped directly to the patient through mail. This factor is expected to limit the clear aligners market growth.

- For instance, the cost of DTC products is considerably lower than that of the business-to-business (B2B) model followed by key market players. The cost of direct-to-consumer clear aligners fall in the range of USD 1,800-4,000. However, the cost of treatment with these products from companies, such as Align Technology, can be in the USD 3,000-8,000 range.

This difference in price will influence the demand for direct-to-consumer products as they are available at lower prices, leading to a higher adoption rate. This factor will negatively impact the sales of products sold through the B2B channel.

Market Opportunities

Adoption of 3D Printing for Clear Aligner Production to Improve Product Efficiency

Clear aligners have revolutionized the teeth straightening treatment by providing an aesthetically driven treatment modality for patients of all ages. The demand for these products has increased significantly in the past years due to their convenient use. To meet this increasing demand, ongoing research aims to enhance efficiency of aligners by improving their production process.

One such technology includes the usage of 3D printing for aligner production. 3D printing minimizes the dependency on external processing by efficiently integrating 3D scanners, software, and printers, giving orthodontists complete control over the production workflow. This factor eliminates the disadvantages associated with the outsourcing of aligner production, helping to lower cost and shorten lead times. Therefore, the increasing adoption of 3D printing technology for the development of aligners will create opportunities for market growth.

Market Challenges

Clinical Limitations of Clear Aligners Tend to Affect Their Adoption

Aligners may not be quite effective for complex tooth movements such as extrusions, rotations, and root torque, especially in severe malocclusions. These clinical limitations, along with the presence of other alternatives, tend to limit the penetration of aligners among the population.

Clear Aligners Market Trends

Unmet Needs of Patient Population to Augment Market Growth

The growing burden of dental disorders such as malocclusion continues to fuel demand for effective treatment. However, the limited availability of dental treatment service providers and awareness regarding effective treatment options create a gap in the adoption of these effective treatment options.

In order to overcome this gap, many health reforms are being implemented to address the unmet needs of the patient population. Many companies and public institutions, such as government agencies, have undertaken initiatives to fill the gaps in orthodontic treatment through partnerships and policies. For instance, as per the Canadian Government Budget 2023, they planned to build a healthy future for Canadians from coast to coast by investing USD 13.0 billion over five years and USD 4.4 billion ongoing to implement the Canadian Dental Care Plan (CDCP). Such government-led initiatives will support dental care expenditure, leading to a spike in the adoption of dental products, including clear aligners, in the coming years.

Other Trends

- Increasing Adoption of Digital Transformation & AI Integration: Advanced 3D printing, intraoral scanning, and AI-based monitoring tools are streamlining production and improving treatment outcomes. Towards Healthcare reports that AI-powered tools for remote patient tracking have been widely adopted by leading providers.

- Penetration of Direct-to-Consumer Models & Hybrid Dental Clinics: Direct-to-consumer models have been gaining significant attention as these models provide orthodontic treatment to patients from the convenience of their homes.

- Increasing Focus on Innovations in the Aligners Material: Market players have been focusing on using materials for aligner production that are stain-resistant.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Patient Age Group

Increasing Focus on Appearance is Responsible for Adult Segment’s Dominance

By patient age group, the global market is bifurcated into teenager and adult.

The adult segment dominated the market with a share of 74.42% 2026, attributed to the increasing preference of adults to improve their facial aesthetics. Furthermore, the growing burden of dental malocclusions has contributed to the segment’s growth.

The teenager segment is expected to grow at the fastest CAGR during the forecast period. Companies are focusing on educating patients, especially teenagers, about the benefits of treating malocclusion. Furthermore, they are offering training to dentists, general physicians, and orthodontists to provide treatment and promote the adoption of these products among the teenage population.

To know how our report can help streamline your business, Speak to Analyst

By Material

Polyurethane/Co-polyester Segment Led due to Presence of Major Players

By material, the global market is segmented into polyurethane/co-polyester, polyethylene terephthalate glycol (PETG), and others.

The polyurethane/co-polyester dominated the market with a share of 81.76% in 2026. The segment’s dominance is primarily attributed to the presence of major players such as Align Technology and Solventum, offering highest selling brands such as Invisalign and Clarity.

The polyethylene terephthalate glycol (PETG) segment is expected to grow at the fastest CAGR during the forecast period. Improved transparency, mechanical, and optical properties are the features which have been fueling the demand for cleaning aligners made by this material.

By End-user

Dentist & Orthodontist Owned Practices to Dominate Due to their High Preference

On the basis of end-user, the market is segmented into dentist & orthodontist owned practices and others.

The dentist & orthodontist owned practices segment dominated the global market contributing 84.49% globally in 2026 and is expected to continue driving market growth during the forecast period. This is primarily due to the high preference for orthodontists and other trained dental practitioners owing to their strong skills and expertise. Furthermore, a rising number of training sessions undertaken by prominent companies in these settings to enhance awareness of their products is expected to boost its dominance. The availability of highly skilled dentists will also contribute to the growth of this segment.

The others segment includes large hospital settings, which are anticipated to account for a lower market share during the forecast period. This is due to the growing preference of the patient population for private clinics including dentist & orthodontist owned practices due to their timely, comfortable, and easily accessible dental care.

Clear Aligners Market Regional Outlook

On the basis of region, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Clear Aligners Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market value of clear aligners in North America stood at USD 1.81 billion in 2025 and is anticipated to dominate the global market during the forecast period. Strong presence of key market players such as Align Technology, Inc., and Solventum, along with the increasing R&D investments, is responsible for the market’s growth in the region. Other contributing factors include increased demand from orthodontists, the surge in the clientele of GPs, favorable reimbursement policies for dentistry, and the presence of well-established orthodontic clinics. For instance, as per the data published by Align Technology, the utilization rate of Invisalign among North American orthodontists reached 25.9 cases per doctor in Q4 2023.

The market in the U.S. has been growing significantly due to the increasing awareness regarding dental aesthetics and the growing burden of dental malocclusion. The U.S. market is valued at USD 1.91 billion by 2026.

Europe

Europe captured a significant global clear aligners market share of 26.4% in 2025 due to increased awareness and the adoption of advanced technologies for treating misaligned teeth. A growing number of companies are expanding their facilities to manufacture and meet the rising demand for these products, particularly among teenagers. Furthermore, the increasing acceptance of these devices among adults is further supporting market growth across the region.The UK market is valued at USD 0.15 billion by 2026, while the Germany market is valued at USD 0.25 billion by 2026.

Asia Pacific

The clear aligners market in Asia Pacific is estimated to record the highest CAGR, especially in developing countries, such as India and China. Major companies are focusing on establishing their presence in hospitals and orthodontic clinics in the untapped Asian market, as it offers a huge patient populationin India and Japan and increasing awareness regarding the product may further contribute to the region’s strong growth rate. According to an article published in the Journal of Population Therapeutics and Clinical Pharmacology in 2023, a cross-sectional study was conducted among 449 Manipal University College Malaysia (MUCM) medical and dental students. The study found that around 80.7% of students know clear aligners. However, the overall knowledge percentage mean was less than about 48.6%. Such studies help to understand the untapped market potential.The Japan market is valued at USD 0.18 billion by 2026, the China market is valued at USD 0.29 billion by 2026, and the India market is valued at USD 0.13 billion by 2026.

Latin America and the Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to grow substantially during the forecast period. The market growth in these regions is due to the growing urbanization and improvements in healthcare facilities.

Competitive Landscape

Key Industry Players

Market Players Focus on New Product Launches to Expand their Offerings

The market is consolidated, with Align Technology, Inc. maintaining a dominant position. The company's dominance is attributable to the strong and sustained demand for its key Invisalign aligner product portfolio. It is the only clear aligner used to treat several complex dental cases, such as adults and teenagers suffering from immature dentition.

- In January 2024, Align Technology, Inc. completed the acquisition of Cubicure GmbH to support and scale Align’s strategic innovation roadmap and strengthen the Align Digital Platform.

Envista is the second-largest player in the global market due to the strong sales performance of its product, Spark Clear Aligner. The company’s strong focus on upgrading the existing product portfolio and new product launches to expand its offering has been fueling its dominance in this market.

Other market players with a significant presence in the global market include Institut Straumann AG, 3Shape A/S, Dentsply Sirona, and Henry Schein, Inc. These companies are anticipated to increase their market share during the forecast period through strategic initiatives, including new product launches.

List of Key Clear Aligners Companies Profiled

- Align Technology, Inc. (U.S.)

- Solventum (U.S.)

- Institut Straumann AG (Switzerland)

- Envista (U.S.)

- Dentsply Sirona (U.S.)

- Henry Schein, Inc. (U.S.)

- Argen Corporation (U.S.)

- Angel Aligner (China)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Align Technology, Inc. announced the launch of professional and consumer campaigns to increase the adoption of Invisalign treatment in kids and teens.

- September 2024: OrthoFX, an orthodontic solution provider, announced the launch of NiTime aligners in India.

- August 2023: Ormco Corporation (Envista) launched Spark clear aligners release 14, which seamlessly integrates with DEXIS Ios and offers the new Spark approver web.

- July 2023: Angelalign Technology Inc. launched custom-made, clear aligners in the U.S. market.

- This development would help the company expand on a global level.

- May 2023: SmileStories partnered with Clear Correct and brought a concierge service for clear aligner treatments to Australia.

REPORT COVERAGE

The global clear aligners market report provides qualitative and quantitative insights into the market’s forecast and a detailed analysis of the market’s size and growth rate for all possible segments in the market. The report also provides an analysis of the global market’s dynamics and competitive landscape. Various key insights presented in the report are an overview of technological advancements, the prevalence of malocclusion in key countries in 2024, pricing analysis, reimbursement scenario for orthodontic treatments, key recent industry developments such as mergers, acquisitions, and partnerships, new product launches, and brand analysis.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.70% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Age Group

|

|

By Material

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to grow from USD4.77 billion in 2025 to USD 13.29 billion by 2034.

In 2025, North America’s market size stood at USD 1.81 billion.

Recording a CAGR of 13.70%, the market will exhibit steady growth during the forecast period of 2026-2034.

Based on patient age group, the adult segment led the market.

The benefits of clear aligners over traditional metal braces, technological advancements in dental treatment, and increasing focus on developing advanced dental aesthetics are major factors driving market growth.

Align Technology, Inc., Institut Straumann AG, and Envista are some of the major players in the global market.

North America is likely to dominate the market by holding the largest share.

The increasing demand for orthodontic treatment and growing adoption of these products across all age groups are expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us