Orthodontics Market Size, Share & Industry Analysis, By Product Type [Instruments and Supplies {Fixed (By Product {Brackets, Bands & Buccal Tubes, Archwires, and Others}, By Type {Conventional and Custom}) and Removable (Aligners, Retainers, and Others)}], By Age Group (Teens and Adults), By End-user (Dentist & Orthodontist Owned Practices, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

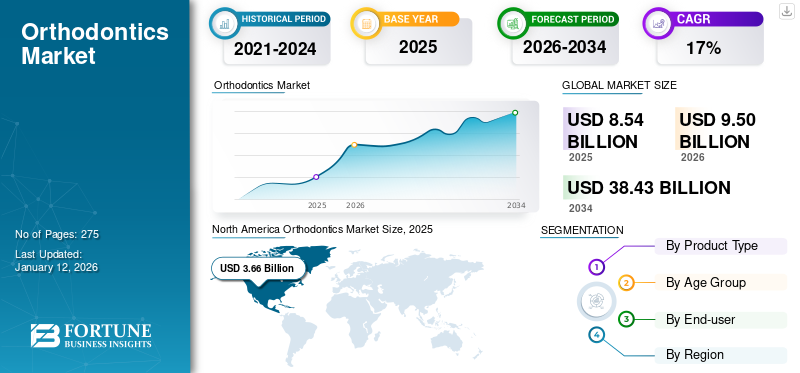

The global orthodontics market size was valued at USD 8.54 billion in 2025. The market is projected to grow from USD 9.50 billion in 2026 to USD 38.43 billion by 2034, exhibiting a CAGR of 19.10% during the forecast period. North America dominated the orthodontics market with a market share of 42.90% in 2025.

Orthodontics is a dental specialty that focuses on straightening the misaligned teeth or malocclusions. It also focuses on the alignment technology, that is, the proper alignment of jaws, known as dentofacial orthopedics. Commonly used orthodontic treatments include the administration of devices, such as traditional braces, clear aligners, retainers, and other appliances that are used to move teeth into their desired positions gradually. Primarily, the increasing demand for dental aesthetics has boosted the market growth. The factors, including increasing prevalence of dental disorders, such as cross-bite, malocclusion, crooked teeth, and bite problems, numerous product launches and technological advancements, among others, further support the product demand.

- For instance, as per the data published in the Journal of Clinical Medicine in January 2023, around 50% of the total population has malocclusions severe enough to require orthodontic care.

The global market has shown robust growth, with projections indicating a continued upward trajectory. Some of the key players operating in the market include Align Technology Inc., Dentsply Sirona, and Institut Straumann AG, among others.

Global Orthodontics Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 8.54 billion

- 2026 Market Size: USD 9.50 billion

- 2034 Forecast Market Size: USD 38.43 billion

- CAGR: 19.10% from 2026–2034

Market Share:

- Region: North America dominated the market with a 42.90% share in 2025. This leadership is driven by a growing number of adults opting for orthodontic procedures, increasing awareness regarding dental aesthetics, and a large patient pool with various dental conditions requiring treatment.

- By Product Type: The Supplies segment accounted for a higher market share. The growth is attributed to the increasing number of new product launches, the growing adoption of clear aligners, and technological advancements such as the development of customized braces.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, the market is driven by a rapidly growing number of dental practices, a high prevalence of dental ailments, and a shifting focus toward the adoption of advanced technologies for treatment.

- United States: The market is fueled by a large patient base, with a strong presence of orthodontists (10,904 in 2023). A significant portion of patients are adults, with one in four patients being 21 years or older, indicating a strong demand for aesthetic solutions.

- China: The market is expanding as part of the high-growth Asia Pacific region. This is supported by the high prevalence of dental ailments and an increasing focus on adopting advanced technologies to meet the rising demand for orthodontic treatments.

- Europe: As the second-largest market, growth is driven by increasing awareness among the general population regarding dental treatments and continuous efforts from market players to enhance treatment accessibility, including new product launches at major international dental shows.

MARKET DYNAMICS

MARKET DRIVERS

Rising Burden of Dental Ailments, Especially Malocclusion Across the Globe to Boost Market Growth

The oral and dental health of an individual is considered a major public health concern globally. The prevalence of dental conditions, such as malocclusions, periodontal diseases, significant tooth loss or decay, and others, is rising among the adult population. Malocclusion is the misalignment of teeth, which is mostly hereditary but is sometimes caused by certain diseases, such as jaw tumors and other dental issues. It can also be caused due to facial injuries and childhood habits, such as thumb sucking. Dental malocclusion is characterized as a morphological variation that may not be associated with other diseases and pathological conditions.

The high prevalence of dental malocclusion across the globe is one of the major factors driving the global orthodontics market growth. An increase in several patients suffering from osteogenesis imperfecta is expected to increase the prevalence of malocclusion globally, as the prevalence is higher in patients suffering from genetic disorders, such as osteogenesis imperfecta.

- For Instance, according to an article published by the National Library of Medicine in 2021, the estimated prevalence of malocclusion in children is 39.0% and adolescents are 93.0%, respectively, on a global level.

MARKET RESTRAINTS

Side Effects Associated with Longer Orthodontic Treatment to Limit Market Expansion

One of the factors limiting the market growth includes adverse events associated with long-term orthodontics treatment. The poor execution of the process during orthodontic treatment can cause multiple adverse incidences, such as severe pain, periodontal disease, temporomandibular dysfunction (TMD), and other severe effects. Orthodontic brackets are extensively used among teenagers to correct teeth alignment. Still, the brackets have well-documented disadvantages, such as gum disease, allergic reaction, ankylosis, soft tissue injuries, or canker sores.

The confluence of all the above-mentioned factors is anticipated to hamper the adoption of orthodontic products, which will, in turn, limit market growth.

MARKET OPPORTUNITIES

Unmet Needs of Patient Population Expected to Positively Impact Market Growth

The increasing prevalence of dental disorders, such as malocclusion, cross-bite, crooked teeth, and bite problems, and the high cost of treatment have created a huge gap, resulting in high unmet patient population needs. Several manufacturers and organizations have started taking initiatives to fill these gaps through partnerships, service expansion, and other policies to address the needs of the unmet patient population.

- For instance, in April 2023, Orthodontic Details collaborated with DynaFlex, 3M Oral Care, G&H Orthodontics, Reliance Orthodontic Products, and other orthodontic suppliers with the aim of making ordering supplies easier for practices.

Along with this, increasing government initiatives and rising partnerships among market players to create awareness are expected to provide long-term opportunities for market growth in the future.

MARKET CHALLENGES

High Cost of Orthodontic Treatment to Limit Market Expansion

Even though the market is rapidly growing, certain factors limit the market growth to a certain extent. The high cost of the treatment is one of the factors that hamper the market growth. The cost associated with the treatment, coupled with the long treatment durations, are estimated to limit the market in the coming years.

- For instance, as per the data published in an article in November 2023, in the U.S., the average cost of traditional braces is around USD 6,000. The lingual braces can cost around USD 6,500 to USD 11,500. The lingual and Invisalign braces are comparatively more expensive than standard metal braces.

Thus, such high product cost limits the number of patients undergoing such treatments, in turn hampering the market growth.

Other Challenges

Limited Insurance Coverage

In many regions, orthodontic treatments are not fully covered by insurance, posing financial challenges for patients seeking care. Even though most of the insurance providers cover these treatments, there are certain conditions to this. In some cases, medical insurance covers orthodontic braces only if they are deemed medically necessary.

Workforce Shortages

The orthodontic industry faces staffing and retention challenges, impacting the ability to meet growing patient demand.

Regulatory Hurdles

Navigating the complex regulatory landscape for medical devices and treatments can delay product launches and market entry.

ORTHODONTICS MARKET TRENDS

Rising Adoption of Technologically Advanced Tools Identified as the Significant Market Trends

The increasing adoption of digital tools, such as artificial intelligence (AI) and 3D printing in this field, is one of the trends emerging in the market. Artificial intelligence has undergone remarkable advancements since its inception and has an extensive range of problem-solving abilities that can be applied in orthodontics. A prominent trend in the market is the utilization of digital tools, including machine learning (ML) and artificial intelligence (AI), for diagnosis and treatment.

- For instance, in April 2023, LuxCreo, a company specializing in 3D-printed clear dental appliances, announced the introduction of the LuxAlign end-to-end workflow for 3D-printed clear aligners. The product launch included iLux Pro Dental, LuxAlign design software, iLuxCure Pro, Direct Clear Aligner Material (DCA), and LuxScale.

Thus, the advancements in 3D printed braces and clear aligners incorporating ML and AI have resulted in enhanced efficiency in treatment planning and outcomes, in turn driving the overall market growth. This is, hence, identified as an important global orthodontics market trend.

Download Free sample to learn more about this report.

Other Trends

Increasing Adult Patient Base

There is a notable rise in the number of adult patients seeking orthodontic treatments, driven by the desire for improved dental aesthetics and the availability of discreet treatment options, such as clear aligners.

- For instance, according to the data published by the American Association of Orthodontists, 25% of the total patients undergoing orthodontic treatment are aged 21 years or more. That means 1 in 4 patients is adults.

Direct-to-Consumer (DTC) Aligners

The emergence of DTC aligner kits offers consumers orthodontic solutions without traditional in-office visits, appealing to those seeking cost-effective and convenient treatments. However, this trend has sparked debates regarding treatment quality and outcomes. Operating players have undertaken various strategies to maintain their market presence.

- For instance, in January 2021, Dentsply Sirona acquired the company Byte. It is one of the leading direct-to-consumer, doctor-directed clear aligner companies.

Focus on Aesthetics

An increasing emphasis on dental aesthetics has led to a surge in demand for orthodontic treatments that offer both functional correction and cosmetic enhancement. Individuals have tended to prefer clear aligners over conventional wire braces due to the superior comfort and greater degree of aesthetics.

IMPACT OF COVID-19

The outbreak of the COVID-19 pandemic negatively impacted the global market. Leading players also witnessed a decline in their revenues amid the pandemic. This was majorly due to the lockdown measures, travel restrictions, and temporary closures of orthodontic clinics. However, the market witnessed a significant rebound due to the increased adoption of digital tools or tele-dentistry. This resulted in the growing adoption of orthodontic products, especially at-home orthodontic products, during the pandemic, and the growth is expected to continue over projected years.

With the case volume returning to pre-pandemic levels, the market is anticipated to witness notable growth in the near future.

Segmentation Analysis

By Product Type

Widespread Adoption of Clear Aligners Supported the Dominance of Supplies Segment

Based on product type, the market is classified into supplies and instruments.

The supplies segment is further studied across fixed supplies and removable supplies. The removable segment is further divided into aligners, retainers, and others. Also, the fixed segment is categorized into brackets, bands & buccal tubes, archwires, and others. Furthermore, the fixed segment can be categorized into conventional and custom. The segment dominated the market with a share of 98.21% in 2026.

The supplies segment accounted for a higher global orthodontics market share in 2025. Key factors contributing to the growth of the segment include increasing new product launches, growing adoption of clear aligners, and technological advancements, such as customized braces, among others. Furthermore, collaboration between healthcare providers and manufacturers is anticipated to increase the demand for clear aligners and the launch of advanced products in the market.

• For instance, in July 2023, Angelalign Technology introduced its custom-made clear aligners to strengthen its presence in the U.S. market.

On the other hand, the instruments segment is expected to witness steady growth in the coming years. These are the tools used by orthodontists during procedures. An increase in the number of clinical visits and teeth aligning procedures in emerging countries, such as India and Australia, is expected to boost the segment growth in the projected years.

To know how our report can help streamline your business, Speak to Analyst

By Age Group

Growing Shift towards Orthodontic Treatments Boosted Adults Segment Growth

Based on age group, the market is divided into adults and teens.

The adults segment captured the major share in 2024. This dominance can be ascribed to the factors, such as the growing adult population looking for daily dental care, awareness of various treatments, and an increase in the referral of adult patients to orthodontists. The segment is expected to hold 89.68% of the market share in 2026.

- For instance, according to the data provided by Orthodontics Australia, in 2025, out of the total number of orthodontics patients in the country, 30% are adults.

In contrast, the teens segment is also poised to witness significant growth throughout the forecast period. Teens are traditionally the primary recipients of orthodontic care. Prevalence of misaligned teeth, jawbone issues, crooked teeth, and other dental issues are common among the teenage population. Whereas malocclusion’s early detection in teens also increased the adoption of clear aligners and orthodontic products. Hence, the segment is growing globally. This segment is likely grow with a considerable CAGR of 17.2% during the forecast period (2026-2034).

By End-user

High Patient Flow for Orthodontics in Dentist & Orthodontist Owned Practices to Boost Segment Growth

Based on end-user, the market is studied across dentist & orthodontist owned practices, and others.

The dentist & orthodontist owned practices segment dominated the global market with the highest share in 2025. The increasing number of dental clinics and the globally growing patient population visiting dentist & orthodontist-owned practices are boosting the demand for teeth-aligning products. Additionally, the easy availability of custom aligners in the clinics and partnerships among manufacturers and service providers further boosted the segment growth. This segment is anticipated to attain 89.5% of the market share in 2026.

- For instance, in December 2021, Dentsply Sirona partnered with Wrights to promote SureSmile as their Clear Aligner in the U.K. This partnership aimed to provide more opportunities for dental practitioners to learn about the SureSmile system, which will benefit their practice and patients.

On the other hand, the others segment is expected to grow considerably in the near future. The emergence of multispecialty hospitals & dental clinics, improvement in reimbursement & dental coverage, and an increase in the number of people adopting dental coverage are likely to boost the segment growth. The other segment is expected to grow with a substantial CAGR of 15.4% during the forecast period (2025-2032).

Orthodontics Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Orthodontics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America generated a revenue of USD 3.66 billion in 2025 and USD 3.66 billion in 2026, in turn dominating the global market with highest share. The key factors contributing to the regional dominance include the growing number of adult individuals opting for orthodontic procedures, especially clear aligners, increasing awareness regarding dental care & dental aesthetics, and the presence of a large patient pool with various dental conditions requiring treatment.

The U.S. held the largest proportion of North America, with a valuation of USD 3.25 billion in 2025. The growth is attributed to the strong presence of orthodontists in the region. For instance, as per the data published by the American Dental Association in 2023, the total number of orthodontists in the country was 10,904. California, New York, and Texas were some of the states with high concentrations of orthodontists. The U.S. market is set to be worth USD 3.53 billion in 2026.

Additionally, the increased number of advanced product launches in the region is anticipated to drive market growth.

- In July 2024, Align Technology Inc. launched the iTero Design Suite to facilitate designs for the 3D printing of models, bite splints, and restorations in practice.

Europe

Europe is the third leading region poised to hold USD 2.23 billion in 2026. The European market is anticipated to witness notable growth in the near future. Factors, such as growing awareness among the general population regarding dental treatments and increasing efforts from various market players to enhance orthodontic treatment accessibility, among others, have majorly driven the European market growth. The U.K. market is estimated to reach USD 0.30 billion in 2026.

- For instance, In March 2023, Institut Straumann AG announced the launch of a series of new dental solutions at the largest international dental show in Cologne.

Germany is foreseen to be valued at USD 0.46 billion in 2026, while France is set to be worth USD 0.33 billion in the same year.

Asia Pacific

Asia Pacific is the second largest market anticipated to hold USD 2.45 billion in 2026. Likewise, the region is poised to witness the highest CAGR during the forecast period. The rapidly growing number of dental practices, high prevalence of dental ailments, and shifting focus toward the adoption of advanced technologies are some of the prominent factors driving the regional market growth. Additionally, strategic initiatives undertaken by operating players in the market further support the regional market growth. The market in China is expanding and is set to reach USD 0.74 billion in 2026.

- In March 2023, Align Technology, Inc. opened the Align Innovation Centre (AIC) in Hyderabad, India. With this, the company aims to develop its Align Digital Platform further.

India is poised to reach a market value of USD 0.39 billion in 2026, while Japan is anticipated to be valued at USD 0.46 billion in the same year.

Rest of the World

The market in the rest of the world region is expected to witness considerable growth in the near future. The increasing patient population opting for dental aesthetic procedures, coupled with growing collaborations between domestic and international players, have supplemented the market growth in these countries.

- For instance, in May 2022, A.B. Dental Devices Ltd. strategically partnered with TRUCARE to launch its dental products in UAE dental market.

COMPETITIVE LANDSCAPE

Key Industry Players

Widespread Adoption of Products Offered by Key Companies Resulted in their Dominating Positions in the Market

The market comprises several key players contributing to its growth and innovation, such as Align Technology, Inc., Ormco Corporation, and 3M, accounting for a significant market share.

Align Technology, Inc. held the dominating market share in 2024. The dominance of the company can be attributed to the company’s strong focus on the expansion of its brand presence through various strategic initiatives, such as collaboration, acquisitions, and others. The company is well-known for its Invisalign system, a leading clear aligner solution available in the market.

- For instance, in January 2024, Align Technology, Inc. announced the acquisition of Cubicure GmbH. The acquired company is an innovator of direct 3D printing solutions for polymer additive manufacturing.

On the other hand, Ormco Corporation (Envista Holdings Corporation) and Institut Straumann AG accounted for a notable share of the 2024 global market. The company’s strong focus on the development of digital platforms to streamline the production of clear aligners has been supporting its presence in the market. Ormco Corporation offers a comprehensive range of orthodontic products, including the Spark Clear Aligner System, whereas Institut Straumann AG provides orthodontic solutions alongside its dental implant offerings.

- In September 2024, Institut Straumann AG introduced SIRIOS – a new intraoral scanner in the market. This strengthened the company’s presence in digital dentistry.

Additionally, Dentsply Sirona, 3M (Solventum), and Henry Schein Inc. are among the other prominent players in the market. Focus on significant investments in the research & development of innovative products has supported the companies’ share in the market.

- For instance, in May 2021, Henry Schein launched Reveal Clear Aligners for patients looking to enhance their facial aesthetics.

LIST OF KEY ORTHODONTICS COMPANIES PROFILED

- Dentsply Sirona (U.S.)

- AMERICAN ORTHODONTICS (U.S.)

- Institut Straumann AG (Switzerland)

- Align Technology, Inc. (U.S.)

- Solventum (U.S.)

- Henry Schein, Inc. (U.S.)

- DB Orthodontics (U.S.)

- ENVISTA HOLDINGS CORPORATION (U.S.)

- Angelalign Technology Inc. (China)

- TP Orthodontics, Inc. (U.S.)

- BRACES ON DEMAND (U.S.)

- LightForce (U.S.)

- Candid Care Co. (U.S.)

- KLOwen (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: The International Orthodontics Foundation and ADA Forsyth Institute collaborated to boost global innovation in the this space.

- August 2024: Angelalign Technology Inc. signed a strategic collaboration agreement with The Lubrizol Corporation to support innovations in clear aligners’ market space.

- January 2024: Henry Schein, Inc. introduced the Carriere Motion Pro bite corrector, designed to treat Class II and Class III occlusions, aiming to reduce orthodontic treatment time.

- December 2023: BRACES ON DEMAND announced a collaboration with EasyRx to help orthodontic practices gain significant workflow efficiencies. The company is involved in 3D printing and digital imaging to provide custom braces.

- November 2023: Vivos Therapeutics, Inc. announced its strategic agreement with Ormco and its product, Spark Clear Aligners. This partnership aimed to improve treatment time by integrating IVOS CARE devices with Spark Aligners.

- February 2023: Koninklijke Philips N.V. partnered with Candid Care Co. to provide an extended range of integrated oral healthcare products, including orthodontic treatments and teeth whitening solutions.

REPORT COVERAGE

The global orthodontics market analysis provides a detailed competitive landscape of the market. It offers information on the prevalence of malocclusion and key industry developments such as partnerships, mergers, and acquisitions. Additionally, it focuses on key points such as new product launches in the market. Furthermore, this report covers the regional analysis of different segments, profiles of key market players, the latest market trends, and the impact of COVID-19 on the market. It also consists of quantitative and qualitative insights that have contributed to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.10% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Age Group

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 8.54 billion in 2025 and is projected to reach USD 38.43 billion by 2034.

In 2025, the market value stood at USD 3.66 billion.

The market is expected to exhibit a CAGR of 19.10% during the forecast period.

The supplies segment led the market by product type.

The key factors driving the market are the increasing burden of teeth malocclusion and a substantial rise in the number of adults seeking treatment.

Align Technology, Inc., Ormco Corporation, and Institut Straumann AG are the top players in the market.

North America dominated the market in 2025.

Increased awareness of dental aesthetics, the launch of technologically superior products, and a surge in the demand for these products in developing markets are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us