U.S. Orthodontics Market Size, Share & Industry Analysis, By Product Type [Instruments and Supplies {Fixed (Brackets, Bands & Buccal Tubes, Archwires, and Others) and Removable (Aligners, Retainers, and Others)}], By Age Group (Teens and Adults), By End-user (Dentist & Orthodontist Owned Practices and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

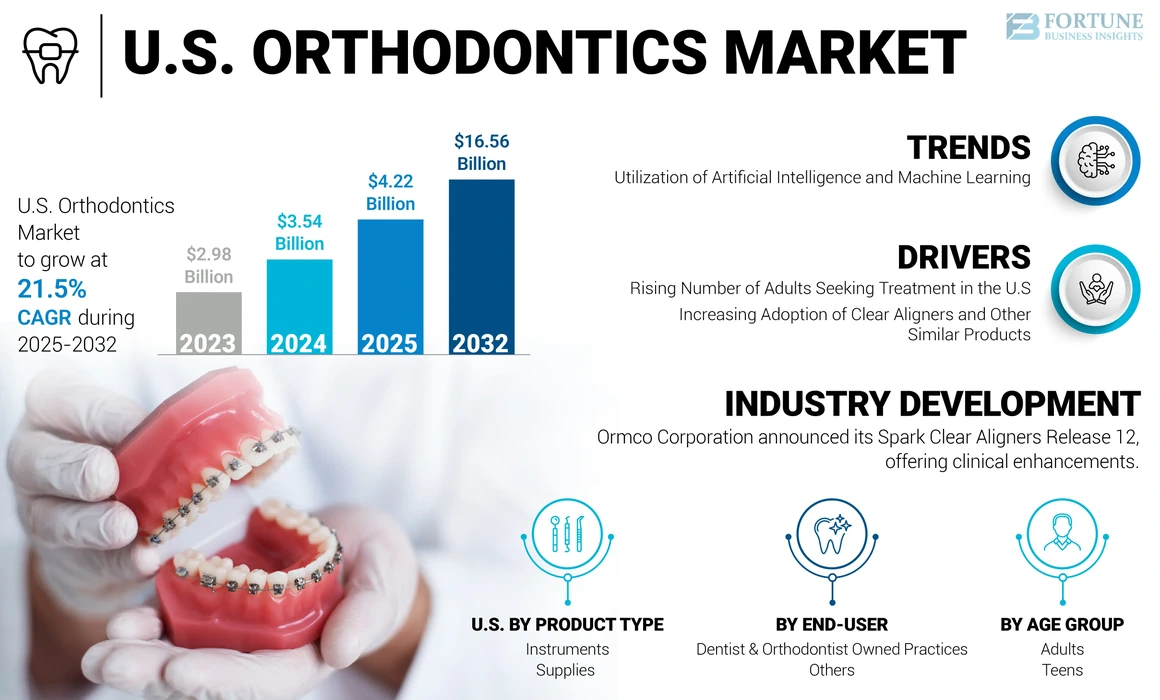

The U.S. orthodontics market size was valued at USD 3.54 billion in 2024. The market is projected to grow from USD 4.22 billion in 2025 to USD 16.56 billion by 2032, exhibiting a CAGR of 21.5% during the forecast period.

Orthodontics aims to enhance both the appearance and function of teeth through the use of mechanical therapy by repositioning them into an optimal alignment. The patient's facial profile, facial balance, and aesthetic concerns are the key factors that determine the alignment. In addition, the orthodontic treatment helps in the management of the various classes of malocclusions. Thus, the rising prevalence of tooth malocclusion and increasing awareness regarding this are the key factors that are anticipated to drive market growth. For instance, according to Humana Inc., an American health insurance company, more than 4 million American individuals wear braces, and 25% of them are adults.

Moreover, the presence of major players with advanced and digital portfolios propels the adoption of teeth alignment procedures across the U.S., which, in turn, results in substantial market growth. The U.S. accounts for most of the orthodontics procedures across the world. In addition, the rapid adoption of advanced dental technologies, including digitalization and 3D printing, is supporting the market growth.

Besides this, advanced product launches, strategic collaborations and acquisitions further propel the growth of the market.

- For instance, in January 2024, Align Technology, Inc. acquired Cubicure GmbH, a pioneer of direct 3D printing solutions for polymer additive manufacturing.

The COVID-19 pandemic reduced the number of teeth alignment procedures in 2020. However, relaxations in the COVID-19-related restrictions increased the demand in the U.S. In addition, teledentistry and digital technologies witnessed significant demand during and after the pandemic.

U.S. Orthodontics Market Trends

Utilization of Artificial Intelligence and Machine Learning to Drive Market Growth

Artificial intelligence plays a crucial role in enhancing orthodontics, particularly aiding orthodontists in making well-informed decisions during treatment planning, including teeth extraction. These advancements in AI and machine learning are anticipated to enhance the efficiency of healthcare professionals and improve treatment outcomes. As a result, there is a growing demand for these technologies as their accuracy during the initial planning stages reduces costs for patients by eliminating additional expenses in later treatment stages, ultimately preventing delays. In addition, AI and ML can help predict the treatment outcome.

Currently, various tools and software have been launched in the U.S. to create 3D models to design clear aligners. Such market developments are anticipated to further increase the adoption of these products in the U.S. Furthermore, rising strategic initiatives among key players for the utilization of AI and ML for model generation are expected to drive the U.S. orthodontics market growth in the coming years.

- For instance, in June 2021, 3Shape A/S partnered with Dentsply Sirona with an aim to integrate 3Shape TRIOS and Dentsply Sirona’s SureSmile clear aligners for a better 3D model generation for clear aligners.

Therefore, ML and AI are anticipated to significantly drive the demand for these products due to their ability to provide more precise treatment planning.

Download Free sample to learn more about this report.

U.S. Orthodontics Market Growth Factors

Rising Number of Adults Seeking Treatment in the U.S. to Fuel Market Growth

One of the strong driving factors dominating this market is the substantial increase in adults opting for orthodontic treatment in the U.S. The key factors contributing to this include increasing awareness and importance of dental aesthetics among adults.

In addition, there has been a notable rise in the number of adults seeking regular dental check-ups, a growing recognition of the importance of these treatments, and an increase in the number of adult patients being referred to orthodontists, which are expected to drive market expansion in the near future. Furthermore, flexibility in payment options for these treatments in the U.S. is also expected to lead to greater adoption of dental care solutions.

Increasing Adoption of Clear Aligners and Other Similar Products to Drive Market Growth

One of the other critical driving factors behind the market growth in the U.S. includes the strong adoption of invisible products such as clear aligners and clear/ceramic braces. This has resulted in a steadily expanding patient population in the country opting for treatment of malocclusion, as these invisible devices offer greater inconspicuousness than traditional metal braces.

- For instance, Align Technology, Inc.’s Clear Aligner sales volume witnessed an increase of 54.8% in 2021 as compared to 2020.

The market for clear aligners is experiencing a notable surge in activities, including acquisitions, partnerships, the training of new doctors, advancements in technology, and more. These factors are anticipated to play a crucial role in bolstering the growth of the market. Enabled by the rising R&D investments in the development and production of advanced invisible clear aligners incorporating AI models, the market is expected to grow considerably in the forthcoming years.

- For instance, in August 2023, LightForce Orthodontics secured USD 80.0 million in series D funding led By Ally Bridge Group and opened a second digital factory. The company offers customized 3D-printed braces using AI models.

RESTRAINING FACTORS

Less Awareness of Malocclusion and the High Cost of Treatment May Restrain Market Growth

One of the factors impacting the adoption of braces, aligners, and other products in the U.S. is the lack of general awareness of malocclusion and its adverse impact on oral health. Malocclusion may cause difficulties in overall oral hygiene, swallowing, chewing, speech, breathing, and predisposing to oral habits, which can ultimately result in pain and discomfort.

Secondly, the high costs associated with orthodontic treatments and other factors, including lack of dental insurance as well as better reimbursement for certain braces, have further restricted the market’s growth.

- According to a ValuePenguin update in 2023, the average cost of braces in the U.S. can be around USD 6,000. In addition, the cost of clear aligners in the country can be up to USD 8,250. The high price of these products is restricting their adoption among the population.

- Further, as per the data published by CareQuest Institute in September 2023, an estimated 68.5 million adults in the U.S. are not secured with dental insurance.

Such factors are expected to impact the widespread adoption of these devices in the U.S. and are anticipated to constrain market growth during the forecast period.

U.S. Orthodontics Market Segmentation Analysis

By Product Type Analysis

Regulatory Approvals to Boost the Supplies Segment Expansion

Based on product type, the market is classified into instruments and supplies.

The supplies segment is further bifurcated into fixed and removable. The fixed segment is further segmented into brackets, bands & buccal tubes, archwires, and others. The removable segment is further divided into aligners, retainers, and others.

In 2024, the supplies segment dominated the U.S. market. Futuristic and customized product launches and regulatory approvals are the key factors supporting the growth of the segment in the U.S.

- For instance, in April 2023, LuxCreo, Inc. received FDA approval for a digital light processing 3D printing system to produce same-day clear aligners.

In addition, rising demand for clear aligners, technological advancements, and the use of computational approaches to create a treatment model are the other factors that increase the adoption of clear aligners. Along with the advantages, the growing focus on aesthetics across the U.S. boosts the segment growth.

- Similarly, as per an article published in the American Journal of Orthodontics and Dentofacial Orthopedics in July 2023, the demand for clear aligners increased by 91% during the pandemic.

Meanwhile, the instruments segment is likely to grow significantly during the forecast period. The rising prevalence of malocclusions and increasing number of teeth aligning procedures in the U.S. are anticipated to boost segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Age Group Analysis

Rising Awareness of Dental Malocclusion to Propel the Adults Segment Growth

Based on age group, the market is segmented into teens and adults. The adults segment dominated the market in 2024 and is anticipated to maintain its dominance throughout the forecast period. The growth of the segment can be attributed to increasing awareness of dental malocclusion amongst adults and the increasing demand for orthodontics in relation to aesthetic needs in adult orthodontic patients.

On the other hand, the teens segment also accounted for a significant share of the U.S. market. The increasing prevalence of dental malocclusion and higher compliance with the treatment in teenagers boost the growth of the segment.

- For instance, according to Burke & Redford Orthodontists, out of the 2.0 million people undergoing orthodontic treatment every year in the U.S., half of them are teenagers, i.e. 50% of people having braces are between the ages of 13 and 19.

In addition, various initiatives by the market players to treat teens and mild to moderate malocclusion are anticipated to propel the segment’s growth over projected years.

- For instance, in March 2023, 3M launched a campaign to help orthodontists attract Generation Z patients by re-creating a trend involving vibrant elastics used in conjunction with APC Flash Free braces.

By End-user Analysis

Dentist & Orthodontist Owned Practices Segment to Register the Largest Share Due to the Presence of a Large Number of Practitioners

Based on end-user, the market is segmented into dentist & orthodontist owned practices and others.

The dentist & orthodontist owned practices segment held the largest U.S. orthodontics market share in 2024 and is anticipated to dominate the market over the study period. The key factors, including numerous private orthodontists owned practices and an increase in the number of group practices that offer dental restoration services, are expected to propel the segment growth.

The others segment is expected to grow at a significant CAGR during the forecast period. The others segment include Dental Service Organizations (DSOs), teledentistry, and direct to customer. Rapid growth in teledentistry, remote monitoring, and digital orthodontics tools is poised to increase the segment growth over the study period. In addition, growth in the DSO affiliation in the U.S. is set to propel the segment growth.

- According to study results published by Virginia Commonwealth University in February 2023, around 60% of American orthodontists are using teledentistry for treatment and monitoring.

Key Industry Players

Strong Product Portfolio of Leading Players to Aid Their Market Dominance

The U.S. market has a huge number of players including both large multinational corporations as well as smaller regional companies. In 2023, Align Technology, Inc., 3M, and Henry Schein, Inc. were the leading organizations in the U.S. market, holding a significant share of revenue. The key factors supporting the dominance of these companies include a strong focus on innovative product launches, higher adoption of advanced digital technologies, and the presence of custom-made products in the portfolio.

- For instance, in March 2022, Align Technology, Inc. launched new Invisalign system innovations for restorative and orthodontic dental treatment, integrating CBCT into its ClinCheck treatment planning software.

On the other hand, regional players, including American Orthodontics and DB Orthodontics, are focused on market expansion activities in the U.S. and other strategic initiatives such as collaborations & partnerships. These factors are contributing to the growth of these players.

Dentsply Sirona and ENVISTA HOLDINGS CORPORATION (Ormco Corporation) are some of the other prominent players in the U.S. The wider product portfolio of traditional braces and clear aligners and new product launches are the key factors contributing to their growth in the market.

- For instance, in May 2023, ENVISTA HOLDINGS CORPORATION (Ormco Corporation) launched Ultima Hook. The Ultima Hook is engineered to correct maloccluded teeth in conjunction with orthodontic appliances, providing performance and efficiency.

LIST OF TOP U.S. ORTHODONTICS COMPANIES:

- Align Technology, Inc. (U.S.)

- SmileDirectClub, Inc. (U.S.)

- Institut Straumann AG (Switzerland)

- 3M (U.S.)

- Dentsply Sirona (U.S.)

- Henry Schein, Inc. (U.S.)

- ENVISTA HOLDINGS CORPORATION (Ormco Corporation) (U.S.)

- AMERICAN ORTHODONTICS (U.S.)

- DB Orthodontics (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Henry Schein, Inc. launched Carriere Motion Pro bite corrector1 to treat Class II and Class III anteroposterior dimension occlusion before placing brackets or aligners and reducing the treatment time of orthodontics procedures.

- October 2022: Carestream Dental LLC. partnered with Overjet., a U.S.-based dental artificial intelligence company, to provide an AI-powered X-ray analysis tool to detect decay and quantify bone loss.

- July 2022: SheepMedical Ltd. collaborated with Sage Dental to offer the KiyoClear orthodontic aligners system in the clinics of Sage Dental across the U.S.

- February 2022: Ormco Corporation announced its Spark Clear Aligners Release 12, offering clinical enhancements, product optimization, and case-planning improvements

- December 2021: Henry Schein, Inc. launched a new web-based treatment planning software, Studio Pro 4.0 for Reveal Clear Aligners, to achieve predictable outcomes for clear aligner treatment planning.

REPORT COVERAGE

The U.S. orthodontics market research report provides a detailed analysis of the market and focuses on key aspects such as the number of dentists and orthodontists in the U.S., the number of procedures, key industry developments, the impact of COVID-19 on the market, the prevalence of dental malocclusion in the U.S. (2023), pricing analysis, reimbursement scenario, brand analysis, technological developments in dental braces, and key industry developments (mergers, acquisitions, and partnerships). Besides this, it offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the U.S. market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 21.5% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Age Group

|

|

|

By End-user

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 3.54 billion in 2024 and is projected to reach USD 16.56 billion by 2032.

Growing at a CAGR of 21.5%, the market is expected to exhibit steady growth during the forecast period (2025-2032).

By product type, the supplies segment led the market in 2024.

Technological advancements, increased demand for dental aesthetics, and an expanding patient population pool are the major factors driving the market growth.

Align Technology, Inc., 3M, and Henry Schein, Inc. are the major players in the U.S. market.

The development of advanced braces and new product launches are expected to drive product adoption in the U.S. market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us