District Cooling Market Size, Share & Industry Analysis, By Technology (Electric Chillers, Absorption Chillers, and Others), By End-User (Residential, Industrial, and Commercial), and Regional Forecast, 2026-2034

District Cooling Market Size

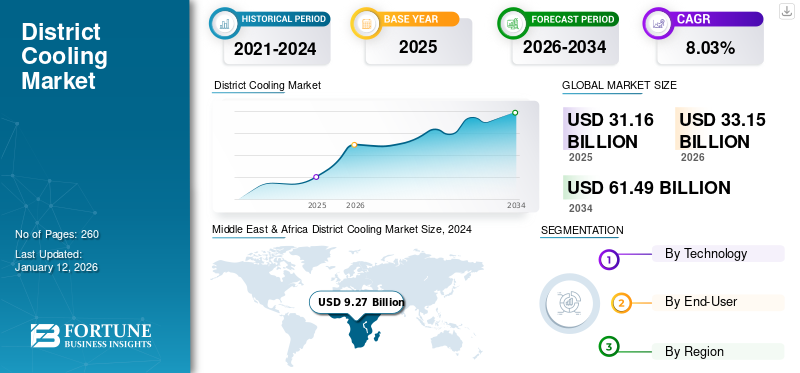

The global district cooling market size was valued at USD 31.16 billion in 2025 and is projected to grow from USD 33.15 billion in 2026 to USD 61.49 billion by 2034, exhibiting a CAGR of 8.03% during the forecast period. Middle East & Africa dominated the global market with a share of 41.52% in 2025. The District Cooling market in the U.S. is projected to grow significantly, reaching an estimated value of USD 9.99 billion by 2032, driven by the rising demand for space cooling applications coupled with renewable energy policies and incentives.

District cooling (DC) is a centralized system used for the distribution of cooling energy. It is majorly utilized for space cooling in apartments, offices, houses, and other areas. Chilled water is distributed via insulated pipes to cool the indoor environment of buildings in an area. Rising awareness of environmental protection and changing manufacturers' preferences from conventional to energy-efficient refrigeration technology are some factors driving the district cooling market growth.

The COVID-19 pandemic had various impacts on the district cooling market, with both short-term disruptions and long-term implications. During the pandemic, many construction projects were temporarily halted or delayed due to lockdowns and supply chain disruptions. This impacted the installation of new district cooling systems and expansion projects.

District Cooling Market Trends

Inclination Toward Sustainability and Energy Efficiency to Drive Market Growth

The increasing demand for electricity drives the district cooling market. In addition, the primary drivers boosting growth are sustainability and energy efficiency. District cooling systems are preferred as they provide a more energy-efficient and sustainable solution for cooling buildings than individual air conditioning systems.

In April 2020, the city utility of Munich, Stadtwerke Muenchen, planned to extend its district cooling networks. Although the city has few cooling centers, with growing demand, Stadtwerke Muenchen is investing around USD 88 million in construction and infrastructure for both generation and required network connections. The plant will deliver clean geothermal district heating to more than 80,000 residents of the city of Munich.

Download Free sample to learn more about this report.

District Cooling Market Growth Factors

Inclination toward Sustainability and Energy-efficiency to Drive Market Growth

The rising requirement for sustainability and energy efficiency in cities and buildings surges the demand as it provides a more energy-efficient and sustainable solution for cooling buildings than conventional air conditioning systems.

For instance, in January 2022, Al Mouj Muscat gave a district cooling concession to Tabreed Oman. This contract presented a chance to improve Al Mouj Muscat’s energy-efficient and high-quality cooling to visitors, residents, and others, guaranteeing optimal temperatures and comfort at all times.

With urbanization and the world population growth, there is a high demand for infrastructure and buildings that have sustainable and energy-efficient designs. Cooling systems utilize centralized cooling plants to cool numerous buildings, which can result in noteworthy energy savings compared to individual air conditioning units. In May 2021, ENGIE South East Asia, one of the leaders in sustainable energy innovation, appointed JTC Corporation to build, own, and operate an underground DC system for the Punggol Digital District in Singapore. It is the first smart business district incorporating community facilities, a national university, and a business park. This project is expected to be finalized in 2024, and ENGIE will operate it for 30 years. This facility will offer the community and business park with reliable, sustainable, and cost-effective air conditioning.

Intense Heatwaves to Augment Demand for District Cooling Systems

In recent years, the world has been experiencing intense heat waves due to drastic environmental changes, so several regions suffer the hot spell. The Middle East & Africa, Asia Pacific, and North America are tackling climate challenges from the heat wave.

As per the World Metrological Organization in 2022, extreme heat that gripped large parts of India and Pakistan was 30 times more likely to be caused by climate change, according to a new rapid attribution study by climate scientists. The heat was prolonged and widespread, accompanied by below-average rainfall, affecting hundreds of millions of people in one of the most densely populated regions of the world.

District cooling is the technology that can offer cooling in multiple buildings at a low cost. Many countries are heavily investing in cooling systems, which will further drive the market.

RESTRAINING FACTORS

Alternative Cooling Technologies to Hinder Market Growth

Several manufacturers and service providers use alternative cooling technologies to deliver a long-lasting cooling experience to multistoried buildings. Technologies, such as Variable Refrigerant Flow (VRF) are one of the fastest-growing technologies in cooling systems. These systems circulate the lowest refrigerant required for each zone to fulfill the building load. This prevents energy waste associated with duct loss. VRF's flexibility and reliability are major factors in hindering the demand for cooling systems. The growing infrastructure and construction activities in the Middle East region will also boost VRF technologies due to the multiple market competitors.

With moderate temperatures, countries, such as the U.S., Canada, China, India, and Mexico are the largest end-users of conventional Air Conditioners (ACs). Residential, commercial buildings, and traditional houses are the dominating end-users for ordinary ACs.

District Cooling Market Segmentation Analysis

By Technology Analysis

Reliable Coefficient of Electric Chillers to Propel Product Demand

Based on technology, the market is segmented into electrical chillers, absorption chillers, and others. The use of various DC technologies can help organizations complete large-scale projects efficiently and on time. Electric chillers and absorption chillers are some of the well-known technologies. However, electric coolers are preferred due to their better coefficient performance. These chillers take up 50% less floor space than absorption chillers, thereby increasing their acceptance.

The technology of absorption chillers helps reduce the use of electrically operated cooling in the energy system and decreases carbon dioxide emissions at the same time.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Commercial Segment Held Dominant Market Share Owing to High Installation of DC Systems in Such Spaces

Based on end-user, the market is segmented into commercial, residential, and industrial. Commercial is the dominating segment in the market with a share of 72.43% in 2026. This system is mainly used in commercial buildings including offices, shops, government buildings, institutions, airports, and organizations. For instance, in 2022, Empower declared the start of operations of the first part of its Zabeel district cooling plant with a production capacity of 27,750 refrigeration tons. The interconnection between the Dubai International Financial Center Plant and the new Zabeel Plant will bring a total production capacity to 112,000 refrigeration tons.

REGIONAL INSIGHTS

Middle East & Africa District Cooling Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global market has been analyzed across five key regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The Middle East & Africa is expected to dominate the district cooling market share owing to the growing commercial & residential sectors and hot climate conditions in the region. For instance, in March 2023, the world's largest district cooling services provider, Emirates Central Cooling Systems Corporation PJSC, inked a contract with Sobha Realty to provide eco-friendly district cooling services to the developer's projects.

In North America, a wide range of policies and programs have been introduced to address energy efficiency in existing and new buildings. According to TERI guidelines for energy efficiency, retrofits of existing buildings result in savings of 20-40% in a building’s energy consumption, increased energy security, reduced emissions of harmful gases, and reduced need for new energy generation and distribution. According to the International District Energy Association (IDEA), nearly 400 systems serve cities and universities across North America. The U.S. market is projected to reach USD 6.37 billion by 2026.

Additionally, the expanding commercial & residential sectors in developing economies, such as China, India, and Southeast Asia, are fueling the requirement for cooling systems. The Germany market is projected to reach USD 0.19 billion by 2026. The Japan market is projected to reach USD 3.19 billion by 2026, the China market is projected to reach USD 3.73 billion by 2026, and the India market is projected to reach USD 0.02 billion by 2026.

Key Industry Players

Key Participants Focus on Increasing Production Capacity Owing to Increasing Demand Globally

ENGIE held the largest market share. ENGIE operates around 320 heating & cooling systems globally and continues to reinforce its presence across the world. Its equity stake in Tabreed, a main player in the Gulf state urban climate control systems market, makes ENGIE the world’s biggest independent player in urban cooling networks. For instance:

- In July 2022, ENGIE, a global energy player, and SIT (Singapore Institute of Technology) announced a partnership to advance district cooling across Southeast Asia. This agreement aims at developing a DC ecosystem in Singapore. It will allow applied research, co-development of curriculum content, reliable learning spaces for SIT students, and knowledge-sharing sessions for the community and industry.

List of Key Companies Profiled:

- Danfoss (Denmark)

- ENGIE (France)

- Tabreed National Central Cooling Company PJSC (UAE)

- Emirates Central Cooling System Corporation (Empower) (UAE)

- Emirates District Cooling LLC (Emicool) (UAE)

- Stellar Energy (U.S.)

- Marafeq Qatar (Qatar)

- Shinryo Corporation (Japan)

- Veolia (France)

- Keppel Corporation Limited (Singapore)

- Ramboll Group (Denmark)

- Vattenfall (Sweden)

- Gas District Cooling (M) Sdn Bhd (Malaysia)

KEY INDUSTRY DEVELOPMENTS:

- In April 2023, Emirates Central Cooling Systems Corporation PJSC, a leading district cooling services provider, started operations of its new DC plant in Dubailand with a capacity of 47,000 refrigeration tons. This plant will cater to the residential community of the Dubai Land Residence Complex (DLRC), one of the prominent residential areas in the city that features several modern facilities including green parks, mosques, libraries, and educational institutes.

- In March 2023, Emirates Central Cooling Systems Corporation PJSC (Empower) signed a contract with Sobha Realty, one of UAE’s leading premium real estate developers, to provide eco-friendly district cooling services to the developer’s new projects, most notably the Sobha Hartland master community with a 17,000 capacity refrigeration tons (RT).

- In August 2022, ENOWA announced a partnership with Japan-headquartered “ITOCHU”, which deals in domestic trading, import/export, and overseas trading of various products, and France’s Veolia to develop a desalination plant powered by renewable energy for district cooling at OXAGON.

- In December 2021, ENGIE and RATP were chosen to run Europe's biggest district cooling network. The two companies will triple the network's size in the coming years by adding 20 new manufacturing plants, 10 new storage facilities, 158 kilometers of distribution lines, and consumers. The arrangement is estimated to generate USD 2.7 billion in revenue over the next two decades and will reduce the emission of 300,000 metric tons of greenhouse gases.

- In June 2021, National Central Cooling Firm (Tabreed) inked an agreement with Miral, an Abu Dhabi-based real estate development, management, and investment company, to offer district cooling services to SeaWorld Abu Dhabi, Miral's marine life theme park on Yas Island.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.03% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Thousand RT) |

|

Segmentation |

By Technology

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was valued at USD 31.16 billion in 2025.

The global market is projected to record a CAGR of 8.03% during the forecast period.

The market size of the Middle East & Africa stood at USD 12.94 billion in 2025.

Based on end-user, the commercial segment holds a dominating share in the global market.

The global market size is expected to reach USD 61.49 billion by 2034.

Inclination toward sustainability and energy efficiency and intense heatwave across the world will augment the demand, thereby fueling the market growth.

Danfoss, ENGIE, and National Central Cooling Company PJSC (Tabreed) are some of the top players actively operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us