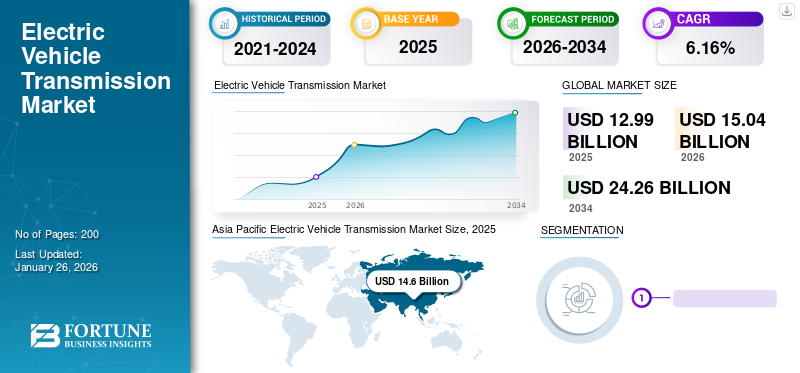

Electric Vehicle (EV) Transmission Market Size, Share & Industry Analysis, By Transmission System (AMT Transmission, CVT Transmission, AT Transmission, and Others), By Transmission Type (Single Speed and Multi-Speed), By Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Hybrid Electric Vehicle) and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

The global electric vehicle (EV) transmission market size was valued at USD 12.99 billion in 2025 and is projected to grow from USD 15.04 billion in 2026 to USD 24.26 billion by 2034, exhibiting a CAGR of 6.16% during the forecast period. Asia Pacific dominated the global market with a share of 54.94% in 2025.

The "electric vehicle transmission market" refers to the segment of the automotive industry that focuses on the development, production, and distribution of transmission systems specifically designed for electric vehicles (EVs). Many electric vehicles, especially those with simpler drivetrains such as rear-wheel-drive or front-wheel-drive configurations, use single-speed transmissions. These transmissions have a fixed gear ratio and do not require shifting gears.

Global Electric Vehicle (EV) Transmission Market Overview

Market Size:

- 2025 Value: USD 12.99 billion

- 2026 Value: USD 15.04 billion

- 2034 Forecast Value: USD 24.26 million, with a CAGR of 6.16% from 2026–2034

Market Share:

- Asia Pacific accounted for the largest market share in 2025, valued at USD 5.85 billion, representing 54.94% of the global market.

- This dominance is attributed to rising EV production in China, India, Japan, and South Korea.

- North America and Europe are also key contributors, with Europe expected to grow significantly due to strict emission norms and increasing EV adoption.

Industry Trends:

- Adoption of single-speed transmissions remains high due to their cost-effectiveness and suitability for most EVs.

- The trend toward multi-speed transmissions is emerging in high-performance EVs and motorsports to improve acceleration and efficiency.

- Use of lightweight materials like aluminum and carbon fiber in transmission design is becoming prominent to enhance overall EV efficiency.

- Automatic Transmissions (AT) dominate the segment due to smoother power delivery and compatibility with electric drivetrains.

Driving Factors:

- Rising demand for zero-emission and fuel-efficient vehicles is a primary growth driver.

- Government initiatives and regulations to curb CO₂ emissions are pushing manufacturers to adopt EVs and related drivetrain innovations.

- Increasing investments in EV production infrastructure, especially in Asia and Europe, are boosting demand for efficient EV transmission systems.

- OEMs are focusing on compact and efficient transmission designs to meet performance expectations while reducing vehicle weight.

Electric vehicles, particularly those with more complex drivetrains such as all-wheel drive or high-performance models, may utilize multi-speed transmissions. These transmissions offer multiple gear ratios to optimize performance, efficiency, or both. Manufacturers are continuously working to improve the efficiency of electric vehicle transmissions to extend driving range and reduce energy consumption.

The outbreak of the COVID-19 pandemic alarmed the global and the European auto industry. According to the Czech Automotive Industry Association, the production factories were partially closed and the demand was projected to drop by as much as 20% in 2020. Many automobile manufacturers were concerned about the fact that this pandemic might halt production processes. The period also recorded a decline in global EV sales.

Electric Vehicle Transmission Market Trends

Downsizing of Transmission System is a Vital Trend

The trend of shifting towards EVs over conventional vehicles is likely to increase over the forecast period owing to their ability to provide zero emission. It will subsequently lead to a rise in the demand for EV transmissions. Additionally, manufacturers of electric vehicle transmission are continuously looking for materials that can reduce the transmission system's total weight without negotiating performance. All these factors are likely to surge the demand for EVs.

Apart from that, efficient use of the power stored in battery packs of EVs is also crucial, which, in turn, has prompted manufacturers to develop unique transmission systems to meet the performances and close tolerances of batteries. For instance, Volkswagen initiated a project on developing super-light cars by reducing its weight by 85 kg with a multi-material approach.

Download Free sample to learn more about this report.

Electric Vehicle Transmission Market Growth Factors

Rising Demand for Fuel-efficient and Low-emission Vehicles to Propel Growth

Gasoline is a fossil fuel. It is not a renewable energy source and is anticipated to be exhausted in the future. EVs do not use gasoline and provide low emission, as compared to conventional vehicles. Gasoline-powered vehicles convert approximately 16%-20% of the energy stored in gasoline to wheels, while EVs convert more than 50% of electric energy from the power source to the wheels.

Also, the demand for fuel-efficient and low-emission vehicles is growing owing to the rising prices of petrol and diesel and stringent emission regulations. All these factors associated with the adoption of EV are expected to increase the electric vehicle (EV) transmission market share. For instance, the scrappage policy introduced in Europe to increase the demand for vehicles would lead to a rise in the adoption of zero CO2 vehicles owing to the implementation of stringent emission regulations in this region.

Increasing Production and Adoption of EVs to Drive Growth

EV have several advantages over fuel-powered vehicles. Owing to this, the demand and production of EVs have greatly increased in recent years. Also, rising investments of EV manufacturers in some regions would boost the market growth. For instance, according to AVERE (The European Association for Electromobility) and the Electric Vehicle Association of Asia Pacific (EVAAP), the investment made by EV automakers to produce electric vehicles together with private companies in Europe was USD 60 billion. In China, it was USD 17 billion. Additionally, the rising stringent emission regulations worldwide to augment the sales and production of EVs would lead to the surging demand for transmission systems.

RESTRAINING FACTORS

High Cost of EVs May Restrain Growth

The cost of EVs is higher as compared to conventional vehicles. The prime reason for this is the usage of expensive raw materials in battery manufacturing and the involvement of costly processes in the production of batteries. There are also many restrictions associated with EV, such as low range of travel anxiety, moderate performance, and lack of charging terminals, which may lead to the lower demand for EV. It will subsequently hamper the growth of this market.

Electric Vehicle Transmission Market Segmentation Analysis

By Transmission System Analysis

AT Transmission Segment to Dominate Market

Based on the transmission system, the market is segmented into AMT transmission, CVT transmission, AT transmission, and others.

The AT transmission segment holds the major share in the global market with a 60.90% in 2026. Various advantages of AT include a smooth riding experience with no gear shift hustle and greater performance.

The AMT transmission segment is also likely to show good and significant growth owing to its dual transmission modes, such as automatic and manual transmission. These transmissions provide the required higher power in manual transmission and the ease of long-distance travel in automatic transmission. The CVT transmission segment is expected to show steady growth during the forecast period due to the declining demand for these transmissions in EVs.

To know how our report can help streamline your business, Speak to Analyst

By Transmission Type Analysis

Single Speed Segment to Hold Largest Share Fueled by Its Ability to Provide Better Performance

Based on the transmission market by type, the market is segmented into single speed and multi-speed.

The transmission type single speed segment accounts for the major share in the global market with a 73.74% in 2026, owing to its better performance with smooth ride experience. It is also used in all battery-powered EVs.

The multi-speed transmissions segment is expected to showcase high growth due to its increasing penetration of EV. It is used in EVs racing activities to empower the electric motor. This factor is also projected to increase the segment's share in this market during the forecast period.

By Vehicle Type Analysis

BEV Segment to Grow Rapidly Stoked by Their Higher Adoption

Based on the vehicle type, the market is segmented into BEV, PHEV, and HEVs.

The BEV segment holds the largest share in the global market. The rising adoption of BEV owing to their various advantages, such as zero-emission vehicles and lower maintenance, would drive the growth of this segment.

Moreover, the PHEV segment is anticipated to establish high growth in the market during the forecast period owing to the rising adoption of PHEV in several developed countries. The HEV segment is also anticipated to show exponential growth due to its rising adoption in Asia with a share of 41.69% in 2026.

REGIONAL INSIGHTS

Asia Pacific

Asia Pacific Electric Vehicle Transmission Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 14.6 billion in 2025. Based on regional analysis, This region holds dominance in the global market and is also expected to show exponential growth in the coming years. The rising production and sales of EVs is a major factor responsible for the growth of this region. China is considered the major contributor to this market due to the rising adoption of mini EVs. The Japan market is valued at USD 1.00 billion by 2026, the China market is valued at USD 6.49 billion by 2026, and the India market is valued at USD 0.13 billion by 2026.

North America

Furthermore, key players such as Tesla are investing in research and development of transmission systems in North America, consequently boosting the market growth in this region. For instance, Tesla introduced an electric truck named SEMI with notable performance in transmission, such as 0-60 mph in five seconds, compared to regular diesel trucks. It takes almost 20 seconds to reach 0-60 mph. The U.S. market is valued at USD 0.90 billion by 2026.

Europe

Europe is likely to show exponential growth owing to the emergence of stringent emission regulations in this region. For instance, the European Union has set a target of 95g CO2 per Km for 2022/2023. Such regulations are set to result in the rising demand for electric vehicle transmission in this region. The UK market is valued at USD 0.58 billion by 2026, and the Germany market is valued at USD 1.79 billion by 2026.

The rest of the world would showcase slow growth in the market due to the automotive industry's partial developments in Latin America and Africa.

List of Key Companies in Electric Vehicle (EV) Transmission Market

Continental AG, ZF Friedrichshafen AG, and AISIN SEIKI CO., LTD. are Top Players

Key players in this market include Dana Limited, ZF Friedrichshafen AG, AVL List GmbH, Continental AG, and Eaton. The majority of them are focusing on expanding their production capabilities to reduce vehicular emissions and lower the carbon footprint of the automotive industry.

For instance, Continental AG has started the mass production of electric powertrains in China, used in electric vehicles from both European and Chinese OEMs. Furthermore, owing to the increasing stringency of emission norms, the company has announced a cease in further investments for parts used in internal combustion (IC) engines signaling the rapid shift in focus towards electrification. Hence, major players' greater focus on R&D activities to develop novel EV technology by major players is set to influence the market's growth.

LIST OF KEY COMPANIES PROFILED:

- Continental AG (Hanover, Germany)

- AISIN SEIKI CO., LTD. (Aichi, Japan)

- ZF Friedrichshafen AG (Friedrichshafen, Germany)

- AVL List GmbH (Graz, Austria)

- BorgWarner Inc. (Michigan, U.S.)

- Allison Transmission Inc. (Indiana, U.S.)

- Dana Limited. (Ohio, U.S.)

- JATCO Ltd (Shizuoka, Japan)

- Schaeffler Technologies AG & Co. KG (Herzogenaurach, Germany)

- Eaton (Dublin, Ireland)

KEY INDUSTRY DEVELOPMENTS:

- In March 2024, Subaru Corporation singed a contract with Aisin Corporation to jointly develop and share production of eAxles 1 for use in battery electric vehicles (BEVs) that Subaru will start producing from the latter half of the 2020s, by combining their knowledge and expertise in vehicle and transmission development.

- In August 2023, Bosch announced that the company is starting volume production of new 800V powertrain systems for electric vehicles at its plant in Hildesheim, Germany. The oil-cooled i-pin bar motor technology, coupled with silicon carbide (SiC) power devices, provides up to 35 percent more power density for the electric motor.

- In October 2022, Bosh announced that the company would invest $260m to expand its electric motor production in Charleston, South Carolina, and convert an area previously used for diesel engines. Demand for the Bosch’s electric motors is being driven by its supply contract with EV maker Rivian.

- In May 2023, Bosh announced that the company has developed machinery, equipment and software to meet the increasing demand for batteries and the recycling of the raw materials they contain, such as lithium, cobalt, and nickel.

- In April 2022, BluE Nexus Corporation signed an agreement with AISIN Corporation and DENSO Corporation to jointly developed an eAxle for Toyota’s new battery electric vehicle (BEV), bZ4X, scheduled to be released on May 12, 2022. BluE’s first eAxle has achieved excellent dynamic performance and downsizing and helps vehicles increase their electric mileage.

REPORT COVERAGE

The global electric vehicle transmission market research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth over recent years.

An Infographic Representation of Electric Vehicle Transmission Market

To get information on various segments, share your queries with us

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.16% over 2026 to 2034 |

|

Unit |

Value (USD Billion) & Volume (Thousand units) |

|

Segmentation |

By Transmission System

|

|

By Transmission Type

|

|

|

By Vehicle Type

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 12.99 billion in 2025.

In 2025, the Asia Pacific market value stood at USD 14.6 billion.

The market is projected to grow at a CAGR of 6.16% over the forecast period (2026-2034).

The AT transmission system segment is expected to lead the market during the forecast period.

The increasing sales and production of EVs is the key factor driving the global market.

Continental AG and ZF Friedrichshafen AG are the major players in the global market.

Asia Pacific dominated the market share in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic