Electric Motor Market Size, Share & Industry Analysis, By Motor Type (Low Voltage (Up to 1 kV), Medium Voltage (1kV-6.6kV), High Voltage (Above 6.6 kV)), By Speed (Regular Speed (Up to 3000 rpm), High Speed (Above 3000 rpm), By Power Rating (Up to 100 KW, 100 to 500 KW, 500 to 1000 KW, 1000 to 1500 KW, 1500 to 2500 KW, 2500 to 3500 KW, 3500 to 4500 KW,4500 KW to 5500 KW, 5500 K-10,000 KW, 10,000-20,000 KW, 20,000-30,000 KW), By Application (Industry Machinery, Power Generation, Oil and Gas, Petrochemicals, and Chemicals), Regional Forecast, 2026-2034

Electric Motor Market Size and Future Outlook

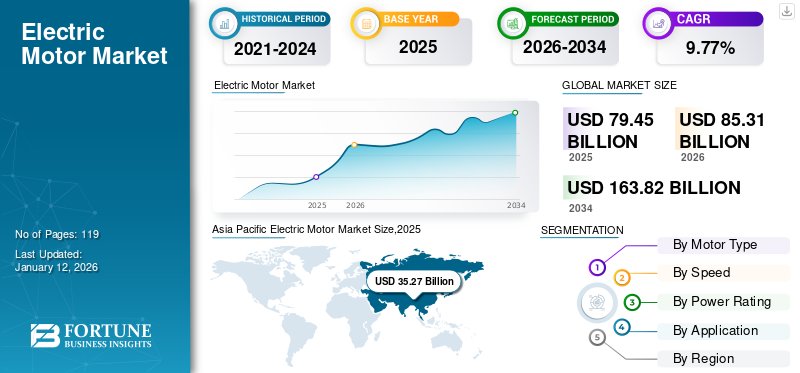

The global electric motor market size was valued at USD 79.45 billion in 2025. The market is projected to grow from USD 85.31 billion in 2026 to USD 163.82 billion by 2034, exhibiting a CAGR of 9.77% during the forecast period. Asia Pacific dominated the global electric motor market with a market share of 44.39% in 2025.

With the increased emphasis on energy-efficient motor solutions, the growth in electric cars on the road, and the industry's adaptation to quick automation, the electric motor sector is thriving. Rising government rules that encourage greater efficiency and lower carbon dioxide emissions in industrial applications are pushing manufacturers to switch to more efficient IE3 and IE4 motors to manage energy usage. Furthermore, the ongoing increase in renewable installations, such as solar trackers and wind turbines, has increased demand for specialized electric motors. Increasing demand for energy-efficient climate control systems is driving consistent expansion in the electric motors industry for the heating, ventilation, and air conditioning (HVAC) segment.

Further factors contributing to the market's growth include increased investments in robotics, HVAC systems, and household appliances, as well as significant infrastructure development and urbanization. In September 2025, ABB India unveiled the IE5, a line of ultra-premium motors that don't use rare earths. Concurrently, it also stated that it would be investing more than USD 15.80 million to improve and modernize its low-voltage motors manufacturing facility in India. The demand for electric motors is increasing due to the expansion of industrial automation, the growth of infrastructure projects, and the adoption of energy-efficient technologies.

Siemens, ABB, and WEG dominate the electric motor market, and they are key companies due to their extensive product portfolios, global manufacturing presence, and strong technological expertise in high-efficiency motor solutions. These companies offer a wide range of AC, DC, servo, and high-voltage motors used across key industries, including manufacturing, oil & gas, chemicals, mining, and transportation.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Growth of Electric Vehicles to Propel Market Growth

The electric motor market growth is driven strongly by the rapid growth of electric vehicles, as every EV relies on one or more advanced traction motors as part of its propulsion system. With worldwide EV sales increasing due to strict emission regulations, tax breaks, and consumer demand for cleaner mobility, the demand for traction motors, such as induction motors, brushless direct current motors (BLDC), and permanent magnet synchronous motors (PMSM), continues to rise. The expansion and demand for the electric vehicle market is thus directly driving the electric motor market, since EVs rely on high-performance motors for energy efficiency and propulsion.

In May 2024, ABB unveiled a new innovative package developed for electric buses, consisting of the AMXE250 motor and the HES580 inverter. This propulsion package combines to offer the industry a superior, more effective, dependable, and accessible alternative, symbolizing a further advancement toward greener and more sustainable modes of transportation.

MARKET RESTRAINTS

High Initial Cost of Premium Efficiency Motors to Restrict Market Expansion

The high initial cost of high-efficiency motors is a significant obstacle to the widespread adoption of next-generation motor technologies. To achieve the IE3, IE4, and IE5 efficiency ratings, motors must be built using superior materials (such as high-quality copper), more precisely made components, and cutting-edge insulation systems, all of which cost far more than typical motor materials. As a result, they are considerably more costly than standard-efficiency motors, which has an impact on the finances of small and medium-sized businesses as well as other cost-conscious segments of the economy.

MARKET OPPORTUNITIES

Rapid Growth in HVAC and Building Infrastructure to Create Lucrative Growth Opportunities

The rapid development of HVAC systems and building infrastructure creates remarkable opportunities for the electric motor market, as motor-driven equipment is highly utilized in modern residential, commercial, and industrial buildings for heating, ventilation, air conditioning, pumping water, and circulating air. Rapid urbanization, growth in high-rise construction, and the development of data centers, metro stations, shopping centers, and smart city projects have significantly increased the demand for HVAC unit installations.

In July 2025, Nidec Corporation, a Japanese manufacturer and distributor of electric motors, selected Teamcenter X software from Siemens' Xcelerator range of industry software to design and consistently supply innovative motors, thereby establishing new industry standards, particularly in the automotive sector, according to an announcement by Siemens Digital Industries Software.

ELECTRIC MOTOR MARKET TRENDS

Rising Demand for Efficient and Compact Brushless DC (BLDC) Motors to Drive Market Growth

The expansion of the electric motor industry is being propelled by the growing demand for Brushless DC (BLDC) motors, which are more efficient, compact, and durable. Compared to traditional brushed motors, BLDC motors are typically known for having higher torque-to-weight ratios, less energy usage, and longer lifespans. Consequently, these qualities make them valuable for a wide range of applications. Due to their energy efficiency and need for precise control, BLDC motors are also becoming increasingly popular in robotics, industrial automation, home appliances, HVAC systems, and electric vehicles.

In December 2022, Nidec announced the development of a low-cost, single-phase, low-vibration brushless DC motor suitable for use in electric fans. In response to the rise in global energy use, the low-cost AC (capacitor) motors that have been the main component of electric fans worldwide may be replaced by more efficient brushless DC motors.

Download Free sample to learn more about this report.

MARKET CHALLENGES

Fluctuating Raw Material Prices to Hamper Market Growth

The continuous fluctuation in raw material prices severely obstructs the growth of the electric motor market, since electric motor manufacture relies heavily on copper, aluminum, steel, and rare-earth elements, such as neodymium and dysprosium, all of which account for a considerable share of production costs and make the market sensitive to changes in pricing. A surge in the cost of copper or magnets has an immediate impact on the price of electric motor manufacturing, including for AC, DC, and BLDC motors, which lowers profits for motor producers and discourages investment in the mass market.

Segmentation Analysis

By Motor Type

Extensive Use Across Residential, Commercial, And Industrial Applications to Drive The Low Voltage (Up To 1kv) Segment Growth

Based on motor type, the market is classified into low voltage (up to 1 kV), Medium Voltage (1 kV-6.6 kV), and High Voltage (above 6.6 kV).

The electric motor market share is dominated by the low-voltage (up to 1 kV) segment with a share of 44.60% in 2026, which is employed in the majority of applications across various industries, including household appliances, HVAC systems, pumps, fans, compressors, conveyors, and general industrial machinery. The demand for these motors remains strong, as they are essential to daily life in homes, businesses, and factories.

The Medium Voltage (1 kV–6.6 kV) segment represents the second-largest category in the electric motor market, as it is essential for heavy-duty industrial applications that require higher power output and greater efficiency.

By Speed

Regular Speed (Up to 3000 rpm) Leads the Segment Owing to Suitability for Powering Pumps, Fans and Other Applications

In terms of speed, the market is categorized into regular speed (up to 3000 rpm), high speed (above 3000 rpm).

The largest segment of the total electric motor industry is the regular speed (up to 3000 rpm), accounting for 83.69% market share in 2026, as it is the most common operating range across commercial, industrial, and consumer applications. The majority of the global demand for electric motors is driven by their suitability for powering pumps, fans, compressors, conveyors, mixers, air conditioning systems, and other general-purpose applications in this sector.

The high-speed (greater than 3000rpm) segment is the second-largest segment in the electric motor market, as these motors are necessary for applications that require high power density, fast acceleration, and a small size.

By Power Rating

The rapid expansion of automation, HVAC systems, and energy-efficient appliances has accelerated the adoption of motors Upto 100 kW

In terms of power rating, the market is categorized into Upto 100 KW, 100 to 500 KW,500 to 1000 KW,1000 to 1500 KW,1500 to 2500 KW,2500 to 3500 KW,3500 to 4500 KW,4500 to 5500 KW,5500-10,000 KW,10,000-20,000 KW,20,000-30,000 KW. The Upto 100 KW segment dominates the electric motor market. The upto 100 kW segment holds the largest share of the electric motor market because these motors are found in pumps, fans, compressors, HVAC systems, machine tools, and general industrial applications, where there is the greatest amount of flexibility, cost-effectiveness, and widespread acceptance across all end-use categories.

The 500–1000 kW segment ranks as the second-largest category in the electric motor market, as motors in this power range are essential for heavy-duty industrial applications that require high torque, continuous operation, and robust performance. The Upto 100 KW segment dominates the electric motor market share with 48.90% in 2026.

By Application

Rising Automation and Increasing Use of Motor-Driven Equipment to Drive Industry Machinery Segment Growth

In terms of application, the market is categorized into industry machinery, power generation, oil and gas, petrochemicals, and chemicals.

The industry machinery segment dominates the electric motor market share with 57.19% in 2026. Industrial operations rely heavily on motors to operate vital equipment, including pumps, compressors, conveyors, mixers, crushers, machine tools, and robotic systems. The largest and most consistent demand base is created by the numerous motors used in manufacturing, processing, and heavy industries, such as chemicals, oil & gas, mining, food processing, and automobiles, for continuous, high-load, and mission-critical applications.

The oil and gas segment ranks as the second-dominant category because extraction, processing, and transportation activities rely heavily on high-power motors to operate pumps, compressors, drilling equipment, blowers, and offshore platforms.

To know how our report can help streamline your business, Speak to Analyst

Electric Motor Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific held the dominant electric motor market share in 2025, valued at USD 35.27 billion, and also took the leading share in 2026, with USD 38.20 billion 2026. The Asia Pacific electric motor market is growing due to rapid industrialization, the strong expansion of the manufacturing, automotive, and electronics sectors, and massive investments in infrastructure and urban development across countries such as China, India, Japan, and Southeast Asia. In 2025, the Chinese market is estimated to reach USD 21.43 billion in 2026. The Chinese electric motor market is growing due to the country’s rapid industrial expansion, strong presence of manufacturing and automation-intensive industries, and continuous investments in infrastructure, construction, and industrial machinery.

Asia Pacific Electric Motor Market Size,2025(USD billion)

To get more information on the regional analysis of this market, Download Free sample

For instance, in February 2025, BorgWarner secured contracts to deliver electric motors for three prominent Chinese automakers, demonstrating a significant commitment to expanding in China’s EV market. The auto supplier will supply 400V high-voltage hairpin motors for a 200kW hybrid, rear-drive platform scheduled to enter production in August 2025. The compressor will also produce motors for a 150kW pure electric platform, which is expected to begin production in March 2026. Two additional contracts involve electric motors for range-extended and plug-in hybrid vehicles, with production scheduled for August and October 2025, respectively.

North America and Europe

Other regions, such as North America and Europe, are expected to experience notable growth in the coming years. During the forecast period, the North America region is projected to record a growth rate of 12.04% in 2025, the second-highest among all regions. It is expected to reach a valuation of USD 19.26 billion by 2026. The U.S. and Canada electric motor market is growing due to strong investments in industrial automation, manufacturing modernization, and energy-efficient technologies. Utilities and industries are increasingly adopting high-efficiency motors (IE3/IE4) to reduce energy consumption and comply with stringent regulatory standards. Backed by these factors, countries including the U.S. are expected to reach a valuation of USD 17.44 billion by 2026, and Canada is expected to reach USD 1.73 billion by 2025. After North America, the European market is projected to reach USD 14.57 billion by 2026, securing the position of the third-largest region in the market. In the region, Germany is estimated to reach USD 3.59 billion in 2026. The European electric motor market is growing due to a strong emphasis on energy efficiency, the strict implementation of EU regulations (Ecodesign Directive), and the widespread adoption of IE3 and IE4 high-efficiency motors across various industries.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions. The Latin America electric motor market is growing due to rapid industrial expansion, increasing infrastructure development, and the rising adoption of energy-efficient motors across manufacturing, oil & gas, mining, utilities, and consumer appliances, which are driving strong demand in the region. The Latin America market in 2026 is expected to reach a valuation of USD 6.38 billion.

Rapid industrial expansion, increasing infrastructure development, and rising adoption of energy-efficient motors across manufacturing, oil & gas, mining, utilities, and consumer appliances are driving strong demand in the region. In the Middle East & Africa, the GCC is set to reach a value of USD 2.61 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players:

Electric motor vendors are pursuing acquisitions to expand their product portfolios, strengthen their regional presence.

Electric motor vendors are pursuing acquisitions to expand their product portfolios, strengthen their regional presence, access new customer bases, and accelerate innovation in high-efficiency and smart motor technologies, thereby staying competitive in a rapidly evolving market.

In November 2025, Mitsubishi Electric will transfer the following assets to EBARA, with the transfer scheduled to take place on November 12, 2025, as per an agreement between Mitsubishi Electric Corporation and EBARA Corporation. The Shinshiro Factory in Shinshiro City, Aichi Prefecture, where Mitsubishi Electric's three-phase motor and Interior Permanent Magnet (IPM) motor companies are located, as well as its manufacturing plants and production lines. (The main factory automation (FA) manufacturing campus for Mitsubishi Electric remains at Nagoya Works, which will continue to produce and develop a wide range of FA control equipment.)

LIST OF KEY ELECTRIC MOTOR COMPANIES PROFILED

- ABB Ltd. (Switzerland)

- Siemens AG (Germany)

- WEG S.A. (Brazil)

- Nidec Corporation (Japan)

- Regal Rexnord Corporation (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Hitachi Industrial Equipment Systems (Japan)

- TECO Electric & Machinery Co., Ltd. (Taiwan)

- Johnson Electric Holdings Ltd. (China)

- Bosch Rexroth AG (Germany)

- Brook Crompton (U.K.)

- SEW-EURODRIVE GmbH & Co KG (Germany)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

KEY INDUSTRY DEVELOPMENTS

- In May 2025, Bosch Rexroth introduced pre-parameterized stepper motors for both single- and multi-axis systems. By allowing pre-parameterization to be performed without additional tools via the onboard controller, the integrated drive controllers in the new high-performance stepping motors reduce setup time. The required connectivity is provided by a multi-Ethernet interface using an EtherCAT communication profile. Additionally, Bosch Rexroth provides customers with a compatible control solution for the ctrlX CORE open control platform as an option.

- In October 2024, Ashok Leyland and Nidec Motor Corporation (Nidec), a Japanese multinational manufacturer of electric motor drives, signed a comprehensive partnership agreement to create innovative and efficient e-drive motor and system solutions that meet the specific demands of India's commercial vehicle sector.

- In September 2024, Johnson Electric, a provider of electromechanical components, electric motors, actuators, and motion control electromechanical subsystems, introduced a new high-speed rotary actuator designed exclusively for divert motion in sliding shoe sorters, which are high-speed automated sortation systems crucial to large e-commerce, postal, distribution, and shipping businesses.

- In September 2023, WEG S.A. announced the acquisition of Regal Rexnord Corporation's industrial electric motors and generators business through its indirect foreign subsidiaries. Regal Rexnord manufactures electromechanical devices worldwide. This transaction has a price of $400 million, which is contingent upon standard price adjustments for this type of transaction. The Industrial Systems division of Regal Rexnord includes the Marathon, Cemp, and Rotor-branded industrial electric motors and generators, which are the focus of this transaction.

- In June 2023, the second millionth IE3 motor in the DRN series was given to plant specialist Vollert by SEW-Eurodrive in Germany. Since 2015, the Bruchsal Company has been selling its energy-efficient DRN series motor in the high-efficiency industry.

REPORT COVERAGE

The global electric motor market analysis provides an in-depth study of the market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also includes a detailed competitive landscape, providing information on market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| Attributes | Details |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Growth Rate | CAGR of 9.77% from 2026-2034 |

| Unit | Value (USD Million) |

| Segmentation | By Motor Type, By Speed, By Power Rating, By Application, and Region |

| By Motor Type |

|

| By Speed |

|

| By Power Rating |

|

| By Application |

|

| By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 85.31 billion in 2026 and is projected to reach USD 163.82 billion by 2034.

In 2026, the market value stood at USD 79.45 billion.

The market is expected to exhibit a CAGR of 9.77% during the forecast period (2026-2034).

The industry machinery segment led the market in terms of application.

Rapid Growth of Electric Vehicles to Propel Market Growth

Hitachi, Siemens, ABB, and other companies are among the prominent players in the market.

Asia Pacific dominated the market and had the highest share in 2025.

Rapid Growth in HVAC and Building Infrastructure to Create Lucrative Growth Opportunities

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us