Equine Health Market Size, Share & Industry Analysis, By Product (Drug Class, {Anti-Infective, Anti-Inflammatory, Parasiticides, and Others}, Vaccines {Inactivated, Live Attenuated, Recombinant, and Others}, and Supplemental Feed Additives), By Disease Type (West Nile Virus, Equine Rabies, Equine Influenza, Equine Herpes Virus, Potomac Horse Fever, Tetanus, and Others), By Distribution Channel (Veterinary Hospitals And Clinics, Retail Pharmacies and Drug Stores, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

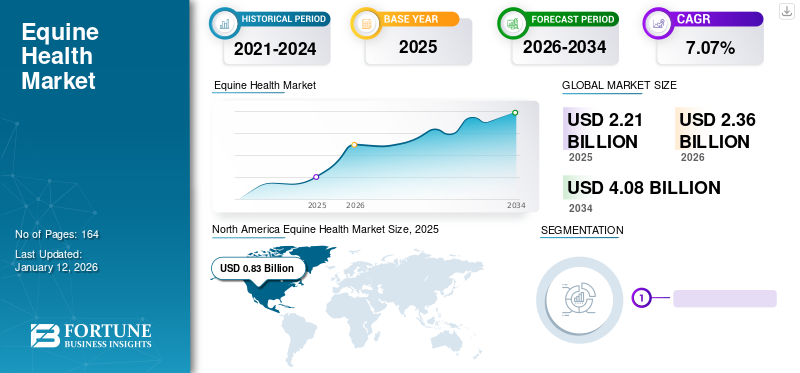

The global equine health market size was valued at USD 2.21 billion in 2025 and is projected to grow from USD 2.36 billion in 2026 to USD 4.08 billion by 2034, exhibiting a CAGR of 7.07% during the forecast period. North America dominated the global market with a share of 37.43% in 2025.

Numerous diseases can pose a serious risk to the health of horses and their welfare. Some diseases are already widespread, while several factors, including environmental changes, cause other ‘exotic’ diseases. In order to prevent and treat such equine diseases, various drugs, vaccines, and supplements are used. The rising prevalence of equine diseases, increasing awareness, and growing government support to prevent the spread of zoonotic diseases are projected to fuel market growth.

- According to the U.S. DEPARTMENT OF AGRICULTURE statistics published in 2022, there were a total of 90 cases of West Nile Virus and 184 cases of eastern equine encephalitis in the U.S. in 2019.

Moreover, increasing strategic activities by key players to launch advanced products and growing R&D initiatives to enhance the efficacy and safety of vaccines globally are expected to drive market growth.

Global Equine Health Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.21 billion

- 2026 Market Size: USD 2.36 billion

- 2034 Forecast Market Size: USD 4.08 billion

- CAGR: 7.07% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 37.43% share in 2025. The region's growth is attributed to a strong equine population, well-developed infrastructure, and growing awareness of various equine health product launches.

- By Product: The Drug Class segment held the dominant market share in 2024. The segment's growth is driven by robust research initiatives and the recent launch of multiple types of drugs for equine care by key players, such as Virbac's Equipred steroid tablets for horses with asthma.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific market, growth is driven by its strong equine population and increasing awareness of zoonotic disease risks, which boosts the demand for health products.

- United States: The market is supported by a large equine population of approximately 7.2 million. Demand is fueled by reported cases of diseases such as West Nile Virus and eastern equine encephalitis, and awareness campaigns like Zoetis's "Long Live the Horse" initiative.

- China: Growth is attributed to a strong equine population and increased awareness regarding the risks associated with zoonotic diseases, which is driving the adoption of equine health products in the Asia Pacific region.

- Europe: The market is propelled by current equine disease epidemics, such as equine influenza in the U.K. Growth is also supported by awareness initiatives, such as the "reducing disease risk together " campaign by British Equestrian.

COVID-19 IMPACT

Resumption of Equine Hospitals and Clinics in the Second Half of the Pandemic Led to Slight Positive Growth in the Market

COVID-19 had a moderate impact on the global equine market in 2020. The market experienced a slower growth trend in 2020 as a result of travel restrictions and supply chain disruptions. In addition, the number of veterinary visits to equine farms and ranches decreased due to travel constraints and market closures.

During the pandemic, the market increased overall, with veterinary healthcare clinics re-opening in the second half of 2020. Revenue growth in the market was lower in 2020 compared to the previous year. In terms of market players, some large companies witnessed slower growth in their animal health product sales, especially for horses, during the first quarter of 2020.

- For instance, Zoetis Services LLC generated USD 215.0 million in net sales from its horse segment in 2020. The horse segment increased 22.3% year-on-year in 2021, driven by an increase in global demand for animal pharmaceuticals, vaccines and diagnostics.

As the number of veterinary visits increased, the growth rate returned to pre-COVID-19 levels in 2021. As a result, the revenue of the different companies stabilized, shifting the market from 2025-2032 growth to pre-covid growth.

Equine Health Market Trends

Transition Toward Intranasal Route from Conventional Route of Administration to Propel Market Growth

In recent years, one of the most prominent global market trends is the transition toward the intranasal route of administration. Intranasal vaccines are used to immunize horses against certain respiratory diseases. The intranasal route of administration of the vaccine enables a lesser risk of sore muscles and also stimulates local immunity. Similarly, prominent players' increased focus and initiatives on developing innovative products are expected to drive the equine health market growth. Hence, this transition is identified as a key global equine health market trend.

- For instance, in September 2020, Boehringer Ingelheim launched the Aservo EquiHaler (ciclesonide inhalation spray) in the U.S. It is the first FDA-approved inhalant therapy for horses with severe equine asthma. Currently, more companies are engaged in launching new and advanced healthcare products to expand veterinary healthcare globally.

Download Free sample to learn more about this report.

Equine Health Market Growth Factors

Surge in Prevalence of Equine Diseases to Boost Market Growth

One of the most prominent drivers driving the equine healthcare market size is the growing prevalence of equine diseases, including West Nile virus, rabies, influenza, herpes virus, Potomac horse fever, tetanus, and others. Due to such a scenario, the demand for equine prevention and treatment has increased. This factor will eventually contribute toward market growth.

- According to an article published by The British Horse Society in 2023, equine influenza is a highly contagious viral respiratory disease. This endemic disease is present in the U.K. Such a rise in the prevalence or incidence of diseases is expected to drive the demand for equine care products in the forecast timeframe.

Rising Awareness for Equine Healthcare to Drive Market Growth Prospects

The market is witnessing robust advancements in equine care globally. There have been increasing initiatives by various universities, government agencies, and other charities to increase veterinary health awareness. The growing awareness will eventually enhance product adoption, propelling market growth.

- In November 2022, the British Equestrian launched its first dedicated equine health awareness week with the theme of “reducing disease risk together.” This has boasted a major social media campaign from prominent veterinary professionals and members of the equine infectious diseases advisory group (EIDAG). This program delivered advice on good health management, bio-security, vaccinations, and the fight against diseases and parasites.

Thus, increased awareness regarding veterinary healthcare and preventive measures is anticipated to augment the overall market growth.

RESTRAINING FACTORS

Shortage of Equine Veterinarians and Vaccine Failure Events to Hinder Market Expansion

One of the major barriers to market expansion is the lack of qualified equine health professionals, particularly in emerging economies. Developed and developing countries face the challenge of skilled and qualified labor, which impedes the uptake of these products.

- According to an ABC News (Australian Broadcasting Corporation) news article published in 2023, equine vets are warning of a "crisis" as a lack of practitioners continues, especially in regional areas. Speaking after taking over the presidency of EVA, Dr. Dolinschek said the specialist sector is facing a crisis. Currently, there are approximately 14,000 registered veterinarians in Australia and 800 new graduates every year. Although there is little information available on the career paths of new vets, it is estimated that only 2-3% of new vets take up a role in equine medicine.

Due to the lack of access to equine care, many livestock owners globally, both in developed and developing countries have been partially unable to provide equine care services. Many equine animals continue to lack care support, which has had an impact on the demand for equine products. Equine populations are also increasingly concerned about the future of vaccines. Many horses are becoming infected with diseases, such as ECE (Eastern Equine Encephalitis), despite being fully vaccinated. The reasons for vaccine failure can range from vaccine handling to immune function to pathogen level, vaccination history, and incorrect diagnosis.

Equine Health Market Segmentation Analysis

By Product Analysis

Robust Product Launches by Key Players Contributed to Drugs Class Segment’s Dominance in the Market

In terms of product, the market is segmented into drug class, vaccines, and supplemental feed additives. The drug class segment held a dominant market share 54.78% in 2026. The drug class segment is further sub-segmented into anti-infectives, anti-inflammatory, parasiticides, and others. The segment growth is attributed to robust research initiatives and recent launches of multiple types of drugs for equine care in the market.

- For instance, in October 2020, Virbac launched Equipred, the first licensed steroid tablet for horses. Each tablet contains 50mg of prednisolone, which is proven to improve lung function in horses with asthma. It is licensed for the treatment of severe equine asthma.

The vaccines segment is projected to register a substantial CAGR over the forecast period. The vaccine type is further sub-segmented into inactivated, live attenuated, recombinant, and others. The live attenuated segments with a share of 18.14% in 2026. The segment’s growth is attributed to the increasing number of zoonotic diseases and the strong demand for equine vaccines globally. Similarly, the supplemental feed additives segment is projected to grow with a suitable market share in 2024. Several product launches in feed additives for equine by veterinary companies contribute to the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

By Disease Type Analysis

Rising Incidence of Multiple Equine Diseases to Drive the Others Segment

Based on disease type, the market is segmented into west nile virus, equine rabies, equine influenza, equine herpes virus, potomac horse fever, tetanus, and others. The others segment held a dominant equine health market share. Multiple equine diseases are included in this segment, such as colic, osteochondritis dissecans, lameness, Lyme disease, and others. The growing incidence of such diseases is augmenting the demand for equine products in the market.

The west nile virus segment is expected to grow at a notable rate over the forecast period. This is due to the rising cases of this disease in various countries and frequent product launches by key players in the market.

The equine rabies, tetanus, and equine influenza segments together accounted for a suitable share due to the growing attention to the prevention of viral diseases through vaccination. Similarly, equine herpes virus, and potomac horse fever segments are expected to grow at moderate CAGR due to the frequent outbreaks of these diseases in various regions. Such factors increase product demand and adoption. Thereby propelling the segmental growth prospects. The equine influenza segments with a share of 21.36% in 2026

By Distribution Channel Analysis

Increasing Number of Veterinary Hospitals and Clinics to Boost Veterinary Hospitals and Clinics Segment Growth

Based on distribution channel, the global market is segmented into veterinary hospitals and clinics, retail pharmacies and drug stores, and others. The veterinary hospitals and clinics segment held a dominant share of the market. The segment growth is attributed to the growing number of veterinary hospitals and clinics business.

- For instance, according to the data mentioned in the American Veterinary Medical Association (AVMA) in 2022, the total number of private clinics that offer treatments primarily for equine is 3,785. Such initiatives are expected to drive market growth.

The retail pharmacies and drug stores segment is expected to grow at a lucrative rate during the forecast period. The rising number of equestrian and disease awareness in emerging countries requires drugs and supplements for equine health. These factors contribute to the segment’s growth during the forecast period.

The others segment is projected to account for a suitable market share during the projected period due to higher adoption of e-prescription and online pharmacies.

REGIONAL INSIGHTS

In terms of geography, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Equine Health Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2026, North America dominated the global equine health market, with a revenue of USD 0.88 billion. The growth is attributed to a strong equine population, well-developed infrastructure, and a growing awareness of various equine health product launches. The U.S. market is projected to reach USD 0.82 billion by 2026.

- For instance, as per the data published in WorldAnimalFoundation.org in 2023, there are almost 7.2 million horses in the U.S. in which Texas holds the highest population.

Europe

Europe held a significant share of the market. This is due to the current equine disease epidemics, which have increased the product demand in the market. The UK market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.11 billion by 2026.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR during 2025-2032, driven by increased awareness of zoonotic disease risks and the strong equine populations in countries. Similarly, government initiatives in major countries such as India and China boost the adoption of equine health products and augment market growth. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.19 billion by 2026, and the India market is projected to reach USD 0.06 billion by 2026.

Moreover, Latin America and the Middle East & Africa markets are growing due to their huge equine populations and new product launches by various key and domestic players.

- For instance, in November 2022, Audevard launched its operations in the UAE. The company has expertise in developing the right medicinal products for equine digestion, joint support, respiratory issues, and many others.

List of Key Equine Health Market Companies

New Launches and Geographical Presence of Key Players to Drive Market Expansion

The competitive landscape of the global market reflects a fragmented structure. The competitive landscape in the market is characterized by the presence of only a few market leaders with significant market shares. Some of the dominant players in the market include Zoetis Services LLC., Boehringer Ingelheim International GmbH, Merck & Co., Inc., and Dechra. The company Zoetis Services LLC holds the largest market share due to its strong product portfolio and strong presence in the equine industry. The company also engages in strategic activities and marketing campaigns to increase awareness of equine care in the market.

- In February 2022, Zoetis Services LLC. launched the Long Live the Horse campaign and demonstrated its commitment to horses and their caregivers.

The market leadership of the equine health industry can be attributed to the strategic acquisitions and partnerships made by the leading players in the industry, such as Dechra, Boehringer Ingelheim International GmbH, and Merck & Co., Inc. Some other players, such as Elanco, Vetoquinol, Neogen Corporation, Virbac, and others, are diversifying their market products and increasing their market penetration to increase their market share.

LIST OF KEY COMPANIES PROFILED:

- Zoetis Services LLC (U.S.)

- Ceva (France)

- Elanco (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Vetoquinol (France)

- Neogen Corporation (U.S.)

- Virbac (France)

- Merck & Co., Inc. (U.S.)

- Norbrook (U.K.)

- Purina Animal Nutrition LLC. (U.S.)

- Kyoritsuseiyaku Corporation (Japan)

- Equine Products UK Ltd. (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- Apr -March 2024 – Strategic Manufacturing Expansion

Zoetis acquired a manufacturing site in Melbourne, Australia, to enhance vaccine production for various animals and expanded its U.S. distribution center in Missouri.

REPORT COVERAGE

An Infographic Representation of Equine Health Market

To get information on various segments, share your queries with us

The global market report highlights a complete market overview of the key segments such as product, disease type, distribution channel, and geography. It includes key insights such as statistics on the equine population, regulatory scenarios, key industry developments, and technological advancements in the market. Furthermore, it provides insights into market dynamics, company profiles of prominent players, and the COVID-19 impact on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.07% from 2026-2034 |

|

Unit |

Value (USD Billion) |

| Segmentation |

By Product

By Disease Type

By Distribution Channel

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 2.36 billion in 2026 to USD 4.08 billion by 2034.

The market is projected to grow at a CAGR of 7.07% during the forecast period.

The North America market size was USD 0.83 billion in 2025.

Based on product, the drug type segment leads the global market.

North America held the dominant share of the global market in 2026.

The rising prevalence of equine diseases, awareness, and favorable government guidelines for prevention and treatment are set to drive global market growth.

Zoetis Services LLC., Boehringer Ingelheim International GmbH, Merck & Co., Inc., and Dechra are the key players in the market.

The increasing equine care awareness and a surge in strategic activities of key players to launch advanced products are key factors contributing to the adoption of equine healthcare products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic