Hot Water Circulator Pump Market Size, Share & COVID-19 Impact Analysis, By Technology (Single Stage and Multistage), By Material Type (Stainless Steel, Bronze, Cast Iron, and Others), By Flow Rate (Upto 2m3/h and Above 2m3/h), By End-user (Residential, Commercial, and Industrial), and Regional Forecasts, 2026-2034

Hot Water Circulator Pump Market Size

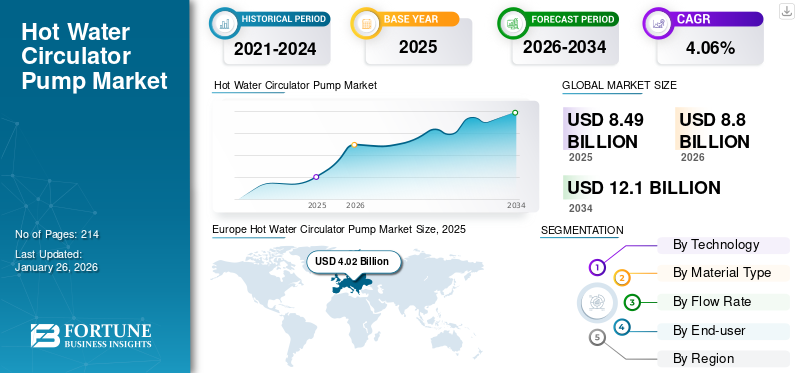

The global hot water circulator pump market size was valued at USD 8.49 billion in 2025 and is projected to grow from USD 8.80 billion in 2026 to USD 12.10 billion by 2034, exhibiting a CAGR of 4.06% during the forecast period. Europe dominated the global market with a share of 47.30% in 2025. The Hot Water Circulator Pump market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.47 billion by 2032, driven by the rising need for energy efficient pumps to reduce cost and maximize energy utilization.

Hot water circulation pumps circulate hot water in homes, the commercial sector, and industries by providing instant hot water at any faucet or shower. These systems work by gradually pumping hot water through dedicated hot or cold water lines and returning it to the water heater. It has acquired traction across building types to guarantee hot water is accessible from the tap without a long wait. This factor drives the market. The initial cold water is possibly being wasted from the tap to a drain, such as a hand washing or shower, while the person waits for the higher temperature. This system's ineffectiveness wastes over gallons of cold water per person annually. A circulator pump resolves the problem of wasted water by pumping hot water via the building’s piping system in a closed loop going back to the water heater constantly so that hot water is more easily accessible when the hot water tap is turned on. Furthermore, the factors that might create lucrative opportunities during the forecast period are increasing awareness regarding water wastage in developing economies, rising spending power toward energy-efficient and water-saving products, and others.

COVID-19 IMPACT

Pandemic Caused Disruptions in Supply Chains, Affecting the Production and Delivery of the Product

The COVID-19 pandemic significantly impacted this industry. The disruptions in global supply chains and the resulting economic uncertainty have changed consumer behavior, leading to fluctuations in demand for circulator pumps. The production and delivery of hot water circulator pumps were affected due to disruptions in the worldwide supply chain, resulting in a shortage of certain products and making it challenging for manufacturers to meet their demands.

Furthermore, the economic uncertainty caused by the pandemic decreased the demand for such pumps. Many individuals face financial insecurities making them less likely to invest in home improvement projects, including the upgrading of their hot water systems. This resulted in a reduction in product demand.

Hot Water Circulator Pump Market Trends

Download Free sample to learn more about this report.

Hot Water Circulation Pump with Smart Technologies is a Key Trend in the Market Development

Smart hot water circulator pumps have integrated sensors and control systems that regulate and monitor the flow of hot water, ensuring energy efficiency and reducing energy waste. Examples of such pumps include the Hot Water Recirculation COMFORT System and ALPHA3.

The Grundfos COMFORT System provides all the necessary components to retrofit a hot water recirculation system in a home without a dedicated return line. The system can be installed in less than two hours and uses a bypass valve and pump with a 24-hour programmable timer to keep hot water in the lines for instant use. It comprises a pump, bypass valve, hose kit, and digital timer. Additionally, the system has NSF/ANSI 61 and 372 certifications and a wet rotor design for whisper-quiet and maintenance-free operation. The rotor cladding and canister construction are made of stainless steel.

The ALPHA3 is a circulator pump designed for heating systems. It is entirely controlled through the Grundfos GO Remote app, making it easy to balance the radiator and underfloor heating systems hydraulically.

Hot Water Circulator Pump Market Growth Factors

Increasing Concern for Energy Efficiency and Reduction of Energy Costs to Surge the Product Demand

Energy efficiency is a significant factor driving the market, and it works in the following ways:

- Government policies: Governments worldwide promote using energy-efficient products through policies, incentives, and subsidies. This has increased demand for hot water circulating pumps, as these products are energy-efficient and eco-friendly.

- Reduced energy costs: Hot water circulators can reduce the time it takes to reach the faucet, reducing the energy required to heat water. As a result, households can enjoy lower energy bills.

- Increased awareness of environmental issues: With growing concerns about environmental sustainability, consumers are becoming more conscious of their energy usage and seeking energy-efficient and eco-friendly products. Hot water circulator pumps can reduce energy usage, and this awareness can surge demand for these products.

- Energy-efficient labeling and certification: Energy-efficient labeling and certification programs have increased consumer awareness of energy-efficient products, including hot water circulator pumps.

Building Codes that Require Energy-efficient and Eco-friendly Products to Surge Demand for the Product

Building codes can be a demand driver for hot water circulator pumps as they regulate the construction of new buildings and renovation of existing buildings to ensure they meet specific safety, sustainability, and energy efficiency standards. Building codes can drive the market in several ways such as green building certifications, incentives for eco-friendly products, and energy-efficient requirements.

Building codes can also include requirements for certifications such as Leadership in Energy and Environmental Design (LEED) or ENERGY STAR. Hot water circulator pumps can play a role in achieving these certifications by reducing energy usage and improving energy efficiency.

Building codes can offer incentives for using eco-friendly and energy-efficient products, including hot water pumps. This can encourage contractors and building owners to choose these products over less efficient alternatives.

Building codes can require that new buildings meet certain energy-efficiency standards and that existing buildings be retrofitted to meet these standards. These pumps can be an important part of this process, as they help to reduce energy usage and improve energy efficiency.

RESTRAINING FACTORS

Lack of Awareness in Developing Regions is Hindering the Demand for the Product

Lack of awareness and understanding of hot water circulator pumps in some parts of developing regions such as Asia and Africa hinder the market growth. Consumers in these regions may not be familiar with the benefits of such pumps or be unaware of their existence. In addition, low-income levels in some parts of Asia and Africa can limit the hot water circulator pump market growth. These products may be seen as luxury items rather than necessary appliances. Furthermore, there may be limited access to the technology and resources necessary to install and maintain the pumps.

Moreover, lack of infrastructure, such as an electrical grid or plumbing system, may be necessary to support hot water circulator pumps. In some parts of Asia and Africa, there may be a shortage of trained professionals, such as plumbers, who can install and maintain such pumps. This can reduce demand for these products, as consumers may not be able to access the services they need to use them.

Hot Water Circulator Pump Market Segmentation Analysis

By Technology Analysis

Single Stage Technology Offers Several Advantages which Might Boost the Market Growth

The market is segmented into single stage and multistage based on technology. Single-stage hot water circulator pumps are widely used globally due to their energy-efficient design, making them an attractive option for both residential and commercial applications, accounting for a 55.05% market share in 2026. They are designed to move hot water quickly and efficiently through a system, which helps to reduce the amount of energy needed to heat the water and keep it moving through the pipes. Single stage pumps are relatively inexpensive to purchase and install, especially compared to other hot water circulation systems. This makes them a popular choice for homeowners and businesses looking for an affordable way to improve their hot water circulation.

By Material Type Analysis

Beneficial Properties of Stainless Steel Make it an Ideal Choice for Hot Water Circulator Pumps

The market can be split based on material type into stainless steel, bronze, cast iron, and others. The stainless steel segment has dominated the market due to its high durability and corrosion resistance, making it an ideal material choice for pumps, accounting for a 48.58% market share in 2026. These pumps are designed to operate in harsh and demanding conditions, and stainless steel's resistance to rust and corrosion ensures that the pumps remain functional over a long period.

By Flow Rate Analysis

Need for Smaller Flow Rate Pumps Drives the Up to 2m3/h Segment Growth

Based on flow rate, the market is segmented into up to 2m3/h and above 2m3/h. Hot water circulator pumps with flow rates of up to 2m3/h are expected to lead in the coming years due to the growing demand for energy-efficient and cost-effective hot water circulation systems. The requirement for smaller flow rate pumps is likely to increase due to their suitability for smaller buildings, residential homes, and single apartment units.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Emphasis on Energy Efficiency and Sustainability in Residential Buildings Drives the Demand for Pumps in Residential Sector

The market is split based on end-user into residential, commercial, and industrial. The residential segment holds the dominant hot water circulator pump market share. The residential segment is one of the largest energy consumers. These pumps can significantly reduce energy consumption by eliminating the need to keep water heated in long pipes. Moreover, the residential sector is more likely to retrofit older buildings and homes with hot water pumps to improve energy efficiency, comfort, and convenience.

REGIONAL INSIGHTS

The global market is divided into five regions, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Hot Water Circulator Pump Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The Europe market holds a dominant share of the market. Europe dominated the global market with a size of 4.02% in 2025.One of the critical factors for its dominance is the cold climate in many parts of Europe. This means that hot water usage is relatively high. Additionally, in areas where the water is naturally colder, a hot water circulation pump can be more effective in providing quick and efficient access to hot water. The UK market is projected to reach USD 0.3 Billion by 2026, while the Germany market is projected to reach USD 0.37 Billion by 2026.

North America

North America plays a significant role in the market. The product demand is more in North America due to the need for faster and more efficient hot water delivery, energy efficiency, and sustainability. It has residential, commercial, and industrial applications, providing faster and more efficient hot water delivery, saving water and energy, and improving efficiency in production processes. The U.S. market is projected to reach USD 2.06 Billion by 2026.

Asia Pacific

The Asia Pacific market is predicted to witness substantial growth in the near future. The product demand in Asia Pacific will grow in the coming years. Many countries in the Asia Pacific region are experiencing rapid urbanization and infrastructure development, which is surging the demand for new construction projects. As more commercial and residential buildings are built, the market might expand. The Japan market is projected to reach USD 0.28 Billion by 2026, the China market is projected to reach USD 0.41 Billion by 2026, and the India market is projected to reach USD 0.35 Billion by 2026.

In addition, water scarcity is a significant issue in many parts of the Asia Pacific region, and water conservation is a top priority for many governments and organizations. It can help reduce water wastage by ensuring that hot water is available immediately without running the tap for a long time.

Latin America

The adoption of hot water circulation pumps in Latin America has been slower than in North America and Europe for several reasons. One of the reasons for the slow adoption is the relatively lower level of awareness and availability of energy-efficient technologies in the region. Lack of understanding about the benefits of hot water circulation pumps means that many people do not consider them an option for their homes. Additionally, the availability of these pumps in some areas may be limited due to lack of distribution channels and retail networks.

Middle East & Africa

Hot water circulation pumps are not highly adopted in the Middle East & Africa (MEA) region for several reasons, despite the potential benefits of this technology. One of the main reasons is the high cost of electricity in many countries in the region. The high energy price means some consumers may not see the immediate financial benefits of installing a hot water circulation pump. The installation costs may also be relatively high, discouraging the adoption of such pumps.

KEY INDUSTRY PLAYERS

Grundfos’ High-quality and Reliable Hot Water Circulation Pumps are Designed to Meet the Market's Specific Needs

Grundfos’ products are known for their energy efficiency, quiet operation, and long lifespan, which helped them to establish a strong reputation in the industry. Grundfos' focus on product quality, innovation, global reach, and sustainability has helped them establish a significant hot water circulation pump market share.

- In October 2022, Grundfos launched its small circulators named Grundfos Digital NEXT. It is designed for the residential heating market, and the range includes the UPSe 15-58 model.

List of Top Hot Water Circulator Pump Companies:

- Grundfos Holding A/S (Denmark)

- Wilo SE (Germany)

- Xylem Inc. (U.S.)

- Flowserve Corporation (U.S.)

- Armstrong Fluid Technology (U.K.)

- Calpeda SA (Italy)

- SAER Elettropompe SpA (Italy)

- US Solar Pumps (U.S.)

- Shimge Pump Industry Group Co., Ltd. (China)

- LEO PUMP (China)

- Taizhou Dalang Pump Industry Co., Ltd (China)

- TACO INC. (U.S.)

- Ningbo Yinzhou H.T. Industry Co. Ltd (China)

- Fujian ELESTAR Motor Co., Ltd. (China)

- Zhejiang Yonjou Technology Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- October 2022 - Grundfos unveiled its latest range of small circulators designed for the residential heating market. In Grundfos Digital NEXT, the range includes the UPSe 15-58 model, which was first introduced in late 2022.

- February 2021 – Grundfos launched the Grundfos UP 10-16 Digital Timer. The hot water recirculation pump, built for residential with a committed return line, comprises a combined digital timer that enables the pump to be organized to only run when hot water is needed, resulting in more efficient water use.

- October 2021 - Wilo introduced the WiloPara MAXO series, a high-efficiency glandless circulator pump designed for heating and solar applications. This new pump offers a high flow and exceptional comfort in electrical installation, commissioning, settings, and diagnostics. In addition, the WiloPara MAXO R variant can be utilized in all cooling and geothermal applications in heat pump systems.

- June 2021 - Grundfos launched a residential circulating pump named COMFORT PM AUTO. It has set the benchmark for energy-efficient and smart hot water recirculation via its AUTOADAPT feature, which grasps the household’s consumption patterns and then adjusts to it.

- August 2022 – Rinnai America Corporation launched the RE Series tankless water heater, the first non-condensing unit with an in-built pump and Smart-Circ Intelligent Recirculation. The Smart-Circ Intelligent Recirculation learns consumers’ hot water utilization patterns, then organizes the built-in pump and times recirculation patterns consequently.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The hot water circulator pump market research report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.06% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology, Material Type, Flow Rate, End-user, and Region |

|

Segmentation |

By Technology

|

|

By Material Type

|

|

|

By Flow Rate

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 8.49 billion in 2025.

The global market is projected to grow at a CAGR of 4.06% over the forecast period.

Europe dominated the global market with a share of 47.30% in 2025.

Based on end-user, the residential segment holds the dominating share in the global market.

The global market size is expected to reach USD 12.10 billion by 2034.

Building codes that require energy-efficient and eco-friendly products surge the product demand.

Grundfos, Wilo SE, and Armstrong Fluid Technology are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us