Centrifugal Pump Market Size, Share & Industry Analysis, By Operation (Electrical, Hydraulic, and Air Driven), By Stage (Single Stage and Multi-Stage), By Flow (Axial, Mixed Flow, and Radial Flow), By End-User (Residential, Commercial, Agriculture, and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

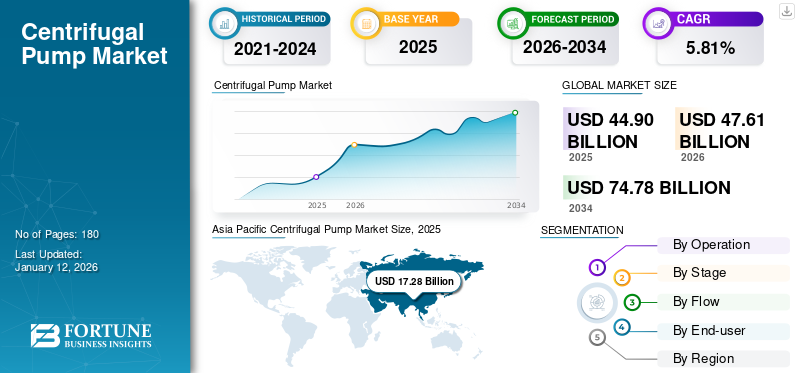

The global centrifugal pump market size was valued at USD 44.9 billion in 2025. It is projected to be worth USD 47.61 billion in 2026 and reach USD 74.78 billion by 2034, exhibiting a CAGR of 5.81% during the forecast period. Asia Pacific dominated the centrifugal pump market with a share of USD 38.56% in 2025, owing to growing industrialization and the presence of a significant agriculture sector in the region.

Centrifugal pumps save energy and are widely in demand due to regulatory requirements and environmental issues. Variable frequency drives (VFDs) provide accurate control over pump velocity, enabling dynamic modifications according to immediate demand, which improves energy efficiency and prolongs the longevity of pump parts. VFDs lower energy usage by decreasing the speed of the motor on an oversized pump or by modifying the motor's speed in response to the application's requirements.

The market is mainly driven by increasing global demand for clean water and wastewater treatment, especially in rapidly urbanizing areas. Additionally, industrial growth, particularly in emerging economies, and expanding oil and gas exploration, fuels the need for reliable fluid handling systems. In June 2023, Sulzer unveiled a closed impeller for the AHLSTAR A single-stage pump lineup. This innovation provides superior performance and greater efficiency. AHLSTAR represents a complete series of end-suction single-stage pumps engineered to handle various liquids in challenging industrial settings.

The growth in the number of vendors such as Grundfos, Sulzer, KSB, and ITT Corporation can be attributed to several key factors. These firms are taking advantage of the rising need for these pumps across different industries, such as water and wastewater management, oil and gas, power generation, and agriculture. As these industries evolve and upgrade their processes, the necessity for effective fluid transfer solutions increases.

MARKET DYNAMICS

MARKET DRIVERS

Increased Demand from the Agriculture Sector to Accelerate Market Growth

Centrifugal pumps are often favored in agricultural settings due to their capability to transport water for irrigation effectively. As farmers progressively embrace contemporary irrigation practices to improve yield, the need for dependable and efficient pumps grows. This pattern is especially pronounced in developing nations where traditional irrigation techniques are dominant.

The global population is consistently rising, resulting in growing demand for essential food items. Areas such as Sub-Saharan Africa and South Asia are anticipated to undergo swift agricultural expansion, requiring improved irrigation functions and, as a result, greater utilization of these pumps.

In August 2022, EBARA Pumps Europe S. p. A (EPE) has set up a branch in Kenya known as EBARA Pumps East Africa (EPEA). EPEA commenced operations and is tasked with the sales of pumps and irrigation equipment throughout the East Africa region. As part of a global market strategy within its mid-term business plan, “E-Plan 2022,” Ebara intended to broaden its presence in new markets along with sales bases.

Rapid Growth in Water and Wastewater Management Sector Will Drive the Market Growth

Industrialization and urbanization propels the water and wastewater infrastructure initiatives, thus driving the market growth. In addition, the other factors contributing to water and wastewater sector growth are increasing population, concerns regarding water scarcity, stringent environmental norms, rising demand for clean water supply, and the requirement for advanced technologies to treat and reuse wastewater.

Developing nations such as India are also taking initiatives in the water and wastewater sector. For instance, according to the International Trade Administration, the U.S. Department of Commerce India has initiated various programs to reinforce basic infrastructure and cater to public health and environmental problems. The Jal Jeevan Mission, launched in 2019, aims to get safe and adequate drinking water to all rural households. In addition, various other governmental initiatives, such as the Urban Transformation (AMRUT), National Mission for Clean Ganga (NMCG), Atal Mission for Rejuvenation, and Community Drinking Water Schemes, propel the Indian water and wastewater treatment sector growth, which consequently upsurges the demand for these pumps.

MARKET RESTRAINTS

Sensitivity to Cavitation and Cost for High-Pressure Application is Hindering the Market Growth

Cavitation takes place when pressure within the pump falls below the fluid vapor pressure, resulting in the formation and subsequent collapse of vapor bubbles. This cavitation problem can damage the impeller and other pump parts. Cavitation can lead to erosion, reduced pump efficiency, and increased vibration and noise intensity.

Furthermore, these pumps have restrictions when it comes to handling high-pressure applications. As the required discharge pressure increases, more stages or specialized pumps are required, resulting in higher acquisition costs. They might need supplementary equipment, such as multi-stage pumps, to attain high-pressure operation. These additions can surge the capital and operational costs. Thus, the cavitation problem and cost for high-pressure applications limit the centrifugal pump market growth.

MARKET OPPORTUNITIES

Rapid Increase in Population is Expected to Create Lucrative Market Opportunities During the Forecast Period

One of the major factors that might create opportunities during the forecast period is the rapidly growing population. The hotspot regions with increasing populations are Asia Pacific and Africa. This rising population will affect the demand for centrifugal pumps, and as the population increases, the demand for water and water infrastructure will upsurge, leading to market growth.

According to the United Nations, Africa has the highest rate of population growth among significant areas. The population of sub-Saharan Africa is expected to grow twofold by 2050. A quick population growth in Africa is expected even if there is a considerable reduction in fertility levels in the coming years.

In addition, India's population is projected to keep rising for several years. For the time being, China's population has recently reached its concentrated size and has witnessed a drop since 2022. According to UN DESA Policy Brief No. 153 projections, the number of people in China will continue to decline and might fall below 1 billion before the end of the century.

MARKET CHALLENGES

Fluctuating Raw Material Prices to Create Challenge for Market Growth

The expenses for crucial materials such as steel, aluminum, copper, and plastics utilized in the production of these pumps can greatly differ due to market fluctuations, geopolitical conflicts, and supply chain interruptions. Such variations result in unpredictable changes in production costs, which directly influence manufacturers' profit margins.

As the prices of raw materials increase unexpectedly, manufacturers find it challenging to keep their product prices competitive. This scenario leads to heightened production expenses that are hard to transfer to consumers without hampering sales or market share. As a result, businesses may encounter reduced profit margins and financial uncertainty.

Download Free sample to learn more about this report.

CENTRIFUGAL PUMP MARKET TRENDS

Rising Integration of Internet of Things (IoT) is Expected to Create Lucrative Opportunities During the Forecast Period

Increasing integration of the Internet of Things (IoT) is one of the significant market trends. The integration of IoT is expected to ease operation and work. For instance, in April 2023, Sulzer and Siemens LDA announced a digital collaboration. The collaboration aims to leverage their expertise by enhancing the digital value proposition for these pumps. They plan to include their respective IoT platforms and services, namely BLUE BOX and SIDRIVE IQ, to offer an integrated solution. This collaboration is designed to reinforce equipment dependability and reduce operational costs for operators. The partnership has been formalized through the signing of a letter of intent. This initiative marks the beginning of a journey that is expected to result in major cost savings for operators of large centrifugal pumps. Sulzer's pump-specific AI-based analytics platform, BLUE BOX, will now be enriched with predictive maintenance data from Siemens LDA's SIDRIVE IQ, an IoT platform for intelligent fleet management.

Hence, the increasing integration of the Internet of Things (IoT) is expected to create significant opportunities for market players. Smart, IoT-enabled pumps are becoming a key trend, offering real-time monitoring, predictive maintenance, and optimized performance, which are adopted on large scale in various industries across globe.

IMPACT OF COVID-19

The pandemic caused extensive lockdowns and restrictions, leading to a temporary cessation of production operations in various sectors, including centrifugal pumps. Manufacturing plants encountered closures, which greatly diminished output levels and postponed product deliveries. Interruptions in the supply chain worsened the circumstances, posing difficulties for manufacturers in obtaining the raw materials and components essential for production.

The early stages of the pandemic observed a sharp reduction in the demand for these pumps, especially from essential sectors such as oil and gas, construction, and manufacturing. The decline in these industries, along with diminished capital expenditures, adversely impacted sales numbers. Leading manufacturing nations such as the U. S., Germany, Italy, and China faced a decrease in demand due to the pandemic's effect on economic activities.

SEGMENTATION ANALYSIS

By Operation

Electrical Segment's Dominance Is Supported By Its Efficiency, Versatility, And Technological Advancements

The market is segmented into electrical, hydraulic, and air-driven based on operation.

The electrical segment is dominating the market. Electrical centrifugal pumps are acknowledged for their efficiency and dependability. They can be fitted with variable frequency drives (VFDs) or electronic controllers, providing exact control over pump speed and output. This flexibility improves their performance in different applications, making them a favored option in sectors such as water treatment, oil and gas, and manufacturing.

The hydraulic segment is the second most dominant in the market. Hydraulic pumps play a vital role in numerous industries for the purpose of moving fluids under pressure. The increasing need for hydraulic systems in areas such as construction, mining, and manufacturing is fueling the expansion of the hydraulic sector. These pumps are crucial for uses that necessitate high pressure and flow rates, rendering them essential in heavy equipment and industrial operations.

By Stage

Wide Applicability, Cost-Effectiveness, and Reliability Positions The Single-Stage Pump As The Dominant Segment

The market is divided into single stage and multi stage.

The single stage is dominating the market. Single stage centrifugal pumps are commonly used in numerous industries due to their adaptability, contributing 58.02% globally in 2026. They are especially well-suited for uses that have low to moderate total dynamic head (TDH) needs, making them perfect for water distribution, irrigation, and wastewater treatment. Their capability to manage high flow rates effectively increases their usefulness in a range of sectors.

In June 2018, Sulzer introduced the new CPE end-suction single-stage centrifugal pump. Sulzer has once more challenged the norms in pursuit of efficiency. These CPE ANSI process pumps are explicitly crafted to surpass the most stringent energy standards across all sectors, along with the stipulations of ASME B73. Featuring groundbreaking hydraulics and outstanding efficiency, they deliver reduced life cycle expenses.

Multi-stage centrifugal pumps are constructed with several impellers (stages) that enable them to produce greater pressure outputs than single-stage pumps. This feature renders them suitable for uses that necessitate high lift or the movement of fluids across extended distances, especially in water treatment, oil and gas, and power generation sectors.

By Flow

Versatility of Radial Flow Pumps Allows them to be Used in a Wide Range of Settings, Driving the Segment’s Growth

The market is divided into axial, mixed flow, and radial flow.

Radial flow is the dominating segment in the market with a share of 72.45% in 2026. Radial flow pumps are recognized for their capability to manage elevated flow rates and deliver effective performance. They operate by pushing fluid outward at the center of the impeller, leading to high pressure and flow effectiveness. This configuration renders them appropriate, especially for use in water treatment, irrigation, and industrial processes, where dependable fluid management is critical.

Mixed flow is the second dominating segment in the market. Mixed flow pumps integrate the characteristics of both radial and axial flow pumps, enabling effective fluid movement over a variety of flow rates and pressures. This adaptability renders them appropriate for numerous applications, such as irrigation, drainage, cooling water circulation, and wastewater treatment.

To know how our report can help streamline your business, Speak to Analyst

By End-User

Industrial Segment's Dominance Is Supported By High Demand Across Various Industries

By end-user, the market is divided into residential, commercial, agricultural, and industrial segments.

The industrial segment is accounting for 46.5% market share in 2026. The rising industrialization in developing economies upsurges the requirement for effective pumping solutions. these pumps is primarily used in industrial applications due to its ability to handle large volumes of liquid. In addition, they can vary the flow rates over a wide range.

The oil and gas sector is one of the major end-users in the market. When it comes to the largest market in the oil and gas sector in the world, the U.S., the Middle East, and Africa are at the forefront.

Commercial is also one of the major end-users in the market. The expansion of commercial structures, such as offices, retail spaces, and hotels, has resulted in an increased need for heating, ventilation, and air conditioning (HVAC) systems. these pumps play a crucial role in these systems by circulating water and refrigerants, making them vital for preserving pleasant indoor conditions.

CENTRIFUGAL PUMP MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Centrifugal Pump Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Growing Demand in the Oil and Gas Sector to Drive the Market Growth in the Region

The North America market is expected to grow at significant rate as the oil and gas industry notably enhances the need for these pumps, particularly in the U.S. centrifugal pumps are important in upstream, midstream, and downstream processes. It is used in applications such as cooling systems, refining processes, fluid transport, firefighting, and others. For instance, in February 2024, ITT Inc. entered into a three-year contract to provide highly specialized API-610 centrifugal pump systems along with associated products and engineered services to the energy and petrochemical firm ExxonMobil.

U.S.

Growing Manufacturing Activities to Drive the Market Growth in U.S.

The market in the U.S. is growing rapidly due to rising manufacturing activities. Chemical production in the U.S. is expected to rise, leading to a heightened demand for these pumps, which are crucial for handling fluids in chemical manufacturing. These are critical in chemical manufacturing as they provide reliable and efficient solutions for handling various fluids under varying conditions. Their versatility and ability to be customized for specific applications make them indispensable in the chemical industry.

In April 2024, Sulzer formally inaugurated its new pump manufacturing lines in Easley, South Carolina, U.S.. Equipped with cutting-edge technology and processes, the Easley manufacturing lines produce submersible sewage and grinder pumps utilizing U.S. materials and labor. With this expansion, Sulzer fortifies its U.S. supply chain partnerships to provide a product range that adheres to the Build America Buy America Act (BABA).

Europe

Presence of the Established Chemical Sector is Driving Market Growth in Europe

The European market is expected to grow at significant rate. The centrifugal pumps are extensively used in the European chemical industry due to their efficiency in pumping large volumes of liquids, especially corrosive ones, making them an important part of many chemical production processes. Notable European companies such as Sulzer and Grundfos are some of the major manufacturers of centrifugal pumps used in the chemical sector. According to the European Union, Europe region is one of the major international players in the trade of chemicals and associated products, with a total trade of around USD 917.75 billion, which consisted of around USD 566.02 billion of exports and around USD 351.73 billion of imports in 2023, resulting in the highest trade surplus of around USD 214.29 billion.

Asia Pacific

Presence of a Considerable Agriculture Sector and Rising Industrial Activities is Driving the Market Growth

Asia Pacific accounts for largest market share due to presence of developing countries in Asia Pacific, such as India, are one of the major markets for agricultural centrifugal pumps. Agriculture significantly contributes to the Indian Economy. For instance, according to the Provisional Estimates of National Income, 2022-23, published by the National Statistical Office (NSO), Ministry of Statistics & Programme Implementation, shows that the agriculture and related sectors accounted for around 18.4 % of India's Gross Value Added at current prices during 2022-23.

Southeast Asia countries are one of the major markets for centrifugal pump manufacturers due to growing industrialization and the presence of a significant agriculture sector. Southeast Asia is also known for its oleo chemicals industry. These factors drive the Asia Pacific centrifugal pump market growth.

China

Presence of Established Manufacturing and Energy Industry in China Drives Market Growth

China accounts for largest market share in Asia Pacific region and is expected to grow at moderate growth rate as China's manufacturing industry significantly depends on centrifugal pumps for fluid management, particularly in areas such as HVAC systems, water treatment, and petroleum refining. Numerous manufacturers in China provide centrifugal pumps. One of these manufacturers, Shanghai Liancheng (Group) Co., Ltd., focuses on the production of pumps, valves, environmental protection equipment, and others.

Furthermore, the expansion of renewable energy industries is driving the need for energy-efficient pumps. Solar centrifugal water pumps convert solar energy into mechanical power to pump water effectively. It utilizes a centrifugal mechanism optimized for solar panel integration, making it appropriate for remote areas.

Latin America

Rising Demand in Municipal Water and Wastewater Treatment to Drive the Market Growth

Latin America Market is expected to witness moderate growth rate. However, the increasing need for centrifugal pumps in the treatment of municipal water and wastewater is expected to propel market expansion in Latin America. These pumps play a crucial role in transporting raw wastewater, influent wastewater, primary and secondary sludge, and effluent wastewater in municipal water facilities.

In July 2021, Weir Minerals introduced the new Multiflo Mudflo hydraulic submersible slurry pump, which is intended for abrasive applications and large particle management, and it incorporates a hydraulically operated wet end to securely reprocess and relocate tailings ponds, support water retention dams, and handle slimes and sludge ponds.

The Multiflo Mudflo pump can pump between 150–1,200m3/h, reach up to 82m head, and integrates the Warman MGS pump end, Multiflo CB32 hydraulic cutters, and ESCO excavation teeth for slurries that are highly charged and abrasive. Weir Minerals' Ultrachrome A05 chrome alloy impeller provides excellent wear resistance, while the suction strainer stops large solids and debris from getting into the pump.

Middle East & Africa

Increasing Demand for Efficient Pumps to Drive the Market Growth

The increasing demand for efficiency in the water and wastewater sector is a significant factor driving regional growth, especially due to water shortages in the area. Investments in water and wastewater facilities are increasing, generating possibilities for centrifugal pump suppliers. The swift industrial growth in the Middle East & Africa is boosting the need for effective pumping solutions. These pumps play a vital role in numerous sectors, such as water and wastewater, oil and gas, and construction.

In March 2022, Amarinth, a globally recognized designer and manufacturer of low lifecycle cost centrifugal pumps and related equipment, focused on the offshore and onshore oil and gas sectors, nuclear and renewable energy production, defense, desalination, process and industrial and others, has fulfilled an order through Gas Arabian Services for custom compact API 610 vertical in-line pumps intended for the Saudi Basic Industries Corporation (SABIC) petro-chemical refinery located in Yanbu.

The Yanbu petrochemical refinery situated in the Al Madinah province of Saudi Arabia processes 400,000 barrels per day (bpd) of crude oil sourced from the Manifa offshore field, resulting in high-quality, ultra-low sulfur-refined products. Initially, two horizontal pumps were planned for the hazardous area, but they could not be accommodated within the severely limited space. Consequently, Amarinth recommended the use of API 610 vertical in-line pumps.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

New Product Launches and Innovations By Key Market Players is Bolstering their Market Positions

The global market is mostly fragmented, with key players operating in the industry. Globally, Flowserve is dominating the market. In July 2024, Flowserve Corporation, a prominent supplier of flow control products and services for global infrastructure markets, obtained the intellectual property and ongoing research and development connected to cryogenic Liquefied Natural Gas (LNG) submerged pump technology, systems and packaging from NexGen Cryogenic Solutions, Inc. (“NexGen Cryo”), a privately owned company based in Arizona that specializes in the engineering, design, and testing of LNG pumps and turbines.

NexGen Cryo’s pump and cold energy recovery turbine (CERT) technology for the liquefaction, shipping, and regasification markets is anticipated to significantly enhance and broaden Flowserve’s LNG product lineup and complement its current offerings of pumps, valves, and mechanical seals. Hence, key players in the market are focusing on strategies like product innovation, mergers and acquisitions, and geographical expansion to maintain and grow their market share.

List of Key Centrifugal Pump Companies Profiled

- Grundfos (Denmark)

- Flowserve Corporation (U.S.)

- Sulzer (Switzerland)

- Wilo SE (Germany)

- CIRCOR (U.S.)

- Baker Hughes (Italy)

- Alfa Laval (Sweden)

- Ingersoll Rand (U.S.)

- WEG (Brazil)

- Schlumberger (U.S.)

- Kirloskar Brothers Limited (India)

- Pentair (U.S.)

- VANSAN Water Technologies (Turkey)

- PSP Pumps Pvt, Ltd (India)

- LEO Pump (China)

KEY INDUSTRY DEVELOPMENTS

- In September 2024, Grundfos, a worldwide frontrunner in advanced pumping solutions and water technologies, introduced groundbreaking solutions aimed at assisting industries in reaching energy efficiency and net-zero emissions targets at the Industry End-User Fair 2024 in India.

- In April 2024, Baker Hughes obtained a contract from Black and Veatch to provide electric-driven liquefaction machinery, which includes centrifugal pumps, to Cedar LNG in Canada. The collection of turbomachinery equipment comprises four electric-driven primary refrigeration compressors, two electric-driven boil-off gas compressors, and six centrifugal pumps. Fueled by renewable energy, Cedar LNG will rank among the lowest carbon-intensity LNG facilities globally.

- In January 2024, Kirloskar Brothers Limited (KBL) has recently introduced its newest product, the Vertical In-line Long Coupled 'KW-LC' Pumps, broadening its continually expanding portfolio in the Heating, Ventilation, and Air-Conditioning (HVAC) sector. The KW-LC pump features a vertical, long-coupled design that conserves space, streamlines piping, and boasts a compact structure.

- In November 2021, Sulzer announced the introduction of the largest medium-consistency pump globally, the MCE93-400. The newly designed MCE pump size is Sulzer’s response to customer requests for increased production rates in pulp mills.

- In April 2021, IDEX Corporation announced that it had signed a definitive agreement to purchase Airtech Group, Inc., US Valve Corporation, and related entities from investment funds operated by EagleTree Capital for cash consideration of USD 470 million, contingent upon standard post-closing adjustments. Airtech designs and creates a broad array of highly engineered pressure technology products, which include vacuum pumps, regenerative blowers, compressor systems, and valves. The company offers tailored solutions across various end markets, such as alternative energy, food processing, medical, packaging, and transportation. Airtech caters to clients worldwide, with operations in the United States, Europe, and Asia.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The expanding industrial sector, particularly in emerging markets preset lucrative opportunities for market players.

- In August 2021, Swedish industrial producer Atlas Copco announced that it had purchased CPC Pumps International Inc., located in Burlington, Ontario. The firm focuses on the design, production, and maintenance of custom-engineered, mission-critical centrifugal pumps. The financial details of the transaction were not revealed.

CPC Pumps has a workforce of 110 and provides services to clients in North America. In the fiscal year 2020, the company generated revenues of around USD 44. 8 million.

REPORT COVERAGE

The centrifugal pump market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering centrifugal pumps. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 5.81% from 2026 to 2034 |

|

Segmentation |

By Operation

|

|

By Stage

|

|

|

By Flow

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 44.9 billion in 2025.

The market is likely to grow at a CAGR of 5.81% over the forecast period (2026-2034).

The single stage segment is expected to lead the market in the forecast period.

The market size of Asia Pacific stood at USD 17.28 billion in 2025.

Rapid water and wastewater sector will drive the market growth.

Grundfos, Flowserve Corporation, Sulzer, and others are some of the market's top players.

The global market size is expected to reach USD 74.78 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us