Predictive Maintenance Market Size, Share & Industry Analysis, By Component (Hardware, Software), By Deployment (On-premise, Cloud-based), By Enterprise Type (Large Enterprises, Small & Mid-sized Enterprises), By Technology (IoT, AI & Machine Learning, Digital Twin, Advance Analytics), By Application (Condition Monitoring, Predictive Analytics, Remote Monitoring, Asset Tracking, and Maintenance Scheduling), By End-Use (Military & Defense, Energy & Utilities, Manufacturing, Healthcare, IT and Telecom, Logistics & Transportation), Regional Forecast, 2026 – 2034

Predictive Maintenance Market Size

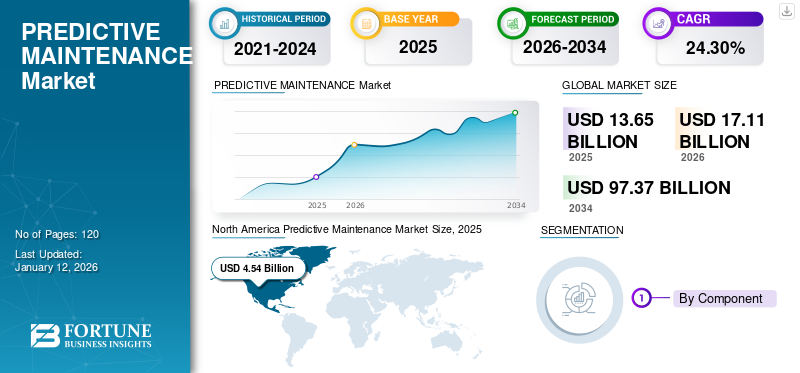

The global predictive maintenance market size was valued at USD 13.65 billion in 2025 and is projected to grow from USD 17.11 billion in 2026 to USD 97.37 billion by 2034, exhibiting a CAGR of 24.30% during the forecast period. North America dominated the market with a share of 33.30% in 2025.

Predictive Maintenance (PdM) is a vital component of Industry 4.0, aimed at monitoring the condition of machinery to foresee potential failures before they occur. Predictive maintenance relies on a combination of hardware and software to evaluate the health of mechanical assets. Key technologies such as the Internet of Things (IoT), predictive analytics, digital twin technology, and Artificial Intelligence (AI) enable this process.

Sensors connected to machinery continuously collect data, which is then analyzed either at the edge or in the cloud using AI and machine learning algorithms. Predictive analytics utilizes techniques from statistics, AI, data analytics, and machine learning to forecast future outcomes. Common business applications include fraud detection, customer behavior prediction, and demand forecasting, all of which contribute to predictive maintenance market growth. Major companies are employing strategies such as collaboration, product launches, and geographic expansion to capture market opportunities. For instance,

- In July 2024, Charlee.ai and Duck Creek Technologies formed a solutions partnership aimed at enhancing business processes through advanced predictive analytics.

Moreover, key players operating in the predictive maintenance market, such as IBM Corporation, General Electric, Siemens, C3.ai, Inc., and others, are engaging in partnership and collaboration strategies. Through these strategies, they aim to boost their operations and scale up their sales. Collaboration between software companies and industrial technology providers is a key strategy to combine expertise and accelerate the development of end-to-end PdM solutions.

The COVID-19 pandemic had a positive impact on the market. It pushed many organizations to fast-track their digital transformation initiatives. With travel restrictions and remote working policies, businesses sought out digital tools to remotely monitor and maintain equipment. Predictive maintenance, driven by IoT, AI, and cloud computing, became critical for keeping operations running smoothly without the need for on-site personnel.

Predictive Maintenance Market Trends

Increasing Demand for Affordable Maintenance Solution Ensures Market Growth

Operational optimization is increasingly driving the demand for cost-effective maintenance solutions within the realm of predictive maintenance. This push for optimization is rooted in the universal objective of businesses to enhance efficiency and reduce operational costs. PdM employs advanced technologies, such as IoT sensors and AI algorithms, to gather real-time data, enabling precise predictions of maintenance needs. This approach ensures that resources—including materials, labor, and equipment—are allocated efficiently, leading to significant cost savings. By predicting potential failures before they escalate, PdM minimizes unplanned downtime, a common disruptor of productivity and profitability. For instance,

- Novity recently launched an IoT solution that leverages sophisticated sensors and algorithms to predict equipment status with over 90% accuracy, extending turnaround times for maintenance.

- According to recent surveys, predictive maintenance can reduce costs by up to 40% compared to reactive maintenance and by 8 to 12% compared to preventive maintenance. It can also decrease equipment downtime by as much as 50% and extend machine life by 20%.

These factors represent some of the key trends fueling predictive maintenance market growth.

IMPACT OF GENERATIVE AI

Increasing Demand for Adoption of Advanced Predictive Maintenance Solution to Enhance Productivity Aids Market Growth

The advancement of technology has significantly transformed the way products are designed, developed, and managed across rapidly evolving industries. While predictive maintenance is already a powerful tool on its own, the integration of generative AI takes it to a new level, enhancing productivity, reliability, and efficiency for companies.

Generative AI introduces a new era in PdM, allowing machine failures to be anticipated, repair plans to be auto-generated, and personalized repair guidance to be provided. This leads to maintenance excellence by addressing many of the challenges faced by traditional predictive maintenance strategies. For instance, generative AI simplifies the development of predictive models, reducing the need for large teams of data scientists. It can efficiently handle data analysis and model creation with greater accuracy and detail, streamlining the implementation of PdM systems.

In the manufacturing industry, generative AI is being used to monitor machinery and predict potential failures. For example, a leading automotive manufacturer adopted a PdM system powered by generative AI, resulting in a 30% reduction in downtime and 20% lower maintenance costs.

Predictive Maintenance Market Growth Factors

Harnessing Predictive Maintenance Into Original Equipment Manufacturing is Driving Market Growth

With predictive maintenance at the OEM (Original Equipment Manufacturer) level, users can detect equipment problems at their earliest stages and address them before they escalate into costly issues. This proactive approach helps to prevent major equipment failures, reduces unplanned downtime, and enhances overall safety.

Many leading companies are increasingly adopting PdM strategies through partnerships and acquisitions to improve vehicle safety, efficiency, and longevity. For instance,

- In September 2024, COMPREDICT and Renault Group announced a partnership focused on predictive maintenance technology using virtual sensors. COMPREDICT's software-based virtual sensors provide real-time data without requiring additional hardware, significantly reducing the total cost of ownership for OEMs.

This innovative approach offers unprecedented flexibility, enabling manufacturers to craft their PdM strategies more effectively.

Moreover, the industry is seeing a trend where automotive manufacturers are partnering with technology companies to enhance PdM capabilities, which further drives demand in the growing market.

Market Restraints

Scarcity of Skilled Workers is Major Restraint in Market Growth

To implement AI-based IoT technologies for predictive analytics, businesses require a workforce that is skilled and trained to manage advanced software systems. As these technologies evolve, employees often need to undergo training to use new and improved predictive maintenance systems efficiently.

While companies are quickly adopting these technologies, many face a significant shortage of highly qualified personnel. With the increased demand for PdM initiatives globally, the need for skilled professionals continues to rise. Businesses are particularly seeking talent in areas such as cybersecurity, networking, and application development to support these initiatives.

Additionally, companies aim to harness IoT data to forecast outcomes, prevent errors, optimize their operations, and innovate new products. Expertise in advanced analytics, including AI and machine learning, is essential for leveraging this data to achieve these goals. The ability to interpret data insights and apply them to predictive models will be critical for businesses looking to stay competitive in this evolving landscape. Thus, this factor is expected to hinder predictive maintenance predictive maintenance market growth.

Predictive Maintenance Market Opportunities

Advancement in Technology and Adoption of Industry 4.0 to Create Lucrative Opportunities for Market Players

Predictive maintenance is a crucial component of Industry 4.0, emphasizing the integration of advanced technologies such as IoT, AI, and extensive projects to enhance manufacturing processes. The predictive maintenance market is experiencing rapid growth, driven by technological advancements and the increasing adoption of Industry 4.0 methodologies. For example,

- A report by PwC reveals that 72% of manufacturing companies have integrated Industry 4.0 technologies, with predictive maintenance emerging as one of the most popular applications. Companies actively engaging in Industry 4.0 initiatives are reporting substantial improvements in operational efficiency, quality, and cost reduction.

One major opportunity lies in the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which enhance the accuracy of equipment failure predictions by analyzing extensive sensor data. The Internet of Things (IoT) is another significant opportunity, enabling real-time monitoring and data collection from machines, which bolsters the predictive capabilities of maintenance systems. These factors collectively create significant opportunities for growth in the predictive maintenance market in the coming years.

Predictive Maintenance Market Segementation Analysis

By Component Analysis

Growing Adoption of Cloud-based Platforms in Enterprises Fuels Demand for Predictive Maintenance Software

Based on component, the market is divided into hardware and software (integrated and standalone). Software captured the largest predictive maintenance market share in 2024, and it is expected to continue its dominance by growing at the highest Compound Annual Growth Rate (CAGR) during the forecast period.

There has been a strong shift toward cloud-based predictive maintenance solutions, which offer scalability, remote accessibility, and seamless integration with other enterprise systems. These platforms allow companies to collect data from IoT sensors and analyze it without the need for on-premise infrastructure. Among software, standalone software dominated the market in 2024. The adoption of standalone software is increasing to meet the need for advanced capabilities by employing vertical-focused and automated maintenance techniques.

Hardware is expected to grow at a noteworthy CAGR in the coming years. Edge computing hardware allows for data processing close to the source, enabling real-time analysis of equipment conditions and reducing latency compared to cloud-only solutions. Edge devices help manage large volumes of data generated by IoT sensors and provide immediate insights to maintain teams. These devices are particularly useful in remote or resource-constrained environments where constant cloud connectivity is not possible.

By Deployment Analysis

Increasing Demand for Greater Data Security and Privacy Fuels Adoption of On-premise Systems

Based on deployment, the market is bifurcated into on-premise and cloud-based. On-premise deployment captured the largest predictive maintenance market share in 2024. One of the primary advantages of an on-premise predictive maintenance system is its ability to keep all sensitive operational data within the organization’s own infrastructure. This is particularly beneficial for industries with strict data privacy regulations or in regions with stringent data sovereignty laws.

Cloud-based deployment is anticipated to grow at the highest CAGR in coming years, owing to factors such as reduced costs, easy access to data, remote access to data, unification of information, and automatic updates, among others, associated with cloud-based deployment. The scalability offered by cloud solutions is unmatched, removing the necessity for expensive hardware upgrades. Businesses can easily adapt to changing demands without limitations, guaranteeing smooth operations regardless of scale.

By Enterprise Type Analysis

Surge in Integration of Predictive Maintenance Solution with Digital Transformation Initiative in Large Enterprises Fuels Market Growth

Based on enterprise type, the market is divided into large enterprises and Small and Mid-sized Enterprises (SMEs). Large enterprises segment accounted for the largest predictive maintenance market share in 2024. Many large enterprises have integrated predictive maintenance as part of broader digital transformation strategies. Companies such as Siemens, General Electric, and IBM have been at the forefront, leveraging this solution to reduce operational risks, improve equipment reliability, and cut costs.

Small and Mid-sized Enterprises (SMEs) are expected to grow at the highest CAGR in the coming years. SMEs typically operate on tighter budgets and are more cautious about investing in expensive hardware or software. However, the increasing availability of affordable SaaS-based PdM platforms, such as UpKeep and Fiix, is enabling SMEs to adopt these solutions with minimal upfront costs and scalable pricing models.

By Technology Analysis

Rise in Demand for Data Collection and Connectivity Propel Adoption of IoT Technology

Based on technology, the market is classified into IoT, artificial intelligence and machine learning, digital twin, advance analytics, and others (modern database, ERP, and others). IoT (Internet of Things) technology captured the largest predictive maintenance market share in 2024. IoT technology plays a crucial role in predictive maintenance by enabling continuous data collection from connected assets.

IoT utilizes connected sensors and advanced analytics to transform equipment maintenance. Through the collection and real-time transmission of equipment performance data, IoT technologies can conduct PdM analysis to detect potential issues that could lead to equipment failure.

Artificial intelligence and machine learning technologies are anticipated to grow at the highest CAGR in the coming years. AI-powered predictive maintenance can decrease equipment stoppages by 30% to 50%. Machine learning principles are applied by artificial intelligence to address various service-related issues. Automation of machine learning creates analytical models that can enable service technicians to take predictive actions to prevent potential downtime before it occurs. AI and machine learning are dynamic systems that yield more robust results as they are exposed to more data.

By Application Analysis

Increase in Demand for Anomaly Detection and Fault Prediction Boost Adoption of Predictive Maintenance Solutions in Condition Monitoring

Based on application, the predictive maintenance market is categorized into condition monitoring, predictive analytics, remote monitoring, asset tracking, and maintenance scheduling. Condition monitoring captured the largest market share in 2024, as it uses AI and machine learning algorithms to detect unusual patterns in sensor data, which could indicate the early stages of equipment failure.

For example, a sudden increase in vibration levels could indicate that a machine component is wearing out. Condition monitoring reduces the necessity for scheduled preventive maintenance tasks, leading to decreased labor costs and lower spare parts expenses.

Predictive analytics is expected to grow at the highest CAGR in the coming years. By detecting deviations from normal operating conditions, predictive analytics helps identify early signs of equipment malfunction. This allows maintenance teams to address issues before they result in costly breakdowns. Predictive analytics accurately predict equipment failures, helping businesses plan maintenance at optimal times and prevent unexpected downtime.

By End-Use Analysis

To know how our report can help streamline your business, Speak to Analyst

Growing Need to Reduce Downtime Fuels Adoption of Predictive Maintenance Solution in Manufacturing

Based on end-use, the predictive maintenance market is categorized into military and defense, energy and utilities, manufacturing, healthcare, IT and telecom, logistics and transportation, and others (chemicals, paper and printing, agriculture, and others).

Manufacturing captured the largest market share in 2024, and it is expected to continue its dominance by growing at the highest CAGR during the forecast period. The manufacturing industry is increasingly adopting predictive maintenance solutions as unplanned downtime is expensive and costs industrial manufacturers close to USD 50 billion annually. PdM minimizes unplanned downtime by optimizing asset performance and identifying faults before they manifest or escalate.

Healthcare is anticipated to grow at a prominent CAGR during the forecast period. Predictive maintenance systems can identify early signs of deterioration or malfunction by constantly monitoring the health and performance of medical devices, prompting proactive interventions to address potential issues. This proactive method assists in reducing downtime and guaranteeing the continuous availability of essential medical equipment.

Regional Insigths

North America Predictive Maintenance Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Predictive Maintenance Industry Trends

North America will hold the largest predictive maintenance market share in 2024, owing to the increasing adoption of predictive maintenance solutions that leverage advanced technologies, including IoT, cloud computing, machine learning, and Artificial Intelligence (AI). The rising demand for advanced AI and cloud computing-based platforms and the rapid adoption of AI technology across North American countries are driving the predictive maintenance market. For instance,

- In March 2023, the global investment in AI technology reached USD 154 billion, marking a 26.9% increase from 2022. It is anticipated that spending on AI-centric systems will exceed USD 300 billion in 2026, according to a report by IDC.

In the region, companies are employing PdM systems to pinpoint operational performance factors and enhance maintenance procedures and dependability. Therefore, these factors play a vital role in driving the predictive maintenance market growth in the region.

Download Free sample to learn more about this report.

According to the U.S. Bureau of Economic Analysis (BEA), manufacturing in the U.S. accounted for 10.3% of value-added output in the U.S. economy in 2023. At the same time, real value-added output in the manufacturing sector increased from USD 2.313 trillion in Q3 to USD 2.360 trillion in Q4. Among the top 10 producing countries, the U.S. is the fourth largest country in value added per capita and ranks 14th among all countries. Further, the presence of a large number of key market players across the U.S. plays an important role in fueling the market growth in the country.

Asia Pacific Predictive Maintenance Industry Trends

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Governments in the region are at the forefront of promoting the integration of Industry 4.0 technologies, utilizing sector-specific planning, incentives, research and development investments, international collaborations, and infrastructure enhancements. As a result, the growing significance of the manufacturing sector in economic advancement is driving up the need for PdM in various industries, as regular condition monitoring of equipment and systems can lead to a reduction of sudden machine failures by more than 50%.

Moreover, key players in the region are increasingly engaging in strategic partnerships to address the growing demand for predictive maintenance solutions across the region. For instance,

- In June 2024, Hitachi, Ltd. engaged in a multi-billion dollar partnership with Microsoft Corporation over the next three years. This collaboration will help the company to boost the growth of Lumada business by improving operational efficiency and productivity with the use of PdM solutions.

South America Predictive Maintenance Industry Trends

South America has become a region with great potential for growth and development in the digital arena. Organizations in the region are adopting emerging technologies at a faster rate than in other regions.

- As per Spiceworks Ziff Davis’ 2022 State of IT report, spending on new tech is increasing in the South American region. Around 74% of organizations in Brazil increased their IT budgets in 2022.

South America is poised for digital transformation and the need for companies to automate their processes and incorporate AI into their operations is a trend. Investment in IT automation technology is expected to grow around 83% by the end of 2024 and 77% for AI. These factors play an important role in fueling the market growth in the region during the forecast period.

Europe Predictive Maintenance Industry Trends

In Europe, the predictive maintenance market is growing at a prominent pace. AI powered PdM solution is becoming increasingly popular in the region due to the positive economic effects it has on European businesses. Approximately 75% of organizations using AI have seen a rise in revenues and productivity. However, around 51% of larger enterprises are more inclined to adopt AI and other digital technologies, compared to 31% of SMEs. SMEs face notable obstacles in adopting AI, primarily due to regulatory issues and the costs associated with implementation. Thereby, the above factors are driving the market growth in the region.

Middle East & Africa Predictive Maintenance Industry Trends

The Middle East & Africa is expected to showcase noteworthy growth during the forecast period. Digital adoption is gaining momentum as the Middle East countries’ governments are executing multiple national initiatives. Governments are conducting digital technology adoption programs supported by technologies such as the Internet of Things, cloud computing, artificial intelligence, and machine learning.

The adoption of PdM technology in smart buildings offers an additional advantage of improved safety, benefiting both systems and building occupants. It plays a vital role in pinpointing potential hazards, as the constant monitoring capabilities facilitate prompt and precise identification of equipment irregularities or indications of deterioration. Identifying issues early can reduce safety concerns, prevent accidents that may harm occupants or cause property damage, and limit disruptions across the region.

KEY INDUSTRY PLAYERS

Key Market Players are Focusing on Partnership and Acquisition Strategies to Expand Their Analytics Services Worldwide

Key players are focusing on expanding their global geographical presence by presenting industry-specific services. Major players are strategically focusing on acquisitions and collaborations with regional players to maintain dominance across regions. Top market participants are launching new solutions to increase their consumer base. An increase in constant R&D investments for product innovations is enhancing market expansion. Hence, top companies are rapidly implementing these strategic initiatives to sustain their competitiveness in the market.

List of Key Companies Profiled:

- IBM Corporation (U.S.)

- General Electric (U.S.)

- Siemens (Germany)

- C3.ai, Inc. (U.S.)

- Rockwell Automation (U.S.)

- PTC (U.S.)

- Hitachi Ltd. (Japan)

- UpKeep (U.S.)

- Augury Ltd. (U.S.)

- The Soothsayer (P-Dictor) (Thailand)

- Fujitsu (Japan)

- SAP SE (Germany)

- Software AG (Germany)

- Oracle Corporation (U.S.)

- Microsoft Corporation (U.S.)

- Schneider Electric SE (France)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- SparkCognition (U.S.)

- MaintainX (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Siemens engaged in a strategic partnership with Merck, a science and technology company. Through this collaboration, the company aims to drive digital transformation and take smart manufacturing to the next level.

- June 2024: IBM Corporation unveiled Maximo Application Suite (MAS) version 9.0. This updated version is enabled with features such as an improved AI-driven PdM solution with a user-friendly interface to enhance usability and expanded IoT integration for real-time data analytics and asset monitoring.

- June 2024: C3.ai, Inc. delivers its C3 AI Reliability solution to Holcim, a provider of sustainable building solutions. Holcim will integrate C3 AI Reliability, a novel PdM solution, across its plants globally for their digital transformation and a net-zero future.

- March 2024: General Electric Vernova announced that it will provide its novel predictive analytics software to National Industrialization Company (TASNEE), a petrochemical company based in Saudi Arabia. Through this software, the company aims to avoid equipment downtime by detecting, forecasting, and preventing critical failures in industrial companies.

- January 2024: Rockwell Automation engaged in a strategic partnership with MakinaRocks, a provider of advanced solutions for the manufacturing industry. Through this collaboration, the company aims to boost the integration of AI solutions in automation. It will help the manufacturers to increase productivity and reduce unplanned shutdowns through the PdM solution.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Heavy Investments to Integrate AI and Machine Learning Technologies

Many companies invest heavily in integrating Artificial Intelligence (AI) and Machine Learning (ML) technologies into their predictive maintenance solutions to enhance accuracy and scalability. This enables the development of more advanced analytics tools capable of predicting equipment failures with greater precision. The key market players include IBM Corporation, General Electric, Siemens, Rockwell Automation, and C3, ai, Inc., among others. These players are focusing and making recurring investments in research and development activities to launch new solutions. For instance,

- In July 2024, General Electric plans to support the aerospace business by providing artificial intelligence and machine learning technology in predictive maintenance services and automated inspection processes. This will help aerospace businesses to improve their products and boost efficiencies.

These factors are expected to create a lucrative opportunity for the market growth.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 24.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Technology

By Application

By End-use

By Region

|

|

Companies Profiled in the Report |

IBM Corporation (U.S.), General Electric (U.S.), Siemens (Germany), C3.ai, Inc. (U.S.), PTC (U.S.), Rockwell Automation (U.S.), Hitachi Ltd. (Japan), UpKeep (U.S.), Augury Ltd. (U.S.), The Soothsayer (P-Dictor) (Thailand), etc. |

Frequently Asked Questions

The market is projected to record a valuation of USD 97.37 billion by 2034.

The market is valued at USD 17.11 billion in 2026.

The market is projected to grow at a CAGR of 24.30% during the forecast period of 2026-2034.

By application, the condition monitoring leads the market.

Harnessing predictive maintenance into original equipment manufacturing is driving the market growth.

IBM Corporation, General Electric, Siemens, C3.ai, Inc., Rockwell Automation, PTC, Hitachi Ltd., UpKeep, Augury Ltd., and The Soothsayer (P-Dictor) are the top players in the market.

North America is expected to hold the highest market share.

By end-use, manufacturing is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us