Industrial Robots Market Size, Share & Industry Analysis, By Robot Type (Articulated, SCARA, Cylindrical, Cartesian/Linear, Parallel, and Others), By Application (Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, and Others), By Payload Capacity (Up to 16 KG, 16 to 20 KG, 61 to 225 KG, and Above 225 KG), By Industry (Automotive, Electrical & Electronics, Healthcare & Pharmaceutical, Food & Beverages, Rubber & Plastic, Metals & Machinery, and Others), and Regional Forecast, 2026-2034

Global Industrial Robots Market Analysis

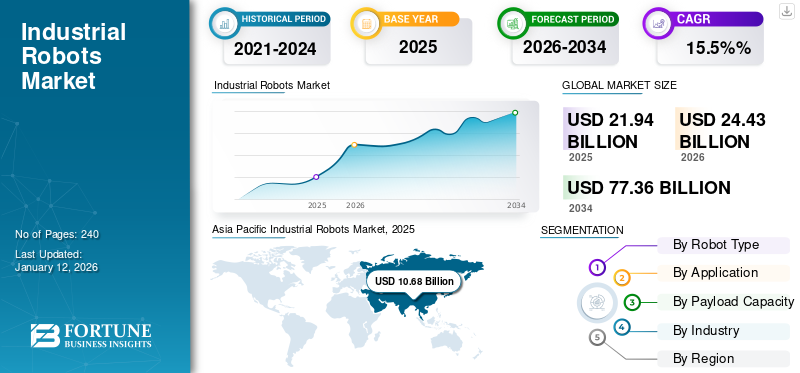

The global industrial robots market was valued at USD 21.94 billion in 2025 and is projected to grow from USD 24.43 billion in 2026 to USD 77.36 billion by 2034, exhibiting a CAGR of 15.5% during the forecast period. Asia Pacific dominated the industrial robots market with a market share of 48.7% in 2025.

An industrial robot is a type of mechanical equipment that receives instructions and is programmed to carry out tasks related to industrial production automatically. These robots can be programmed, and the program can be adjusted as needed for different applications. These robots help improve productivity, reduce costs, and produce high-quality products in automation settings. Robots consist mainly of drives, end-effectors, robotic manipulators, sensors, and controls. The robotic controller serves as the robot's brain, providing instructions for its operations. Microphones and cameras are utilized as sensors to help the robot detect its industrial environment. They have been used in various industries, including automotive, electrical & electronics, pharmaceutical, and food & beverages sectors.

The industrial robot market is driven by several factors, such as the rising usage of robots and smart manufacturing processes in industrial sectors, which, in turn, leads to the rising demand for automated robots, thereby driving the growth of the industrial robots market. Moreover, the rising penetration of Industry 4.0 practices and the growing trend of electric automobiles across the globe drive the growth of the global market. In addition, the rising growth in the automotive and transportation industries surges the demand for such robots for performing automotive operations driving the growth of the industrial robots market. For instance, according to the source of the European Automobile Manufacturers Association (ACEA), the automotive sector growth in Germany increased by 4.2% in 2024 as compared to 2023. Moreover, rising automotive sales in Asia Pacific countries, including China, Japan, and others, resulted in the rise of the installation of automated robots, fueling the global market growth.

IMPACT OF TECHNOLOGY ON MARKET

Rising Adoption of Smart Technologies in Industrial Sectors to Drive Market Growth

With the adoption of smart technology, such robots have become more sophisticated and versatile. Industrial robot manufacturers planned to implement several technologies in such robots such as AI, machine learning, cloud robotics, edge computing, additive manufacturing, and advancements in sensors and vision systems. These advancements in various technologies have boosted efficiency, reduced operational costs, and enhanced precision. Also, these technologically advanced robots are adopted in various industrial settings such as automotive, manufacturing, electronics, and healthcare.

MARKET DYNAMICS

Market Drivers

Increase in Investments across Industries to Drive Market Growth

The demand for industrial robots is high in industries such as pharmaceuticals, consumer electronics, packaging, automotive, and equipment. However, this demand is dependent on the type of robot needed to optimize industrial operations and reduce expenses. For instance, players in the consumer electronics industry may choose to deploy robots more rapidly to enhance production flexibility. Moreover, rising investment in the robotics market surges the demand for such robots in industrial applications, fueling the market growth.

Consequently, substantial investments are being made in the industry, leading to an increased requirement for these robots. As an example, in July 2022, ABB Ltd launched a new IRB 365 delta robot for performing picking and place application. It has payload capacity of up to 1.5 KG. It offers features such as long durable, easy to use, and fast in operation. It is used to pick lightweight materials such as chocolates, cookies, peppers, candies, and parcels in industrial operation. All such factors are the driving factors for the market growth.

Market Restraints

High Initial Capital Investment and Require High Maintenance Cost to Restraint Market Growth

The installation and maintenance costs for these robots are substantial. Additionally, the expansion in sectors such as automotive, food & beverage, metal & machinery, and rubber & plastic necessitates further investment. Consequently, a significant initial capital investment is essential for implementing production automation with industrial robots, which hinders market growth. These robots can cost anywhere from USD 25,000 to USD 100,000, varying according to the industry. The substantial cost of these products poses a significant challenge for both small and medium-scale enterprises, limiting the growth of the industrial robots market.

Market Opportunities

Rising Adoption in Emerging Economies to Provide Lucrative Opportunities for Market Growth

Rising demand for industrial robots from small as well as medium-scale enterprises among emerging economies such as India, China, Japan, and others results in the rising demand for such robots, fueling the growth of the market. In addition, major government and local authorities are planning to invest in the robotic sector across the globe, surging the demand for such robots and driving market growth. For instance, according to IFR, the “Horizon Program” initiated by European nations quoted that the European government planned to invest around USD 780 million in improving the robots market in Europe in 2020. Such an investment in the robotics sector increases the global industrial robots market size.

MARKET TRENDS

Rise in Logistics Sector is Expected to Aid Market Growth

A rising consumer preference for purchasing online boosts the demand for such robots in e-commerce and logistics centers. Increasing adoption of autonomous mobile robots and growing trends of adopting machine learning in such robots lead to increased productivity and efficiency of such robots. Also, this system is used among merchants, facility owners, merchants, distribution centers, and warehouses. These are used for providing features such as saving money on labor, improving efficiency, delivering on time, and production at every step. This is one of the most important considerations for the deployment of such robots.

Moreover, growing trends of industry 4.0 practices and smart factories promote data exchange, automation, and more agile production processes. Moreover, growth in logistics and e-commerce sectors across the globe creates the demand for more robots for performing various tasks to fuel the growth of the market. For instance, according to the source of the International Trade Administration, global e-commerce sales are anticipated to grow at a rate of 14.4% from 2023 to 2027. Such a huge growth in robots fuels the industrial robots market expansion.

COVID-19 Impact

The COVID-19 pandemic impacted positively during the pandemic owing to growing automation and growth in the e-commerce sector which boosted the demand for the robots in the logistics, warehousing and packaging sector, fueling the growth of the market.

SEGMENTATION

By Robot Type Analysis

Articulated Robots Segment is Predicted to Gain Highest Market Share Due to Growing Applications

Based on the robot type, the industrial robots market is divided into SCARA, articulated, cartesian/linear, cylindrical, parallel, and others. Others consist of delta robots.

The articulated robot held the largest industrial robots market share in 2026, with a valuation of 40.85%. It is projected to grow substantially owing to its wide adoption in various industrial applications such as welding, painting, packaging, heady duty lifting, and material handling. Moreover, it offers features such as high flexibility and is capable of complex movements in multiple industrial plants.

Cylindrical and SCARA robots are projected to grow at a steady rate during the forecast period, owing to larger adoption from industries such as automotive, electronics, and pharmaceuticals. Moreover, this type of robot has a payload capacity of 5, 5-15, and more than 15 kg. Moreover, key players have a strong portfolio of such industrial robots.

Cartesian/linear robots and parallel robots are projected to grow at moderate growth during the forecast period, owing to factors such as increased automation in the manufacturing sector. They offer special features such as being cost-efficient, customizable, and flexible, and able to integrate with other systems. Also, it is widely adopted in warehouses, logistics centers, distribution centers, and manufacturing facilities.

Other consists of delta robots. This robot is anticipated to grow at a decent rate during the forecast period due to rising automation in manufacturing and rising growth in the e-commerce sector. Delta robots are small in size and adopted in various industrial settings, fueling the segment’s market growth.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Material Handling to Dominate Owing to Rising Adoption from Chemical and Pharmaceutical Sectors

Based on application, the industrial robots market segmentation into welding & soldering, pick and place, assembling, material handling, cutting & processing, and others.

Material handling dominates the industrial robots market share with 33.65% in 2026, and is expected to be the dominant force in the market. The segment is projected to experience the highest growth during the forecast period. This is due to the expansion of food and beverage, pharmaceutical, and electrical sectors. Additionally, material handling plays a crucial role in the chemical and pharmaceutical industries, as it is involved in the concentrated handling and transportation of hazardous compounds. In these industries, robots are often utilized to reduce accidents and ensure the safety of staff.

Welding & soldering, material handling, and pick and place applications are expected to experience a consistent growth rate during the forecast period, driven by the increasing demand for these robots in the automotive, electrical, electronic, and metal industries.

The cutting & processing segment is projected to experience moderate growth during the forecast period. The rising trend of automotive personalization and the growing emphasis on precision cutting in various applications are expected to significantly boost the cutting and processing industry in the coming years.

The other segment includes painting, among other things. Painting robots are anticipated to grow steadily as there is a growing demand for them from industries such as automotive, glass, aerospace, smartphones, shipyards, and household product manufacturing. These factors are contributing to the segment’s industrial robots market growth.

Assembling segment is anticipated to grow at a highest CAGR of 14.80% during the forecast period.

Material handling segment is poised to exhibit a CAGR of 16.14% during the forecast period (2025-2032).

By Payload Capacity Analysis

Up to 16 KG Capacity of Industrial Robots Dominate Market Owing to Rising Demand from Electronics and Pharmaceutical Sectors

Based on payload capacity, the industrial robots market is segregated into Up to 16 KG, 16 to 60 KG, 61 to 225 KG, and above 225 KG.

Up to 16 KG of robots are often used in electronics, pharmaceuticals, and small-scale assembly applications, where lightweight and precise handling is essential. Moreover, rising growth in the electronics and pharmaceutical sectors leads to rising demand for such robots, fueling the growth of the market. This segment is projected to dominate the industrial robots market with a valuation of 33.44% in 2026.

16 to 60 KG robots are projected to expand at the highest CAGR of 14.45% during the forecast period (2025-2032), due to the growing adoption of such types of robots in industries such as electronics, pharmaceuticals, and automotive industries. Moreover, these robots offer features such as high speed in operation, increasing productivity, and flexibility during performing applications driving the industrial robots market growth.

61 to 225 KG and above 225 KG robots are projected to grow at a moderate rate during the forecast period due to growing automation in the automotive and heavy industries. Moreover, growth in the aerospace and electronics sector fuels the demand for such robots for handling heavy material thereby improving the efficiency of material handling applications and fueling the growth of the market. Moreover, government initiatives and regulations regarding investment in the robotics sector boost the sales of such products and drive industrial robots market growth.

By Industry Analysis

Healthcare & Pharmaceutical to Develop Rapidly During Forecast Period Owing to Increasing Usage in Medical Operations

Based on industry, the market is segregated into electrical & electronics, automotive, food & beverages, healthcare & pharmaceutical, metals & machinery, rubber & plastic, and others.

The healthcare & pharmaceutical industrial robots market is estimated to hold 34% in 2025, owing to factors such as rising demand for such robots in hazardous environments, rising adoption of delta robots for surgeries, and the ability to handle viscous materials.

The automotive sector is projected to dominate the market in terms of revenue share in 2024, owing to factors such as rising adoption of such products in various applications such as material handling, welding & soldering, and cutting. Also, growth in the automotive sector across Asia Pacific and European regions is projected to drive the demand for such robots, fueling the market growth. For instance, according to the Indian Automotive industry, the global automotive sector grew by 12% in 2023 as compared to 2022.

The electrical & electronics and food & beverages sectors are projected to grow at a potential rate during the forecast period, owing to factors such as the rising adoption of such robots in semiconductor, electronics, and food manufacturing plants to perform applications such as material handling and soldering, driving the market growth.

Rubber & plastic and metals & machinery sectors are projected to grow at a potential growth rate during the forecast period, owing to factors such as growth in the metal sector and rubber processing plants. Also, the adoption of such robots in performing applications such as welding, soldering, and material handling is projected to drive the growth of the market.

Others consist of the construction and logistics sectors. This segment registered decent growth during the forecast period due to factors such as enhanced safety and flexibility in e-commerce applications. Also, growth in the construction and e-commerce sectors across the globe creates the demand for such robots, fueling market growth.

INDUSTRIAL ROBOTS MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

ASIA PACIFIC

Asia Pacific Industrial Robots Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held the largest industrial robots industrial robots market share with a valuation of USD 10.68 billion in 2025 and USD 11.89 billion in 2026, and is anticipated to grow at a significant rate during the forecast period due to growth in the automotive and manufacturing sectors. Moreover, growth in e-commerce and logistic sectors across the Asia Pacific region and rising automation in manufacturing sectors across India, China, and Japan countries, fuels the market growth. For instance, according to Invest India, the automotive sector in India grew by 13.8% in September 2024 as compared to September 2023. All such factors drive the growth of the Asia Pacific industrial robots market. The market in India is foreseen to be worth USD 0.44billion in 2026, while Japan is expected to be valued at USD 1.19 billion in the same year.

Download Free sample to learn more about this report.

China Set to Dominate Market Owing to Surge in Demand from Automotive and Other Industrial Sectors

In terms of both value and volume, China is predicted to capture the greatest share of the industrial robots market with a value of USD 7.78 billion in 2026. An increasingly aging population in China puts more robotic systems into operation, owing to the lack of young population present in the market. Additionally, the growth in the automotive sector increased by 97% year on year across China’s prominence. Also, the rising number of such robots in China’s industrial sectors boosts the demand for such robots, driving the growth of the industrial robots market.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is expected to hold the second largest industrial robots market share with a value of USD 7.44 billion in 2026 and is expected to grow at the highest CAGR of 15.74% during the forecast period (2025-2032). Rising automation in the manufacturing sector and growth in the automotive, food & beverages, and chemical industries increase the demand for industrial automation, driving the growth of the market. Also, the growth in the automotive sector across countries such as Germany, France, Italy, the U.K, and others boosts the demand for such robots for performing various industrial applications, driving the market growth. The U.K. market continues to grow and is projected to reach a value of USD 0.68 billion in 2026. For instance, according to the European Automobile Manufacturers Association (ACEA), new car sales in Europe increased by 14% in 2023 as compared to 2022. All such factors drive the growth of the market in the region. Germany is anticipated to reach a market value of USD 3.15 billion in 2026, while France is estimated to be worth USD 0.82 billion.

North America

North America is the third largest market and is projected to reach a value of USD 4.51 billion in 2026. The demand for SCARA robots is on the rise in the U.S. and Canada due to growth in the electrical & electronics, automotive, food & beverages, and material handling sectors. The automotive sector alone contributed around 3% to the total GDP in the U.S. in 2024, driving the need for these robots. These factors are contributing to the growth of the industrial robot market.

The U.S. market is expected to grow steadily during the forecast period, owing to increased adoption in industries such as electronics, automotive, pharmaceuticals, and food & beverages. Moreover, rising government investment in the robotic sector and growth in the automotive sector drive the growth of the market in the region. The U.S. market is anticipated to be valued at USD 3.71 billion in 2026.

Middle East & Africa

The Middle East & Africa region is projected to grow at a moderate rate during the forecast period, owing to growth in industrial automation and rising government investment in automation, driving the growth of such robots in the region and fueling the growth of the market. GCC is estimated to reach a market value of USD 0.1 billion in 2025.

Latin America

Latin America is anticipated to grow decently during the forecast period with a valuation of USD 0.37 billion in 2026, due to growth in the automotive and food & beverages sectors. The rising integration of industry 4.0 practices drives the demand for such products and fuels the industrial robots market growth in the region.

KEY INDUSTRY PLAYERS

Major Players Engaged in Adopting Various Key Developmental Strategies to Intensify Market Competitive Landscape

Key players, such as Kawasaki Heavy Industries, KUKA AG, ABB, and others, are engaged in the adoption of product launch, acquisition, and product development as key developmental strategies to strengthen the geographical presence of their product portfolio and intensify the market competition. For instance, in March 2024, Universal Robots, a subsidiary of Teradyne Robotics, signed a partnership with NVIDIA to bring new technologically advanced AI-enabled robots into the market. Teradyne Robotics launched a new MiR1200 pallet jack robot for material handling applications across automotive, food & beverages, and other sectors.

List of Key Companies Studied:

- ABB (Switzerland)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Mitsubishi Electric Corporation (Japan)

- NACHI-FUJIKOSHI CORP. (Japan)

- Comau SpA (Italy)

- KUKA AG (Germany)

- FANUC CORPORATION (Japan)

- DENSO CORPORATION. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Omron Corporation (Japan)

- Staubli (Switzerland)

- Universal Robots (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: KUKA AG planned to launched a new KR SCARA robot for automotive and pharmaceutical sector. It has features such as payload capacity of 60 KG, maintain precision, high speed, and accuracy. It has three availability reaches of 800 mm, 1000 mm, and 1200 mm.

- October 2023: ABB introduced a new IRB 1090 education robot designed to train employees in industrial plants and offer competitive advantages. The robot supports programming, next-generation controllers, and simulation software. It can reach up to 580mm and has a payload capacity of 3.5 KG.

- November 2023: Yaskawa Electric Corporation launched a new MOTOMAN series of robots. These adaptive industrial robots are designed for performing various applications in automotive and other manufacturing sectors. They are available in five types with payload capacities of 4, 7, 10, 20, and 35 KG.

- November 2023: Universal Robots opened a new manufacturing facility in Barcelona, Spain. The facility is of 1,500 square meters and can sell around 39,000 cobot units around the globe.

- July 2022: Nachi Fujikoshi Corp launched a new series of industrial robots, MZ07LF and MZ07F, for industrial machinery, automotive, and electronics sectors. It is used for picking and placing precision material. It has features such as being lightweight, rigid, flexible, high-speed operation, and able to perform precision handling.

REPORT COVERAGE

The industrial robots market report provides an in-depth analysis of the industrial robots market industry dynamics and competitive landscape. It also provides market estimation and global industrial robots market forecast based on robot type, application, payload capacity, offering, industry, and region. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

|

Study Period |

2021-2034 |

|

|

Base Year |

2025 |

|

|

Estimated Year |

2026 |

|

|

Forecast Period |

2026-2034 |

|

|

Historical Period |

2021-2024 |

|

|

Growth Rate |

CAGR of 15.5% from 2026 to 2034 |

|

|

Unit |

Value (USD Billion), and Volume (Units) |

|

|

Segmentation |

By Robot Type, By Application, By Payload Capacity, By Industry, and By Region |

|

|

Segmentation |

By Robot Type

By Application

By Payload Capacity

By Industry

By Region

|

|

|

Key Market Players Profiles in the Report |

ABB (Switzerland), Yaskawa Electric Corporation (Japan), Mitsubishi Electric Corporation (Japan), Nachi-Fujikoshi Corp (Japan), Comau SpA (Italy), KUKA AG (Germany), Fanuc Corporation (Japan), Denso Corporation (Japan), Kawasaki Heavy Industries Ltd (Japan), and Omron Corporation (Japan). |

|

Frequently Asked Questions

As per Fortune Business Insights, the market was worth USD 21.94 billion in 2025.

By 2034, the market size is expected to record a valuation of USD 77.36 billion.

The market is projected to grow at a CAGR of 15.5% during the forecast period of 2026-2034.

The Asia Pacific is expected to hold a dominant market share, with its value standing at 11.89 billion in 2026.

Within the robot type, the articulated segment is expected to lead the market share during the forecast period.

An increase in investments across the industries is driving the growth of the market.

ABB, FANUC CORPORATION, and KUKA AG are the top companies in the global market.

The top ten players in the market constitute 62% - 65% of the market, which is largely due to their brand name and presence in multiple regions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us