Industrial Seals Market Size, Share & Industry Analysis, By Type (Axial Seals, Radial Seals, Mechanical Seals, and Carbon Seals), By End Use Industry (Automotive, Renewable Energy & Utilities, Semiconductor, Metal and Mining, Food & Beverage, Oil & Gas, Energy, Aerospace & Defense, Marine, Construction & Agriculture Equipment, Chemicals and Pharmaceuticals, Water and Wastewater Treatment, Paper and Textile Manufacturing, and Life Sciences), and Regional Forecast, 2026 – 2034

INDUSTRIAL SEALS MARKET SIZE AND FUTURE OUTLOOK

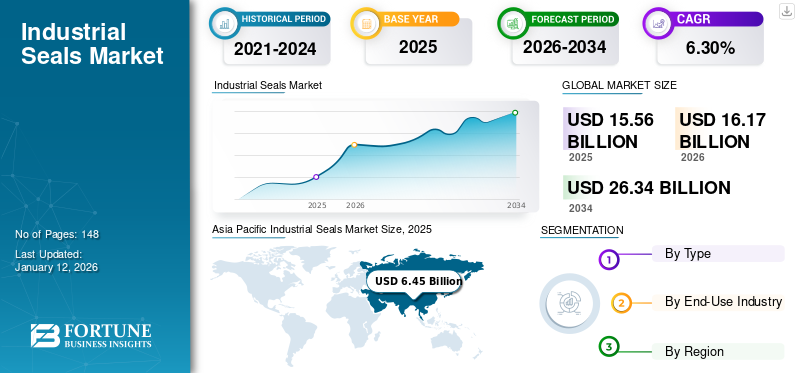

The global industrial seals market size was valued at USD 15.56 billion in 2025. The market is projected to grow from USD 16.17 billion in 2026 to USD 26.34 billion by 2034, exhibiting a CAGR of 6.30% during the forecast period. The Asia Pacific dominated global market with a share of 39.30% in 2025.

Industrial seals are components used at interfaces to prevent leakages, maintain pressure, and deflect contamination. The advent of Industry 4.0 and smart manufacturing is fueling the demand for advanced seals, while the increasing traction for electric vehicles, alongside the continued growth of conventional vehicles, is driving the demand for seals that ensure vehicles perform safely and optimally. As industries become more interconnected on a global scale, there is a growing need for dependable sealing solutions that can prevent leaks, maintain pressure, and shield against contamination at interface points. Furthermore, the ongoing shift toward automation across various sectors underscores the necessity for reliable and efficient sealing solutions to ensure the smooth operation of automated machinery. The rising automation and maintenance activities will further boost the market expansion.

The demand for the manufacturing sector is experiencing strong growth owing to favorable investment policies in emerging countries. This would increase the adoption of machine tools and industrial equipment for the manufacturing process, which will boost the industrial seals market share during the forecast period. For improved machine optimization, companies are installing thermal-resistant industrial seals manufactured by leading companies that allow machines to work properly for longer hours.

Download Free sample to learn more about this report.

The short-term impact of the COVID-19 pandemic on the manufacturing industry primarily included the difficulties in improving production, manufacturing facility shutdown, and supply chain disruption owing to the traffic restrictions and lack of personnel mobility. The pandemic had a negative impact on the market. The extended lockdown halted the manufacturing and assembling units, causing less supply to consumers that require customized sealing products.

On a long-term basis, the market recorded strong growth owing to the resuming manufacturing facilities across the globe. The manufacturers re-opened their manufacturing units by complying with the safety regulations stated by the local, regional, and global governmental bodies.

IMPACT OF SUSTAINABILITY

Eco-Friendly Material Based Sealing Solutions to Gain Market Traction Owing to Growing Sustainable Practices

Industries are progressively prioritizing the integration of sustainability objectives by improving the use of renewable or biodegradable materials in the production of sealing solutions. Advancements in material technology are significantly contributing to the development of sustainable sealing solutions worldwide. By committing resources to eco-friendly materials and cutting-edge manufacturing processes, manufacturers are facilitating the transition toward a more sustainable industrial environment. This shift encompasses the utilization of bio-based polymers, recycled substances, and enhanced production methods, indicating that the future of industrial seals aligns with sustainability. For instance, in February 2024 Schreiner MediPharm launched sustainable closure seals for packaging industries with sustainable materials and ecologically friendly.

INDUSTRIAL SEALS MARKET TRENDS

Electric Vehicle Battery Growth to Propel Market Expansion

Government initiatives, investment from both public and private sectors, and growing awareness of lower carbon emissions, are driving Electric Vehicle (EV) sales across the globe. Electric transportation offers significant benefits, such as reduced environmental impact, long-term cost savings, and a stimulus to economic development. For instance, the International Energy Agency reported that the global sales of electric cars surpassed 10 million units in 2022. The EV market was projected to witness a year-on-year growth rate of over 35% in 2023, leading to an increased demand for batteries.

Industrial seals play a vital role in EV battery systems, effectively reducing dust, moisture, and heat within the batteries. They also aid in dividing the upper and lower housing sections of EV batteries. Many significant market players are actively pursuing the development of innovative sealing solutions for EVs, broadening their product offerings, and expanding their customer base.

MARKET DYNAMICS

Market Drivers

Rising Foreign Direct Investment in Manufacturing Sector and Power Generation to Propel Market Growth

Foreign Direct Investment (FDI) is surging globally across various regions, which is poised to drive the robust expansion of the manufacturing sector in the foreseeable future. Many countries are adopting investment policies aimed at boosting manufacturing. For instance, in July 2021, the India Brand Equity Foundation (IBEF) highlighted that allowing 100% FDI in the power sector has significantly enhanced FDI inflows in this domain.

Moreover, cooling processes are essential for maintaining normal temperatures in power plants, where large-scale machinery operates continuously. Industrial mechanical seals are crucial for ensuring the smooth and efficient operation of these machines, providing both safety and economic feasibility to the system. Consequently, the demand for seals in the power generation industry is on the rise, driven by increasing FDI activities and the growth of the manufacturing sector, thereby fueling the global industrial seals market growth.

Market Restraints

Availability of Substitutes and High Manufacturing Cost May Hinder Market Growth

End-users, over the past few decades have embraced industrial seals, owing to their high reliability and durability. However, they have shifted their focus on seal-less driving shafts attributed to their high maintenance and tough installation processes. Seal-less driving shaft offers benefits, such as zero leakage and provides total control on fugitive emissions, thereby eliminating the requirement of extra seal flush piping and complex seal support systems. The sealless magnetic drive pump is enclosed by the magnet set, which helps in transporting the magnetic field to the shaft. These are a few of the factors which might impact the demand for industrial seals.

Market Opportunities

Partnership with Industrial Internet of Things (IIoT) Solution Providers to Accelerate Market Growth

The manufacturers have an opportunity to collaborate with IIoT solution providers and adopt digital transformation technologies and services such as condition monitoring and enhanced Condition Data Point Monitoring (eCDPM), and predictive analytics services to identify the actual equipment performance, detect the wear & tear in a machine and resolve detected failures. The Internet of Things (IoT) has been a phrase in the limelight in all forms of applications including, industrial, commercial, and others. It is the gateway to enable the predictive maintenance programs to practice as it potentially creates more efficient processes that could lessen the cost through equipment dependability.

SEGMENTATION ANALYSIS

By Type

Radial Seals Segment to Dominate the Market Owing to Heavy Duty Industrial Applications

By type, the market is classified into axial seals, radial seals, mechanical seals, and carbon seals. Mechanical seals include pusher and non-pusher, conventional seals, o-rings, balanced and unbalanced seals, and cartridge.

The radial seals segment is predicted to lead the market in terms of revenue throughout the forecast period. Heavy-duty industrial applications, including metal, mining, paper, oil drilling, or wind turbines, require a large number of radial shaft seals. Seals are required in gearboxes, pumps, axles, power steering columns, transmission, and speed reducers. Several end-use industries, such as chemicals, automotive, renewable energy, food & beverage, and oil gas are generating a strong demand for radial seals owing to rising new and aftermarket sales across several countries. The radial seals segment led the market share by 33.21% in 2025.

The mechanical seals segment is projected to experience the highest CAGR during the forecast period as a result of their rising applications in pumps, agitators, and mixers across a variety of sectors. Mechanical seals prevent leakage of water or oil into the external environment. Carbon seals benefit end-users owing to its self-lubricating and corrosion resistant properties further propelling the demand for sealing solutions over the forecast period.

By End Use Industry

Automotive Sector to Hold Highest Market Share Due to High Need for Optimal Vehicle Performance

By end-use industry, the market is segmented into automotive, renewable energy & utilities, semiconductor, metal and mining, food & beverage, oil & gas, energy, aerospace & defense, marine, construction & agriculture equipment, chemicals and pharmaceuticals, water and wastewater treatment, paper and textile manufacturing, and life sciences. The aerospace and defense segment is further divided into space, commercial aviation, and defense.

The automotive segment is expected to dominate the market share of 34.14% at the global level in 2026. Seals have versatile applications in the automotive sector as they help ensure optimal performance and safety of vehicles. They reduce noise and help prevent leaks to improve fuel efficiency in conventional and electric vehicles. Furthermore, they also prevent the entry of dust and water into components, minimizing the maintenance and repair costs for end users. Widespread application of seals in vehicle parts, such as engines and doors can ensure efficient and safe driving experience.

The semiconductor segment is expected to grow significantly with a CAGR of 9.69% over the forecast period owing to the rising application of seals in processing systems. Seals are required in semiconductor manufacturing process to prevent leakage of highly corrosive fluids and gases. They enhance the product’s service life and offer extended planned maintenance for semiconductor manufacturing equipment.

To know how our report can help streamline your business, Speak to Analyst

INDUSTRIAL SEALS MARKET REGIONAL OUTLOOK

Based on region, the market is classified as North America, Europe, Asia Pacific, South America, and Middle East & Africa.

Asia Pacific

Asia Pacific Industrial Seals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest market share of value USD 6.12 billion in 2025 owing to heavy-duty industrial applications of seals.

The trend of automation in various industries requires reliable and efficient sealing solutions to ensure the proper functioning of automated machinery. The rise of Industry 4.0 and smart manufacturing contributes to increased sales of technologically advanced seals that drives the Asia Pacific industrial seals market. Rising EV demand and steady growth of conventional vehicles have further enhanced the demand for seals ensuring the safe and optimal performance of vehicles. As industries become more interconnected globally, there is an increased demand for reliable sealing solutions in diverse geographic locations. Companies with a global presence and the ability to supply high-quality seals worldwide are set to experience increased sales.

Rapid industrialization and the increasing demand for industrial seals across different sectors, including automotive, petrochemical, and oil & gas refineries, will propel the demand for seals. Government associations in emerging and developing countries, such as India and China are making significant investments in the manufacturing sector. For instance, ASEAN countries, such as Indonesia, Malaysia, Thailand, and Vietnam released incentive-based policies to boost the demand for electric vehicles in 2023. Numerous global manufacturers have a strong presence and an interconnected and well-developed supply chain across the region. These factors are a few of the primary contributors to the decent sales and adoption of industrial seals. Moreover, China and India are experiencing growth in technology ecosystems, with an emphasis on innovation and startups. The Asia Pacific market is anticipated to experience the highest growth rate as a result of increasing demand from the energy sector and power plants and growing semiconductor manufacturing. The market of India accounts for USD 1.77 billion, while China projects the market size with the value of USD 2.52 billion and the Japan market valued for USD 1.09 billion in 2026.

China’s increasing automotive manufacturing, including both conventional and electric vehicles, is surging the demand for industrial seals. Seals in the automotive industry are used in engine systems, transmission systems, steering, and suspension systems. Along with the automotive sector, growing industrial manufacturing and maintenance activities across the country are further set to boost the demand for seals for different applications, including gear reducers, gearboxes, motors, pumps, robotic arms, machines, turbines, and others. Government investment and supportive policies are further generating strong demand for industrial components. For instance, the Ministry of Finance in China, allocated around USD 2.52 billion to rebuild manufacturing foundations in March 2025.

North America

The North American industrial seal market’s anticipated valued is USD 3.45 billion in 2025 and projected to grow at a steady pace during the forecast period. North America has always been at the forefront in manufacturing, such as automotive, utility, energy, and aerospace, with a better focus on the utilization of better and high-quality products that can aid their sales in the region. Furthermore, the region also has a prominent power and energy sector, which can improve product sales in the aforementioned end-use industries. U.S. to account for high demand for industrial seals with an expected market valued of USD 2.2 billion in 2026, owing to new oil reserves discovery and increased upstream activities. Continuous technological advancements, allowing for the development of seals with improved performance and durability to further bring market opportunities for industrial seals in the U.S. market.

Europe

Europe is the second-leading market, and will hit USD 4.63 billion in 2026, with a CAGR of 4.72% can be categorized as a mature market with limited growth opportunities compared to Asia Pacific due to already established and well-structured infrastructure setups in most of the countries. The average market performance of some of the leading market vendors in the region is another reason behind the limited market growth in the region. Substantial growth in the region is attributed to growing food & beverage and oil & gas industries. The market proceedings are spearheaded by the two countries, namely Germany and the U.K. Both countries are at the forefront of technological innovation, driving growth in this sector. The U.K. market will account for USD 0.91 billion, while France projects the market size of USD 0.78 billion and Germany at USD 1.27 billion in 2026.

Middle East and Africa

The Middle East & Africa is the fourth largest market with expected value of USD 1.12 billion in 2026 and projected to witness moderate growth as a result of the power and oil & gas industries. The sharp increment in the requirements for fossil fuel in the past decade has encouraged oil-rich countries to work more efficiently and effectively to retrieve most from their oil reserves and work with precision to meet the high rise of demands across the globe. With decent growth in sales, the oil suppliers have moved their focus toward the installation of innovative equipment to augment the profit margins in the business. The GCC market size is anticipated to reach USD 0.62 billion in 2025.

South America

Niche opportunities for the development of the manufacturing industries, limited presence of global market players in the region, and underdeveloped distribution channels for the market are the factors in South America that dictated sluggish growth of the region during the forecast period.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies to Focus on Strategic Acquisitions and Sustainable Development Strategy to Strengthen their Market Positions

Manufacturers are evaluating their portfolios to ensure the delivery of sustainable differentiation, along with consistent long-term performance. This allows for making portfolio adjustments and evaluating high-quality acquisitions for long-term growth potential. Seals for industrial applications come according to the sizes of the equipment that are required to be sealed. Additionally, key players supply equipment on custom requirements, enabling them to create custom seals with sustainable materials and sizes. As a result, the manufacturers have significant opportunities over the forecast period to enhance their business with the production of innovative products.

- For instance, the Freudenberg Group emphasized the continuous development of its sustainability strategy and the implementation of a uniform, Group-wide HR system in 2020.

Major Players in the Industrial Seals Market

End-users are inclined to purchase the seals from them which benefits them at the time of installation, maintenance, and replacement after the wear and tear of the seals. SKF, Flowserve Corporation, John Crane (Smiths Group plc), are few of the top players in the market. The dominance of these players is owed to their presence in additional industrial equipment manufacturing markets such as bearings, shafts, etc. along with a variety of industrial seals.

List of Key Industrial Seals Companies Profiled:

- Freudenberg SE (Germany)

- Fenner Group Holdings Limited (Hallite Seals) (U.K.)

- Waukesha Bearings Corporation (U.S.)

- Hi-Tech Seals (U.S.)

- Tenneco Inc. (Federal-Mogul LLC) (U.S.)

- Spareage Sealing Solutions (India)

- AESSEAL (U.K.)

- The Timken Company (U.S.)

- SKF (AB SKF) (Sweden)

- Flowserve Corporation (U.S.)

- John Crane (Smiths Group plc.) (U.K.)

- Trelleborg AB (Sweden)

- EnPro Industries, Inc. (Garlock GmbH) (U.S.)

- Dover Corporation (Waukesha Bearings) (U.S.)

- SHV (ERIKS Group) (Netherlands)

- BELL D.O.O. (Slovenia)

- Carl Werthenbach Konstruktionsteile GmbH & Co. KG (Germany)

- Dickson Bearings & Transmissions Ltd (Ireland)

- Rea Hellas S.A. (Greece)

- Globseals Africa Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: John Crane, a leader in rotating equipment solutions and services for process industries, introduced the Type SB2/SB2A USP seal. This innovative seal combines the robust Type SB2/SB2A twin cartridge seal with John Crane’s proprietary Upstream Pumping (USP) technology. Renowned for its exceptional performance, the Type SB2/SB2A seal is now part of John Crane’s latest USP product line, enhancing service offerings in the pulp & paper and mining sectors.

- February 2023: Momentum Group’s subsidiary, Momentum Industrial, acquired LocTech AB. This strategic acquisition strengthens Momentum Industrial’s market position by integrating LocTech, a comprehensive provider of seals for both rotational and stationary applications.

- October 2022: Trelleborg AB completed its acquisition of Lindau, Germany-based company MG Silikom GmbH from the Saint Gobain Group. With annual sales of approximately USD 14 million, MG Silikon specializes in sealing products for aerospace and industrial applications.

- June 2022: Trelleborg Sealing Solutions introduced the Isolast K-Fab Seal, designed to enhance productivity in high-temperature semiconductor subfab applications. This solution aims to reduce unexpected downtime and total cost of ownership, potentially driving growth in the global industrial seal market.

- May 2022: Gallagher Fluid Seals, Inc. took over IEQ Industries, a distributor of new, used, and remanufactured pumps, pump parts, and pump packages for various commercial and industrial applications. The objective of the acquisition was to help the company diversify its product portfolio. Having an intersection in market segments will allow the company to benefit from historical customer relationships.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading industries of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.3% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

| Segmentation | By Type, By End Use Industry, and Region |

|

Segmentation |

By Type

By End Use Industry

By Region

|

|

Companies Profiled in the Report |

AB SKF (Sweden), Dover Corporation (U.S.), Enpro Industries (U.S.), Flowserve Corporation (U.S.), Freudenberg Group (Germany), John Crane (U.S.), SHV (ERIKS) (Netherlands), Tenneco Inc. (U.S.), The TIMKEN Company (U.S.), Trelleborg Group (Sweden). |

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach a valuation of USD 26.34 billion by 2034.

In 2025, the market was valued at USD 15.56 billion.

The market is projected to grow at a CAGR of 6.30% during the forecast period.

By end use industry, the automotive segment is leading segment is anticipated to dominate the market owing to rising demand for conventional and electric vehicles.

The heavy demand for electric vehicle batteries is a key trend in the market.

Increasing foreign direct investment and the growing manufacturing sector are key factors driving the market expansion.

AB SKF, Flowserve Corporation, John Crane (Smiths Group plc), Freudenberg SE, and Tenneco Inc. are a few of the key market participants globally.

Asia Pacific led the global market in 2025 owing to increasing need for automation in various industries

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us