Managed Pressure Drilling Market Size, Share & Industry Analysis, By Technology (Constant Bottom-Hole Pressure (CBHP), Pressurized Mud-Cap Drilling (PMCD), Dual Gradient (DG)), By Application (Onshore, Offshore), and Regional Forecast, 2026-2034

Managed Pressure Drilling Market Size

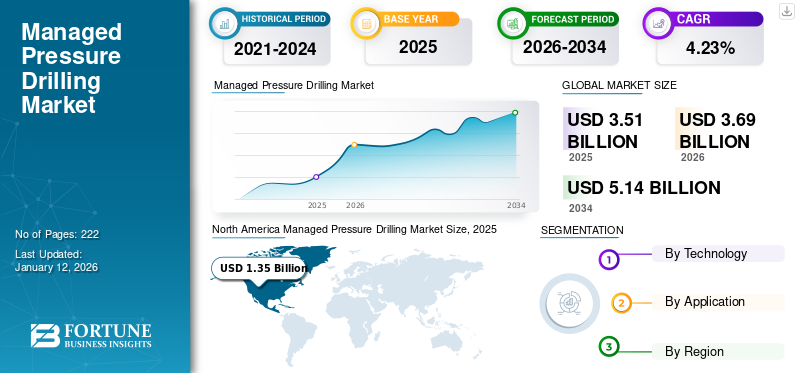

The global managed pressure drilling market size was valued at USD 3.51 billion in 2025. The market is projected to grow from USD 3.69 billion in 2026 and reach USD 5.14 billion by 2034, exhibiting a CAGR of 4.23% during the forecast period. North America dominated the managed pressure drilling industry with a market share of 38.44% in 2025. The managed pressure drilling market in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.62 billion by 2032, driven by the growing energy consumption and export opportunities in the country.

The remarkable development of exploration activities worldwide has increased the demand for advanced drilling technology. Traditionally, managed pressure drilling (MPD) systems have helped operators “thread the needle” into tight drill windows, allowing them to complete wells that rank among the world's toughest by return flow control drilling. However, in today's competitive drilling environment, all well types can deploy the MPD to improve drilling efficiency, manage wellbore stability, and improve kick detection and management. The downhole pressure plays a vital role in any drilling scenario and MPD allows operators to manage bottom-hole stresses to improve their drilling performance.

The outbreak of COVID-19 has had a significant impact on the oil and gas industry.

Managed Pressure Drilling Market Trends

Favorable Government Initiatives to Meet the Increasing Demand for Oil and Gas

Increasing government investment in new oil and gas reserves creates new growth avenues in the drilling market. Projects are being launched in several regions to meet the increasing demand for crude oil, further increasing the requirement for drilling equipment and managed pressure drilling.

For instance, initiatives such as the National Green Hydrogen Mission in India has an initial allocation of USD 2.3 billion and is primarily aimed at increasing domestic electrolyzer manufacturing and hydrogen production. In addition, it involves a state capital infusion of USD 3.5 billion for OMCs (Oil Marketing Companies).

In 2020, Egypt announced an investment of USD 1.4 billion for oil and natural gas exploration in nine new locations in the Mediterranean Sea and the Red Sea. Under the same, the State Department of Petroleum and Natural Resources is expected to drill 23 new wells in both seas. MPD is used to precisely control the annular pressure profile throughout the wellbore.

Rise in Global Product Demand due to Increase in Shale Gas Drilling

Shale gas is a natural gas explored by multi-stage hydraulic fracking and horizontal drilling from shale rock or underground reservoirs. According to the IEA Shale Gas Report, shale gas reserves are found worldwide in sizable amounts of about 16,103 trillion cubic feet. China has become the largest shale gas producer globally since 2005, with 1,115 trillion cubic feet in 2022, followed by Argentina, Algeria, and the U.S. The increasing number of offshore projects and increasing production of shale gas worldwide will increase the need for offshore drill pipe. At the same time, crude oil production has led to large investments in offshore production and exploration activities worldwide.

Download Free sample to learn more about this report.

Managed Pressure Drilling Market Growth Factors

Market Value to Surge Due to Discoveries of New Oil Fields

Rising investment to explore and produce a bulk volume of hydrocarbons to meet international energy demand is expected to be one of the major elements increasing global demand. Additionally, continued exploration from wild wells and deploying geological studies to discover new reservoirs of capacity that can efficiently supply oil production over a more extended period are expected to create new opportunities for the industry.

For example, in October 2020, Odfjell Drilling announced that it had been awarded a 15-well contract by Equinor to drill and complete wells in the North Sea as part of its Breidablikk project. The new drilling locations are expected to be offshore Aberdeen and start in 2022, with a 2.5-year expansion.

Increased Investment in the Offshore Sector to Boost Market Growth

Many of the world's potential hydrocarbon reserves lie under the sea. The hydrocarbon industry has developed techniques suited to offshore conditions to find oil & gas and produce them successfully. Oil production from the offshore sector is expected to be the fastest-growing segment over the forecast period owing to increased investments in the subsea oil & gas industry and the growing energy demand.

Oil and gas companies are making record profits from the surge in fossil fuel prices caused by the Ukraine war to step up the search for new deposits. This has been observed in spite of repeated calls by the United Nations to stage out hydrocarbons to prevent a climate crisis.

The growing investment in the offshore sector is helping to drive the market growth. According to the World Investment Report, in 2019, investment in new offshore locations increased to USD 93.3 billion from USD 61.5 billion in 2018. Therefore, the growing investment scenario in the offshore sector is driving the demand for drilling services, thereby propelling the managed pressure drilling market growth.

RESTRAINING FACTORS

Rising Inclination toward the Acceptance of Renewable Energy Technologies to Hinder Market Expansion

Several governments and organizations have hosted considerable renewable energy production targets to limit carbon emissions, which can hinder the market. In addition, different jurisdictions are aimed at reducing their reliance on fossil fuels and promoting the adoption of low-emission technologies. For instance, in April 2022, International Renewable Energy Agency showed that renewables have continued to exhibit appreciable growth in spite of global uncertainties.

Managed Pressure Drilling Market Segmentation Analysis

By Technology Analysis

Narrow Pressure Window in Depleted Areas to Boost the Constant Bottom-Hole Pressure Segment Growth

The market has been segmented into Constant Bottom-Hole Pressure (CBHP), Pressurized Mud-Cap Plug Drilling (PMCD), and Dual Gradient (DG) based on technology. The CBHP segment holds the dominant market share of 47.43% in 2026, as foraging in depleted areas often results in narrow pressure windows and loss of circulation issues. Forage in these areas requires a more consistent bottom-hole pressure to stay within the narrow pressure window.

The managed pressure drilling technique has many applications, including high-pressure and high-temperature wells, deep water drilling with lost circulation, and narrow drilling windows. CBHP provides a higher level of safety when foraging. It applies bottom-hole pressure consistently above pore pressure and below burst pressure by applying surface backpressure to the surface. The technique is also used to drill narrow margins, allowing precise surface backpressure application to maintain Bottom-hole pressure. Similarly, other managed pressure drilling techniques, such as PMCD and dual gradient drilling, are also used to drill fractured carbonates and deep wells.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Onshore Drilling Activities to Augment the Onshore Segment Growth

Based on application, the market has been segmented into onshore and offshore. The onshore segment accounted for a large portion of the global MPD market revenue owing to the increased exploration and production activities in onshore oil and gas fields. Onshore segment accounts for 81.84% of worldwide oil and gas production.

REGIONAL INSIGHTS

The global market has been analyzed across major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Managed Pressure Drilling Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

The North America market share stood at USD 1.22 billion and is expected to record appreciable growth over the forecast period. According to the U.S. Energy Information Administration, shale gas will provide half of the U.S.’s domestic gas by 2035. The increasing number of unconventional natural gas wells in the country is expected to grow until 2040 as companies invest steadily, considering the rising price of oil and gas. This is a significant reason for the increasing demand for drilling services, including managed pressure drilling across the region. The U.S. market is projected to reach USD 1.12 billion by 2026.

Asia Pacific

Asia Pacific is the fastest-growing managed pressure drilling market due to the region's large presence of undiscovered reserves. The region is one of the promising markets with a positive market outlook. The demand for hydrocarbons is constantly increasing due to the massive demand for infrastructure, the demographic explosion, and the aeronautical and maritime industry expansion, among others. India and China invest heavily in discovering oil and gas reserves to meet the massive demand for oil and gas. Moreover, the annual growth in drilling to meet the exponential demand for hydrocarbons is expected to boost the market. The China market is projected to reach USD 0.88 billion by 2026, and the India market is projected to reach USD 0.075 billion by 2026.

Middle East & Africa

The market in the Middle East & Africa holds substantial market potential to explore the untapped capacity of developing hydrocarbons and non-complex formations to effectively drill wells, which will drive the growth of the drilling services market in the coming years. Countries in the Middle East and Africa, including the United Arab Emirates, Saudi Arabia, Kuwait, Bahrain, and others, are members of the Organization of the Petroleum Exporting Countries (OPEC) and concentrate on achieving the production objectives set by the association. Oman, Algeria, Qatar, and Nigeria are other vital countries engaged in the market in the region.

Europe

Growing shale oil & gas exploration in Russia will propel the demand for managed pressure drilling. might be attractive to Europe as it will offer the security of energy supply to some countries particularly dependent on Russian gas; it could supply a cleaner fuel than coal in power stations. The most prospective areas for oil exploration in Europe include the eastern Baltic, northeastern Ukraine, western Ukraine, the Balkans, central Poland, northern Germany, parts of southern Norway and Sweden, Netherlands, north of France, and northern England. And the demand for MPD services is comparatively high in those regions. The UK market is projected to reach USD 0.024 billion by 2026.

Latin America

Furthermore, Latin America is also experiencing positive growth due to growing deep drilling activities in Brazil and Mexico. For instance, in Dec 2021, Brazilian conglomerate Petrobras broke the record for Brazil's deepest exploratory oil well, with a depth of 7,700 meters.

Key Industry Players

Halliburton and Schlumberger to Lead with Extensive Service Profile

The market has several players focused on providing managed pressure drilling services. The market players are developing various technological advancements, including techniques that enhance performance characteristics and improve drilling. Most players in the market focus on CBHP. As the drilling industry grows, an expanding market for commodities and energy will create profitable opportunities for oil and gas companies.

LIST OF TOP MANAGED PRESSURE DRILLING COMPANIES:

- Beyond Energy Services & Technology Corporation (Canada)

- Enhanced Drilling (Norway)

- Stena Drilling Ltd (U.K.)

- Nabors Industries Ltd (U.S.)

- OilSERV (UAE)

- Ensign Energy Services (Canada)

- ADS Services, LLC (U.S.)

- Salos Sunesis Limited (U.K.)

- MAERSK DRILLING (Denmark)

- Aker Solutions (Norway)

- Schlumberger (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2022 - Stena Drilling entered a new contract with Shell UK Ltd. for the Mobile Offshore Drilling Unit (MODU). The work will start in the 2nd quarter of 2023 for a firm with an alternative of extending the contract for an additional period of up to 1 year in direct continuation.

- March 2022 - Nabors Industries Ltd. invested USD 8 million in GA Drilling. The investment strengthens the company's commitment to deep drilling technologies for the development of ultra-deep, super-hot rock reservoirs. In addition, Nabors continued with its energy transition strategy, targeting low-carbon energy markets with high expansion potential.

- April 2021 – National Energy Services Reunited Corp. (NESR), a leading provider of integrated energy services in the Middle East & North Africa and Asia Pacific regions, announced that it has entered into a partnership and started operations with Beyond Energy Services and Technology. Via the deal, the company intends to provide and deploy managed pressure drilling services in the Middle East, Asia, and Africa regions.

- June 2021 – NORSKE SHELL inked a revision to their existing agreement with Enhanced Drilling, a Norwegian oilfield services company, to shelter the use of EC-Drill - the Controlled Mud Level (CML) system. The operation, which was set to begin in Q1 2022, would use a joint CML and Riserless Mud Recovery (RMR) system on the Ormen Lange Field.

- July 2020 - Ensign Energy Services announced plans to secure Halliburton's 40% stake in Trinidad Drilling International for USD 33.4 million. The deal will expand Ensign's platform in the Middle East with some of the technically advanced and newest drilling rigs in the region.

REPORT COVERAGE

The research report highlights regional and country-level analysis to understand the user better. Furthermore, the report provides insights into the latest market trends and market analysis of technologies deployed rapidly globally. It further highlights some drivers and restraints, helping the reader gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 4.23% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 3.69 billion in 2026 and is projected to reach USD 5.14 billion by 2034.

In 2025, the North America market was valued at USD 1.35 billion.

The market is expected to expand at a CAGR of 4.23%, exhibiting substantial growth during the forecast period (2026-2034)

Based on application, onshore exploration is expected to maintain its dominant position in the market over the forecast period.

Halliburton and Schlumberger are some of the key players operating in this market.

North America dominated the managed pressure drilling industry with a market share of 38.44% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us