Perovskite Solar Cell Market Size, Share & Industry Analysis, By Type (Rigid and Flexible), By Application (BIPV, Power Station, Transportation and Mobility, Consumer Electronics, and Others), and Regional Forecast, 2026-2034

PEROVSKITE SOLAR CELL MARKET SIZE AND FUTURE OUTLOOK

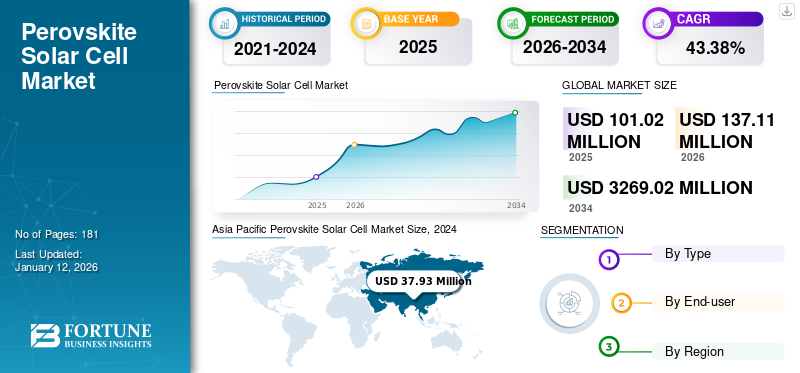

The global perovskite solar cell market size was valued at USD 101.02 million in 2025 and is projected to grow from USD 137.11 million in 2026 to USD 3269.02 million by 2034, exhibiting a CAGR of 43.38% during the forecast period.

Perovskite solar cell is a type of solar cell made of a perovskite structured compound, typically a hybrid organic-inorganic lead or tin halide-based material. This class of materials has a unique crystal structure that efficiently converts sunlight into electrical energy. These cells have gained significant attention due to their potential to provide high power conversion efficiencies, low manufacturing costs, and easy fabrication processes. However, some challenges still need to be addressed, such as improving the stability and durability of the materials in real-world conditions. The increasing share of market share is driven by their superior efficiency, lower costs, versatile applications, rapid energy payback, and strong policy support.

According to reports, these solar cells have made remarkable progress, with rapid increases in efficiency, from around 3% in 2009 to over 25% in 2021. They have become highly efficient, but several challenges remain to be addressed as they may become a competitive commercial technology. As per the Government of India, a major share of solar panels and modules are imported from China, along with other equipment, such as prefabricated structures, raw materials, and inverters in India.

Saule Technologies, Oxford Photovoltaics, Hiking PV Technology Co., Ltd, and others are the major players in the market. These companies are leveraging advancements in technology and increasing investments to enhance the efficiency and commercial viability, positioning themselves as leaders in the renewable energy sector.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Introduction of Modern BIVP Products in the Market is Driving Demand for the Product

The perovskite solar cell market is driven by an increase in demand for more favorable conditions. One of the major end-users of the perovskite solar cell is the BIPV (building integrated photovoltaic) market, which incorporates modern technologies with renewable sources. Products such as windows, roofs, and walls are being combined with the perovskite solar cell to generate power without any complex operations. Besides power generation and consumption, this also helps in protecting the building interior from harsh environments. This has drawn government organizations' and several industries' attention to investing in perovskite solar cell technology development.

Global emissions are additionally expected to be around 50% by 2050 if the current trend of energy consumption befalls. Therefore, replacing building energy generation from non-renewable sources with modern renewable sources by integrating technology is highly demanding.

The perovskite solar cell market share is driven by the application of the product in current energy demand. In addition, BIVP products are more inclined towards a sustainable future driven by their lightweight material and deliver different advantages to operations. The flexible designs of the perovskite allow it to be installed on any surface and in any part of the building design easily. All these factors make market more demanding for BIVP products and thus contribute to the growing demand as the modern era shifts towards renewable sources.

Favorable Government Incentives and Policies Regarding Solar Energy is Driving the Market Growth

Solar energy is becoming a favorable renewable source for several applications driven by growing awareness in businesses. Various companies and locals are increasingly installing solar panels across the globe. As a modern energy source, many buildings are installing perovskite solar cells in their windows, roofs, and open walls to convert sun rays to energy. However, installing solar panels and farms is not easy as they must go through many standards for solar panels, structures, piles, geotechnical surveys, and others. Government policies and standards advise LPAs (Layered Process Audits) to consider their possible impacts on the environment and the view of local communities when identifying suitable sites and installation equipment such as perovskite solar cells.

For instance, on March 9, 2023, the Uttarakhand state government launched two agendas to provide self-employment opportunities to enterprising youth and farmers in order to meet the growing demand for energy in rural areas by developing alternative energy sources such as solar. In addition, in the coming years, perovskite will be the most used residential product due to its applications, as per the data.

On February 2, 2023, the Tokyo Metropolitan Government fronted a de-carbonization movement at Morigasaki Water Reclamation Center in Ota District, Tokyo, by setting up a demo experiment of the modern solar power generation perovskite solar cell. Moreover, The metropolitan government is making various efforts to increase the percentage of renewable power sources used to around 50% by 2030.

Such government initiatives and standards may drive the solar equipment market, where perovskite solar cells have become essential products to support solar systems. The market is rapidly growing owing to the demand for energy transition and will continue to grow with an annual growth rate of around 50%.

MARKET RESTRAINTS

Imperfection Designs and Challenges in Installation, Testing & Inspection Hinder the Market Growth

Utility-scale solar installations are increasing globally, offering consumers numerous advantages. However, they also present significant challenges, such as issues in designing ground-level installation of solar technology and materials. In recent years, perovskite technology has taken a step toward increasing production and explored the marketplace for commercializing these devices in residential and commercial sectors. Several issues hinder market growth while exploring the products and materials associated with solar energy.

Installation of the perovskite solar cells comes with technical challenges, such as opting for fabrication of bottom and top electrodes, effective deposition of charge extraction layers, lower efficiency of large cell modules, imperfect designs of the products, and others. To address these challenges, businesses must focus on building small and large-scale perovskite solar cell devices. Lack of imperfection leads to the destruction of the projects, becoming a problem and not easy to overcome.

For instance, On August 30, 2022, a Japan-based lab-made perovskite solar panel missed 25% of efficiency over 9 months. This is owing to the high temperatures and the need for better performance than expected. Investigators have been working closely for around 25 years to stabilize solar degradation. Another limiting factor is that sub-surface conditions as solar sites are susceptible to variable conditions that can harm solar projects. On a positive note, this challenge can be addressed in the upcoming years as technologies evolve to provide a more stable and reliable structure for solar systems.

MARKET OPPORTUNITIES

Shift towards Renewable Sources and Growing Investments Creates New Opportunities in the Market

Innovations in the solar industry, such as enhanced materials and design developments, create huge opportunities for the market. The ongoing development of more cost-effective and sustainable solar power and material solutions positions the market to capitalize on technological advancements and cater to the changing needs of the solar energy sector. Considering these factors, many private and government bodies are investing heavily in the market owing to its popularity and advantages.

For instance, in 2023, Perovskite solar technology pioneer Tandem PV held USD 6 million in funding, bringing its total to USD 27 million in capital and government support. The company's tactics are to allocate the resources to advance research and development and pledge to build its inaugural manufacturing facility. Perovskite holds numerous potential applications. In recent years, there have been huge investments in perovskite R&D, and companies believe these materials will evolve as a game-changer, typically in the solar market. Financiers and investors who believe perovskite has a positive future are creating new opportunities in the market.

Owing to the availability of a few players in the solar market, there is a high chance for the new players to enter and deliver quality products to the end-user. The global market is not complex enough to establish companies, and this can positively impact the manufacturing sectors in the PV industry.

MARKET CHALLENGES

Manufacturing Complexities of Perovskite Solar Cells to Create Challenges for Market Growth

The production method for perovskite solar cells includes several material selections, and the absence of a completely standardized material system heightens uncertainty and expenses. Various research groups might employ different combinations of perovskite materials, resulting in differences in performance and stability results.

The creation of superior perovskite layers depends on intricate crystallization methods. Changes in these techniques could lead to substantial variations in the quality and functionality of perovskite thin films, making the shift from lab-scale production to industrial manufacturing more challenging.

PEROVSKITE SOLAR CELLS MARKET TRENDS

Increased Investment in Research and Development of Perovskite Solar Cells has Emerged as a Market Trend

Increased financial support aids in the development of innovative manufacturing methods, such as solution printing and vapor deposition, which reduce production expenses and enhance scalability. These developments enable the large-scale production of perovskite solar cells while upholding high efficiency and quality.

As more resources are allocated to R&D, perovskite solar cells become increasingly competitive with traditional silicon-based solar technologies. Enhanced efficiency and reduced costs position them favorably in the growing renewable energy market, which is projected to expand significantly over the coming years. The worldwide focus on sustainability propels investments in renewable technologies such as perovskite solar cells. As countries work to achieve their climate-related objectives, increased funding for research and development corresponds with the larger goal of shifting to sustainable energy systems.

IMPACT OF COVID-19

The pandemic resulted in considerable disturbances in supply chains, influencing the accessibility of raw materials required for the production of perovskite solar cells. This interruption resulted in a hold on the manufacturing and project schedules, affecting overall market expansion. Numerous research and development initiatives were halted due to lockdowns and restrictions, delaying advancements in perovskite technology. The lack of ability to perform experiments and trials obstructed the progress in enhancing efficiency and stability, which are essential for commercial feasibility. The broader economic uncertainty throughout the pandemic impacted consumer confidence as well as investment in emerging technologies, such as renewable energy options. This reluctance hindered the perovskite solar cell market growth during the peak of the crisis.

SEGMENTATION ANALYSIS

By Type

Higher Efficiency Of Rigid Products Drive Growth for Rigid Segment

The market is segmented into rigid and flexible, based on type.

The rigid segment is dominating the market. Rigid perovskite solar cells have shown exceptional power conversion efficiencies, frequently surpassing 25% in controlled laboratory conditions. This level of efficiency is notably greater than the flexible alternatives, rendering its appeal for uses where performance is essential, such as in conventional rooftop setups and solar energy farms. This segment is set to attain 74.32% of the market share in 2026, documenting a significant CAGR of 89.99% during the forecast period (2025-2032).

The flexible segment is the second dominating segment in the market, as these are designed to be fabricated on flexible substrates, such as plastic or metal foils, allowing them to conform to curved surfaces or be integrated into flexible electronics. These cells offer versatility and lightweight properties, making them suitable for applications where traditional rigid solar panels are impractical or portability is essential.

By Application

BIPV Is Growing Owing To Sustainability Requirements And Technological Advancements

The market is divided into BIPV, power stations, transportation and mobility, consumer electronics, and others, based on application.

The BIPV is the dominant and fastest-growing segment in the market. Building-integrated photovoltaics (BIPV) have a dual purpose: to serve as the structure's outer layer and generate electricity for on-site use or export to the grid. BIPV systems save on material & electricity costs, reduce pollution, and increase the architectural appeal of buildings. The segment held 44.09% of the market share in 2026.

Transportation and mobility is the second dominating segment in the market. Perovskite solar cells are recognized for their light and flexible properties, which are crucial for incorporating into diverse transportation uses, including electric vehicles (EVs), drones, and portable electronic gadgets. This adaptability enables straightforward integration into surfaces that necessitate minimal extra weight and is essential in the transportation industry, where effectiveness and performance are critical.

To know how our report can help streamline your business, Speak to Analyst

PEROVSKITE SOLAR CELL MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Perovskite Solar Cell Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Rising Energy Need and Renewable Energy Targets to Drive the Market Growth in the Region

Asia Pacific dominated the market with a value of USD 48.85 million in 2025 and USD 68.32 million in 2026. The Asia Pacific region is expected have largest revenue share in perovskite solar cells market, driven by rising energy demand owing to urbanization and industrialization, increasing renewable energy targets, including solar energy, the presence of favorable climate supporting solar projects installations, and rising technological advancement in the solar cells. The region is witnessing rapid economic development and industrialization coupled with the growing population and urbanization, which has increased energy demand across the region. According to the International Energy Agency, Asia Pacific produced around 14,030,721 GWh of electricity in 2021, contributing to about 49% of the global production. This has resulted in excessive demand from the region's end-users and power output, contributing to around 53% of the carbon emissions. India is expected to reach a valuation of USD 1.12 million in 2026, while Japan is anticipated to gain USD 1.71 million in 2026.

China

Robust Manufacturing Capabilities to Drive the Market Growth in the Country

China has vast manufacturing capabilities that enable the mass production of perovskite solar cells. The nation has experienced substantial investments aimed at increasing manufacturing capacities, which allows for effective scaling and a decrease in production costs. China is the dominating country in the Asia Pacific perovskite solar cells market, accounting for around 96% of the regional share. The surging installation of solar energy projects coupled with the rising government target to increase solar energy projects will lead to an increase in the market in the coming years. For instance, the country has around 757 GW of operating wind and solar power plants, and an additional 750 GW of wind and solar power plants are under construction, which is expected to commence by 2025. The significant development in solar projects is expected to meet the government target of achieving 1,200GW of solar and wind power five years earlier, scheduled for 2030. Hence, the rapid development of these projects, coupled with rising R&D in the solar industry, would boost the china perovskite solar cells market over the forecast period. China is expected to grow with a value of USD 62.05 million in 2026.

North America

Escalating Adoption of Renewable Energies for Catering to Carbon Emissions is Leading to Market Growth Across the Region

North America is the third largest market set to be worth USD 26.51 million in 2026. The surging adoption of renewable energies for catering to carbon emissions is leading to multiple research & developments in renewable energies, including solar energies. Solar energy is gaining widespread traction in the region, and countries such as the U.S. and Canada have expanded their solar energy installations considerably. According to the U.S. Energy Information Administration, the installed solar capacity totaled more than 125GW by August 2023, including 80 GW of utility-scale solar capacity and an estimated 45 GW of small-scale solar capacity. Also, there were around 32.4 gigawatts-direct current (GWdc) installations in 2023, showcasing an increase of about 51% over 2022. Also, according to the Canadian Renewable Energy Association, solar energy has surged by around 810 MW in 2022, reaching a total of about 4GW, witnessing an increase of 25.9% from the previous year.

U.S.

Pilot Projects and Collaborations to Drive the Market Growth in the U.S.

Numerous pilot projects and collaborations among industry players are underway in the U.S., aimed at refining production processes and enhancing product reliability. For instance, at least 40 pilot-scale production lines are actively working on scaling up perovskite fabrication techniques. On March 5, 2021, the Department of Energy has designated USD 40 million to assist 22 initiatives centered on perovskite photovoltaic technologies. These initiatives seek to improve the stability, efficiency, and scalability, which are essential for their commercial acceptance. The U.S. market continues to grow, projected to reach a market value of USD 25.28 million in 2026.

Europe

Stringent Environmental Regulations & Initiatives Outlined By The Governments To Drive The Market Growth

Europe is the second leading region expected to be valued at USD 39.42 million in 2026, registering a substantial CAGR of 40.45% during the forecast period (2025-2032). Severe environmental regulations & initiatives framed by the governments of the regional countries and European Unions for curbing carbon emissions and fostering sustainable energy practices have resulted in the expansion of the European perovskite solar cells market. Environment regulations including European Climate Law, Green Deal, 8th EAPs (Environment Action Programmes), and others have been implemented to achieve a carbon-neutral economy by 2050. These regulations set targets for reducing greenhouse gas emissions, promoting renewable energy integration, and improving overall energy efficiency standards. The U.K. market is foreseen to reach USD 8.92 million in 2026. For instance, in 2020, the European Commission increased the 2030 target for GHG emission reduction to at least 55% instead of 40% previously. Also, a deal was reached during the COP28 UN Climate Change Conference in Dubai in 2023 to accelerate emission reductions towards net zero by 2050. This includes an agreement to transition away from fossil fuels and to reduce global emissions by 43% by 2030. Germany is likely to hold USD 20.49 million in 2026, while France is set to gain USD 14.58 million in the same year.

Latin America

Rising Solar Projects to Drive the Market Growth in the Region

Latin America is the fourth leading region poised to gain USD 1.58 million in 2026. The rising solar projects in the Latin America region and significant steps taken by the governments of other regional countries to boost the installation of solar projects would provide a positive outlook for the market. For instance, by 2020, solar power will comprise around 18.5% of Argentina's total renewable energy output. Over recent years, the Argentine government has allocated around USD 1.8 billion towards clean energy production, demonstrating its dedication to boosting the renewable energy portion of the nation's energy blend by over 20% before 2025. Furthermore, the region is witnessing abundant sunlight and a favorable climate for PV installation, which is inclining the countries' governments towards solar energy, further providing opportunistic growth to the market.

Middle East & Africa

Increasing Research and Development Activities in the Region to Drive the Market Growth

The Middle East & Africa region holds a marginal share in the market owing to the presence of minimum research & development in perovskite solar cells. Some Middle Eastern countries such as the UAE, Israel, Saudi Arabia, and other economically developed countries have been involved in R&D, which will lead to an upliftment of the market in the coming years. For instance, in May 2023, Scientists led by Saudi Arabia's KAUST attained a power conversion efficiency of 33.7% for a perovskite-silicon solar cell. With cutting-edge updates, perovskite/silicon tandem solar cells have reached an impressive 33.7% certified power conversion efficiency, surpassing the previous milestone of 33.2%, which has been qualified by the European Solar Test Installation (ESTI). The 1 cm² cell also achieved an open-circuit voltage of 1.974 V, a short-circuit current density of 20.99 mA/cm² and a fill factor of 81.3%. Saudi Arabia is predicted to stand at USD 0.55 million in 2025.

Moreover, the researchers, scientists, and specialists have presented the latest scientific and technical progress of organic and organic-inorganic hybrid perovskite cells at the first Middle East and North Africa Solar Conference (MENA-SC) 2023. Thus, similar research & development contributed by the webinars & seminars for the development and commercialization of perovskite solar would amplify the regional market growth in the coming future.

Furthermore, regional countries including all GCC countries, Egypt, and others have made visionary plans such as Saudi Vision 20230 and Egypt Vision 2030, which are plans to enhance solar energy and limit carbon emissions. For instance, in 2023, the Egyptian government announced an increase in its dependence on renewable energy to constitute 42% of the nation's overall electricity demand by 2030 and achieve a renewable energy capacity portion of 60% by 2040.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Technological Advancements and Increased Product Portfolio Assists Companies in Gaining Market Share

The global market is mostly fragmented, with key players operating in the industry. Globally, Oxford Photonics is dominating the market. In September 2024, Oxford PV started the commercialization of their record-breaking tandem solar technology with the first shipment to a U.S.-based customer. This shipment of 72-cell panels is comprised of perovskite-on-silicon solar cells, which are capable of producing up to 20% more energy than a standard silicon panel. These cells were used in a utility-scale installation, reducing the cost of electricity (LCOE) and thus, contributing to more efficient land use by generating more electricity from the same area.

List of Key Perovskite Solar Cell Companies Profiled

- Saule Technologies (Poland)

- GCL (Group) Holdings Co., Ltd. (China)

- Oxford Photovoltaics (U.K.)

- Microquanta Semiconductor (China)

- UtmoLight Co., Ltd. (China)

- Hubei Wonder Solar (China)

- Heiking PV Technology Co., Ltd. (China)

- Hunt Perovskite Technologies (HPT) (U.S.)

- Greatcell Energy (Australia)

- Wuxi UtmoLight Technology Co. Ltd (China)

- EneCoat Technologies Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS

- In December 2024, MicroQuanta Semiconductor announced the successful grid connection of an 8.6 MW ground-mounted PV plant in Lishui, Zhejiang province. The plant is the world’s largest to be built with perovskite solar technology, which integrates agriculture with solar generation. The 90 W modules measure 1,245 mm x 635 mm and weigh 12.5 kg.

- In November 2024, UtmoLight launched a 450 W perovskite solar panel with a power conversion efficiency of 16.1%. It features an open-circuit voltage of 190.7 V, a short-circuit current of 3.19, and a fill factor of 73.7%. This panel is currently the largest perovskite photovoltaic module available in the market.

- In September 2024, Oxford PV started the commercialization of their record-breaking tandem solar technology with the first shipment to a U.S.-based customer. This shipment of 72-cell panels is comprised of perovskite-on-silicon solar cells, which are capable of producing up to 20% more energy than a standard silicon panel. These cells will be used in a utility-scale installation, reducing the cost of electricity (LCOE) and thus contributing to more efficient land use by generating more electricity from the same area.

- In March 2023, Wonder Solar announced the manufacturing and promotion of new kinds of low-cost PV devices. The perovskite cell project that the company has initiated spans an area of 97 mu and entails an investment of USD 1 billion. The project will be developed in three phases. Once it is fully completed and enters operation, its fully ramped-up production capacity will reach at least a level of 2,000MW (2GW) per year.

- In May 2022, Saule Technologies and Columbus Energy partnered with Google Cloud. The company has signed a strategic cooperation agreement to develop new products using perovskite solar cells and solutions in the field of distributed energy and the Internet of Things (IoT).

INVESTMENT ANALYSIS AND OPPORTUNITIES

In April 2021, Hunt Perovskite Technologies (HPT) revealed that it had been chosen for an award of USD 2.5 million in funding from the U.S. Department of Energy's (DOE) Office of Energy Efficiency and Renewable Energy Solar Energy Technologies Office Fiscal Year 2020 Perovskite Funding Program.

Furthermore, HPT serves as a co-principal Investigator and collaborative partner in two additional DOE perovskite funding award selections, which include a USD 1.5 million award to SLAC National Accelerator Laboratory and a USD 1.25 million award to University of North Carolina at Chapel Hill (UNC).

REPORT COVERAGE

The global perovskite solar cell market report delivers a detailed insight into the market and focuses on key aspects such as leading companies and their operations offering perovskite solar cells. Besides, the report provides insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 43.38% from 2026 to 2034 |

|

Unit |

Value (USD Million), Volume (MW) |

|

Segmentation |

By Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 101.02 million in 2025.

The market is likely to grow at a CAGR of 43.38% over the forecast period.

The rigid segment is expected to lead the market in the forecast period.

The market size of Asia Pacific stood at USD 48.85 million in 2024.

Modern BIVP products in the market are driving demand for solar technologies.

Saule Technologies (Poland), GCL (Group) Holdings Co., Ltd. (China), Oxford Photovoltaics (U.K.), and others are some of the market's top players.

The global market size is expected to reach USD 3269.02 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us