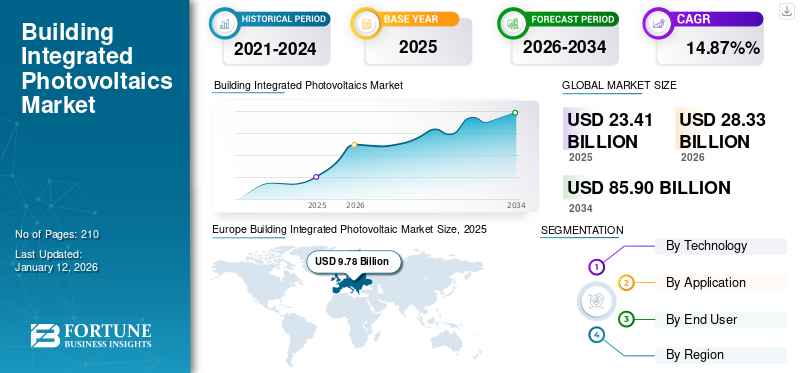

Building Integrated Photovoltaic Market Size, Share & Industry Analysis, By Technology (Crystalline Silicon, Thin Film, and Others), By Application (Roof, Wall, Glass, and Others), By End User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Building Integrated Photovoltaic Market Size and Future Outlook

The global building integrated photovoltaic market size was valued at USD 23.41 billion in 2025 and is projected to grow from USD 28.33 billion in 2026 to USD 85.9 billion by 2034, exhibiting a CAGR of 14.87% during the forecast period. Europe dominated the building integrated photovoltaics market with a share of 41.80% in 2025.

Building Integrated Photovoltaics (BIPV) are solar energy systems integrated into building elements such as facades, roofs, walls, and windows, replacing conventional construction materials. Unlike traditional solar panels, BIPV enhances both aesthetics and functionality while generating renewable energy. It helps reduce electricity costs, lowers carbon emissions, and improves building sustainability. BIPV plays a key role in net-zero energy buildings and smart cities by improving energy efficiency.

Building integrated photovoltaic market growth is driven by increasing demand for sustainable and energy-efficient buildings and stringent government regulations promoting renewable energy adoption. The technology is gaining traction in commercial, residential, and industrial applications, making buildings more self-sufficient. Advancements in PV technology, such as thin-film and transparent solar panels, are enhancing efficiency and aesthetics.

Onyx Solar is one of the key players in the BIPV market. It specializes in integrating photovoltaic glass into buildings, offering solutions such as solar windows, facades, and skylights. It has been actively innovating in transparent and customizable PV glass to enhance both energy efficiency and architectural aesthetics. The company has collaborated on high-profile projects worldwide, including airports, corporate buildings, and smart cities, promoting net-zero energy structures.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Emission from Building Sector to Drive Demand for Building Integrated Photovoltaic

The rising emissions from the building sector have made Building Integrated Photovoltaics (BIPV) a crucial solution for sustainable construction. Buildings contribute significantly to global carbon emissions due to energy-intensive heating, cooling, and lighting systems. According to the World Green Building Council, buildings account for 39% of global energy-related carbon emissions, with 28% coming from operational energy use for heating, cooling, and power. In comparison, the remaining 11% is attributed to emissions from construction and building materials. By integrating solar power generation directly into building materials, BIPV reduces reliance on non-renewable energy sources and lowers overall carbon footprints. This technology not only helps meet stringent environmental regulations but also enhances energy efficiency and sustainability in urban development. As the demand for greener buildings grows, BIPV offers a practical way to combat emissions while maximizing renewable energy use in the built environment.

Stringent Government Regulations to Accelerate Market Growth

Stringent environmental regulations play a crucial role in driving the adoption of Building Integrated Photovoltaics. Governments worldwide are enforcing stricter building codes, carbon reduction targets, investments, renewable energy mandates, and increasing solar power generating capacities to combat climate change. In 2022, the U.S. Department of Energy (DOE) allocated USD 32 million for over 30 building retrofit projects to enhance affordable housing technologies. Seven awardees will test innovative renovation methods, including prefabricated walls and drop-in HVAC and water systems, to improve efficiency with minimal tenant disruption. These advancements aim to accelerate building decarbonization and support the goal of a net-zero carbon economy by 2050. These policies encourage developers and building owners to integrate sustainable solutions such as BIPV to meet energy efficiency and emissions standards. Additionally, incentives such as tax credits, subsidies, and green certification programs are also expected to drive the market in the coming years. As regulations continue to tighten, the demand for energy-efficient buildings will rise, positioning BIPV as a key solution for achieving compliance while reducing reliance on fossil fuels.

MARKET RESTRAINTS

Complex Installations Process to Constrain Market Growth

The installation of Building Integrated Photovoltaics is more complex than traditional solar panels due to its dual function as both a building material and an energy generator. Unlike conventional PV systems that can be mounted separately, BIPV must be seamlessly integrated into roofs, facades, or windows, requiring specialized design, engineering, and construction expertise. This complexity increases labor costs and project timelines, making adoption more challenging. Additionally, ensuring proper wiring, structural integrity, and weather resistance further complicates installation. Thus, without standardized processes and skilled professionals, widespread implementation of BIPV remains difficult.

MARKET OPPORTUNITIES

Rising Research & Development to Offer Lucrative Opportunities for Market

Research and Development (R&D) in Building Integrated Photovoltaics is focused on enhancing efficiency, affordability, and seamless integration into modern architecture. Innovations in photovoltaic materials, such as transparent solar glass, flexible thin-film solar panels, and improved energy conversion technologies, are making BIPV more viable for widespread adoption. In September 2024, the Fraunhofer Center for Silicon Photovoltaics (CSP) launched the AluPV project to explore advanced manufacturing processes and material usage for BIPV. Collaborating with Baltic Renewable Partners, the Institute for Solar Energy Research, MN Metall, Solarnative, and VHF Plan Liesenhoff, the project aims to enhance BIPV efficiency and integration. Research will continue at Fraunhofer’s facility in Germany until the end of next year. R&D efforts also aim to improve durability, weather resistance, and multifunctionality, allowing BIPV systems to replace conventional building materials without compromising performance. Additionally, advancements in smart grid integration and energy storage solutions are increasing the reliability of BIPV-generated power. With continuous investment in technology and design, BIPV is evolving into a key component of sustainable and energy-efficient building practices, further leading to the growth of the global building integrated photovoltaic market.

MARKET CHALLENGES

High Initial Cost to Restrain Market Growth

The high initial costs of Building-Integrated Photovoltaics (BIPV) present a significant barrier to widespread adoption. Unlike traditional building materials, BIPV systems incorporate photovoltaic technology, making them more expensive to manufacture and install. Additionally, the need for specialized design and labor increases overall project expenses. While BIPV can reduce long-term energy costs, the upfront investment remains a challenge for developers and building owners. Without financial incentives, subsidies, or reductions in production costs, the adoption of BIPV may be limited, especially in cost-sensitive markets.

BUILDING INTEGRATED PHOTOVOLTAIC MARKET TRENDS

Urbanization and Surging Smart Cities to Emerge as One of the Key Market Trends

Urbanization and the rise of smart cities have become leading factors in the adoption of Building-Integrated Photovoltaics in recent years. As cities expand and energy demand increases, BIPV offers a sustainable solution by transforming buildings into decentralized power sources. In 2021, the U.K. and Thailand launched the "UK Thailand Tech Export Academy" to support smart city development in Thailand. The initiative has connected over 200 businesses from both countries. Smart city initiatives prioritize energy efficiency, reduced carbon emissions, and intelligent grid management, all of which align with BIPV technology. By integrating solar power into building facades, windows, and rooftops, BIPV supports self-sufficient energy generation while enhancing urban aesthetics. Additionally, advancements in IoT and AI-driven energy management systems enable BIPV to optimize power production and consumption, making it an essential component of future sustainable urban development.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the global Building-Integrated Photovoltaic (BIPV) market, causing disruptions in supply chains, project delays, and a temporary decline in demand due to economic uncertainty. Lockdowns and restrictions affected manufacturing and installation activities, leading to slower adoption of BIPV solutions. However, as governments introduced stimulus packages and renewable energy incentives to support economic recovery, the market gradually rebounded. The pandemic also highlighted the importance of sustainable energy solutions, accelerating interest in energy-efficient buildings and integrated solar technologies. As a result, the market has regained momentum, driven by growing investments in green infrastructure and stricter environmental regulations.

SEGMENTATION ANALYSIS

By Technology

Higher Efficiency & Durability to Boost Crystalline Silicon Segment’s Growth

The market is segmented by technology into crystalline silicon, thin film, and others.

Crystalline silicon solar cells hold the largest share of the BIPV market due to their high efficiency, durability, and long lifespan. It offers energy conversion rates between 18-22%, making it a preferred choice for applications such as solar facades, integrated rooftop PV, and transparent solar glass. However, its rigidity and higher production costs compared to thin-film technologies limit its adoption in applications requiring flexible solar solutions. This segment is set to attain 68.57% of the market share in 2025.

Thin-film technology is expected to grow at the CAGR of 20.16% during the forecast period (2025-2032), particularly for applications that demand flexibility and lightweight materials. It includes various types, such as Cadmium Telluride (CdTe), Copper Indium Gallium Selenide (CIGS), and Amorphous Silicon (a-Si). CdTe is known for its cost-effectiveness, while CIGS offers higher efficiency and adaptability. These thin-film solutions perform better in low-light conditions and are commonly used in solar windows, facades, and walkable PV surfaces.

By Application

Optimal Solar Exposure in Roof Areas to Drive Roof Segment’s Growth in the Market

The market is segmented by application into roof, wall, glass, and others.

Roof-integrated photovoltaics hold the largest share in the BIPV market, as rooftops provide an ideal surface for solar energy generation without altering building aesthetics. These systems are widely used in both residential and commercial buildings, benefiting from improved efficiency, government incentives, and net-zero energy building initiatives. The demand for BIPV roofing is driven by the need to optimize space while complying with sustainability regulations. This segment is estimated to grow with a CAGR of 18.55% during the forecast period (2025-2032).

Wall-integrated BIPV is growing at the fastest rate in the market owing to its adoption, particularly in urban environments where vertical surfaces offer additional solar energy potential. While wall-mounted panels are less efficient than rooftop systems due to limited direct sunlight exposure, advancements in thin-film and transparent PV technologies are improving their viability. These installations contribute to energy efficiency in high-rise buildings and help meet green building standards.

The glass segment is likely to gain 52.70% of the market share in 2025.

By End User

To know how our report can help streamline your business, Speak to Analyst

Rising Initiative by Government to Limit Emission from Commercial Buildings Drive Segment Growth

The market is segmented by end user into residential, commercial, and industrial.

The commercial segment holds the largest share and is the fastest-growing segment as businesses and institutions prioritize sustainability and energy efficiency. Office buildings, shopping malls, and public infrastructure increasingly incorporate BIPV solutions, such as solar facades, glass-integrated PV, and shading systems, to meet green building certifications such as LEED and BREEAM. Large commercial spaces offer ample surface area for integration, making BIPV a viable alternative to traditional solar installations. The segment gained 55.88% of the market share in 2024.

The residential sector is the second leading segment in the market, driven by the increasing adoption of rooftop solar solutions, government incentives, and the push for net-zero energy homes. Homeowners are opting for solar-integrated roofs, facades, and windows to reduce energy costs and enhance property value. The demand is further fueled by aesthetic solar solutions that seamlessly blend with modern architectural designs.

BUILDING INTEGRATED PHOTOVOLTAIC MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, and the rest of the world.

Europe

Europe Building Integrated Photovoltaic Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Stringent Energy Regulations and Strong Government Incentives to Foster Europe Market Growth

Europe held the largest revenue share of the market valued at USD 9.78 billion in 2025 and USD 11.73 billion in 2026. The region leads with a dominant building integrated photovoltaic market share, driven by strong government policies, sustainability goals, and strict energy efficiency regulations. Germany, France, and the Netherlands actively promote BIPV adoption through incentives and building mandates. For instance, in March 2022, France introduced incentives for landscape-integrated Building-Integrated Photovoltaics as part of a support program for PV systems up to 500 kW launched by the Ministry of Ecological Transition in October. The Italy market continues to grow, expected to reach USD 3.72 billion in 2025. The initiative includes a feed-in tariff bonus for solar tiles that meet specific landscape integration criteria. The region’s focus on net-zero energy buildings and green certifications such as BREEAM has further accelerated demand, particularly for solar-integrated facades, roofs, and glass applications in commercial and residential sectors. France is foreseen to acquire USD 3.66 billion in 2025, while Germany is set to be valued at USD 0.92 billion in the same year.

Asia Pacific

Rapid Urbanization and Government-backed Renewable Initiatives to Fuel Market

Asia Pacific is the second largest market estimated to hit USD 8.57 billion in 2026, recording a CAGR of 18.76% during the forecast period (2025-2032). The region is experiencing rapid growth in BIPV adoption due to increasing urbanization, rising energy demand, and government-backed renewable energy initiatives. For instance, in April 2023, South Korea’s MOTIE allocated USD 185.5 million for renewable energy rebates in 2023. Rebates for BIPV systems increased to 15%, while conventional rooftop PV rebates dropped to 47%. China, Japan, and South Korea are at the forefront, investing heavily in smart city projects and solar-integrated building designs. China is forecasted to reach a market value of USD 2.74 billion in 2025. The region’s strong manufacturing base and advancements in thin-film solar technologies are also contributing to the expanding market, particularly in high-density urban environments where space optimization is crucial. Japan is poised to hold USD 1.66 billion in 2025, while India is expected to stand at USD 1.24 billion in the same year.

China

Strong Policies and Smart City Projects to Expand the Market

China holds a dominant position in the global BIPV market, supported by strong government policies, large-scale infrastructure projects, and a robust solar manufacturing industry. The country’s commitment to carbon neutrality by 2060 has accelerated the adoption of BIPV across residential, commercial, and industrial sectors. For instance, in October 2023, SP Group completed and integrated its first 4 MWp BIPV project in Guangdong, China. Installed at Guangdong Lingxiao’s new plant, the system follows a “surplus-to-grid” model, generating 4.36 million kWh annually. Over 25 years, it is expected to produce 110 million kWh of clean energy, reducing coal use by 1,600 tons and cutting carbon emissions by nearly 4,500 tons per year. Moreover, high urbanization rates and smart city initiatives are also fueling demand, particularly for solar-integrated building materials. Additionally, advancements in thin-film and perovskite solar technologies are making BIPV more viable for widespread deployment, positioning China as a key player in the global market.

North America

Supportive Policies, Tax Incentives, and Green Building Certifications to Propel North American Market

North America is the third largest market anticipated to hold USD 5.75 billion in 2026. North America, particularly the U.S. and Canada, is witnessing significant adoption of BIPV, fueled by supportive regulations, tax incentives, and green building initiatives such as LEED certification. New York, California, Toronto, and other cities in the U.S. and Canada have implemented policies requiring solar integration in new buildings, boosting demand for BIPV solutions. The commercial sector is a key driver, with corporations and real estate developers incorporating solar-integrated facades and rooftops to meet sustainability goals and reduce operational costs. For instance, in June 2022, Toronto-based Mitrex partnered with Durisol and Silentium Group to develop photovoltaic highway noise barriers. These Canadian-made barriers enhance aesthetics, reduce noise with a coefficient of up to 0.7, and generate clean energy.

U.S.

Solar Mandates, Corporate Sustainability Targets, and Net-Zero Energy Building Initiatives to Drive Product Demand

The U.S. BIPV market is expanding rapidly due to government incentives, state-level mandates, and the push for energy-efficient buildings. Policies such as California's solar mandate for new residential constructions and New York’s Local Laws 92 and 94, which require sustainable roofing solutions, have significantly boosted demand. Commercial and institutional buildings are the primary adopters, integrating solar facades, transparent PV glass, and solar roofs primarily made up of crystalline silicon and thin film to achieve sustainability targets. Additionally, the increasing focus on net-zero energy buildings and corporate sustainability commitments is driving further investment in BIPV solutions. The U.S. market is set to grow with a value of USD 4.06 billion in 2025.

Rest of the World

Rising Energy Costs and Adoption of Sustainability Goals in the Region to Positively Impact Market

The rest of the world is the fourth largest market estimated to be valued at USD 1.96 billion in 2025. The market in the rest of the world, including Latin America and the Middle East & Africa, is in the early stages but growing steadily. Increasing energy costs, climate concerns, and infrastructure development are encouraging the adoption of solar-integrated building solutions. The UAE and Saudi Arabia, are investing in BIPV to align with renewable energy targets, while Latin American nations are exploring BIPV applications in urban development projects.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Onyx's Advancement in Product Solutions to Lead Market Growth

Onyx Solar continues to advance the BIPV industry with innovative solutions such as its new walkable PV tiles, which are designed for rooftops and urban spaces. These glass-glass modules, compliant with IEC and UL standards, offer a practical way to integrate solar power into pedestrian areas without sacrificing usable space. The company has supplied PV tiles to major clients, including Apple and Spanish institutions, and is expanding in New York, where local regulations encourage solar adoption. By enabling energy generation in high-value real estate areas, Onyx Solar is driving the transition to sustainable building solutions. For instance, In November 2024, Onyx Solar introduced walkable PV tiles designed for rooftops and urban spaces like decks and sidewalks. Weighing 23 kg and measuring 75 x 75 cm, these glass-glass modules have a 75 W capacity, with custom sizes available. Made with 8 mm thick safety glass and an anti-slip surface, they can support up to 400 kg/m², ensuring durability for pedestrian use.

List of Key Building Integrated Photovoltaic Companies Profiled:

- WAAREE Energies (India)

- AGC Inc. (Japan)

- SunPower Corporation (U.S.)

- Tesla (U.S.)

- Canadian Solar (Canada)

- First Solar (U.S.)

- Hanwha Q CELLS (South Korea)

- Kyocera Corporation (Japan)

- Trina Solar Limited (China)

- Ascent Solar Technologies, Inc. (U.S.)

- Mitrex Integrated Solar Technology Inc. (Canada)

- Onyx Solar (Spain)

- SoliTek UAB (Lithuania)

- Hanergy (China)

- Solaria (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In January 2025, Swiss startup Climacy introduced the CLI400M10, a 400 W semi-transparent glass-glass BIPV panel designed for roofs and facades in residential, commercial, and industrial buildings. With 17.25% efficiency and 20% transparency, it allows more natural light into spaces such as industrial halls and atriums, enhancing daylight utilization compared to conventional PV panels.

- In May 2024, YKK AP Inc. and Kandenko Co., Ltd. formed a business alliance to develop and promote Building-Integrated Photovoltaics (BIPV). The collaboration focuses on integrating solar technology into windows and walls of commercial buildings as part of a renewable energy initiative for carbon neutrality. They plan to conduct demonstration tests using perovskite solar cells and other advanced technologies.

- In December 2023, Switzerland-based Climacy introduced its Smart Solar Roof, a BIPV solution designed for residential, commercial, and industrial applications. The system incorporates 430 W TOPCon double-glass, frameless solar panels with 22.5% efficiency and a specialized mounting system on the backside for seamless integration.

- In October 2023, Solarstone launched a cutting-edge BIPV factory in Estonia, capable of producing 60 MW annually. The facility assembles 13,000 integrated solar panels each month, supporting around 6,000 homes with 10 kW solar roofs per year. Aiming to transform the roofing industry, the company focuses on both re-roofing and new construction. CEO Silver Aednik emphasized that this milestone brings energy-producing homes closer to reality, accelerating the global shift toward prosumer-driven energy solutions.

- In March 2023, GoodWe launched the Galaxy series, an ultra-lightweight BIPV solution designed for commercial and industrial use. Weighing just 6 kg/m2, its frameless design is ideal for roofs with low load capacity and poor waterproofing. The 1.6mm ultra-thin glass enhances impact resistance against hail and strong winds, ensuring durability and all-weather protection. In addition to being lightweight and easy to install, the Galaxy series delivers high-efficiency solar power generation.

REPORT COVERAGE

The report delivers a detailed insight into the market and focuses on key aspects, such as leading companies. Besides, it offers insights into the market trends & technologies and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors and challenges that have contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.87% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology, Application, End User, and Region |

|

Segmentation |

By Technology

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 28.33 billion in 2024.

The market is likely to record a CAGR of 14.87% over the forecast period of 2026-2034.

By end-user, the commercial segment is expected to lead the market during the forecast period.

The Europe market size was valued at USD 9.78 billion in 2025.

Rising initiatives to limit carbon emissions from the building sector is the key factor driving the market’s growth.

Some of the key players in the market are Onyx Solar, Tesla, First Solar, Canadian Solar, and others.

The global market size is expected to reach a valuation of USD 85.9 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us