Pressure Ulcer Prevention Market Size, Share & Industry Analysis, By Product Type (Static Support Surfaces {Foam Mattresses, Gel Overlays, Alternating Pressure Pads, and Others}, Dynamic Support Surfaces {Alternating-air Mattresses, Low air-loss Mattresses, Air-fluidized or High-air-loss Mattresses, and Others}, Dressings, Positioners & Protectors, and Creams & Others), By End User (Hospitals & Ambulatory Surgery Centers, Clinics, Long Term Care & Urgent Care Centers, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

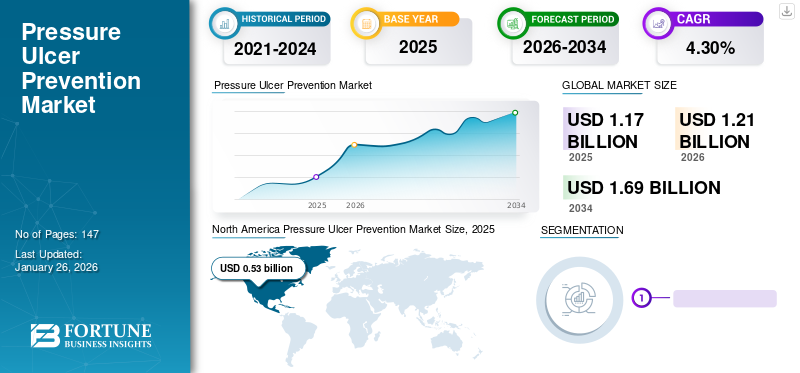

The global pressure ulcer prevention market size was valued at USD 1.17 billion in 2025 and is projected to grow from USD 1.21 billion in 2026 to USD 1.69 billion by 2034, exhibiting a CAGR of 4.3% during the forecast period. North America dominated the pressure ulcer prevention market with a market share of 45.30% in 2025. Moreover, the U.S. pressure ulcer prevention market size is projected to grow significantly, reaching an estimated value of USD 604.9 million by 2030, driven by a high risk of pressure ulcers among ICU patients and the geriatric population.

The ageing population are more prone to chronic disorders such as COPD, diabetes and renal failure. This results in long-term hospitalization, which can cause pressure injuries among the geriatric population. Furthermore, the substantial economic burden associated with treating such a condition could be avoided if proper prevention is taken. As per an article published by the National Institutes of Health (NIH) in 2019, the estimated hospital‐acquired pressure injury (HAPI) national cost for the treatment ranges from USD 3,300.0-11,000 million annually. Thus, the need for such preventive devices strongly contributing to product adoption in the market. In addition, increasing awareness programs to enhance preventive measures against pressure ulcers are favoring the growth opportunities of the market during the forecast period.

Global Pressure Ulcer Prevention Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 1.17 billion

- 2026 Market Size: USD 1.21 billion

- 2034 Forecast Market Size: USD 1.69 billion

- CAGR (2026–2034): 4.3%

- U.S. Market Forecast: Expected to reach USD 604.9 million by 2030

Market Share Analysis:

- North America dominated with 45.30% share in 2025, driven by high prevalence of ICU-related pressure ulcers, advanced technologies, and strong product adoption.

- By Product Type, Dynamic Support Surfaces held the largest share in 2024 due to cost-effectiveness, clinical efficiency, and growing product availability.

Key Country Highlights:

- United States: High burden of hospital-acquired pressure injuries, coupled with increasing geriatric population, supports strong market demand.

- United Kingdom: Ongoing national campaigns like “Stop The Pressure” and government-backed guidelines drive prevention device adoption.

- China, Japan, India: Asia Pacific shows highest CAGR due to government initiatives like the PPPIA guidelines, expanding healthcare access, and rising elderly population.

- Brazil & Mexico: Latin America shows growth with increasing collaborations for awareness campaigns and infrastructure upgrades.

- Gulf Cooperation Council (GCC) Countries: Improving healthcare investments and growing adoption of preventive care measures fuel market expansion in the Middle East.

COVID-19 IMPACT

Decline in Non-COVID-19 Hospital Admissions Led to Negative Impact on the Market

The COVID-19 pandemic negatively impacted the market in 2020 due to a decline in non-COVID-19 hospital admissions and disruptions in the supply chain. Meanwhile, patients' average hospital stay was substantially longer among the inpatient admissions suffering from the COVID-19 pandemic, which further led to the adoption of pressure ulcer prevention measures. For instance, as Statistics Netherlands (CBS) estimates, in 2020, the average hospital stay was substantially longer amongst the inpatient admissions for COVID-19, with an average of 8.4 days, compared to inpatient admissions unrelated to COVID-19 (5.2 days).

In 2021, the rebound in inpatient hospital admissions, post-pandemic across the globe, and the high adoption of these devices by healthcare settings boosted the market. According to an article published by KAISER FAMILY FOUNDATION in February 2021, the total U.S. hospital admissions dropped to 69.2% of predicted admissions during April 2020 compared to the previous year. However, according to PETERSON-KFF Health System Tracker estimates in August 2021, the overall hospital admissions in April 2021 were 85.5% of predicted admissions. Such factors have diverted the market to the pre-pandemic growth in the forecast period.

LATEST TRENDS

Download Free sample to learn more about this report.

Use of Advanced Technologies in Prevention of Pressure Ulcers to Determine Growth

One of the prominent trends witnessed by the global market is the rising technological advancements for the prevention of pressure ulcers. The market players are emphasizing launching automated devices such as wheelchairs, specialized beds, and alternating surfaces that automate the task of offloading. For instance, in January 2022, Invacare Corporation launched a narrower version of the Invacare AVIVA STORM RX rear-wheel drive power wheelchair. It is a next-generation rear-wheel drive power wheelchair for patients suffering from pressure ulcers.

Furthermore, certain private hospitals are employing motion detection sensors which aid caregivers by alerting them if patients show restricted movement over a period of time. Thus, the growing use of advanced technologies across healthcare centers and the rising introduction of advanced devices by key players aid in the high adoption of these devices and augment the market expansion.

PRESSURE ULCER PREVENTION MARKET GROWTH FACTORS

Growing Risk of Pressure Ulcers amongst Hospitalized & Geriatric Populace to Boost Demand for Preventive Devices

A significant proportion of the geriatric population is suffering from chronic disorders such as COPD, diabetes, and renal failure. Moreover, the surge in the number of long-term hospitalizations of elderly patients owing to chronic conditions has led to a high risk of developing other debilitating complications such as pressure ulcers, pneumonia and contractures.

- According to America’s Health Rankings Senior Report in 2021, the total number of adults aged 65 and above is estimated to increase to 85.7 million in 2050, around 20% of the overall U.S. population. Also, the risk of developing pressure ulcers is rising due to certain factors such as complex care needs, poor nutrition and hydration, reduced mobility, and an increased risk of incontinence among elderly patients.

Furthermore, high healthcare expenditure by developed countries on pressure ulcer treatment poses a burden on the healthcare system. Thus, preventing pressure ulcers is necessary amongst the hospitalized population with minimum costs compared to treatment. Therefore, these factors will boost the demand for prevention devices, further propelling pressure ulcer prevention market growth.

Surge in Initiatives for Pressure Ulcer Prevention to Augment Growth

The increasing incidence of pressure ulcers amongst patients with long-term hospitalizations and the ageing population has increased the need for pressure ulcer prevention devices across the globe. The lack of awareness regarding such conditions might lead to further complications, such as sepsis, cellulitis and bone or joint infections. Therefore, various healthcare settings have adopted selective measures such as awareness programs and clinical nursing practicesto prevent such complications. Several government authorities are raising awareness of the impact of pressure ulcers in their global awareness campaigns and education programs. Such programs are boosting awareness regarding pressure injury prevention and the risks associated with pressure ulcers amongst all healthcare organizations and the civil population.

Moreover, several healthcare companies are now collaborating with government bodies such as the National Health Service (NHS) trusts and private hospitals & homecare settings to increase awareness and understanding of pressure ulcer prevention and management.

- In October 2020, the Talley Group, a healthcare company, launched the ‘STOP THE PRESSURE 2020’ educational resource in the U.K.

These resources have led to the deliverance of class-leading education and information to healthcare providers, clinicians, caregivers and patients regarding the prevention of pressure ulcers. Therefore, such factors are expected to drive market growth.

RESTRAINING FACTORS

High Costs Associated with Pressure Ulcer Prevention to Hamper Market Growth

Despite the intense need for prevention and care for pressure ulcers, one of the factors that potentially hamper the market growth is the high cost associated with these products. The high prices of pressure ulcer prevention products, such as alternating air pads, air-fluidized mattresses, and specialized beds & support surfaces, are hampering product adoption amongst the population, a per NCBI estimates published in a cohort study of 1000 patients for 52 weeks, in April 2021, one wearable sensor cost was around USD 39,580.

In terms of emerging nations like Asia Pacific, Latin America and Middle East Africa, the high cost of these devices is limiting the adoption rate. This is influencing greater preference towards more economical products in healthcare settings. Therefore, the high cost of products for pressure ulcer treatment, such as negative pressure wound therapies and prevention products, will lead to its lesser adoption amongst the patient population, limiting the market growth.

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Cost Effectiveness of Dynamic Support Surfaces to Dominate the Market in 2024

Based on product type, the market is segmented into static support surfaces, dynamic support surfaces, dressings, positioners & protectors, and creams & others. The dynamic support surfaces segment is further sub-segmented into alternating-air mattresses, low air-loss mattresses, air-fluidized or high-air-loss mattresses, and others. The dynamic support surfaces segment dominated the global pressure ulcer prevention market share with 66.94% in 2026. The segment’s dominance is primarily attributed to the effectiveness of dynamic support surfaces. Also, these devices are available at a comparatively lower price, leading to a high patient adoption rate. Also, increasing strategic initiatives such as partnerships and acquisitions by key players are favoring the segment's growth. In October 2021, Agiliti Health, Inc. acquired Sizewise, a leading manufacturer of specialized hospital beds, surfaces, and patient-handling equipment. This acquisition broadened the company's wound care and pressure ulcer prevention products.

The static support surfaces segment held the second-highest position in the global market. The segment's growth is attributable to the higher adoption of static support surfaces and the increasing geriatric population's higher chance of developing pressure ulcers.

The positioners & protectors segment gained a considerable share in 2024. Effective use of these products in surgical procedures to prevent ulceration will likely augment the segment's growth. The dressings are also projected to witness growth prospects in the market. Several prominent and emerging companies are engaged in R&D initiatives to develop novel wound care products to meet demand. The creams & others segment held the lowest market share globally.

By End User Analysis

Favorable Government Policies to Drive the Growth of Hospitals & Ambulatory Surgery Centers

In terms of end user, the global market is segmented into hospitals & ambulatory surgery centers, clinics, long term care & urgent care centers, homecare settings, and others. The hospitals & ambulatory surgery centers segment dominated the global market share with 56.20% in 2026. Greater adoption rate of treatment options for pressure ulcers in hospitals and ambulatory surgery centers favors segmental growth. For instance, according to the study published by Springer Nature Switzerland AG in August 2022, it was reported that data from 90 countries highlighted that ICU-acquired pressure ulcer prevalence was 16.2%.

Similarly, certain government bodies are implementing various policies for health professionals to protect the public from pressure ulcers. In October 2021, the Public Health England team launched the Office for Health Improvement and Disparities (OHID). They have mentioned certain policies that must be followed by healthcare professionals for the prevention of pressure ulcers in the U.K. Such initiatives will enhance the preventive measures and, thus, are contributing to the segment’s growth in the forecast period.

The long term care & urgent care centers segment occupied the second-largest market share owing to the long-term hospitalizations of elderly patients leading to chronic conditions such as pressure ulcers. The homecare settings segment and clinics are expected to grow due to the utilization of ulcer prevention products for personal care and the global increase in standalone clinics.

REGIONAL INSIGHTS

In terms of geography, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Pressure Ulcer Prevention Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America generated a revenue of USD 0.53 billion in 2025. The increasing burden of chronic diseases and technological advancements for the prevention of pressure ulcers facilitated it to hold a dominant position in the global market. For instance, according to the Agency for Healthcare Research and Quality (AHRQ), more than 2.5 million individuals in the U.S. annually develop pressure ulcers. The U.S. market is projected to reach USD 0.51 billion by 2026.

Europe

Europe held a substantial share of the global market in 2024. The growth of this region is attributed to the rising initiatives by various organizations to increase awareness regarding pressure ulcers in Europe. The Direct Health Group (DHG) supported the ‘Stop The Pressure’ campaign held on 17th November 2022. The European Pressure Ulcer Advisory Panel (EPUAP) coordinated the campaign to increase national awareness and enhance pressure ulcer prevention education. The UK market is projected to reach USD 0.06 billion by 2026, and the Germany market is projected to reach USD 0.08 billion by 2026.

Asia Pacific

The Asia Pacific exhibited the highest CAGR during the forecast period. The growing government initiatives for these devices across Asia Pacific countries boost the market expansion. In November 2020, the Pan Pacific Pressure Injury Alliance (PPPIA) announced that the 2019 International Pressure Ulcer/Injury Guideline had been accepted by the emergency care research institute (ECRI) Guidelines Trust. This allows healthcare professionals to compare the guideline with other relevant policies on the ECRI Guidelines Trust website. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

Latin America and Middle East & African

Furthermore, the growth of Latin America, the Middle East, and African market is due to the rising collaborations among leading players to develop educational awareness tools for the population about ulcer prevention. Also, the growing healthcare infrastructure in these regions augments the market expansion in the near future.

KEY INDUSTRY PLAYERS

Strong Market Presence and Product Portfolio of Stryker, Hill-Rom Holdings, Inc., and Invacare Corporation Aided them to Gain a Top Position

The global market’s competitive landscape is primarily fragmented, with various global and regional players. Stryker, Hill-Rom Holdings, Inc., and Invacare Corporation dominated the global market. The dominance is attributed to a strong product portfolio and a robust presence in the international market. Also, active strategic acquisitions have been some of the prominent driving factors for the dominance of market players. For instance, in December 2021, Hill-Rom Holdings, Inc. was acquired by Baxter. The acquisition helped Baxter in entering this market. It also aided in expanding Baxter’s digital health and connected care offerings.

Arjo, Mölnlycke Health Care AB, Savaria, and Medline Industries, LP are other prominent players operating due to their increasing strategic initiatives in the market. In October 2020, Arjo acquired Bruin Biometrics (BBI), giving Arjo exclusive distribution rights for BBI's portable SEM scanner. This device allows for early detection of pressure injury risk, which reduces patient suffering and healthcare costs.

The other players, such as Agiliti Health, Inc., Coloplast Corp., and Smith & Nephew plc, hold a slightly lower share in the global market. Increasing market presence through innovative product launches and strategic initiatives is expected to strengthen the market position of the firms mentioned above.

LIST OF KEY COMPANIES PROFILED IN PRESSURE ULCER PREVENTION MARKET:

- Agiliti Health, Inc. (U.S.)

- Arjo (Sweden)

- Savaria (Canada)

- Medline Industries, LP (U.S.)

- Coloplast Corp. (Denmark)

- Smith & Nephew plc (U.K.)

- Stryker (U.S.)

- Mölnlycke Health Care AB (Sweden)

- Hill-Rom Holdings, Inc. (U.S.)

- Invacare Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2022: Smith & Nephew launched their WOUND COMPASS Clinical Support App to reduce practice variation in the wound care business.

- July 2022: Medline Industries, LP launched a new version of Optifoam Gentle EX foam dressing that aids in preventing pressure injury. This enhancement helped the company to expand its product portfolio further.

- June 2022: Medline launched their Optifoam Gentle EX foam dressing to prevent pressure injury. This helped the company to expand its product portfolio further.

- January 2022: Invacare Corporation added new features to its LiNX electronics system, incorporating popular features from the MK6. This makes operating a power wheelchair easier for users by facilitating control through the LiNX system.

- October 2022: Medline Industries, LP, opened a new distribution centre for long-term care supplies in Grayslake, US. This helped the company to expand its distribution channel across US healthcare centres.

REPORT COVERAGE

The global market report depicts a complete market analysis. The report highlights key aspects such as product type, end user, and geography. It also describes the insights into market dynamics, key industry developments, disease prevalence, technological advancements, key players, and COVID-19's impact on the market. Additionally, the report comprises the distribution of market size for wound dressings in pressure ulcers by treatment and prevention and by standard vs anatomically modified segment. Similarly, the report covers several factors that affect the overall market growth.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.3% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type, End User, and Region |

|

By Product Type |

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 1.21 billion in 2026 to USD 1.69 billion by 2034.

The market will exhibit to grow at a CAGR of 4.3% during 2026-2034.

The North America market stood at USD 0.55 billion in 2025.

The dynamic support surfaces segment is the major segment of this market.

North America dominated the global market in 2025.

The rising incidence of pressure ulcers among hospitalized & geriatric populace and growing initiatives raise awareness drive global market growth.

Stryker, Hill-Rom Holdings, Inc., and Arjo are significant market players.

Increasing pressure injury awareness and a surge in long-term hospitalizations are the major contributing factors to product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us