Wound Care Market Size, Share & Industry Analysis, By Type (Advanced Wound Dressings, {Antimicrobial Dressings, Alginate Dressings, Foam Dressings, Hydrocolloid Dressings, and Others}, Traditional Wound Care Products, Negative Pressure Wound Therapy, Bioactives {Biological Skin Equivalents, Growth Factors, and Others}, and Others), By Application (Chronic Wounds {Diabetic Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Others} and Acute Wounds {Surgical Wounds and Others}), By End-user (Hospitals, Clinics, Homecare Settings, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

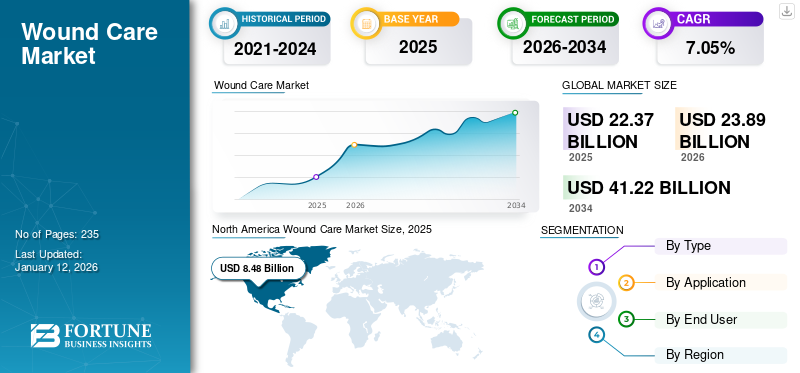

The global wound care market size was valued at USD 22.37 billion in 2025 and is projected to grow from USD 23.89 billion in 2026 to USD 41.22 billion by 2034, exhibiting a CAGR of 7.05% during the forecast period. North America dominated the wound care market with a market share of 37.9% in 2025.

Wound care is a comprehensive process that involves the assessment, treatment, and management of injuries to promote healing and prevent complications such as infections. The market growth is anticipated to be propelled by the growing burden of patients with chronic and acute wounds, thereby boosting the demand for wound care products in the forthcoming years. Moreover, the global market is fragmented, with several established players operating in the wound care industry, which include 3M, Smith + Nephew, ConvaTec Inc., and others. These key players are implementing various growth strategies to expand their market share and support market expansion.

- For instance, in January 2024, as per the data published by the Springer Nature Journal indicated that approximately 25.0% of individuals with diabetes faced the risk of developing diabetic foot complications over their lifetime. This increasing risk of diabetic foot ulcers is expected to drive a greater demand for wound care products, thereby propelling the market growth.

Additionally, the governments and private and non-profit organizations of emerging countries are constantly focusing on various awareness programs to increase awareness of advanced wound care products and treatment options for chronic and advanced wounds. For instance, in June 2023, The Wound Care Center at HSHS St. Francis Hospital initiated a program during Wound Care Awareness Month to increase awareness regarding the risks of chronic wounds. Such factors, along with favorable reimbursement policies in developed countries, are propelling the adoption rate of wound care products, thereby boosting the market growth in the coming years.

Global Wound Care Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 22.37 billion

- 2026 Market Size: USD 23.89 billion

- 2034 Forecast Market Size: USD 41.22 billion

- CAGR: 7.05% from 2026–2034

Market Share:

- Region: North America dominated the market with a 37.9% share in 2025. The region's leadership is driven by the strong presence of key players, a large patient population suffering from chronic and acute wounds, and higher per capita healthcare expenditure.

- By Type: The Advanced Wound Dressings segment held the largest market share in 2024. This is due to the high demand and adoption of foam, antimicrobial, and alginate dressings, driven by the rising prevalence of chronic wounds, an increasing number of surgical procedures, and the superior benefits these dressings offer compared to traditional products.

Key Country Highlights:

- Japan: The market is characterized by the introduction of highly innovative and medically approved products, such as the launch of the first and only dHACM (dehydrated human amnion/chorion membrane) allograft for wound care available in the country.

- United States: Growth is fueled by strategic initiatives from prominent companies to enhance customer reach, such as launching new diabetic wound care products in major retail locations like Walmart, and receiving consistent FDA approvals for innovative wound therapy systems.

- China: As a key country in the fastest-growing Asia Pacific region, the market is driven by a large patient pool for chronic wounds and increasing research and development activities focused on advanced wound care solutions.

- Europe: The market is propelled by a well-established healthcare infrastructure in countries like the U.K. and Germany, a high incidence of chronic wounds such as venous leg ulcers in France, and continuous product innovation and clinical trials from major companies based in the region.

MARKET DYNAMICS

Market Drivers

Increasing Incidence of Chronic and Acute Wounds to Boost Demand for Treatment Solutions

The growing prevalence of chronic and acute wounds, such as diabetic ulcers, pressure ulcers, surgical wounds, and burn wounds, is significantly leading to a high burden on healthcare systems globally. This is propelling the number of patients seeking treatment for wound healing, which is anticipated to drive the demand for wound care products in the coming years.

- For instance, according to the data published by Frontiers in 2021, an estimated global prevalence of venous leg ulcers (VLU) was approximately 2.0%.

- Similarly, a study from Sage Journal in August 2021 reported that France witnessed around 263,000 new or recurrent cases of venous leg ulcers (VLU) annually. Such increasing incidences are expected to boost the demand for effective treatment options, thereby driving the significant growth of advanced wound care products.

Moreover, the growing occurrence of acute wounds, including surgical wounds and burns globally, is projected to surge the demand for various wound care products such as hydrogel dressings.

- For instance, a meta-analysis from the National Library of Medicine in 2023 highlighted that the global pooled incidence of surgical site infections (SSI) stands at 2.5%, which further indicated a rising need for wound care products.

Furthermore, these chronic and acute wounds may impose a substantial economic burden on healthcare systems worldwide. For instance, the National Health Services (NHS) in the U.K. reported an expenditure of approximately USD 11.4 billion each year on wound management. As a result, there is an increasing need for effective wound care treatments, particularly in emerging countries where patient populations are expanding. Moreover, the rising prevalence of diabetes is also anticipated to increase the burden of chronic wounds such as diabetic foot ulcers (DFU). This scenario is expected to fuel the market growth significantly throughout the forecast period.

Market Restraints

High Treatment Costs and Extended Recovery Period May Hinder Wound Care Adoption

The global market faces significant limitations in growth primarily due to the high costs associated with advanced treatment options and the extended recovery times required. These factors may lead to a substantial economic burden for both patients and healthcare systems in both developed and developing countries.

- For instance, as per the data published by Dove Medical Press Limited, a study conducted in January 2022 revealed that the average cost for managing diabetic foot ulcers within the U.K.'s National Health Service (NHS) could range from approximately USD 2,407.7 for healed ulcers to USD 9,900.9 for those that remain unhealed. This cost was observed to increase with the severity of the ulcer, as more complex cases require longer healing durations.

- Similarly, an article published by the Journal of Wound Care in 2023 highlighted that a stage 4 diabetic foot ulcer may take an average of 190 days to heal, with a significant proportion of patients suffering from venous leg ulcers facing a 12% to 47% chance of non-healing after a year of treatment.

Such increasing costs of wound care treatments may limit their adoption in countries with low budgets. Additionally, inadequate reimbursement policies, particularly in emerging markets, may limit the adoption of innovative bioactive wound care devices. The financial burden placed on patients due to out-of-pocket expenses for wound care products and limited coverage for advanced treatments is further expected to hinder the global market growth in the coming years.

Market Opportunities

Recent Product Approvals and Strong Pipeline to Augment Market Growth

Prominent companies are largely focused on investing in the research and development of advanced bioactive products for hard-to-heal wounds. Several candidates are in the end stage of development, which is expected to launch sooner and boost market expansion. Prominent companies are continuously launching new products, coupled with significant innovations, to contribute to the rising demand for wound care products.

- For instance, in January 2024, Medline introduced the OptiView transparent dressing featuring HydroCore Technology, designed to facilitate the monitoring of at-risk skin and detect early signs of skin breakdown.

- Similarly, in March 2024, Integra LifeSciences unveiled the MicroMatrix Flex, which provides improved access to challenging areas in complex wound cases, thereby expanding its product range. Such launches are expected to contribute to wound care globally, driving market growth.

Moreover, to foster innovation in wound care for patients with hard-to-heal wounds, several key players are signing strategic partnerships and acquisitions, thereby increasing their product presence worldwide.

- For instance, ConvaTec Inc. acquired Triad Life Sciences Inc. in March 2022 to enhance its presence in the global wound biologics market. This trend is indicative of a broader strategy among firms to develop cutting-edge wound care solutions.

Such factors contributing to the high penetration of wound care products are projected to boost the market expansion in the near future.

Market Challenges

Limited Access in Low-Income Regions to Restrict Market Growth

In many developing countries, inadequate healthcare infrastructure and limited access to advanced medical technologies restrict the availability of effective wound care solutions. Patients in these areas often rely on less effective traditional treatments due to economic constraints. Moreover, despite advancements in wound care technologies, infection management remains a critical challenge. Chronic wounds are particularly susceptible to infections, which can complicate treatment and prolong healing times. This ongoing risk may necessitate continuous innovation in infection control measures within wound care products.

Moreover, there are several cases of delayed diagnosis of chronic wounds due to several factors, such as delayed referrals of patients with chronic wounds and the limited expertise among physicians to identify diabetic foot ulcers and neuropathic ulcers, particularly in the emergency departments.

- For instance, a recent study published in the Diabetic Foot Journal in 2023 reported delays in managing chronic limb-threatening ischemia and foot ulcers in diabetic patients. Moreover, the findings revealed that the median duration from the onset of symptoms to receiving a specialist healthcare assessment varied significantly, ranging from 15 to 126 days. Furthermore, the median time before treatment was initiated ranged from 1 to 91 days.

These delays highlighted critical gaps in timely care for individuals suffering from these serious conditions. Such a combination of factors may pose a significant challenge to market growth during the forecast period.

Dearth of Skilled Professionals and Stringent Regulatory Scenario to Curtail Growth Prospects

Certain other contributive factors that may restrict the market growth are the lack of presence of trained healthcare professionals and the longer timelines needed to launch products. Proper wound management requires specialized training, and a shortage of skilled healthcare professionals can hinder effective treatment. Furthermore, the navigation of the complex regulatory landscape for product approvals can delay the introduction of innovative wound care solutions.

Wound Care Market Trends

Increasing Application of Regenerative Products, such as Bioactive Therapies for Late-Stage Wounds

Bioactive therapies, including skin substitutes and growth factors, are gaining huge popularity among healthcare professionals, especially in the treatment of late-stage wounds. Several players are currently entering the market by focusing on allograft, xenograft, nanofiber, dermal substitutes, and cell-based therapies to cater to the growing demand for urgent and effective wound management therapies among patients.

- For instance, in January 2023, Gunze Medical, a subsidiary of Osaka-Gunze Limited, launched a dehydrated human amnion/chorion membrane (dHACM) allografts for wound care. This is the first and the only medically approved product available in Japan.

- Similarly, in November 2021, Sanara MedTech Inc. announced the commercial launch of FORTIFY TRG, a tissue repair graft, and FORTIFY FLOWABLE extracellular matrix to treat chronic wounds, including pressure ulcers, venous ulcers, diabetic ulcers, chronic vascular ulcers, and other types of ulcers.

Also, technological advancements in bioactive therapies have resulted in a reduction in the overall duration and cost of treatment, which has been able to attract the patient population. This factor presents a huge growth opportunity for new entrants and established players to focus on this segment. It has prompted them to launch new bioactive therapies to fulfill the growing demand for them in the global market. Hence, these have emerged as key global wound care market trends.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The market witnessed negative growth in 2020 due to the COVID-19 pandemic. This was mainly due to the disruptions in care continuity and outcomes of chronic wounds in that period. Moreover, the temporary closure of hospitals, supply chain disruptions, and lockdown restrictions also significantly led to decreased utilization of wound care products, which declined the market growth in 2020.

- For instance, as per the Journal of the Post-Acute and Long-term Care Medical Association (JAMDA) in April 2022, a study in 45 U.S. states and the District of Columbia reported that the impact of COVID–19–related disruptions on care continuity and outcomes of chronic wounds in 488 wound care clinics found that case volume declined around 40.0% in 2020. Such a substantial decline led to a decrease in market growth in 2020.

However, in 2021, the market regained its momentum due to the relaxation of lockdown restrictions, decreased COVID-19 cases, and a surge in revenues of key players due to increasing sales of wound care products. Moreover, the increasing number of patient appointments for chronic wound treatments also allowed the market to recover in 2022 and 2023, with a projection of sustained growth throughout the forecast period.

Segmentation Analysis

By Type

Advanced Wound Dressings Segment Expected to Dominate Market Due to High Demand

Based on type, the market is segmented into advanced wound dressings, traditional wound care products, negative pressure wound therapy, bioactives, and others.

Advanced wound dressings further can be sub-segmented into antimicrobial dressings, alginate dressings, foam dressings, hydrocolloid dressings, and others. On the other hand, the bioactives consist of biological skin equivalents, growth factors, and others.

The advanced wound dressings segment held a dominating global wound care market share of 44.27% in 2026, owing to higher demand and adoption of foam dressings, antimicrobial dressings, and alginate dressings. The rising prevalence of chronic wounds, increasing number of surgical procedures, and various benefits associated with advanced wound dressing when compared to traditional dressings are the factors predominantly driving the segment growth. Additionally, increasing product launches in this segment will also support the demand for advanced wound dressings, propelling the segment's growth. For instance, in October 2022, Theruptor Novo, a new wound dressing portfolio, was launched by Healthium Medtech. These products can be used for the management of chronic wounds, such as leg ulcers.

The bioactives segment is expected to register the highest CAGR, owing to the increasing application of tissue-engineered products derived from artificial or natural sources to treat slow-healing wounds.

The negative pressure wound therapy (NPWT) segment is expected to record a moderate CAGR due to the introduction of technologically advanced NPWT devices by market players, which may increase product availability in the market.

- For instance, in July 2024, AOTI, INC. obtained FDA approval for the NEXATM negative pressure wound therapy (NPWT) system, expanding its usage in the home care setting. These approvals are anticipated to spur the segment growth during the forecast period.

The traditional products and others segments are expected to register a comparatively significant CAGR during the forecast period owing to the increasing shift of healthcare professionals and patients toward advanced products.

By Application

Increasing Prevalence DFU and Pressure Ulcers to Boost Chronic Wound Segment Growth During Forecast Period

Based on application, the market is segmented into chronic wounds and acute wounds. The chronic wound segment can be further divided into diabetic ulcers, pressure ulcers, leg ulcers, and others. On the other hand, acute wounds consist of surgical wounds and others.

The chronic wounds segment held a dominating share of the market in 2024. This dominance is attributed to a rise in the percentage of the patient population suffering from diabetic foot ulcers and pressure ulcers, along with increasing expenditure on treating these conditions. The segment is expected to dominate the market share of 68.58% in 2026.

- For instance, according to data released by Elsevier B.V. in February 2022, the global prevalence of diabetic foot ulcers was nearly 6.3%. Additionally, the National Diabetes Services Scheme (NDSS) estimated that diabetic foot disease costs Australia's healthcare system around USD 642.0 million.

The acute wounds segment is projected to expand at a significant CAGR of 6.9% during the forecast period of 2025-2032, due to the increasing number of surgeries and burn cases contributing to the high occurrence of acute wounds. This is expected to increase the adoption of wound care products, thereby fueling the segment's growth in the forthcoming years.

The acute wounds segment is expected to register a significant CAGR during the forecast period due to increasing number of surgeries. This has resulted in a higher incidence of surgical wounds and the launch of advanced products by market players for acute wounds.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Hospitals to Dominate Due to Higher Number of Hospitals with Dedicated Facilities for Wound Management

Based on end-user, the market is segmented into hospitals, clinics, homecare settings, and others.

The hospitals segment held a dominating share in 2024 due to an increase in the number of multispecialty hospitals with departments dedicated to wound management, especially in emerging countries. The segment is expected to dominate the market share of 42.19% in 2026.

The homecare settings segment is expected to register a higher CAGR of 6.9% during the forecast period. This is due to the increasing incidence of chronic wounds among the geriatric population and the rising shift of patients toward home care treatments. Moreover, the key players' increasing product launches of suitable products for homecare usage are also expected to boost segmental growth.

- For instance, in April 2024, Smith + Nephew launched the RENASYS EDGE NPWT system, a lightweight, compact device for home care usage. This device aids in the treatment of chronic wounds in homecare settings. Such launches are expected to spur segment growth during the forecast timeframe.

The clinics and others segments are anticipated to display a significant CAGR due to increasing investments by public and private players in small and medium-sized clinics. The presence of long-term care centers is also growing across the world to improve healthcare infrastructure, further augmenting the segment's growth.

WOUND CARE MARKET REGIONAL OUTLOOK

North America

North America Wound Care Market Size, 2025 (USD billion)

To get more information on the regional analysis of this market, Download Free sample

The North America wound care market size stood at USD 8.48 billion in 2025, and in 2026, the market size was USD 9.02 billion. The strong presence of key players in the region, the large patient population suffering from chronic & acute wounds, and the higher per capita healthcare expenditure are some of the major factors responsible for the region's dominance in the market.

The U.S. market size is estimated to be USD 7.89 billion in 2026. In the U.S., strategic initiatives by prominent companies to launch novel products and enhance their customer reach are expected to fuel the country's market growth. For instance, in December 2023, Laviour launched its diabetic hydrogel wound dressing and diabetic first aid gel, both made from plant-based ingredients, at Walmart locations throughout the U.S.

Moreover, in Canada, the rising awareness programs and increasing collaborations for the introduction of advanced treatments of acute and chronic wounds are anticipated to boost the country's market growth.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to account for the second-highest market size of USD 8.11 billion in 2026,

exhibiting the second-fastest growing CAGR of 7.3% during the forecast period, due to a well-established healthcare infrastructure in the U.K. and Germany and an increase in the adoption of innovative products in these countries. Moreover, the initiatives by key players, such as the opening of new sales offices, are projected to augment the wound care market revenue, expanding their offerings in the region.

- For instance, in May 2024, ConvaTec Inc. announced clinical study results for AQUACEL Ag+ Extra. It was a multinational, randomized controlled trial (RCT) that showed the healing of venous leg ulcers effectively with AQUACEL Ag+ Extra than standard dressing. Such factors in the European market boost the growth of the region's segment.

The market value in U.K. is expected to be USD 0.85 billion in 2026.

On the other hand, Germany is projecting to hit USD 2.13 billion and France is likely to hold USD 0.41 billion in 2025.

Asia Pacific

Asia Pacific is expected to be anticipated the third-largest market with USD 5.17 billion in 2026, showcase the highest CAGR due to the increasing incidence of diabetes-related comorbidities, such as diabetic foot ulcers, in the region. The region's growth can be attributed to the higher patient pool for chronic wounds and increasing research activities being carried out in the region. Moreover, the growing aging population in the region is also contributing to the rising prevalence of chronic wounds, such as diabetic foot ulcers, propelling the regional market growth. The market value in China is expected to be USD 2.46 billion in 2026.

On the other hand, India is projecting to hit USD 0.38 billion and Japan is likely to hold USD 1.29 billion in 2026.

- In March 2024, a collaborative study by researchers from the University of Sheffield and the University of South Australia explored the use of plasma-activated hydrogel dressings to combat antibiotic-resistant pathogens in the treatment of diabetic foot ulcers and internal wounds. This innovative approach is anticipated to enhance market growth in this region significantly.

Latin America

The Latin American market is expected to be the fourth-largest market size with USD 0.87 billion in 2026 and grow at a significant CAGR during the forecast period due to the increasing healthcare expenditure in key countries such as Brazil. Furthermore, studies representing the cost-effectiveness of wound care devices and dressings in the region are also driving product adoption, thereby expected to boost the regional market growth.

- For instance, a study published by Elsevier Inc. in 2022 aimed to assess the potential budget impact of negative pressure wound therapy (NPWT) compared to conventional wound treatment (CWT) for diabetic foot ulcers (DFU). The findings indicated that utilizing NPWT for 100 DFU patients could lead to significant cost savings: USD 184,783 (38.1%) in Chile, USD 128,179 (28.0%) in Colombia, and USD 146,766 (30.1%) in Brazil. Such financial advantages are contributing to the growth of the region.

Middle East & Africa

Middle East & Africa is anticipated to register a noteworthy CAGR during the forecast period. The growth of the region is primarily attributed to the increasing burden of chronic wounds and rising awareness of its treatment, which is expected to boost the adoption of various traditional and advanced wound care solutions. The GCC market is expecting to be USD 0.39 billion in 2025.

- For instance, as per the article published by IntechOpen in 2024, the prevalence range of DFU in African nations (excluding North Africa) was reported between 10.0% and 30.0%. This is expected to increase the demand for various wound care products, inspiring several key players to market their products in this region.

COMPETITIVE LANDSCAPE

Key Market Players

Wide Operating Network and Focus on Inorganic Strategies Led to Dominance of 3M, Smith & Nephew, ConvaTec Group PLC, and Mölnlycke Health Care AB in 2024

The competitive landscape of the global wound care market is fragmented, with a few established players dominating the advanced wound dressings segment. The global market was dominated by 3M, Smith & Nephew, ConvaTec Group PLC, and Mölnlycke Health Care AB in 2024. The introduction of innovative treatment options for wounds, a rise in product launches, and expansion of sales channels are key strategies adopted by leading players to maintain their dominant position in the market.

- In April 2023, 3M received approval from the U.S. FDA for two innovative products under its 3M Veraflo Therapy line: the 3M Veraflo Cleanse Choice Complete Dressing and the 3M V.A.C. Veraflo Cleanse Choice Dressing. This approval aims to enhance 3M's offerings in the wound care market.

Also, a strong focus on strategic development to increase product portfolio and awareness among the physician and patient population is expected to provide a strong foothold to the players in the market.

- In March 2022, ConvaTec Group PLC completed the acquisition of Triad Life Sciences for manufacturing wound biologics to address the unmet clinical needs in surgical wounds.

The other key market players operating in the market are Cardinal Health, Johnson & Johnson Services, Inc., Coloplast Corp, PAUL HARTMANN AG, Integra LifeSciences Corporation, and BSN Medical.

LIST OF KEY COMPANIES PROFILED:

- Smith & Nephew (U.K.)

- 3M (U.S.)

- ConvaTec Inc. (U.K.)

- Cardinal Health (U.S.)

- Coloplast A/S (Denmark)

- Integra LifeSciences Corporation (U.S.)

- Mölnlycke Health Care AB (Sweden)

- PAUL HARTMANN AG (Germany)

- Johnson & Johnson Services, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024 – 3M announced the launch of V.A.C. peel and place dressing, an integrated dressing and drape. This served as an extended-wear wound dressing for V.A.C. therapy.

- April 2024 – Smith+Nephew launched the RENASYS EDGE NPWT system, a lightweight and compact device to treat chronic wounds in the U.S., further enhancing its presence in the country.

- September 2023 – MiMedx Group, Inc. launched EPIEFFECT, an advanced wound care solution, to expand its product portfolio.

- May 2023 - Smith & Nephew received an innovative technology contract from Vizient, Inc. for its PICO Single Use Negative Pressure Wound Therapy Systems.

- March 2023 – Bactiguard AB collaborated with Quintess Medical and launched its wound care product line in Ireland and the U.K. Through this collaboration, the company aimed to strengthen its position in the country.

- June 2022 – Smith & Nephew announced the establishment of a new R&D and manufacturing facility in the U.K. for its advanced wound care management business. The new manufacturing facility is anticipated to raise the company's sales by USD 10 billion in the first 10 years of operation.

- November 2021 – ConvaTec Group PLC extended its partnership with Vizient, Inc. for advanced wound treatment products, technologies, and services by three years up to 2025.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, competitive landscape, products, applications, and end-user. Besides this, it offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the market in recent years.

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.05% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type, By Application, By End-user, and By Region |

|

By Type |

|

|

By Application |

|

|

By End-user |

|

|

By Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the global wound care market was valued at USD 22.37 billion in 2025 and is projected to grow from USD 23.89 billion in 2026 to USD 41.22 billion by 2034, at a CAGR of 7.05%.

Recent trends include rising adoption of advanced bioactive therapies, negative pressure wound therapy, and regenerative products like hydrogels and biological skin equivalents driven by increasing prevalence of diabetic ulcers, chronic wounds, and surgical site infections.

The top global players are 3M, Smith & Nephew, ConvaTec, Integra LifeSciences, and Tissue Regenix, each known for launching innovative bioactive dressings, NPWT systems, and advanced wound devices.

The market splits into acute wounds (surgical wounds, burns), chronic wounds (diabetic foot ulcers, pressure ulcers), and bioactive or advanced products

North America led in 2025, capturing approximately 37.9% of the market across various segments standard wound care, advanced dressings, active therapies, and devices.

Key innovations include transparent, moisture-managing hydrogels, electrospun nanofiber dressings, cell based therapies, growth-factor products, and ML-based wound image classification tools to optimize healing outcomes.

The wound care market is projected to grow at a compound annual growth rate (CAGR) of 7.05% during the forecast period., according to fortune business insights reports.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us