Chronic Wound Care Market Size, Share & Industry Analysis, By Type (Diabetic Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Others), By Product (Advanced Wound Dressings, Wound Care Devices, Active Therapy, and Others), By End-User (Hospitals & Wound Care Centers and Homecare Settings & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

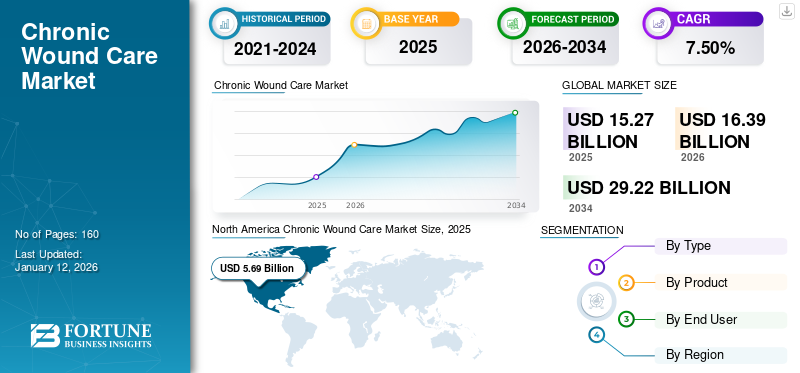

The global chronic wound care market size was valued at USD 15.27 billion in 2025. The market is projected to grow from USD 16.39 billion in 2026 to USD 29.22 billion by 2034, exhibiting a CAGR of 7.50% during the forecast period. North America dominated the chronic wound care market with a market share of 37.42% in 2025.

According to various research reports and data published by Mission Regional Medical Center, it was estimated that around 6.7 million people in the world were suffering from chronic wounds. Also, according to an article published by Fairfax Media in August 2021, it was estimated that around 420,000 people in Australia are diagnosed with various types of wounds each year. Chronic wounds are difficult to heal and are recognized by symptoms such as loss of skin or tissue surrounding the wound or by the duration required for healing. Once a wound becomes chronic, intensive medical intervention and chronic wound care products are required to treat the wound. The Wound Healing Society (WHS) has classified these wounds into four main categories, i.e., diabetic ulcers, pressure ulcers, venous ulcers, and arterial ulcers.

Also, it is observed that these wounds exert a huge economic burden on patients and healthcare systems globally. For instance, according to a research study published by SAGE Publications in August 2021, it was estimated that around USD 4.94 billion were spent on venous leg ulcers and other associated diseases in the U.S. Also, according to Fairfax Media, it was estimated that the Australian government spends around USD 3.00 billion per year for chronic wound care.

The COVID-19 pandemic negatively impacted a few medical device segments due to reduction of non-essential procedures and healthcare services. This factor resulted in the exemption of wound care from the essential procedures list and has been considered an elective procedure in most countries. Also, healthcare settings such as hospitals and specialty clinics were temporarily shut down and wound clinics accepted only emergency cases. Thus, this resulted in a significant drop in the number of patient visits in healthcare settings for chronic wound care.

However, the revocation of lockdowns, and COVID-19 restrictions in 2021 by the majority of the countries, coupled with an increasing number of patient visits in the hospitals and wound centers, fueled the demand and adoption of wound dressings and other devices. The market is anticipated to witness a significant growth over the forecast period.

Global Chronic Wound Care Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 15.27 billion

- 2026 Market Size: USD 16.39 billion

- 2034 Forecast Market Size: USD 29.22 billion

- CAGR: 7.50% from 2026–2034

Market Share:

- Region: North America dominated the market with a 37.42% share in 2025. The region's leadership is attributed to the growing prevalence of chronic wounds, higher costs of treatment which drives the market value, and the presence of adequate reimbursement policies in the U.S. and Canada.

- By Product: Advanced Wound Dressings accounted for the dominant market share. This is due to the lower cost of these dressings coupled with their high efficiency in managing various types of wounds, making them a primary choice for treatment.

Key Country Highlights:

- Japan: The market is driven by a significant incidence of chronic wounds, with data indicating that the rate of diabetic foot ulcers in Japan is 2.9 per 1,000 people annually. Key players are also entering exclusive distribution agreements to introduce new active therapies like placental tissue allografts into the market.

- United States: Growth is fueled by a high prevalence of chronic wounds, with an estimated 1.0 to 3.0 million people suffering from pressure injuries annually, and about 5.0% of diabetic patients developing a foot ulcer. The market is also characterized by continuous new product launches, such as advanced foam dressings.

- China: The market is expanding due to growing awareness among the patient population about available treatment options and increasing per capita healthcare spending. This has led to regulatory approvals for innovative products, such as at-home topical oxygen therapies for diabetic ulcers.

- Europe: The market is propelled by the significant economic and health burden of chronic wounds, with the annual cost of venous leg ulcer treatment in the U.K. estimated at USD 2.57 billion. Growth is also supported by collaborations to distribute new products, such as gentle wound debriders, and the launch of novel dressings in key markets like Germany.

Chronic Wound Care Market Trends

Increasing Application of Active Therapies in Treatment of Chronic Wounds

Several market players and research organizations are constantly focusing on the active therapy segment due to the increasing application of bioactive therapies such as bioequivalent and skin graft in treating these wounds. For instance, a study was published by a team of researchers from the University of Fort Hare, South Africa, in February 2022. They demonstrated the high potential of polymer-based dressings loaded with bioactive agents in accelerating wound healing. Similarly, in July 2021, a team of researchers from Michigan State University started developing biopolymer dressing to heal the injuries associated with diabetic foot ulcers.

Thus, such introduction of advanced active therapies by market players is leading to increasing adoption of active therapies, which subsequently will aid the global chronic wound care market growth during the forecast period.

Download Free sample to learn more about this report.

Chronic Wound Care Market Growth Factors

Growing Prevalence of Chronic Wounds to Surge the Demand for Treatment

The rising prevalence of diabetic ulcers, pressure ulcers, and others is expected to increase the demand for dressings, devices, and active therapies to treat these wounds. For instance, according to a research article published by National Center for Biotechnology Information in December 2021, it was reported annually an estimated 1.0 to 3.0 million people in the U.S. are suffering from pressure injuries of the skin and soft tissues. Also, according to data published by National Center for Biotechnology Information in 2021, it was reported that the incidence of diabetic foot ulcers in Japan was 2.9 per 1000 people each year.

Additionally, pressure ulcers are one of the leading causes of chronic wounds. According to an article published by Fernandez Firm Accident Injury Attorneys in April 2021, pressure ulcers are one of the most common side effects of long-term care globally, affecting about 8.4% of hospital patients. Also, as per statistics published by Nursing Home Law Center LLC, major patient factors that increase the risk of pressure wounds or ulcers are severe mental illness (75%), epilepsy (34%) and diabetes (33%).

Hence, the increasing prevalence of different types of chronic wounds globally is generating a high demand for treatment products and, subsequently, fueling the adoption of wound dressings, devices, and other products during the forecast period.

Technological Advancement in Treatment Options is Propelling Market Growth

In October 2021, Healthium Medtech Limited launched TRUSHIELD NXT, a surgical wound dressing with patented infection prevention technology combined with 3D hydrocellular substrate to improve wound healing. Additionally, investments in R&D and the launch of several novel wound healing products such as foam dressing and others by market players is expected to fuel the adoption of advanced wound care products for the urgent treatment of diabetic foot ulcers, and others.

Furthermore, the integration of artificial intelligence in chronic wound management also supplements the market growth. For instance, the AI-integrated solutions from Care of Sweden AB aid in the prevention of pressure ulcers. The company’s CuroCell IQ Cirrus platform utilizes a range of AI sensors to adjust the internal mattress pressure based on the patient's weight and position in the bed. These sensors constantly read the patient’s data, such as weight, height, and body position in bed, and thus help in preventing pressure ulcers by modifying beds and mattresses accordingly.

RESTRAINING FACTORS

High Cost of Treatment and Inadequate Reimbursement Policies in Emerging Countries to Restrict Adoption

Even with a large patient pool with chronic wounds, certain factors are restricting the adoption of chronic wound care products globally. One of them is the high cost of products such as advanced wound dressings, chronic wound care devices, bioactive products coupled with lack of reimbursement for these products in emerging countries.

For instance, according to a research article published by Elsevier B.V. in March 2021, it was estimated that the cost of individual patients ranges from USD 894.7 to USD 98,730.2 for hospital-acquired pressure ulcer treatment. Hence, the high cost of treatment of these hard-to-heal ulcers and inadequate reimbursement policies, especially in emerging countries, have been instrumental in the lower adoption of active products and devices in the global market.

Chronic Wound Care Market Segmentation Analysis

By Type Analysis

Rising Prevalence of Diabetes and Diabetic Ulcers Led to the Segmental Dominance in 2024

The market is segmented into diabetic ulcers, pressure ulcers, venous leg ulcers, and others in terms of type. The largest chronic wound care market share of 44.06% was captured by the diabetic ulcers segment in 2026. The segment's dominance is attributable to the higher prevalence of diabetes globally and the increasing incidence of diabetic ulcers among diabetic patients.

- For instance, according to a research study published by National Center for Biotechnology Information in August 2021, it was reported that about 5.0% of diabetic patients in the U.S. develop a foot ulcer and 1.0% of patients among them undergo amputation.

The pressure ulcers segment is expected to grow at a significant CAGR during the forecast period due to the increasing patient pool suffering from pressure ulcers and increasing expenditure on its treatment.

However, the venous leg ulcers segment is anticipated to register a moderate CAGR from 2024-2032.

To know how our report can help streamline your business, Speak to Analyst

By Product Analysis

High Efficiency Coupled with Technological Advancement Responsible for Dominance of Advanced Wound Dressings in 2024

Based on product, the market is segmented into advanced wound dressings, wound care devices, active therapy, and others. Advanced wound dressings segment accounted for a dominant market share 47.72% in 2026. The dominance is attributed to the lower cost of wound dressings coupled with its high efficiency in managing various types of wounds. The devices segment is expected to grow at a significant CAGR during the forecast period due to the constant focus of market players in introducing advanced devices in the market.

The active therapy segment is projected to grow at a higher CAGR during the forecast period owing to the increasing use of active therapies in the urgent and effective treatment of chronic wounds.

By End User Analysis

Increasing Patient Flow in Hospitals & Wound Clinics to have a Dominant Market Share during the Forecast Period

Based on end user, the market is segmented into hospitals & wound clinics and home care settings & others. The hospitals & wound clinics segment is anticipated to dominate the market share of 69.39% in 2026. The dominance is due to an increasing patient flow in hospitals suffering from hard-to-heal chronic wounds.

On the other hand, the home care setting & others segment is anticipated to register a significant CAGR by the end of the forecast period due to patients' rising preference shift from hospital to home care settings for personalized care.

REGIONAL INSIGHTS

North America Chronic Wound Care Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 5.69 billion in 2025 and USD 6.09 billion in 2026. The dominance of this region is attributable to the growing prevalence of chronic wounds, higher cost of treatment, and presence of adequate reimbursement policies in the U.S and Canada. For instance, according to an article published by Mary Ann Liebert, Inc., in October 2021, it was reported that the prevalence of venous leg ulcers was around 1.69% among the U.S. adult population in 2020. Also, it was stated that the annual economic burden for venous leg ulcers was approximately USD 14.90 billion in the U.S. Thus, the huge patient pool suffering from chronic wounds results in the growing demand and adoption of wound dressings, and is responsible for the market dominance of this region. The U.S. market is projected to reach USD 5.44 billion by 2026.

Europe

Whereas, the market in Europe is anticipated to register a significant CAGR during the forecast period due to the increase in a patient population with chronic wounds coupled with higher expenditure on the treatment of diabetic ulcers, pressure ulcers, venous ulcers, and others. For instance, according to the article by Manchester University NHS Foundation Trust in February 2020, the annual cost of venous leg ulcer treatment was estimated to be USD 2.57 billion in the U.K. The UK market is projected to reach USD 0.49 billion by 2026, and the Germany market is projected to reach USD 1.15 billion by 2026.

Asia Pacific

The Asia Pacific market is expected to grow at a higher CAGR due to the region's constant focus on market players. Comparatively lower diagnosis and treatment rates in emerging countries, especially in China, and India, have been pivotal for the lower share of the region in the global market. However, growing awareness among the patient population toward available treatment options, and increasing per capita healthcare spending, has led to the entry of global players in the region. For instance, in April 2021, Essity Aktiebolag (publ) acquired the distribution rights of Sorbact in Australia and New Zealand, intending to prevent and treat chronic wounds. The Japan market is projected to reach USD 0.87 billion by 2026, the China market is projected to reach USD 1.83 billion by 2026, and the India market is projected to reach USD 0.32 billion by 2026.

Latin America and the Middle East & Africa

However, Latin America and the Middle East & Africa accounted for a comparatively lower share of the market due to lack of awareness about wound care, lower per capita income, and inadequate reimbursement policies in these regions. According to a research article published by Elsevier B.V. in 2022, it was reported that the treatment cost of a diabetic foot ulcer is approximately USD 10,450.0 per patient in Latin America. Thus, this huge expense is unaffordable for the majority of the countries in this region. This factor results in limiting the adoption of dressings, and devices, and subsequently restraining the market growth during the study period.

To know how our report can help streamline your business, Speak to Analyst

List of Key Companies in Chronic Wound Care Market

Emphasis on New Product Launches and Company Acquisition to Reinforce the Leading Market Position

The market structure is consolidated, with major players such as Smith & Nephew, ConvaTec, Inc., and 3M, occupying a dominant market share in 2023. Factors such as a strong product portfolio for chronic and acute wounds, along with a wide distribution network, are primarily responsible for the dominance of these players in the global market. For instance, in January 2023, Convatec Group launched ConvaFoam in the U.S. market. The product is a super absorber foam dressing intended to manage highly exuding wounds, including venous leg ulcers, pressure ulcers, and diabetic foot ulcers.

Along with that, a strong emphasis on strategic expansion of their product offerings through the acquisition of domestic players is anticipated to provide a strong foothold in the global market. For instance, in January 2021, Integra LifeSciences Corporation announced the acquisition of ACell, Inc., intending to provide more comprehensive complex wound management solutions to the patients. Other key players engaged in the market are Cardinal Health, Coloplast Corp, Integra LifeSciences Corporation, B. Braun Melsungen AG, and Tissue Regenix.

LIST OF KEY COMPANIES PROFILED:

- Smith & Nephew (U.K.)

- Mölnlycke Health Care AB (Sweden)

- 3M (U.S.)

- ConvaTec Group PLC (U.K.)

- Tissue Regenix (U.S.)

- B. Braun Melsungen AG (Germany)

- Integra LifeSciences Corporation (U.S.)

- Coloplast Corp (Denmark)

- Cardinal Health (U.S.)

- MiMedx (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023 – JeNaCell, an Evonik company, introduced epicite balance for chronic wounds. This product was launched in the German market.

- January 2023 – Mimedx entered into an exclusive distribution agreement with Gunze Medical Limited to sell placental tissue allograft, Epifix for wound healing in Japan. Upon this agreement, the company aims at strengthening its position in the Japan market.

- November 2022 – Medela LLC partnered with MedPro to expand access to its wound therapy systems. Through this partnership, the company is anticipated to strengthen its market presence.

- March 2022 – ConvaTec Group PLC acquired Triad Life Sciences to enter the wound biologics segment. Through this acquisition, the company aimed to expand its advanced wound care product portfolio

- March 2022- Advanced Oxygen Therapy Inc., one of the companies operating in the wound care market, received Chinese National Medical Products Administration (NMPA) approval for its product “cyclically pressurized Topical Wound Oxygen (TWO2) therapy” intended for diabetic ulcers.

- June 2021 – ConvaTec Group PLC announced a collaboration with RLS Global to distribute Chlorasolv, a gentle wound debrider, in the European market and later on in the U.S. market and the rest of the world.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the report offers insights into the global market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.50% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Type

|

|

By Product

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 16.39 billion in 2026 and is projected to reach USD 29.22 billion by 2034.

In 2025, North America’s market value stood at USD 5.69 billion.

Growing at a CAGR of 7.50%, the market will exhibit steady growth during the forecast period (2026-2034).

The diabetic ulcers segment is expected to be the leading segment by type in this market during the forecast period.

The increasing prevalence of chronic wounds and the introduction of advanced products by market players are major factors driving the market growth.

Smith & Nephew, 3M, and ConvaTec Inc. are major global market players.

North America dominated the chronic wound care market with a market share of 37.42% in 2025.

The launch of advanced technologies by market players such as active therapies NPWT are expected to drive the adoption in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us