Kaolin Market Size, Share & Industry Analysis, By Application (Paper, Ceramic & Sanitary Ware, Fiberglass, Paints & Coatings, Rubber, Plastics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

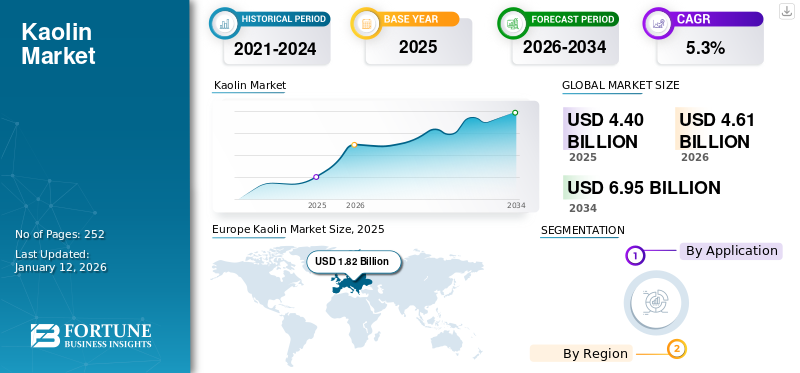

The global kaolin market size was valued at USD 4.4 billion in 2025 and is projected to grow from USD 4.61 billion in 2026 to USD 6.95 billion by 2034, exhibiting a CAGR of 5.3% during the forecast period. Europe dominated the kaolin market with a market share of 41% in 2025. Moreover, the U.S. kaolin market is projected to reach USD 933.25 million by 2032, driven by increasing demand in ceramics, paper, and construction industries.

Kaolin or Kaolinite Al2Si2O5(OH)4, also known as china clay, is a type of material that is composed of a sheet of tetrahedral sheet of silica with layered silicate mineral co-linked through oxygen atoms to alumina. It is used in different applications, including paper, ceramic & sanitary ware, and others, owing to their chemical properties, such as inertness toward the chemicals, and acts as an adsorbent. Moreover, it delivers waterproofing properties owing to the hydrogen bond available in the chemical structure that makes it non-swelling. It is widely used as the filling agent in the paper industry, providing the surface with color, opacity, and good printability. Increasing product adoption in various applications is expected to drive market growth.

Global Kaolin Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 4.40 billion

- 2026 Market Size: USD 4.61 billion

- 2034 Forecast Market Size: USD 6.95 billion

- CAGR: 5.3% from 2026–2034

Market Share:

- Europe dominated the kaolin market with a 41% share in 2025, driven by strong demand across paper, rubber, plastic, and ceramics industries, as well as a shift toward eco-friendly packaging.

- By application, the paper segment held the largest market share in 2024, supported by its high usage as a filler and coating agent to improve brightness, opacity, and printability in various types of paper.

Key Country Highlights:

- United States: Projected to reach USD 933.25 million by 2032, fueled by demand in paper, ceramics, and construction sectors; additionally, a focus on green initiatives is propelling the market.

- China: Rapid industrialization and the Belt and Road Initiative continue to stimulate demand for kaolin in construction and ceramics.

- India: Growing urban population and expanding paper and ceramic sectors are bolstering product usage.

- Germany: Europe's industrial hub is experiencing high demand for kaolin in automotive, construction, and paper applications, driving regional growth.

Kaolin Market Trends

Sustainable Mining & Production to Foster Global Market Growth

Kaolin is widely used in industries such as ceramics, papermaking, agriculture, and environmental science. However, its extraction and processing often result in significant environmental challenges, including soil degradation, pollution, and biodiversity loss. Sustainable mining and processing methods are increasingly emphasized to mitigate these impacts. Europe witnessed a kaolin market growth from USD 1.82 billion in 2025 to USD 1.9 billion in 2026.

The growing emphasis on sustainable mining reflects a broader shift toward environmentally responsible mineral extraction. By integrating renewable energy, adopting efficient processing technologies, rehabilitating mined lands, and leveraging ecological insights for restoration, the industry can significantly reduce its environmental footprint. These measures preserve ecosystems and also ensure the long-term viability of kaolinite as a critical resource for various industries.

Kaolin mining predominantly employs open-pit methods due to its cost-effectiveness. This process involves removing overburden and extracting the mineral from shallow deposits. While efficient, it disrupts ecosystems, degrades soil quality, and generates waste materials. To address these environmental concerns, several sustainable practices are being adopted.

For instance, transitioning mining operations from fossil fuels to renewable energy sources reduces carbon emissions. Countries such as Chile and South Africa have pioneered renewable energy use in mining sites, signaling a shift toward cleaner operations. Moreover, advanced carbon capture methods are being explored to neutralize emissions associated with kaolin mining. Techniques such as mineral carbonation can trap carbon dioxide within mined materials, potentially making operations carbon-neutral or even carbon-negative.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Product Demand from Paper Industry to Aid Market Growth

The increasing product use in the paper industry is driving the market growth during the forecast period. Kaolin is utilized mainly in the paper industry as a filler, as it imparts properties such as better paper opacity, extent fiber, printability, and brightness. Kaolinite-based coatings for paper improve characteristics, including ink receptivity, smoothness, porosity, and wax absorption, for producing quality print. As the global paper industry continues to expand, particularly in developing economies with rising literacy rates and packaging consumption, the need for high-quality material surges. This demand extends across various paper grades, from printing and writing paper to packaging materials.

The unique product properties make it indispensable in the paper production process. Its fine particle size and inert nature allow it to fill voids and enhance the paper's surface properties. This, in turn, leads to improved print quality and a smoother, more appealing finished product, ultimately driving the kaolin market growth.

Rise in Construction Industry is Propelling Product Demand

In the past few years, the population has increased at a significant growth rate. According to the United Nations- Data Portal Population Division, the global population was estimated at 8 billion on November 15, 2022, and is expected to reach 9.7 billion by 2050. Therefore, the number of construction projects such as buildings, apartments, villas, and skyscrapers has gained momentum to meet the increasing demand.

In cement production, china clay acts as a pozzolanic material, enhancing the strength and durability of the final product. Its use in the ceramic industry, such as in tiles and sanitaryware, is driven by its plasticity, whiteness, and ability to withstand high temperatures during firing. Furthermore, it contributes to the properties of bricks, mortars, and other building components, improving workability and reducing cracking.

As urbanization and infrastructure development continue to accelerate globally, the demand for these construction materials escalates correspondingly. This, in turn, directly translates to heightened product demand, solidifying its crucial role in supporting the burgeoning construction industry and shaping our built environment. The future looks bright for the market, closely tied to the continued growth and innovation in the construction sector.

Market Restraint

Availability of Substitutes May Hinder Market Growth

Kaolin has witnessed a major growth in demand from several end-use industries globally. However, the development and introduction of substitutes in these end-use industries are restraining the market growth. These substitutes include digitalization in every aspect of human life, leading consumers to shift their workload from paper-based notebooks toward digital gadgets, such as mobile phones and laptops, which is restraining market growth.

Substances such as calcium carbonate, talc, and even synthetic materials can often perform similar functions to china clay, depending on the specific application. Calcium carbonate, for instance, is a common alternative in paper manufacturing, offering comparable opacity and brightness at potentially lower costs. Similarly, talc finds use as a filler and extender in paints and plastics, directly competing with certain product grades.

Furthermore, titanium oxide is gaining attention from the end-use industries such as ceramics, cement, plastics, paper, and coatings as a substitute. Titanium oxide has excellent light-scattering properties, making it an ideal choice for paper, coatings, plastics, and pigment applications. Thus, the availability of multiple substitutes may hinder the market growth during the forecast period.

Market Opportunities

Rising Product Adoption in Various End-Use Industries to Provide Growth Opportunities

Kaolin is experiencing a surge in adoption across a diverse range of end-use industries. This increased demand stems from its unique properties, including whiteness, softness, chemical inertness, and good absorption characteristics, making it a valuable ingredient in numerous applications.

Beyond paper, the market is experiencing growth in the ceramics industry. Its excellent plasticity and firing characteristics make it ideal for producing a wide array of ceramic products, including tableware, sanitaryware, and tiles. With a global construction boom pushing the demand for ceramic building materials, kaolin's role in this sector is only expected to grow.

Furthermore, the plastics and rubber industries are increasingly incorporating china clay as a functional filler. It enhances the mechanical properties of plastics, improving strength, stiffness, and dimensional stability. In rubber applications, it contributes to reinforcement, wear resistance, and improved processing characteristics, making it a valuable addition to tires, hoses, and other rubber goods.

Market Challenges

Environmental Concerns to Act as Challenge for Market Growth

China clay mining activities, primarily conducted through open-pit methods, can cause significant ecological disturbances. These impacts necessitate stringent regulations and the adoption of sustainable practices to mitigate environmental degradation. Mining disrupts ecosystems primarily through soil destruction, water contamination, and biodiversity loss. During the processing, large quantities of water are used to create slurries. This process often leads to the release of harmful materials into nearby water bodies, contaminating aquatic ecosystems. For example, the St. Austell River in Cornwall became known as the "white river" due to kaolin waste pollution.

China clay mining alters the bacterial diversity in rhizosphere soils of native plants. Studies have shown a decline in beneficial bacteria such as Actinoplanes and Mycobacterium, which are crucial for soil health. Conversely, resilient species such as Ralstonia thrive under mining-induced stress, indicating significant ecological shifts.

Impact of COVID-19

The COVID-19 pandemic significantly disrupted the global market, particularly during 2020, due to the widespread economic slowdown and restrictions on industrial activities. Government-imposed lockdowns and restrictions led to a temporary halt in mining operations, delaying ongoing projects and reducing production. This caused supply chain disruptions for industries dependent on kaolinite, such as paper, ceramics, and construction.

The pandemic-induced economic downturn resulted in decreased demand from key sectors such as construction and manufacturing. For instance, the ceramics industry experienced a slowdown as construction projects were delayed globally. Supply chain disruptions increased costs for raw materials and transportation, leading to price hikes in products.

By 2023, the market had largely recovered to pre-pandemic levels, driven by rising demand from key industries such as paper packaging, ceramics, and paints. Moreover, the pandemic accelerated demand for packaged goods due to increased e-commerce activity. This boosted the product consumption in paper packaging materials for food and consumer products. The growing focus on green construction and infrastructure development has created new opportunities for applications in cement and paints. Additionally, innovations in advanced ceramics and nanotechnology are expected to drive future demand. Thus, while COVID-19 initially disrupted the market, its recovery has been bolstered by increased demand across diverse sectors and regional growth opportunities.

Segmentation Analysis

By Application

To know how our report can help streamline your business, Speak to Analyst

Paper Segment Held for Most Significant Share Due to Increasing Product Demand

In terms of application, the market is segmented into paper, ceramic & sanitary ware, fiberglass, paints & coatings, rubber, plastics, and others.

The paper segment accounted for the dominant kaolin market share in 2024 due to the high demand for paper from various applications in packaging and printing. The growing e-commerce activities around the globe are further fueling the demand for this product. This material provides brightness, opacity, and strength to paper, making it more effective to use and easily printable. These benefits of china clay have led to its high usage, thus propelling market growth.

The ceramic & sanitary ware segment accounted for the second-largest share of 30% in 2024. The segment includes product use for improving the quality of steel lamination in motors and stators. The product finds application in the electric vehicles industry, where it provides increased magnetic properties. The shift toward electric vehicles and hybrid vehicles has increased the demand for high-performance electrical steel in various automotive components.

In paints & coatings, this material is added in infrastructural coating to provide scratch resistance, enhance durability, and offer glossy texture. Moreover, the increasing demand for rubber, fiberglass, plastics, and cosmetics is fueling the global market.

Kaolin Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Kaolin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe was the largest consumer in 2025, generating a valuation of USD 1.82 billion. In 2026, the market value led the region by USD 1.09 billion. The region is expected to show substantial market growth during the forecast period. This growth can be attributed to the increasing product demand for applications in the rubber, plastic, paper, and glass end-use industries. The spread of COVID-19 has shifted consumer preferences toward packaged foods & beverages. This has led to a high demand for quality packaging materials for food products. Further, the production and consumption of china clay in automotive, paper, and ceramics & sanitary ware applications is leading the Europe market growth. The market value in U.K. is expected to be USD 0.27 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.42 billion in 2026 and France is likely to hold USD 0.17 billion in 2025.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is anticipated to account for the second-highest market size of USD 1.25 billion in 2025, exhibiting the second-fastest growing CAGR of 5.60% during the forecast period. Asia Pacific region was the largest market in terms of volume in 2024, which can be attributed to the increasing product demand from ceramics, refractories, cement, and paper applications. The economic development within countries such as Japan, China, and India is causing a significant demand spike for ceramics in household and institutional applications, which, in turn, is driving the market in the Asia Pacific region. The market value in China is expected to be USD 0.48 billion in 2026.

On the other hand, India is projecting to hit USD 0.25 billion and Japan is likely to hold USD 0.12 billion in 2026.

North America

North America region is to be anticipated the third-largest market with USD 0.8 billion in 2026. North America is estimated to have a significant share of the global market, which can be associated with the growing technological advancements and rising disposable income in the region. The growing demand for paper from the packaging and printing industries is boosting the regional market. This, along with rising trade activities such as exports from the region, is driving the market.

The North American market exhibits diverse dynamics, with the U.S. leading in market size and technological advancements. At the same time, Canada offers promising growth opportunities driven by industrial expansion and increasing consumer demand for sustainable products. In 2024, the U.S. market generated USD 0.54 billion in revenue, supported by its robust paper, ceramics, and construction industries. The country’s focus on innovation and green energy initiatives further strengthens its position as a key player in the regional market.

Canada, on the other hand, is emerging as a growing market due to its expanding industrial base and heightened emphasis on sustainability. The increasing adoption of eco-friendly practices across industries such as packaging, paints, and coatings aligns with global trends toward environmental responsibility. This shift is expected to drive demand for kaolin-based products in Canada, creating new opportunities for suppliers and manufacturers.

Together, these dynamics underscore the strategic importance of North America’s market in meeting both technological and sustainability goals. The U.S. market is expected to be USD 0.6 billion in 2026.

Latin America

Latin America is expected to show promising growth. Industrialization and infrastructure development activities in the emerging economies of the region are expected to indicate growth in Latin America. Additionally, favorable growth of key industries, including plastics, building & construction, paper and others, is estimated to fuel the demand in the region.

Middle East & Africa

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 0.3 billion in 2026. The Middle East & Africa region is a major hub for mining and raw materials, which are available easily and at cheaper prices for the end-product manufacturers in the region. This reduces the total production cost of the product. Moreover, the growing economy within the region and improved lifestyles of consumers are further surging the high demand for finished consumer goods, such as cosmetics, ceramic products, and packaged food products. Saudi Arabia market is expected to reach USD 0.07 billion in 2025.

Competitive Landscape

Key Industry Players

To know how our report can help streamline your business, Speak to Analyst

Market Players Are Leveraging Expansion Strategy To Boost Their Presence

Imerys S.A., Ashapura Group, EICL Limited, Sibelco, and Thiele kaolin Company are the top 5 players operating in the industry. To strengthen their competitive position and address the risks posed by new market entrants, manufacturers are actively scaling up their operations. The market is competitive, with both international and regional players leveraging extensive distribution networks, regulatory expertise, and robust supplier relationships to gain a strategic advantage. Companies are also pursuing strategic initiatives such as contract agreements, acquisitions, and partnerships with industry leaders to expand their market presence and enhance their reach. These efforts aim to capitalize on emerging opportunities while consolidating market positions in an increasingly dynamic and competitive landscape. The global market is fairly fragmented, with the top 5 players accounting for around 40% of the market share.

LIST OF KEY COMPANIES PROFILED

- Imerys S.A. (France)

- Ashapura Minechem Ltd. (India)

- EICL Limited (India)

- Sibelco (Belgium)

- KaMin LLC (U.S.)

- Thiele kaolin Company (U.S.)

- LB Minerals, Ltd. (Australia)

- Quarzwerke GmbH (Germany)

- Sedlecký kaolin a. s. (Czech Republic)

- I-Minerals Inc. (U.S.)

- W. R. Grace & Co. (U.S.)

- 20 Microns (India)

KEY INDUSTRY DEVELOPMENTS

- January 2023: Sibelco announced that it had used different materials within the glass batch to help improve melting efficiency and reduce the overall carbon footprint of the glass manufacturing process. The company aims to reduce scope 1 and 2 emissions intensity by 5% annually from 2021 to 2030.

- September 2022: Imerys announced that the company had signed a binding agreement with Syntagma Capital to sell most of its assets serving the paper market. These activities represented less than 10% of Imerys's revenue in 2022.

- July 2022: Sibelco acquired Echasa S.A., a mining company active in the extraction of silica sand from the Laminoria quarry located near Vitoria. This acquisition is aligned with the Sibelco 2025 strategy and Sibelco’s vision to become the global leader in silica sand.

- May 2022: Thiele Kaolin Company announced a price increase of 9% for all product categories effective from July 1, 2022, owing to the change in the current global economic scenario that has increased the costs of manufacturing operations worldwide. The price increase will impact the labor, energy, and other inputs needed to produce quality products to meet customers' needs.

- March 2022: Imerys announced the completion of the sale to Thiele Kaolin Company, one of the world's leading producers of processed kaolin clay, of certain North American assets and mining resources supplying hydrous kaolin to the paper & packaging markets.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and end-use industries. Additionally, it offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, it encompasses various factors contributing to the market's growth in recent years. This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) Volume (Million Ton) |

|

Growth Rate |

CAGR of 5.3% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 4.4 billion in 2025 and is projected to record a valuation of USD 6.95 billion by 2034.

In 2026, the Europe market size stood at USD 1.9 billion.

Growing at a CAGR of 5.3%, the market will exhibit steady growth during the forecast period.

Based on application, the paper segment led the market in 2026.

Increasing demand for china clay from the paper industry is a key factor driving market growth.

Imerys S.A., Ashapura Group, EICL Limited, Sibelco, and Thiele kaolin Company are major players operating in the industry.

Europe dominated the kaolin market with a market share of 41% in 2025.

Unique properties, including whiteness, softness, chemical inertness, and good absorption characteristics, are expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us